Weak global cues drag markets lower; Nifty manages to hold 25,100

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, Sandeep breaks down a strong comeback from the bulls! With easing global tensions and festive cheer in the air, benchmark indices logged solid gains for the second straight week — setting a positive tone as we head closer to Diwali.

Market Overview

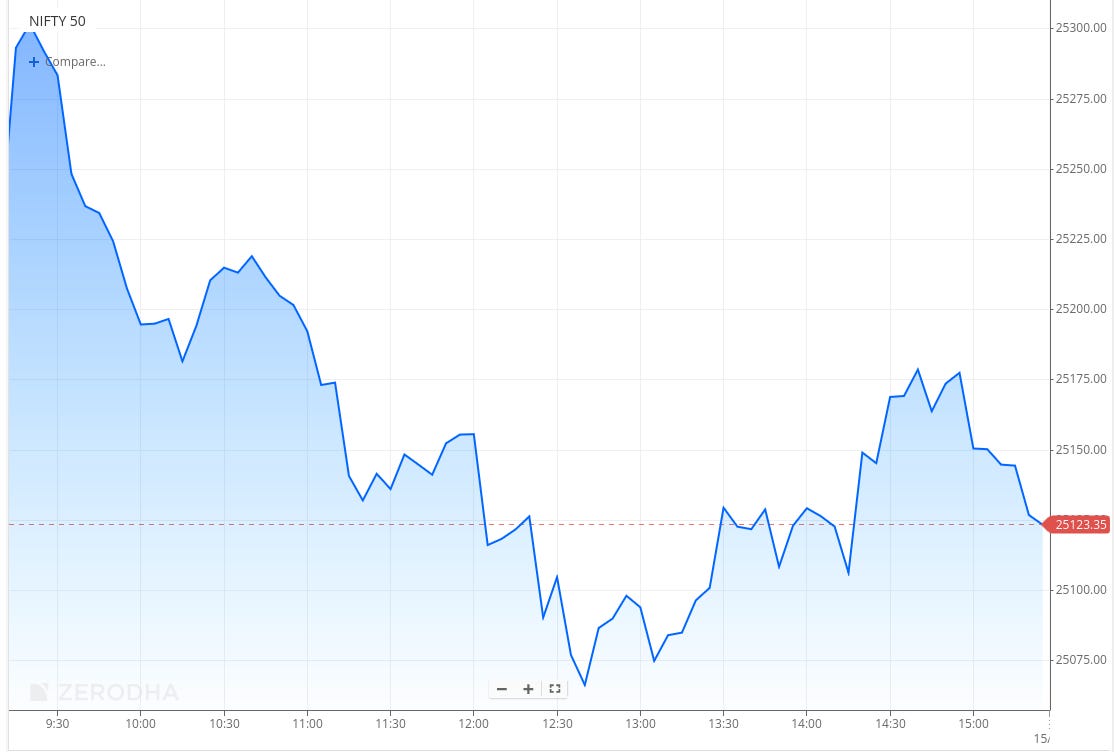

Nifty opened with a 50-point gap-up at 25,278, extending early gains from the previous session. However, the index quickly lost momentum and slipped below 25,200 within the first half-hour as selling pressure emerged across sectors. Through the morning, Nifty drifted lower, testing the 25,060–25,070 zone amid weak global cues and caution ahead of key earnings announcements.

