Nifty consolidates around 24,600-24,700 after recent volatility

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

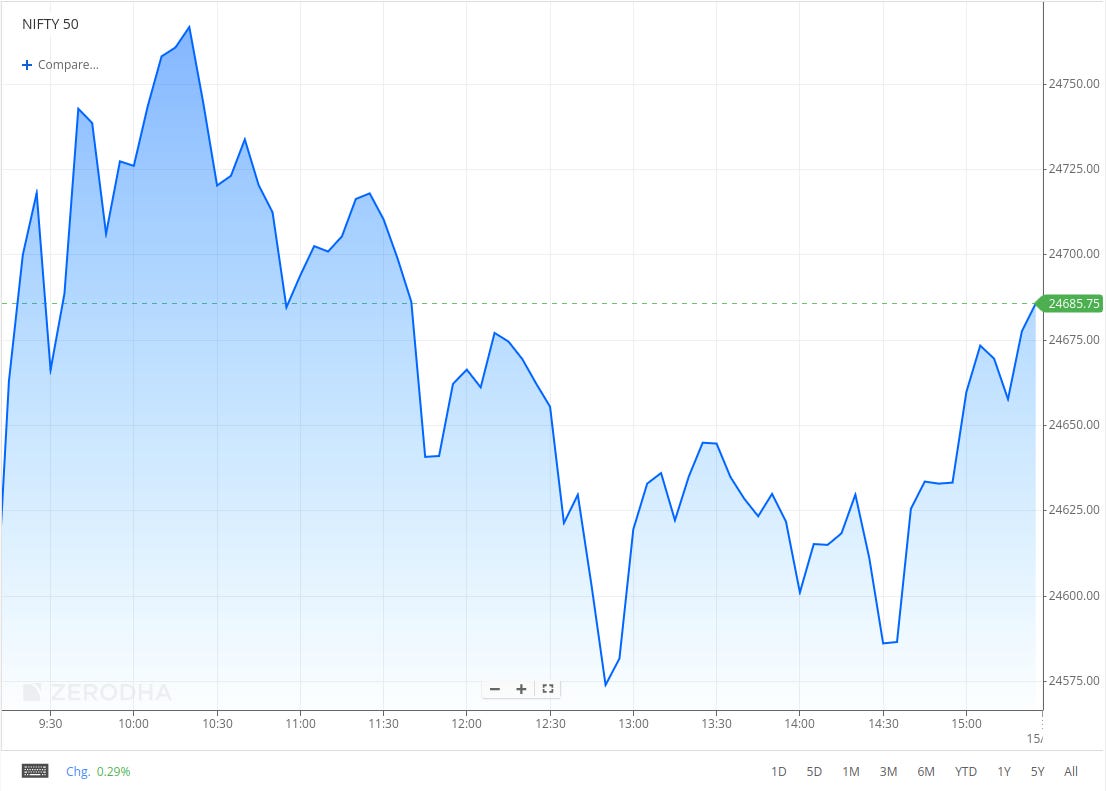

Nifty opened with a 60-point gap up at 24,613.80 and, despite early volatility, climbed to 24,767 in the first hour. This was followed by an intraday sell-off, with intermittent recoveries, pushing the index to a low of 24,535.55 around 1 PM. However, it stabilized and rebounded to 24,630 by 2:30 PM, eventually closing at 24,666.90, up 0.36%.

While steady FII inflows, positive global cues, and lower CPI and WPI inflation are lending support, geopolitical tensions and the ongoing earnings season remain critical for near-term market direction.

Broader Market Performance:

Broader markets had a strong session today. Of the 2,960 stocks traded on the NSE, 2,183 advanced, 694 declined, and 83 remained unchanged.

