Weak global cues drag Nifty lower; 26,000 proves tough to hold

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down a week defined by trend continuation, fresh all-time highs, and a clear return of bullish momentum across major indices.

The global headline belonged to Warren Buffett, who officially announced his retirement — marking the end of an era in investing.

On the home front, Bihar’s election results brought a mid-week jolt of uncertainty. While we expected it to be a non-event, the market clearly had other ideas.

Market Overview

Nifty opened flat at 26,022 and immediately slipped lower, weighed down by very weak global cues, with U.S. and Japanese indices falling 1.5–3%. Within the first 30 minutes, the index dropped sharply toward the 25,890–25,900 zone and struggled to stabilise as selling pressure persisted through the morning. By midday, Nifty attempted a mild rebound toward 25,970 but failed to sustain it, slipping back into the 25,930–25,940 range.

In the second half, the index inched higher toward 25,980, but upside momentum remained capped near the 25,980–25,990 zone. After 2:30 PM, Nifty weakened once again, giving up intraday gains and sliding steadily through the final hour. The index eventually closed near the day’s low at 25,910.05, down 0.4%, marking a cautious, risk-off session dominated by global weakness.

Looking ahead, markets are expected to remain sensitive to developments around the India–U.S. trade deal and broader global cues.

Broader Market Performance:

The broader markets had an extremely weak session today. Of the 3,214 stocks traded on the NSE, 968 advanced, 2,168 declined, and 78 remained unchanged.

Sectoral Performance:

The top losing sector was Nifty Realty, slipping 1.91%, while no sector ended in the green, making Nifty Consumer Durables the least negative performer with a 0.08% dip. All 12 sectoral indices closed in the red, with none ending the session positive, indicating broad-based weakness across the market.

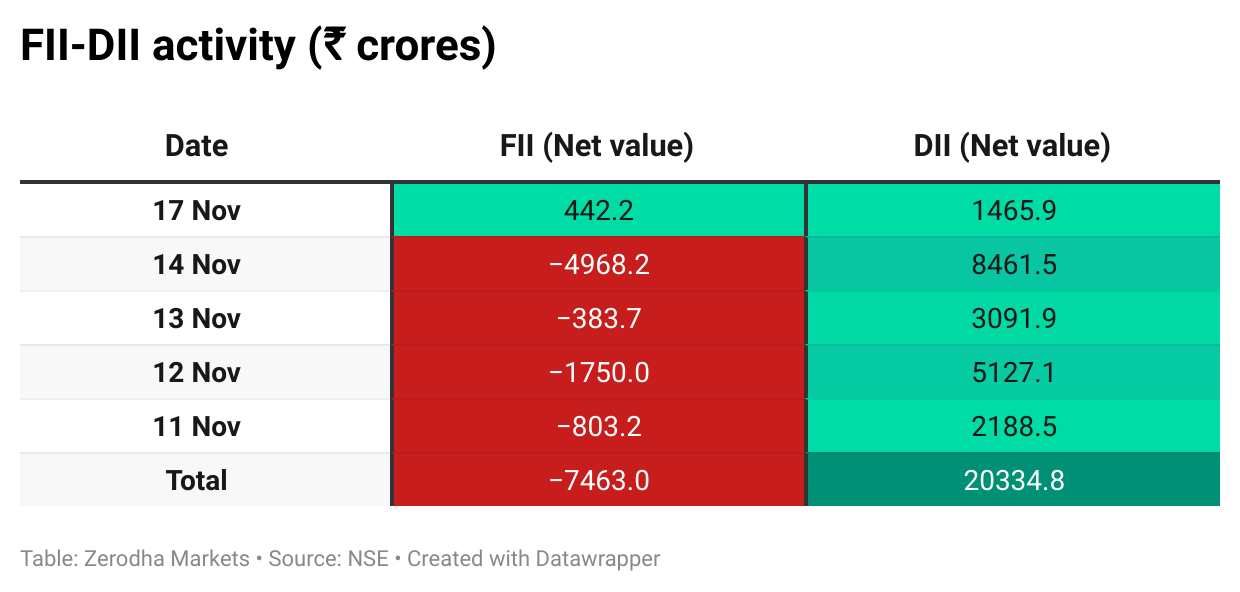

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 25th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,500, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

LIC has asked the government to make insurance services zero-rated for GST to restore input tax credit. It also proposed raising the tax-free premium limit on maturity proceeds to ₹10 lakh. The insurer says these changes would help offset margin pressures after the recent GST exemption. Dive deeper

