Year-end buying pushes Nifty past 26,150; record highs in sight

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore a small detour to close out the year with a curated movie watchlist for traders and investors—feature films (no documentaries, no series, no spoilers) that revolve around money, markets, power, risk-taking, and human behaviour.

Spanning the 2008 Global Financial Crisis, Wall Street excesses, niche trading ideas, Indian market films, and a few unexpected outliers, each movie is viewed through a simple trader’s lens: what it teaches, how real it feels, and how relatable it is if you’ve spent time around markets. Think of it as an end-of-year watchlist to dip into over the holidays—no charts, but still very much about money.

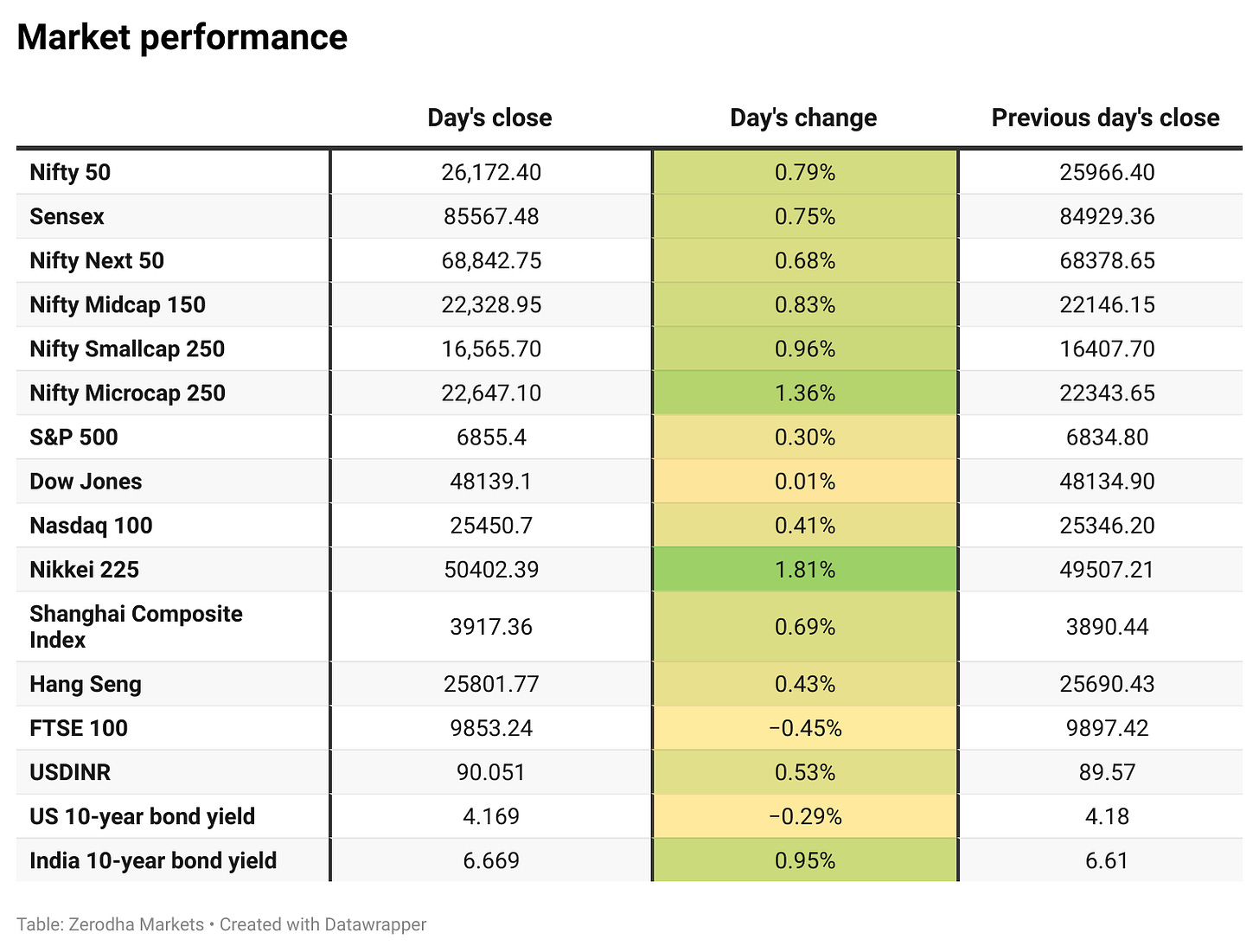

Market Overview

Nifty opened with a strong 90-point gap-up at 26,056, supported by positive global cues and follow-through momentum from last week’s close. After the initial spike, the index traded with a steady upward bias, consolidating between 26,080 and 26,130 through the first hour as buying interest remained healthy.

By around 12:30 PM, Nifty inched higher and crossed the 26,150 mark, holding firm through most of the afternoon with only shallow intraday pullbacks. In the final hour, the index extended gains toward 26,180 and closed near the day’s highs at 26,172.40, up about 0.8%, marking a constructive session backed by sustained buying and improving sentiment.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market continued the strong momentum from Friday. Out of 3,278 stocks that traded on the NSE, 2,250 advanced, while 921 declined, and 107 remained unchanged.

