Markets pause as Nifty slips below 24,600

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

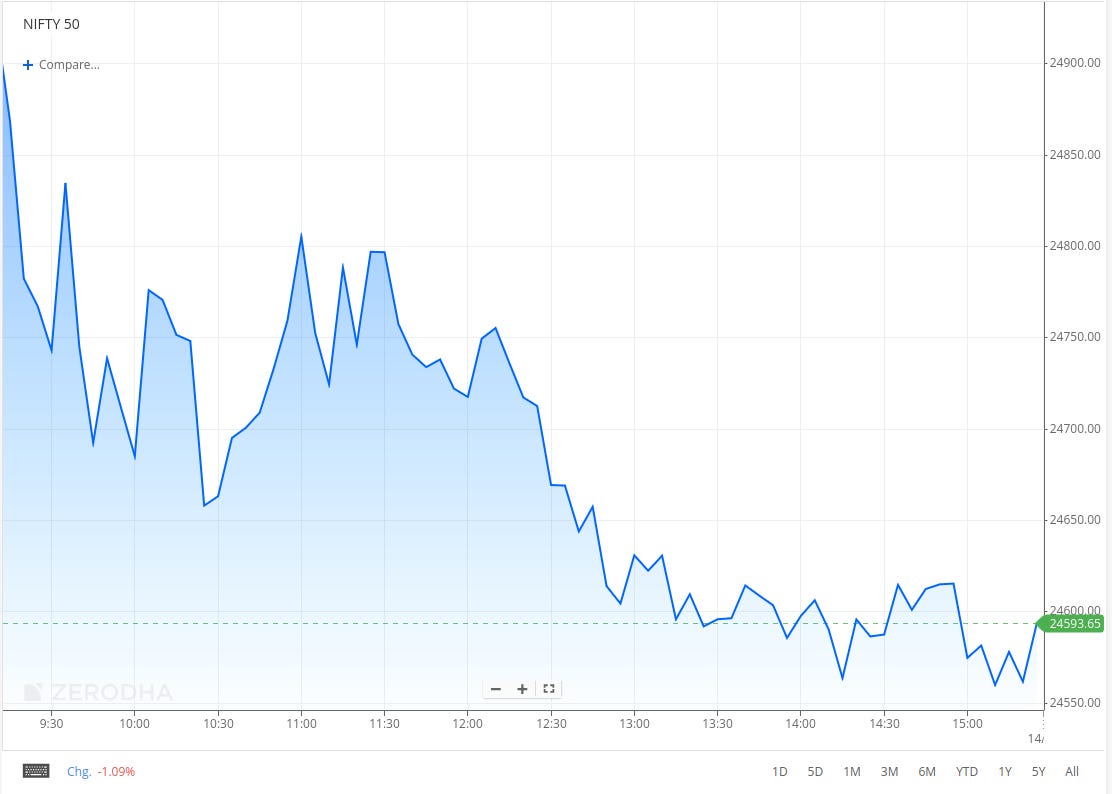

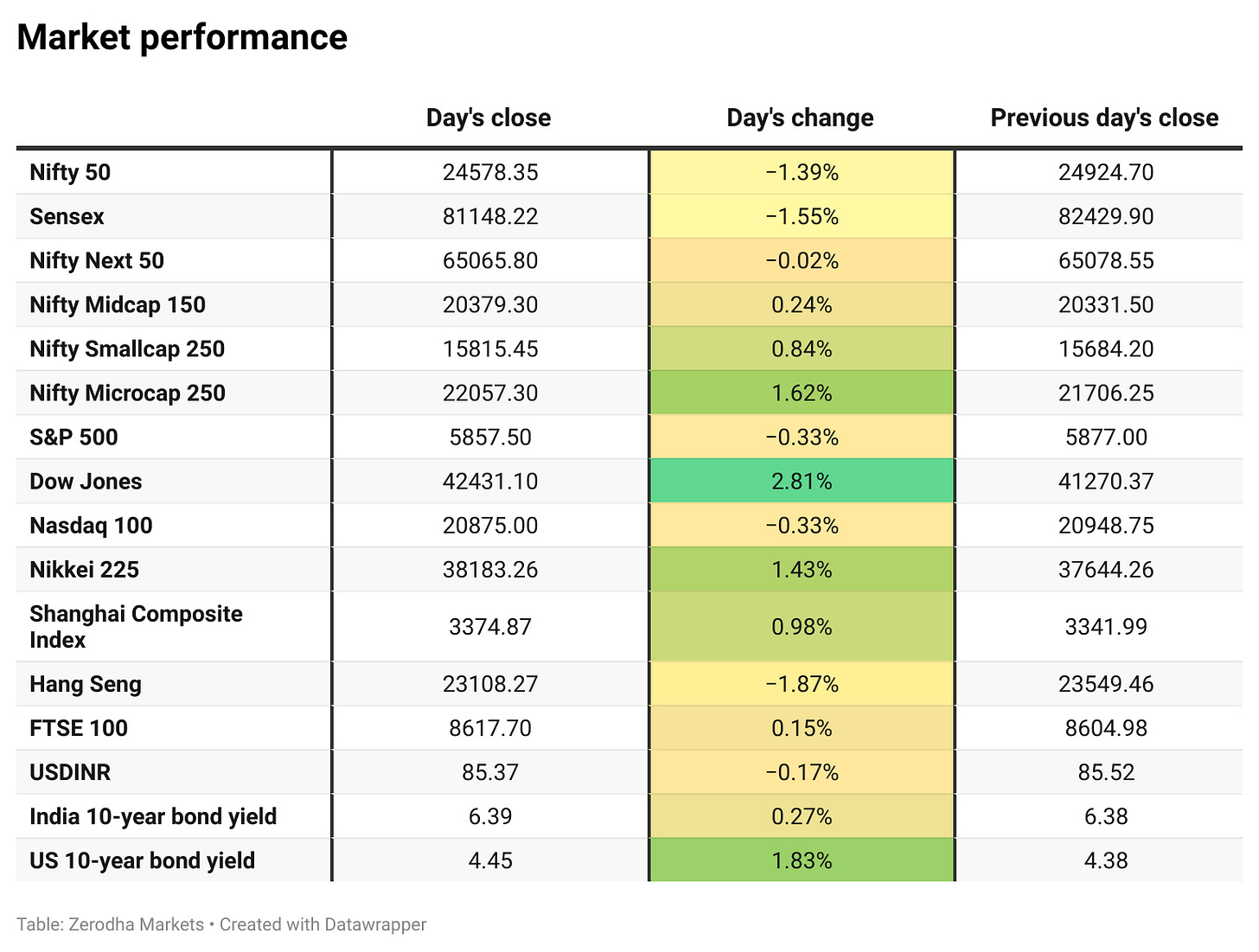

Nifty opened with a 60-point gap down at 24,864.05 but quickly recovered, hitting an intraday high of 24,973.80 before sliding towards 24,700 within the first hour. The index remained volatile, trading between 24,700 and 24,800 until 12:30 PM. In the second half, selling pressure intensified, pushing Nifty into the 24,550-24,625 range, eventually closing at 24,578.35, down 1.36%.

While steady FII inflows and positive global cues are providing some support, geopolitical tensions and the ongoing earnings season remain crucial for near-term market direction.

Broader Market Performance:

Broader markets had a strong session today, outperforming the main indices. Of the 2,959 stocks traded on the NSE, 1,948 advanced, 937 declined, and 74 remained unchanged.

Sectoral Performance:

