Nifty ends above 25,000 as trade deal optimism lifts sentiment

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

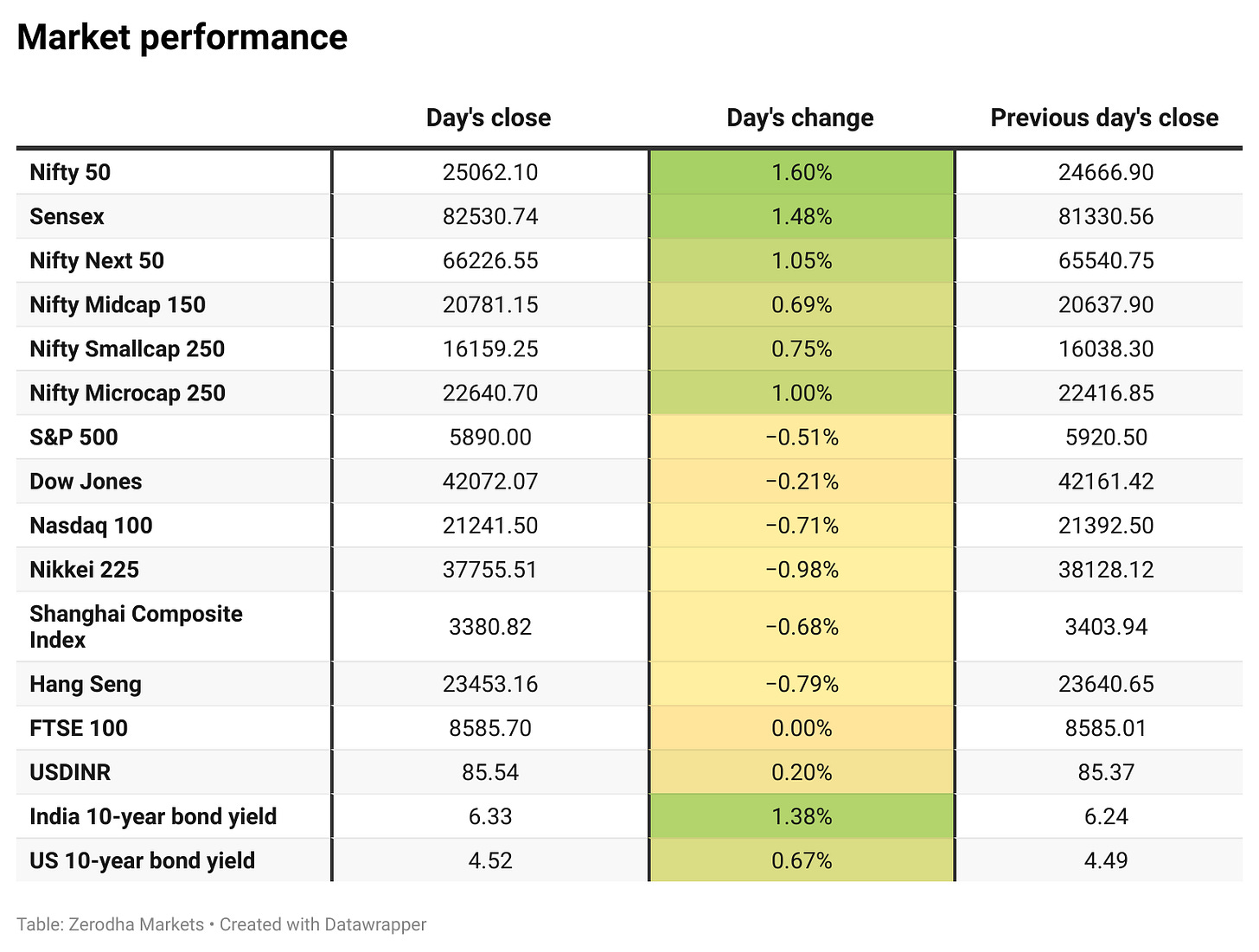

Market Overview

Nifty opened with a 30-point gap up at 24,694.45, initially dipping towards the 24,500 zone in the first hour. However, it quickly recovered, gaining 300 points within 15-20 minutes to reach the 24,800 level around 11 AM. The index then retreated to 24,600 but bounced back to the 24,700 zone by 1 PM. In the afternoon, Nifty gained strong momentum, breaking key resistance levels to test 25,100 by 2 PM. It then consolidated in a tight range between 25,050 and 25,100 in the final hour, eventually closing above 25,000 for the first time in seven months at 25,062.10, up 1.60%.

