Nifty gains late amid cautious mood over trade talks

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

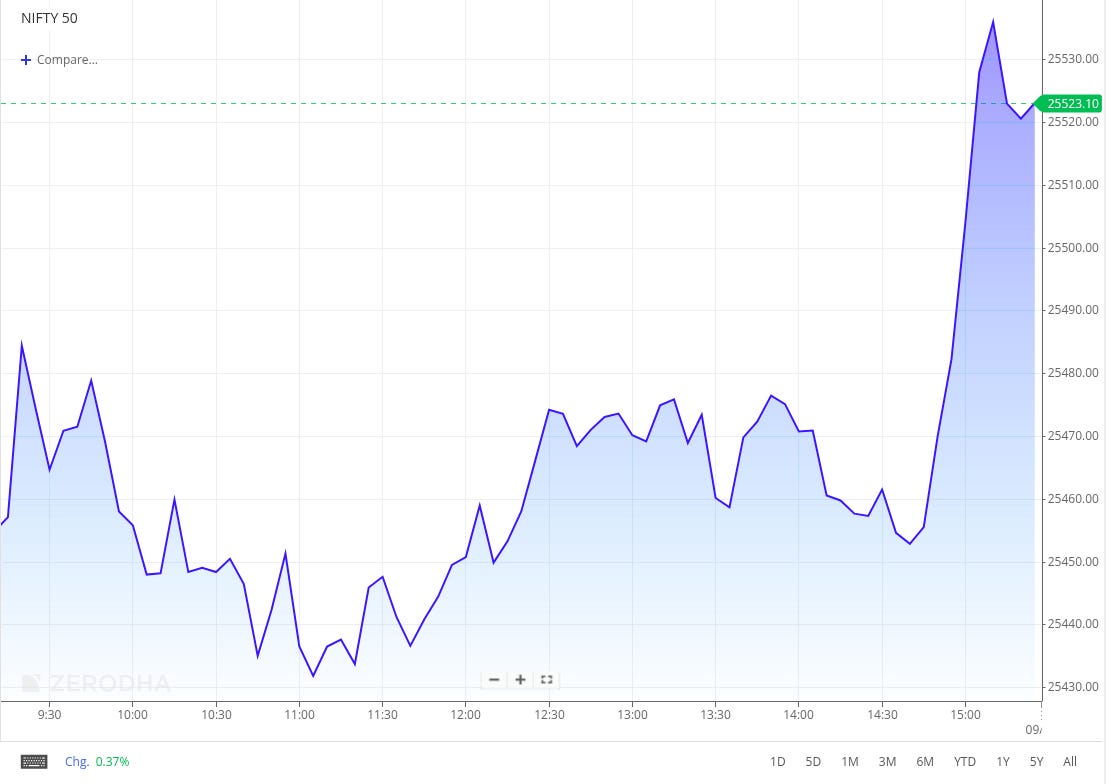

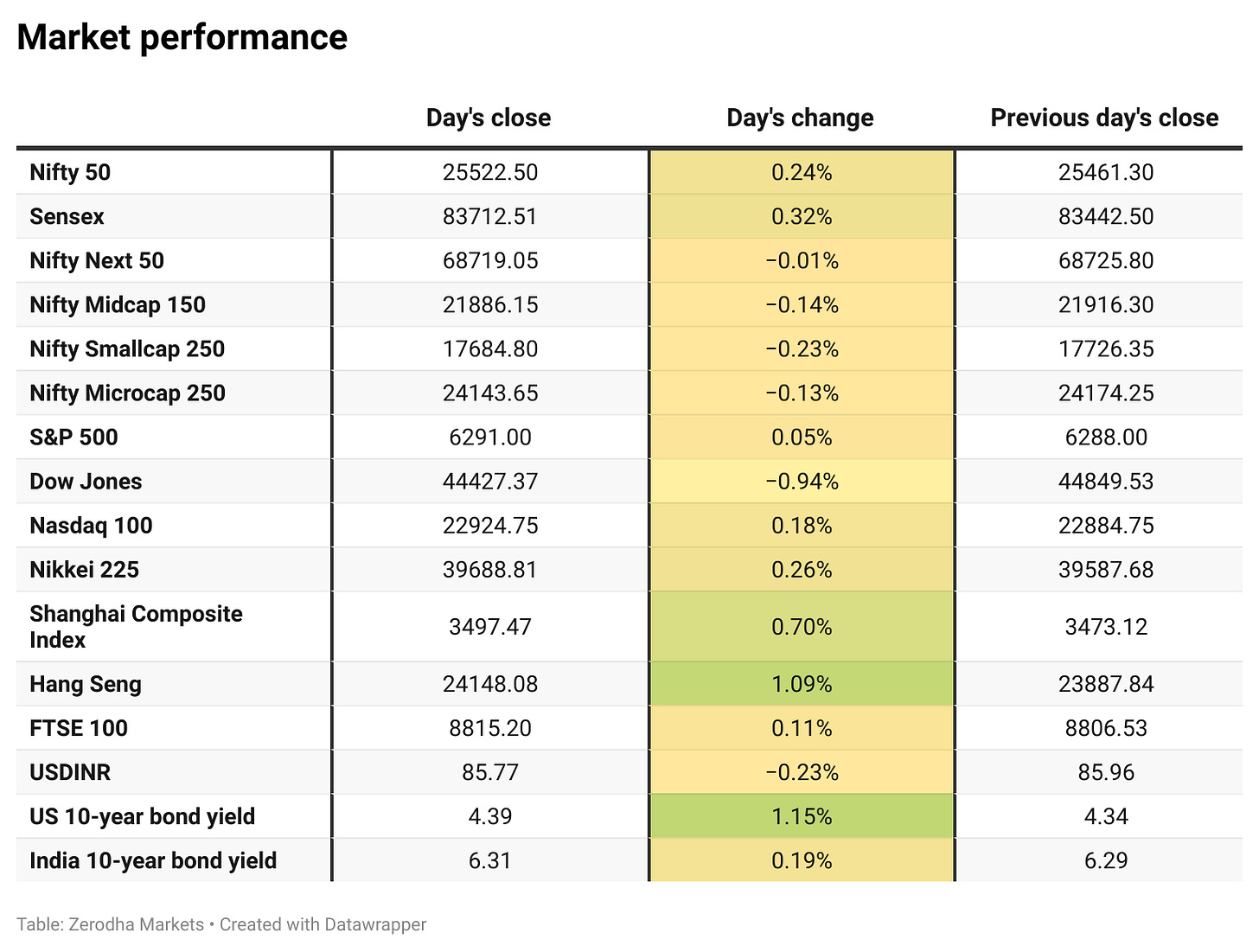

Nifty opened slightly lower at 25,427.85 and rose to 25,494.70 in the opening hour. It traded sideways thereafter, hitting an intraday low of 25,430. In the final hour, the index surged to a high of 25,547.40 and closed near the high at 25,522.50, up 0.24%.

Markets mirrored gains in Asian peers while tracking updates on the India–US trade deal, with the US extending the tariff suspension deadline to August 1. Investor sentiment remained cautious despite mildly encouraging signals. Attention now turns to earnings and upcoming macro data.

Broader Market Performance:

Broader markets remained subdued. Out of 3,024 stocks traded, 1,350 advanced, 1,561 declined, and 113 remained unchanged.

Sectoral Performance:

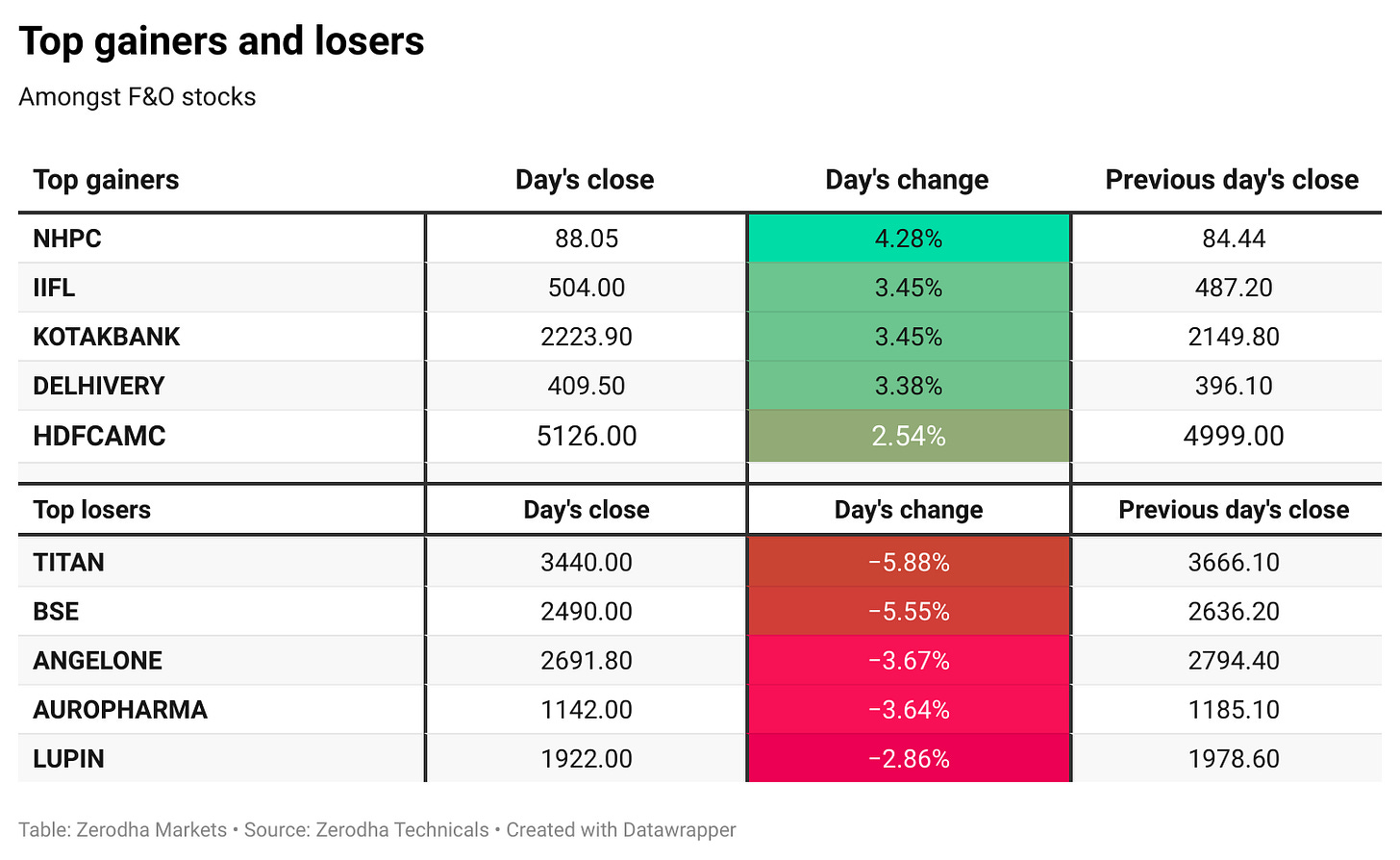

Nifty Realty outperformed, gaining 0.99%, followed by Services up 0.55% and Bank up 0.54%. IT and Energy also closed in the green with modest gains.

On the other hand, Consumer Durables saw the sharpest decline at 2.29%, followed by Pharma down 0.89% and Auto down 0.38%. FMCG, PSU Bank, and Media ended slightly negative.