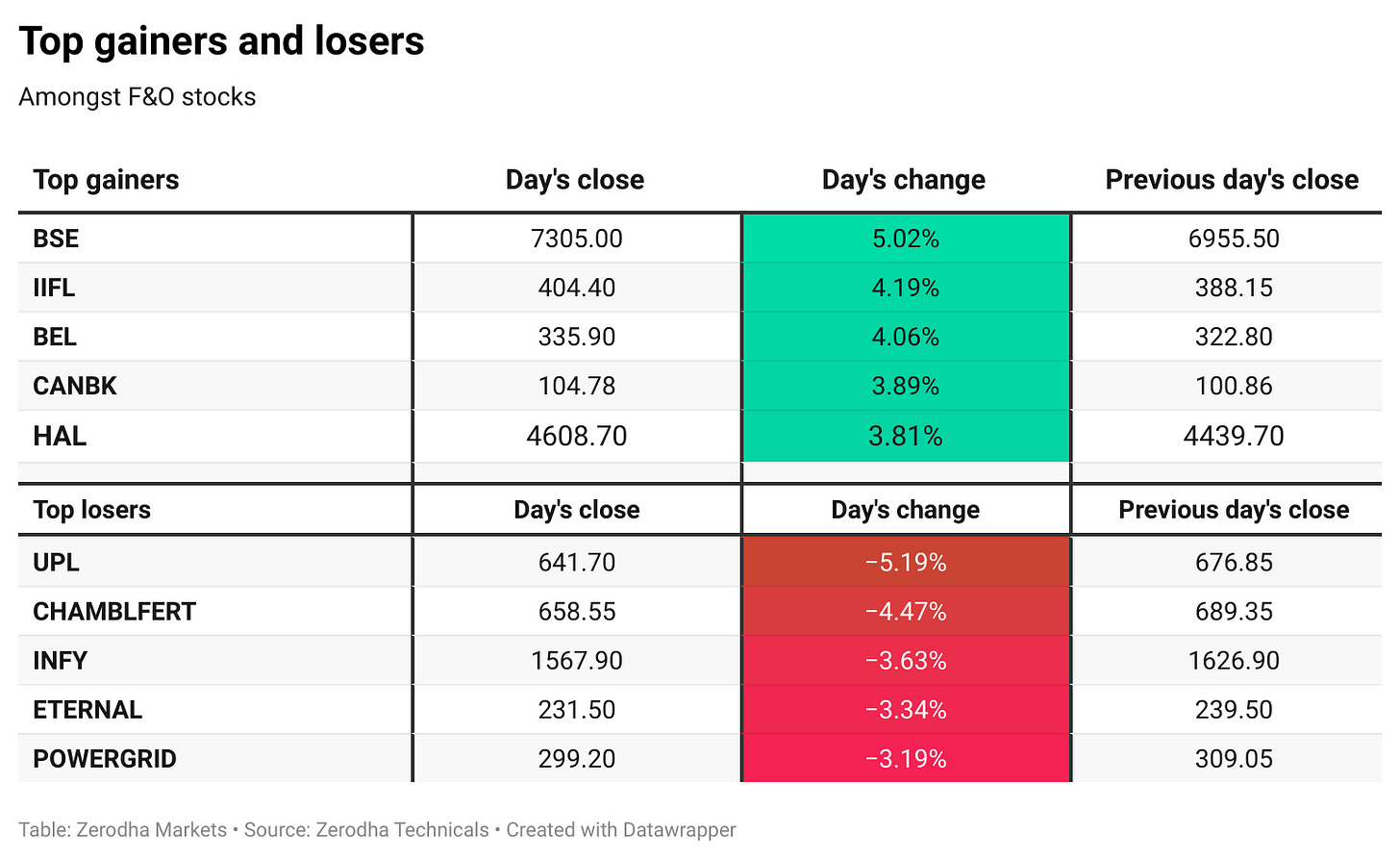

Nifty Media emerged as the top gainer, rising by 1.66%, followed closely by Nifty PSU Bank at 1.56% and Nifty Pharma at 1.22%. On the other hand, Nifty IT was the top loser, declining 2.42%, with Nifty Service down 1.60% and Nifty FMCG slipping 1.34%.

In total, 3 sectors closed in the green, while 9 sectors ended the session in the red, indicating a broadly negative market sentiment despite a few sectors outperforming.

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 15th May:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,800, indicating strong resistance at these levels.

The maximum Put Open Interest (OI) is 24,200, followed by 24,500, suggesting strong support at 24,500 and additional support at 24,300.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

