Markets continue to remain cautious at higher levels ahead of Fed policy

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

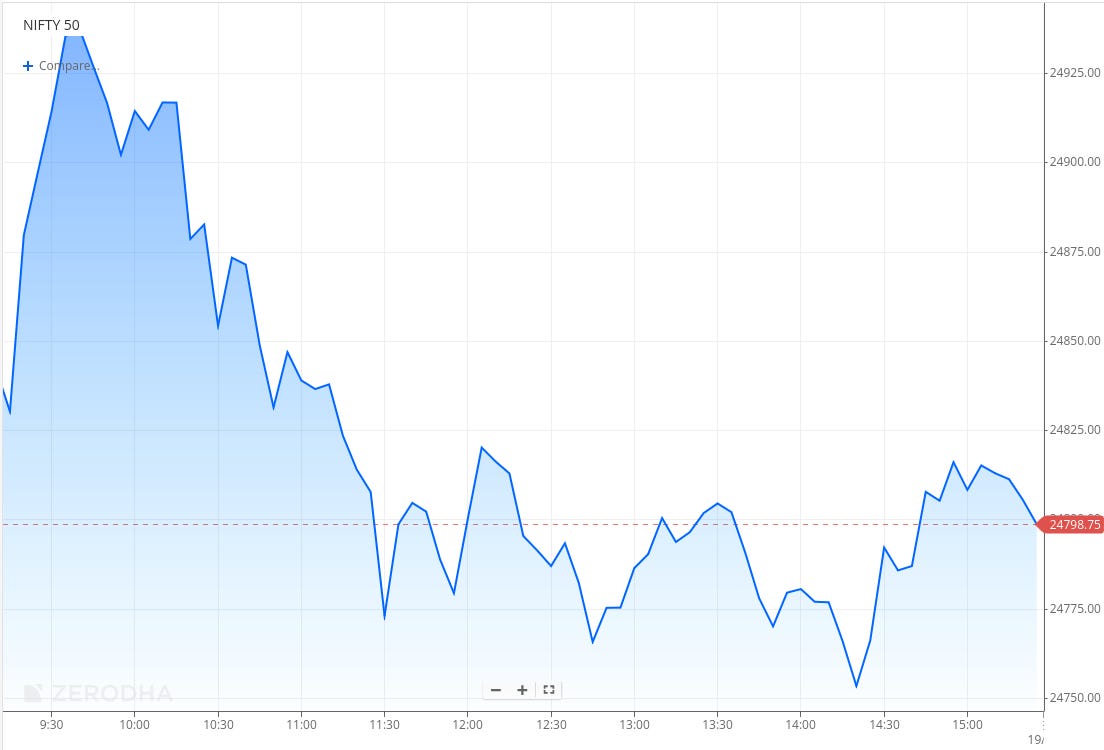

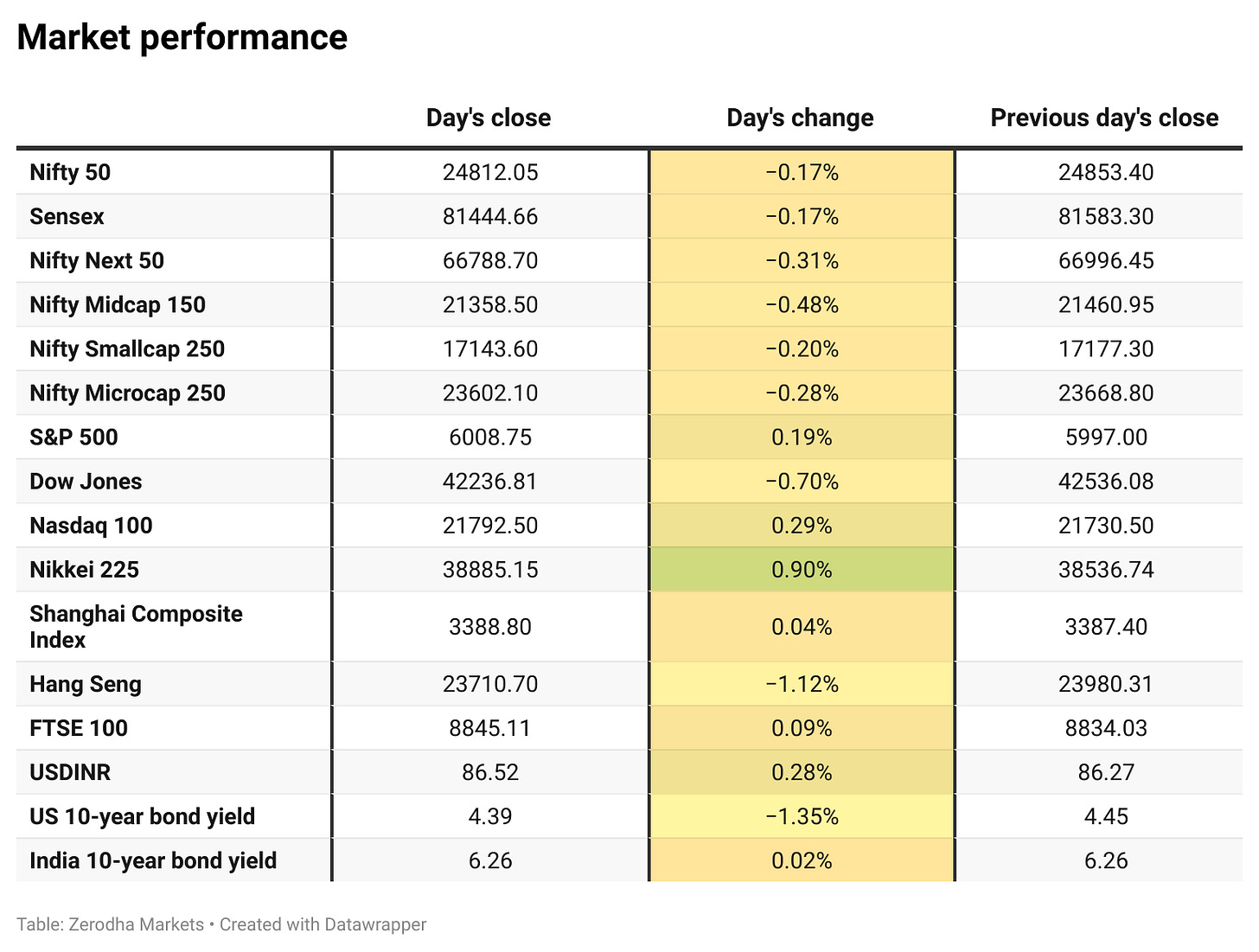

Nifty opened with a 65-point gap-down at 24,788.35 but quickly rebounded, rising by 160 points within the first 30 minutes. The index then consolidated in a narrow range between 24,900 and 24,940 before sliding 170 points by 11:30 AM. For the rest of the session, Nifty traded in a tight range between 24,750 and 24,825, eventually closing at 24,812.05, down 0.16%.

The RBI’s sharper-than-expected rate and CRR cuts provided early support. However, sentiment turned cautious as rising tensions in the Middle East pushed oil prices higher. Investors are now focused on the U.S. Federal Reserve’s interest rate decision and policy commentary scheduled for tonight.

Broader Market Performance:

Broader markets had a weak session today. Of the 2,955 stocks traded on the NSE, 1,026 advanced, 1,851 declined, and 78 remained unchanged.

Sectoral Performance:

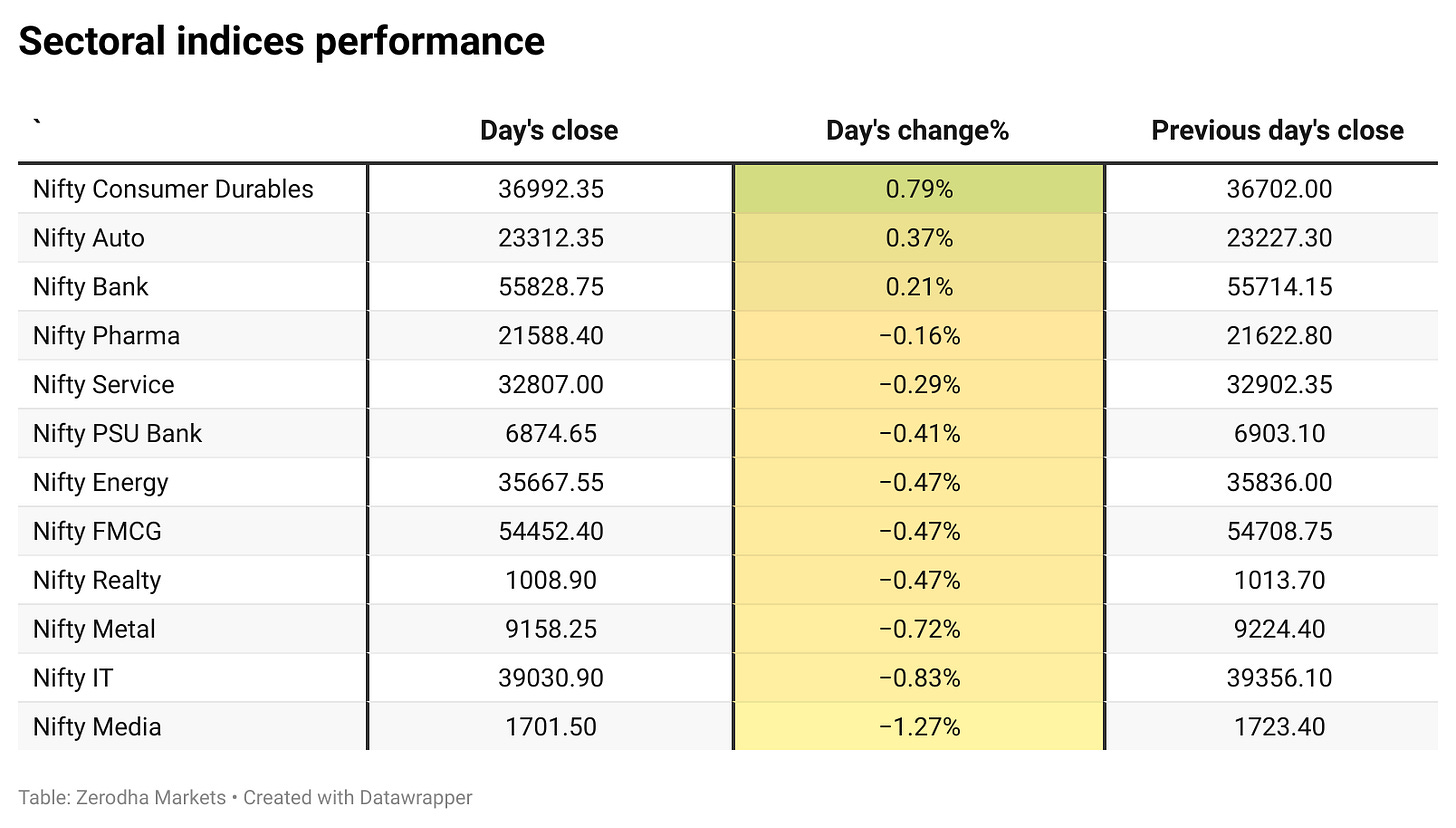

The top-gaining sector for the day was Nifty Consumer Durables, which rose by 0.79%, while the worst-performing sector was Nifty Media, which declined by 1.27%. Out of the 12 sectoral indices, 3 closed in the green—Consumer Durables, Auto, and Bank—while 9 ended in the red, led by Media, IT, and Metal.