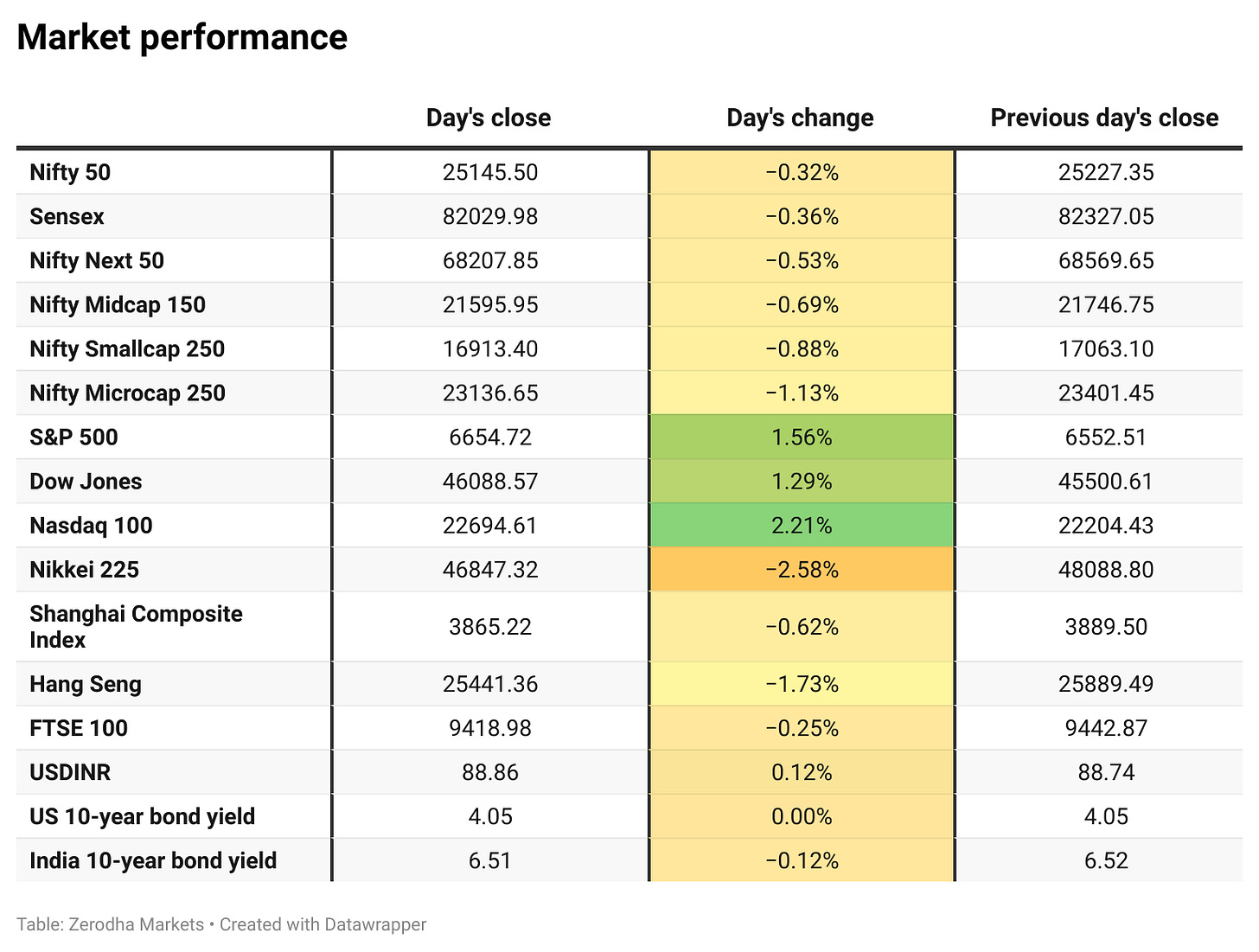

In the second half, the index attempted a mild recovery till 25,180 levels but failed to sustain above the 25,150 mark. Choppy trade dominated the later session as investors booked profits in select sectors. Nifty eventually closed at 25,145.50, down 0.32%, after a volatile day.

Market sentiment has once again turned optimistic on demand revival following GST cuts, despite the cautious sentiment prevailing on the global trade front with high tariffs from the U.S. As we advance, investors will closely track quarterly results, festival season sales, and management commentary on demand trends across various industries.

Broader Market Performance:

Broader markets had a very weak session today. Of the 3,197 stocks traded on the NSE, 836 advanced, 2,266 declined, and 95 remained unchanged.

