Nifty overcomes tariff woes, ends in green

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

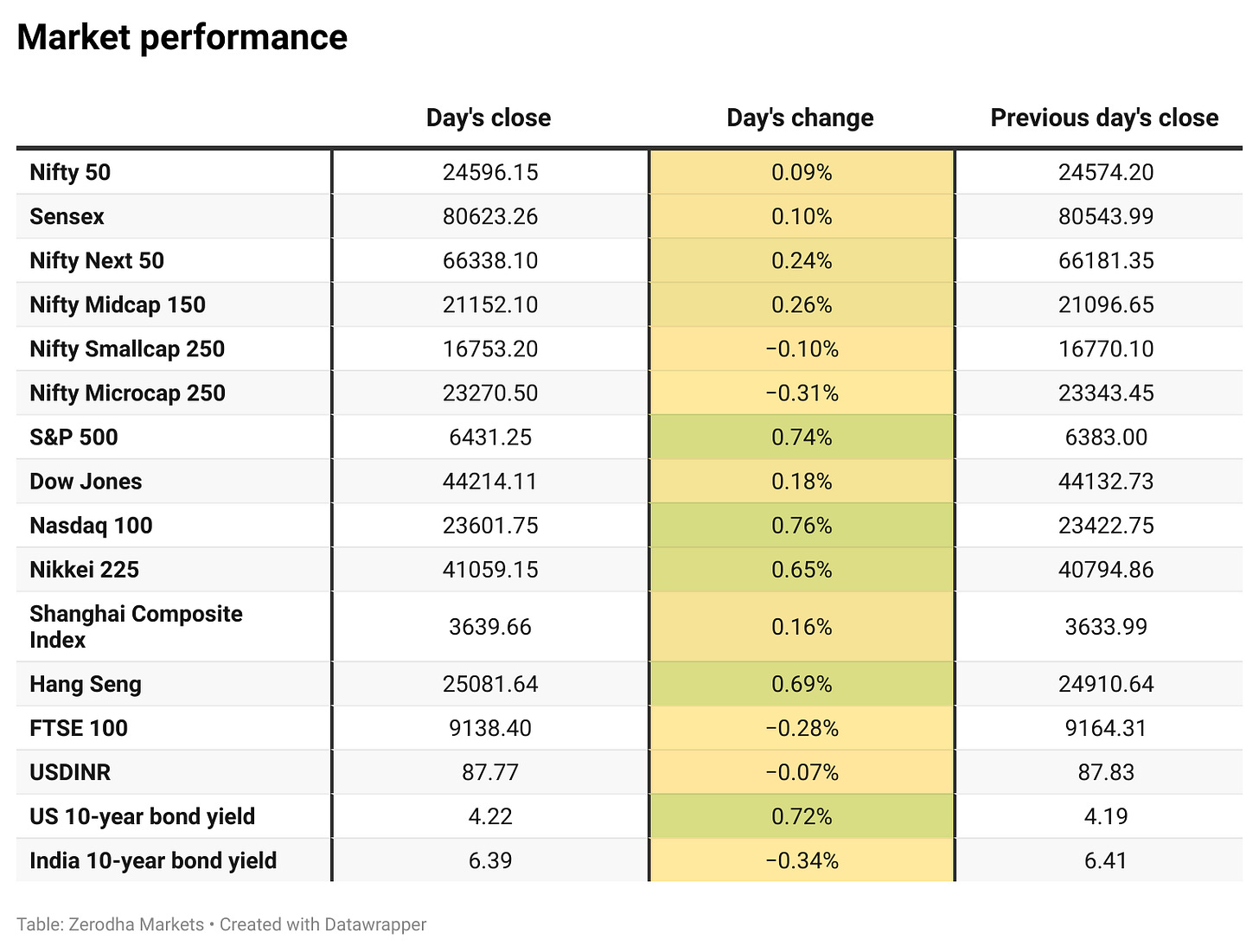

Market Overview

Nifty opened with a 110-point gap down at 24,464.20 after U.S. President Trump announced an additional 25% tariff on Indian exports, bringing the total tariff to 50%. The index quickly recovered 80 points to reach 24,540 in the first 15 minutes, but selling pressure re-emerged at higher levels, dragging Nifty down by 140 points to test the 24,400 mark by 11 AM.

From there, the index remained rangebound between 24,400 and 24,450 until 1 PM, before breaking lower to test 24,350. Around 2 PM, Nifty began a sharp recovery, rallying nearly 280 points in a one-sided move to surpass the day’s high above 24,600. It eventually closed near the day’s high at 24,596.15, up 0.08%.

Market sentiment stayed cautious amid weak global cues, continued FII outflows, and subdued earnings reactions. Investors remain focused on the escalating U.S.-India trade tensions, which are expected to guide near-term market direction.

Broader Market Performance:

Broader markets had a mixed session today. Of the 3,062 stocks traded on the NSE, 1,421 advanced, 1,554 declined, and 87 remained unchanged.

