Weakness persists as Markets fall for third consecutive day

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Market Overview

Nifty opened with a nearly 35-point gap down at 24,466.7 but immediately went higher till 24,550 levels and slipped from higher levels in early trade, briefly dipping below 24,480 in the first hour.

Through the mid-day session, the index remained rangebound between 24,500 and 24,550, with multiple failed breakout attempts. Post 2 PM, Nifty witnessed a gradual decline, losing strength and slipping below 24,450, making lows of around 24,404 in the final half hour.

The index eventually closed at 24,426.85, near the day’s low, reflecting sustained weakness and selling pressure at higher levels.

Market sentiment remains fragile, while last week’s GST cut announcement boosted consumption hopes, concerns over rising tariffs, continued FII outflows, and muted earnings are weighing on sentiment. Investors remain watchful of worsening U.S.-India trade tensions, which are expected to guide near-term market direction.

Broader Market Performance:

Broader markets had a mixed session with a bearish bias today. Of the 3,084 stocks traded on the NSE, 1,319 advanced, 1,668 declined, and 97 remained unchanged.

Sectoral Performance

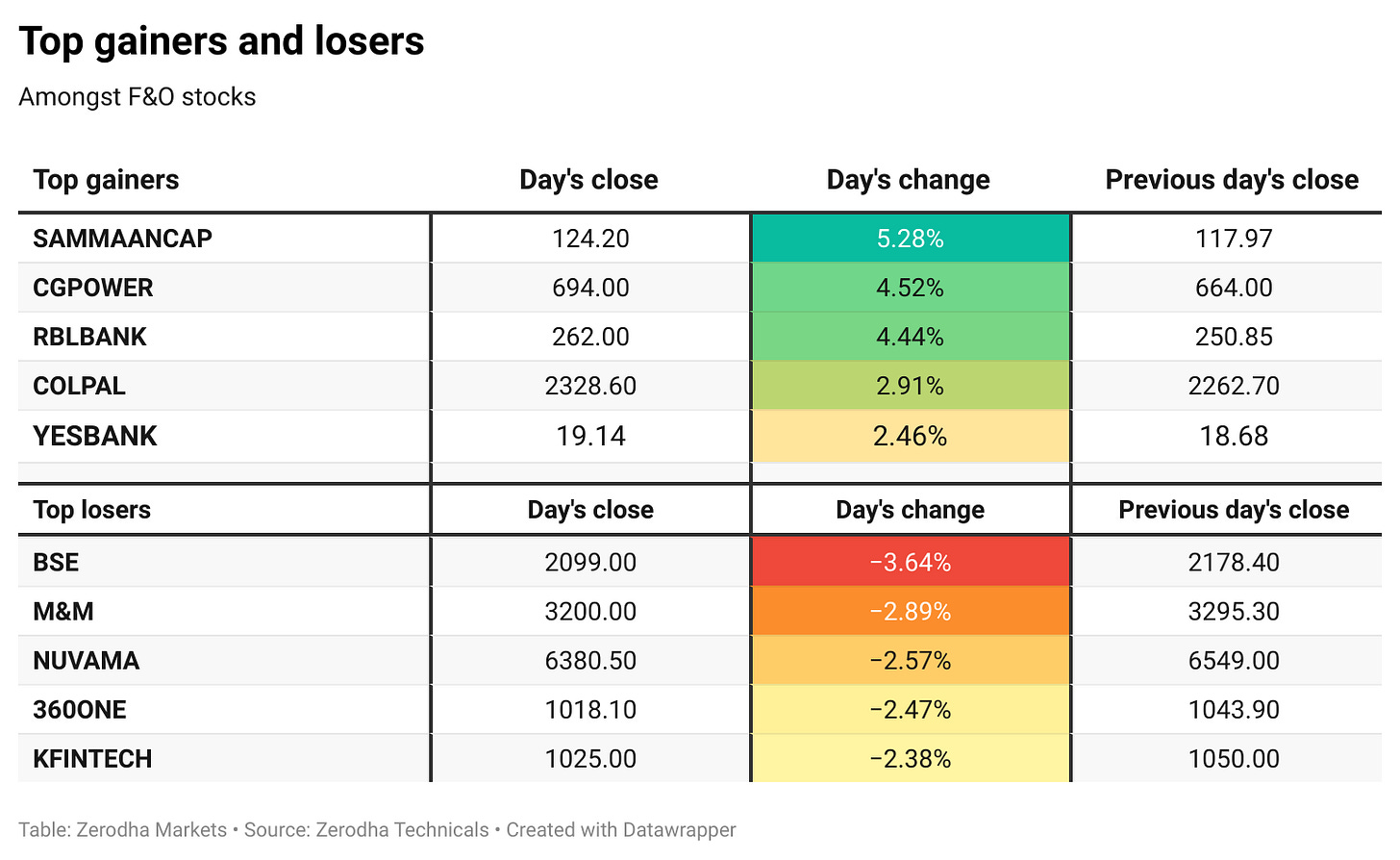

Nifty FMCG was the top gainer, rising 0.95%, while Nifty Realty was the top loser, falling 1.33%. Out of the 12 sectoral indices, 3 closed in the green, and 9 ended in the red, indicating broad-based weakness with limited sectoral support.

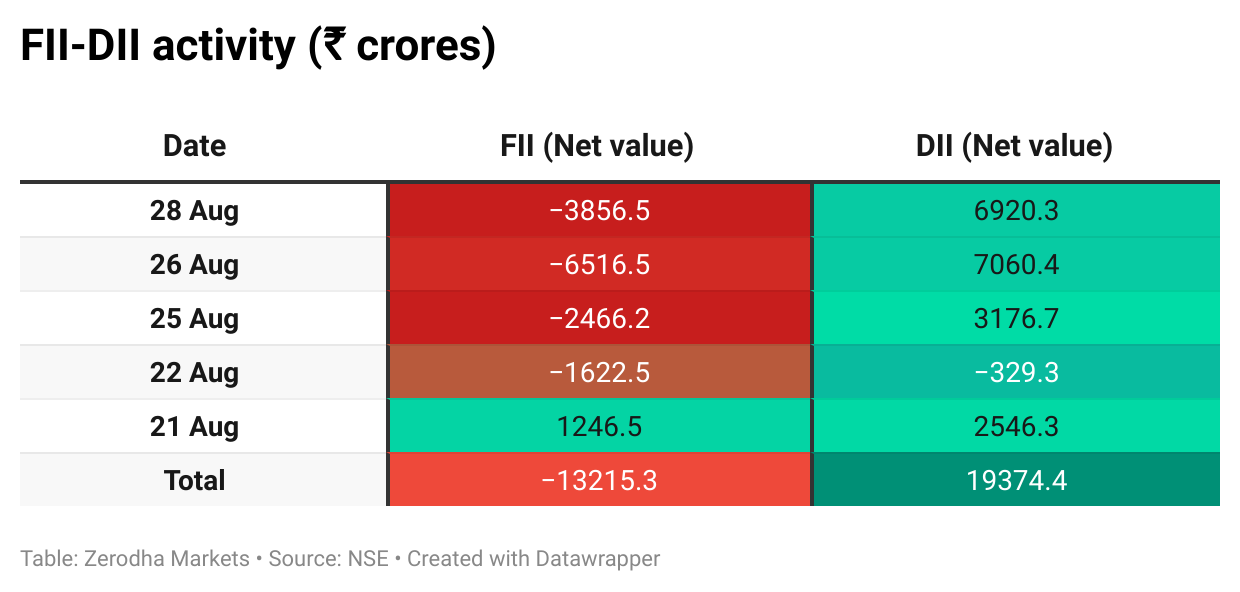

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd September:

The maximum Call Open Interest (OI) is observed at 24,600, followed closely by 24,500, suggesting strong resistance at 24,600 - 24,700 levels.

