Volatility knocks early, but markets hold their ground

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened flat with an 18-point gap-up at 24,560 and moved higher to touch 24,610, but soon faced selling pressure, dragging the index to the day’s low of 24,530 within the first hour. The market then stabilized and remained rangebound between 24,580 and 24,630 for the rest of the session, eventually closing at 24,620.20, up by 0.32%.

While domestic fundamentals remain strong—supported by robust GDP growth and easing inflation—global macroeconomic uncertainty and escalating geopolitical tensions continue to weigh on investor sentiment. Market participants are also closely tracking developments around the India-U.S. trade deal.

Broader Market Performance:

Broader markets had a mixed session with a positive bias today. Of the 2,978 stocks traded on the NSE, 1,650 advanced, 1,236 declined, and 92 remained unchanged.

Sectoral Performance:

The top gaining sector for the day was Nifty Metal, which rose by 0.60%, followed by Nifty Energy with a gain of 0.52%. On the other hand, Nifty Realty was the only sector to close in the red, declining by 0.70%. Out of the 12 sectoral indices, 11 closed in the green, while 1 closed in the red, indicating broad-based buying across sectors.

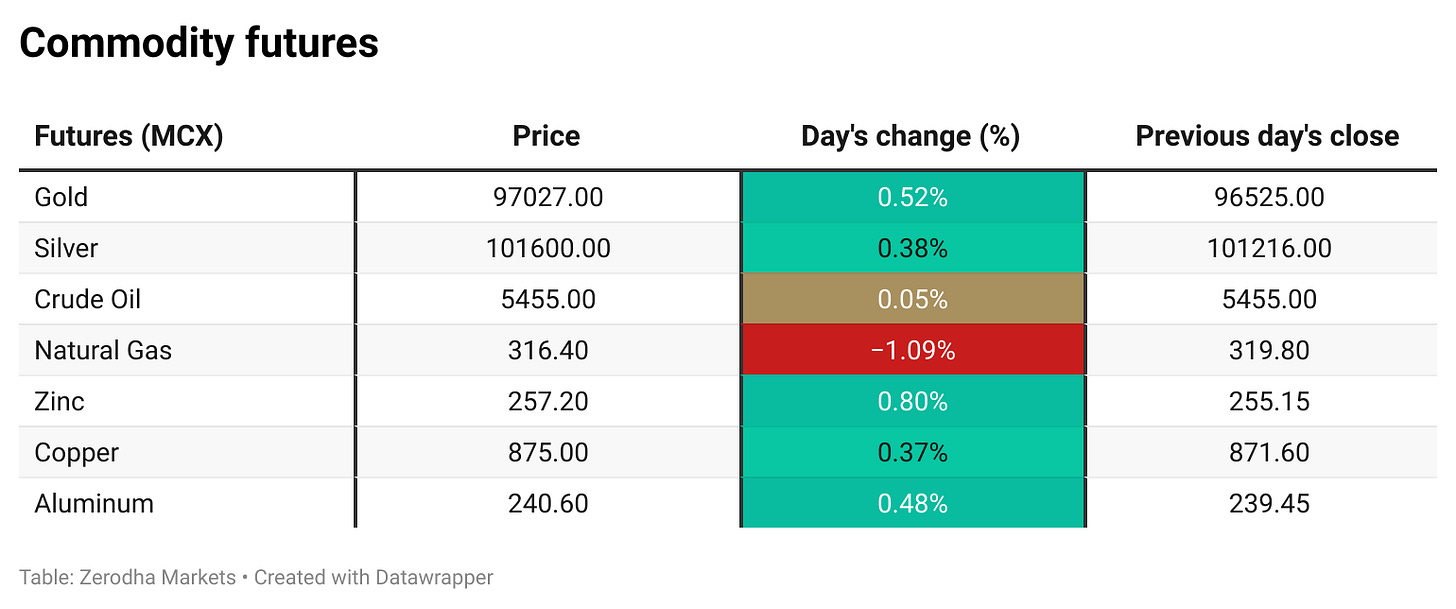

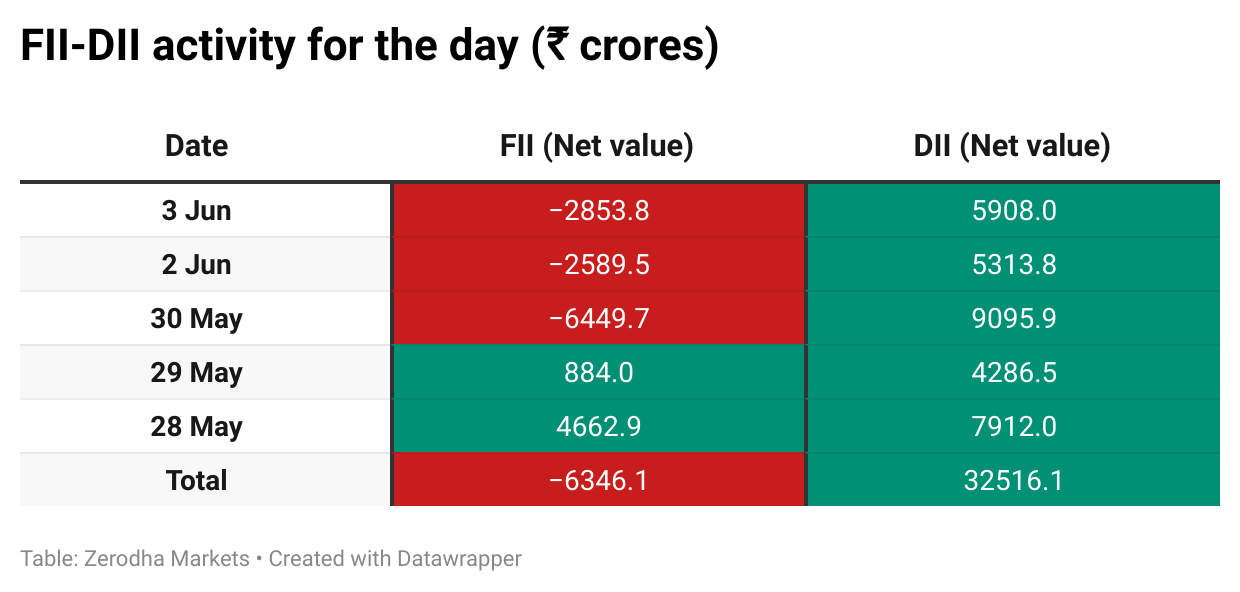

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 5th June:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,600, suggesting strong resistance at 24,800 - 25,000 levels.

The maximum Put Open Interest (OI) is observed at 24,600, followed closely by 24,500, suggesting strong support at 24,500 to 24,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

