Strong IT rally drives Nifty to a steady finish near 26,050

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we sit down with Tom Sosnoff — trader, entrepreneur, and one of the most influential voices in modern options trading. He talks about his early journey from the CBOE floor to building Thinkorswim and Tastytrade, his contrarian approach to risk, and why most traders misread probability and volatility. Tom also shares his take on Indian markets, the rise of retail participation, and the future of quantitative thinking for everyday traders.

Market Overview

Nifty opened flat at 25,918 and initially slipped to around 25,860 before stabilising near the 25,900–25,920 band. From there, the index staged a steady recovery, crossing 25,950 by mid-morning and gradually moving toward the 25,980–26,000 zone ahead of noon.

Throughout the second half, the Nifty maintained a firm upward bias, largely supported by the strength in IT stocks. The index comfortably held above 26,000, oscillating between 26,000 and 26,050, before inching toward the day’s high near 26,075 in the final hour.

Nifty eventually closed at 26,052.65, up nearly 0.55%, marking a constructive session with sustained intraday buying and a clean reclaim of the 26,000 mark.

Looking ahead, markets are likely to remain sensitive to developments around the India–U.S. trade deal, along with broader global cues.

Broader Market Performance:

Despite a strong upmove in Nifty, the broader markets had a weak session today. Of the 3,212 stocks traded on the NSE, 1,413 advanced, 1,703 declined, and 96 remained unchanged.

