Trump’s renewed tariff threat on India hits market sentiment

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

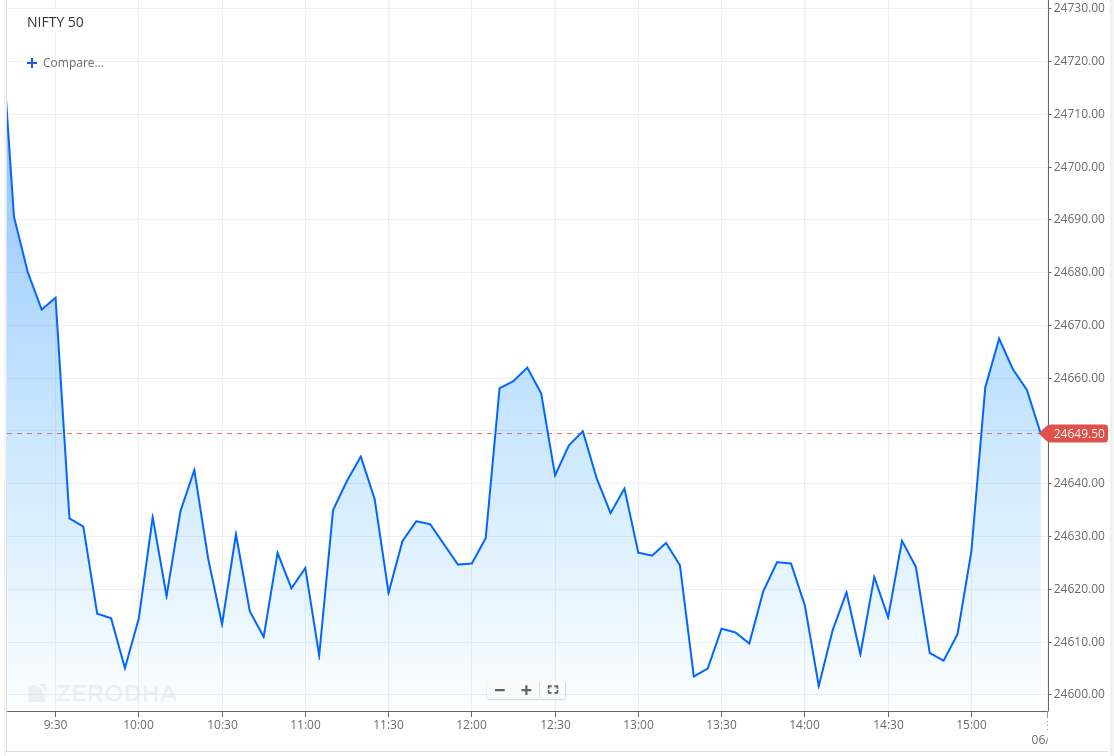

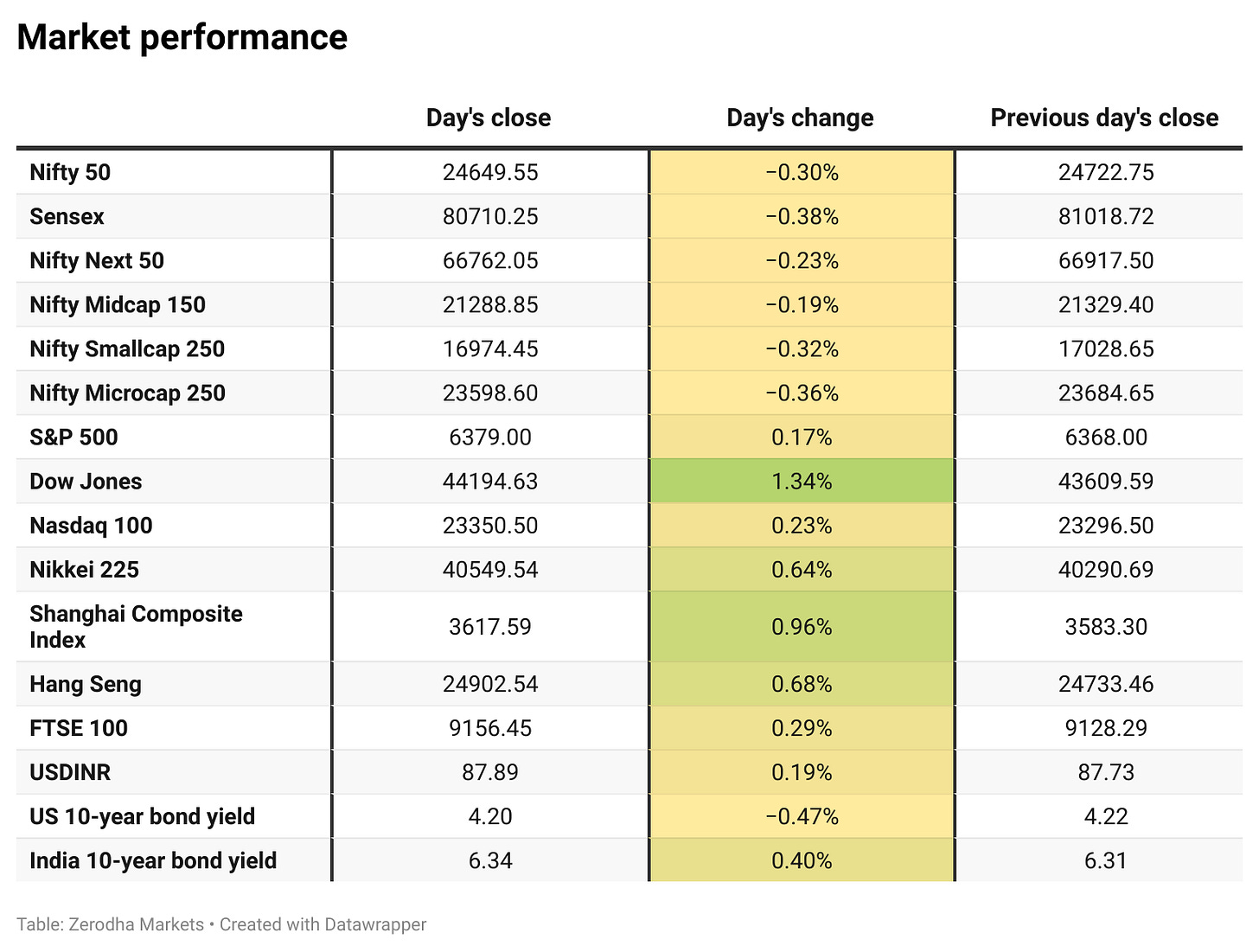

Nifty opened flat at 24,720 but soon came under pressure as sentiment turned weak following overnight comments from US President Trump, who threatened additional tariffs on India. The index slipped to 24,600 in the first hour and then remained rangebound in a narrow 50-point band between 24,600 and 24,650 for the rest of the day. Nifty eventually closed at 24,649.55, down by 0.29%.