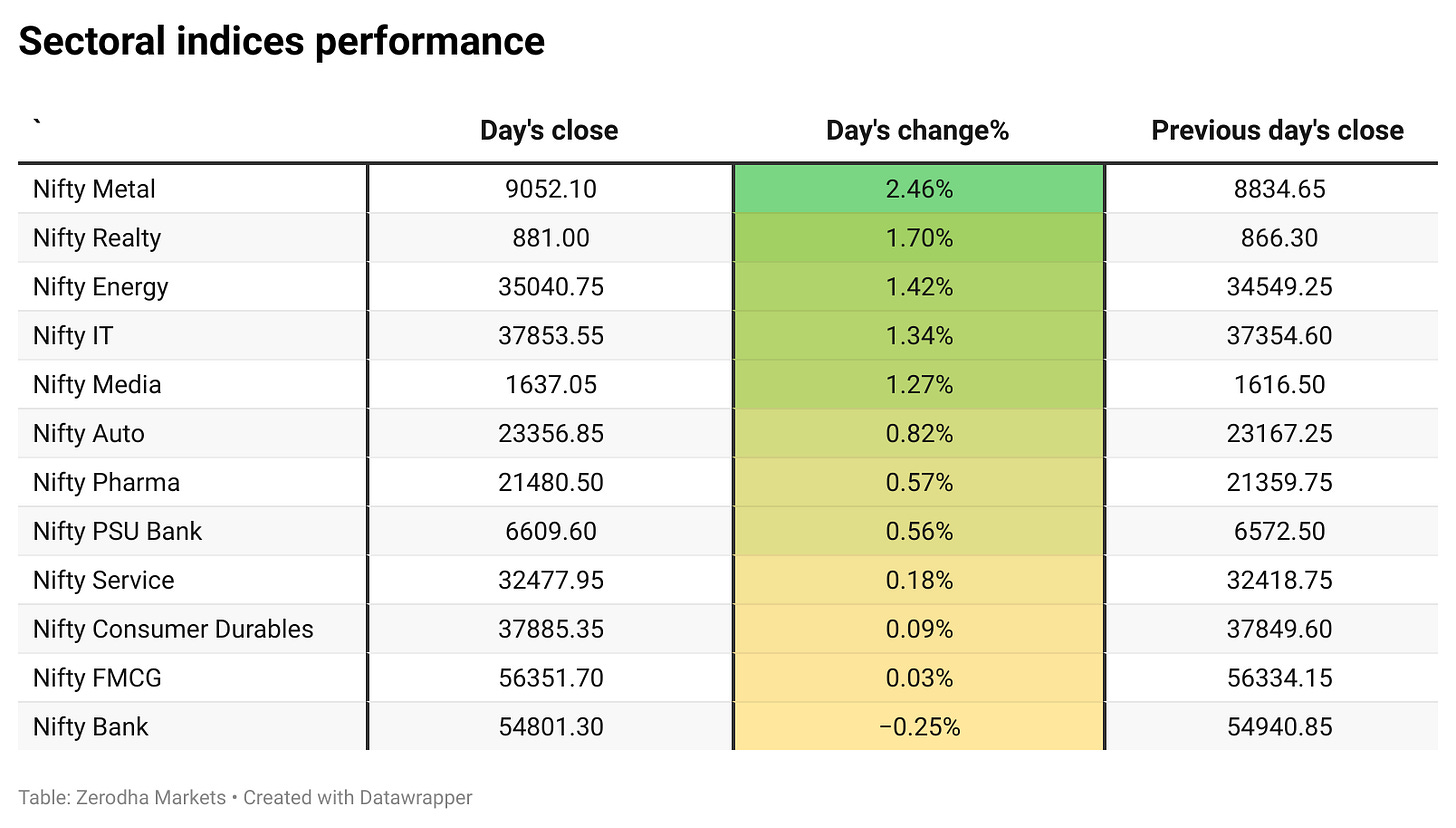

Sectoral Performance:

Nifty Metal emerged as the top gainer, closing up by 2.46% at 9,052.10, while Nifty Bank was the only sector to close in the red, down 0.25% at 54,801.30. In total, 12 sectors ended the day in green, while just 1 sector (Nifty Bank) closed in the red, reflecting broadly positive market sentiment.

