Nifty slips to 25,600 as weak sentiment and global cues weigh

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down everything that mattered — from NIFTY’s “chai-pattern” setup to BANKNIFTY’s record monthly close, the continued outperformance in midcaps, and a quick look at NIFTY’s monthly seasonality trends as we head into year-end.

Market Overview

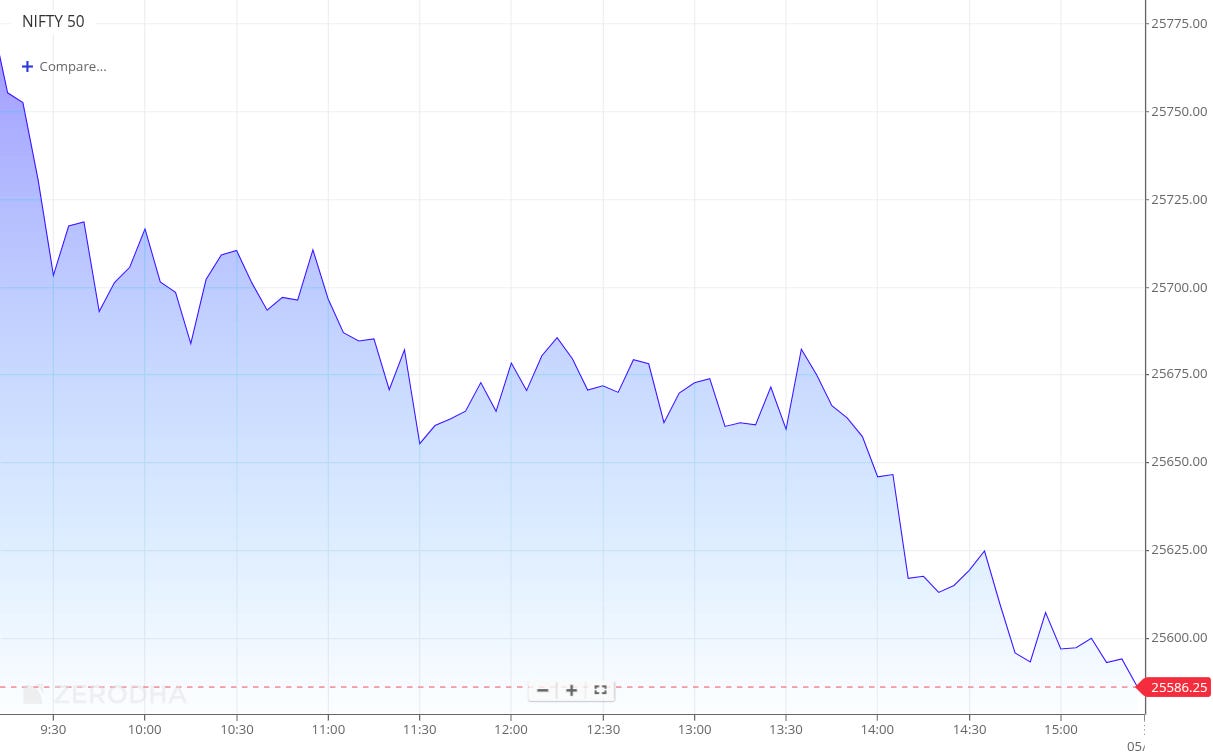

Nifty opened flat with a mild 20-point dip at 25,745 and slipped another 40 points in early trade before finding temporary support near the 25,700 mark through the first couple of hours. However, selling pressure intensified as the day progressed, pushing the index steadily lower. Nifty hovered in a narrow 25,660–25,680 range until around 2 PM, after which weakness deepened, dragging the index to the 25,580 zone. The index eventually closed near the day’s low at 25,597.65, down 0.64%, extending its corrective phase after failing to sustain above 25,750 levels earlier in the week.

Looking ahead, markets are likely to remain sensitive to updates on the India–U.S. trade deal, while investors continue to track Q2 earnings and management commentary on festive-season demand momentum following the recent GST cuts.