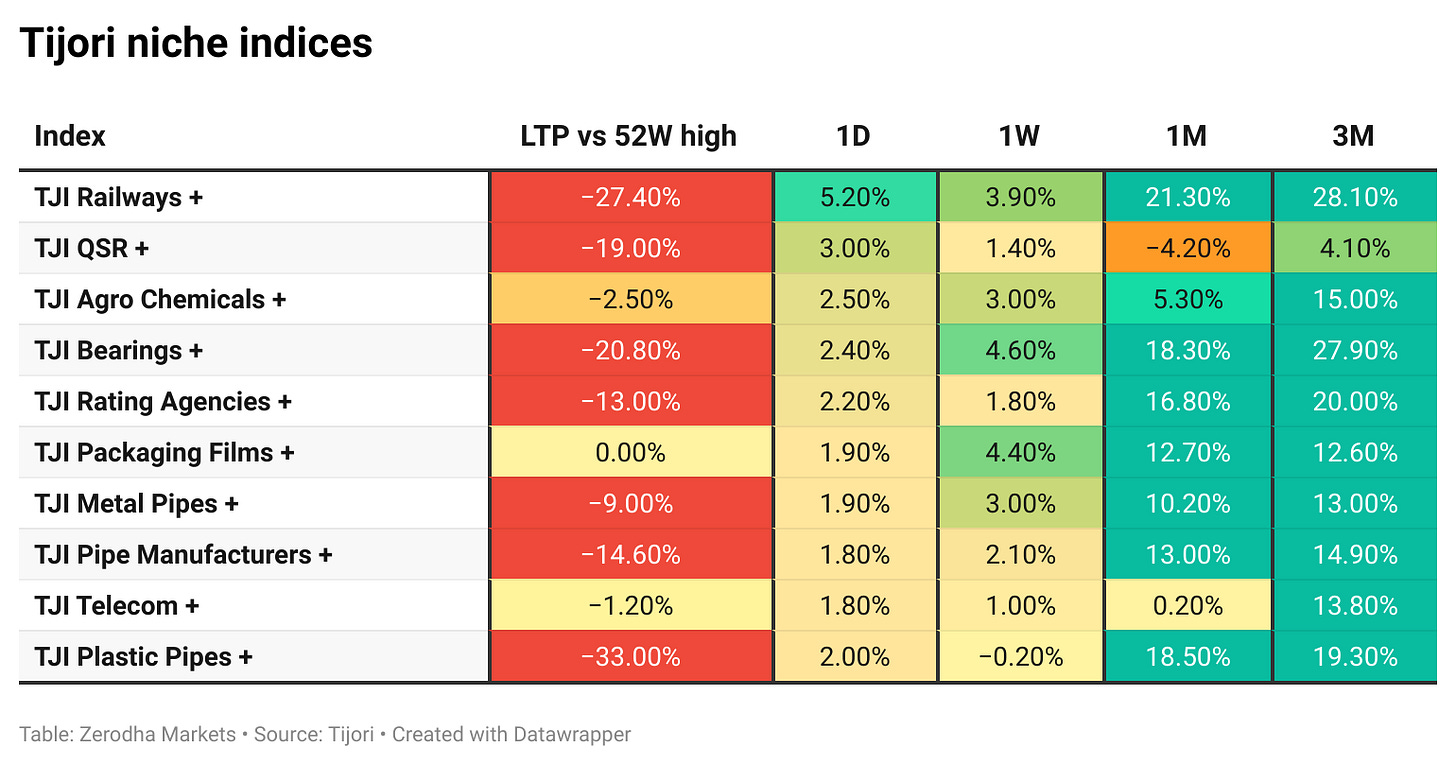

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

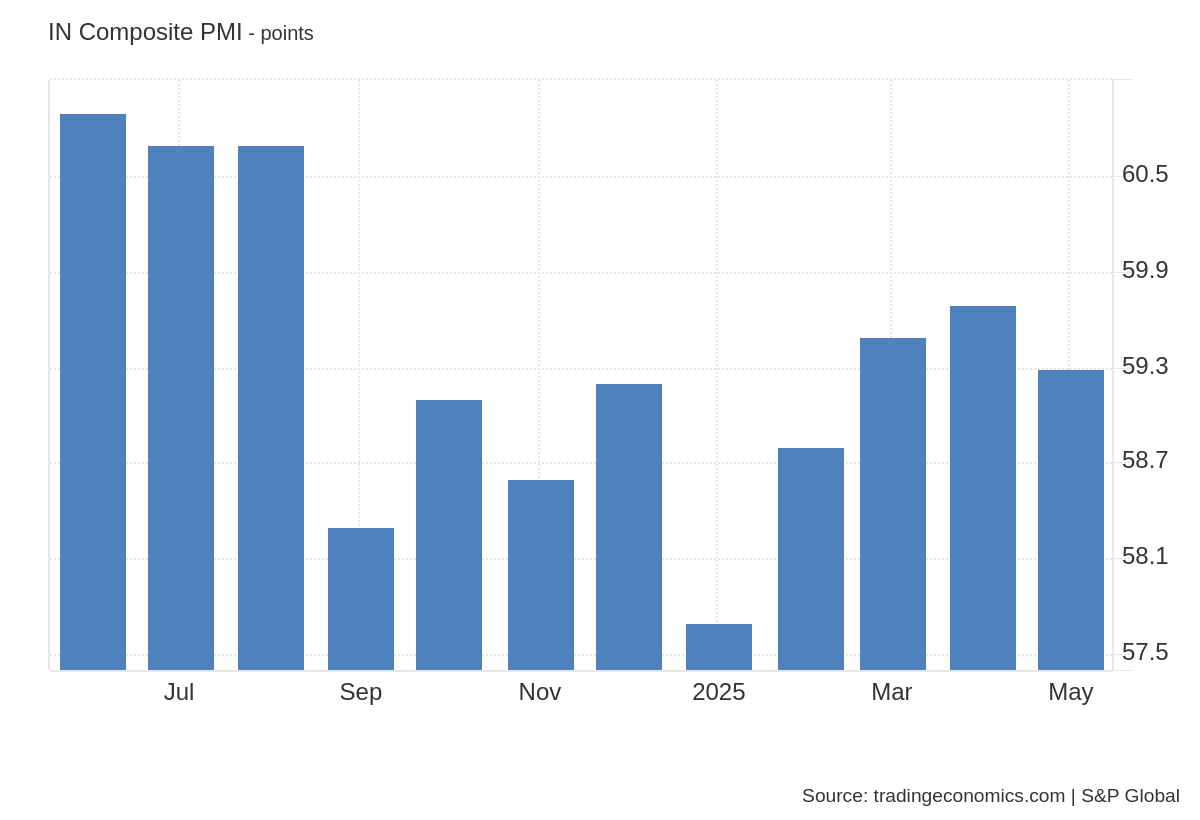

India’s Composite PMI stood at 59.3 in May 2025, slightly above April but below the flash estimate, indicating slower factory output despite stronger services growth. New order growth eased, but employment rose at a record pace. Input and selling price pressures also intensified, especially in manufacturing. Dive deeper