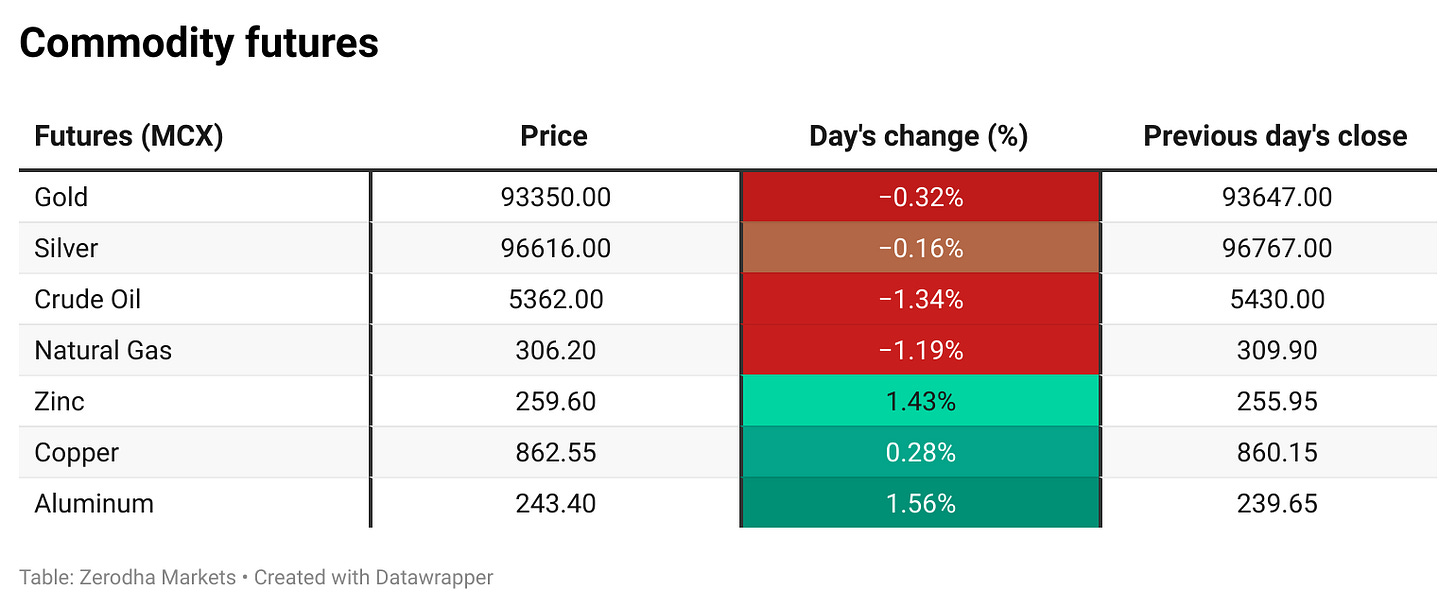

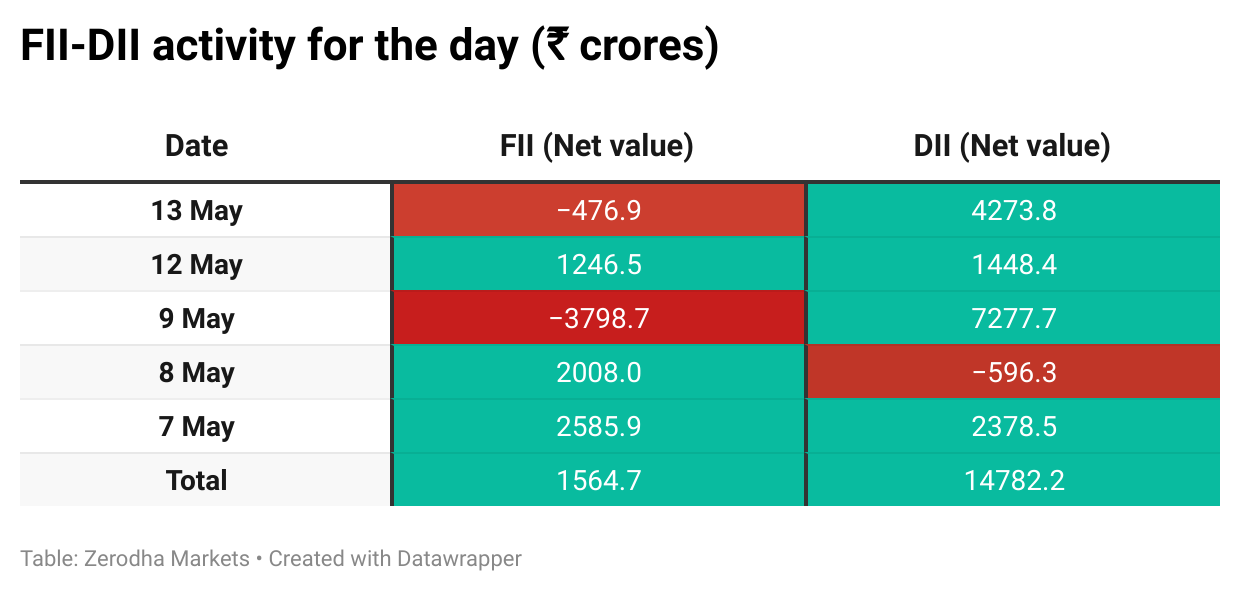

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 15th May:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,700 & 24,800, indicating strong resistance at these levels.

The maximum Put Open Interest (OI) is 24,500, followed by 24,600, suggesting strong support at 24,500 and additional support at 24,300.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

HAL reported an 8% year-on-year decline in consolidated net profit to ₹3,977 crore for Q4 FY25, with revenue from operations falling 7% to ₹13,700 crore. Despite this, full-year net profit rose 10% to ₹8,364 crore, while revenue increased 2% to ₹30,981 crore. Dive deeper

Tata Elxsi has partnered with Mercedes-Benz Research and Development India to enhance vehicle software engineering, expanding its decade-long collaboration. Following the announcement, Tata Elxsi's stock rose 2.5%, reaching ₹6,134.85. Dive deeper

Wholesale inflation in India fell to 0.85% in April 2025, the lowest in 13 months, driven by sharp declines in vegetable (-18.26%), potato (-24.3%), and fuel (-2.18%) prices. Crude oil and gas inflation dropped to -15.55%, while overall food inflation eased to a 22-month low of 2.55%. Dive deeper

The Indian Cabinet approved a ₹3,706 crore semiconductor plant in Jewar, Uttar Pradesh, by HCL and Foxconn. This sixth project under the India Semiconductor Mission aims to reduce import dependency by producing 20,000 wafers per month. Dive deeper