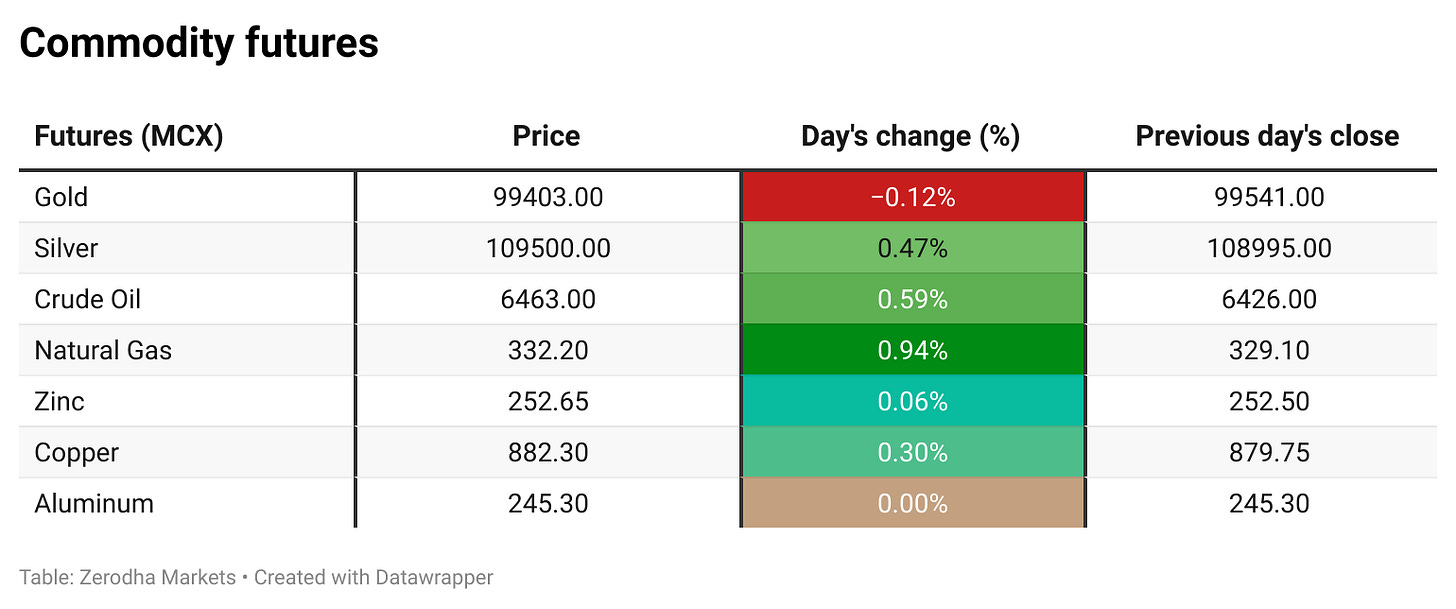

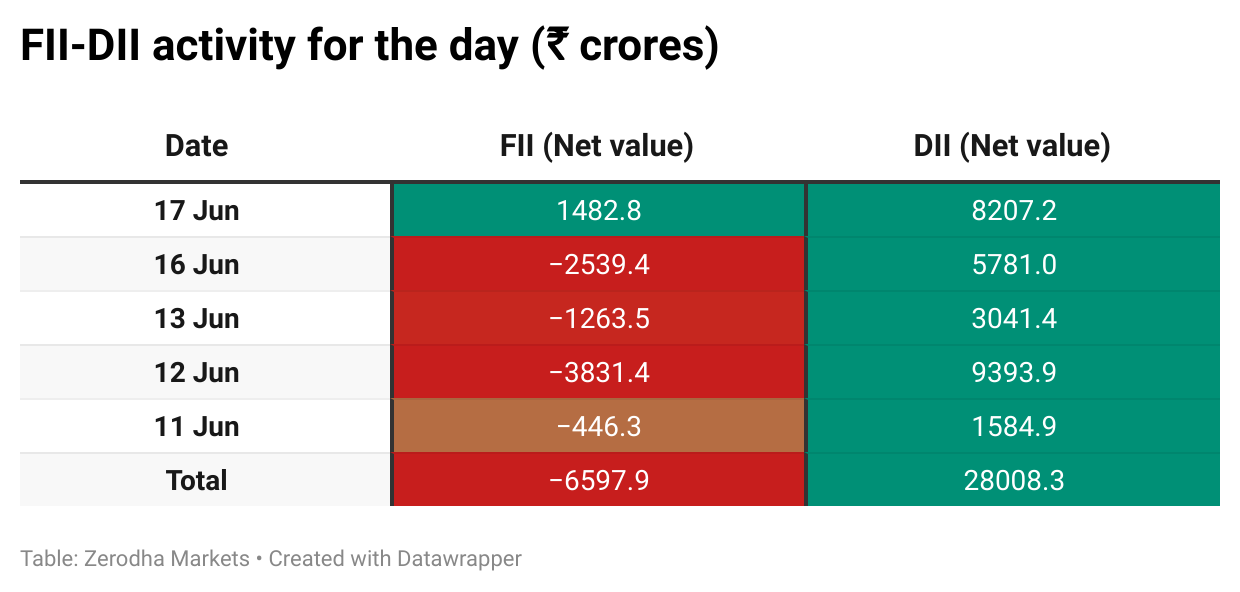

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 19th June:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,900, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,800, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

