Nifty drifts lower in cautious trade ahead of monthly expiry

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

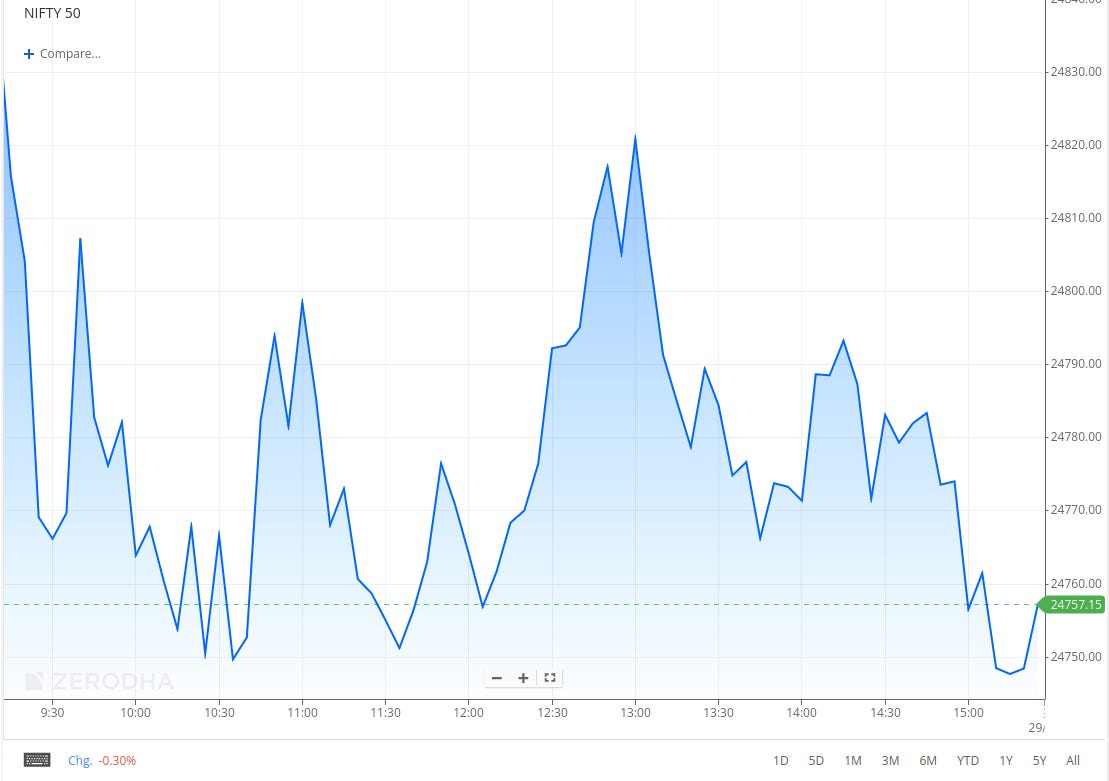

Nifty opened flat at 24,832.50 and touched the day’s high of 24,864.25 within the first 15 minutes. However, it quickly slipped by 100 points and remained in a narrow 50-point range between 24,750 and 24,800 through the first half. In the second half, apart from a brief spike to 24,820, the index stayed rangebound between 24,750 and 24,790, eventually closing at 24,752.45, down by 0.30%.

After yesterday’s volatility, the market traded in a tight range today ahead of the monthly expiry. Rising macroeconomic uncertainty remains a key concern. Investors are closely tracking developments in the India-U.S. trade deal, while the ongoing earnings season continues to guide near-term market sentiment.