Jio Credit raised ₹1,000 crore in its maiden bond issue at a 7.19% yield, attracting strong demand with bids totaling ₹1,500 crore, reflecting robust investor confidence in the Jio brand. Dive deeper

REC shares fell nearly 3% after the company cut its FY26 AUM growth guidance to 11-13% from 15-17%. Despite this, it reported a 5.6% year-on-year rise in Q4 profit to ₹4,304 crore and declared a ₹18 per share dividend. Dive deeper

Coromandel International and FSN E-Commerce Ventures (Nykaa) were added to the MSCI Global Standard Index, effective after market close on May 30, potentially attracting passive inflows of $252 million for Coromandel and $199 million for Nykaa. Dive deeper

Chemplast Sanmar announced a ₹340 crore investment to produce R-32 refrigerant gas, a key air conditioning component, positioning itself against competitors like SRF and Navin Fluorine. Following this, SRF and Navin Fluorine shares fell by 1.75% and 1%, respectively, while Chemplast Sanmar's stock gained 0.75%. Dive deeper

Bharti Airtel reported a 77% year-on-year increase in adjusted net profit to ₹5,223 crore for Q4 FY25, with revenue rising 27% to ₹47,876 crore. The company declared a ₹16 per share dividend and achieved an ARPU of ₹245, driving its stock up by 1.9%. Dive deeper

What’s happening globally

The dollar index fell to 100.3 today, pulling back from recent highs as the boost from US-China tariff reductions faded. Softer-than-expected inflation data also fueled speculation that the Federal Reserve could cut interest rates twice this year, adding to the dollar’s weakness. Dive deeper