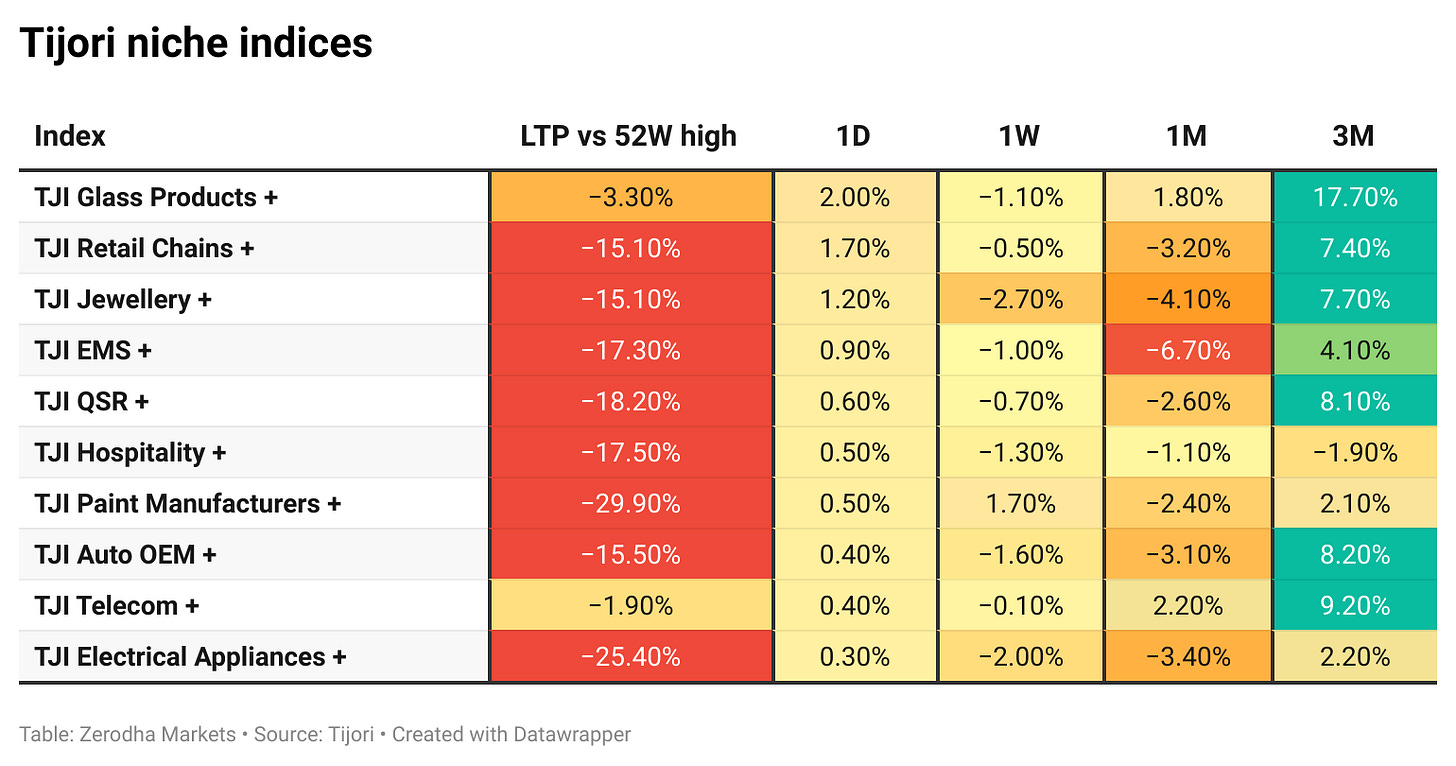

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

SEBI has approved shifting NSE's weekly F&O expiry from Thursday to Tuesday starting September 1, 2025, while directing BSE to move its Sensex derivatives expiry to Thursday to avoid overlap. Following the announcement, BSE shares fell nearly 6% intraday amid concerns over potential loss in volumes and market share. Dive deeper