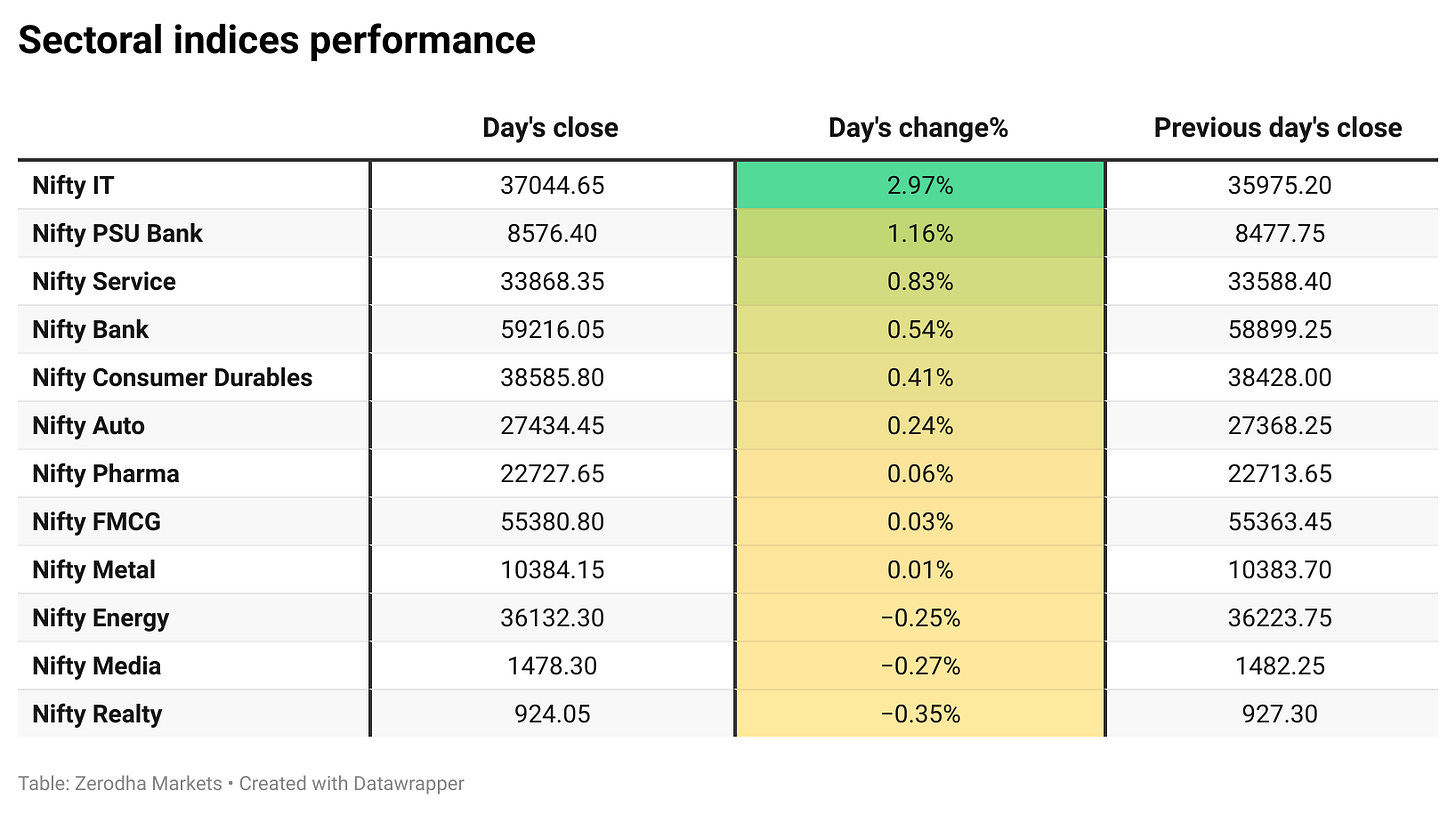

Sectoral Performance:

Nifty IT emerged as the top gainer with a sharp 2.97% rise, while Nifty Realty was the worst performer, slipping 0.35%. Out of the 12 sectoral indices, 9 ended in the green and 3 closed in the red, indicating broad-based market strength with notable leadership from IT and PSU Banks.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 25th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,500, indicating potential resistance at the 26,200 -26,300 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,900, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Shares of major IT firms including Infosys, TCS, HCL Tech, and Persistent Systems rose up to 4%, lifting the Nifty IT index by 3%. The rally came as a global “anti-AI trade” gained traction amid concerns of an AI bubble, along with triggers such as Infosys’ ₹18,000-crore buyback starting tomorrow. Dive deeper

Tenneco Clean Air India made a strong market debut, listing at ₹505 on the NSE, a 27% premium to its ₹397 issue price, and at ₹498 on the BSE. The stock closed 23.63% higher on its first trading day. Dive deeper

Sammaan Capital Ltd., formerly Indiabulls Housing Finance, plunged as much as 14% to ₹157 after the Supreme Court directed the CBI to file an FIR in a case involving the company. Dive deeper

Larsen & Toubro, in partnership with the UK’s BAE Systems, will locally manufacture and supply BvS10 Sindhu armoured vehicles to the Indian Army under a new contract. Dive deeper

Waaree Energies slipped up to 3.5% after the company said officials from the Income Tax Department had visited some of its offices and facilities. Dive deeper

KP Energy rose 4% after signing an exclusive MoU with Inox Wind to jointly develop 2.5 GW of wind and wind–solar hybrid projects across several Indian states. The partnership combines Inox Wind’s turbine and manufacturing capabilities with KP Energy’s project development and balance-of-plant expertise. Dive deeper

What’s happening globally

Nvidia and Microsoft announced a combined $15 billion investment in AI startup Anthropic, the maker of the Claude chatbot. Nvidia will invest up to $10 billion, while Microsoft will contribute up to $5 billion, reflecting the intensifying race and soaring spending in the AI sector. Dive deeper

Nvidia will report its quarterly earnings later tonight, giving investors a clear view of where the massive wave of AI spending is heading. Expectations are high, with analysts forecasting over 50% growth in both revenue and net income for its fiscal third quarter. Dive deeper

The UK’s annual inflation rate eased to 3.6% in October 2025, a four-month low and in line with expectations. The slowdown was driven largely by weaker housing and utilities inflation, with gas and electricity prices dropping sharply after Ofgem’s revised energy price cap took effect. Dive deeper

The United States and Saudi Arabia signed agreements on civil nuclear cooperation and the sale of advanced F-35 fighter jets during Crown Prince Mohammed bin Salman’s visit to Washington on Tuesday, the White House said. DIve deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Commerce and Industry Minister Piyush Goyal, on export diversification for shrimp & fish exports and FTA with the EU:

“Russia is also on the course of approval nearly 25 fishery establishments,”

“India is in talks with several other countries including the UAE to diversify its shrimp and fish exports.”

“I am very confident that in the coming months we should be able to come to an understanding with the EU subject to sorting out some of the last mile issues which are currently under negotiations.” - Link

Elon Musk weighed in on the broader H-1B debate after Ford CEO Jim Farley warned that the company is struggling to fill 5,000 mechanic roles paying around $120,000 a year

“America has a major shortage of people who can do challenging physical work or who even wish to train to do so.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!