Sectoral Performance

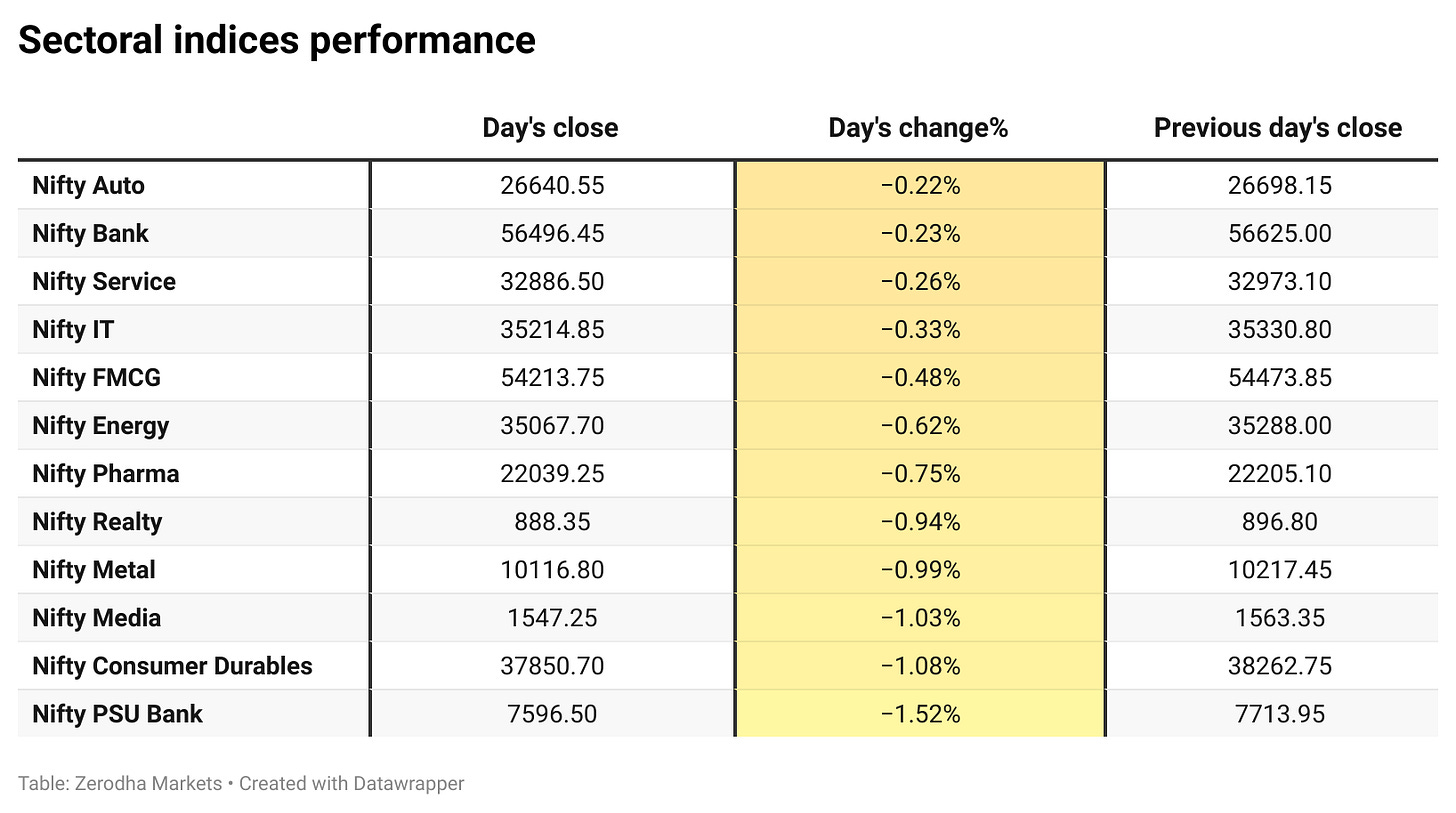

Relatively outperforming sector for the day was Nifty Auto, down the least at -0.22%, while the worst-performing sector was Nifty PSU Bank, which fell 1.52%.

All 12 sectors closed in the red, with 0 sectors in green