Midcap Index hits fresh highs as Nifty stays stuck near 25,750

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down everything that mattered — from NIFTY’s “chai-pattern” setup to BANKNIFTY’s record monthly close, the continued outperformance in midcaps, and a quick look at NIFTY’s monthly seasonality trends as we head into year-end.

Market Overview

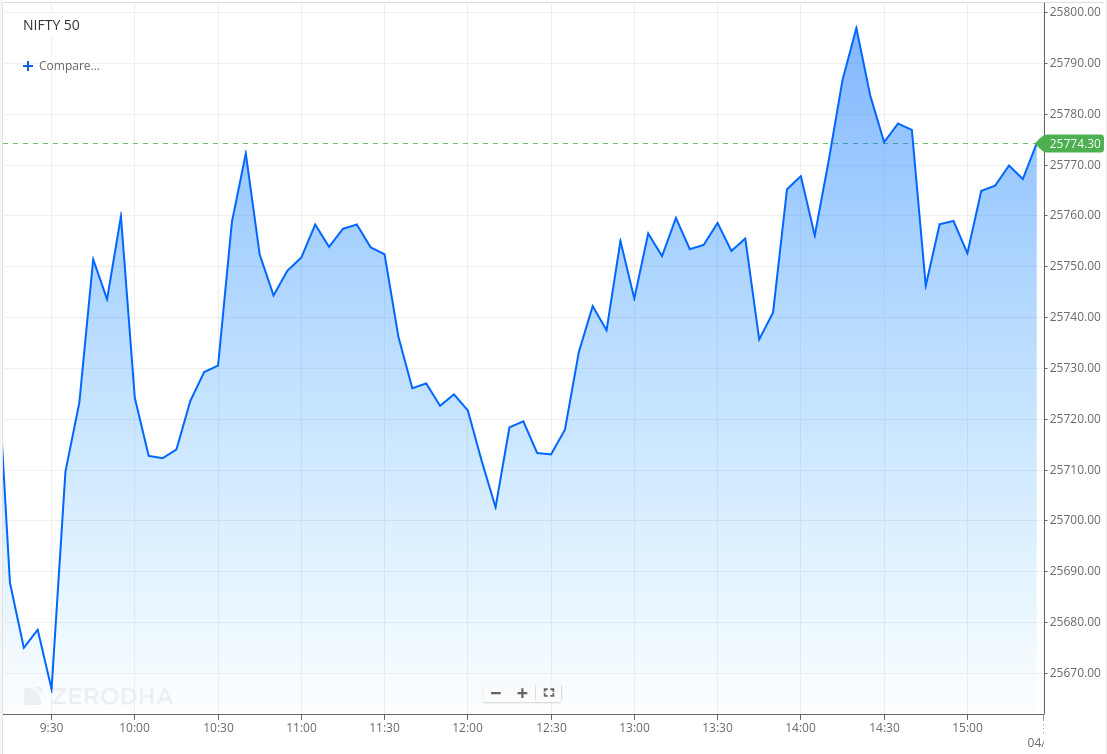

Nifty opened flat with a mild 25-point gap-down at 25,697 and briefly dipped toward 25,650 in early trade. However, the index quickly recovered, rallying toward the 25,760 mark within the first hour. The strength was short-lived, as Nifty gradually slipped back toward the 25,700 zone through late morning trade.

In the second half, the index attempted to stabilise, moving in a tight range as intraday volatility stayed elevated. Post 2 PM, Nifty picked up momentum and tested the 25,800 level, marking the day’s high, before witnessing another round of selling pressure. Despite the back-and-forth moves, the index closed marginally higher at 25,763.35, up 0.16%, signalling a cautious yet resilient start to the new month. Notably, while headline indices consolidated, mid-cap indices continued to hover near record highs, indicating strong broader market participation.

Going forward, markets are expected to remain sensitive to developments around the India–U.S. trade deal, while investors track Q2 earnings and management commentary on festive-season demand trends following the recent GST cuts.