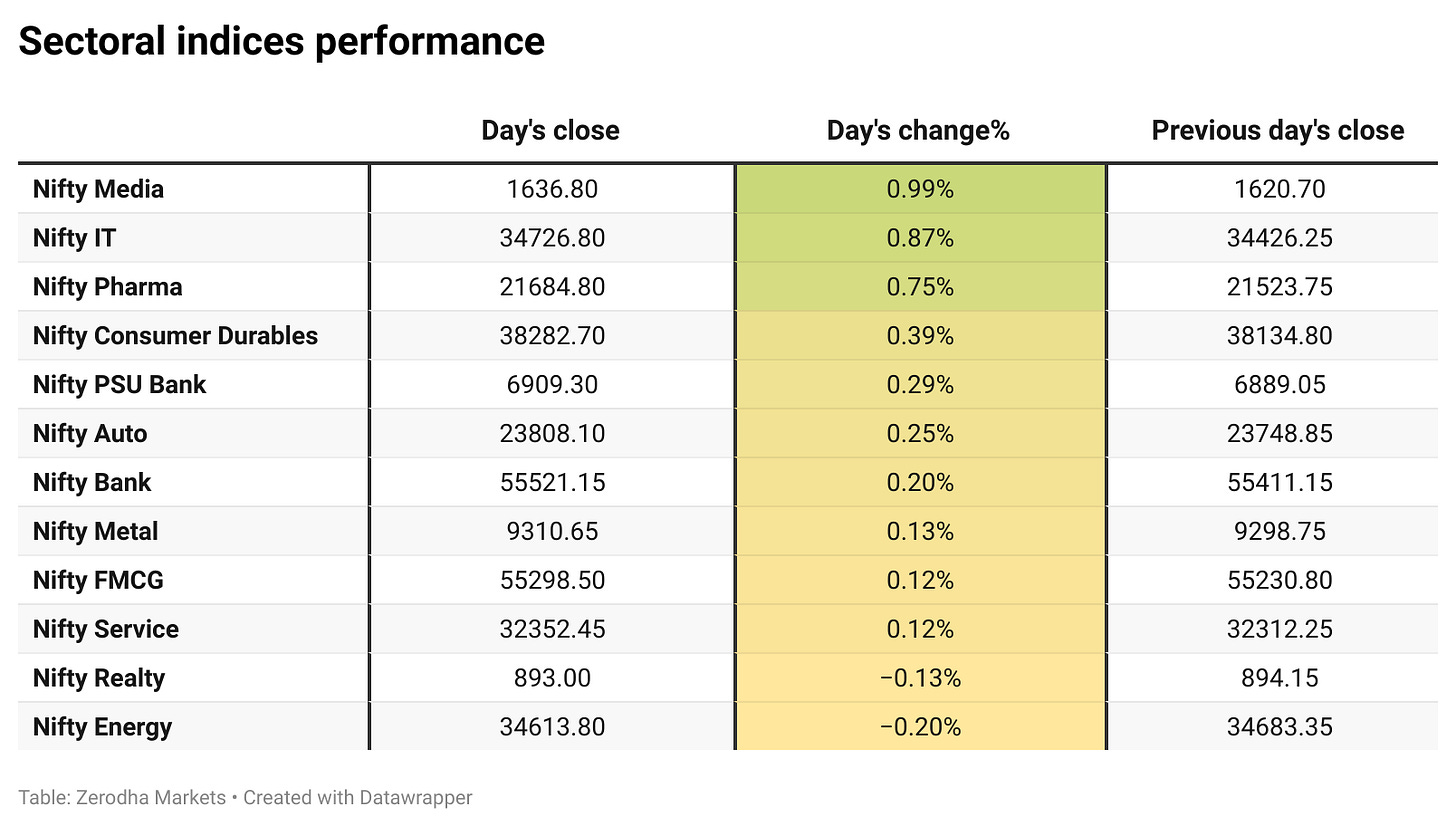

Sectoral Performance

Nifty Media was the top gainer of the day, rising 0.99%, followed by Nifty IT and Nifty Pharma, which gained 0.87% and 0.75% respectively. On the flip side, Nifty Energy was the worst performer, slipping 0.20%, followed by Nifty Realty, which declined 0.13%. Out of the 12 sectoral indices, 10 closed in the green while only 2 ended in the red, reflecting a broadly positive sentiment across sectors.