Auto stocks like Maruti Suzuki, Eicher Motors, and TVS Motors gained after reports that India may import rare-earth magnets from Australia to reduce reliance on China, which controls 90% of global supply. While Maruti stated there's no immediate production impact, future EV plans could be affected if the magnet shortage persists. Dive deeper

Delhivery got CCI approval to acquire 99.4% of Ecom Express for ₹1,407 crore. This deal boosts Delhivery’s reach in smaller cities and strengthens last-mile delivery. After the news, Delhivery stock jumped ~2%, and analysts remain bullish. Dive deeper

The rupee fell to a two-month low of ₹86.28 against the dollar due to rising crude oil prices and tensions in West Asia. Heavy dollar demand from oil importers and speculators added pressure on the currency.RBI intervened to control volatility, and markets now await the U.S. Fed decision. Dive deeper

Ola Electric launched a nationwide zero-commission model, letting drivers keep 100% of their fare earnings. The rollout starts with autos, followed by bikes and cabs, impacting over a million driver-partners. This move could boost driver loyalty and support Ola’s competitive positioning. Dive deeper

The government will launch a FASTag annual pass for ₹3,000 from August 15, allowing up to 200 highway trips annually. This is only for private non-commercial vehicles like cars and vans. The aim is to simplify toll payments and reduce congestion at toll plazas. Dive deeper

India has made BIS certification mandatory for all imported steel raw materials starting June 16, 2025. The sudden rule change with just three days' notice has triggered panic among MSMEs due to high compliance costs. Industry groups warn it could disrupt supply chains and force small manufacturers to shut down. Dive deeper

CG Power has received a ₹641 crore order from Power Grid Corporation for 765/400 kV transformers and reactors. This is the company’s largest-ever single contract with a delivery timeline of 18–36 months. The stock gained after the news, boosting CG Power’s position in high-voltage infrastructure. Dive deeper

Polycab India won a ₹6,448 crore contract from BSNL under the BharatNet project for Karnataka, Goa, and Puducherry. The project includes building the middle-mile network and maintaining it for 10 years. This deal boosts Polycab’s presence in telecom infrastructure and supports future growth. Dive deeper