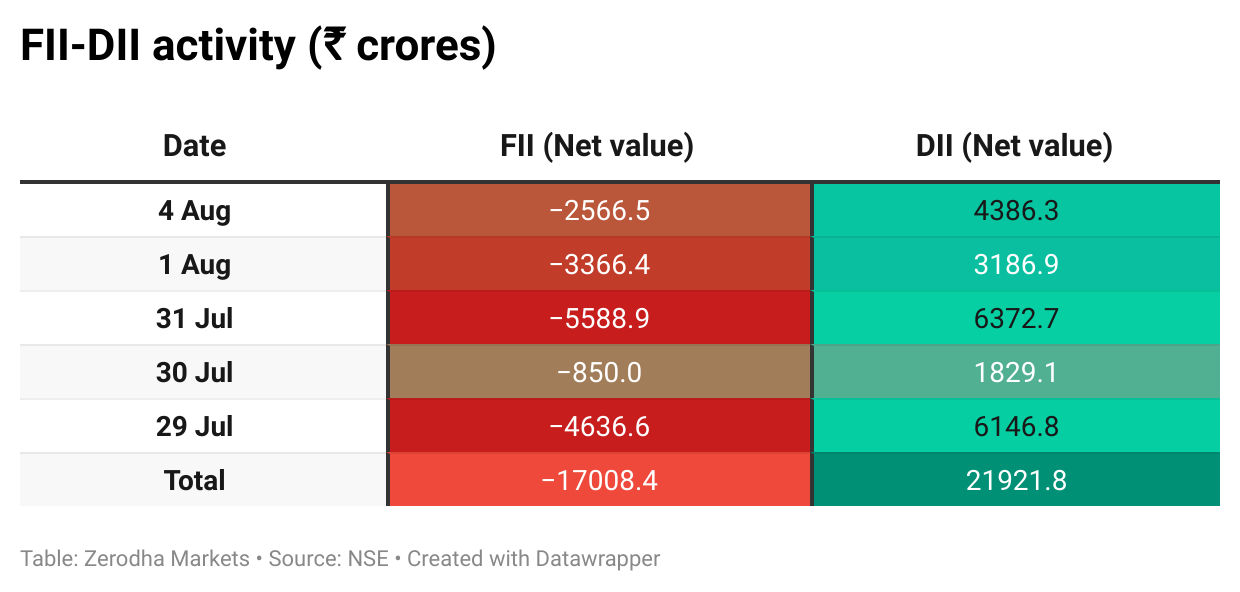

Sentiment stayed cautious amid weak global cues, persistent FII outflows, and muted earnings, with focus on tomorrow’s RBI monetary policy meet and ongoing US-India trade tensions to guide near-term direction.

Broader Market Performance:

Broader markets mostly traded with a negative bias today. Of the 3,065 stocks traded on the NSE, 1,200 advanced, 1,784 declined, and 81 remained unchanged.