Broader Market Performance:

The broader markets had a weak session today. Of the 3,181 stocks traded on the NSE, 1,032 advanced, 2,062 declined, and 87 remained unchanged.

Sectoral Performance:

Nifty Consumer Durables was the top gainer, closing 0.39% higher, while Nifty Metal was the worst performer, falling 1.44%. Out of the 12 sectoral indices, only one ended in the green, while the remaining 11 closed in the red, indicating broad-based weakness across the market.

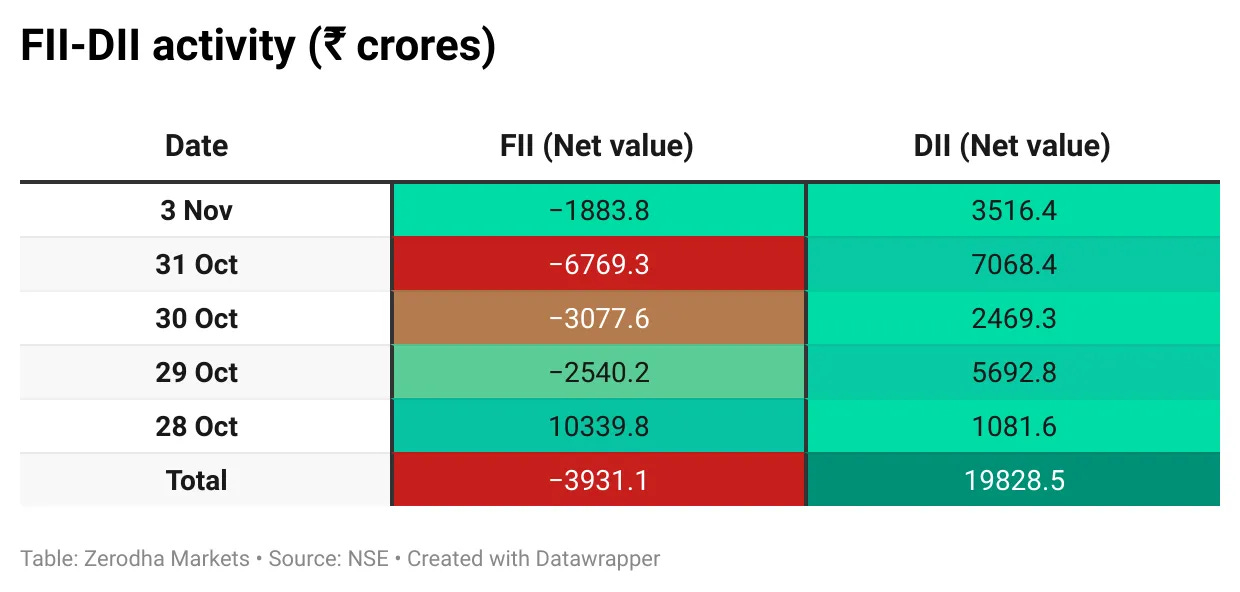

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 11th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,800, indicating potential resistance at the 25,800 -25,900 levels.

The maximum Put Open Interest (OI) is observed at 25,200, followed by 25,250, suggesting support at the 25,500 to 25,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