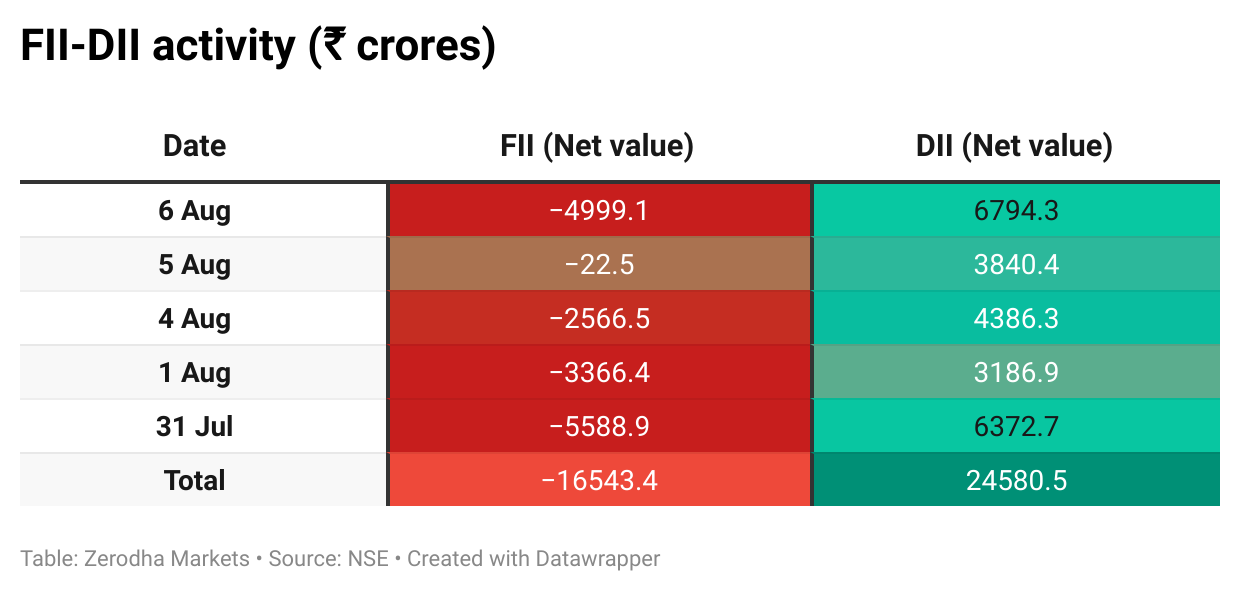

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

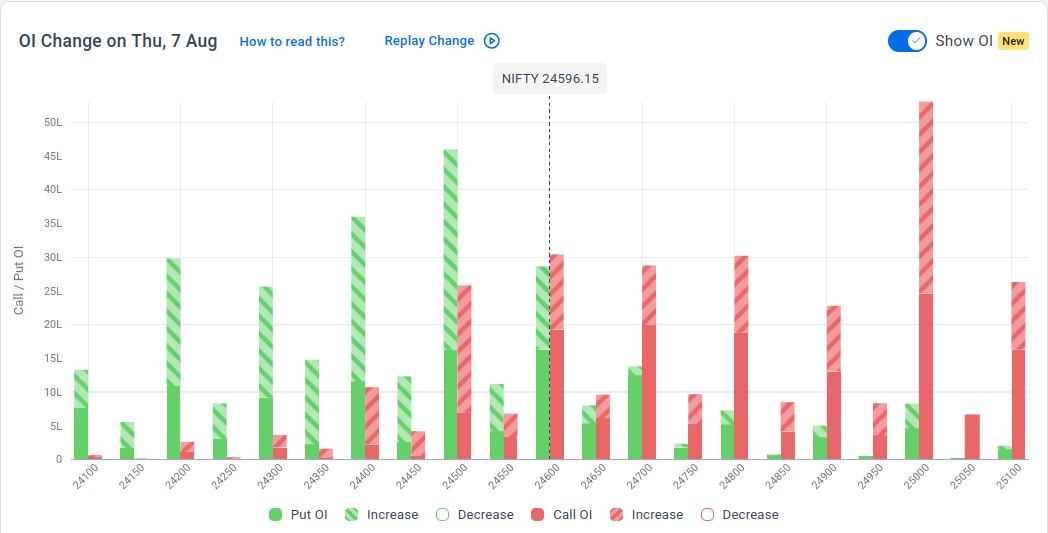

The following is the change in OI for Nifty contracts expiring on 14th August:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,600, suggesting strong resistance at 24,800 - 24,900 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,400, suggesting strong support at 24,500 to 24,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

