Volatile week ends on a strong footing; Metals, PSU banks drive rally

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we go beyond the classic Buffett vs. Simons debate to ask a practical question for individual investors: what actually makes more money—trading or investing? We break down the math, the psychology, and the structure of returns, showing why it isn’t just “one or the other” but how a smart combination can tilt the odds in your favor. We’ll explore how long-term compounding (Buffett’s style) compares with systematic trading (Simons’ style), why investing is non-negotiable, how pledging and leverage change the game, and why many veterans dismiss trading despite its potential.

Market Overview

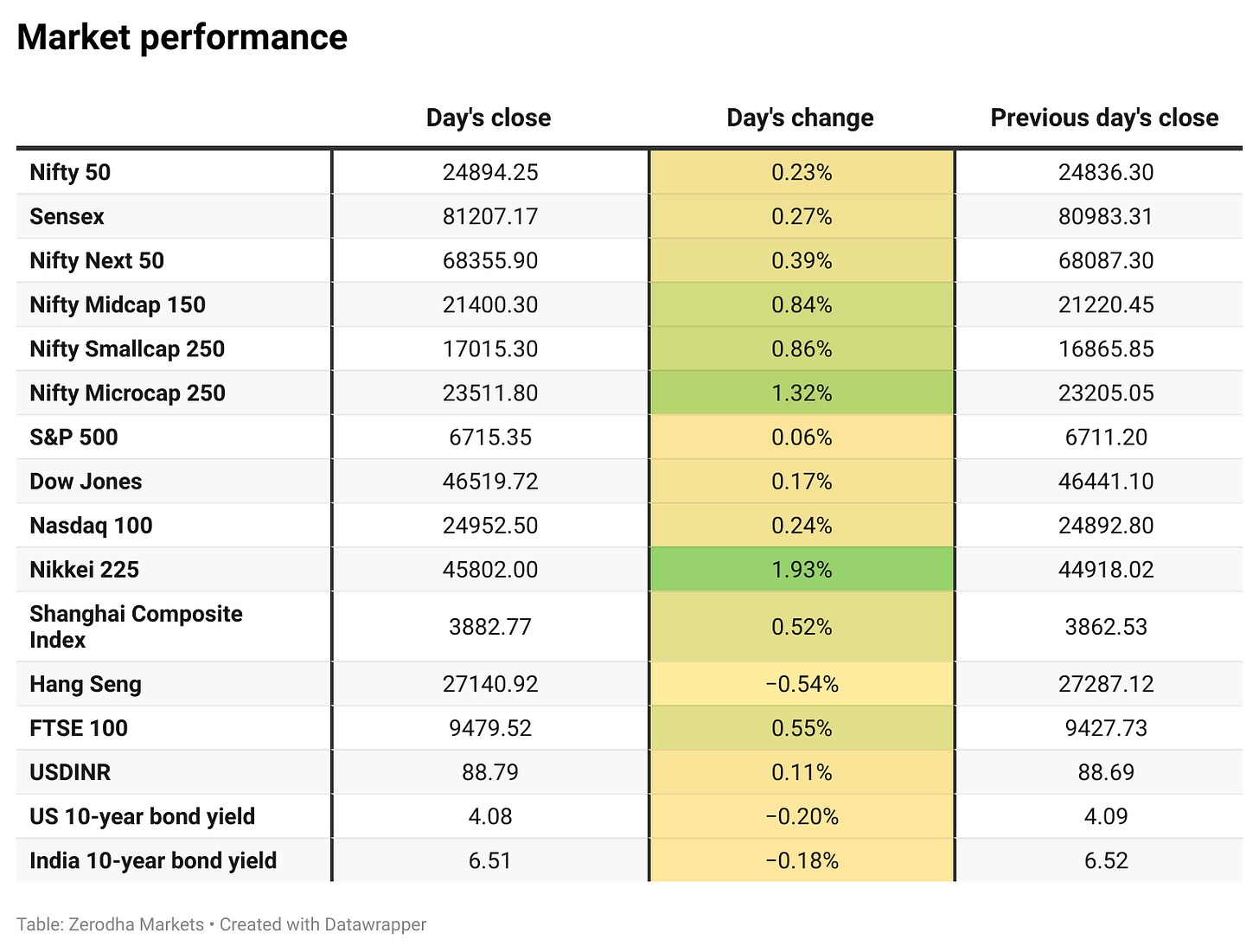

Nifty opened with a gap down of 75 points at 24,760, as weak global cues weighed on sentiment. After a slow start in the opening half hour, the index managed to stabilize and gradually clawed back gains. Through the mid-session, Nifty held a steady upward bias, trading in a narrow range around the 24,800 levels.

