Weak breadth and late collapse pull Nifty to 25,950

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore how Week 47 of 2025 turned into one of the strongest stretches for Indian equities, powered by the sharpest earnings recovery in over a year. NIFTY and SENSEX nearly reclaimed new highs after a long 14-month wait, while BANKNIFTY and MIDCPNIFTY broke into fresh all-time-high territory. Sentiment stayed firmly bullish overall, though a late-week wobble in US markets now raises the question of whether India will have to absorb some global volatility in the days ahead.

Market Overview

Nifty opened with a 55-point gap-up at 26,123 following positive global cues, but the early strength fizzled out as the index steadily drifted lower in the first hour toward the 26,070–26,080 zone. Through the late morning, Nifty attempted to stabilise but remained under pressure, moving in a narrow 26,080–26,120 range with a slight downward bias.

In the second half, the index continued to struggle, failing to retest its intraday highs and oscillating between 26,030 and 26,070. Selling intensified after 3 PM, triggering a sharp decline that dragged Nifty into the 25,920–25,930 zone. It eventually closed near the day’s low at 25,959.50, down almost 0.4%.

Looking ahead, markets are expected to stay sensitive to developments around the India–U.S. trade deal, alongside broader global cues.

Broader Market Performance:

The broader markets continue to remain extremely weak. Of the 3,214 stocks traded on the NSE, 810 advanced, 2,315 declined, and 89 remained unchanged.

Sectoral Performance:

Nifty IT led the gains with a rise of 0.41%, while Nifty Realty was the worst performer, falling 2.05%. Out of the 12 sectoral indices, only one (Nifty IT) ended in the green, while the remaining 11 closed in the red, indicating broad-based weakness across sectors.

Here’s the trend of FII-DII activity from the last 5 days:

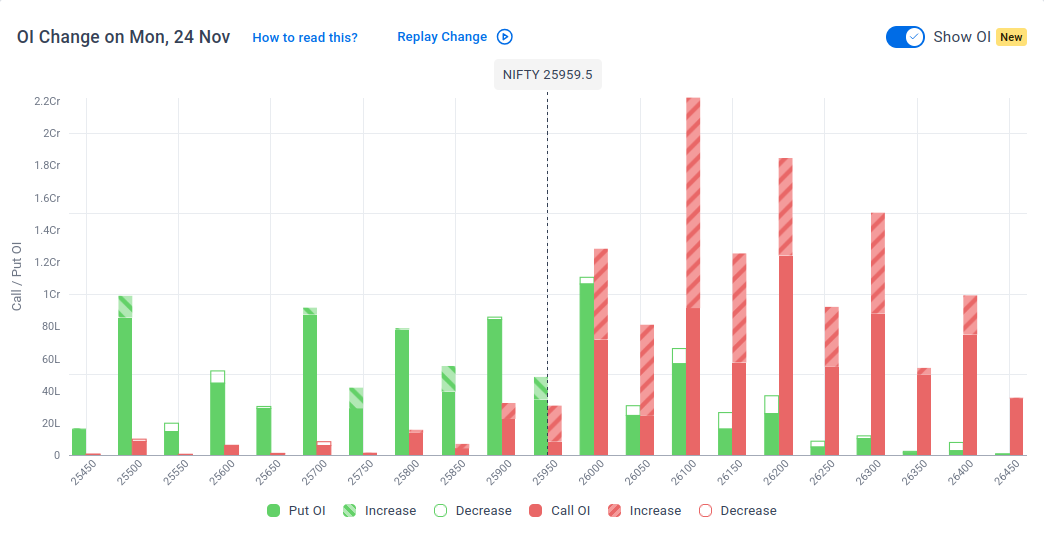

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 25th November:

The maximum Call Open Interest (OI) is observed at 26,100, followed by 26,200, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,500, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s finished steel imports fell 34.1% year-on-year to 3.8 million metric tons in April–October, provisional government data reviewed by Reuters showed. Despite the decline, India remained a net importer of finished steel during the period. Dive deeper

Hindustan Aeronautics Ltd (HAL) said that last week’s Tejas fighter jet crash in Dubai was an isolated incident caused by exceptional circumstances. Dive deeper

India’s solar panel exports fell sharply to about $80 million in September, down from $134 million in August, largely due to U.S. tariffs and increased scrutiny of imports. Dive deeper

TeamLease Services shares surged 11% intraday before ending 2% higher, as India’s newly implemented labour codes, effective November 21, are expected to reshape the staffing sector. The reforms could channel billions from the unorganised workforce into the formal economy, benefiting compliance-focused players. Dive deeper

ACME Solar Holdings said that it has won a 130 MW round-the-clock renewable energy project in a tender issued by Railways (REMCL). The company secured the bid at ₹4.35 per unit, it said in a statement. Dive deeper

Tata Power has signed commercial agreements for the ₹13,100 crore Dorjilung Hydro Power Project in Bhutan, a 1,125 MW facility. Dive deeper

Truhome Finance, backed by Warburg Pincus, is aiming for an IPO in the next financial year. The lender expects strong growth and is targeting the position of India’s second-largest affordable housing financier. Dive deeper

What’s happening globally

Brent crude fell toward $62 per barrel, hitting a one-month low as progress on a potential U.S.-backed Russia-Ukraine peace proposal raised the prospect of sanctions on Russian oil being lifted. Dive deeper

Gold inched up to around $4,070 per ounce as traders awaited U.S. data for clues on the Fed’s next move. Dive deeper