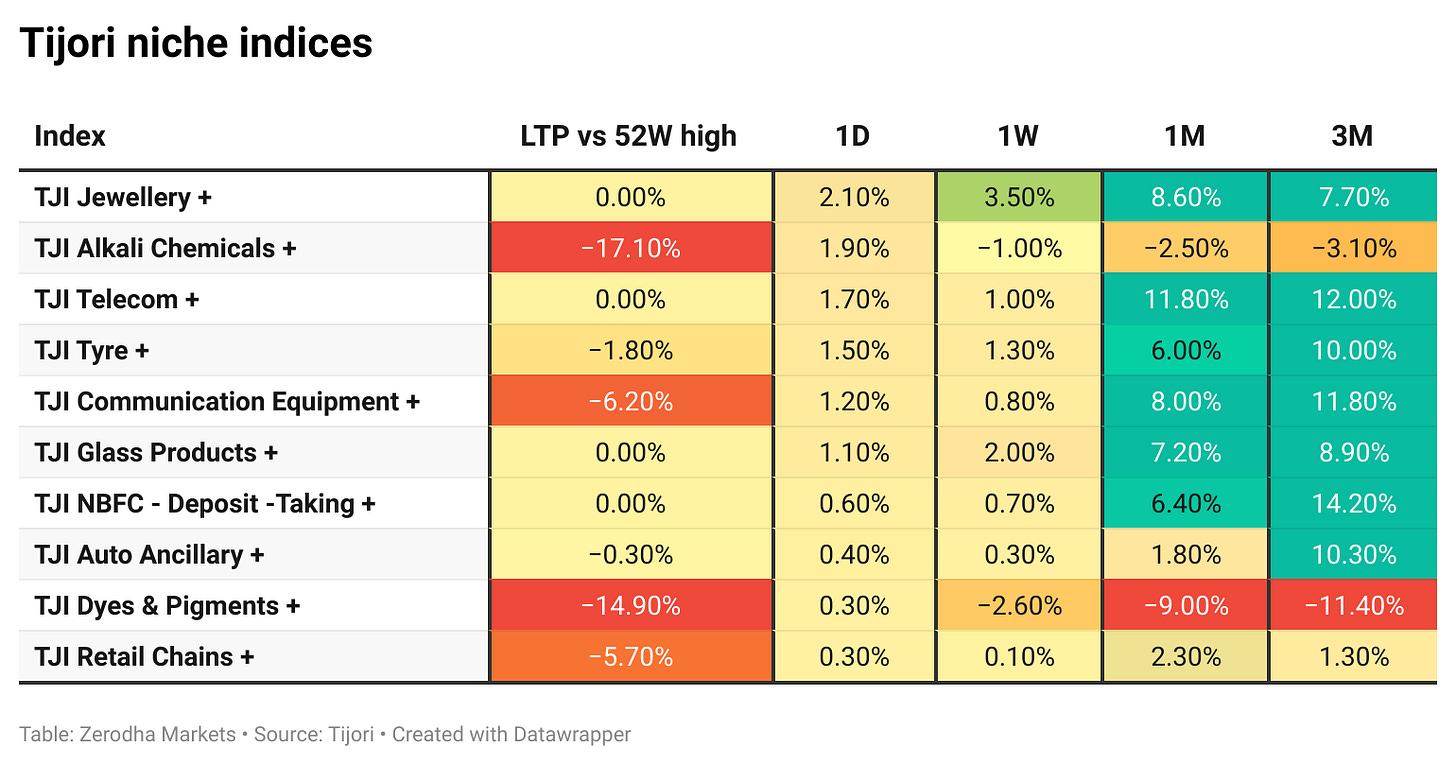

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

NSE will launch a pre-open session for index and stock futures from December 8, 2025, to improve price discovery and market stability. Dive deeper

State Bank of India reported a 10% YoY rise in Q2FY26 net profit to ₹20,160 crore, driven by a ₹4,593 crore gain from selling a 13.18% stake in Yes Bank and improved asset quality. Dive deeper

Titan Company reported a 59% YoY rise in Q2FY26 net profit to ₹1,120 crore, driven by festive demand and strong jewellery sales. Revenue grew 22% to ₹16,461 crore, with robust performance across jewellery, watches, and eyewear segments. Dive deeper

Adani Enterprises reported an 84% YoY rise in Q2 net profit to ₹3,199 crore, aided by exceptional gains from stake sales in Adani Wilmar, even as revenue fell 6% to ₹21,249 crore. EBITDA declined 10% to ₹3,902 crore, while the airports business saw strong growth. The board approved a ₹25,000 crore partly paid-up rights issue to strengthen the balance sheet and support new projects. Dive deeper

One Mobikwik Systems reported a Q2FY26 net loss of ₹28.6 crore as revenue fell 7% YoY to ₹270.2 crore. EBITDA rose 80% sequentially, driven by cost efficiency and stronger margins across payments and lending. Dive deeper