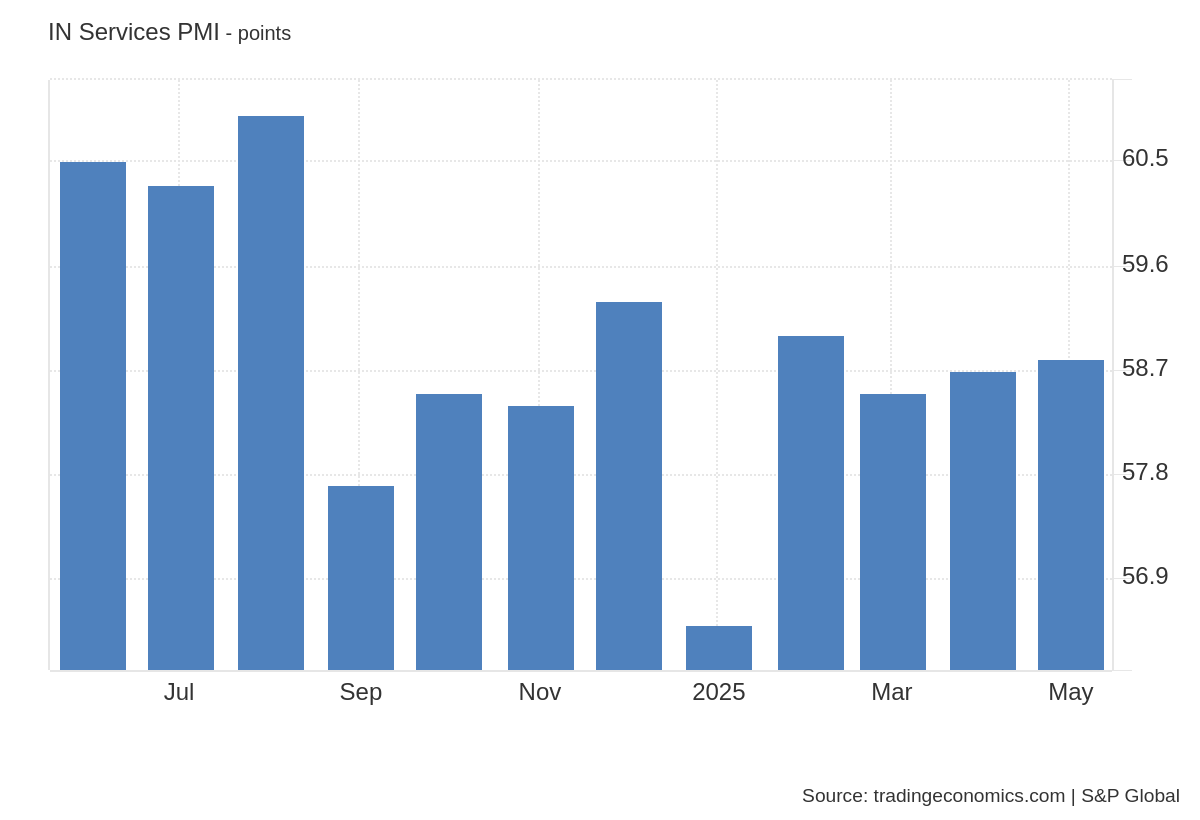

India’s Services PMI was revised to 58.8 in May 2025 from the flash estimate of 61.2, still above April’s 58.7 and marking the fastest expansion since February. Output, new orders, and foreign demand rose sharply, while job creation hit a record high. Dive deeper

Yes Bank’s board approved raising ₹16,000 crore through a mix of equity and debt, ₹7,500 crore via equity securities and ₹8,500 crore via debt instruments, with dilution capped at 10%. It also approved changes to its Articles of Association as part of the share purchase agreement with SMBC and SBI, subject to RBI and shareholder approval. Dive deeper

Auto Q4FY25 saw strong profit growth from two-wheeler makers like TVS Motor, Eicher, and Bajaj Auto, while Tata Motors and component firms like Apollo Tyres and Bosch reported declines. OEMs outperformed suppliers. FY25 ended with solid domestic and export momentum across segments. Dive deeper