The maximum Put Open Interest (OI) is observed at 24,400, followed closely by 24,400, suggesting strong support at 24,300 to 24,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

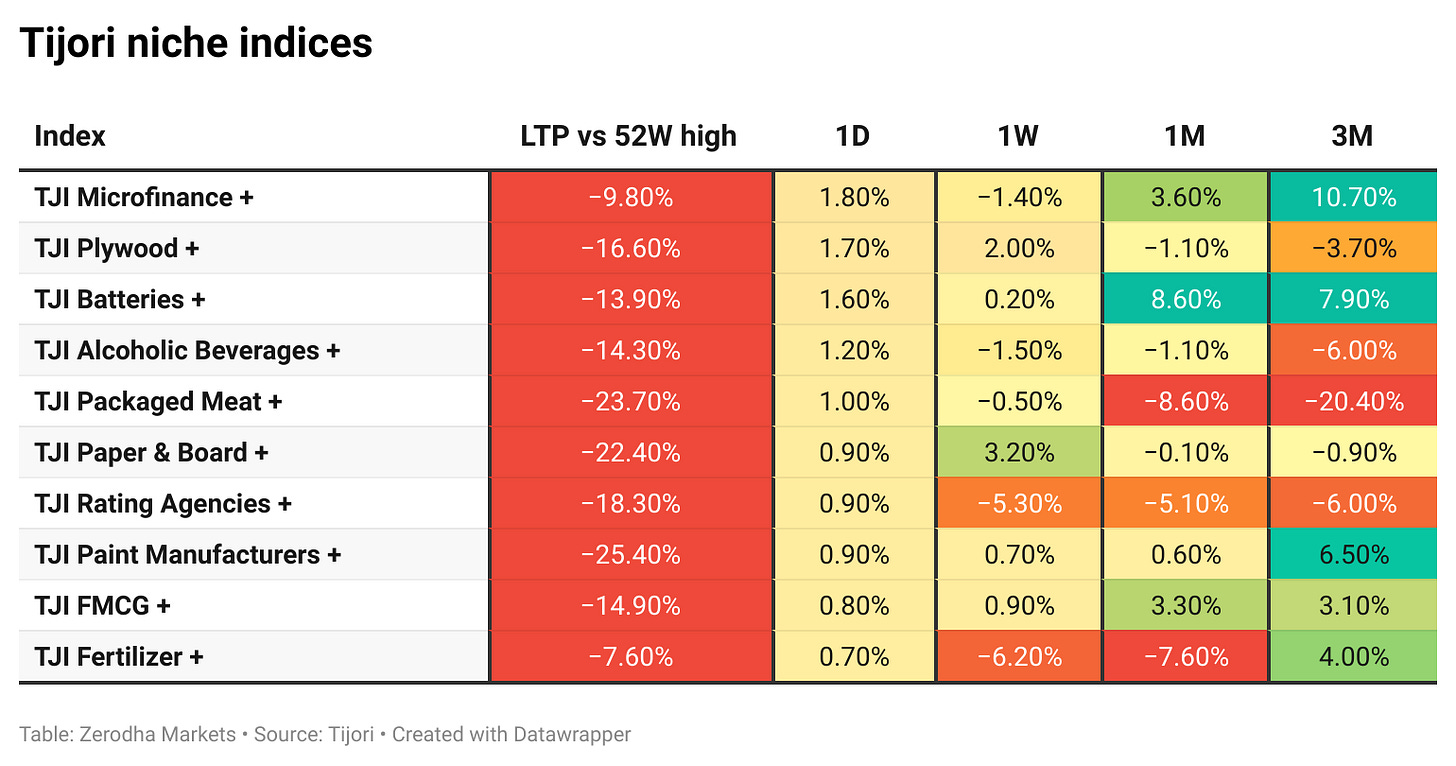

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s GDP grew 7.8% in Q2 2025, the fastest in five quarters and above forecasts, driven by stronger consumption, higher government spending, and firm investment. However, net external demand weighed on growth as imports outpaced exports amid US tariff pressures. Dive deeper

India’s fiscal deficit widened to INR 4.68 trillion in the first four months of FY26 from INR 2.77 trillion a year earlier, driven by higher spending of INR 15.6 trillion against receipts of INR 10 trillion. The government ramped up support amid growth concerns and US sanctions risks. Dive deeper

The rupee hit a record low of 88.25 per dollar as US tariff hikes on Indian exports and sustained foreign outflows weighed on sentiment. Dive deeper

NSE has proposed launching a pre-open session for index and stock futures from December 8, 2025, aligning with BSE’s plan. Testing will begin on October 4, with further operational details to be shared through a separate circular. Dive deeper