and 12 in red, indicating a broad-based decline across the board.

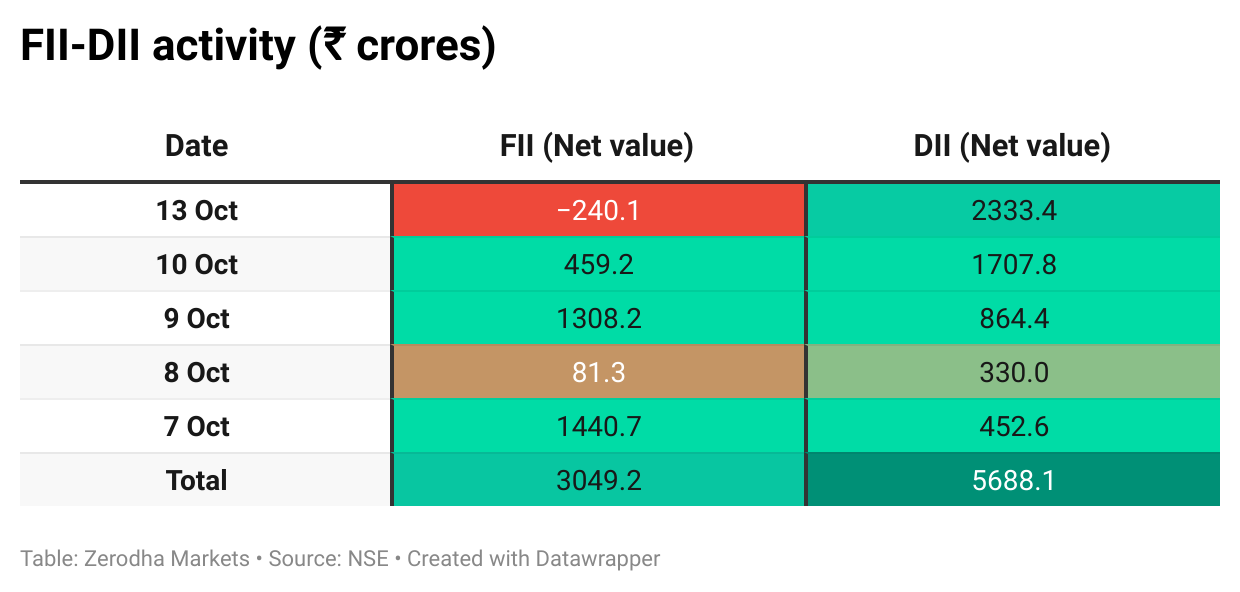

Here’s the trend of FII-DII activity from the last 5 days:

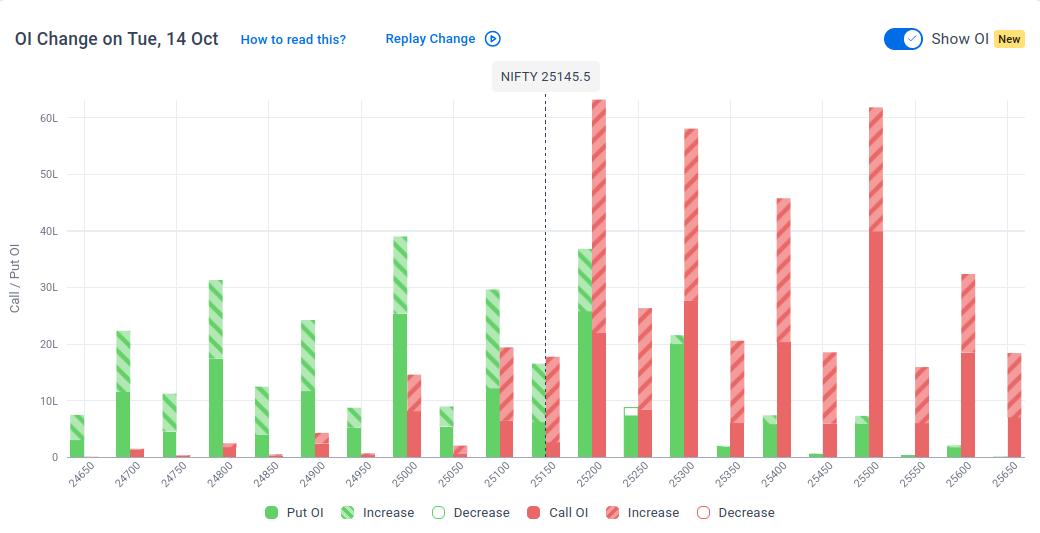

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th October:

The maximum Call Open Interest (OI) is observed at 25,200, followed by 25,500, indicating potential resistance at the 25,300 -25,400 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,200, suggesting strong support at the 25,100 to 25,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

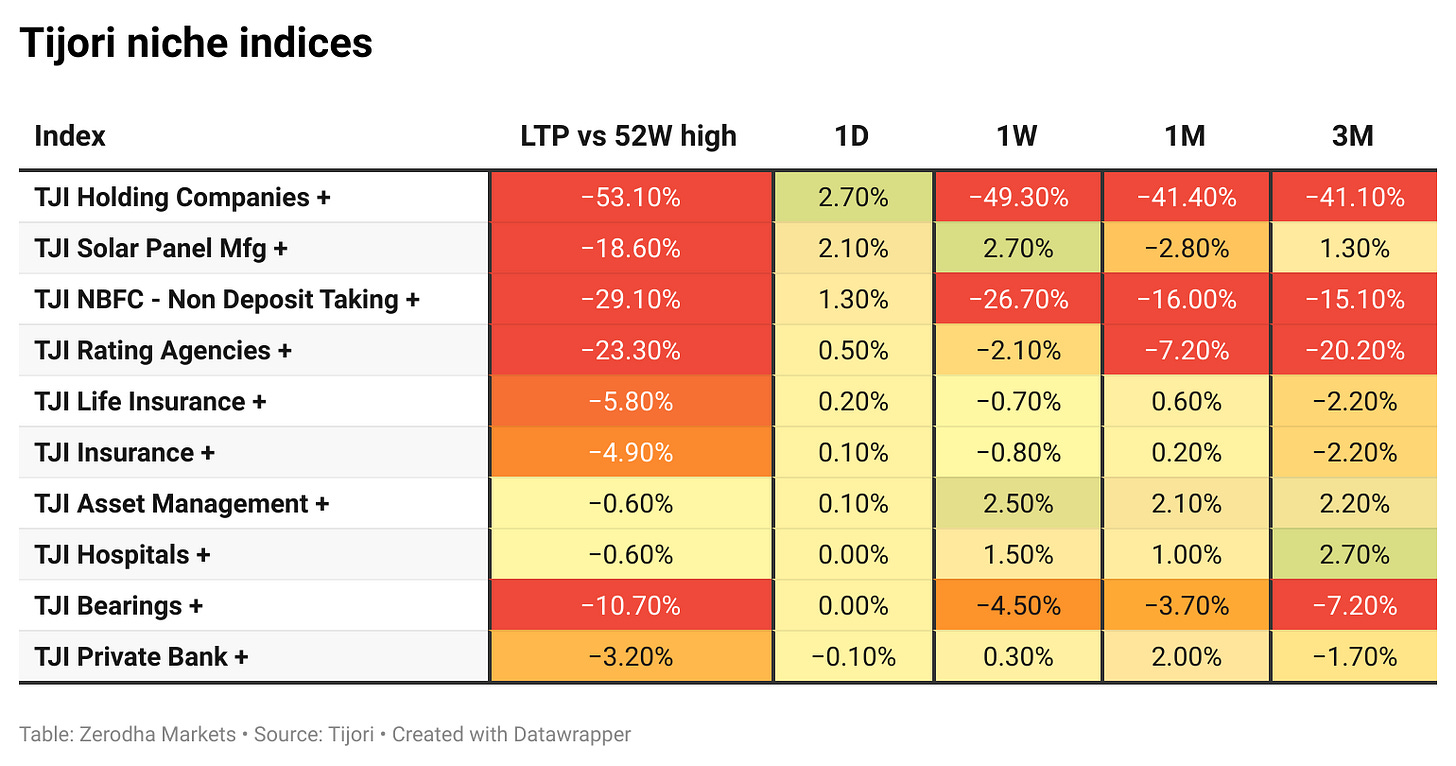

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

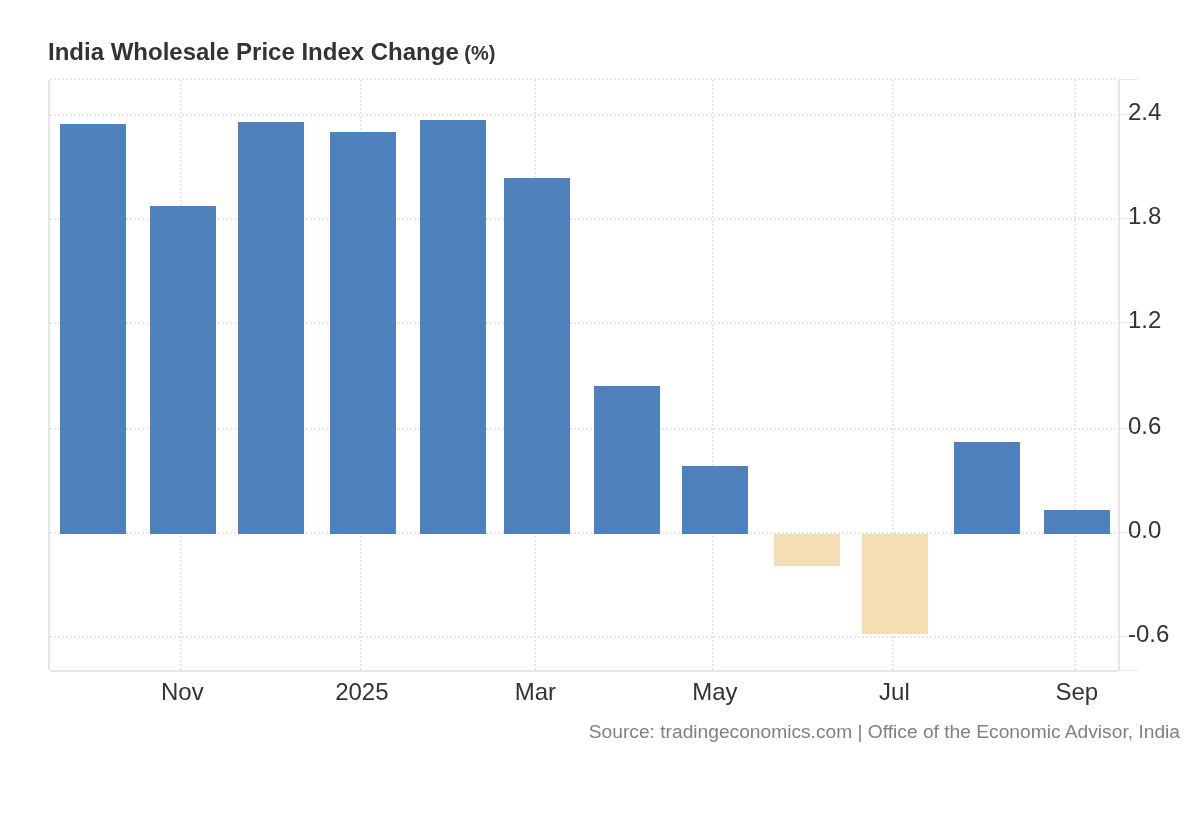

India’s wholesale inflation eased to 0.13% in September from 0.52% in August, below expectations, as food and manufacturing prices declined. Monthly wholesale prices fell 0.19%, reversing the previous month’s rise. Dive deeper

LG Electronics India shares jumped 50% on debut after raising $1.3 billion in one of the year’s largest IPOs. Dive deeper

India’s state-owned refiners cut Russian oil imports by over 45% between June and September, according to Kpler data, amid U.S. trade pressures and narrowing discounts. Meanwhile, private refiners Reliance Industries and Nayara Energy have increased their Russian crude purchases. Dive deeper