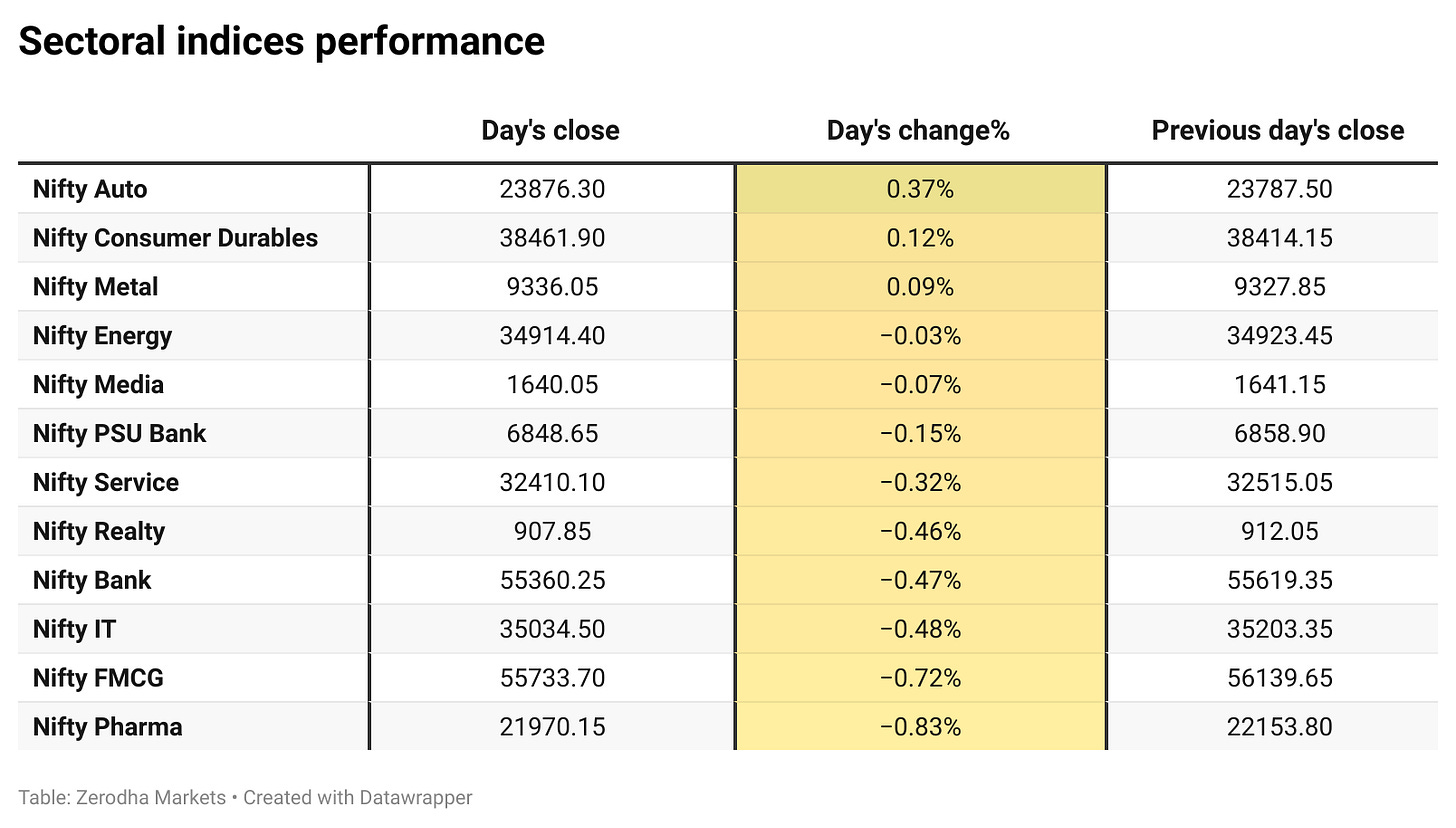

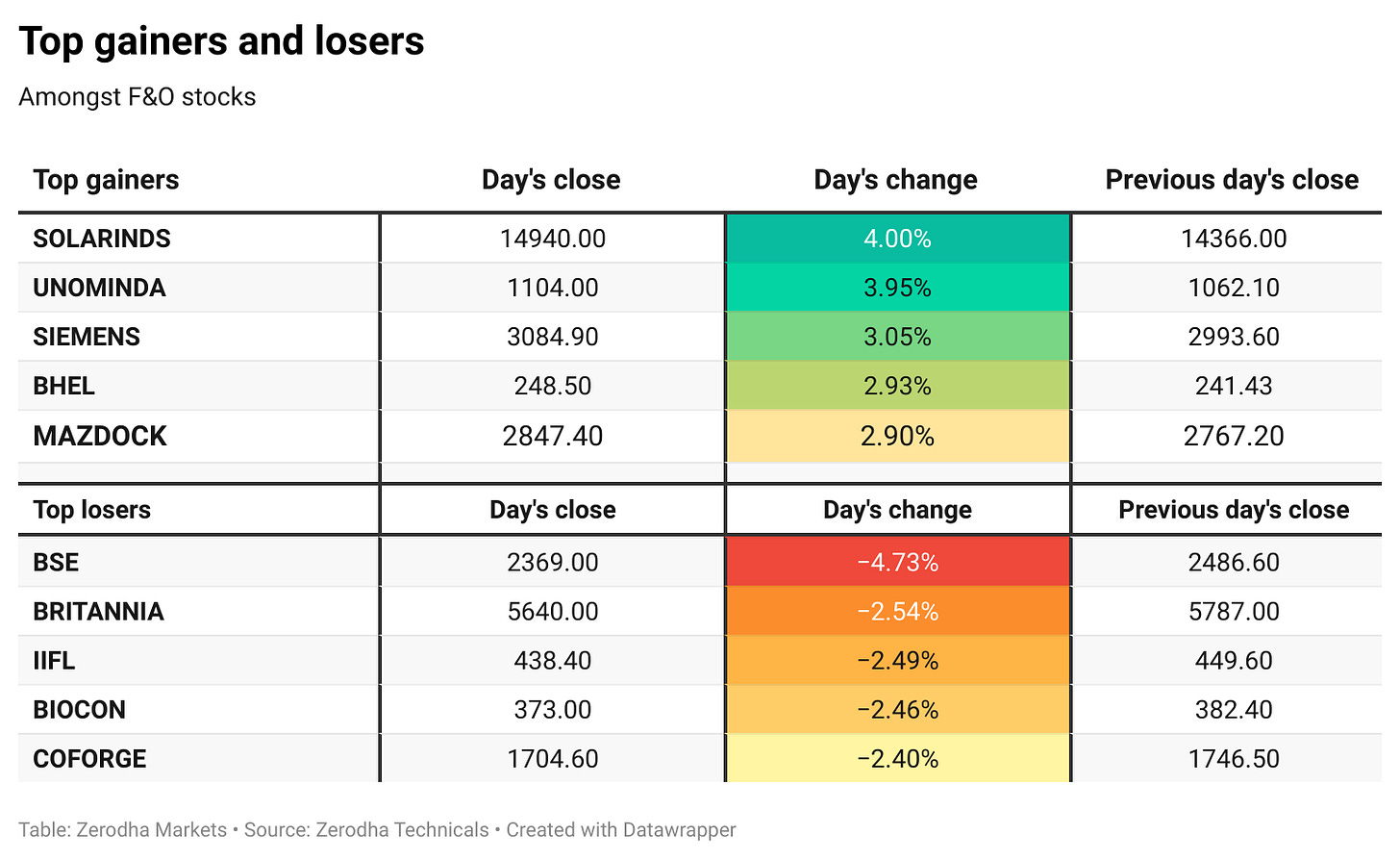

Sectoral Performance

Nifty Auto was the top gainer for the day, rising by 0.37%, followed by Nifty Consumer Durables and Nifty Metal, which edged up 0.12% and 0.09% respectively. On the flip side, Nifty Pharma was the worst performer, falling 0.83%, followed by Nifty FMCG and Nifty IT, which declined 0.72% and 0.48% respectively. Out of the 12 sectoral indices, 3 ended in the green while 9 closed in the red, indicating a broadly negative market sentiment across sectors.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 7th August:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,700, suggesting strong resistance at 24,800 - 25,000 levels.

The maximum Put Open Interest (OI) is observed at 24,600, followed closely by 24,500, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