RBI turned net seller in June, offloading $3.66 billion in the spot forex market by selling $4.82 billion and buying $1.16 billion. The rupee slipped 0.2% during the month, trading between 85.30 and 86.89 against the dollar. Dive deeper

Sebi clarified its cybersecurity framework applies only to systems used for regulated activities, with RBI-equivalent compliance accepted. It also defined critical systems broadly, encouraged zero-trust practices, and revised thresholds for regulated entities. Dive deeper

TVS Motor introduced the Orbiter electric scooter with a 158 km range and a 3.1 kWh battery, expanding its EV portfolio. Dive deeper

Indian exporters are shifting production to Africa to bypass the 50% US tariff, with apparel, textile, and jewelry firms among the worst hit. Lower levies and incentives in countries like Ethiopia and Botswana make them attractive alternatives. Dive deeper

Societe Generale bought over 31 lakh shares of RBL Bank worth Rs 79 crore via a bulk deal at Rs 250.57 apiece, while offloading a small portion in another trade. Dive deeper

IndiGo received a six-month DGCA extension to operate two leased Boeing 777s from Turkish Airlines until February 2026, though no further leeway will be granted. The regulator asked the airline to explore dry-lease options, while investor focus also stays on a recent promoter stake sale. Dive deeper

Infosys partnered with Mastercard to enhance cross-border payments, integrating Mastercard Move with its Finacle platform to offer banks faster, more secure onboarding and lower implementation costs. Dive deeper

NTPC’s board approved transferring its coal mining business, which generated Rs 7,735 crore in FY25, to its subsidiary NTPC Mining under a slump sale. The move involves six coal blocks and related assets, with the transaction to be completed within a year, subject to approvals. Dive deeper

Yes Bank shares gained after reports that Japan’s Sumitomo Mitsui may infuse an additional ₹16,000 crore through a mix of debt and equity, on top of its earlier ₹13,500 crore investment for a 20% stake. The fresh funding could raise SMBC’s holding to 24.99%, subject to regulatory approvals. Dive deeper

Samvardhana Motherson will acquire Honda-owned Yutaka Giken for Rs 1,610 crore, picking up an 81% stake along with interests in subsidiaries. The deal strengthens ties with Honda, expands reach with Japanese OEMs, and opens cross-selling opportunities in emerging markets. Dive deeper

CRISIL projects India’s shrimp exports to drop 15-18% this fiscal as US tariffs jump to 58%, hitting revenues and margins. Exporters face competitive disadvantage against peers like Ecuador and Vietnam, making the US market unviable. Diversification to the UK, China, and Russia may provide limited cushion. Dive deeper

What’s happening globally

Gold traded near $3,410 per ounce, heading for a second weekly gain as Fed rate cut bets and safe-haven demand supported prices. Dive deeper

WTI crude slipped to $64 per barrel, set for its first monthly loss in four, as weaker US demand and supply glut concerns weighed on prices. Geopolitical risks and India’s stance on Russian imports offered some support. Dive deeper

European natural gas futures fell over 5% to €31.6/MWh as weak demand and LNG inflows offset reduced Norwegian supply, with storage at 76.6% of capacity. Dive deeper

The US PCE price index is expected to rise 0.2% in July, with core PCE up 0.3%, keeping annual inflation steady at 2.6% and core at 2.9%, a five-month high. The gauge remains the Fed’s key inflation measure. Dive deeper

France’s inflation eased to 0.9% in August, below forecasts, driven by softer services and goods prices, while food stayed steady and energy declines moderated. On a monthly basis, CPI rose 0.4%, led by a rebound in clothing. Dive deeper

France’s 10-year bond yield climbed to 3.51% on political instability as PM Francois Bayrou faces a confidence vote on €43.8 billion budget cuts, risking fresh elections. Meanwhile, Q2 GDP grew 0.3% and inflation eased to 0.9% in August. Dive deeper

Germany’s jobless rate held at 6.3% in August, the highest since September 2020, but unemployment fell by 9,000 to 2.96 million, marking the sharpest monthly drop in over three years. Dive deeper

The Shanghai Composite and Shenzhen Component extended August gains of 8% and 15%, lifted by easing US-China tensions and strong liquidity. AI and semiconductor stocks led, though some tech firms flagged risks after sharp rallies. Dive deeper

Spain’s inflation held at 2.7% in August, a five-month high, as higher fuel costs offset declines in food, drinks, and electricity. Core inflation edged up to 2.4%, while EU-harmonised CPI was steady month-on-month. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Akash Ambani, Chairman, Reliance Jio Infocomm at RIL AGM

"With 300 million paying subscribers, JioHotstar is now the world’s second-largest streaming platform, achieved entirely in India."