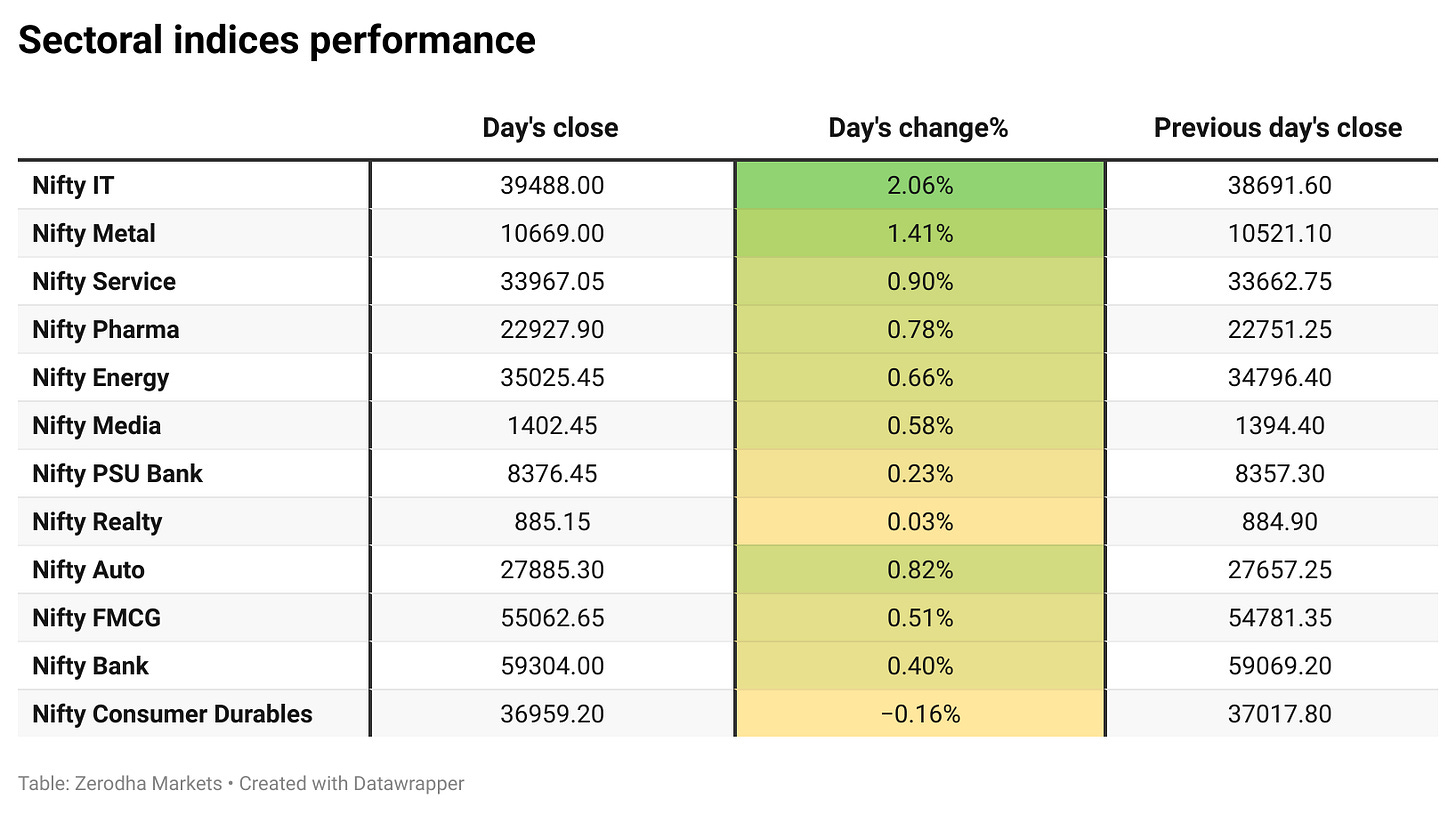

Sectoral Performance:

Nifty IT led the gains with a strong 2.06% rise, while Nifty Consumer Durables was the sole loser, slipping 0.16%. Out of the 12 sectoral indices, 