Market dips on global trade jitters, awaits earnings cues

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

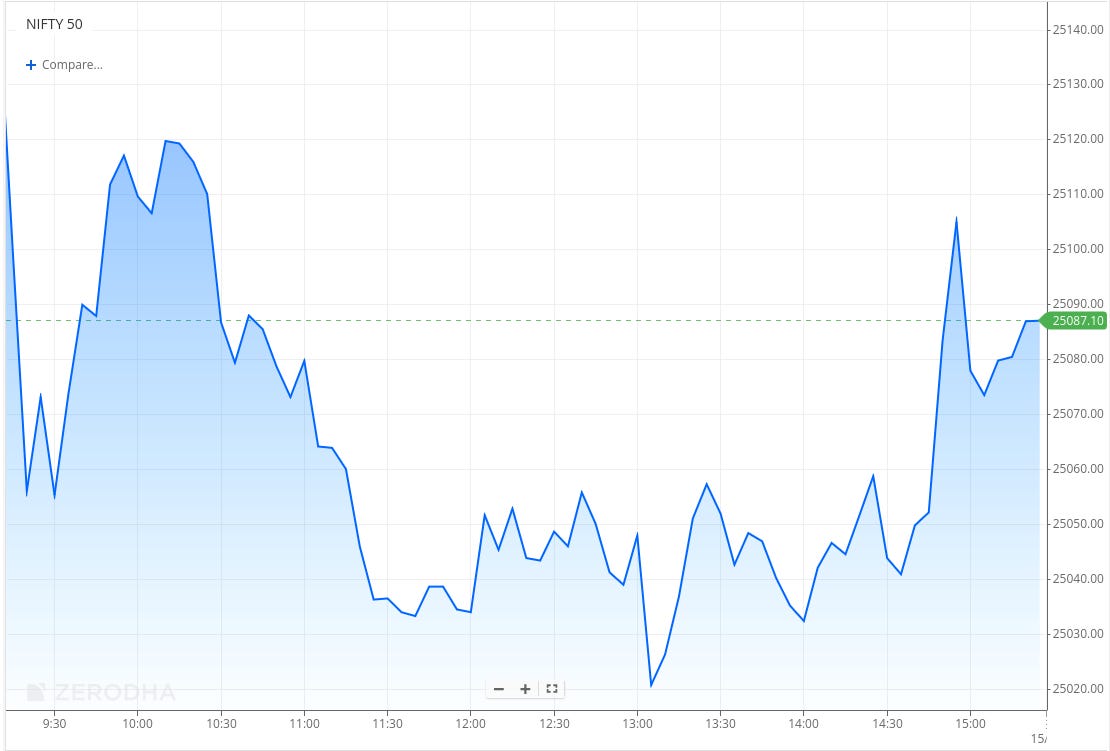

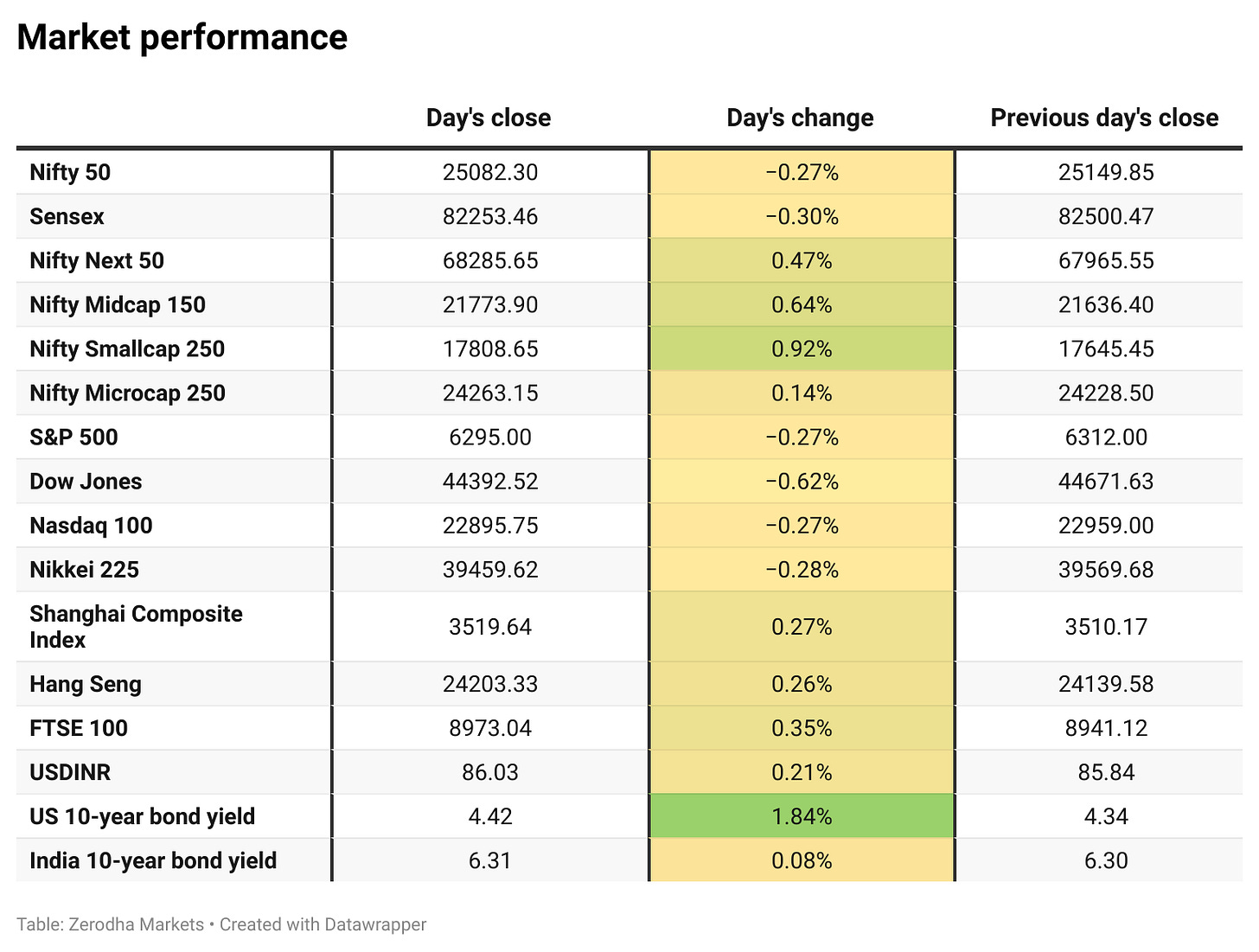

Nifty opened flat at 25,149.50 and quickly dropped nearly 90 points to touch 25,060 within the first 15 minutes. After a brief rangebound phase in the first hour, the index spiked to 25,120 but later slipped to the 25,000 mark in the second half. In the final hour, it recovered by nearly 100 points and eventually closed at 25,082.30, down 0.26%.

Investor sentiment remained subdued due to weak Q1 results from TCS and renewed global tariff concerns, following fresh U.S. duties on the EU’s imports. Broader uncertainty around global trade and muted market cues kept investors cautious. The near-term market direction is expected to hinge on upcoming earnings announcements and key macroeconomic data.

Broader Market Performance:

Broader markets were mixed but continued to outperform the headline indices in today's session. Of the 3,043 stocks traded, 1,464 advanced, 1,482 declined, and 97 remained unchanged.

Sectoral Performance:

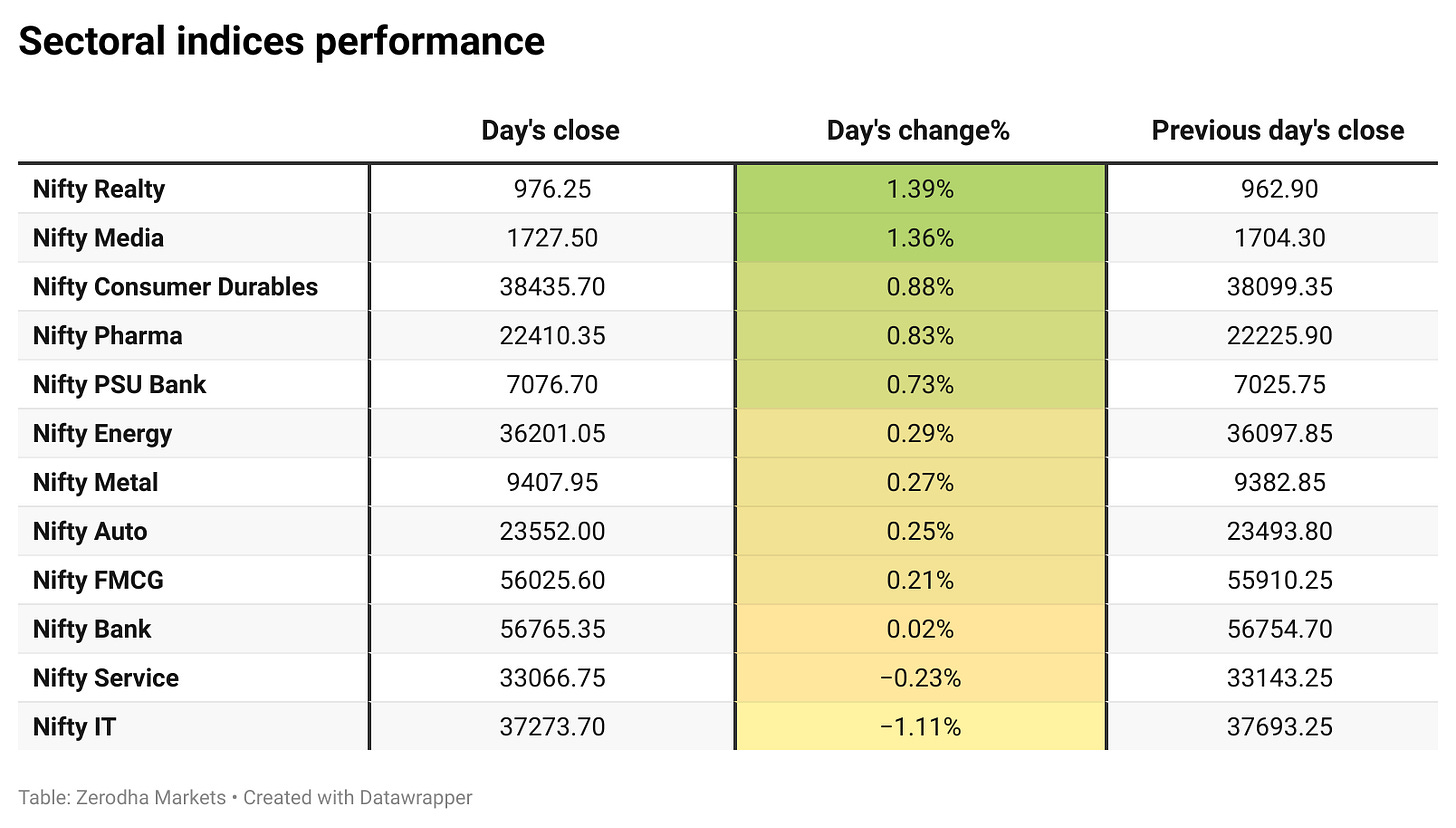

Nifty Realty was the top gainer among sectoral indices, rising 1.39%, followed closely by Nifty Media, which gained 1.36%. On the other hand, Nifty IT was the worst performer, declining by 1.11%. Out of the 12 sectoral indices listed, 10 closed in the green while 2 ended in the red.

