Nifty cracks below 26,000 as broader markets continue to bleed

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore what proprietary trading really means versus what the term has unfortunately come to represent in India, breaking down how true prop firms operate, how the space evolved, and how recent scams twisted the concept into unrealistic leverage pitches. By using real regulatory context, historical examples, and recent cases, we separate genuine institutional prop models from the shadow ecosystems built around misleading promises and illegal structures.

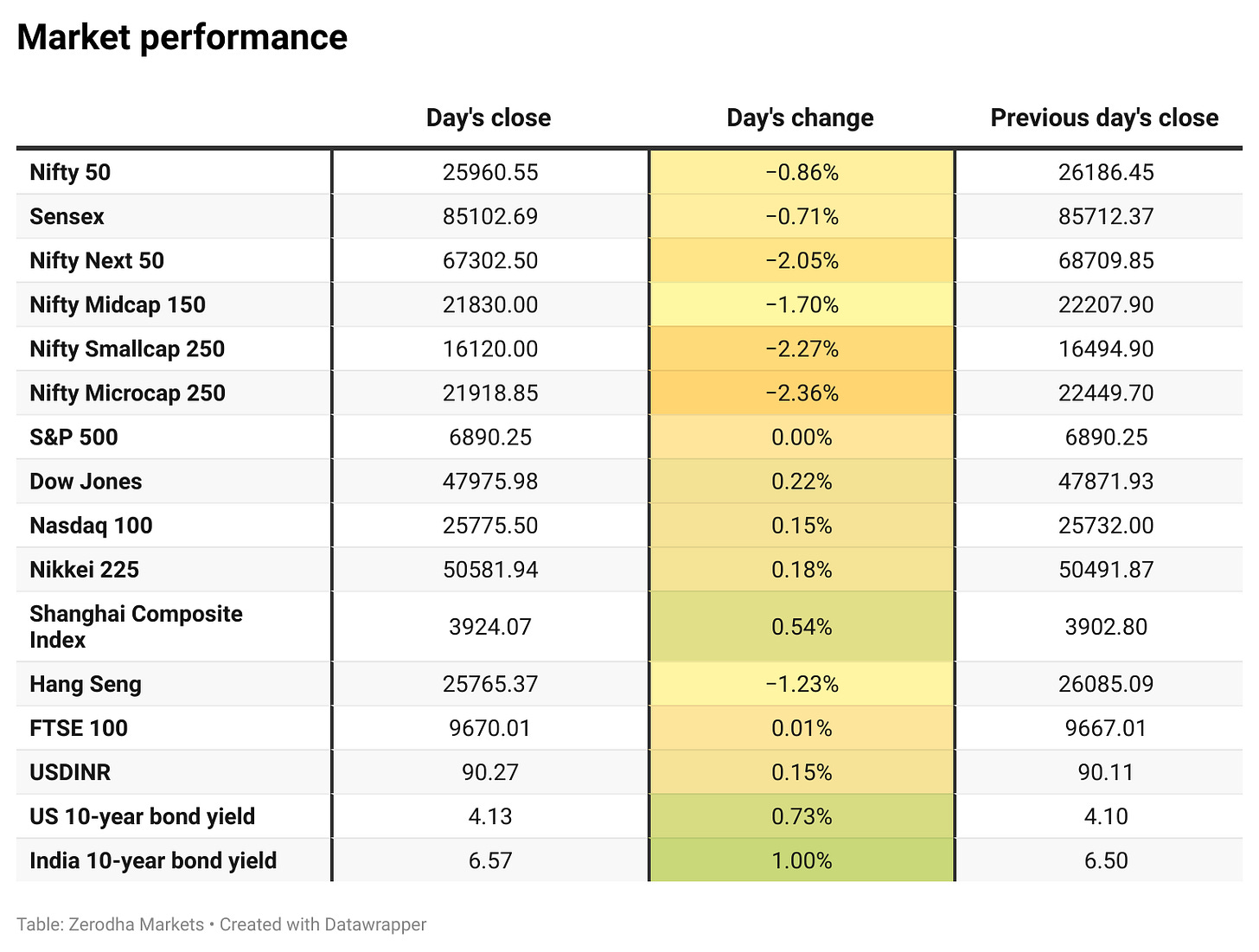

Market Overview

Nifty opened with a small 27-point gap-down at 26,160 and slipped right from the opening bell, testing the 26,070 zone and trading in a narrow 26,050–26,100 band till noon, with very limited recovery attempts.