In the second half, buying momentum picked up, especially in the last hour, with the index surging past 24,880. Despite bouts of intraday volatility, Nifty closed strong at 24,894.25, recovering fully from its early losses and finishing near the day’s high, reflecting resilience ahead of the weekend.

Market sentiment has once again turned cautious after tariffs on Pharma and a hike in H1-B visa fees affecting the IT sector. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries.

Broader Market Performance:

Broader markets had a super strong session today. Of the 3,185 stocks traded on the NSE, 2,140 advanced, 960 declined, and 85 remained unchanged.

Sectoral Performance

Nifty Metal was the top gainer for the day with a 1.82% rise, while Nifty Realty ended as the top loser, slipping 0.11%. Out of the 12 sectoral indices, 10 closed in the green and only 2 ended in the red, indicating broad-based buying across sectors.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 7th October:

The maximum Call Open Interest (OI) is observed at 25,000, followed by 24,900, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,800, followed by 24,700, suggesting strong support at 24,700 to 24,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year bond yield hovered near 6.50% as markets awaited the auction of a new ₹32,000 crore security, with expectations that the cutoff will guide further movement. RBI’s unchanged policy, lower inflation forecast, and easing OIS rates have fueled hopes of a December rate cut. Dive deeper

Global copper prices hit a 16-month high amid supply disruptions and rising demand, following a force majeure at Freeport-McMoRan’s Grasberg mine. Vedanta, through Sterlite Copper, remains significantly exposed to the metal, having once met up to 36% of India’s demand. Dive deeper

The textile sector is awaiting a revised PLI scheme with a focus on manmade fibre textiles, including new HSN codes, lower investment thresholds, and a 10% turnover-linked incentive. Industry leaders said the changes will accelerate growth, attract MSME investments, and expect an official notification soon. Dive deeper