Broader Market Performance:

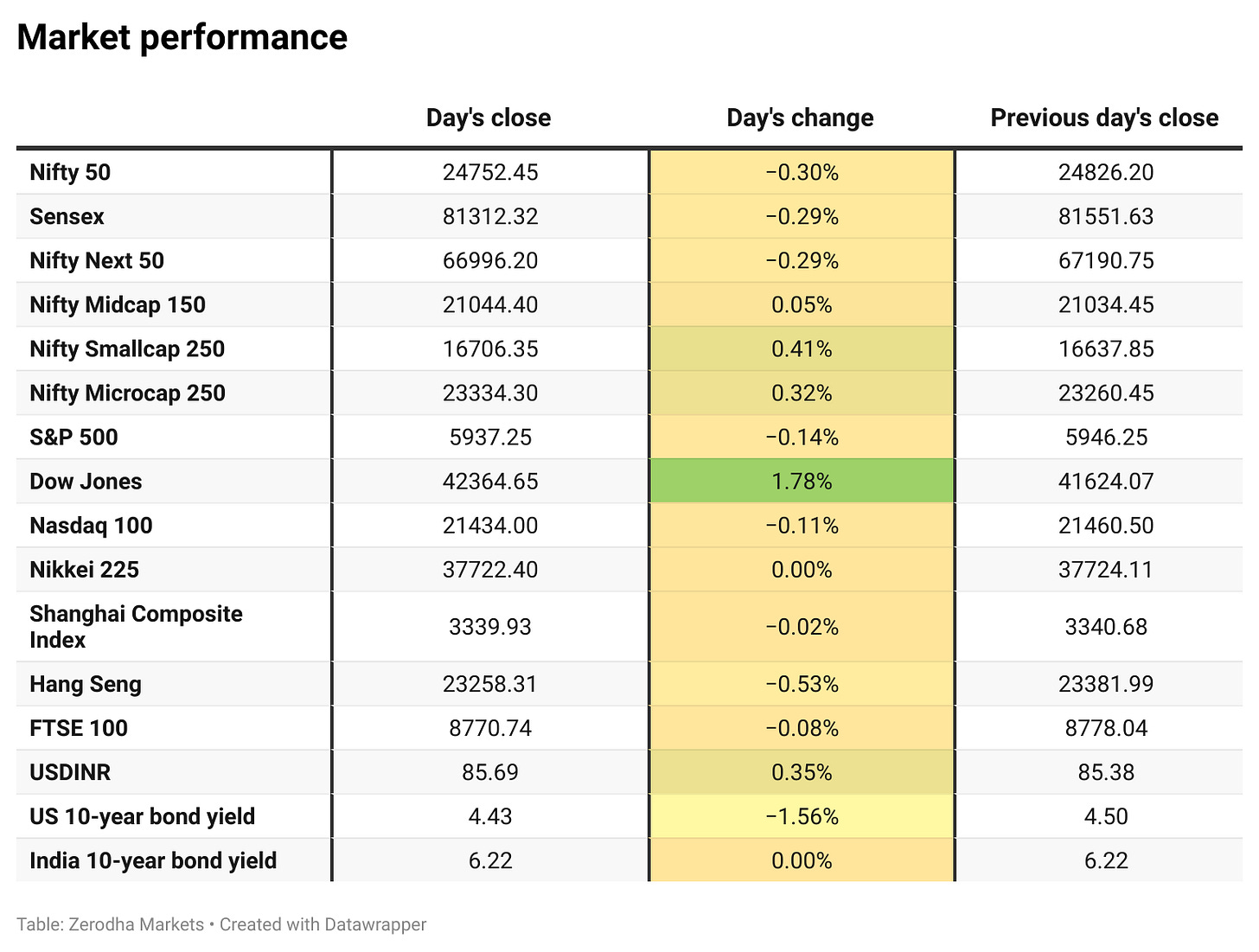

Broader markets had a mixed session with mildly positive bias today. Of the 2,940 stocks traded on the NSE, 1,462 advanced, 1,395 declined, and 83 remained unchanged.

Sectoral Performance:

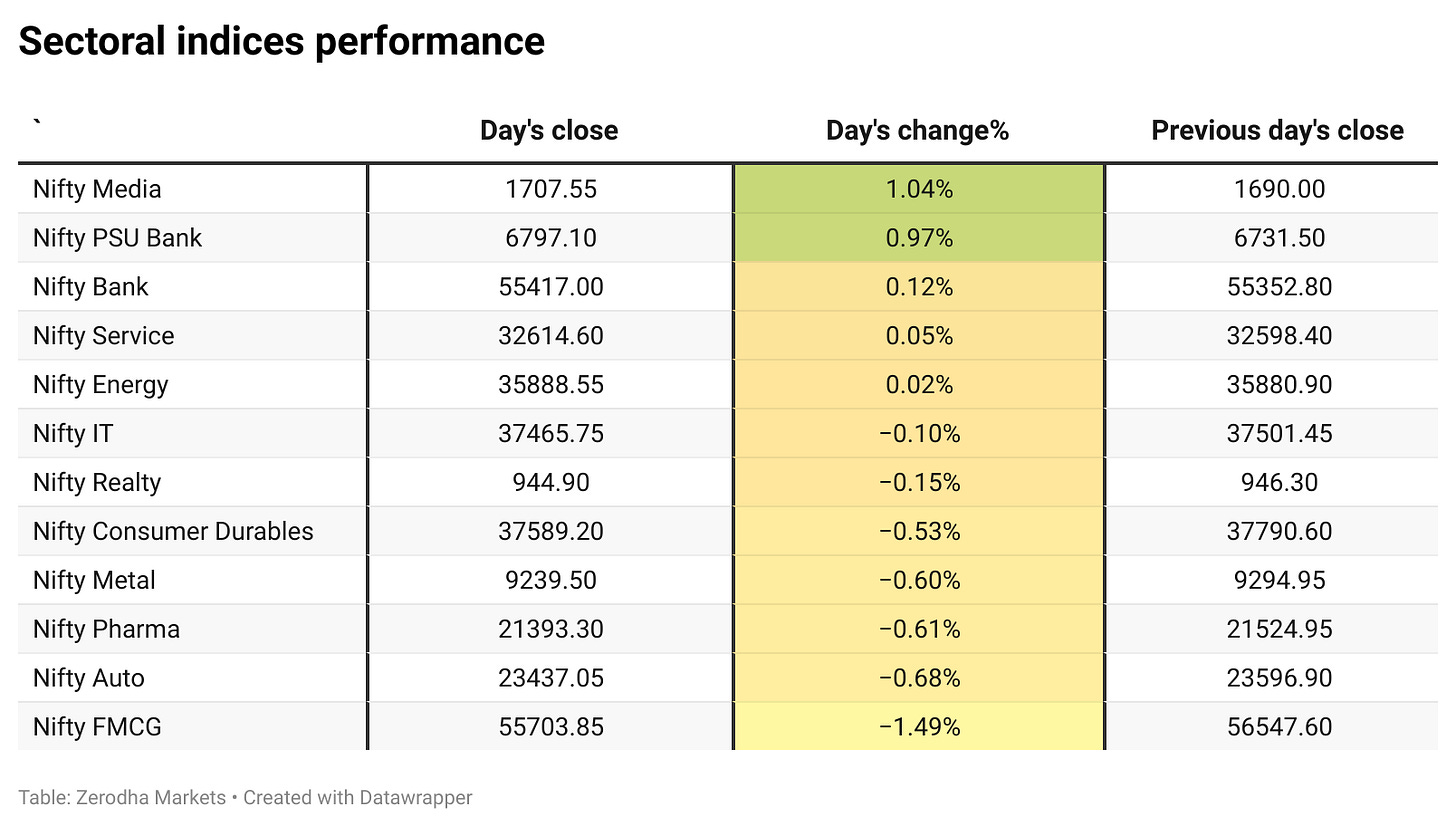

Nifty Media was the top gaining sector, rising by 1.04%, while Nifty FMCG was the top loser, slipping by 1.49%. Out of the 12 sectors listed, 5 sectors ended in the green and 7 sectors closed in the red.