"Over 600 million users joined JioHotstar within three months, including more than 75 million connected TVs."

"With a 34% TV market share, JioStar is on its path to serve a billion screens across mobile, TV, and connected devices, combining the best of content, software, and AI." - Link

Brijendra Pratap Singh, CMD, Nalco, on capex and expansion plans

"We will invest close to ₹30,000 crore in capex by 2030, focusing on mining, refining, smelting, and power capacity expansion."

"A new bauxite mine by June 2026 will raise capacity by 3.5 million tonnes, and smelting output will more than double to over 9,60,000 tonnes annually."

"We are also venturing into foil production and strengthening our value-added portfolio while securing strategic minerals through overseas joint ventures." - Link

Sundar Pichai, CEO, Google, on India and Reliance partnership at RIL AGM

"India has always been a special place to Google… It is home to some of the world’s most dynamic businesses, a thriving start-up ecosystem, and incredible creativity and ambition."

"Our partnership with Reliance and Jio has been key to bringing affordable internet access to millions, and now we are building on this to shape the next leap with AI."

"Together we are establishing a Jamnagar Cloud region dedicated to Reliance, bringing world-class AI and compute from Google Cloud, powered by clean energy and connected by Jio’s network."

Mark Zuckerberg, CEO, Meta, on AI collaboration with Reliance

"We are seeing glimpses of our AI systems starting to improve themselves… superintelligence will let us build things we can’t even imagine today."

"Meta and Reliance are going to deliver our open-source AI models to Indian businesses, helping fuel productivity, creativity, and innovation across every corner of India."

"With Reliance’s scale and reach, this venture will be a model for how AI and one day superintelligence can be delivered to everyone." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

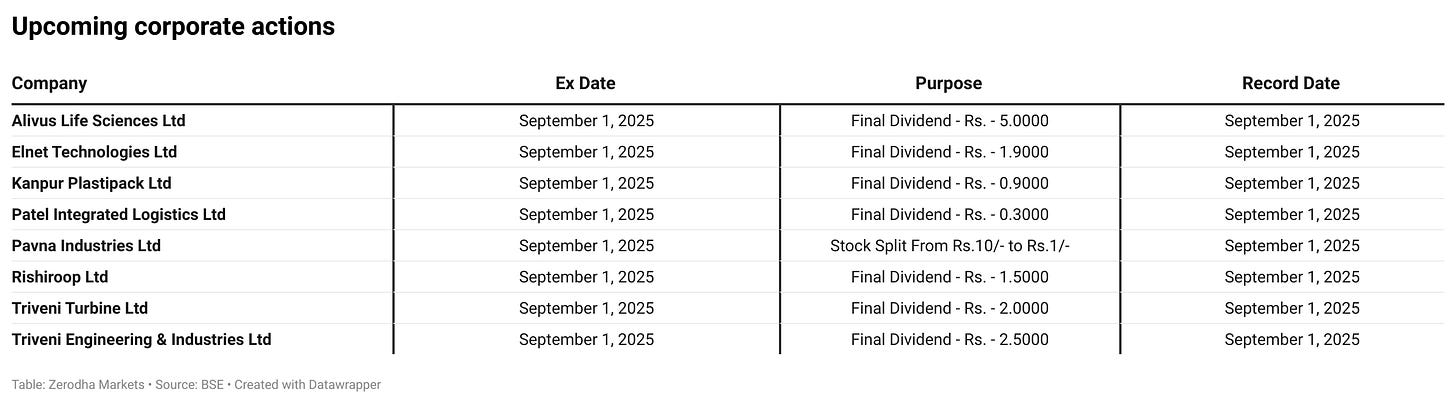

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.