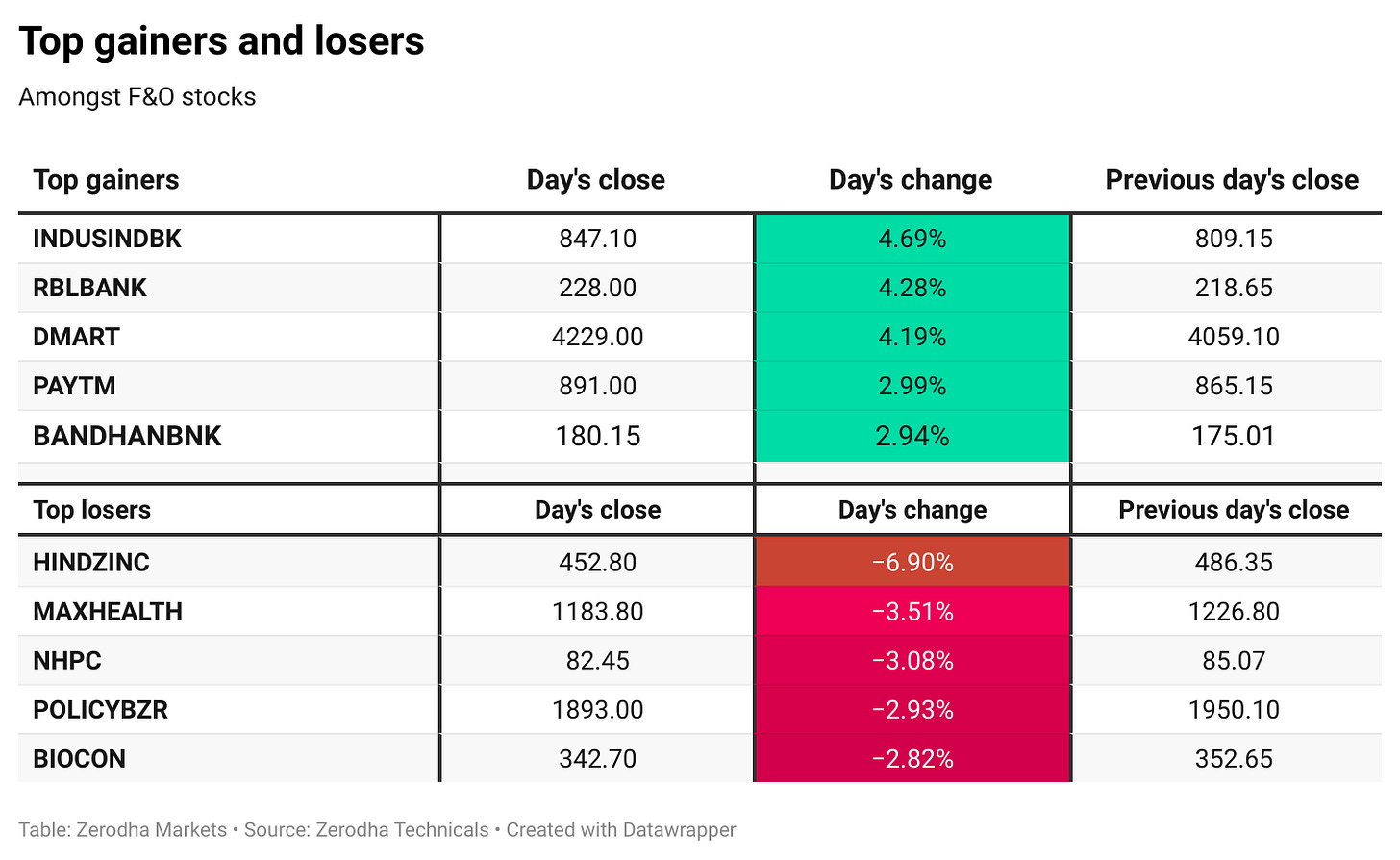

Vedanta declared a ₹7 per share interim dividend for FY 2025–26, with a record date of June 24. The total payout will be around ₹2,737 crore. It follows a recent ₹3,028 crore stake sale in Hindustan Zinc to reduce debt. Dive deeper

Vedanta sold a 1.6% stake in Hindustan Zinc for ₹3,028 crore through block deals. The move is aimed at reducing debt and strengthening its balance sheet. This comes ahead of Vedanta’s planned demerger into multiple focused entities. Dive deeper

DLF sold ₹11,000 crore worth of luxury homes in its Privana North Gurugram project within a week. The project includes 1,164 units, mostly 4BHKs and penthouses, in a premium township. DLF shares rose 2% after the strong sales response. Dive deeper

What’s happening globally

Iran’s Supreme Leader Ayatollah Ali Khamenei declared that the country will not surrender to Israel, responding to U.S. President Donald Trump’s call for Iran’s capitulation as the conflict entered its sixth day. Dive deeper

Oil prices surged on Tuesday, with Brent and WTI rising 4.4% and 4.3% respectively, amid escalating tensions between Israel and Iran and fears of a broader conflict involving the U.S. Prices climbed after President Trump demanded “unconditional surrender” from Tehran, pushing Brent to $76.45 and WTI to $74.84 per barrel. Dive deeper

The Fed is expected to hold rates steady at 4.25%–4.5%, maintaining a cautious stance amid tariff-related uncertainty and a slight uptick in inflation to 2.4% in May. Officials continue to signal no urgency for policy changes as they monitor evolving economic risks. Dive deeper

Silver surged past $37.20/oz today, hitting its highest level since 2012, driven by strong industrial demand, ongoing supply shortages, and safe-haven buying amid geopolitical tensions. Over half of global silver demand now comes from solar, electronics, and electrification sectors, highlighting its growing structural importance. Despite a projected 21% narrowing of the supply deficit in 2025, this marks the fifth straight year of shortage, keeping prices elevated. Dive deeper

Zinc futures traded below $2,640 per tonne in June, testing the lowest level in one month as tariffs and macroeconomic uncertainty limited the outlook for galvanization demand, zinc's main industrial use. Dive deeper

The Nikkei 225 Index climbed 0.9% to close at 38,885 on Wednesday, reaching its highest level in four months as softer economic data tempered expectations for further Bank of Japan interest rate hikes. May exports declined for the first time in eight months under pressure from US tariffs, while imports fell more than expected. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sanjeev Bikhchandani, Founder and Executive Vice Chairman, Info Edge, on VC funding and IPOs

“If you take investors’ money, you have to be ready to give them an exit. Either don’t take their money or be prepared to work toward an exit.”