Hitachi Energy India reported a fourfold jump in Q2FY26 net profit to ₹264.4 crore, with revenue rising 23% YoY to ₹1,915.2 crore. Margins expanded sharply, with operating EBITDA up 130% YoY to ₹291.6 crore and PAT margin improving to 13.8% from 3.4% a year ago. Dive deeper

Ambuja Cements reported a 268% YoY rise in Q2FY26 net profit to ₹1,766 crore, driven by record volumes and strong cost control, while revenue grew 25% to ₹9,130 crore. The company achieved its highest-ever quarterly volume of 16.6 million tons, up 20% YoY. Dive deeper

3M India reported a 43% YoY rise in Q2FY26 net profit to ₹191 crore, with revenue up 14% to ₹1,266 crore, supported by growth across all business segments. EBITDA grew 33% to ₹268 crore, while PAT and sales also improved sequentially, reflecting broad-based operational strength. Dive deeper

The Supreme Court has allowed the Centre to reassess Vodafone Idea’s pending AGR dues beyond FY 2016-17, clarifying that the review isn’t limited to that year. The move could offer broader financial relief to the debt-laden telecom operator. Dive deeper

Bharti Airtel’s Q2 results showed strong growth with ARPU rising to ₹256, EBITDA margin exceeding 48%, and improved performance from its Africa operations, signaling continued business momentum. Dive deeper

Godfrey Phillips India reported a 23% YoY rise in Q2FY26 net profit to ₹305 crore, while revenue remained flat at ₹1,632 crore. The board declared an interim dividend of ₹17 per share for FY26. Dive deeper

What’s happening globally

Samsung SDI is in talks to supply Tesla with Energy Storage System (ESS) batteries in a deal reportedly worth over 3 trillion won ($2.11 billion). If finalized, the agreement would further Tesla’s efforts to reduce dependence on China, as Samsung shifts some U.S. EV battery lines toward ESS production. Dive deeper

Microsoft signed a $9.7 billion deal with IREN to secure Nvidia chips and expand AI computing capacity without building new data centers. The five-year agreement will also help fund IREN’s $5.8 billion Dell partnership.Dive deeper

OpenAI signed a $38 billion, seven-year deal with Amazon Web Services to access large-scale Nvidia GPUs and CPUs for expanding its AI infrastructure. The partnership aims to power next-generation “agentic AI” systems, with full AWS capacity expected to be utilized by 2026. Dive deeper

Japan’s manufacturing activity contracted at its fastest pace in 19 months in October, weighed down by weak demand in the automotive and semiconductor sectors. The S&P Global Manufacturing PMI fell to 48.2 from 48.5 in September, marking its lowest level since March 2024. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sanjiv Bajaj, Chairman, Bajaj Finance, on the festive season updates

“The government’s next-generation GST reforms and personal income tax changes have given a fresh push to India’s consumption-led growth story. The positive impact is not only evidenced in the 27% higher disbursement of consumption loans, but also a premiumization trend with consumers shifting to higher-quality products for better lifestyles.”

“Over half of our new customers during this festive season are new-to-credit, taking their first loan from the formal financial system. With Bajaj Finance’s digital platforms and on-ground presence at 239,000 active distribution points across 4,200 locations Pan-India, we continue to deepen financial inclusion and power the rise of the Indian consumer.” - Link

Tuhin Kanta Pandey, Chairperson, SEBI, on cyber security and algotrading safeguards

“Cyber security remains a foremost concern for all market participants, firms must protect sensitive client data and critical infrastructure from sophisticated threats.”

“With greater reliance on technology vendors, third-party and outsourcing risks have increased, requiring stronger oversight and due diligence.”