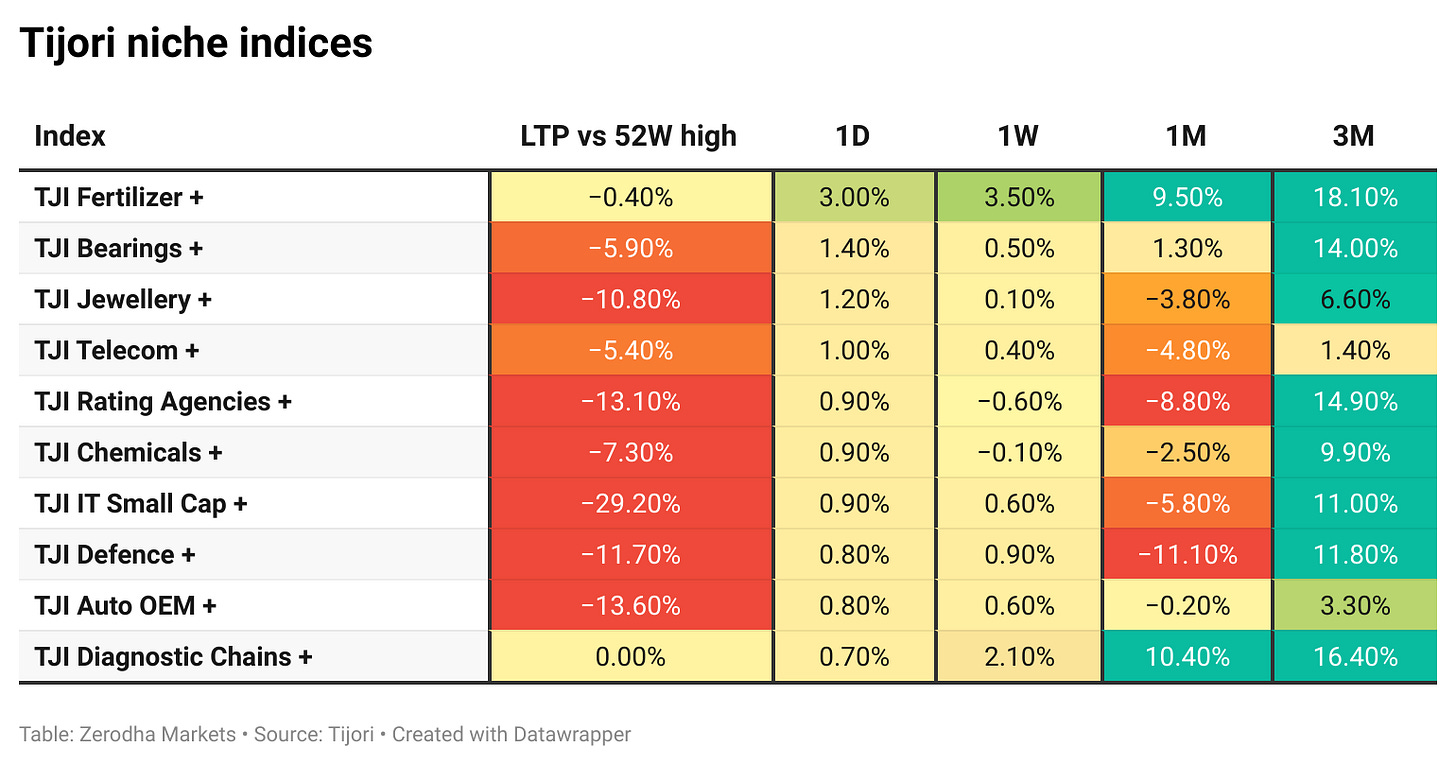

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

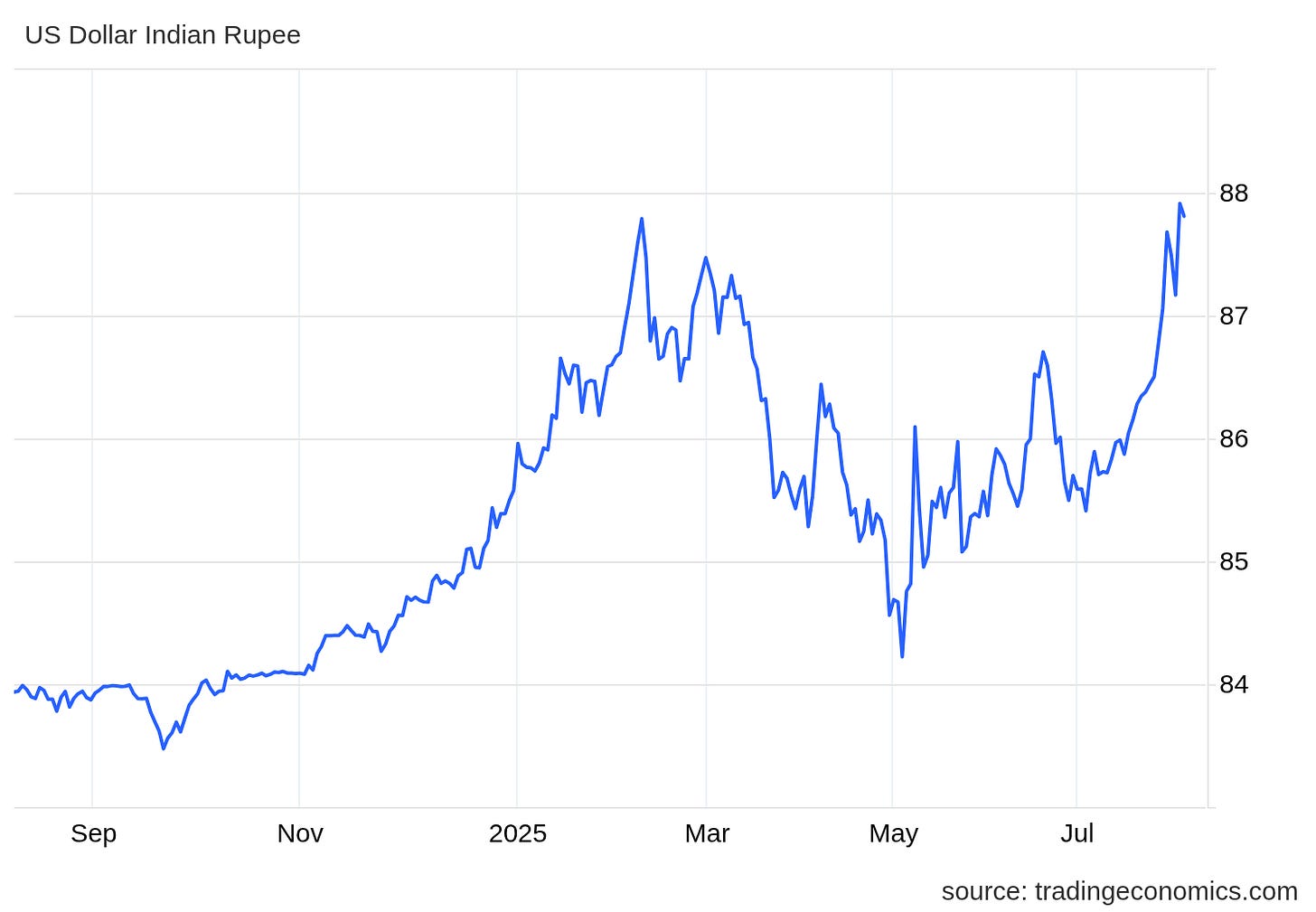

The rupee hovered near its record low of 88.1 as US tariffs and threats of further levies heightened trade tensions. Modi defended energy imports from Russia, while inflation dropped to 2.1%, fueling expectations of more RBI rate cuts despite a likely pause this week. Dive deeper

GMR Airports is raising ₹6,000 crore via NCDs from banks and mutual funds to refinance debts of GAL and DIAL, with rates up to 10.5% and a tenor of up to 3 years. The move aims to lower borrowing costs, with Crisil assigning an A+ rating. Dive deeper

The government saved ₹560 crore in interest costs this fiscal through bond switches and conversions, up from ₹54 crore a year ago, by extending debt maturity. The RBI conducted four switch auctions worth ₹1.13 lakh crore between April and July, compared to ₹86,000 crore last year. Dive deeper

Adani Infra acquired a 21.83% stake in PSP Projects, buying 8.65 million shares at ₹640 each for about ₹554 crore through a BSE block deal. The purchase is part of its plan to acquire up to 30.07% from promoter Prahaladbhai S Patel. Dive deeper

Godfrey Phillips India reported a 56% YoY jump in Q1 FY26 consolidated net profit to ₹356.28 crore and announced a 2:1 bonus share issue, with a record date of September 16. The profit surge was driven by higher sales, reflecting strong performance in its FMCG and tobacco businesses. Dive deeper

Siemens Energy India’s Q3 profit rose 80% YoY to ₹263 crore, with revenue up 20% to ₹1,785 crore and EBITDA margin at 19.1%. New orders surged 94% to ₹3,290 crore, lifting its order backlog to ₹15,000 crore and supporting strong medium-term growth prospects. Dive deeper