Broader Market Performance:

Broader markets had a strong bullish session today. Of the 3,212 stocks traded on the NSE, 1,796 advanced, 1,313 declined, and 103 remained unchanged.

Sectoral Performance:

Nifty Realty led the gains with a 2.23% rise, followed by Nifty PSU Bank up 1.92%. On the flip side, Nifty Consumer Durables was the top loser, slipping 0.29%. Out of the 12 sectoral indices, 9 ended in the green and 3 closed in the red, reflecting a broadly positive market sentiment.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 4th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,900 & 25,800, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,700, followed by 25,600 & 25,500, suggesting support at the 25,700 to 25,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s Manufacturing PMI rose to 59.2 in October 2025 from 57.7 in September, signaling faster factory growth driven by strong demand and GST reform optimism. New orders and output surged, employment rose for the 20th straight month, and confidence remained high despite rising output prices. Dive deeper

The Reserve Bank of India will meet select banks and primary dealers on Tuesday to discuss market conditions amid tightening liquidity. The move follows the RBI’s cancellation of a ₹110 billion bond auction, which led to a drop in benchmark yields. Dive deeper

India extended the relaxation on stainless steel import restrictions until December 31, allowing sales of BIS non-compliant steel due to limited domestic supply. The move aims to support local producers amid rising imports, particularly from China. Dive deeper

India’s GST collections rose 4.6% year-on-year in October 2025, reflecting strong festive demand and economic activity. The slowdown from September’s 9.1% growth came after GST 2.0 reforms reduced tax slabs to 5% and 18%, alongside a special 40% rate for select items. Dive deeper

India’s 10-year government bond yield eased to 6.54% from a two-month high of 6.59% after the RBI cancelled a 7-year bond auction, rejecting bids worth ₹110 billion. The move signaled discomfort with higher yields, while tight liquidity and a weak rupee limited further declines. Dive deeper

Bharti Airtel’s Q2 FY26 net profit more than doubled to ₹8,651 crore, compared to ₹4,153 crore a year ago, driven by strong operational growth. Revenue rose 26% YoY to ₹52,145 crore, with India revenue up 23% and Average Revenue Per User (ARPU) improving 10% to ₹256. Dive deeper

Tata Consumer Products reported a 10.7% rise in consolidated net profit to ₹406.5 crore for Q2 FY26, driven by strong growth in its India business. Revenue from the India segment rose 17.6% year-on-year to ₹3,122.15 crore. Dive deeper

Aquilius Investment Partners raised $1.1 billion for its second Asia Pacific real estate secondaries fund, the region’s largest. The fund exceeded its $700 million target, with half already deployed. Remaining capital will be invested across Japan, Korea, India, and Australia. Dive deeper

Shriram Properties will develop a new housing project on a 5-acre land parcel at Bannerghatta Road, Bengaluru, with an estimated revenue potential of over ₹350 crore. The Villament community project is planned for launch this fiscal year, strengthening its mid-premium housing portfolio. Dive deeper

AWL Agri Business reported a 21% YoY decline in net profit to ₹244.85 crore for Q2 FY26, while revenue rose 22% to ₹17,604.57 crore. The company announced leadership changes, appointing Shrikant Kanhere as MD & CEO and Angshu Mallick as Executive Deputy Chairman. Dive deeper

Shriram Finance reported a 7% YoY rise in Q2 FY26 net profit to ₹2,314 crore, with total income at ₹11,921 crore and improved asset quality as GNPA fell to 4.57%. Dive deeper

The Enforcement Directorate provisionally attached assets worth over ₹3,083 crore linked to the Reliance Anil Ambani Group under the PMLA. The attachment covers 42 properties across major cities, including 30 belonging to Reliance Infrastructure and others tied to group entities. Dive deeper