In the second half, selling pressure intensified, dragging the index further towards the 25,900–25,910 area by around 2:30 PM. Although there was a mild 70–80 point rebound in the last hour, the index failed to sustain it and eventually settled at 25,960.55, down about 0.86% from the previous close.

Overall, it was a weak, one-way downtrend through the session with sellers firmly in control, closing Nifty well below the psychological 26,000 mark. Weakness was even more pronounced in mid and small caps, which slipped nearly 2%.

Looking ahead, markets are likely to remain sensitive to progress on the India–U.S. trade deal, movements in USDINR, and broader global cues.

Broader Market Performance:

The broader markets witnessed a brutal sell-off, with stocks hammered across the board. Out of 3,247 names traded on the NSE, only 580 advanced, while a staggering 2,580 declined, and 87 remained unchanged.

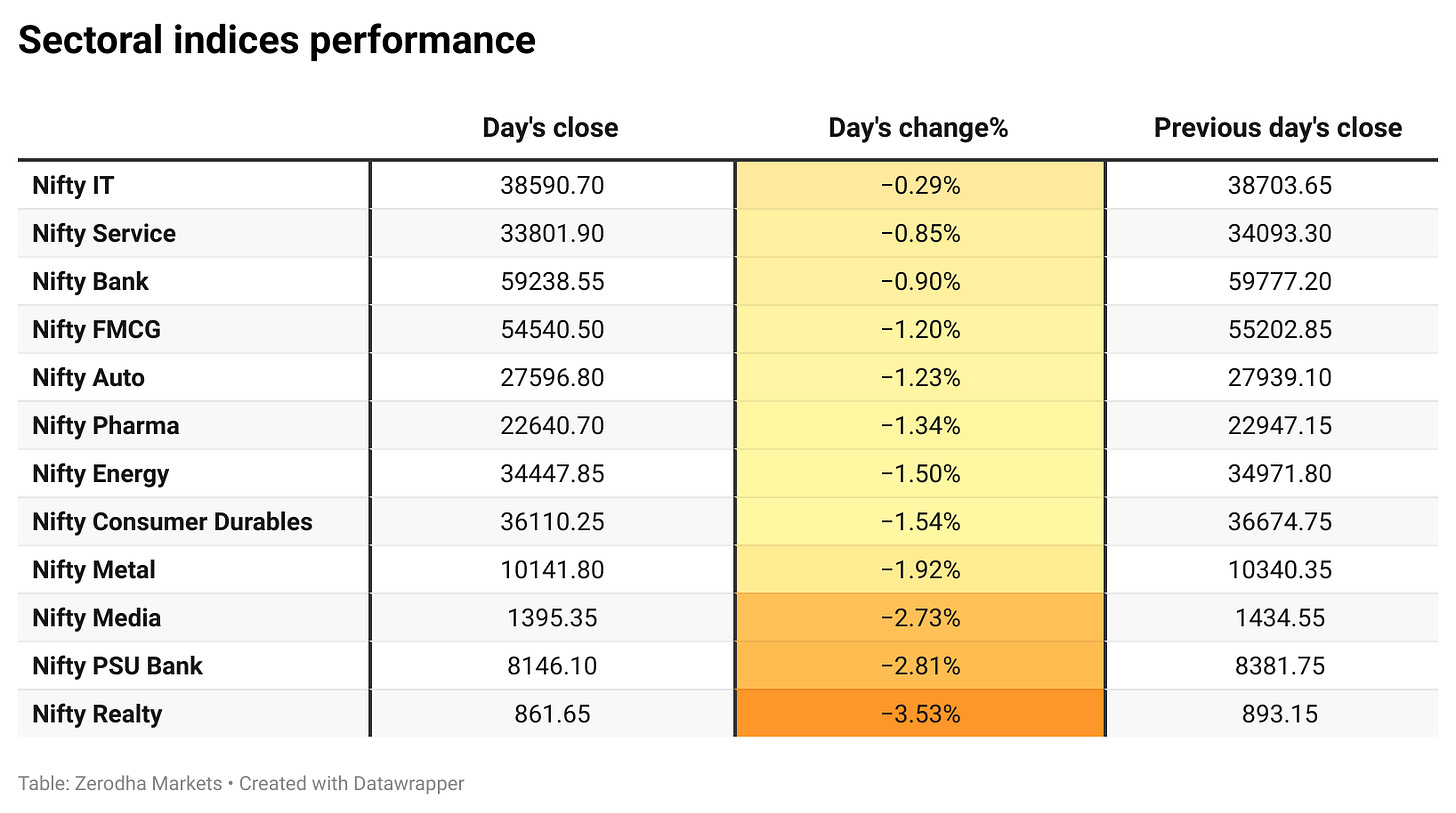

Sectoral Performance:

Nifty IT was the least negative sector with a minor dip of -0.29%, while Nifty Realty was the worst performer, plunging -3.53%. All 12 sectoral indices closed in the red today, reflecting broad-based weakness across the market.

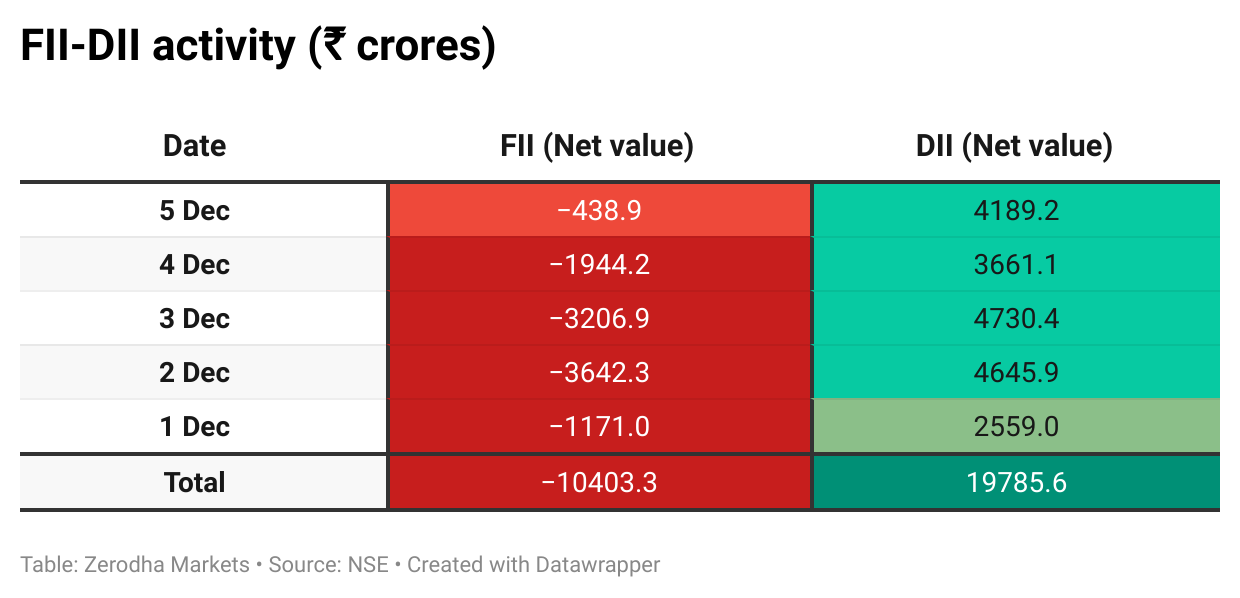

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th December:

The maximum Call Open Interest (OI) is observed at 26,200, followed by 26,100, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 25,900, followed by 25,800, suggesting support at the 25,800 to 25,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