Bosch’s Q1 consolidated net profit more than doubled to ₹1,115 crore, aided by an exceptional gain of ₹556 crore, while revenue rose 11% to ₹4,788 crore. EBITDA grew 23% to ₹639 crore with margins improving to 13.3% from 12% last year. Dive deeper

GST officers uncovered a fake ITC racket in the iron and steel sector involving ₹47.12 crore based on bogus invoices worth about ₹261 crore without actual goods supply. A city-based trader was arrested after investigations found ITC claims from cancelled and suspended GSTINs. Dive deeper

Tata Motors has appointed PB Balaji as Jaguar Land Rover CEO effective November 2025, succeeding Adrian Mardell. Dive deeper

BEML has secured a ₹282 crore order from the Ministry of Defence to supply HMV 8x8 vehicles, following a ₹293.8 crore HMV 6x6 order last week. Dive deeper

PNB Housing Finance will look internally and externally for a new CEO after Girish Kousgi’s resignation, with executive director Jatul Anand taking interim charge and Valli Sekar named chief business officer for affordable housing. Dive deeper

The RBI has approved Rajiv Anand as MD & CEO of IndusInd Bank for a three-year term starting August 25, succeeding Sumant Khatpalia after his exit over an accounting discrepancy. Dive deeper

DLF posted a 19% YoY rise in Q1 FY26 net profit to ₹766 crore, with sales bookings up 78% to ₹11,425 crore and consolidated revenue at ₹2,981 crore. The company reported a net cash position of ₹7,980 crore and strong demand across its housing and commercial portfolio. Dive deeper

Irdai has fined Policybazaar Insurance Brokers ₹5 crore for violations under the Insurance Act and related regulations, while also issuing directions, advisories, and cautions to the company. Dive deeper