BPCL reported a 170% YoY jump in Q2 FY26 net profit to ₹6,191 crore, driven by higher refining margins, cost control, and LPG compensation. Revenue rose 3% YoY to ₹1.21 lakh crore, and the board declared an interim dividend of ₹7.5 per share. Dive deeper

Urban Company reported a widened Q2 FY26 net loss of ₹59 crore from ₹2 crore a year ago, despite a 37% rise in revenue to ₹380 crore. The losses were driven by its new Insta Help vertical, while core operations excluding it achieved an adjusted EBITDA profit. Dive deeper

Zen Technologies secured two defence ministry contracts worth ₹289 crore to upgrade its Anti-Drone Systems, with completion expected within a year. The upgrades address evolving operational needs from recent missions, reinforcing India’s defence capabilities. Dive deeper

Pine Labs set a price band of ₹210–221 per share for its ₹3,900 crore IPO, comprising a ₹2,080 crore fresh issue and an OFS by existing investors. The issue opens on November 7 and closes on November 11, with employee reservations and a ₹21 discount per share. Dive deeper

Indian Hotels, EIH, and ITC Hotels are among 40 companies that have expressed interest in acquiring JW Marriott Bengaluru, owned by the Advantage Raheja Group and currently under insolvency proceedings. The 281-room property’s sale is being overseen by the bankruptcy court, with Omkara ARC as the largest secured creditor. Dive deeper

Oyo parent PRISM will introduce a new inclusive bonus structure covering all shareholders, including CCPS holders, after withdrawing its earlier proposal. The revised plan aims to ensure equal participation, transparency, and governance-first growth without any opt-in process. Dive deeper

What’s happening globally

Brent crude oil traded around $64.7 per barrel after OPEC+ decided to pause output increases next quarter amid concerns of slowing demand and potential oversupply. Dive deeper

Gold prices fell below $4,000 per ounce as expectations for further US rate cuts faded and safe-haven demand weakened after the US-China trade deal. Dive deeper

Wheat futures rose above $5.40 per bushel, the highest since July, on renewed Chinese demand following a recent US-China trade truce. Reports suggest China is inquiring about US wheat shipments for early 2026, though ample global supply may cap gains. Dive deeper