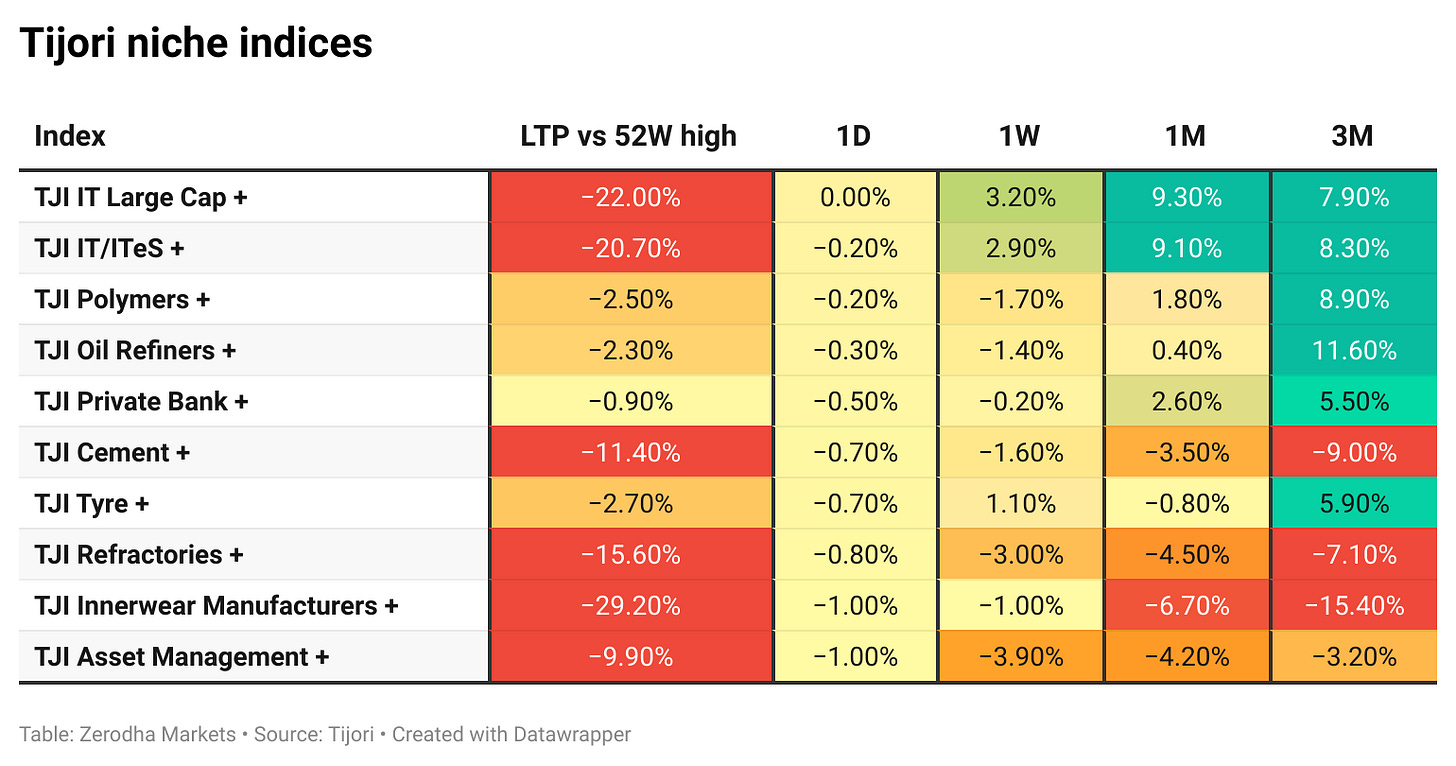

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s IPO fundraising has hit a record in 2025 as strong retail participation and steady institutional demand keep primary issuance buoyant despite muted secondary-market returns. Dive deeper

IndiGo tumbled 8% amid a wave of flight cancellations, rising fuel costs, and a sharply weaker rupee. This marked the stock’s worst single-day drop since February 2022. Dive deeper

India’s fuel demand rose to a six-month high in November, led by stronger diesel consumption, pointing to firmer transport and industrial activity. Dive deeper

Ola Electric said it has started mass deliveries of vehicles powered by its indigenously developed 4680 “Bharat Cell” battery packs, positioning this as a step toward deeper localisation in its supply chain. Dive deeper

RailTel received a Letter of Acceptance from the Ministry of External Affairs to act as project implementing agency for procurement and supply of AI-enabled laptops, adding to its recent order wins. Dive deeper

Sebi launched a new Past Risk and Return Verification Agency (PaRRVA) framework to standardise performance reporting and curb mis-selling by enabling digital audit trails and consistent disclosures. Dive deeper