11 ended in the green and only 1 closed in the red — marking a broadly positive session across the board.

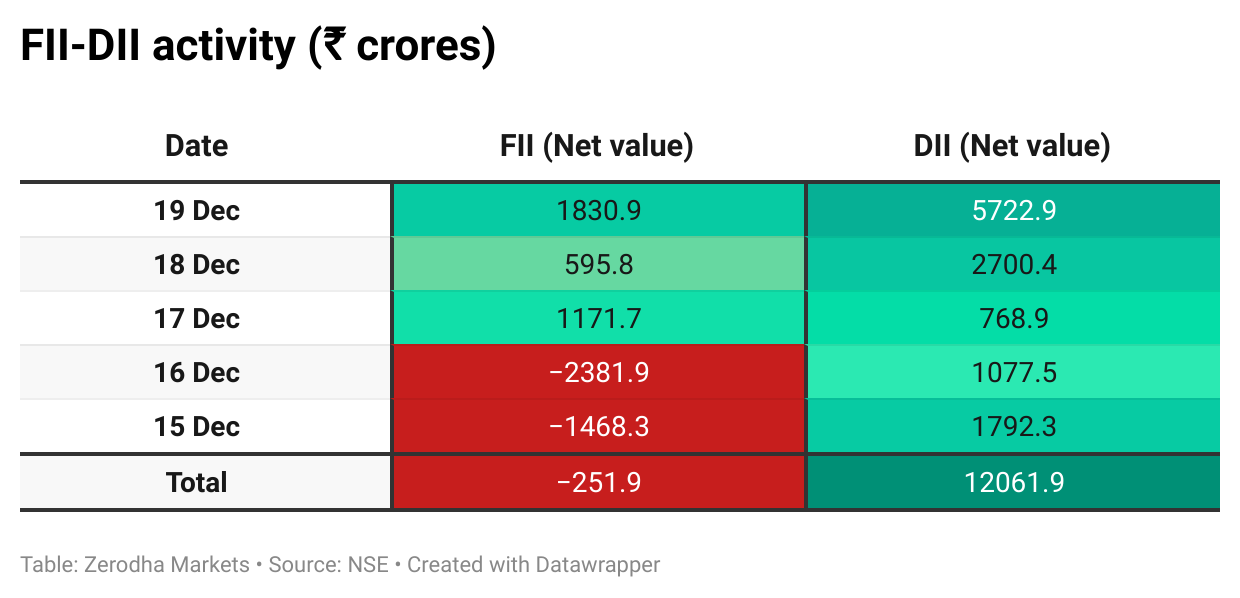

Here’s the trend of FII-DII activity from the last 5 days:

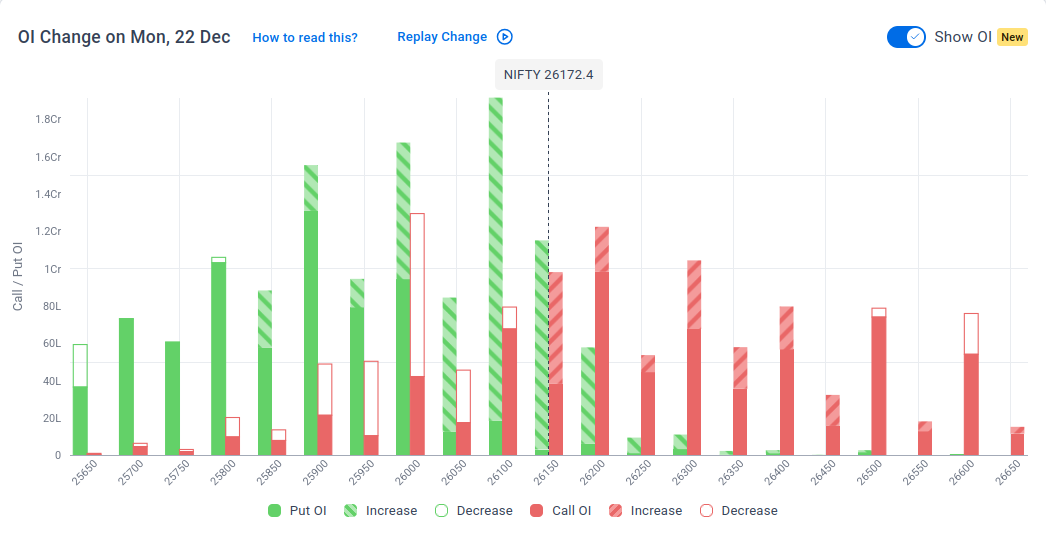

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd December:

The maximum Call Open Interest (OI) is observed at 26,200, followed by 26,300, indicating potential resistance at the 26,200 -26,300 levels.

The maximum Put Open Interest (OI) is observed at 26,100, followed by 26,000, suggesting support at the 26,100 to 26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