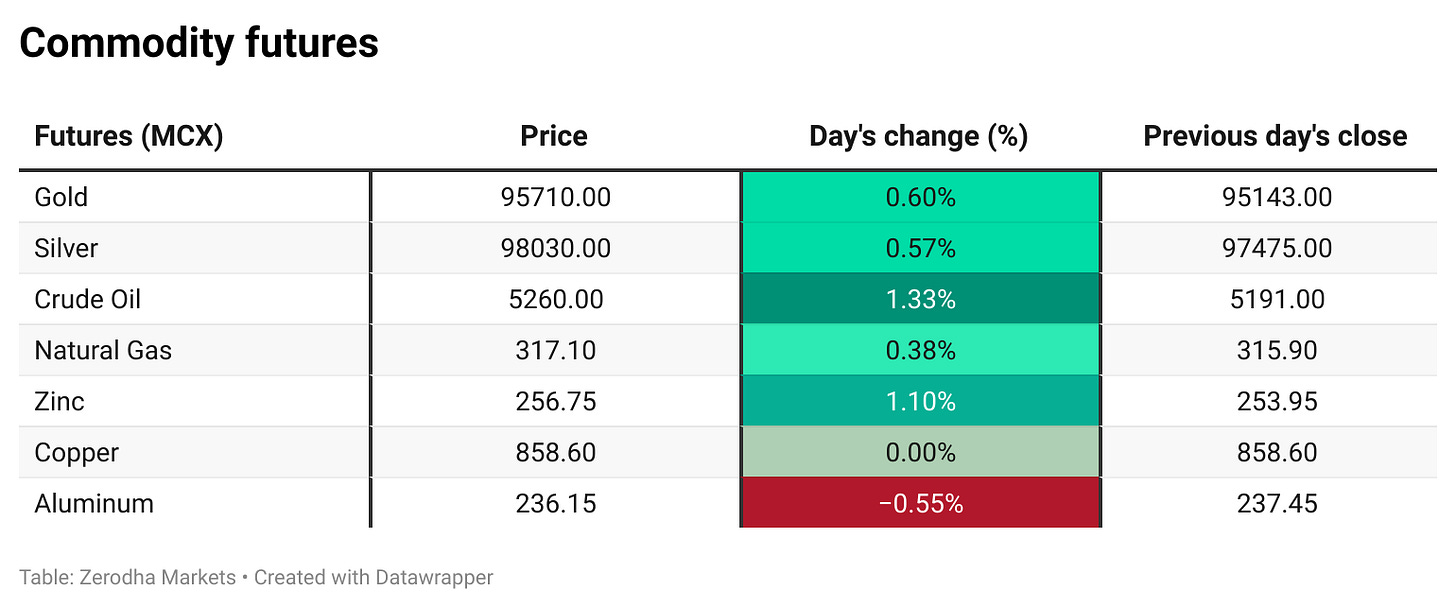

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 29th May:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,800, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,800, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