What’s happening globally

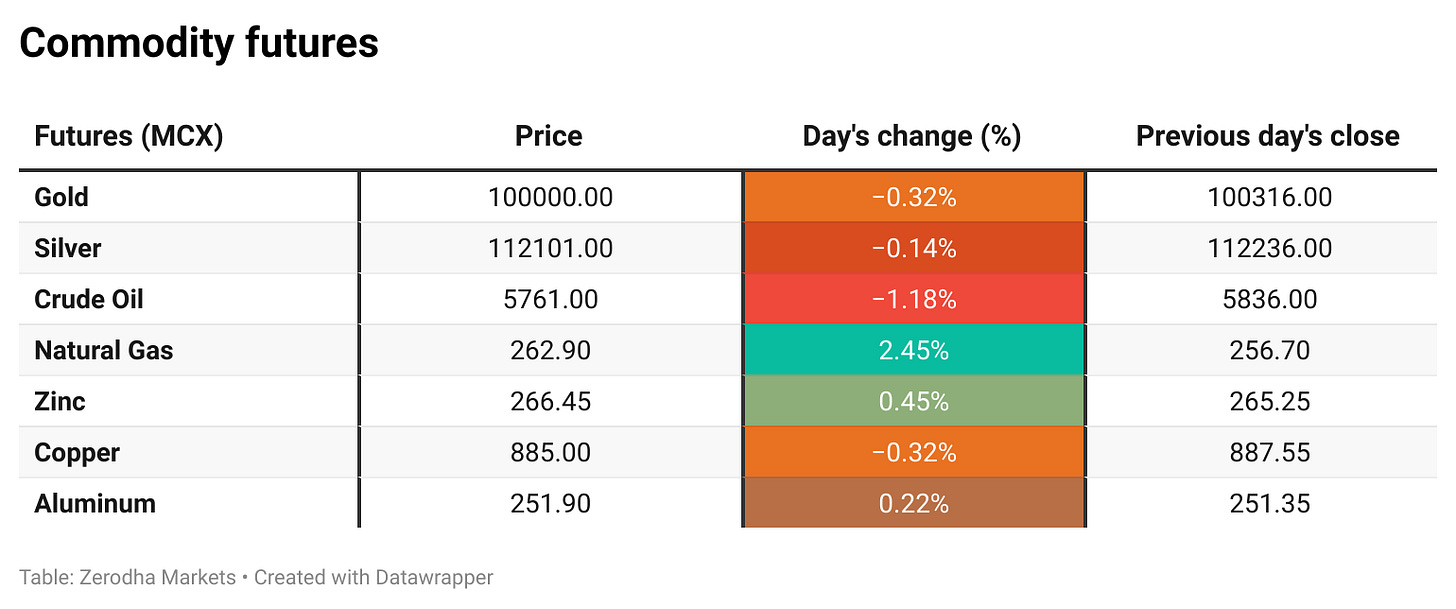

Gold eased to about $3,360 per ounce but stayed near a one-week high, supported by expectations of a September US rate cut after weak jobs data. Dive deeper

The US Logistics Manager’s Index eased to 59.2 in July from 60.7, driven by slower growth in inventory costs and levels, lifting warehousing capacity. Smaller firms led the shift, while larger retailers cut inventories to curb costs. Transportation utilization rose, with capacity and prices little changed. Dive deeper

Italy’s Composite PMI edged up to 51.5 in July from 51.1, with growth driven by services while manufacturing contracted. New orders rose slightly, exports fell at a slower pace, and employment growth softened. Firms faced weaker cost pressures but raised selling prices at the fastest rate in 15 months. Dive deeper

Spain’s industrial production grew 2.3% year-on-year in June, the fastest since October 2024, driven by strong gains in energy and capital goods. Consumer and intermediate goods also rose, while output increased 1% month-on-month after a 0.5% gain in May. Dive deeper

France’s industrial production jumped 3.8% in June, the strongest monthly rise since July 2020, led by a sharp rebound in manufacturing and a surge in transport equipment output. Mining, energy, and utilities also saw faster growth, though annual output fell 0.4% and Q2 activity dipped 0.1% from Q1. Dive deeper

Indonesia’s GDP grew 5.12% in Q2 2025, the fastest since Q2 2023, supported by strong gains in investment, consumption, and exports ahead of new US tariffs. Imports also surged, government spending contracted more slowly, and output rose across manufacturing, real estate, and mining. Dive deeper

China’s Caixin services PMI climbed to 52.6 in July, the fastest growth since May 2024, driven by stronger new business and a rebound in foreign demand. Employment rose at the quickest pace in a year, while input and selling prices increased, and business confidence reached its highest since March. Dive deeper

Tesla approved an interim compensation award of 96 million shares, worth about $29 billion, for Elon Musk as it appeals a court ruling that voided his 2018 pay package. The move aims to retain Musk amid competition for top talent, with a longer-term CEO compensation plan still in development. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

K.N. Balagopal, Finance Minister, Kerala, on tariff war impact

“The tariff war looming over us will worsen our economy further.”

“The influx of imports at low tariffs would create an economic situation much worse than the COVID-19 pandemic.”

“It has to be examined how these policies impact the Indian economy and specifically Kerala, whose exports cover multiple sectors.”

“The academic community should organise a roundtable discussion on the implications of these policies for India and Kerala to generate clarity on what lies ahead for the economy.” - Link

Mamata Banerjee on GST collections for July 2025

“Glad to share that West Bengal has reported a robust 12% year-on-year growth in gross Goods and Services Tax collections for July 2025, recording collection of Rs 5,895 crore, compared to Rs 5,257 crore in the same month last year, according to provisional figures just released by the Government of India.”