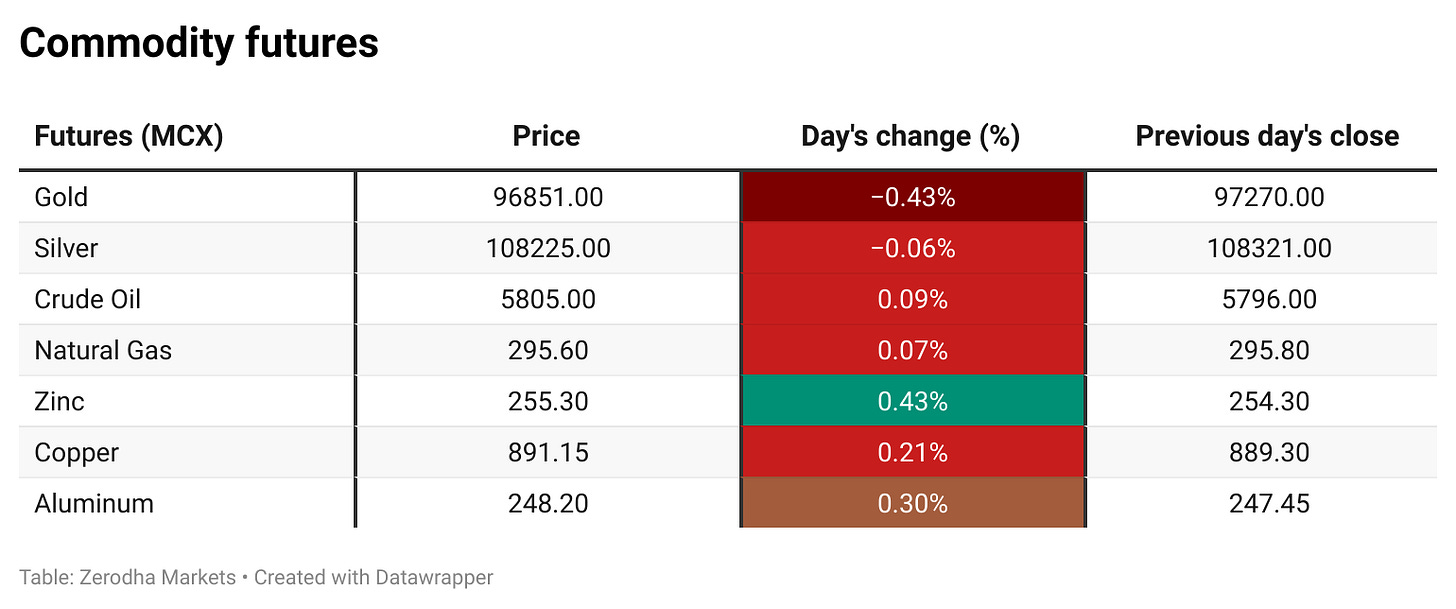

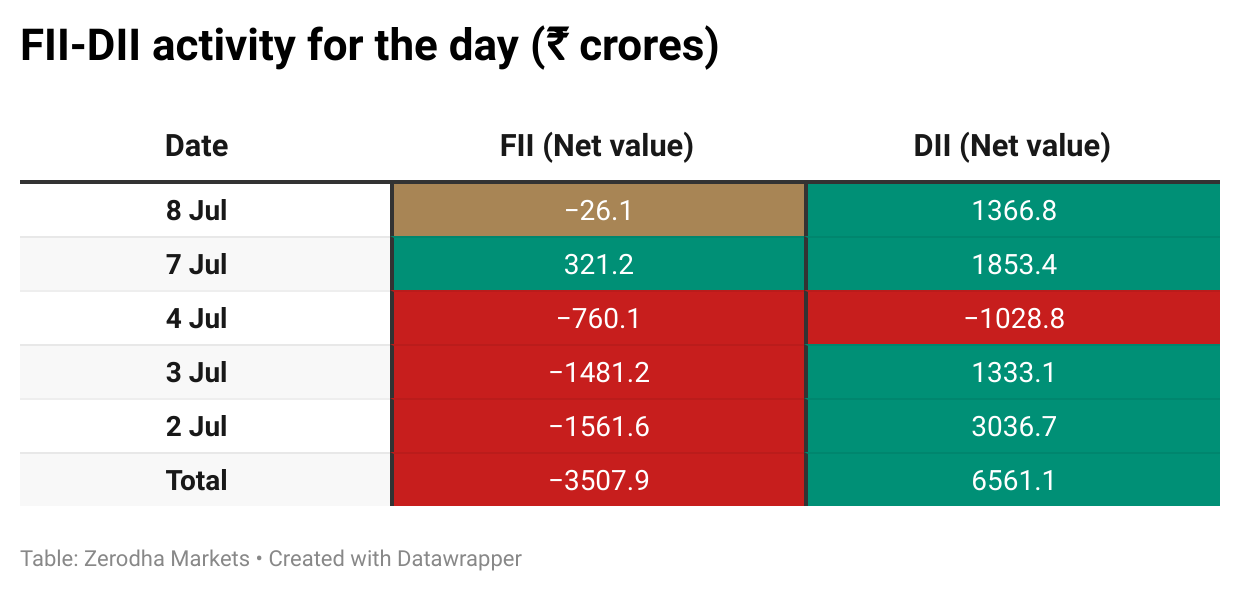

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

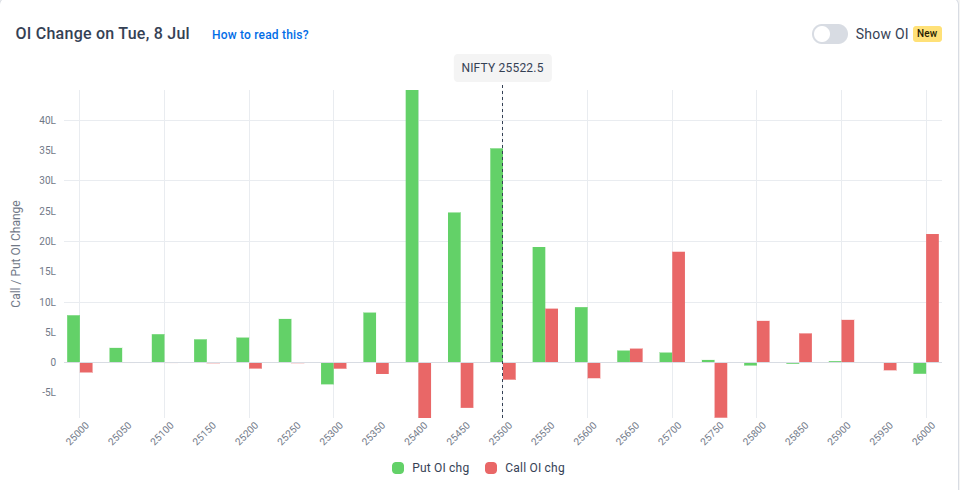

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 10th July:

The maximum Put Open Interest (OI) addition is observed at 25,400, followed closely by 25,500, suggesting strong support around 25,400 to 25,500 levels.

The maximum Call Open Interest (OI) addition is seen at 26,000, followed by 25,700, indicating strong resistance around 25,700 to 26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI suggests resistance in a falling market, while an increase in Put OI suggests support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

SEBI's latest study revealed that 91% of individual traders in equity derivatives incurred net losses in FY25, similar to FY24, despite regulatory curbs. Index options turnover fell year-on-year, and individual investor participation also declined. Dive deeper

Adani Group has raised over $3.2 billion in six months and is on track to complete a $5 billion fundraising target in FY26. Capital is being raised across Adani Green, Enterprises, and Services through equity, debt, and JVs. The group plans to invest $15-20 billion over five years in infrastructure. Dive deeper

Jio BlackRock plans to launch nearly a dozen low-cost equity and debt funds by year-end, targeting retail and institutional investors directly. The venture aims to bypass distributors using Jio’s digital platforms and BlackRock’s Aladdin system. It has already raised over ₹17,800 crore across three debt funds. Dive deeper

Puravankara secured redevelopment orders for eight residential societies in Mumbai’s Chembur suburb, with a total development value of ₹2,100 crore. The projects span four acres and will unlock over 1.2 million sq. ft. of potential. Dive deeper