Adani Airports Holdings raised $750 million through External Commercial Borrowings led by First Abu Dhabi Bank, Barclays, and Standard Chartered. The funds will be used to refinance debt and upgrade infrastructure at six airports. The move also supports the expansion of non-aeronautical services across its network. Dive deeper

Leela Hotels operator Schloss Bangalore secured an 80-year lease for a plot in Mumbai’s BKC for ₹1,302 crore to develop a 250-key luxury hotel and mixed-use project. The lease was awarded by MMRDA to a consortium led by Schloss. The project expands Leela’s presence in a prime business district. Dive deeper

Zydus Lifesciences will acquire two biologics manufacturing units in California from Agenus for $125 million to enter the global CDMO space. The deal includes exclusive manufacturing rights for two Phase-3 immuno-oncology drugs and expands Zydus’ presence in the U.S. biotech hub. Dive deeper

Ericsson sold its remaining 0.6% stake in Vodafone Idea via a ₹428 crore bulk deal, offloading 63.37 crore shares at ₹6.76 each. The move follows Nokia’s earlier ₹786 crore exit in April. Both vendors had received shares last year to settle dues, but their stakes were diluted after the government's equity conversion. Dive deeper

Apollo Micro Systems raised ₹741.5 crore via preferential allotment of shares and warrants, with participation from promoters, LIC Mutual Fund, and a non-executive director. ₹308.28 crore came from equity shares and ₹108.49 crore from upfront warrant proceeds. The remaining ₹325.5 crore is expected in six months. Dive deeper

Vedanta launched a bond issue to raise ₹4,100 crore via unsecured non-convertible debentures, with a greenshoe option to take the total to ₹5,000 crore. Proceeds will be used for debt repayment, capex, and general corporate purposes. Dive deeper

HDFC Bank shares are in focus after its subsidiary HDB Financial Services received SEBI approval for a ₹12,500 crore IPO, comprising a ₹2,500 crore fresh issue and ₹10,000 crore OFS. The listing is mandatory by September 2025 as per RBI norms. Dive deeper