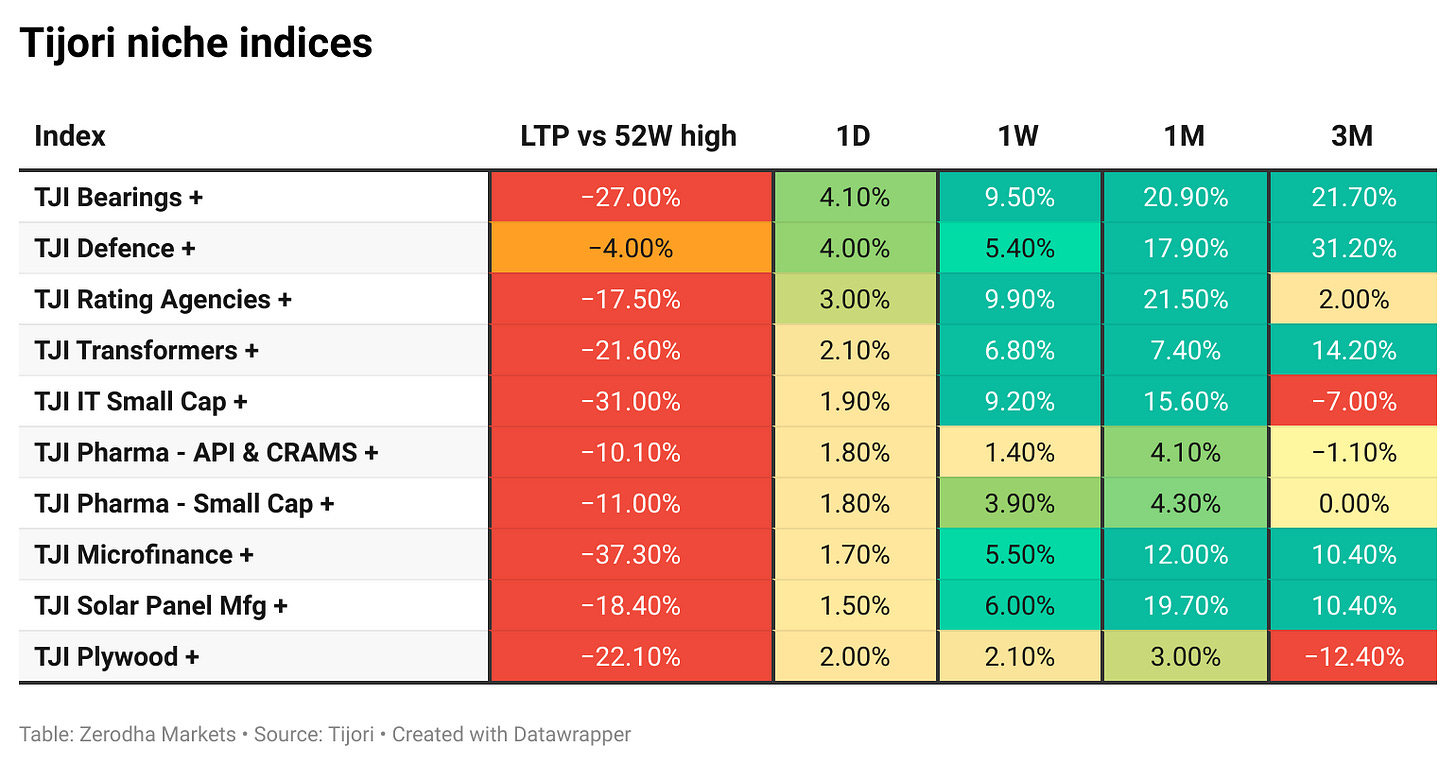

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India's retail inflation, measured by the Consumer Price Index (CPI), eased to 3.16% year-on-year in April 2025, marking the lowest level since July 2019. This decline from March's 3.34% was primarily driven by a significant drop in food inflation, which fell to 1.78% from 2.69%, with vegetable prices decreasing by 11% year-on-year.

CPI-based inflation has now stayed below the RBI's medium-term target of 4% for the third consecutive month. Dive deeper

India has notified the WTO about imposing retaliatory tariffs on U.S. goods worth $1.91 billion. This move responds to the U.S. reimposing 25% tariffs on Indian steel and aluminium exports. The step could strain ongoing trade talks between India and the U.S. Dive deeper

Larsen & Toubro Ltd. has secured orders worth Rs 2,500-5,000 crore for government projects. These include EPC contracts for Common Central Secretariat buildings in New Delhi and the State Legislative Assembly in Andhra Pradesh. Dive deeper

Hero MotoCorp has declared a final dividend of ₹65 per share, taking the total dividend for FY25 to ₹165 per share. In Q4 FY25, the company reported a 6.4% YoY rise in net profit to ₹1,081 crore and a 4.4% increase in revenue to ₹9,939 crore. Following the announcement, the stock rose over 2% even as the broader market was down. Dive deeper

Cipla reported a 30% year-on-year increase in net profit for Q4 FY25, reaching ₹1,222 crore, with revenue rising 8.5% to ₹6,597.72 crore. The company's board declared a total dividend of ₹16 per share, comprising a ₹13 final dividend and a ₹3 special dividend to commemorate its 90th anniversary. The record date for the dividend is set for June 27, 2025. Dive deeper

Indian defence stocks surged following Prime Minister Narendra Modi's call for increased self-reliance in military equipment. Bharat Dynamics led the gains with a 7.8% rise, reaching ₹1,692.35 per share, while Bharat Electronics climbed 4.5% to ₹337.30, and Hindustan Aeronautics advanced 4% to ₹4,617. This rally reflects investor optimism towards the government's 'Make in India' defence initiative and the sector's growth prospects. Dive deeper

Tata Motors' profit fell 35% this quarter to ₹1,382 crore, but it’s not all bad. They declared a ₹6 dividend, JLR made strong profits, and the company is now completely debt-free on the auto side. Looks like they’re cleaning things up for long-term growth. Solid steps overall. Dive deeper