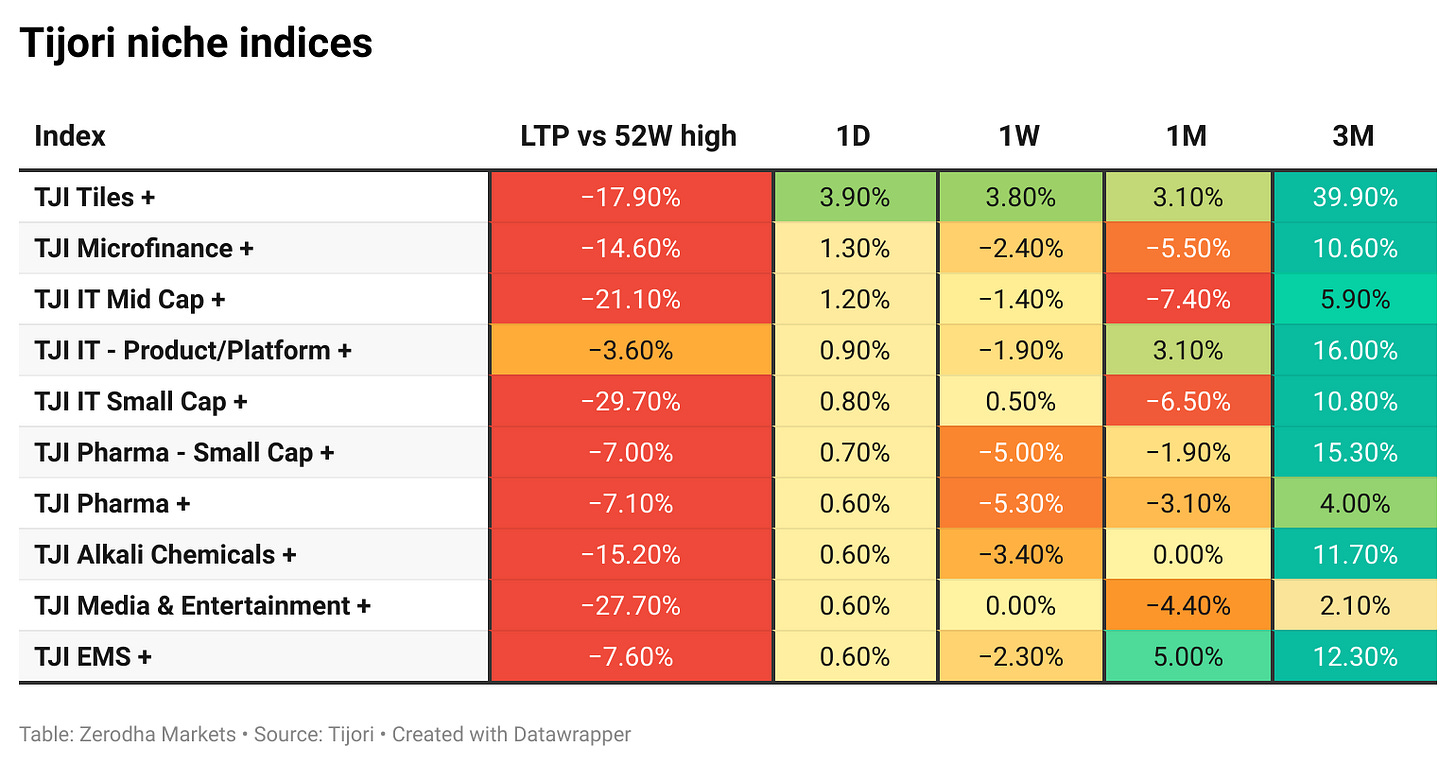

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

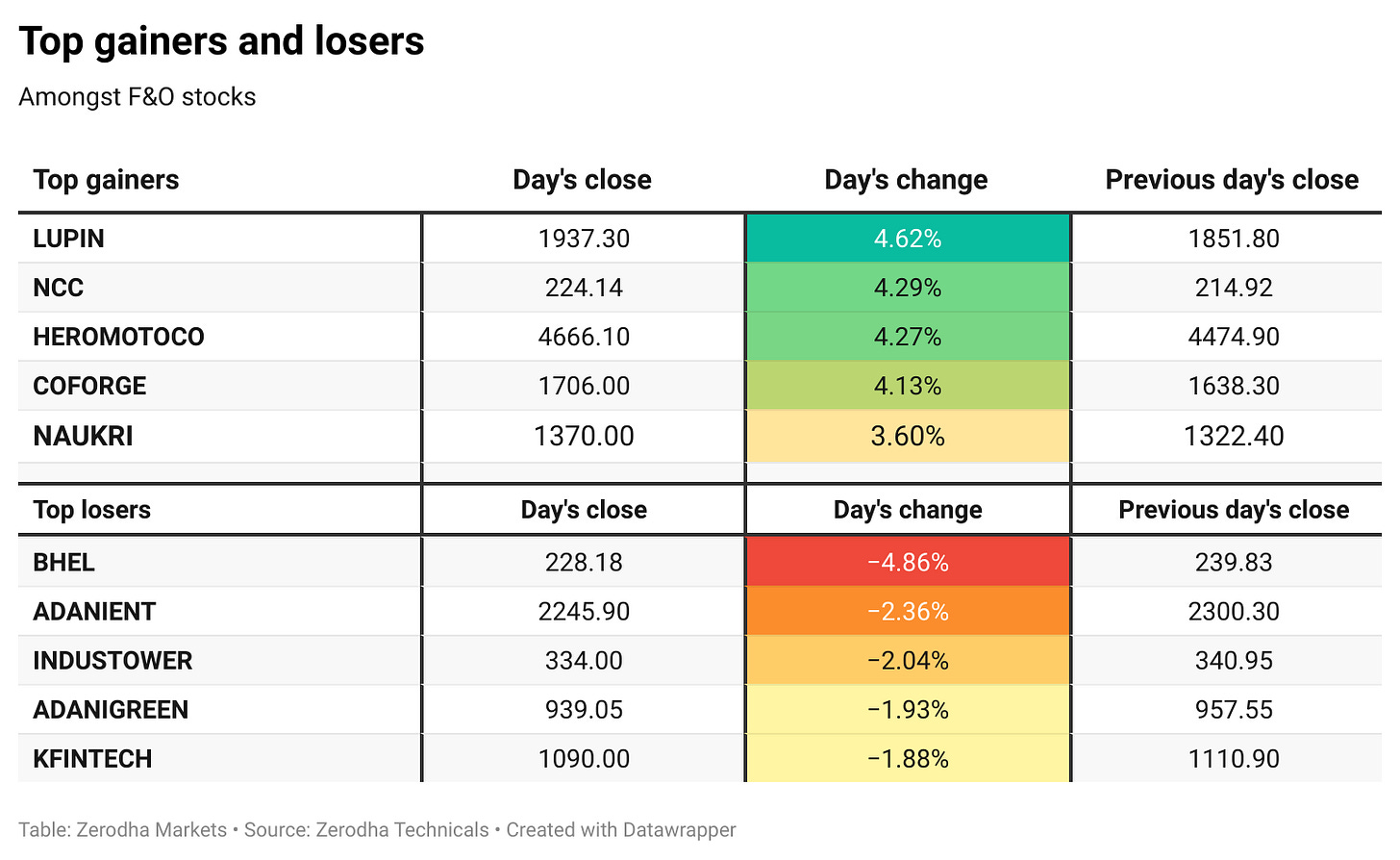

Hero MotoCorp’s Q1 standalone net profit remained flat at Rs 1,126 crore, while revenue fell 6% to Rs 9,579 crore. The company saw strong demand in entry-level motorcycles and 125cc scooters, with its electric mobility business under VIDA gaining traction. Dive deeper

Bureau of Indian Standards raided 22 warehouses of Amazon, Instakart, and Blinkit in FY25, uncovering 142 uncertified products during market surveillance. The raids targeted non-compliant goods without valid BIS certification or with counterfeit ISI marks across several states. Dive deeper

Prestige Hospitality Ventures has received SEBI approval for its ₹2,700 crore IPO, comprising a ₹1,700 crore fresh issue and ₹1,000 crore offer for sale by Prestige Estates Projects. Proceeds will fund debt repayment, acquisitions, and corporate purposes. Dive deeper

NBCC has secured a Rs 103 crore contract to refurbish the Lokpal of India office in South Delhi, including repair, retrofitting, and interior upgrades. The agreement was signed on August 1, 2025. Dive deeper

IRB Infrastructure reported a 10% rise in toll revenue to ₹548 crore in July 2025, led by ₹147.6 crore from IRB MP Expressway and ₹70.9 crore from IRB Golconda Expressway. The company expects further growth with the upcoming festive season. Dive deeper