Fino Payments Bank received the RBI’s in-principle approval to convert into a small finance bank, a first for a payments bank in India. Dive deeper

British American Tobacco has offloaded a 9% stake in ITC Hotels via block deals worth about Rs 3,856 crore, paring its holding in the company. Dive deeper

JSW Port Logistics, a unit of JSW Infrastructure, will acquire full ownership of JSW Rail Infra, JSW Minerals Rail, and JSW (South) Rail from JSW Shipping & Logistics. The ₹1,212-crore deal consolidates the group’s rail-based logistics operations under one platform. Dive deeper

What’s happening globally

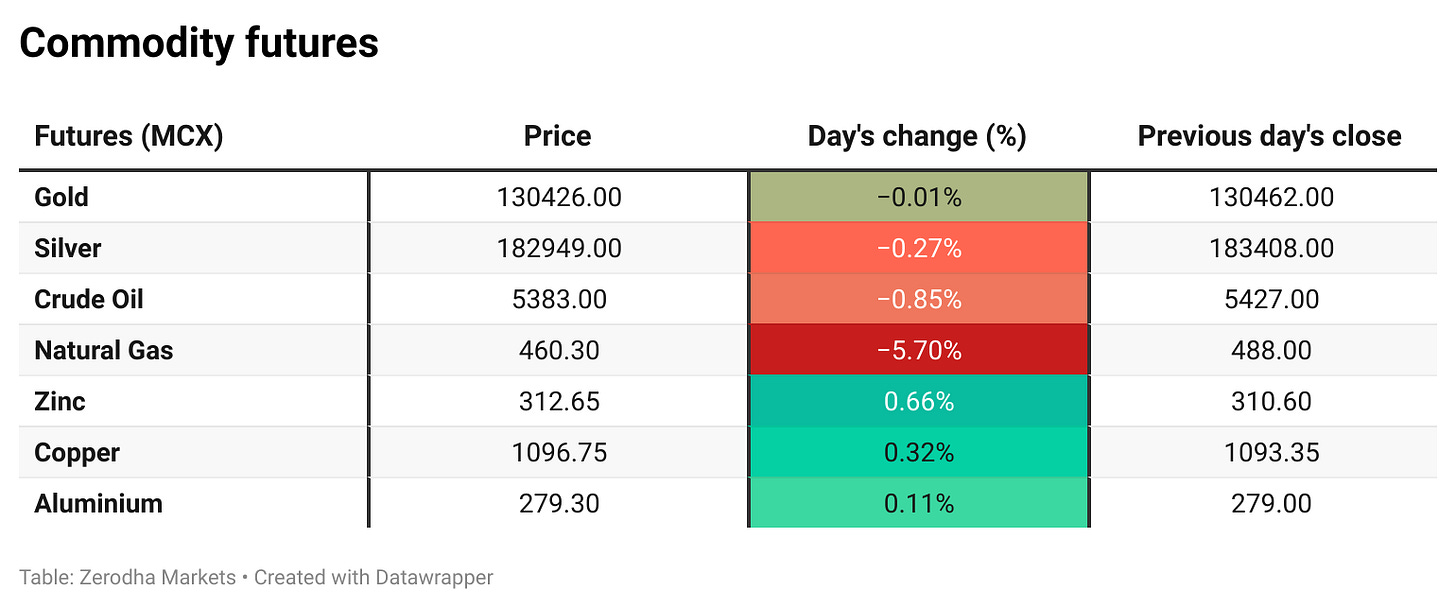

Oil prices stayed firm on geopolitical risk, with Ukraine peace talks stalled and uncertainty around potential US action in Venezuela adding supply concerns. Dive deeper

Gold rebounded above $4,200 as markets positioned for a likely Fed rate cut and looked to updated projections for the 2026 policy path. Dive deeper

Germany’s 30-year government bond yield has climbed to its highest level since 2011, extending the global selloff in long-dated bonds. Dive deeper

China’s trade surplus hit a record above $1 trillion for the first 11 months as exports stayed resilient and imports were weak, helped by a rebound in November shipments. Dive deeper

The dollar stayed soft as markets leaned toward a Fed rate cut this week, with attention shifting to whether policymakers signal a cautious pace of further easing in 2026. Dive deeper

Japan’s Q3 GDP contraction was revised deeper, driven mainly by a surprise drop in business investment, signalling growing pressure from higher borrowing costs. Consumption rose only marginally, and trade remained a drag as exports weakened after new US tariffs. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Ram Mohan Naidu, Civil Aviation Minister, Government of India, on airline competition amid the IndiGo crisis:

“We have envisioned the demand to be growing at such a rate that we want to have more airlines in the picture… The demand that India is creating today, we need to have five big airlines.”