Steady FII inflows, positive global cues, easing CPI and WPI inflation, and optimism around trade deals supported the market, though geopolitical tensions and the ongoing earnings season remain critical for near-term direction.

Broader Market Performance:

Broader markets had a strong session today. Of the 2,942 stocks traded on the NSE, 1,980 advanced, 890 declined, and 72 remained unchanged.

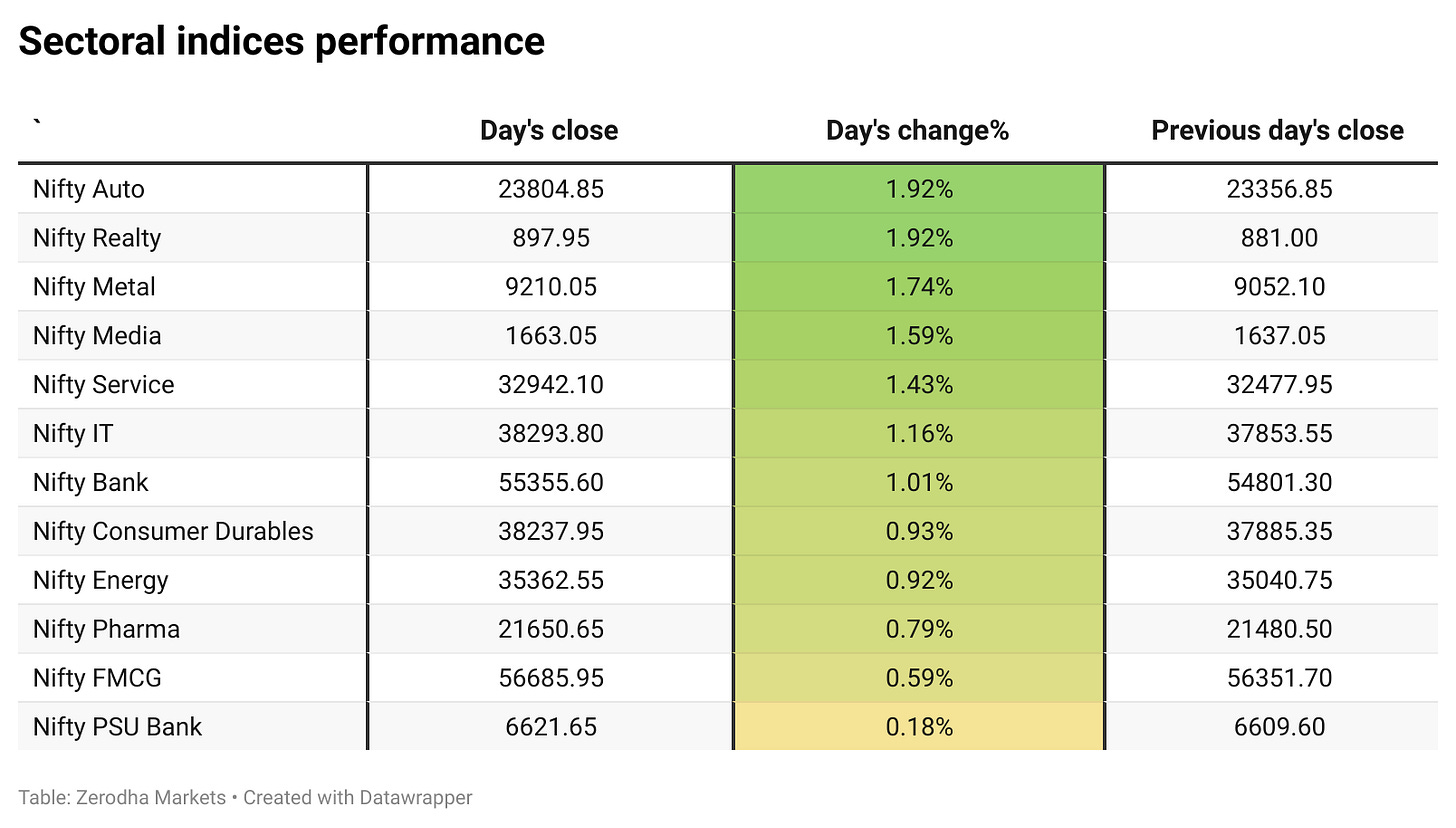

Sectoral Performance:

The top-gaining sector for the day was Nifty Auto, which closed 1.92% higher at 23,804.85, followed closely by Nifty Realty, also up 1.92% at 897.95. On the other end, Nifty PSU Bank was the weakest performer, closing just 0.18% higher at 6,621.65.

Overall, all 12 sectors closed in the green, reflecting broad-based buying across the market, with no sectors ending the day in the red.

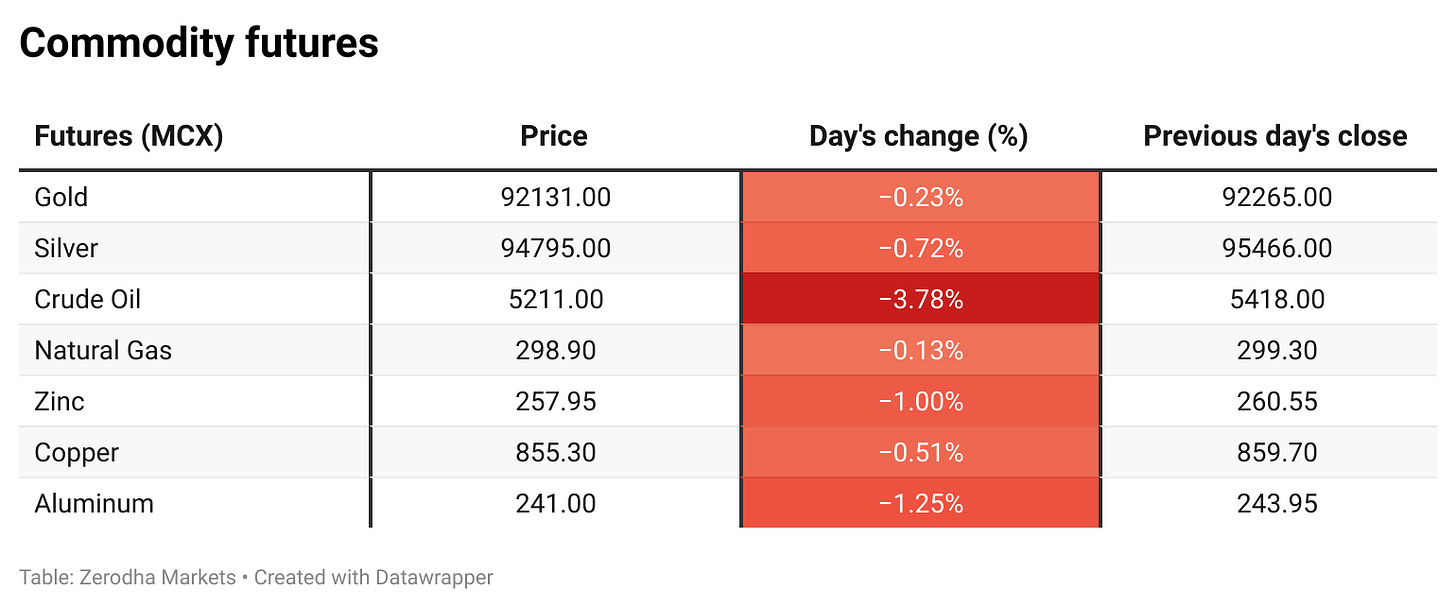

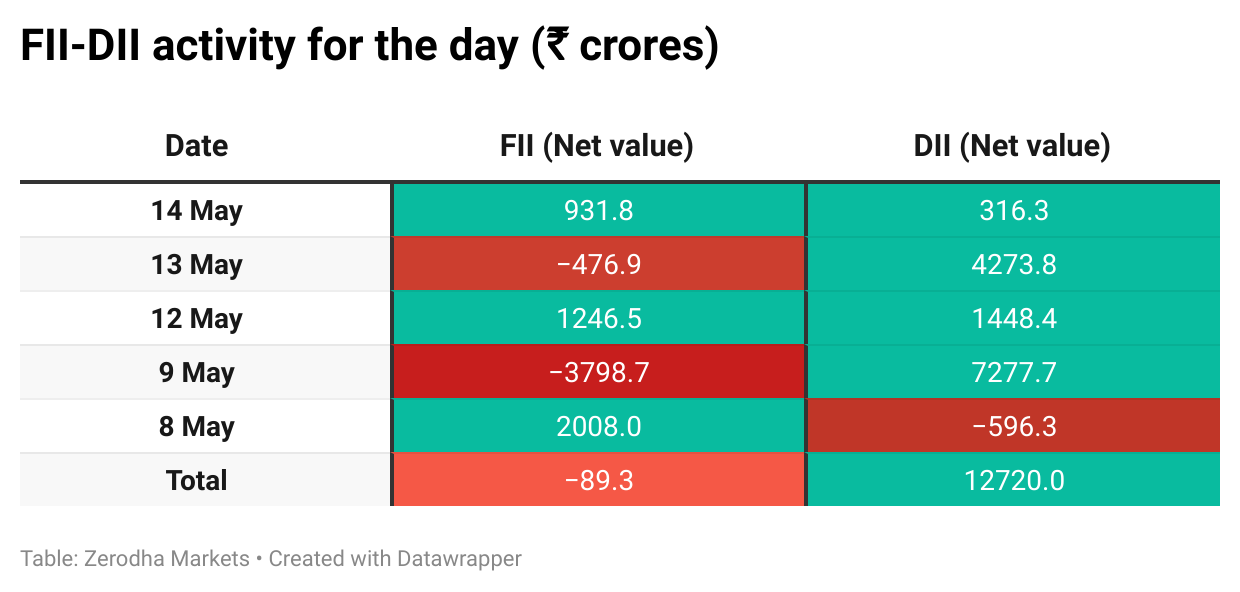

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 22nd May:

The maximum Call Open Interest (OI) is observed at 25,500, followed closely by 25,000, indicating strong resistance at 25,200 to 25,400 levels.

The maximum Put Open Interest (OI) is 25,000, followed by 24,600, suggesting strong support at 25,000 and additional support at 24,600.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

US President Donald Trump, during a visit to Doha, announced that India has proposed a trade deal offering "basically zero tariffs" on a broad range of American goods, as reported by Reuters. This follows his earlier remarks on April 30, where he expressed optimism about ongoing tariff negotiations with India, stating, "India tariff talks are going great, think we'll have a deal soon." Dive deeper

ITC Hotels reported a 41% year-on-year increase in net profit to ₹257 crore for Q4 FY25, with revenue rising 17% to ₹1,061 crore. This marks the company's first quarterly earnings announcement since its demerger from ITC. Dive deeper