Divi’s Laboratories reported a 27% YoY rise in Q1 net profit to ₹545 crore on 14% higher revenue of ₹2,410 crore. Sequentially, both net profit and revenue declined from the March quarter. Dive deeper

BHEL reported a widened consolidated net loss of Rs 455.5 crore in Q1 FY26, compared to a Rs 211.4 crore loss a year ago. Total income rose slightly to Rs 5,658 crore, but higher expenses of Rs 6,280 crore weighed on profitability. Dive deeper

Indian textile stocks faced pressure after US President Trump doubled tariffs on Indian goods to 50%, affecting textiles, gems, seafood, and other sectors. India’s Ministry of External Affairs condemned the move as unfair and unjustified. Dive deeper

NBCC reported a 26% rise in Q1 net profit to Rs 132.13 crore on 11.6% higher revenue of Rs 2,391.19 crore. The company declared a first interim dividend of Rs 0.21 per share for FY26, with a record date of August 13, 2025. Dive deeper

Bosch Ltd received a customs demand of over Rs 140 crore for differential duty, interest, and penalties related to the classification of oxygen sensors. The company plans to appeal the order and will make a mandatory 7.5% pre-deposit on the demanded amount. Dive deeper

Kalyan Jewellers reported a 49% rise in Q1 net profit to ₹264 crore on 31.5% higher revenue of ₹7,268 crore. EBITDA grew 38% with margins expanding to 7%, while international revenue rose 32% to ₹1,070 crore. Dive deeper