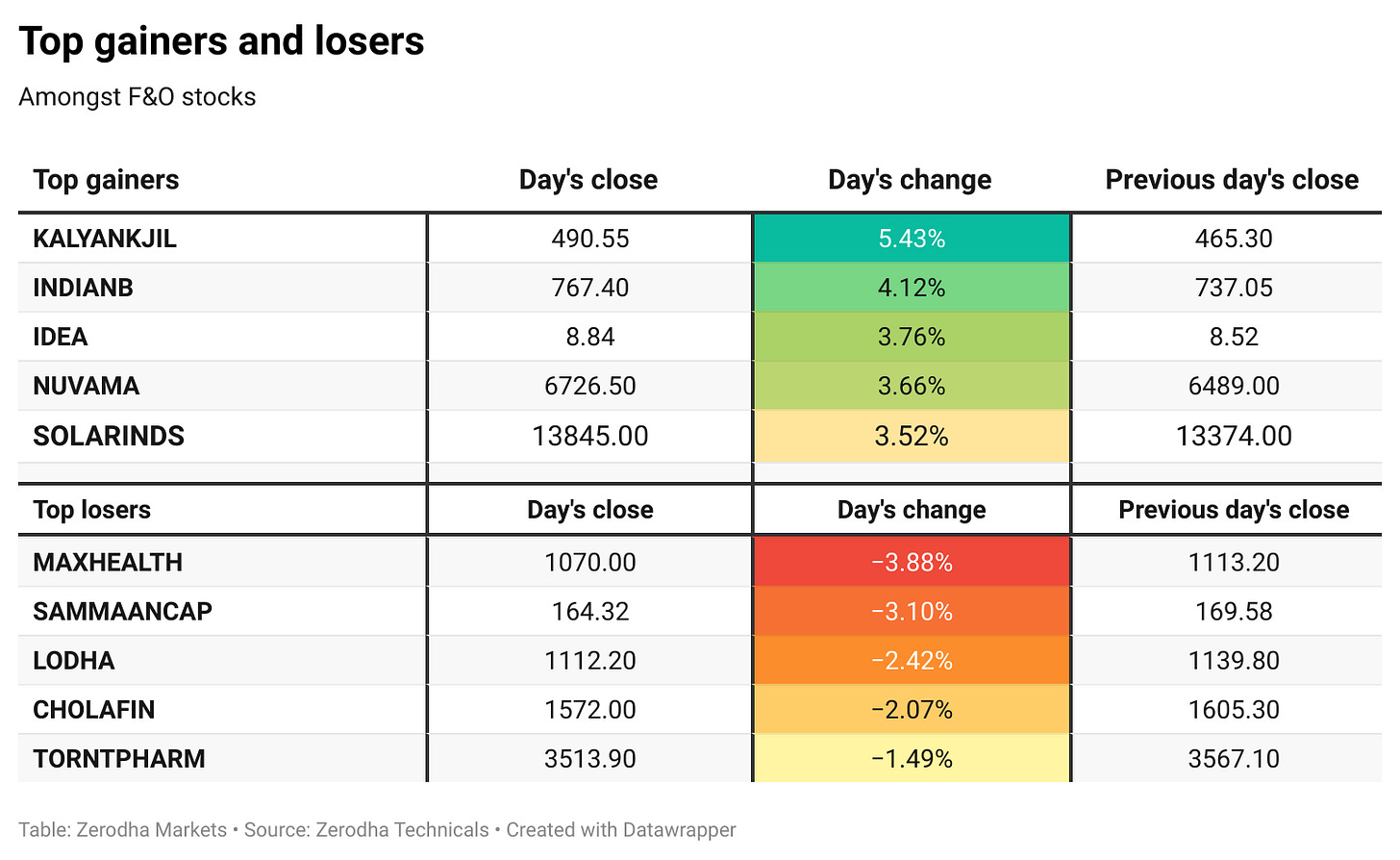

Abu Dhabi’s Avenir Investment, an affiliate of IHC, will acquire a 43.46% stake in Sammaan Capital for $1 billion through preferential shares and warrants. The deal, India’s largest NBFC capital infusion, will give Avenir promoter status and trigger an open offer for an additional 26%. Dive deeper

LG Electronics India’s upcoming ₹11,607 crore IPO values the company at $8.7 billion, nearly on par with its South Korean parent’s $8.9 billion. The issue, priced at ₹1,080-1,140 per share, will open on October 7 and close on October 9. Dive deeper

India’s credit growth, currently below 10%, could see a boost of up to ₹5 lakh crore as the RBI eases corporate exposure norms and permits M&A financing. These measures may shift large borrowings back to banks, though weak demand remains the key hurdle for faster expansion. Dive deeper

Reliance Consumer Products is entering India’s ₹30,000 crore packaged water market with its new brand Campa Sure, aiming to disrupt the segment through competitive pricing, regional partnerships, and wide distribution. Dive deeper

Tata Motors reclaimed the No. 2 position in India’s passenger vehicle market in September, surpassing Hyundai and Mahindra with 40,594 registrations. Dive deeper

Adani Green Energy’s ₹7,000 MW solar supply deal with Andhra Pradesh faces hurdles over demands for transmission fee waivers, raising the risk of delays in power offtake under the 2021 agreement with SECI. Dive deeper

Orient Technologies is expanding into data centre and AI infrastructure under the IndiaAI mission, with plans to deploy 6,000 GPUs to support remote compute and AI services across India. Dive deeper

Hero MotoCorp reported an 8% year-on-year rise in September sales to 6,87,220 units and became the first Indian manufacturer to cross 125 million cumulative two-wheeler production. VAHAN registrations grew 19% to 3,23,230 units, reflecting strong festive demand momentum. Dive deeper

What’s happening globally

OpenAI hit a $500 billion valuation after employees sold $6.6 billion in shares to investors, including SoftBank and Thrive Capital. The sale underscores its rapid growth, with $4.3 billion in revenue generated in the first half of 2025. Dive deeper

WTI crude traded near $60.8 per barrel, set for its worst week since June, as prospects of OPEC+ raising output by up to 500,000 bpd and rising US inventories fueled oversupply concerns. A US government shutdown and the resumption of Kurdish oil exports added to the pressure. Dive deeper