“Cumulative growth rate in our state's GST revenue till the month of July is 7.71%. This marks a steady improvement in business and consumption in West Bengal, which is a sign of good economic health.” - Link

Richard Redoglia, CEO, Matrix Global Holdings, on Trump’s tactics and India’s energy imports

“You may see IOC and other state-owned refiners scale back their Russian imports. But the bigger picture is that Trump is juggling many priorities at once. In this case, I believe he’s applying pressure on Russia through India.”

“India needs to import oil, that’s its necessity. Its job is to ensure a stable energy supply for its people.”

“Trump is negotiating, he’s always dealing, always in motion.”

“The global oil market is dealing with overcapacity, which puts downward pressure on prices.”

“Markets recover quickly. They are efficient at repricing, especially in commodities.”

“The fact that the U.S. stock market is at all-time highs and the oil market appears to be in balance suggests that what we’re witnessing now is simply a negotiation.”

“The dollar is likely to weaken. The latest employment report showed some softness, which suggests we may see a rate cut in September, and possibly another by year-end.”

“Trump’s goal, at least what he says, is free trade. He’s putting tariffs in place to draw people into the U.S. market, but the broader aim seems to be enhancing the ability for global transactions.”

“What matters more is that Trump appears to be negotiating for peace in various parts of the world. That, in my view, should be the key focus for the markets.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

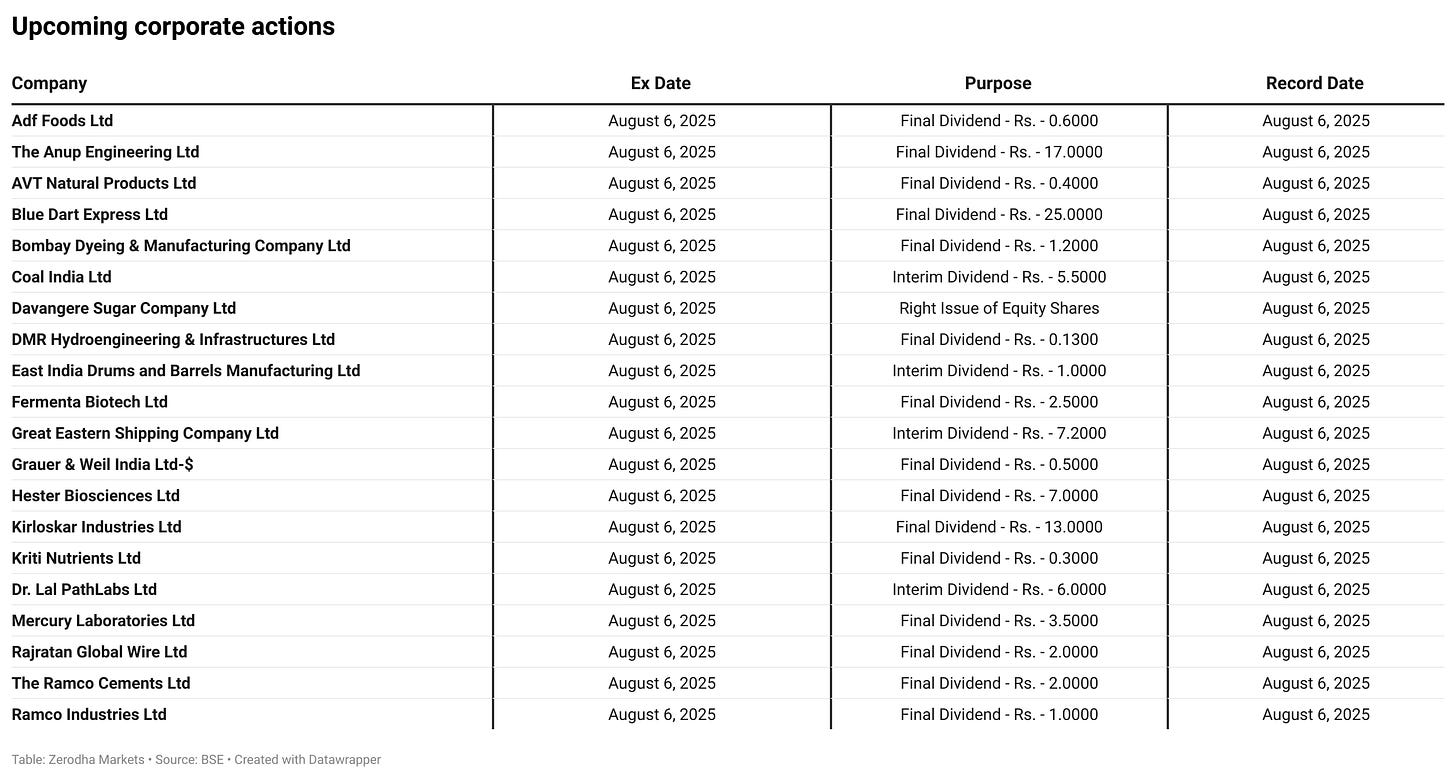

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.