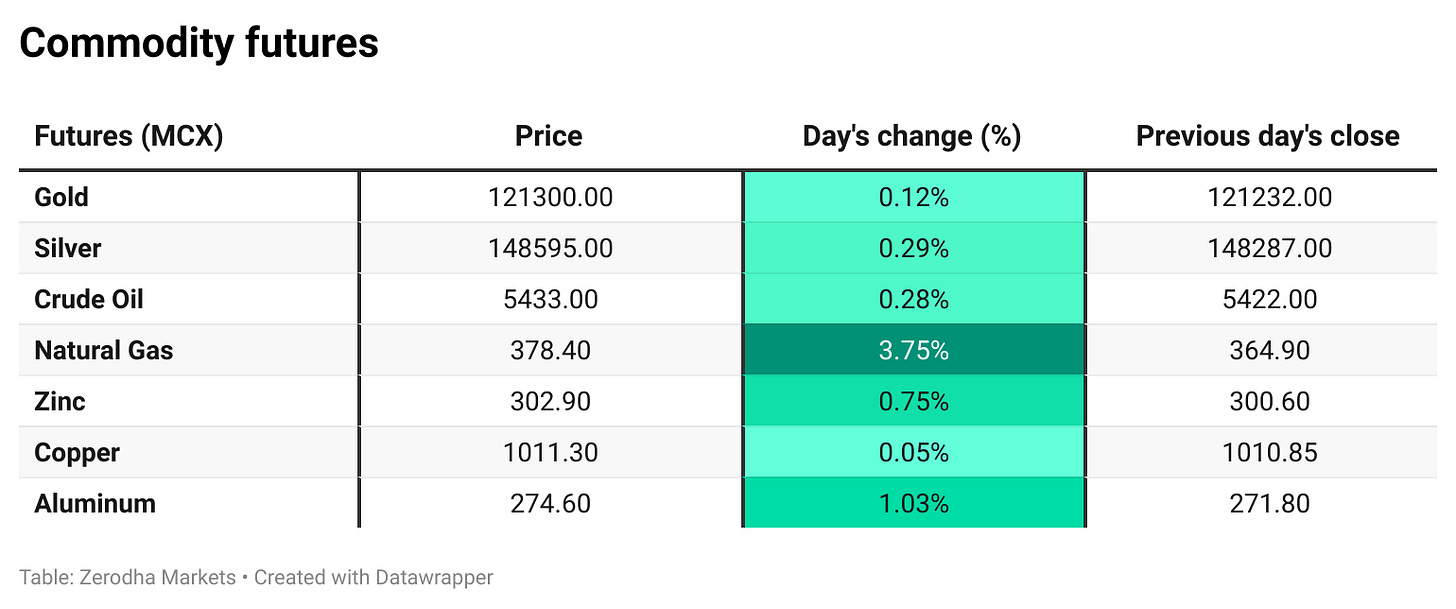

US natural gas futures rose above $4.20 per MMBtu, the highest since March, driven by strong heating demand, record LNG exports, and colder winter forecasts. Exports averaged 16.6 billion cubic feet per day in October, while storage rose by 74 bcf, exceeding expectations. Dive deeper

Spain’s Manufacturing PMI rose to 52.1 in October 2025 from 51.5 in September, marking a sixth straight month of expansion. Stronger domestic demand boosted output and new orders, while export demand weakened. Input costs eased, and firms showed improved confidence despite continued job declines. Dive deeper

Turkey’s annual inflation eased to 32.87% in October 2025 from 33.29% in September, below expectations and marking the lowest since November 2021. Price growth slowed across most categories, led by food, housing, and health, while transport and tobacco costs rose. Dive deeper

China’s Manufacturing PMI fell to 50.6 in October 2025 from 51.2, signaling slower factory growth as new orders and output softened. Export demand weakened sharply, while employment rose for the first time in seven months. Business confidence eased amid rising trade concerns. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rajesh Sharma, MD, Capri Global Capital Ltd, on growth targets and strategy

“We’re on track for 40% AUM growth in FY25 and are targeting ₹50,000 crore in assets under management by FY28.”

“Our growth is powered by branch expansion, technology-led efficiency, and a sharp focus on secured lending through gold and MSME loans.”

“Despite scaling rapidly, we expect to sustain around 4% ROA and 18% ROE while reducing our cost-to-income ratio to 40% over the next 18 months.”

“Our portfolio remains 100% secured, with nearly 38% backed by gold, ensuring asset quality stability even amid market volatility.” - Link

Neetish Sarda, MD & Founder, Smartworks, on the new Mumbai campus

“Our alliance with the Niranjan Hiranandani Group for ‘Eastbridge’ marks a major milestone in Smartworks’ journey.”

“With this new centre set to become the largest managed campus globally, we continue to break our own records and set new benchmarks in the managed workspace segment.”

“We’re focused on creating scalable, sustainable spaces with modern amenities that inspire productivity and collaboration.” - Link

Amrish Rau, CEO, Pine Labs, on the company’s IPO downsizing and pricing strategy

“The IPO size was trimmed because some existing shareholders chose to sell less at the current price band.”

“We’ve priced the offer to ensure goodwill within the ecosystem — this balance made several investors decide to retain a larger stake.”