What’s happening globally

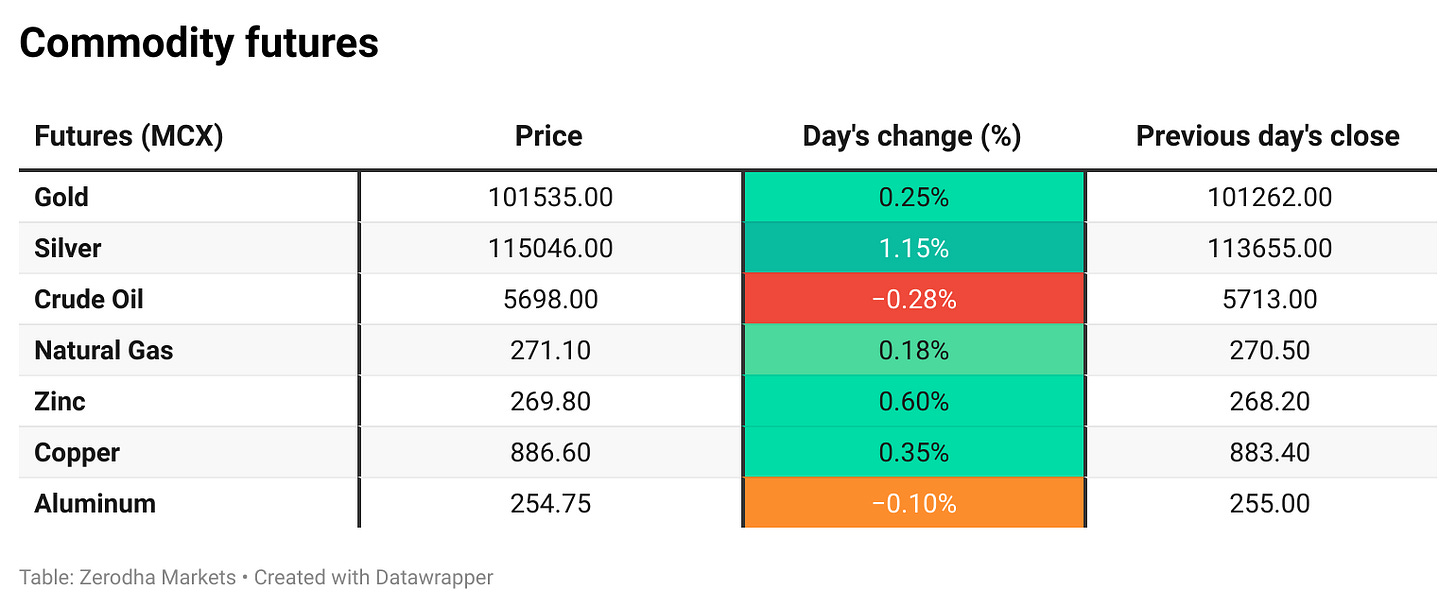

Brent crude futures rose above $67, ending a five-day slide amid US tariffs on Indian goods and geopolitical tensions. A larger-than-expected 3 million barrel drop in US inventories and Saudi Arabia’s price hike for Asia supported prices. Dive deeper

Gold rose to around $3,380 per ounce, reaching a two-week high as US tariff threats and expectations of dovish Fed policy boosted demand. Tariffs include 100% on imported chips, 25% on Indian goods, and 50% on select Brazilian products. Dive deeper

Silver climbed above $38 per ounce, hitting a one-week high on growing expectations of Fed rate cuts amid signs of the US labor market softening. Dive deeper

The Bank of England cut interest rates by 25 basis points to 4%, the lowest since March 2023, following a rare split vote. Inflation is expected to peak at 4% in September, while growth forecasts for 2025 were raised to 1.25%. Dive deeper

Germany’s exports rose 0.8% month-on-month to €130.5 billion in June 2025, driven by stronger demand within the EU. Exports to the US fell 2.1%, marking a third straight monthly decline, while shipments to Russia and China increased. Dive deeper

China’s exports rose 7.2% YoY to $321.8 billion in July 2025, driven by increased shipments to Southeast Asia and other key markets amid a temporary tariff easing. Exports to the US fell 21.7% for the fourth consecutive month, while rare earth and semiconductor exports surged. Dive deeper

US President Trump announced a 100% tariff on imported computer chips and semiconductors, exempting companies that manufacture them in the U.S. The move aims to boost domestic production amid rising global chip demand and supply shortages. Dive deeper

Sony reported a 23% rise in Q1 profit to 259 billion yen ($1.8 billion), driven by strong demand for games, network services, and imaging solutions. The company raised its full-year profit forecast to 970 billion yen, citing less impact from US tariffs than initially expected. Dive deeper

Toyota cut its full-year net profit forecast by 14% to 2.66 trillion yen ($18.06 billion) due to US tariffs and other factors, following a 36.9% drop in Q1 net income. The US-Japan trade deal in July lowered tariffs to 15%, but the impact and implementation timing remain uncertain. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Prime Minister Narendra Modi on the US tariff hike and farmers' interests

“Interests of farmers are a top national priority. India will never compromise on the interests of farmers, livestock holders, and fishermen.”

“I know I'll have to pay the price for it personally, but I'm ready to do it for the farmers.”

Ministry of External Affairs (MEA) statement on US tariffs

“India will take all actions necessary to protect its national interests.”