What’s happening globally

WTI crude oil futures rose to $62.4 per barrel, marking a two-week high, driven by a temporary US-China tariff truce that eased trade war fears. However, concerns remain as the 90-day truce nears expiry, while rising OPEC output and Middle East developments continue to pressure prices. Despite the recent gains, oil remains over 10% lower since early April. Dive deeper

Trump is expected to sign an order to cut US drug prices by linking them to the lowest global rates. This may hurt India’s pharma exports, especially those selling to the US under Medicare. Experts warn it could pressure margins and reduce competitiveness. Dive deeper

The US dollar held on to recent gains, supported by optimism around the US-China trade agreement. The pact is expected to boost U.S. exports and ease global trade tensions, improving investor sentiment. Markets are now watching upcoming U.S. inflation data and Fed policy signals for the next move. Dive deeper

The US Small Business Optimism Index fell to 95.8 in April 2025, its lowest level since October 2024, but slightly above expectations of 94.5. The Uncertainty Index also dropped 4 points to 92, easing from February’s record high but still well above the historical average, reflecting ongoing trade policy concerns. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Ed Yardeni of Yardeni Research, observing a shift in market sentiment.

The market has, in a matter of weeks, moved from lots of things to worry about to suddenly maybe nothing to worry about. Even on the geopolitical front, there seems to be a lot of potential ceasefires going on, even a potential ceasefire between India and Pakistan, between the United States and the Houthis, between Russia and Ukraine. These are all tentative, but it certainly suggests that things are moving towards a more peaceful diplomatic and negotiating approach to dealing with world problems.

Here in the United States, the odds of a recession have gone down now that Trump's trade war seems to be simmering down and we have not only 90 days through July 8th for negotiating with every country around the world except China and now we have 90 days from today and negotiating with China with certainly lower tariffs than we had at the end of last week. - Link

Kiran Mazumdar-Shaw, executive chairperson of Biocon Ltd. on Trump's Drug-Price Order

"Trump is only looking at developed-world reference pricing. He is not looking at developing-world-reference pricing," He's not calling out India."

Active pharmaceutical ingredients are among India's key pharma exports, and they will not fall under the reference pricing."So I am not concerned about it impacting Indian pharmaceutical companies in any way." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

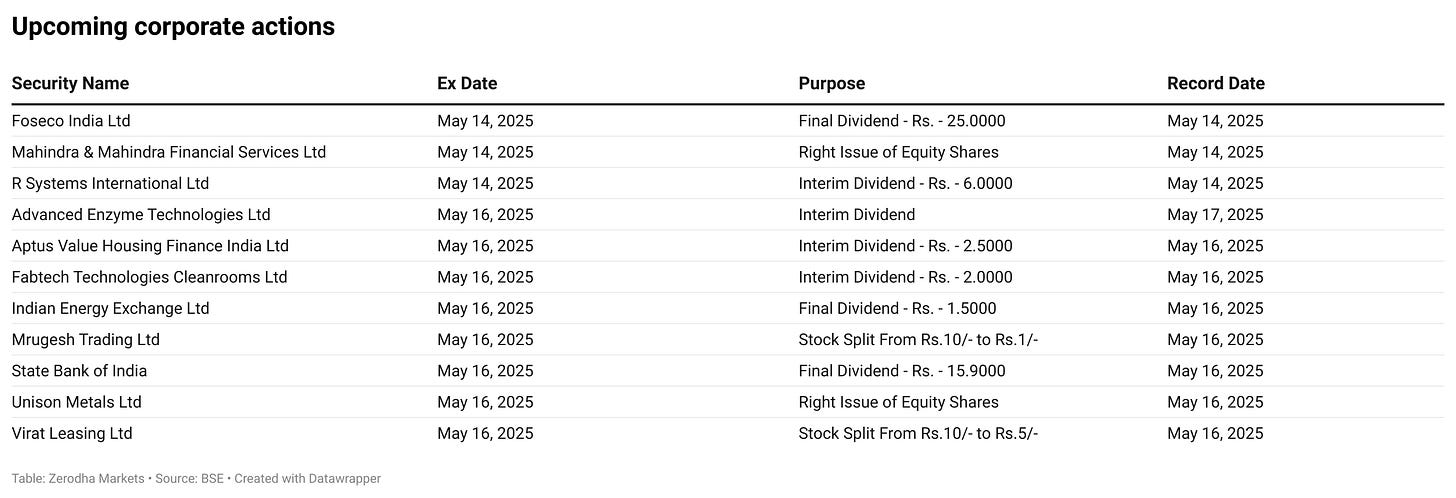

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Good morning