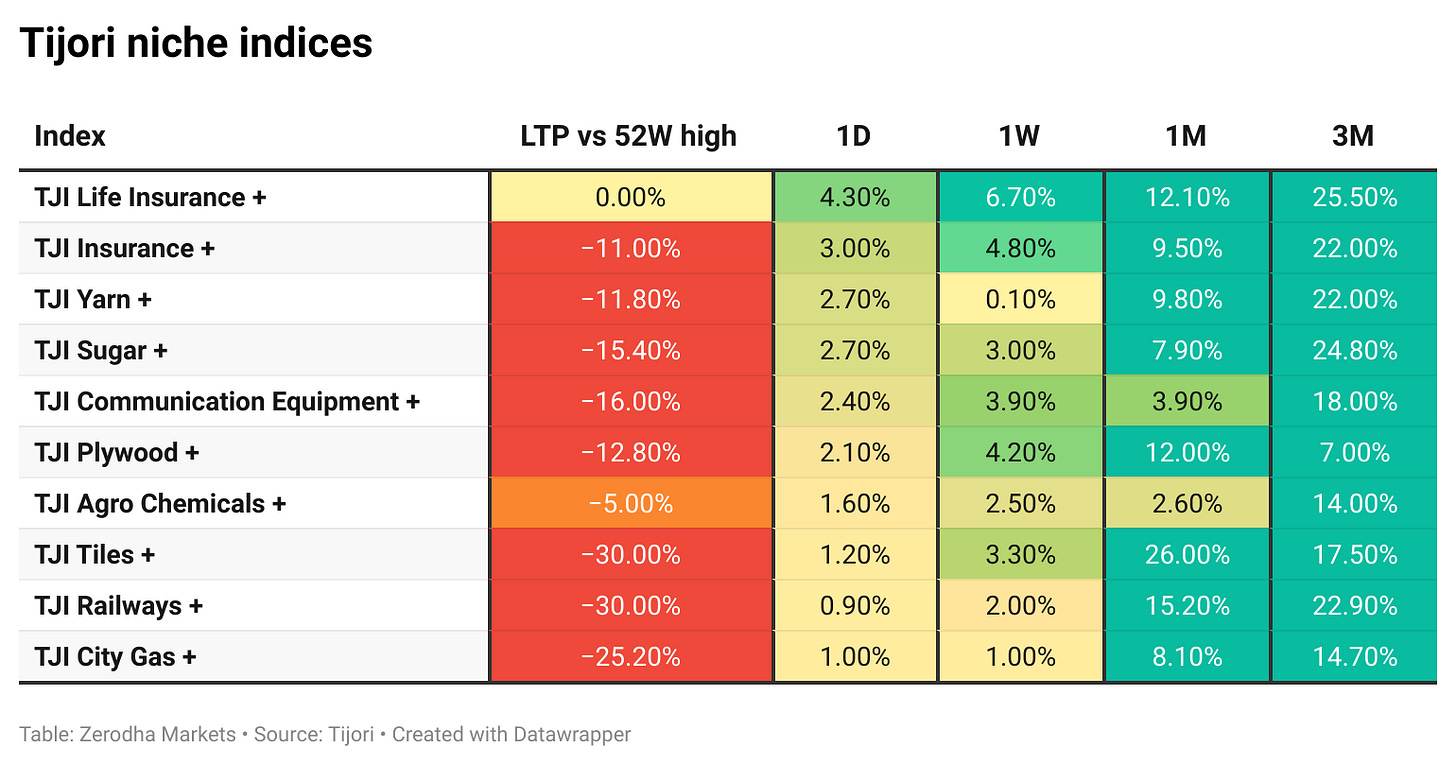

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

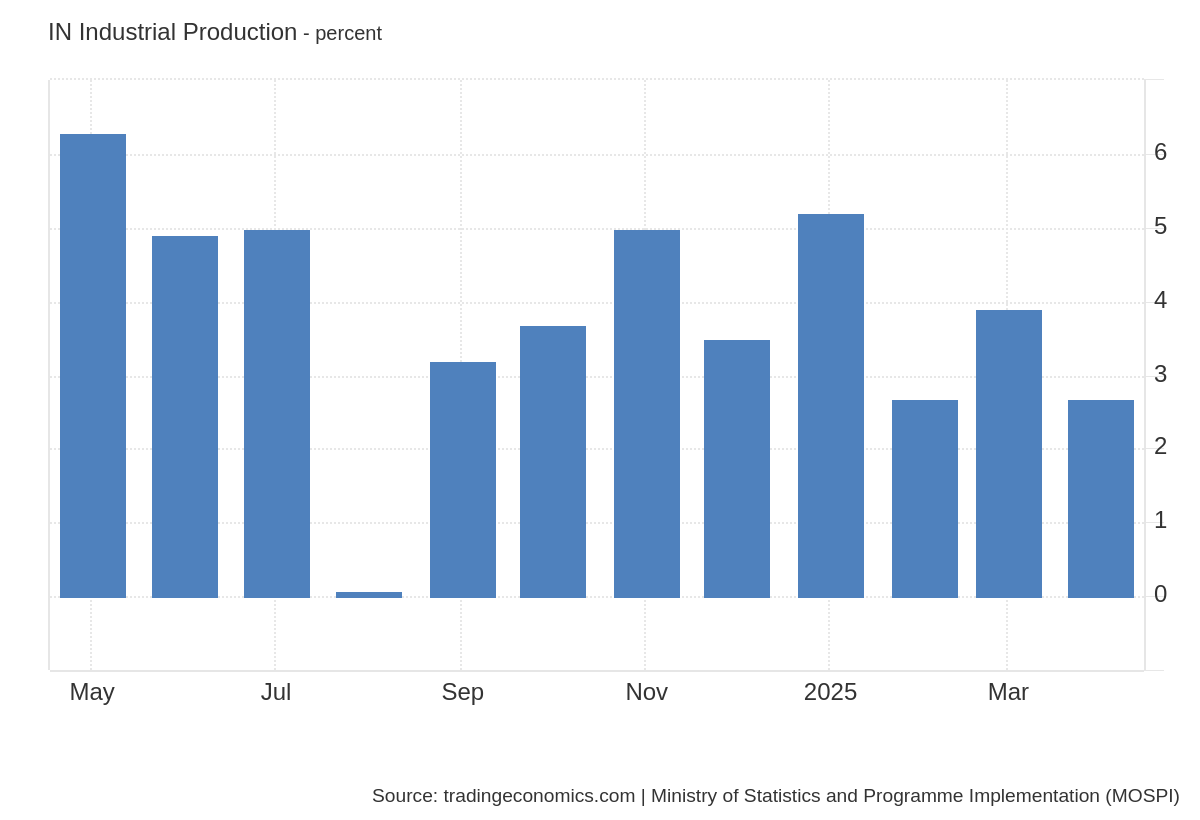

India’s industrial output rose 2.7% YoY in April, easing from 3.9% in March but beating forecasts. Manufacturing grew 3.4%, while electricity slowed and mining declined. Gains in electronics and autos offset pharma and chemical dips. Dive deeper

British American Tobacco, ITC’s top investor with a 20.3% stake, is considering further reducing its holding via an on-market sale. Last year, it sold a 3.5% stake for $2 billion in a major block deal. BAT said there's no certainty the transaction will proceed. Dive deeper