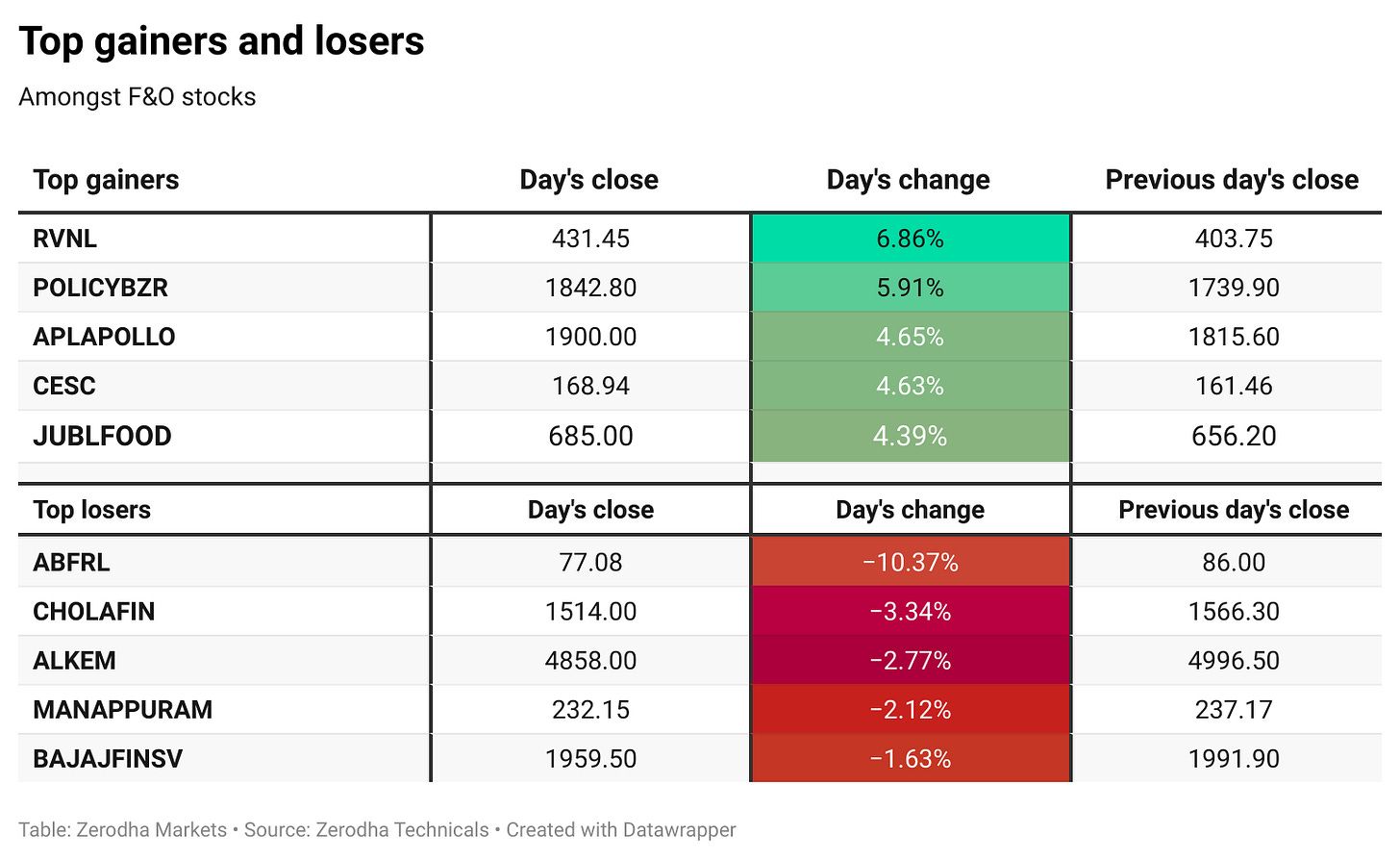

Flipkart sold its entire 6% stake in Aditya Birla Fashion & Retail via a ₹582 crore bulk deal, managed by Goldman Sachs. The sale came at a discount, leading to an over 11% drop in ABFRL’s stock. This follows the recent demerger of its Madura Fashion & Lifestyle business. Dive deeper

Texmaco Rail won a ₹122.3 crore contract from Mumbai Railway Vikas Corp. to build a gas-insulated traction substation with a 50 MVA transformer for the Mumbai Suburban Railway. The project aims to improve efficiency and reliability. Dive deeper

Carlyle Group is set to fully exit Indegene by selling its 10.2% stake via a ₹1,420 crore block deal at a floor price of ₹580 per share. The sale will be executed through open market transactions on June 4. IIFL and Kotak are acting as bookrunners. Dive deeper

Tesla has leased 24,500 sq. ft in Mumbai’s Lodha Logistics Park for warehousing and service, marking its sixth India address. The five-year agreement adds to its growing footprint, with no manufacturing plans. Other locations include Mumbai, Delhi, Pune, and Bengaluru. Dive deeper

Reliance Infrastructure received relief after NCLAT suspended an NCLT order admitting it into insolvency, following the company's full payment of ₹92.68 crore to Dhursar Solar Power. The case was deemed infructuous, leading to the withdrawal of the insolvency proceedings. Dive deeper

What’s happening globally

US job openings rose by 191,000 to 7.39 million in April 2025, beating expectations. Gains were led by retail, healthcare, and professional services, while accommodation and education saw declines. Regional increases were seen in the Northeast, South, and West, with little change in hires and separations. Dive deeper

The average 30-year fixed mortgage rate in the US eased to 6.92% in the week ended May 30, 2025, down from a four-month high of 6.98% the week prior. Rates remain lower than the 7.07% seen a year ago, per the Mortgage Bankers Association. Dive deeper