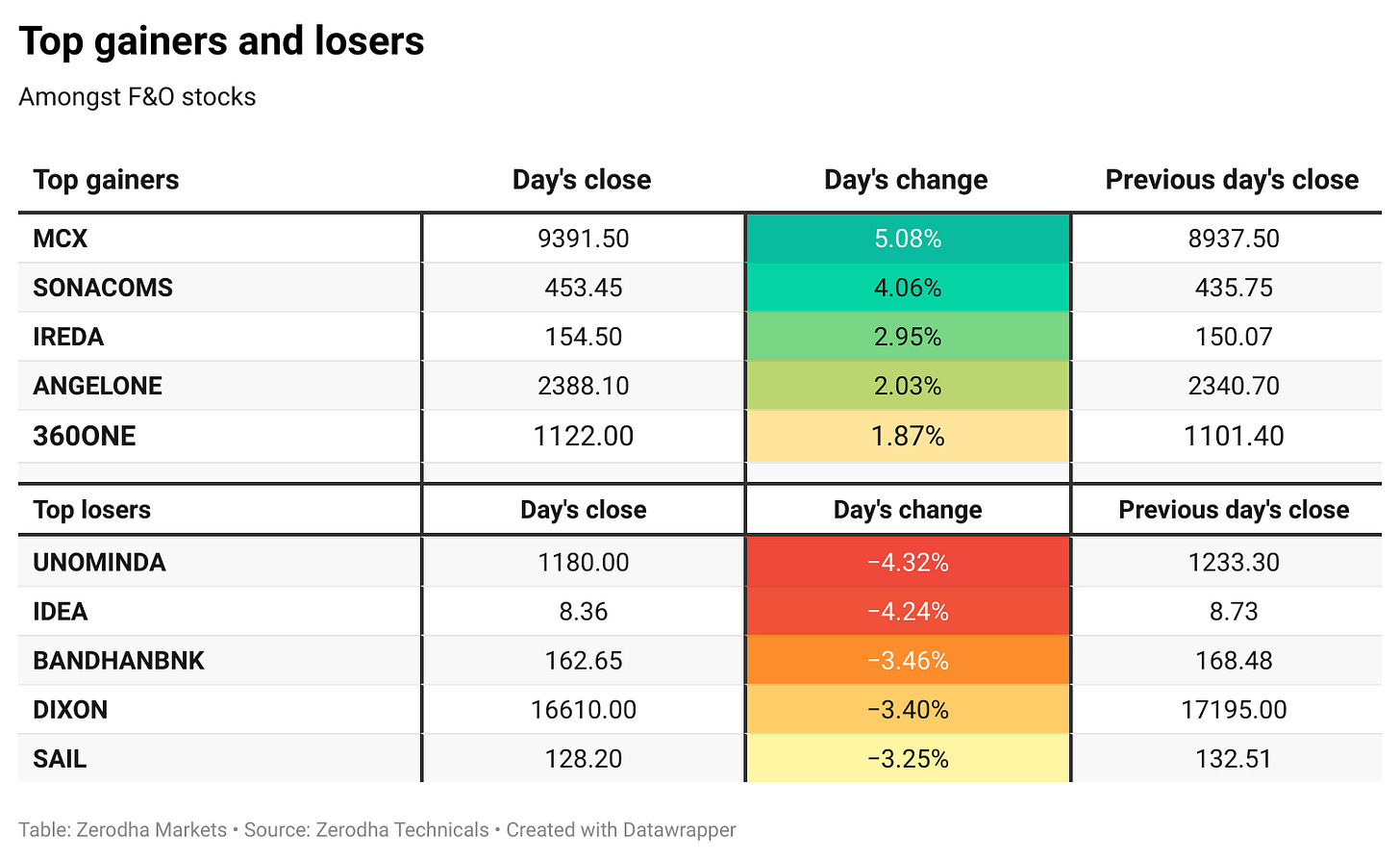

IREDA reported a 41% year-on-year rise in Q2 net profit to ₹549 crore, with revenue up 26% to ₹2,057 crore. Asset quality improved, and the loan book grew 31% year-on-year to ₹84,445 crore. Dive deeper

RBL Bank is in advanced talks with Emirates NBD for a ₹15,000 crore investment through a preferential allotment and open offer, as reported, to help the UAE lender acquire a controlling stake and expand its India presence. Dive deeper

Anant Raj Ltd raised ₹1,100 crore through a qualified institutional placement to expand its data center and cloud infrastructure business. The funds will support its goal of reaching USD 1 billion in revenue and 307 MW capacity by FY32. Dive deeper

Lenskart plans to launch its ₹8,000-crore IPO in early November, comprising a ₹2,150-crore fresh issue and an offer for sale by existing shareholders. The eyewear retailer reported a ₹297-crore profit in FY25, reversing a loss from the previous year. Dive deeper

Aurobindo Pharma’s promoters raised ₹2,000 crore through a two-tranche financing structure to fund real estate and asset acquisitions via Auro Realty. The ₹650 crore Series 1 carries an 11.75% coupon, while the ₹1,450 crore Series 2 has a four-year tenor. Dive deeper

Sebi has issued revised guidelines requiring listed companies to provide reasons, valuation details, and turnover impact when seeking approval for related party transactions. Smaller RPTs below 1% of turnover or ₹10 crore are exempt from these detailed disclosures. Dive deeper

HCL Technologies reported a consolidated net profit of ₹4,235 crore for Q2 FY26, up 10.2% sequentially. Revenue rose 10.6% year-on-year to ₹31,942 crore. The company maintained its FY26 overall growth guidance at 3–5% and raised its services revenue forecast to 4–5%. Dive deeper