In April 2025, passenger vehicle dispatches rose 4% YoY, led by strong SUV demand. Two-wheeler sales fell 17% due to weak rural demand and inflation. SIAM said the auto market showed mixed trends with PVs up and bikes struggling. Dive deeper

Wendt India shares crashed 20% after its German promoter launched an Offer for Sale at a 38% discount. The promoter plans to sell up to a 37.5% stake with a floor price of ₹6,500 per share. Heavy discount triggered panic selling in the stock. Dive deeper

Page Industries Q4 profit jumped 52% YoY to ₹1,640 crore, beating estimates, driven by strong athleisure demand. Revenue rose 10.6% to ₹10,980 crore, and EBITDA margin improved to 21.4% from 16.6% last year. Growth was aided by more stores, online sales, and stable raw material costs. Dive deeper

Solar Industries shares hit a 52-week high after a successful deployment of its Nagastra-1 drones by the Indian Army. Nagastra is a precision loitering munition developed with ZMotion, capable of GPS-guided strikes and parachute return. The first batch of 480 drones was delivered in June 2024, boosting confidence in India’s defense tech. Dive deeper

Remsons Industries shares jumped 18% to a 4-month high after winning a ₹300 crore order from Stellantis North America. This is Remsons' biggest deal ever, worth 63% of its market cap. The 7-year contract covers control cables for Jeep, Smart Cars, and three-wheelers. Dive deeper