“India's imports of Russian oil are based on market factors and done with the overall objective of ensuring the energy security of 1.4 billion people of India.”

“It is therefore extremely unfortunate that the US should choose to impose additional tariffs on India for actions that several other countries are also taking in their own national interest.” - Link

Tuhin Kanta Pandey, Chairman, Securities and Exchange Board of India (SEBI), on India’s PMS industry

“India’s Portfolio Management Services industry is standing at a crucial juncture, poised for transformative growth driven by investor sophistication, technological advancement, and an evolving regulatory environment.”

“You offer bespoke solutions aligned with an investor’s risk appetite, financial goals, and time horizon, backed with transparency and performance-linked fees.”

“Discretionary AUM, excluding EPFO and Provident Funds, has grown at 23% annually. That’s a sign of growing trust in active management.”

“Onboarding, reporting, and engagement must be digitally enabled. SEBI’s tech-driven supervision now puts the onus on the entire PMS ecosystem to embrace innovation.”

“India’s PMS industry is at an inflection point... sustained growth will depend on continuous innovation, strengthened processes, investment in technology, and above all, keeping clients’ interests at the centre.” - Link

Scott Wang on inward-looking trade policies and globalisation impacts

“There is a rise of unilateralism, protectionism, and nationalism. These are all sort of inward-looking. Tariffs are the same thing. It’s to protect domestic manufacturers.”

“Inward-looking doesn’t necessarily mean focusing exclusively on domestic markets, but that international policy is also becoming increasingly region-based or block-based, resulting in trends like near-shoring and friend-shoring.”

“If you look at the situation right now, it didn’t happen overnight. It has kind of been evolving over the past decade at least.”

“When you’re talking about the ‘golden era’ of globalisation, it brought prosperity and growth on a global scale, but there were also issues. The issue was that the distribution of wealth was very uneven among countries and among classes inside a country.”“These are all kind of because of some of the issues with that ‘golden’ version of globalisation. So, the World Trade Organisation’s position is that we’re moving towards a more inclusive, more sustainable, more common prosperity type of globalisation, but we’re not there yet.”

“We’re probably in a transitional period where you see a lot of uncertainty, a lot of turmoil.” - Link

Tim Cook on Apple’s US manufacturing investment

“This year alone, the American manufacturers are on track to make 19 billion chips for Apple in 24 factories across 12 different states.”

“We’re committed to buying American-made and advanced rare-earth magnets developed by MP Materials, which will become part of Apple’s devices shipped around the world.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