What’s happening globally

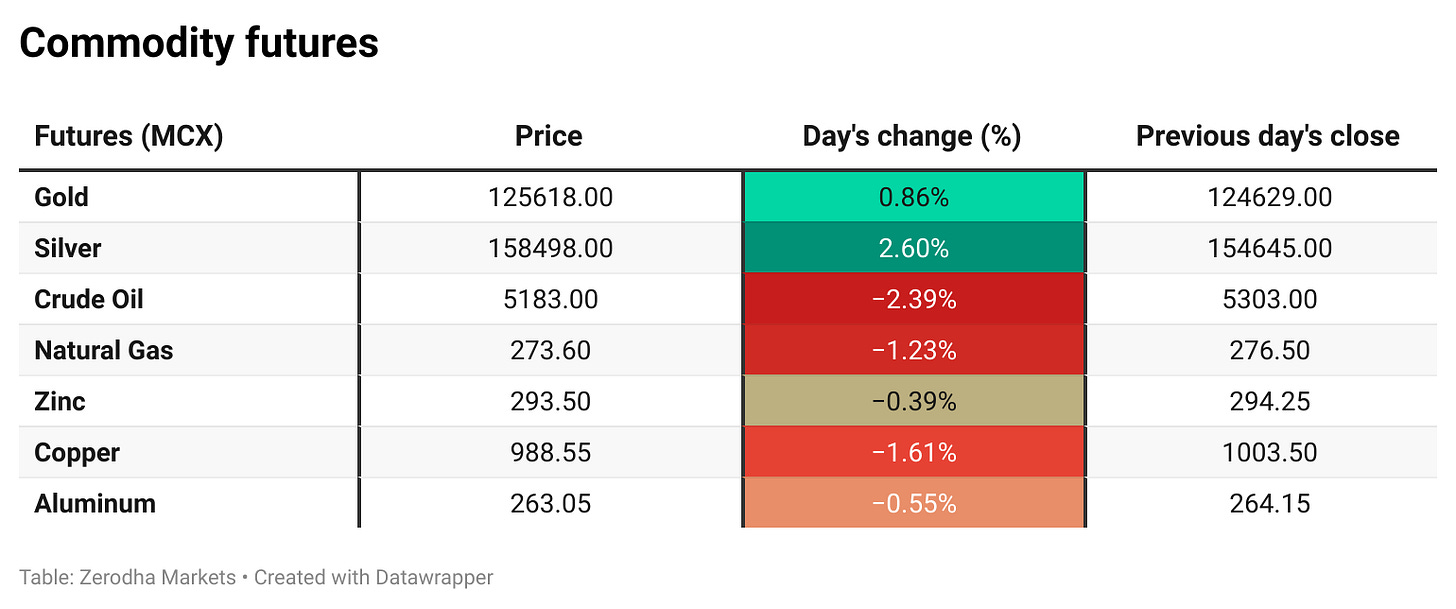

Brent crude fell 2% to below $62 a barrel after the IEA projected a growing supply surplus and slower demand growth. Dive deeper

Gold climbed to a record $4,140 per ounce as safe-haven demand rose amid escalating US-China trade tensions and expectations of further Fed rate cuts. Dive deeper

Silver surged past $53 per ounce to a record high before easing, driven by a global short squeeze, soaring London lease rates, and tightening physical supply. Dive deeper

UK regular earnings rose 4.7% year-on-year to £682 per week in June–August, the weakest since mid-2022, as private sector pay growth slowed while public sector wages rose 6%. Real wage growth eased to 0.6%, the lowest since 2023. Dive deeper

China’s vehicle sales rose 14.9% year-on-year to 3.23 million in September, the highest in nine months, while NEV sales jumped 24.6% to 1.6 million, accounting for nearly half of total sales. Dive deeper

Singapore’s economy grew 2.9% year-on-year in Q3 2025, the slowest in two years, as manufacturing stagnated and construction activity eased. The slowdown reflects weaker external demand amid higher U.S. tariffs on key exports. Dive deeper

UK retail sales rose 2% year-on-year in September, slowing from 2.9% in August and missing forecasts, as inflation concerns and upcoming tax hikes curbed spending. Food sales rose 4.3%, while non-food sales inched up 0.7% amid mild weather. Dive deeper

Japanese shares fell sharply, with the Nikkei down 2.6%, as political uncertainty over the next premier and renewed U.S.–China trade tensions weighed on sentiment. A stronger yen and fading optimism over Sanae Takaichi’s leadership added pressure on markets. Dive deeper

Salesforce will invest $15 billion in San Francisco over five years to boost AI innovation and establish an AI incubator hub. The move, announced ahead of its Dreamforce conference, aims to advance AI adoption and reinforce the company’s leadership in enterprise technology. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Radhika Gupta, CEO, Edelweiss Mutual Fund, on market outlook and consumption-led growth

“India’s next market rally will be driven by consumption, supported by tax cuts, GST reforms, and rising domestic demand.”

“SIP flows have shown remarkable resilience from ₹4,000 crore in 2017 to ₹30,000 crore now. And could reach ₹1 lakh crore a month by 2030.”

“Hospitals, hotels, and capital markets are three structural themes where we see multi-year compounding and sustained investor opportunity.” - Link

Tata Mutual Fund is on suspension of fresh investments in the Silver ETF Fund of Fund

“Due to a global and domestic shortage of physical silver, Silver ETFs are trading at a premium to their iNAVs.”

“Tata Mutual Fund has temporarily suspended fresh investments, switch-ins, SIP, and STP registrations in the Tata Silver ETF Fund of Fund effective October 14, 2025.”

“Existing SIPs and STPs will continue as usual, while redemptions and switch-outs remain permitted during the suspension period.” - Link

Sam Altman, CEO & Co-founder, OpenAI, on partnership with Broadcom

“Partnering with Broadcom is a critical step in building the infrastructure needed to unlock AI’s potential and deliver real benefits for people and businesses.”

“The collaboration will enable OpenAI to design custom AI chips, making our models faster and more powerful while reducing reliance on off-the-shelf processors.”

“This partnership marks another major move toward expanding our global AI infrastructure as demand for computing power continues to surge.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