Persistent Systems fell 3% after key client UnitedHealth's CEO quit and the company pulled its 2025 forecast. UnitedHealth brings in over $100M and is Persistent’s biggest healthcare client. Brokerages said future growth may shift away from healthcare, pressuring valuations. Dive deeper

What’s happening globally

Brent crude prices fell over 3% to below $64 per barrel on Thursday, pressured by rising global supply concerns, including a potential US-Iran deal, unexpected US inventory builds, and OPEC’s reduced output growth forecast for 2025. Dive deeper

Eurozone industrial production rose by 2.6% month-over-month in March 2025, the strongest gain since November 2020, driven by a sharp rebound in durable consumer goods (3.1%), capital goods (3.2%), and non-durable consumer goods (2.3%), while intermediate goods maintained a steady 0.6% growth. Dive deeper

The Eurozone economy grew by 0.3% in Q1 2025, slightly below the initial estimate of 0.4%, supported by strong domestic demand, easing inflation, and lower borrowing costs, but facing headwinds from new U.S. tariffs, with Germany growing 0.2% and Spain leading with 0.6%. Dive deeper

US producer prices are expected to rise by 0.2% in April 2025, rebounding from a 0.4% decline in March, with core PPI projected to increase by 0.3%, while annual headline producer inflation is forecast to slow to 2.5%, the lowest in seven months. Dive deeper

The British economy grew by 1.3% year-on-year in Q1 2025, slightly below the previous quarter’s 1.5% but above market expectations, with the services sector expanding by 1.5% while industrial production continued to contract at -0.2%. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

US President Donald Trump to Apple CEO Tim Cook on "building in India"

"I said to him, my friend, I am treating you very good. You are coming up with $500 billion, but now I hear you are building all over India. I don't want you building in India. You can build in India, if you want to take care of India because India is one of the highest tariff nations in the world, so it is very hard to sell in India," - Link

Mr. B. Thiagarajan – Managing Director, Blue Star Ltd., on opportunities in the data center front

First, we are a leading player with a significant market share in MEP (Mechanical, Electrical, and Plumbing) solutions for data centers. This includes assembling all data center-related equipment, excluding servers. In the MEP segment, we have a strong presence and are a preferred vendor.

Additionally, we manufacture a range of chillers, including models specifically designed for data center applications, and we are actively expanding this portfolio. While liquid cooling has not yet gained significant traction in India, we are in discussions with several international partners to bring this technology to our market. - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