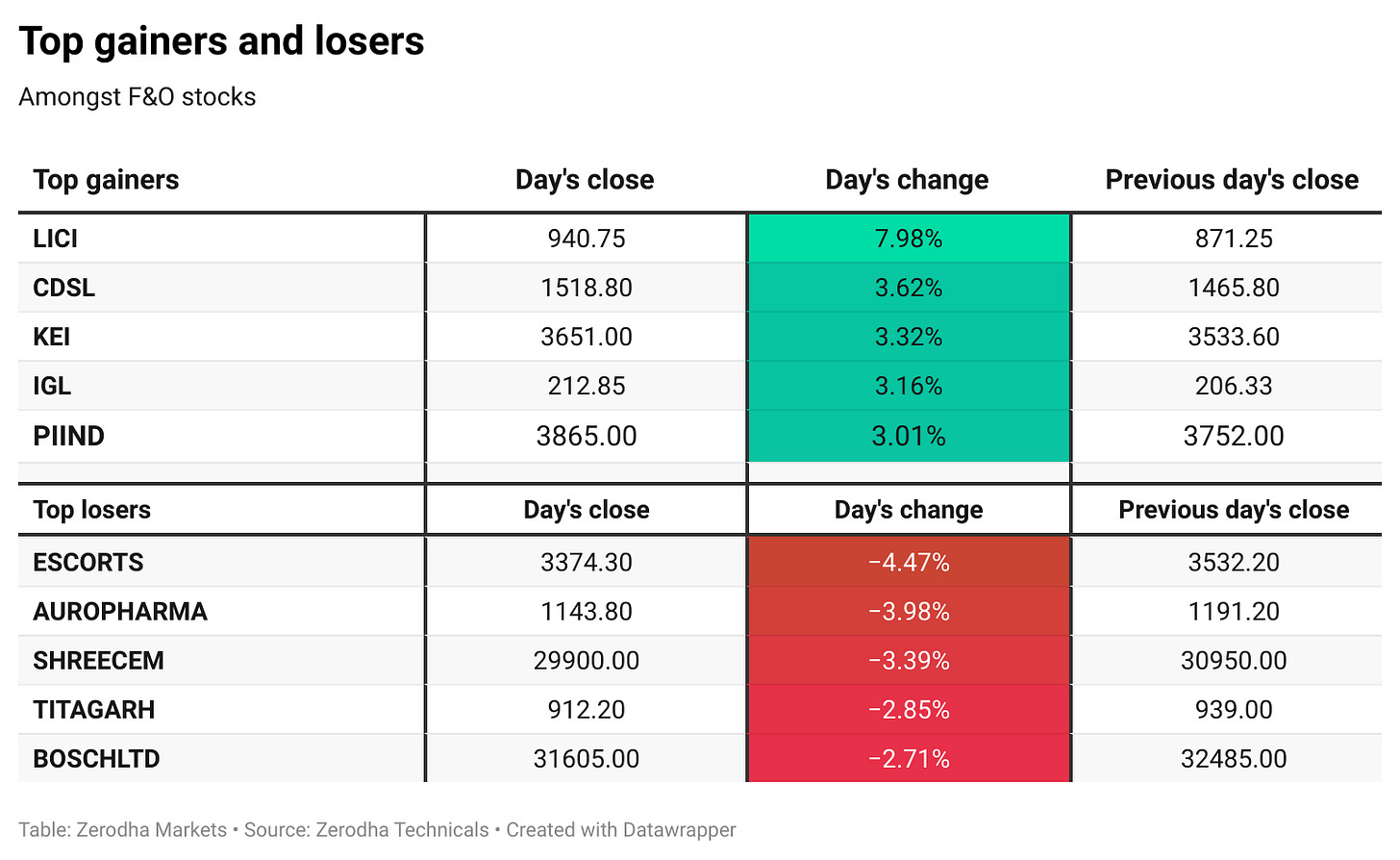

LIC reported a 38% YoY rise in Q4 profit to ₹19,013 crore and declared a ₹12 final dividend for FY25, with July 25 set as the record date. Annual profit rose 18% to ₹48,151 crore, while first-year premium income declined. The solvency ratio improved to 2.11 times, reflecting stronger financial stability. Dive deeper

Hero FinCorp has received SEBI approval for a ₹3,668 crore IPO, comprising a ₹2,100 crore fresh issue and ₹1,568 crore OFS by existing investors. Proceeds will support its lending operations. The NBFC had an AUM of ₹51,821 crore and a 1.18 crore customer base as of March 2024. Dive deeper

India’s data centre sector is projected to attract $20–25 billion in investments over the next six years, driven by rising demand for cloud and AI, according to Colliers. Capacity is expected to grow from 1,263 MW to over 4,500 MW by 2030, expanding the real estate footprint from 15.9 to 55 million sq ft. Dive deeper

The government has extended the income tax return filing deadline for FY 2024–25 from July 31 to September 15, 2025. Dive deeper

3M India’s Q4 FY25 net profit fell 59% YoY to ₹71.37 crore, impacted by a sharp rise in tax expenses, despite a 9.5% increase in revenue to ₹1,198 crore. The board declared a ₹160 final and ₹375 special dividend per share. Dive deeper

PepsiCo India reported ₹9,096.62 crore in consolidated revenue and ₹883.39 crore in profit for the 2024 calendar year, following a shift to a Jan–Dec reporting cycle. Snacks contributed ₹6,889.66 crore and beverages ₹2,206.96 crore to revenue. Domestic sales stood at ₹8,475 crore, with exports at ₹386 crore. Dive deeper

NMDC reported a 5% YoY rise in Q4 net profit to ₹1,483 crore, with revenue up 9% to ₹7,497 crore, driven by higher iron ore and pellet sales. FY25 net profit rose over 17% to ₹6,539 crore. The board declared a final dividend of ₹1 per share, in addition to a ₹2.30 interim dividend. Dive deeper

India’s coal imports fell 7.9% to 243.62 MT in FY25, saving around ₹60,682 crore ($7.93 billion) in forex. Despite a rise in coal-based power generation, imports for blending dropped 41.4%, reflecting stronger domestic output and reduced reliance on imports. Dive deeper

IRDAI has flagged concerns over life insurers tweaking actuarial assumptions to meet the 150% solvency ratio requirement. It has warned CEOs and actuaries, launching risk-based inspections. The regulator is tightening oversight to ensure assumptions reflect experience. Dive deeper

Vodafone Idea’s board will meet on May 30 to consider fundraising options, including rights issues, public offers, or debt instruments, amid mounting AGR dues. This follows the Supreme Court’s dismissal of the company's plea for relief, reaffirming that any concessions must come from the government. Dive deeper