Adani Power has completed the ₹4,000 crore acquisition of Vidarbha Industries Power Ltd, which operates a 600 MW coal-based plant in Maharashtra. The resolution plan was approved by NCLT and implemented on July 7. The plant was acquired under the IBC process. Dive deeper

Lodha Developers has raised ₹300 crore via non-convertible debentures on a private placement basis to support business growth. The debentures carry a 7.96% coupon and will be redeemed at par after three years. The allotment was approved by the board’s executive committee. Dive deeper

Adani Group has partnered with MHADA for the redevelopment of Motilal Nagar in Goregaon (West), Mumbai, touted as India’s largest at 142 acres. The project includes free rehabilitation into 1,600 sq. ft. apartments and a five-acre central park. MHADA will receive 397,100 sq. m. of constructed area. Dive deeper

MCX will launch electricity futures on July 10, a day before NSE, with contracts available for all 12 calendar months. The contracts will be cash-settled based on IEX prices and aim to aid hedging in the power sector. Initial trading will cover the current and next three months. Dive deeper

Edelweiss Financial Services has launched a ₹300 crore secured NCD issue with yields up to 10.49% across 12 series, offering tenures from 24 to 120 months. The funds will be used to repay debt and meet corporate needs. Dive deeper

Trident shares rose after the US imposed a 35% tariff on Bangladeshi textiles, potentially boosting Indian exporters. Regulatory clarity and strong technicals also supported sentiment. India currently faces a 10% average tariff on textile exports to the US. Dive deeper