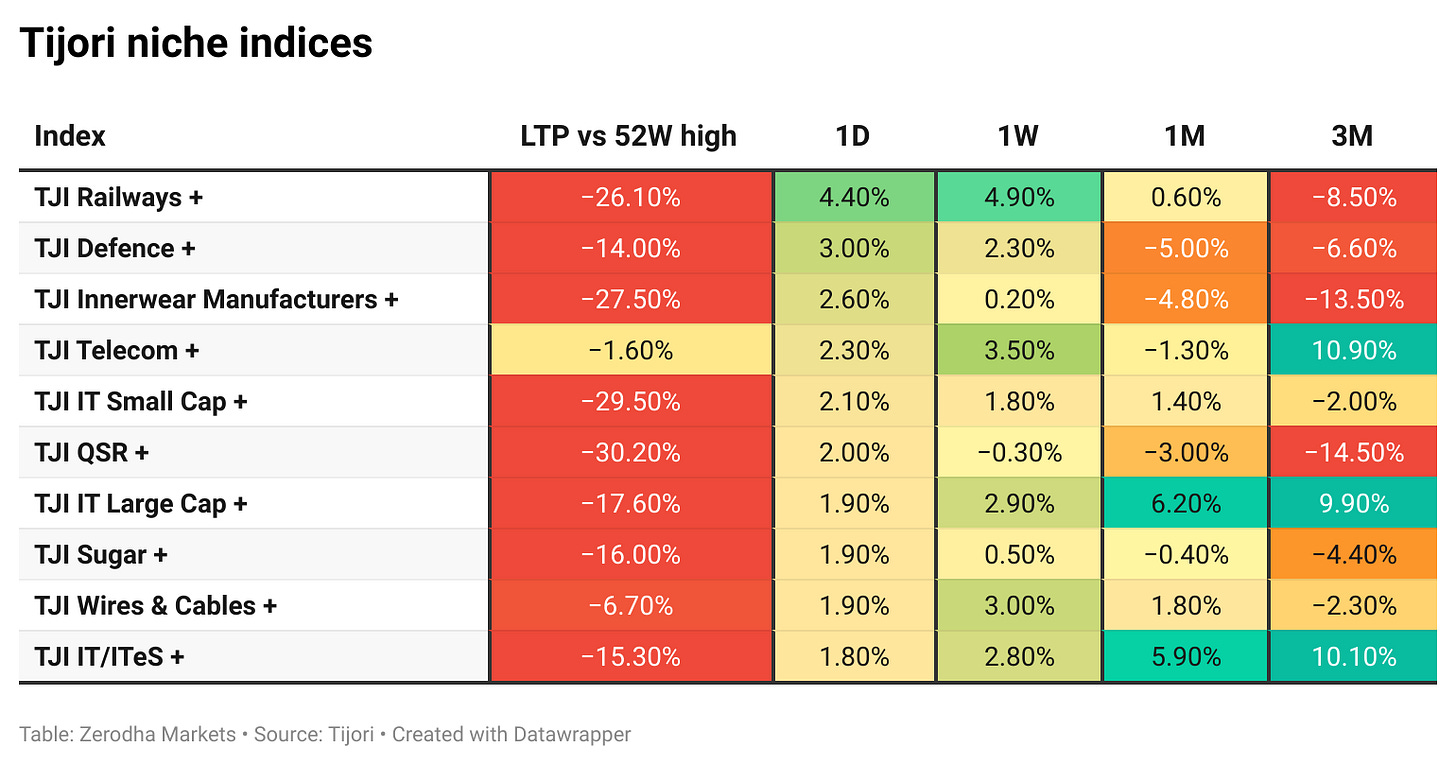

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Infosys said its NYSE-listed ADR saw unusual volatility on December 19 that triggered two trading pauses, but clarified there were no material events requiring disclosure. The company said the filing was issued for transparency and to avoid unwarranted speculation. Dive deeper

BSE plans to launch more monthly index options and revamp the Bankex index to strengthen its derivatives offering. Dive deeper

Coal India’s wholly-owned arm Bharat Coking Coal (BCCL) is expected to tap the primary market with an IPO of around ₹1,300 crore in the next two weeks, according to a report. Dive deeper

The rupee slipped after last week’s rebound, as strong dollar demand and high forward premiums kept corporate hedging costs elevated despite RBI support. Dive deeper

India and New Zealand have concluded FTA talks aimed at doubling bilateral trade in five years, with the pact expected to be signed in the first half of next year. Dive deeper

Fortis Healthcare will acquire Bengaluru’s People Tree Hospital (Yeshwantpur) for ₹4.3 billion via a 100% buyout of TMI Healthcare, strengthening its presence in South India. Dive deeper

India’s 10-year G-Sec yield climbed to a nine-month high as markets digested a larger-than-scheduled state bond auction, amplifying supply concerns amid heavy quarterly borrowing. Dive deeper

HCC’s joint venture secured a Railways contract worth about ₹901 crore, adding to the company’s order book. The order is expected to improve near-term execution visibility. Dive deeper

Apollo Micro Systems received DRDO approvals for two technology transfers, covering a 10 kW laser-based Directed Energy Weapon system and an EO tracking system, which enabled it to build and support key DEW subsystems. Dive deeper

What’s happening globally

Brent rose toward $61/bbl as US–Venezuela tensions and tanker-related incidents raised fresh supply-risk concerns, alongside escalating attacks linked to the Russia–Ukraine conflict. Dive deeper