US stock futures rose, with the Dow, S&P 500 and Nasdaq 100 edging higher as traders increased bets on a December Fed rate cut after comments from New York Fed President John Williams. Dive deeper

China’s FDI fell 10.3% year-on-year to CNY 621.93 billion in October, marking the softest decline since December 2023 but extending a multi-year contraction. Dive deeper

European shares edged higher as hopes of a U.S. rate cut and progress in Ukraine-Russia peace talks boosted sentiment. Dive deeper

Russia’s GDP grew 0.9% year-on-year in September, faster than the 0.4% pace of the prior two months, driven by construction, manufacturing, and agriculture. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Shailesh Chandra, CEO & MD of Tata Motors Passenger Vehicles, MD and CEO on the second half of FY

‘So, overall, in the financial year, because the first half had seen a decline of 1.6% before the festive period, it should be in the zone of 5% or so,’

‘In addition to the growing traction for our portfolio, we will drive strong volume growth on the back of new product launches that will strengthen our portfolio,’- Link

Piyush Goyal, Commerce & Industry Minister of India on India–Canada cooperation in critical sectors:

“We have tremendous potential on critical minerals, critical mineral processing technologies, nuclear energy, and emerging technologies like AI.”

“Canada and India are natural allies… we don’t compete with each other, we actually complement each other.”

“The strengths of Canada and India together can become a force multiplier for businesses and investors, and the recent meetings between the Prime Ministers have given a clear direction for the future of the relationship.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

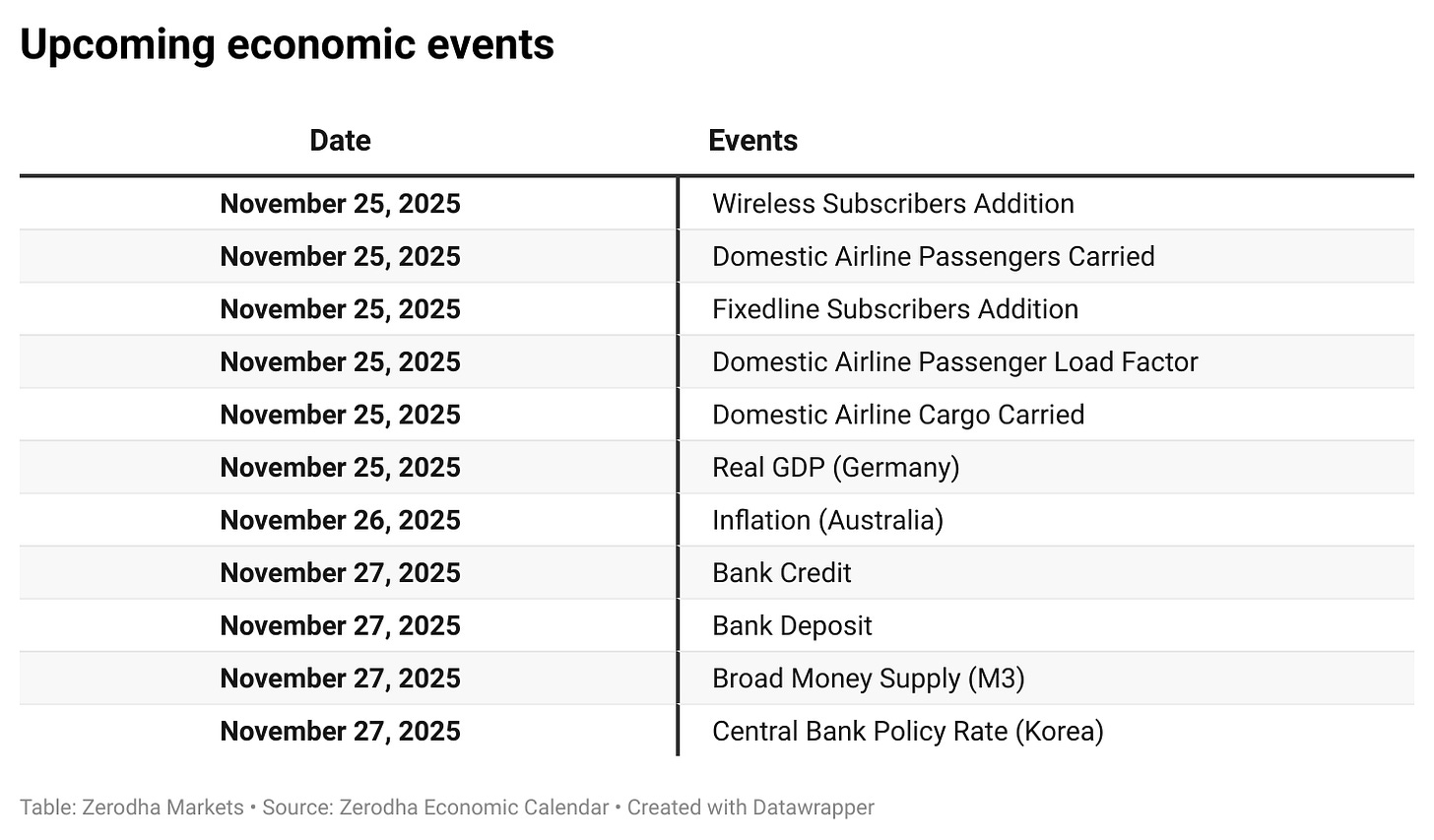

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!