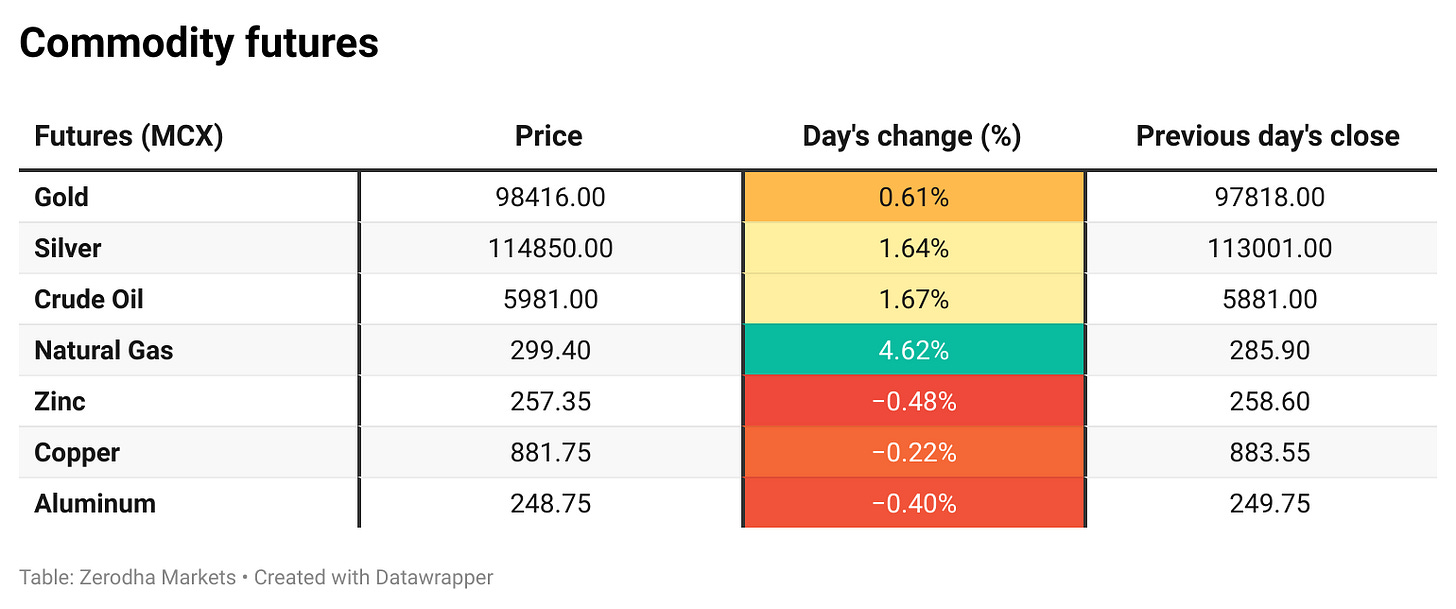

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 17th July:

The maximum Call Open Interest (OI) is observed at 25,500, followed closely by 25,300, suggesting strong resistance at 25,400 - 25,500 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 25,100, suggesting strong support at 25,000 - 24,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