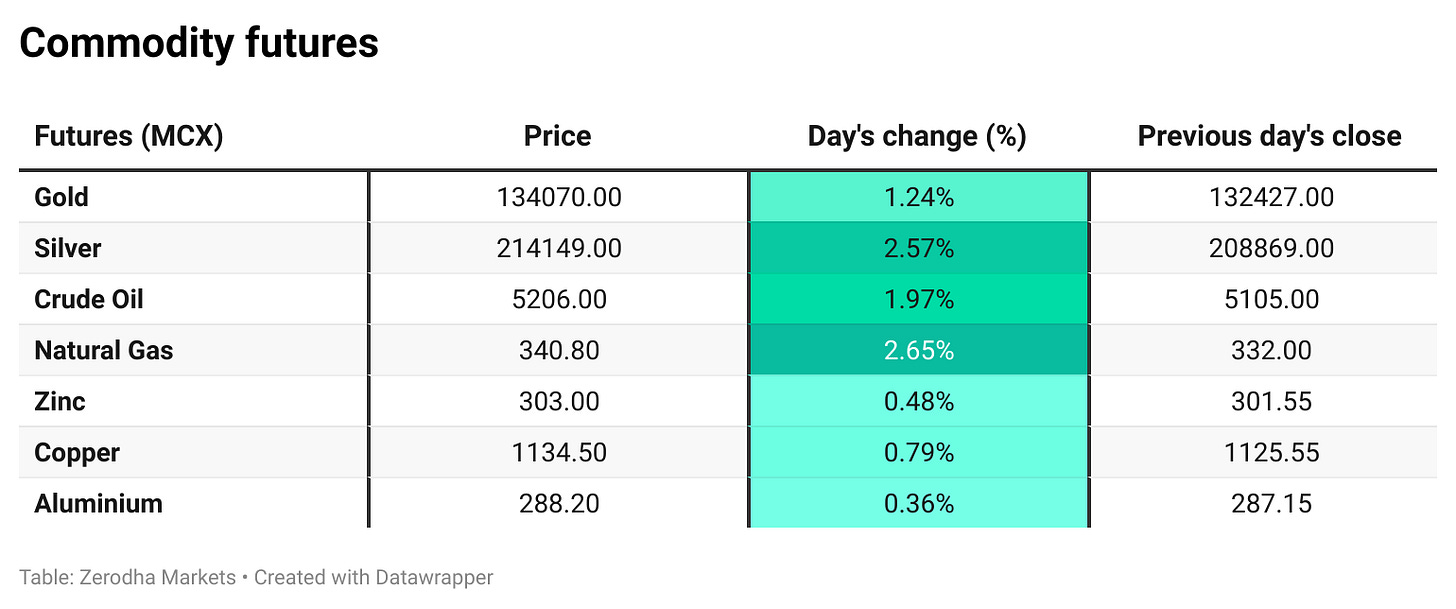

Gold crossed $4,400/oz for the first time as expectations of Fed rate cuts and geopolitical tensions boosted safe-haven demand. The metal is up over 60% this year, heading for its strongest annual performance since 1979. Dive deeper

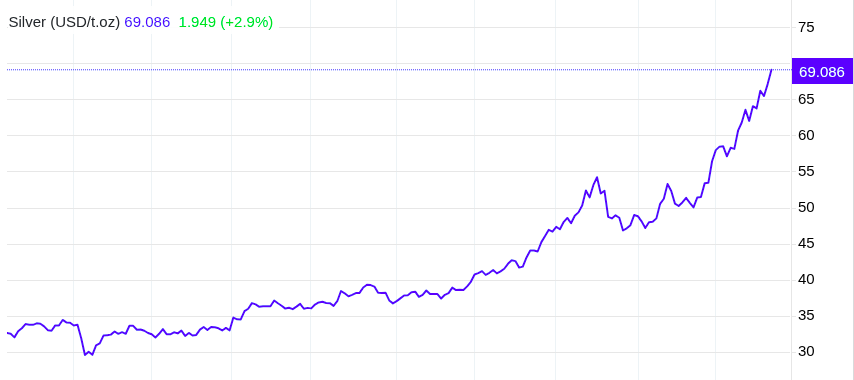

Silver crossed $69/oz to a record as expectations of Fed rate cuts and geopolitical tensions lifted safe-haven demand, while strong industrial use provided additional support. Dive deeper

The UK’s current account deficit narrowed sharply to £12.1 billion (1.6% of GDP) in Q3 2025, the smallest since Q3 2024, helped mainly by a much improved primary income balance. Dive deeper