Apollo Micro Systems Ltd., through its subsidiary Apollo Defence Industries Pvt Ltd, acquired 100 % of IDL Explosives Ltd. from the Hinduja Group for approximately ₹107 crore. Dive deeper

PayU has received RBI approval to operate as a payment aggregator across online, offline, and cross-border transactions under the PSS Act. The authorisation allows it to offer integrated payment acceptance and settlement services. Dive deeper

Power Grid Corporation of India plans to raise up to ₹3,800 crore through a bond issuance via private placement. The issue will comprise unsecured, non-convertible, non-cumulative, redeemable taxable bonds listed on the stock exchanges. Dive deeper

More Retail, backed by Amazon, has selected banks for its planned Indian IPO which is expected to raise around US $300 million. The company is targeting a public listing in India to support its expansion and capital-raising efforts. Dive deeper

PhysicsWallah Ltd. shares debuted with a strong listing, rising up to 42% above the IPO price. Dive deeper

SBI Research estimates India’s Q2 GDP growth at 7.5% or higher, citing a consumption boost following the recent GST rate cut. The RBI had earlier projected 7% growth for the quarter. Dive deeper

One97 Communications, the parent of Paytm, saw SAIF Partners and Elevation Capital offload up to 2% equity in a block deal worth about ₹1,640 crore. Dive deeper

AstraZeneca Pharma India Ltd announced a deal with Sun Pharmaceutical Industries Ltd to expand distribution of the hyperkalaemia drug sodium zirconium cyclosilicate (SZC) in India. Dive deeper

What’s happening globally

Brent crude fell to $63.7 per barrel as expectations of a supply glut and resumed loadings at Russia’s Novorossiysk port pressured prices. The drop comes despite looming U.S. sanctions on Rosneft and Lukoil that have led major buyers to cut purchases. Dive deeper

Switzerland plans to issue bonds worth US $5.7 billion in 2026 to fund its operations and manage public finances. The issuance forms part of the country’s strategic debt management for the upcoming year. Dive deeper

Aluminium futures in the UK fell toward $2,700 per tonne, the lowest since late October, amid broader risk-off sentiment and cautious Fed commentary. Dive deeper

China’s urban youth unemployment rate (16–24, excluding students) fell to 17.3% in October from 17.7% in September, its lowest level since June. The overall urban jobless rate eased to 5.1%, while unemployment for 25–29-year-olds stayed at 7.2%. Dive deeper

US initial jobless claims reached 232,000 for the week ending October 18, staying above post Q2 averages following the federal shutdown. Outstanding unemployment claims rose to 1.957 million, near the highest since 2021. Dive deeper

IOI Properties plans to pursue REIT listings in Malaysia and Singapore, targeting assets worth approximately US $8 billion. The move is aimed at unlocking value from its real estate portfolio and tapping international capital markets. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Arvind Panagariya, Chairman, Sixteenth Finance Commission, on submission of the 2026–31 report

“The Sixteenth Finance Commission has submitted its report for the 2026–31 period to President Droupadi Murmu.”

“The Commission’s mandate includes recommending the basis for tax distribution between the Centre and the States, along with principles for grants-in-aid.”

“The Union Cabinet had earlier approved the terms of reference, with the report slated for submission by October 31, 2025.” - Link

Aditi Nayar, Chief Economist, ICRA, on India’s Q2 FY26 GDP and GVA outlook

“GDP growth is expected to ease to 7 per cent in Q2 FY26 from 7.8 per cent in Q1, with GVA growth moderating to 7.1 per cent from 7.6 per cent.”

“A lower year-on-year rise in government spending is likely to weigh on GDP and GVA growth compared to Q1 FY26.”

“Inventory stocking from the early festive season, GST-rationalisation-led volume pickup, and upfronting of US-bound exports are expected to boost manufacturing and help industry GVA outpace services after four quarters.” - Link

Aditya Soman, Executive Director, CLSA, on GST cuts, festive demand, and shifting FMCG market dynamics

“The GST rate cut caused temporary disruption, but consumption bounced back strongly during the festive season.”

“Unlike 2018–19, the competitive landscape is now far more fragmented, with small and digital-first brands consistently outperforming larger FMCG players in volume growth.”

“FMCG valuations are unlikely to return to earlier 60–70x levels as consumer behaviour has structurally changed and the scarcity premium has faded.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Insightful !