Steel rebar futures rose toward CNY 3,000 after the US doubled steel import tariffs to 50%, boosting domestic prices and pressuring global markets. China is expected to be the most impacted by weak demand. A Caixin survey showed May manufacturing contracted to a two-year low. Dive deeper

Australia’s economy grew 0.2% in Q1 2025, the slowest in three quarters and below forecasts, as public spending, exports, and household demand weakened. Severe weather disrupted key sectors, and public investment declined. Annual GDP growth held steady at 1.3%, missing expectations. Dive deeper

Volkswagen said around 20,000 employees in Germany have agreed to leave by 2030 through early or normal retirement as part of its restructuring. The move aims to cut production capacity and reduce costs amid rising competition and weak demand in Europe. The company has set aside €900 million for severance. Dive deeper

Tesla’s sales in Germany fell 36.2% in May to 1,210 units, even as the country’s overall EV market grew 44.9% year-on-year. In contrast, Chinese EV maker BYD sold 1,857 units, marking a ninefold increase. Dive deeper

Coca-Cola CEO James Quincey sold 266,403 shares worth $19.2 million on May 30 as part of a pre-arranged trading plan. This follows earlier divestments totaling around $17 million this year and $24 million last year. CFO John Murphy also sold $6.4 million worth of stock in May. Dive deeper

Volvo reported a 12% drop in global sales for May 2025, with 59,822 vehicles sold as EV deliveries declined. Fully electric sales fell 27% while plug-in hybrids dropped 11%, though mild hybrids and ICE models declined just 5%. Year-to-date sales are down 8%, with a 22% dip in fully electric models. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Amitava Mukherjee, Chairperson, NMDC, on FY26 revenue targets and growth plans

"Our guidance for this fiscal is around 55 million tonnes of iron ore sales."