The Korean won appreciated past 1,400 per USD, gaining nearly 3% in May, outperforming other Asian currencies amid speculation that US officials discussed a weaker dollar with Korean counterparts, potentially as part of broader trade negotiations. Dive deeper

Nvidia stock jumped 5.6% after a deal to supply 18,000 AI chips to Saudi Arabia. This pushed its market value to $3 trillion and CEO Jensen Huang’s net worth to $120 billion. Big AI investments are flowing into Saudi and UAE from Nvidia, AMD, Amazon, and others. Dive deeper

China's new yuan loans fell to a 20-year low in April 2025, with banks extending just CNY 280 billion, significantly below the CNY 730 billion seen a year earlier and market expectations of CNY 700 billion, as the ongoing US-China trade war dampened business and household demand for credit. Dive deeper

Japan's wholesale inflation rose to 4.0% in April, driven by companies passing on higher raw material and labor costs. This persistent price pressure is expected to keep the central bank on track for further interest rate hikes.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Chirayu Upadhyaya, Head of Investor Relations at Polycab India Limited, on the company's higher margins compared to peers

Definitely, one of the reasons is the business mix that we have, cables versus wires and the margins that we make on those products. The pricing of our products is relatively higher as compared to the other players in the industry, about 2% to 3% on the cables side, about 4% to 5% on the wires side and that definitely helps as far as margin improvement is concerned. The other thing is even in our exports business, the margins that we make are relatively much superior as compared to what our peers make on their exports business. So that definitely helps. The other part is also the mix within the domestic cables. So HDC versus LDC cables – LDC cables is a better margin business, and we have a relatively better mix of our product sales within our domestic cable sales and that also helps us in terms of the relatively superior margin that we make in the cables and wires segment. - Link

Mr. Pravin Chaudhari, Managing Director, Kansai Nerolac Paints Limited on Margins

Till quarter 4, actually it is set off. Whatever crude benefit that we got actually got offsetted by the dollar. But yes, beyond this, if it comes, there will be some pass through also will happen as far as industrial is concerned. So, we will try to retain asmuch as possible but of course not whole thing will come as margin. - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

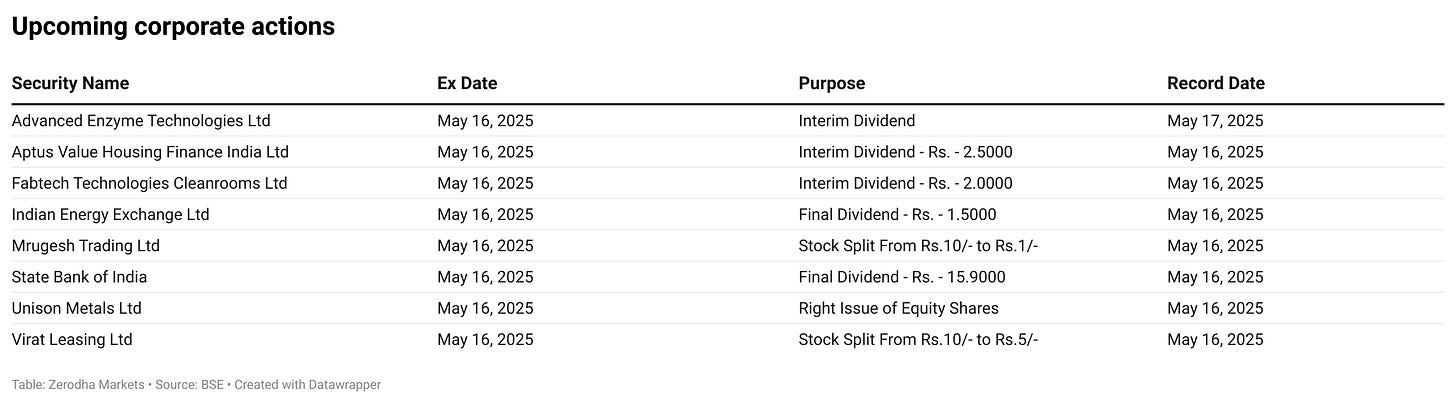

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.