Acme Solar plans to invest ₹17,000 crore in FY27 to expand its firm and dispatchable renewable energy capacity. The company aims to operationalize 6,970 MW by 2028 and reach 10 GW by 2030. It has already completed 450 MW of its 550 MW FY26 target. Dive deeper

Shakti Pumps raised ₹292.6 crore through a Qualified Institutional Placement by issuing 31.87 lakh shares at ₹918 each. The funds will be used to set up a 2.20 GW solar cell and PV module manufacturing plant in Madhya Pradesh. Dive deeper

What’s happening globally

Brent crude fell to $69.2/barrel as US tariff threats raised demand concerns and OPEC+ announced a bigger-than-expected supply hike of 548,000 bpd for August. This marks the fourth straight output increase, reversing most earlier voluntary cuts. Dive deeper

Gold fell to around $3,320/oz as markets reacted to Trump's tariff threats on 14 countries, including Japan and South Korea. Fears eased slightly after he delayed the tariffs from July 9 to August 1, allowing more time for deals. Dive deeper

Taiwan’s trade surplus jumped to $12.07 billion in June 2025, more than double last year’s figure. Exports hit a record high of $53.32 billion, led by tech products, especially info-comm and electronics. Imports rose 17.3%, driven by machinery and tech parts, while overall trade grew sharply in the first half of the year. Dive deeper

The yen fell to a two-week low after President Trump announced 25% tariffs on Japanese and South Korean goods, effective August 1. The won also dipped before slightly recovering. Both countries plan to negotiate with the U.S. to ease the impact. Dive deeper

Romania’s central bank kept interest rates unchanged at 6.5% due to inflation concerns. Upcoming tax hikes in August are expected to push inflation higher in the short term. But these measures may help reduce the budget deficit and lower inflation later. Dive deeper

The euro rose slightly above $1.175, nearing a 3-year high, after the US proposed a 10% baseline tariff deal with the EU, easing trade tensions. Key sectors like aircraft and spirits may get exemptions, but autos and metals remain excluded, raising EU concerns. Dive deeper

Samsung Electronics has signed a deal to acquire U.S.-based healthcare platform Xealth as part of its push into mobile healthcare services. The move aims to integrate Samsung’s wearable tech with Xealth’s platform, which connects over 500 U.S. hospitals with patients. Dive deeper

France’s trade gap widened to €7.8 bn in May 2025, its largest since last September. Exports slipped 0.3 % to €48.9 bn, hurt by lower energy and publishing sales and weaker demand from Asia and the Americas, though shipments to the EU rose. Imports edged down 0.2 % to €56.7 bn, rising from the EU and Africa but falling elsewhere, leaving the deficit larger. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Aadhar Bansal, Director, Nexgen Exhibitions, on India’s drone industry growth

“The entire world has witnessed the impressive capabilities of drones during Operation Sindoor.”

“I firmly believe that adopting indigenous drones will strengthen the Make in India initiative and contribute to national prosperity across multiple sectors.”

“About 20% of the respondents believe that drones will create a boom in rural India in the next five years by enhancing smart agriculture in the region.” - Link

Elon Musk’s X on India’s social media account bans

“We are deeply concerned about ongoing press censorship in India due to these blocking orders.”

“X is exploring all legal options available.”

“Unlike users located in India, X is restricted by Indian law in its ability to bring legal challenges against these executive orders.”

“We urge affected users to pursue legal remedies through the courts.” - Link

Thomas Dohmke, CEO, GitHub, on AI and software developer jobs

“If you 10x a single developer, then 10 developers can do 100x.”

“I think the idea that AI, without any coding skills, lets you just build a billion-dollar business is mistaken. Because if that would be the case, everyone would do it.”

“The recent rounds of employee firings and recruitment freezes are a natural conclusion for the short term.”

“AI has already added more work to the backlogs. I haven't seen companies saying, 'Well, we're draining all our backlog and we have almost nothing left.’”

“AI would democratise access to coding skills for many, making it easier to learn coding for beginners and easier to code for experienced developers.”

“As the technology evolves, so will the capabilities of engineers.”

“Now is the most exciting time to be a developer.”

“The dream of software development was always that I can take the idea that I have in my head on a Sunday morning, and by the evening, I have the app up and running on my phone.” Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Thanks for reading Aftermarket Report by Zerodha! Subscribe for free to receive new posts and support my work.