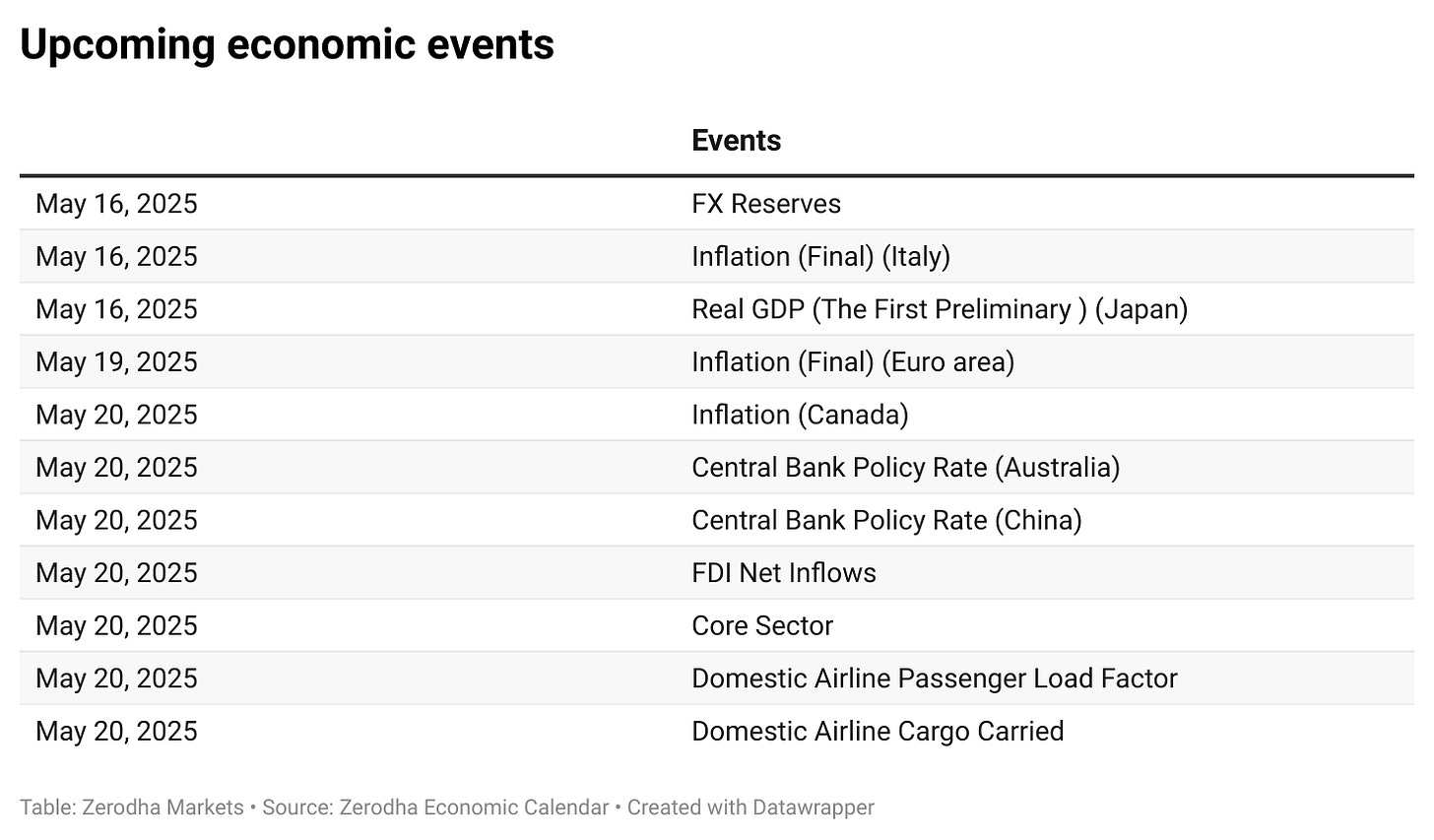

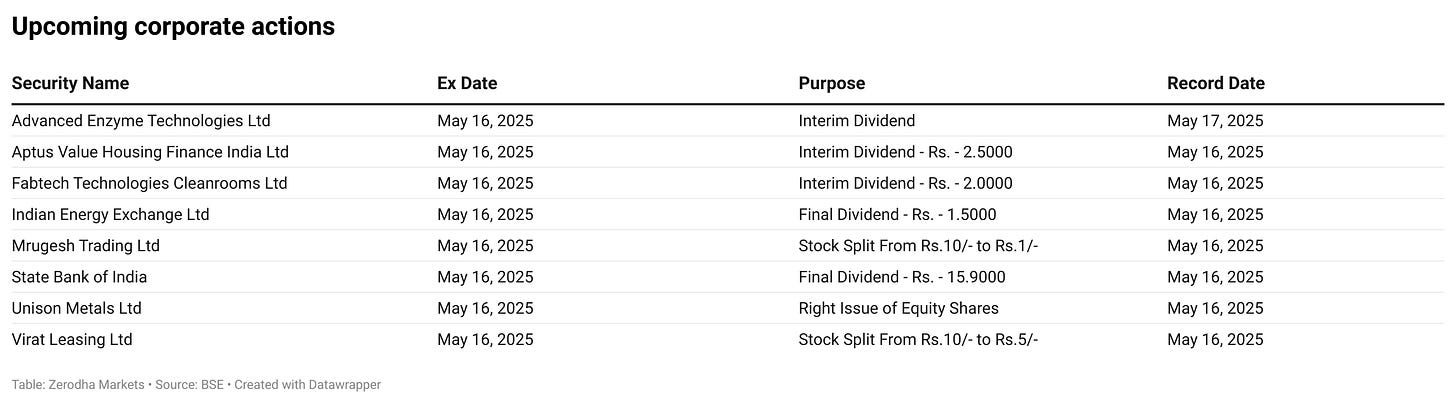

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.