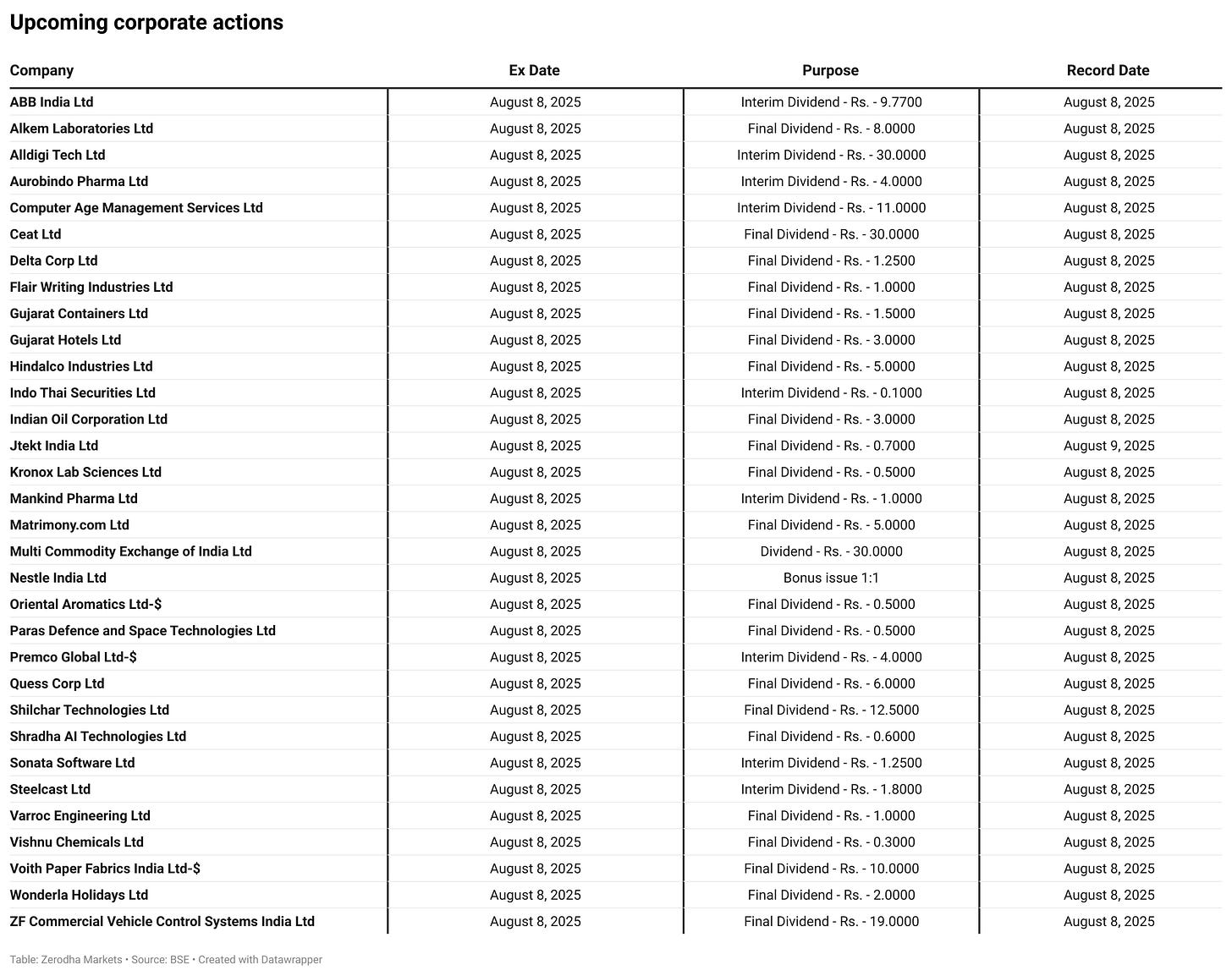

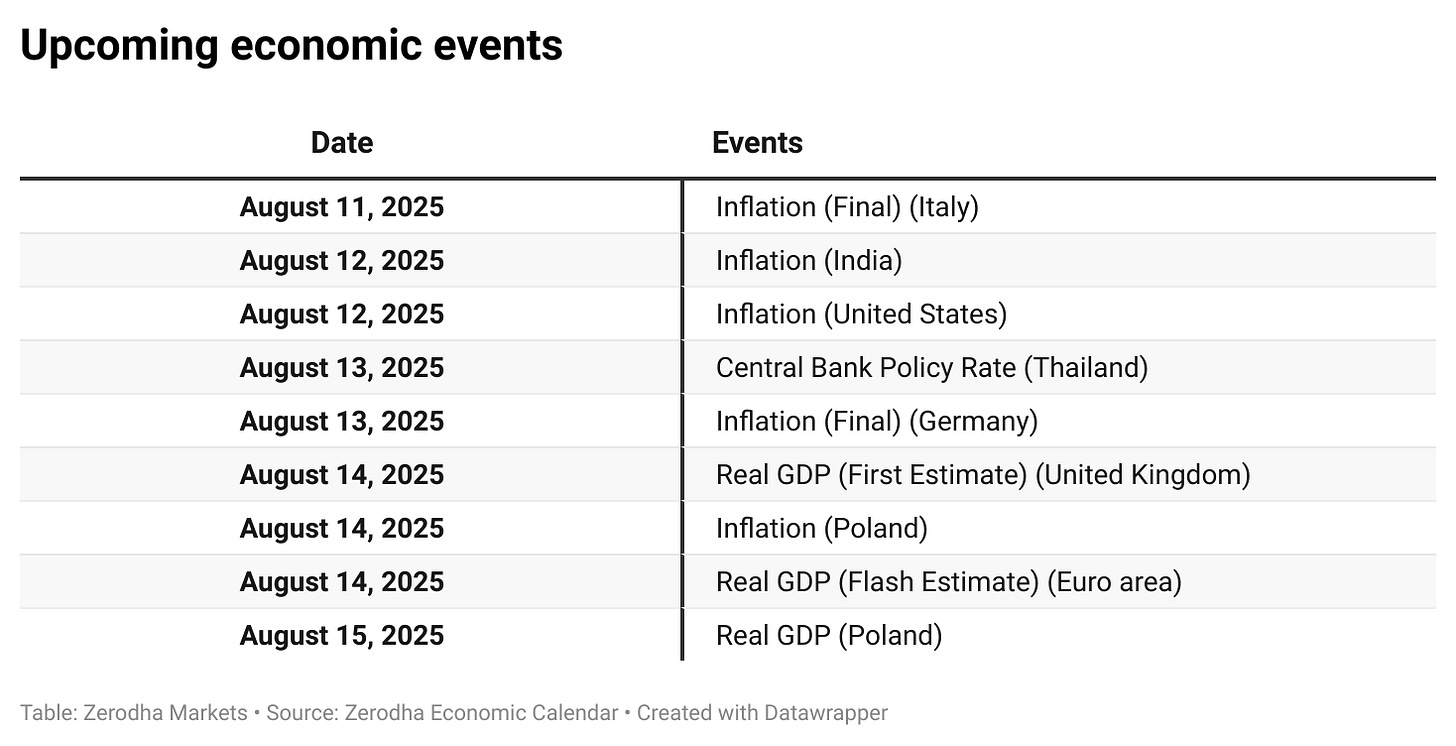

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Why is it " former us president trump" ?