A good IPO becomes a win-win. The company goes public, the investor gets a market exit, and the founder gets independence from shareholder agreements. “But trying to take a company public before it’s ready is a recipe for disaster.” - Link

Sundararaman Ramamurthy, MD and CEO, BSE on expiry day change to Thursday

BSE decided to go ahead with Thursday as expiry in the interest of the market

Global markets also have expiries on Thursday or Friday

BSE gained market share even when the expiry day was Friday

The great advantage of relative value trading on Thursday appears to be a better & ideal choice - Link

Arun Misra, CEO of Hindustan Zinc Ltd., on future plans

We will add roughly 1.6 million tonnes of zinc, 1.4 million tonnes of lead, and 1,500 tonnes of silver. The annual capex outlay will be largely funded by internal accruals. The company plans to launch all programmes on the ground three months from now. - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

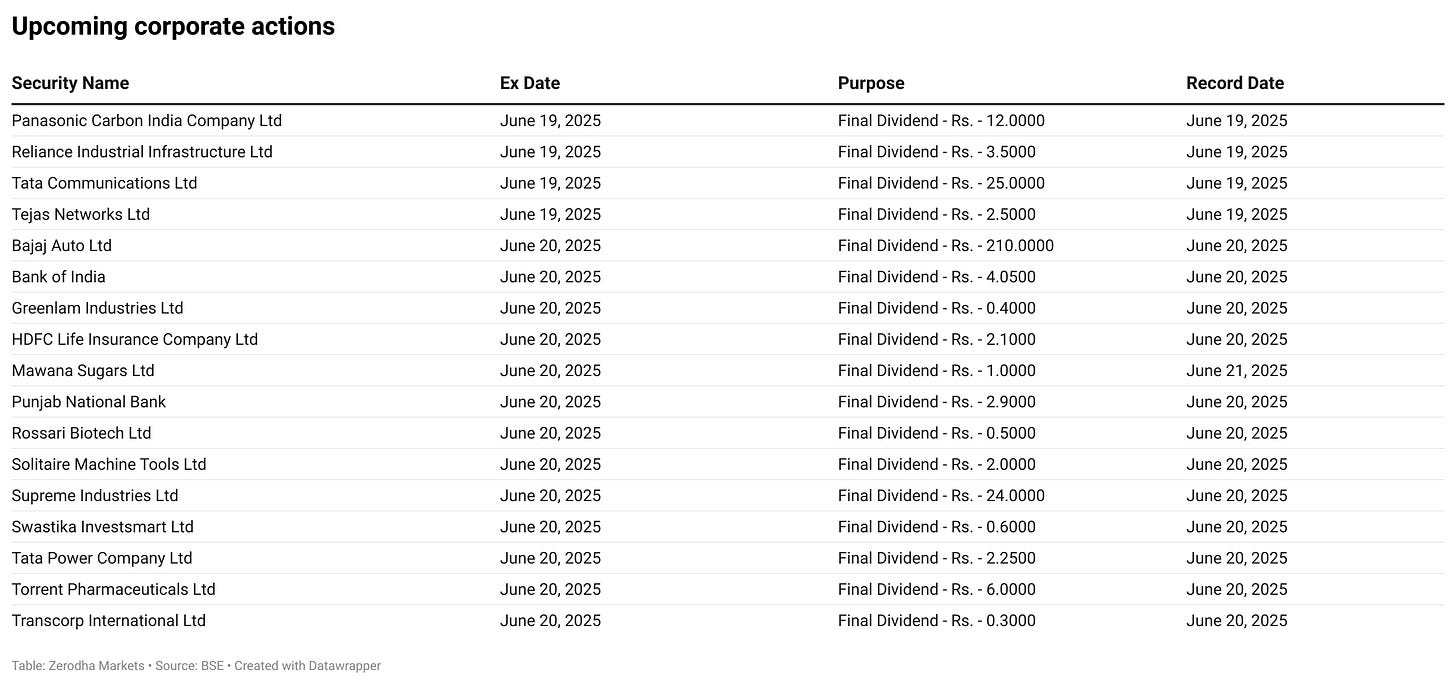

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.