China’s central bank kept lending rates at record lows for a seventh straight month, signalling limited urgency for additional stimulus as growth remains on track. Softer November data and weaker new loan growth, however, highlight lingering property stress and subdued credit demand. Dive deeper

Japan’s Nikkei topped the 50,000 mark, tracking a tech-led rally on Wall Street and support from a weaker yen after the BOJ raised rates to 0.75%. Investors now look to Governor Ueda’s Christmas Day remarks for further signals on the policy path. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

CS Setty, Chairman, State Bank of India, on SBI Mutual Fund IPO timeline and capital position:

“Our focus is on completing the IPO of SBI Mutual Fund within 12 months. No plans for other IPOs or stake sales.”

When asked if SBI would need fresh capital, Setty said not for the next five years, citing “CRAR at 15%” and “CET1 at 12%.”

“I think it is important that diversified companies are listed on the exchanges… As for pricing and valuation, they are like beauty in the eyes of the beholder.” - Link

Gurmeet Chadha, Managing Partner & CIO, Complete Circle Consultants, on MUFG’s investment in Shriram Finance and rerating potential:

MUFG’s proposed equity investment is a “vote of confidence” in Shriram Finance and the broader Indian NBFC space.

The investment could lower Shriram Finance’s funding costs, potentially support better credit ratings, and accelerate its growth trajectory.

The deal may trigger a positive rerating/valuation upside, with near-term dilution seen as manageable. - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