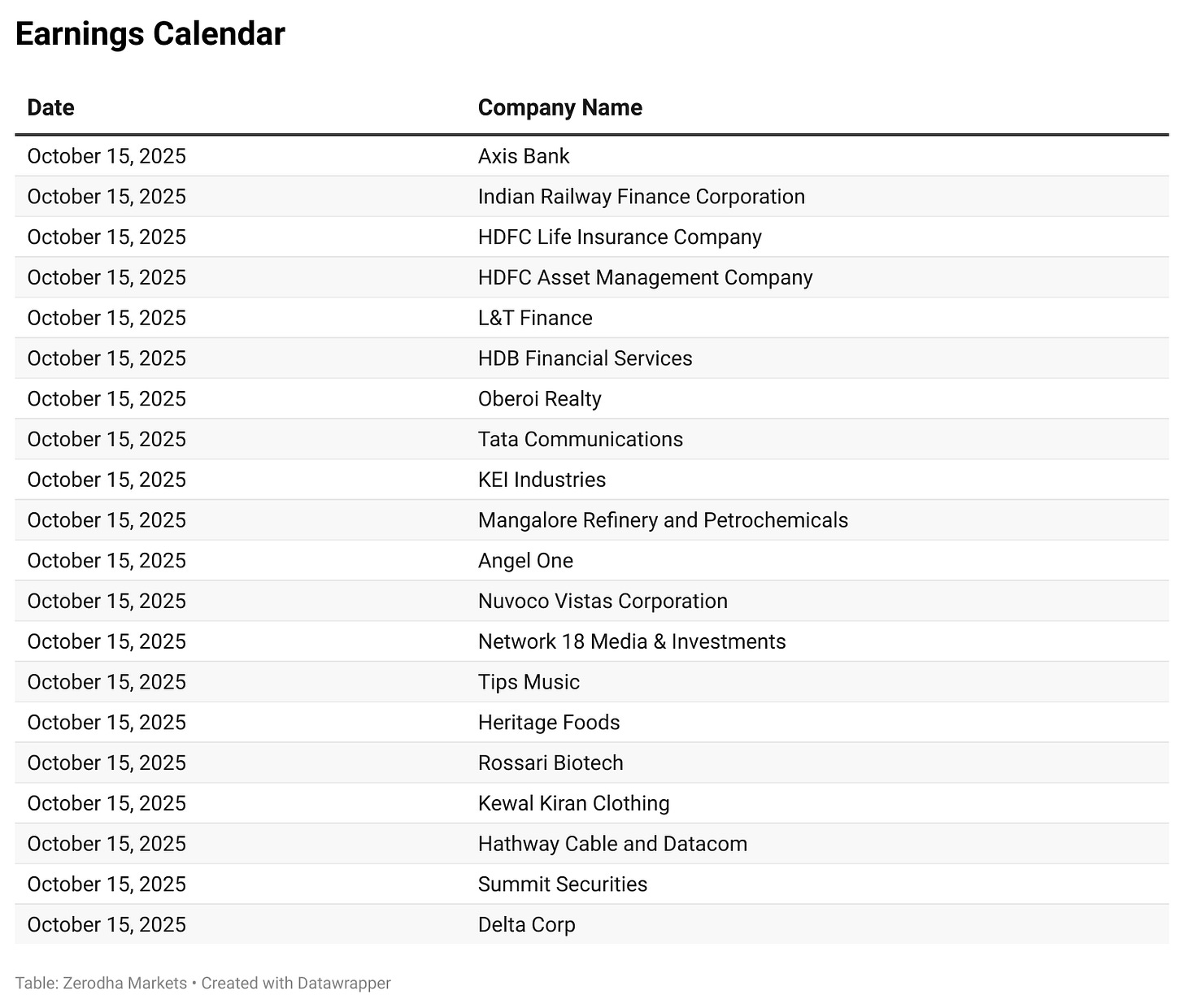

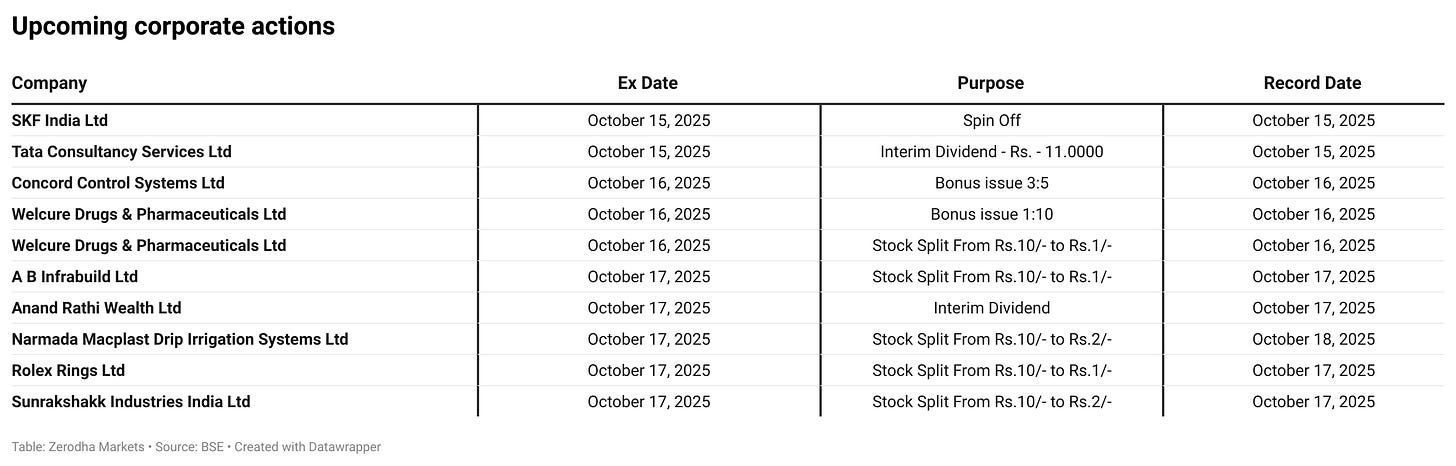

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Thanks for sharing — weak global cues are clearly putting pressure on markets everywhere. Risk sentiment is fragile, and any cracks in macro or earnings will be punished swiftly. It’ll be essential to monitor central bank moves, inflation surprises, and geopolitical developments. In such a backdrop, quality and defensives may outperform cyclicals.

I still didn't understand why every sector is in red today