"Going by that, I think we should be able to log our top line of around Rs 30,000 crore this year.""We have a list of 10 assets we would like to acquire, even abroad. Coking coal is one of the main minerals." - Link

Krishna Sanghavi, Chief Investment Officer – Equity, Mahindra Manulife MF, on the results season

The results season was better than expected, and the muted expectations clearly helped in judging the output as better—or maybe worse. For a change, we are having a better results season, and the nice part is that it's really well spread across. In fact, if you look at the Energy index, there is 7–8% earnings growth as a combined basket, and profits are broadly spread across BFSI as well as the commodity aggregate basket of oil and gas, metal, cement on one side, or the resource consumers—which is the entire non-BFSI, non-commodity piece—on the other. - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

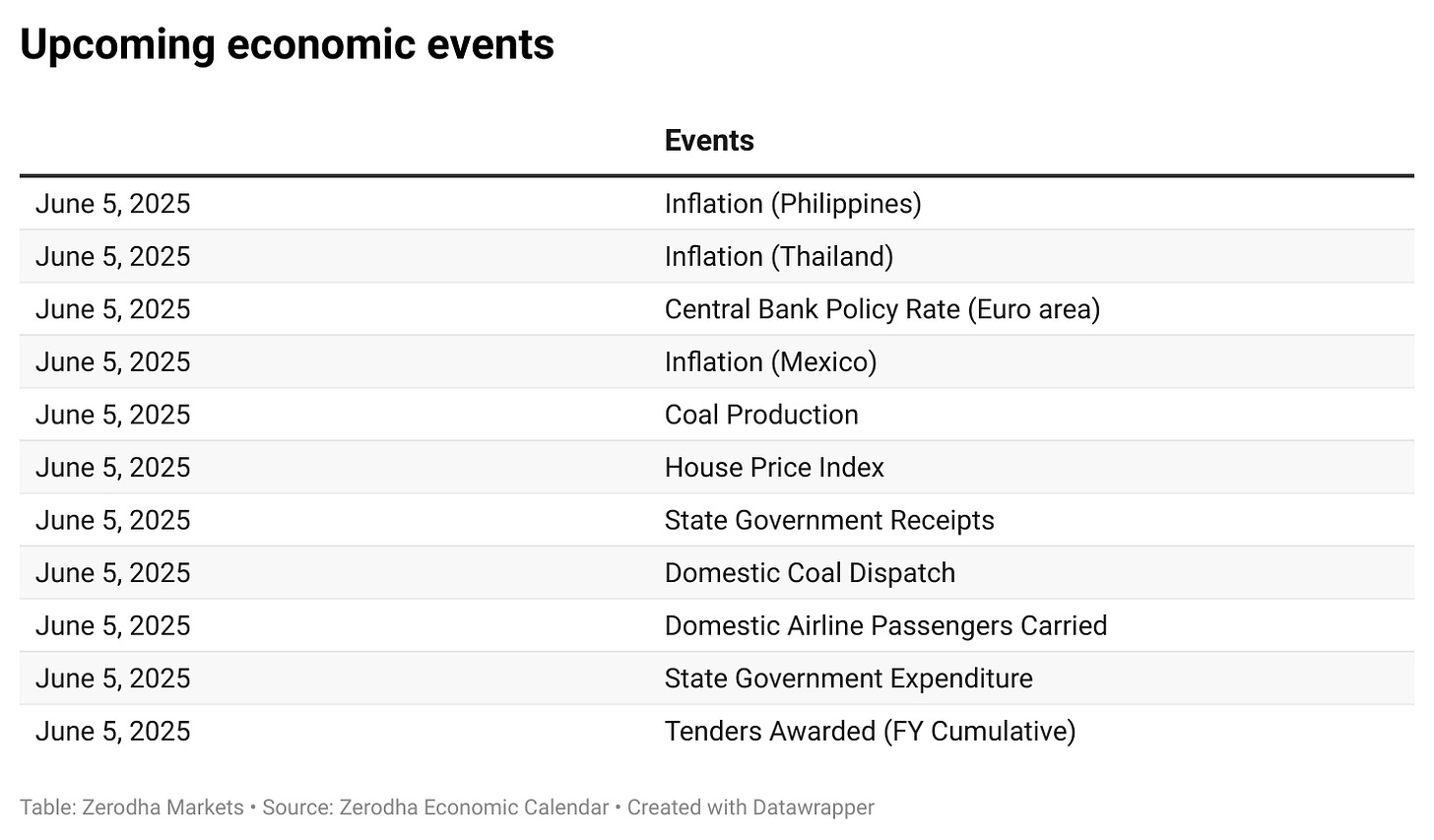

Calendars

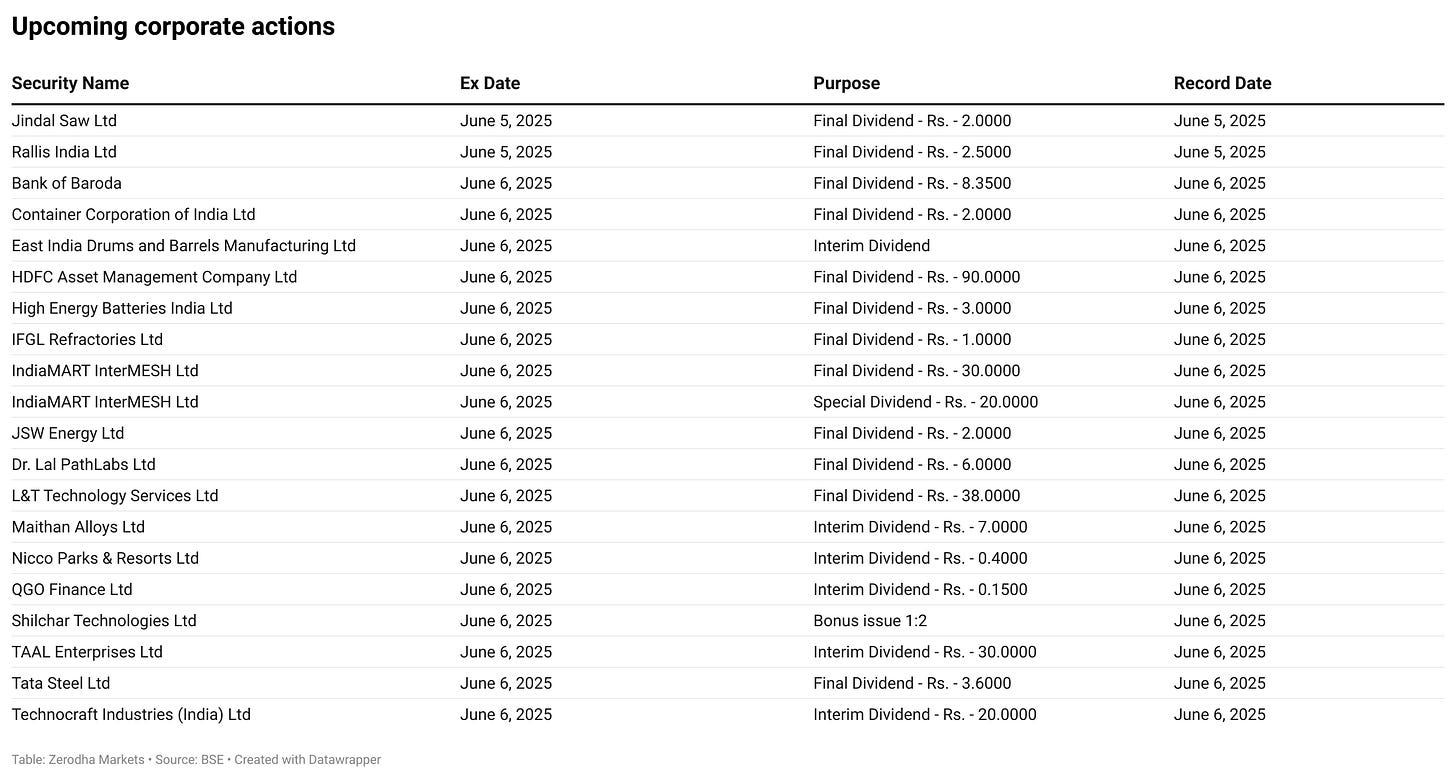

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.