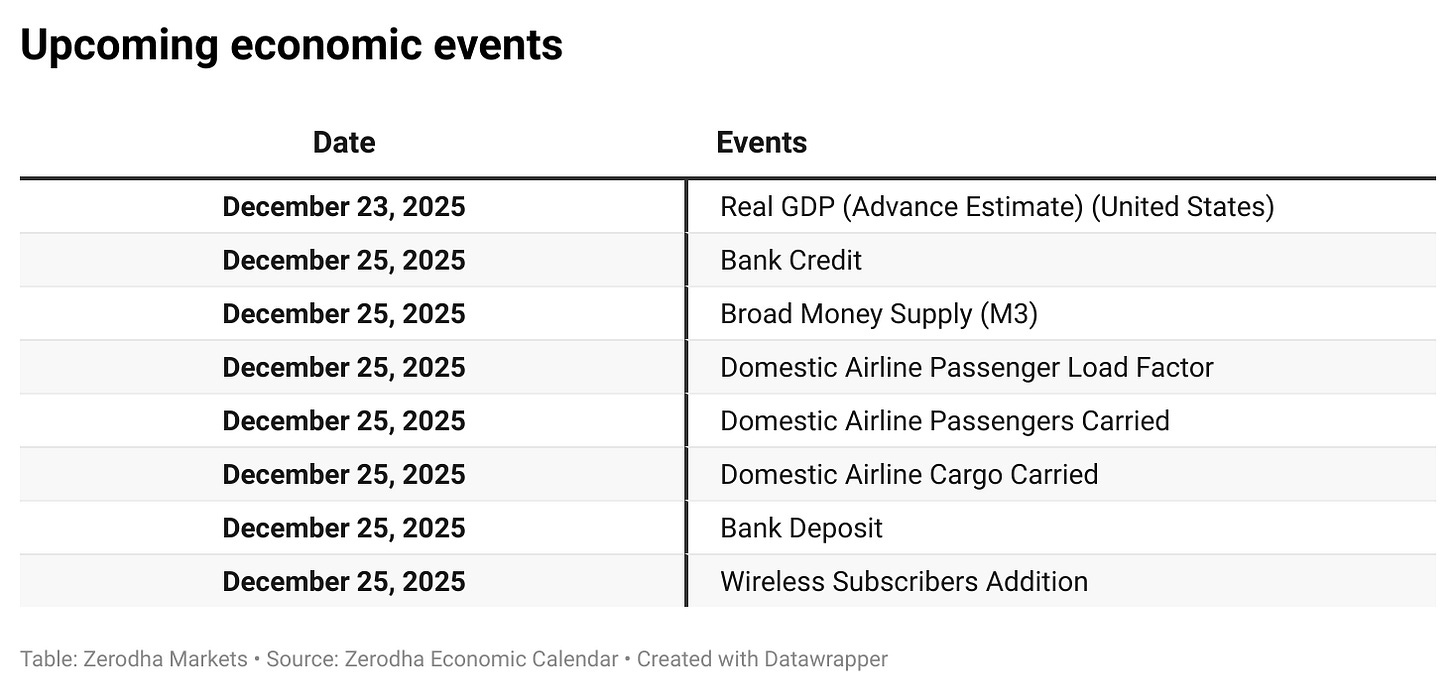

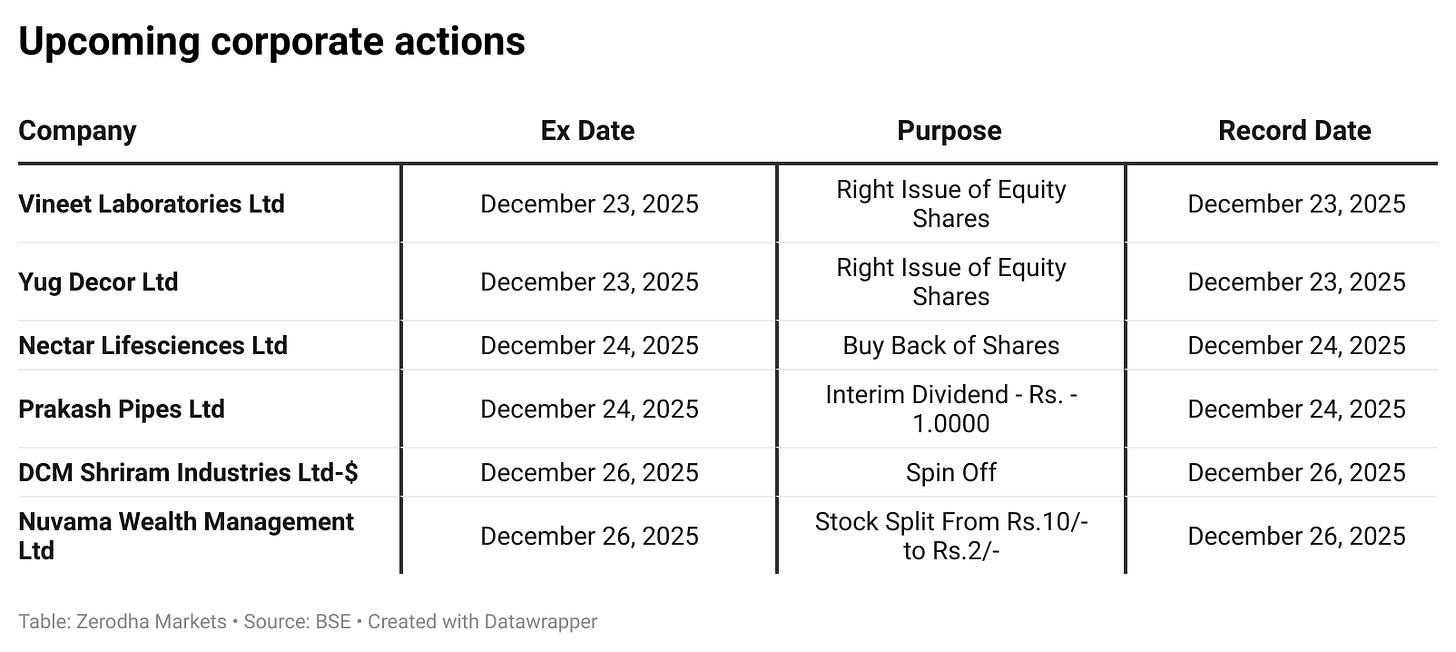

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

In commodity futures silver is stated wrongly as 2142149

Can you start an sip on rare earth minerals so i can invest in it