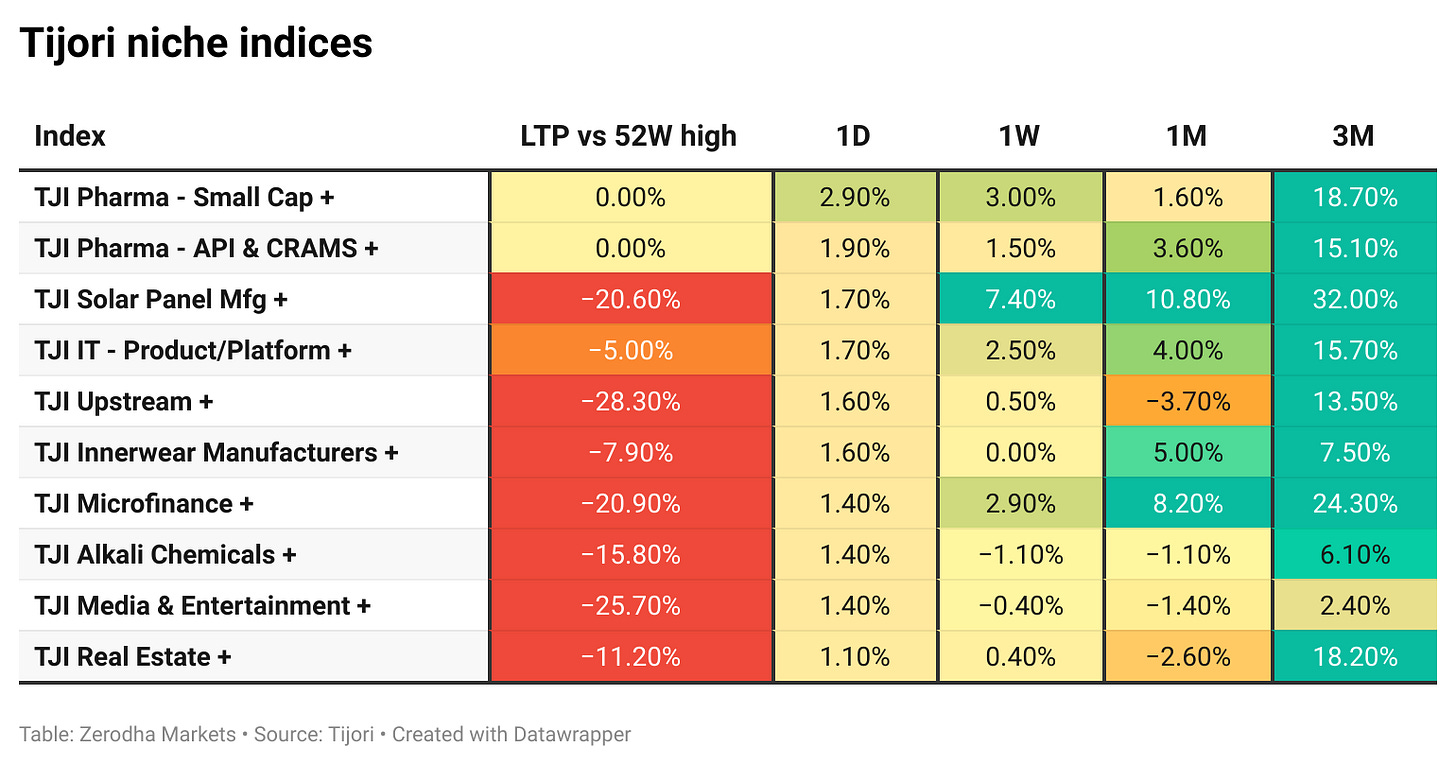

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee hovered around 85.7 per USD, pressured by a lack of clarity on U.S. tariff decisions. Indian officials are set to resume trade talks in Washington soon. Dive deeper

India’s CPI inflation eased to 2.10% in June, its lowest since 2019, driven by negative food inflation and a sharp fall in vegetable prices. Dive deeper.

India’s wholesale inflation fell to –0.13% in June, the first decline in 19 months, led by steep drops in food and vegetable prices. Dive deeper.

Neuland Laboratories surged 20%, closing at ₹11,665 on Monday as investors rallied ahead of its July 18 record date for a ₹25 per share final dividend. Dive deeper.