“As algorithmic and high-frequency trading gain traction among retail traders, robust risk controls, real-time monitoring, and compliance safeguards are essential.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

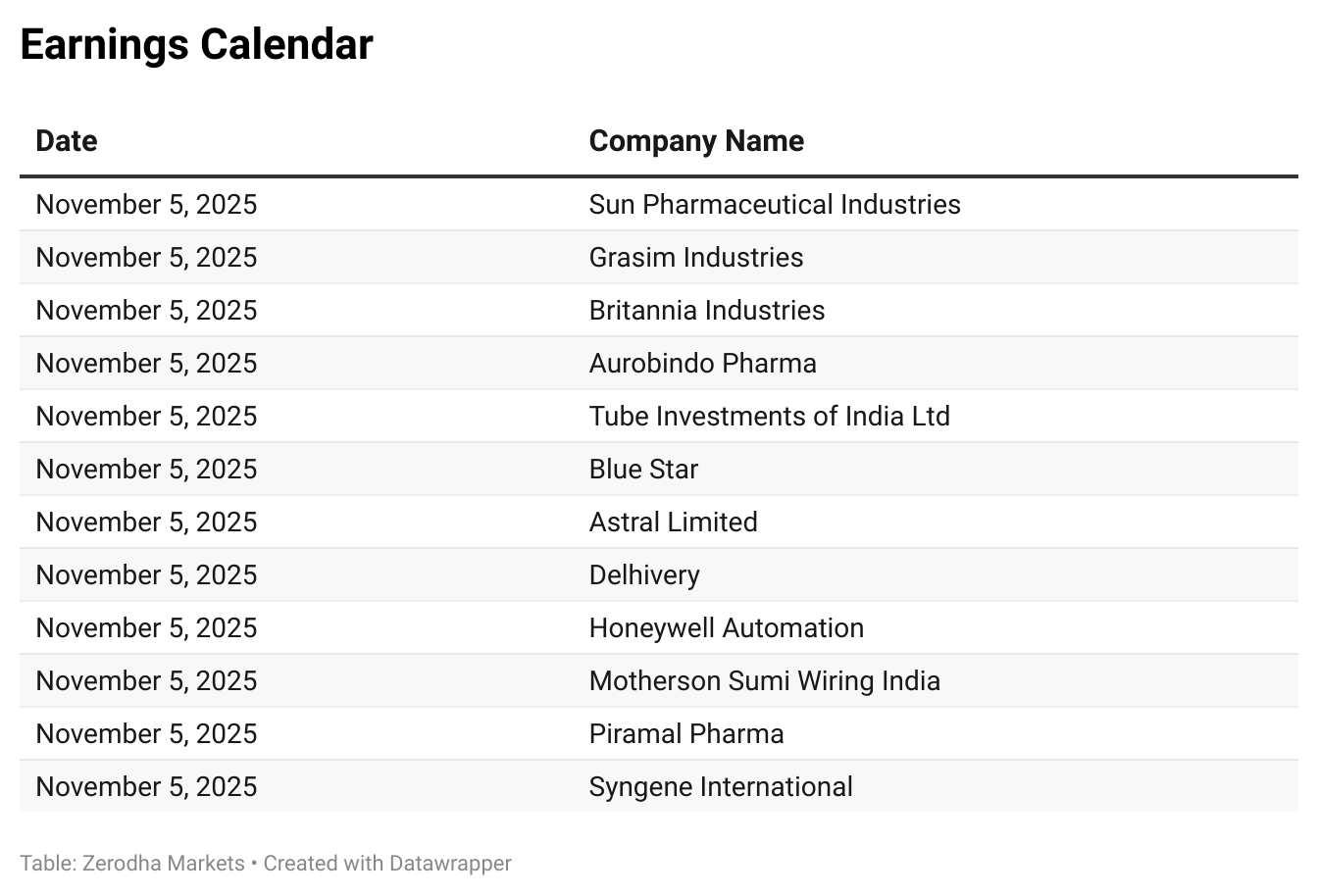

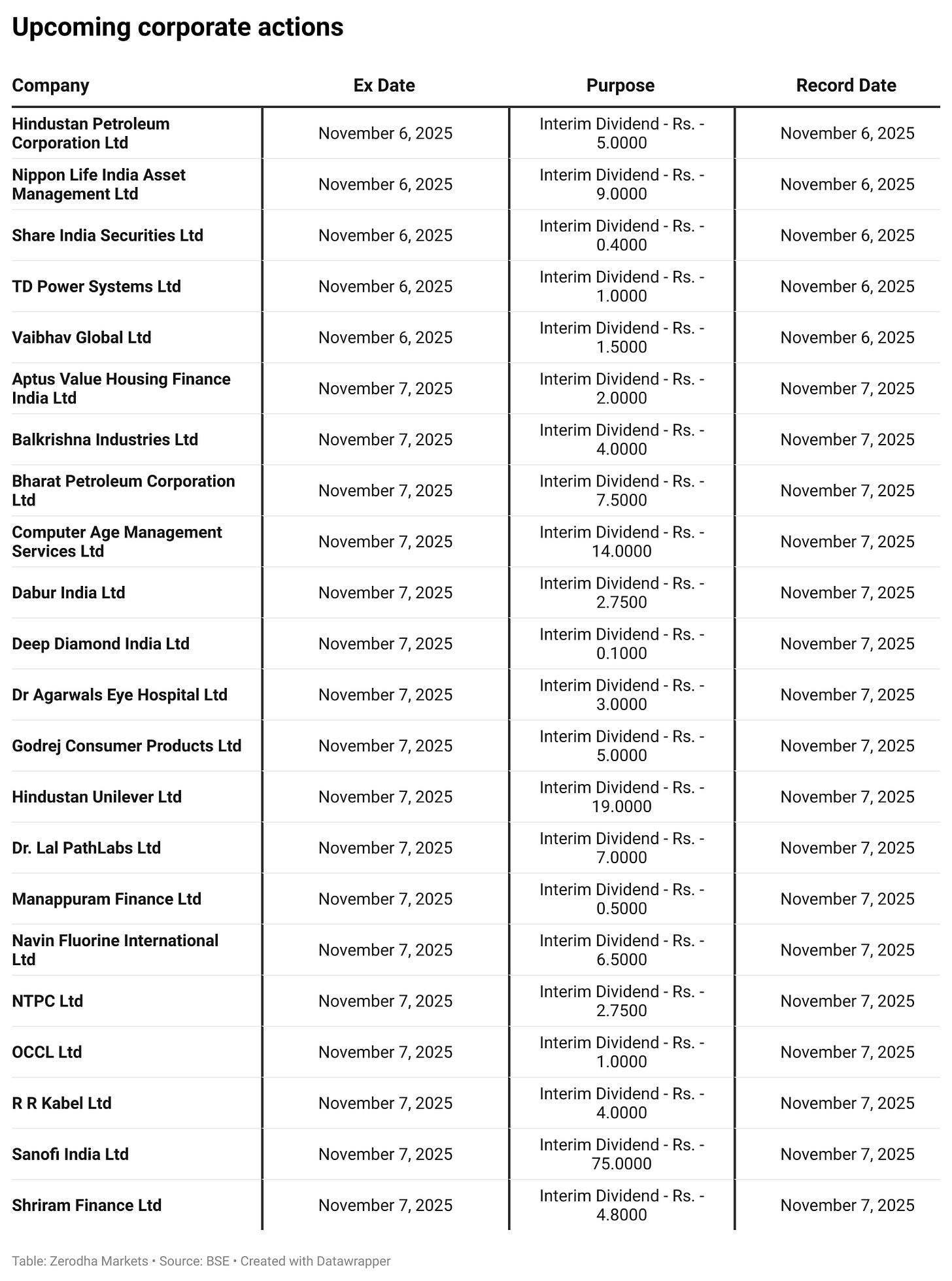

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

excellent Team work..i' ve read how your team organised to prepare this reports is awesome..all the best and Thanks 🙏

Excellent analysis done on day to day basis. I just had one request, could you please provide a hindi or multi lingual support, Many of the investors don't have good hold on techinical jargons in English. Considering the financial point, instead of unclear messages it is better to have a multilingual or atleast hindi support.