“We want more players to be in this industry. This is the time to start an airline in India.”

“Any miscompliance or non-adherence by any airline, operator, or individual in civil aviation will face very strong action.” - Link

Aakash Ohri, Joint Managing Director & Chief Business Officer, DLF Homes on NRI demand cycle and luxury housing trends:

“Global Indians are no longer viewing property purchases as short-term or speculative bets, but as long-term, lifestyle-driven investments.”

“At DLF, we have seen NRI sales accelerate sharply over the past three financial years, from about USD 240 million in FY23 to USD 408 million in FY24, and further to approximately USD 421 million in FY25.”

“Since the pandemic, the average age of first-time homebuyers dropped by nearly a decade, with many now in their early 30s.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

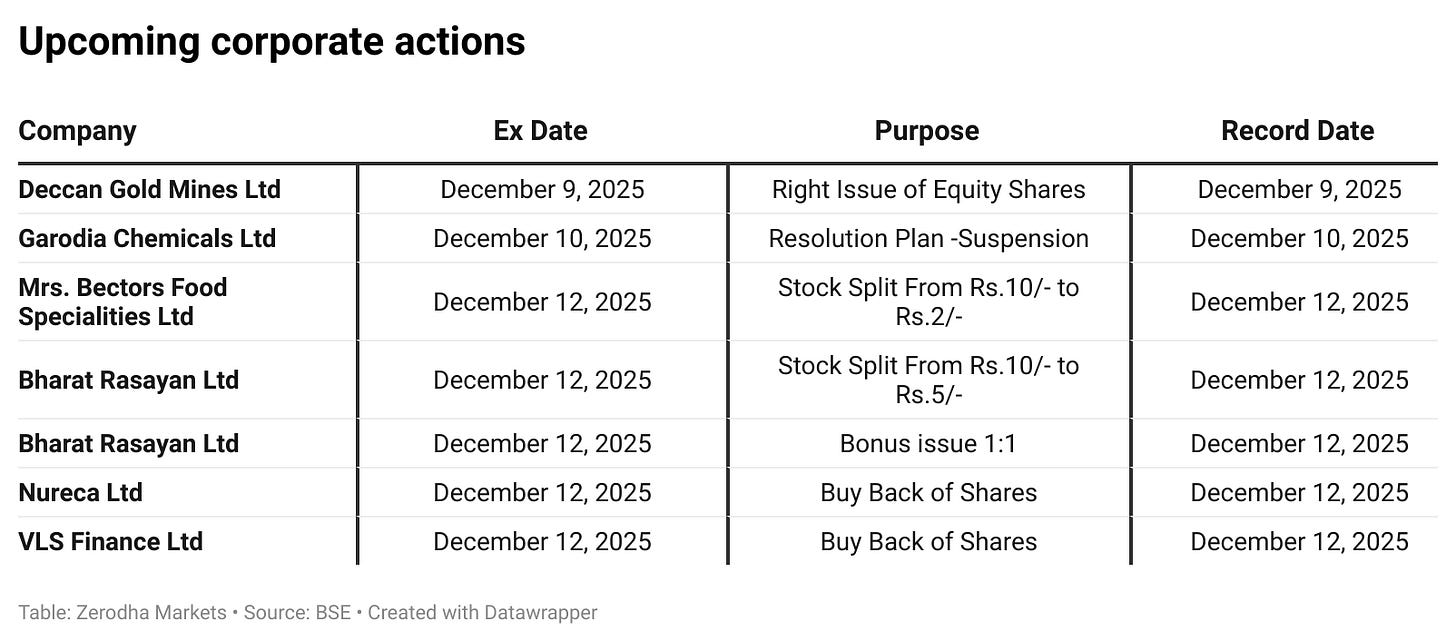

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Really appreciate your work

Good work Sir