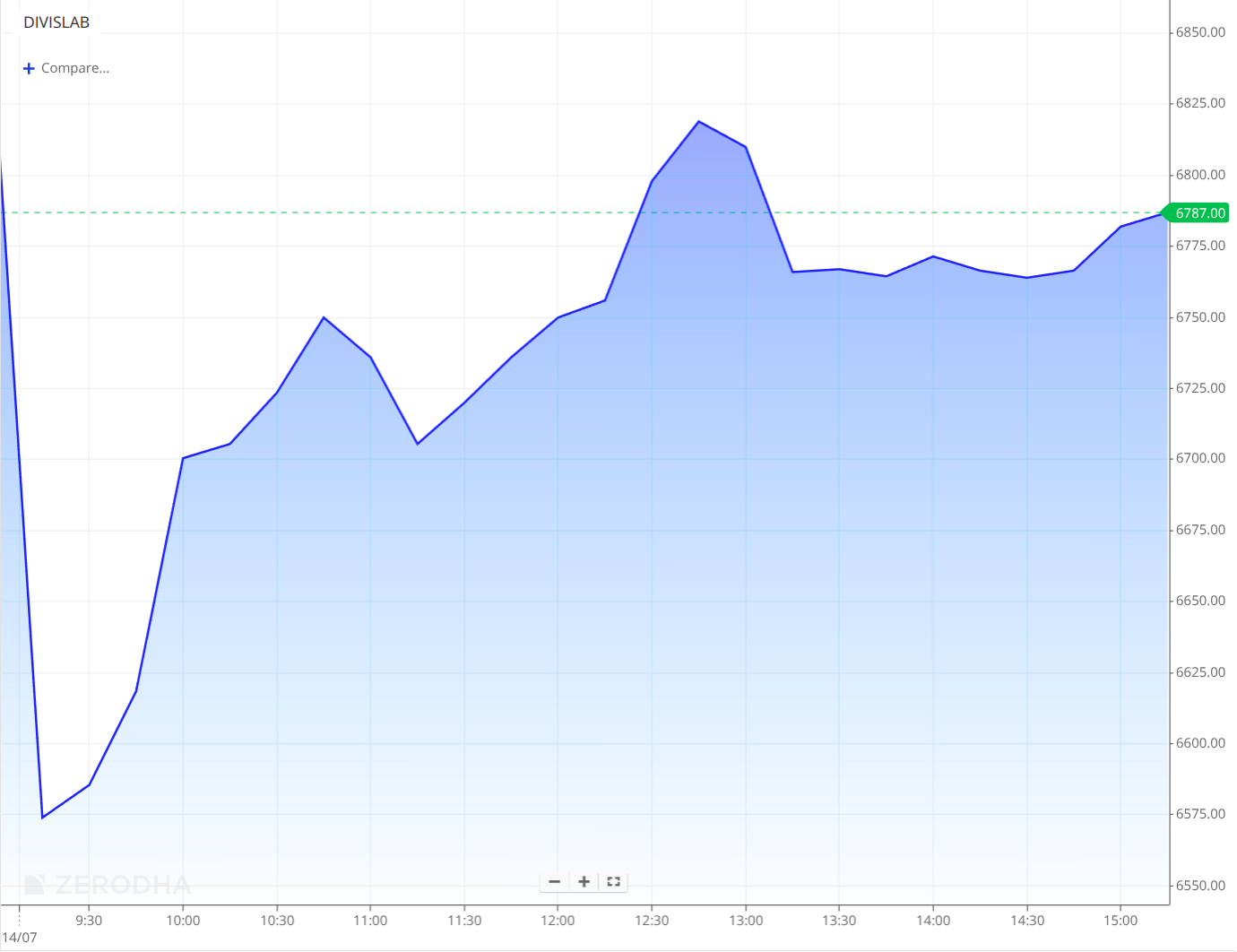

Divi’s Labs fell 4% after a U.S. court cleared MSN Pharma to launch a generic of Novartis’ Entresto, raising concerns for Divi’s, a key API supplier for the drug. Dive deeper.

Jane Street has deposited ₹4,843.6 crore in escrow and asked SEBI to lift trading curbs imposed on July 3, insisting its trades were standard arbitrage. SEBI is reviewing the request. Dive deeper

Fuel prices for petrol and diesel were kept flat on July 14 across major cities despite global oil volatility. Dive deeper

Ola Electric is expected to report a larger net loss of ₹459 crore in Q1, with revenues estimated at ₹685 crore and volumes around 60,000 units. Dive deeper

India’s income-tax refunds have surged over 470% in the last 10 years, from ₹83,008 crore in FY14 to ₹4.76 lakh crore in FY25, according to government data. Dive deeper

India Ratings upgraded Reliance Infrastructure’s credit rating by three notches to IND B (Stable/A4), removing the “Default” tag after six years. The stock jumped nearly 4% in reaction to the upgrade. Dive deeper

What’s happening globally

European markets slipped, with the STOXX 600 down ~0.5%, after Trump proposed 30% tariffs on EU and Mexico imports starting August 1. Auto stocks led the decline, while Germany’s DAX fell ~0.7% and France’s CAC 0.5%. Dive deeper.

The Hang Seng rose 64 points to 24,203, boosted by stronger-than-expected June export growth of 5.8% and a rebound in imports. Dive deeper

Gold prices climbed to a three-week high as safe-haven demand increased following fresh tariff threats from the US on EU goods. Fears of a full-blown trade war kept global investors risk-averse. Dive deeper

The euro weakened after Donald Trump proposed a 30% tariff on EU imports, escalating global trade concerns and pressuring the European Central Bank to maintain dovish policy. Dive deeper

With upper-house elections looming July 20 and opposition parties likely gaining influence, the Bank of Japan may face political pressure to maintain its ultra-loose monetary policy and delay rate hikes. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Hero MotoCorp Chairman Pawan Munjal on international market expansion

"Our entry into Europe and the UK later this year marks the next phase in our global ambition backed by engineering excellence and innovation,"

"A bold global expansion roadmap will see Hero MotoCorp extend its presence into Germany, France, Spain, and the United Kingdom in the second quarter of FY 2025-26, as we carry our vision of mobility without boundaries to new markets." - Link