Gold hovered near $3,860 per ounce, heading for a seventh straight weekly gain as safe-haven demand grew amid the US government shutdown and expectations of Fed rate cuts. Dive deeper

Euro Area producer prices fell 0.3% month-on-month in August 2025, led by a drop in energy and intermediate goods, while capital and non-durable goods saw slight gains. On a yearly basis, prices declined 0.6%, the first annual fall since November 2024. Dive deeper

The FAO Food Price Index fell 0.7% in September 2025 to a three-month low, with cereals, sugar, oils, and dairy all declining on strong global supply. Meat was the only category to rise, up 0.7% to a new record high on higher bovine and ovine prices. Dive deeper

Japan’s unemployment rate rose to 2.6% in August 2025, the highest since July 2024, as unemployed persons climbed to 1.79 million and employment fell to 68.1 million. The jobs-to-applicants ratio eased to 1.20, its lowest since January 2022. Dive deeper

Australia’s composite PMI eased to 52.4 in September 2025 from 55.5 in August, marking the weakest growth since June. Softer new business and export demand weighed on momentum, though hiring remained strong and services activity continued to expand. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

RBI Governor Sanjay Malhotra at Kautilya Economic Conclave 2025

“India’s macro fundamentals remain very strong, with low inflation, robust forex reserves, a narrow current account deficit, and strong balance sheets of banks and corporates.”

“It is the combined efforts of government policymakers, regulators, and regulated entities that have ensured resilient growth.”

“Despite recent odds, the economy seems well settled into an equilibrium of resilient growth, making India an anchor of stability in a volatile world.” - Link

FM Nirmala Sitharaman at Kautilya Economic Conclave 2025

“Innovations like stablecoins are transforming the landscape of money and capital flows. Nations must prepare to engage with them, whether we welcome these shifts or not.”

“These changes may force binary choices, adapt to new monetary architectures, or risk exclusion. No nation can insulate itself from systemic change.”

“India’s capacity to absorb external shocks is strong, but there is no room for complacency — eternal performance is the price of strategic independence.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

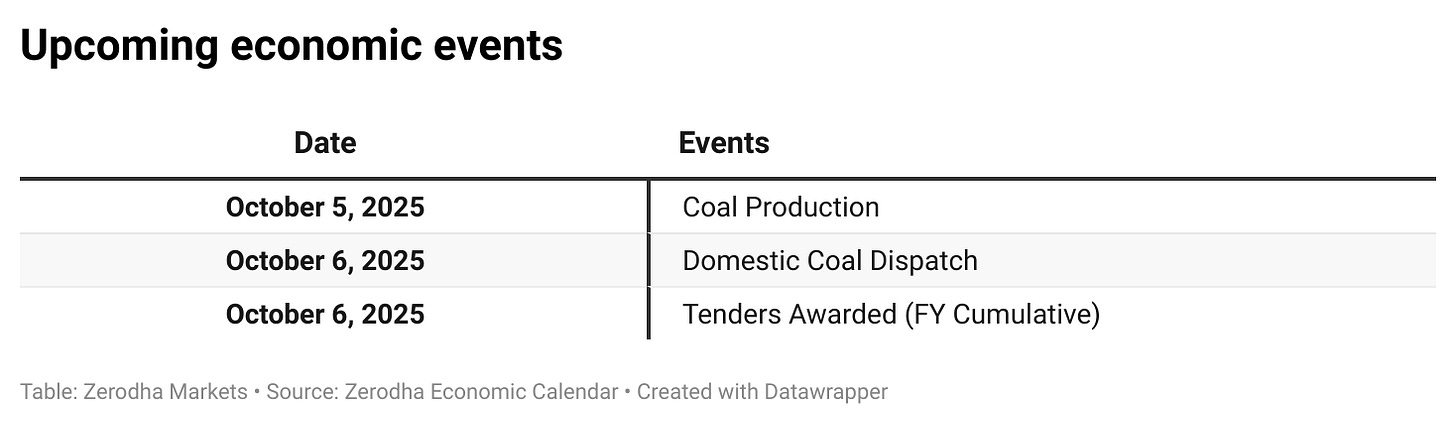

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!