“With our financial position improving and debt levels comfortable, we reduced the primary issue size to minimize equity dilution.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

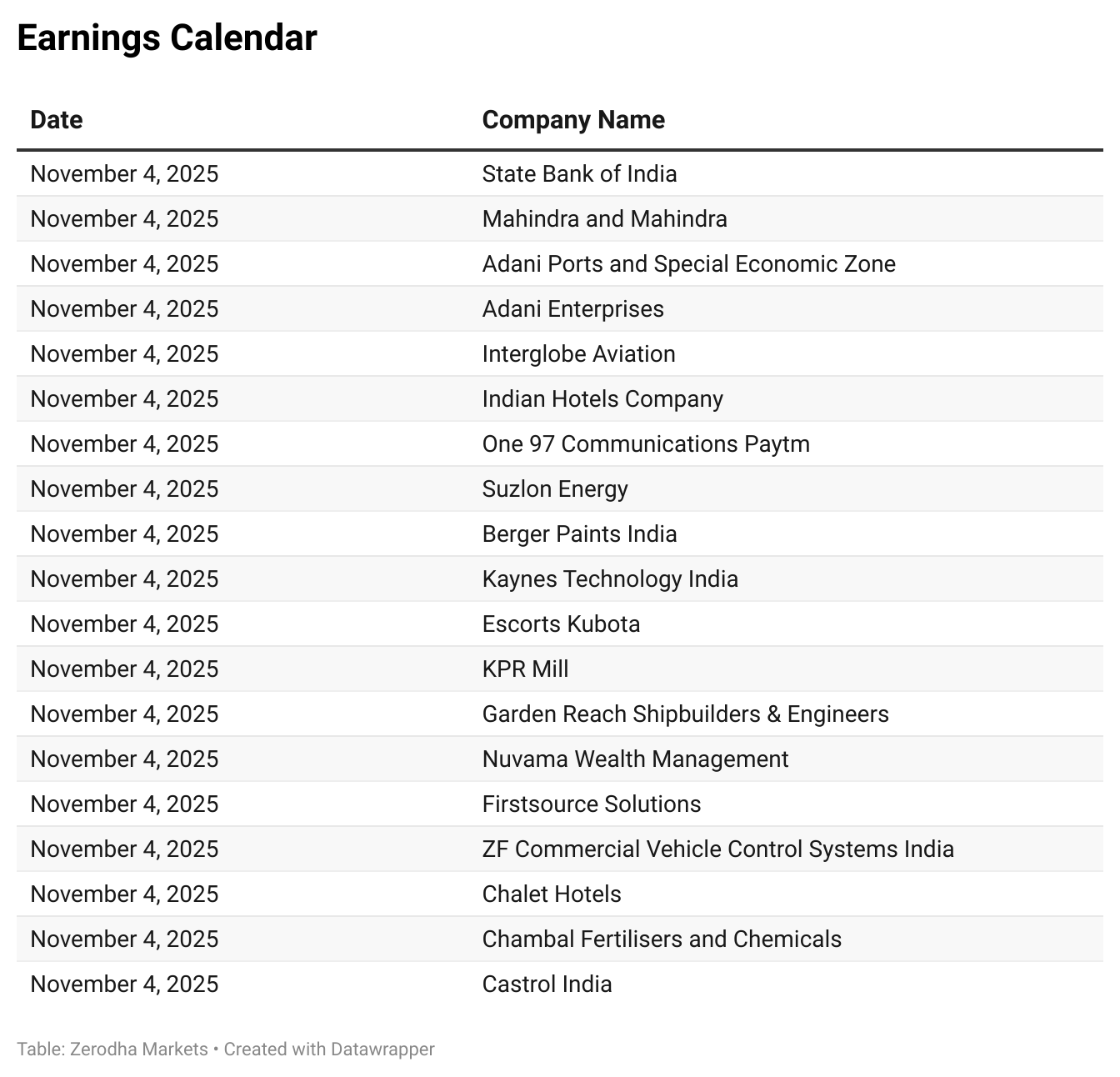

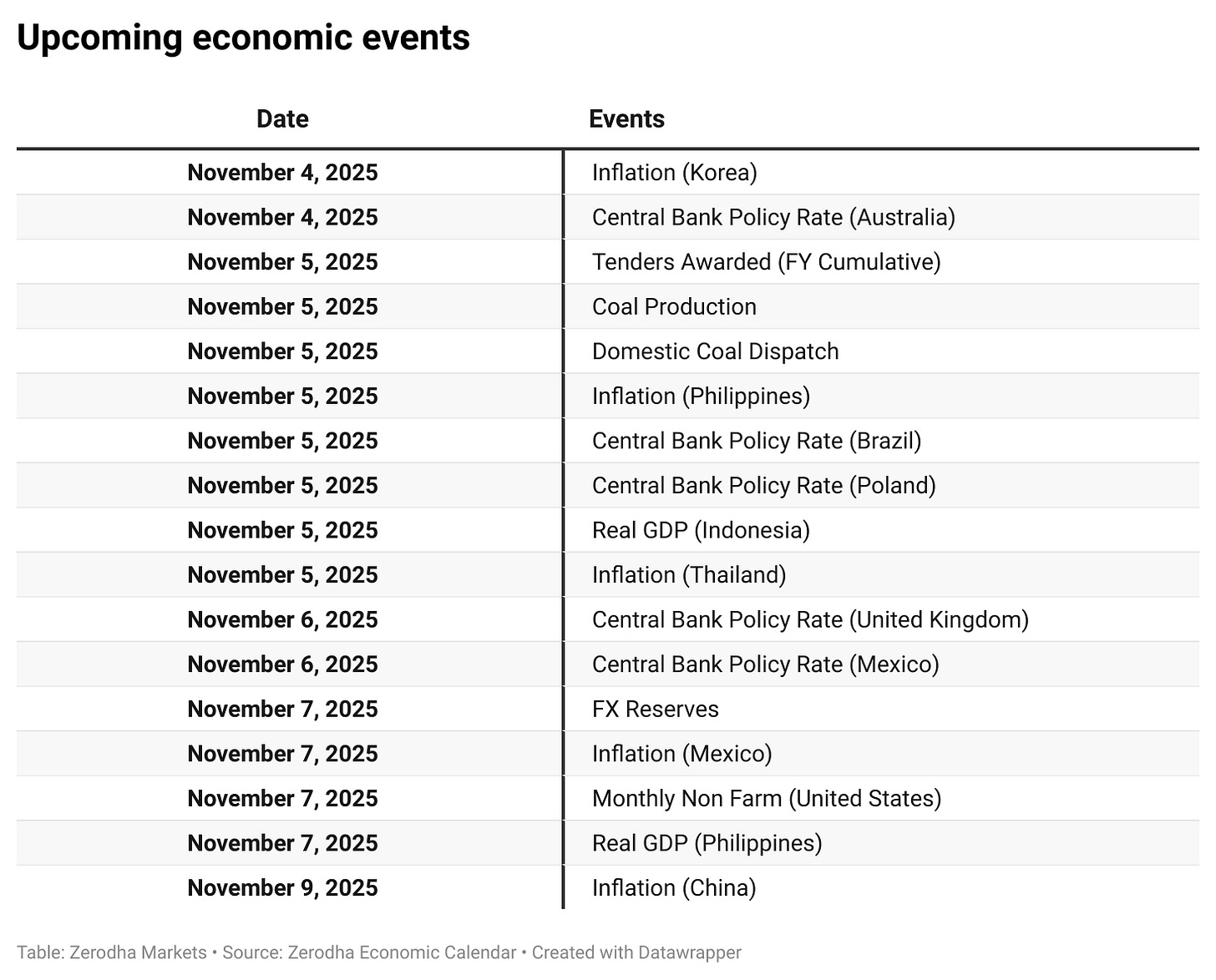

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Please check the link for looks like pointed to wrong link "Tata Consumer Products reported a 10.7% rise in consolidated net profit to ₹406.5 crore for Q2 FY26, driven by strong growth in its India business. Revenue from the India segment rose 17.6% year-on-year to ₹3,122.15 crore. Dive deeper"