VIP Industries Chairman Dilip Piramal on the sale of Promoter stake in the business

"We are a family-owned business, and the next generation is not very keen on running it"

"For me, it’s important to safeguard shareholder interests—which aligns with my own. The only viable path forward was to bring in a new management team with ownership interest," - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

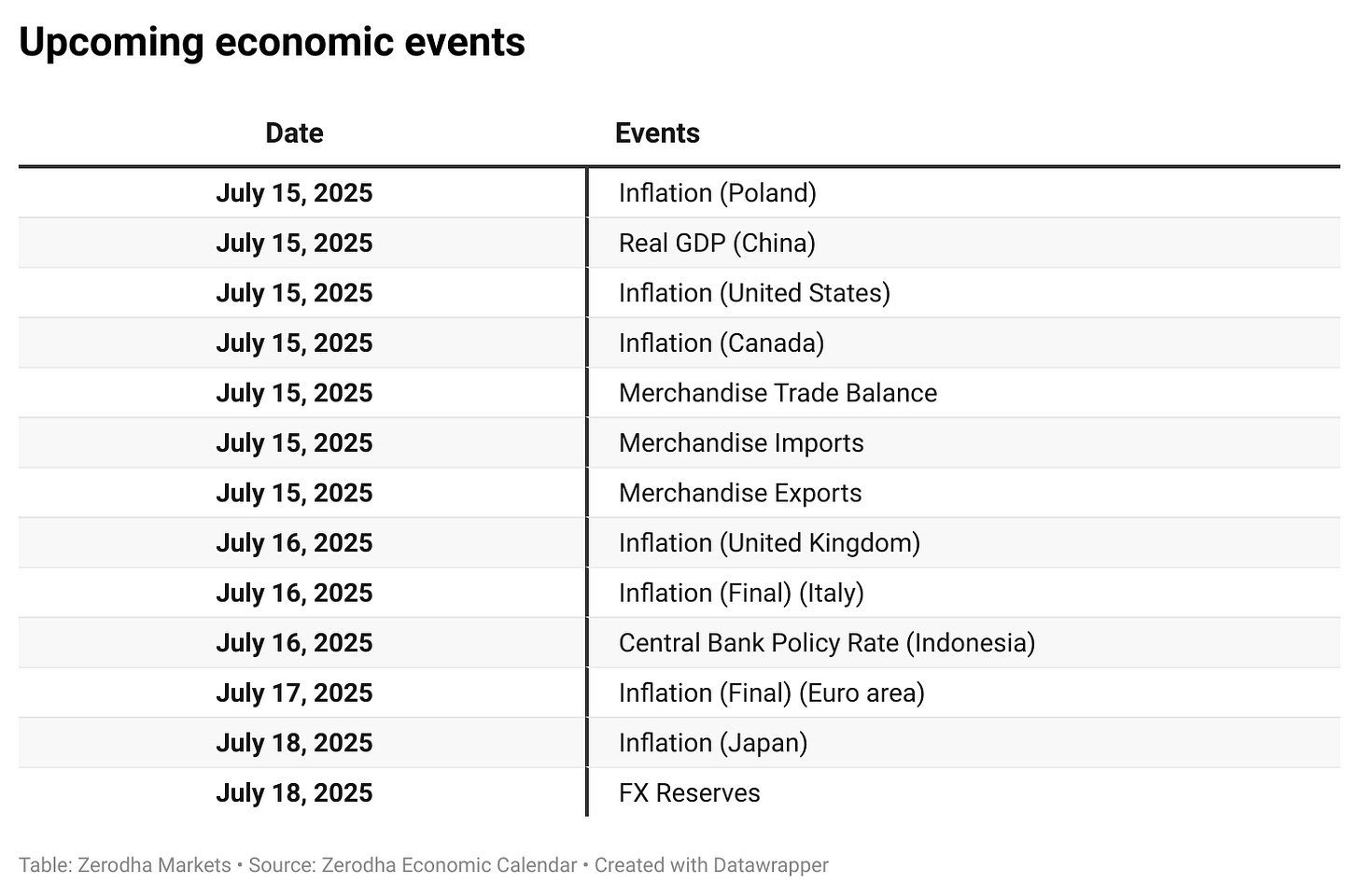

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.