Rakesh Gangwal and his family trust sold a 5.72% stake in IndiGo for ₹11,564 crore via open market transactions, reducing their combined holding to 7.81% from 13.53%. Dive deeper

Jyoti CNC Automation aims to sustain FY25 growth in FY26 by targeting 90% capacity utilisation, backed by a ₹4,500 crore order book. The company plans further expansion within two years, driven by rising demand in Europe and Indian manufacturing. A new facility is set to be operational by FY27. Dive deeper

PG Electroplast is in focus after the Government of Singapore acquired shares worth ₹288 crore via a block deal at ₹754.80 each, triggering fresh interest in the stock. Dive deeper

Unacademy co-founders Gaurav Munjal and Roman Saini are stepping back from active roles as the firm shifts to an offline-first strategy. Munjal plans to spin off the language app Airlearn as an independent entity. Dive deeper

IndiGo has named Vikram Singh Mehta as chairman and will be the first to operate from Navi Mumbai Airport, starting with 18 daily flights. It plans to scale up to 140 daily departures, including 30 international, by November 2026. Dive deeper

What’s happening globally

WTI crude hovered around $61 as markets awaited the OPEC+ decision on a likely July output hike of 411,000 bpd. Meanwhile, US tensions with Russia rose, and Chevron faced new curbs on Venezuelan oil exports. Dive deeper

Gold steadied near $3,310/oz after recent losses, as investors awaited Fed minutes and US inflation data. Despite better economic sentiment and trade progress, caution persisted. Dive deeper

The dollar index rose to 99.7, extending gains amid trade tensions and pending fiscal decisions under Trump. It stayed near 2023 lows, with traders eyeing FOMC minutes and possible yen intervention by Japan. Dive deeper

US mortgage applications fell 1.2% last week, hitting a 3-month low as 30-year rates neared 7%. Refinance applications dropped 7.1%, while purchase applications rose 2.7%. Dive deeper

US factory orders fell 6.3% in April to $296.3 billion, led by a 17.1% drop in transportation equipment amid weaker Boeing demand. The decline followed a tariff-driven surge in March and came in softer than the expected 7.8% fall. Dive deeper

The Reserve Bank of New Zealand (RBNZ) cut its cash rate by 25 bps to 3.25%, the fifth cut in recent months, citing contained inflation and global demand risks. It now sees rates falling to 2.85% by Q1 2026 amid export concerns. Dive deeper

Germany’s import prices fell 0.4% YoY in April 2025, the first drop since Oct 2024, driven by an 11.2% fall in energy costs. Excluding energy, prices rose 0.8%. Monthly import prices declined 1.7%, more than expected. Dive deeper

Shein is shifting its IPO plan to Hong Kong after failing to get Chinese approval for a London listing. The delay comes despite UK FCA clearance. Regulatory hurdles and forced labour allegations have complicated its global listing efforts. Dive deeper

China will collect a record $22 billion in BRI loan repayments from 75 developing countries in 2025, as grace periods on past lending expire. This marks a shift from lender to debt collector amid global scrutiny over debt sustainability. Dive deeper

Nissan is exploring a $7 billion funding plan through debt, asset sales, and a UK government-backed loan, Bloomberg reported. The proposal includes issuing convertible bonds and selling stakes in Renault, AESC, and global plants. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Moody’s on India’s EV and auto market outlook

“India’s EV adoption remains slow, with BEVs under 2% of car sales, due to limited infrastructure, high costs, and consumer hesitation.”

“Yet, global and domestic automakers are committing over $10 billion through 2030 to develop local battery manufacturing, new EV models, and charging networks.”

“Despite near-term challenges, India is poised to see one of Asia’s highest BEV growth rates, driven by rising incomes, affordability improvements, and government policy support.” - Link

BOJ Governor Ueda on super-long bond yields and tapering

“We’ll be vigilant to large swings in super-long yields, as they could spill over to shorter-term borrowing costs and affect the economy.”

“Short- and medium-term rates have more economic impact, but we’re closely watching market developments ahead of our June policy review.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

What is deep diver?