Strong GDP data fails to impress markets as markets fall from day's highs

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Market Overview

Nifty opened sharply higher on optimism over strong Q2 GDP data, touching fresh all-time highs near 26,325, but the bounce did not sustain. The index tested 26,330–26,325 zone within the first hour, before gradually losing steam through the session. By the afternoon, Nifty drifted lower, eventually settling at 26,175.75, down 27.20 points (-0.10 %), reflecting indecision among participants.

Looking ahead, focus will stay on global cues, interest-rate expectations abroad (especially U.S.), and upcoming domestic developments, including the policy decision from the Reserve Bank of India (RBI).

Broader markets showed modest weakness today. At close, Sensex fell 64.77 points (-0.08 %) to 85,641.90, while many mid- and small-cap stocks underperformed. The broader market breadth was weak with 1328 stocks advancing, 1727 declining, and 110 unchanged.

Broader Market Performance:

Auto stocks bucked the general trend; the Nifty Auto index outperformed, rising ~0.8 % on strong volume and auto-sales data, while sectors such as realty, consumer durables, and pharma lagged, dragging overall sentiment.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd December:

The maximum Call OI is at 26,500, followed by 26,300, indicating a clear resistance zone between 26,300 and 26,500. The large build-up of call writers at these strikes suggests traders expect upside to be capped in this region.

On the Put side, the highest Put OI is at 26,000, with additional interest at 26,100 and 26,200. This creates a support band between 26,000 and 26,200, where put writers are likely to defend the downside.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Atomberg Technologies, backed by Temasek, is considering an IPO that could raise around $200 million. The smart-appliance maker is exploring a listing to support expansion and strengthen its position in India’s consumer electronics market. Dive deeper

India’s gross GST collections grew 0.7% in November to ₹1.70 lakh crore, as domestic revenues fell 2.3% following recent rate cuts on 375 items. Import-linked GST rose 10.2% to ₹45,976 crore, partly offsetting the weakness in domestic collections. Dive deeper

Life Insurance Corporation of India (LIC) has raised its stake in Cipla to 7.055%, buying shares between July and November 2025, using a recent dip in Cipla’s stock as an entry point. Dive deeper

Hyundai Motor India shares gained after the company posted strong November sales, with both domestic demand and exports showing healthy momentum. The auto maker reported a 14.3% year-on-year (YoY) rise in consolidated net profit to Rs 1,572 crore for the quarter ended September 2025, up from Rs 1,375 crore in the same period last year. Dive deeper

Mahindra & Mahindra’s SUV sales to dealers rose 22% in November, supported by strong demand following the GST cut on larger-engine SUVs. Dive deeper

India’s manufacturing PMI slipped to 56.6 in November, its weakest pace since February, as softer new orders and slowing export demand signaled easing momentum. Dive deeper

The rupee held near record lows around 89.5 per USD despite stronger-than-expected 8.2% GDP growth, weighed down by importer dollar demand, trade imbalances, and foreign outflows. Dive deeper

NCC is set to be in focus after announcing fresh orders worth ₹2,792.43 crore secured in November. The new contracts add to the company’s execution pipeline and support its ongoing growth momentum. Dive deeper

What’s happening globally

Gold rose to about $4,240/oz, a six-week high, as rising expectations of a US rate cut and weak economic data boosted safe-haven demand. Dive deeper

Brent crude rose to about $63.5 a barrel after OPEC+ reaffirmed its plan to halt production increases in Q1, easing supply concerns. Dive deeper

US stock futures declined as investors grew cautious ahead of Fed Chair Powell’s remarks, despite major indexes having their best week since June. Dive deeper

Japan’s 10-year bond yield rose above 1.85%, the highest since 2006, as expectations for a BOJ rate hike strengthened following Governor Ueda’s latest comments. Dive deeper

Airbus said nearly all of the roughly 6,000 A320-family jets flagged for a flight-control software issue have now been modified, with fewer than 100 still awaiting fixes. Dive deeper

Silver rose above $57 per ounce to a new record high, supported by supply concerns, near-decade-low inventories in China, and expectations of a US rate cut. Dive deeper

China’s manufacturing PMI slipped to 49.9 in November, signaling a mild contraction as output and new orders stagnated and firms cut jobs and purchases. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

President Droupadi Murmu on expanding India’s footwear industry and export potential:

“India is a major footwear exporter of the world, but to further boost our exports, the footwear business needs to be expanded even more.”

“Huge opportunities are there for the businesses in the fast-growing sports and non-leather sectors.”

“Exports are four times more than imports and it would increase further; India ranks second in footwear production and consumption, and I hope the country will become the global leader in this segment.” - Link

Manish Sonthalia on mid- and small-cap equities:

“The ongoing decline in mid- and small-cap stocks … may present a lucrative buying opportunity.”

“This correction may turn out to be one of the best accumulation phases in years for these segments.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

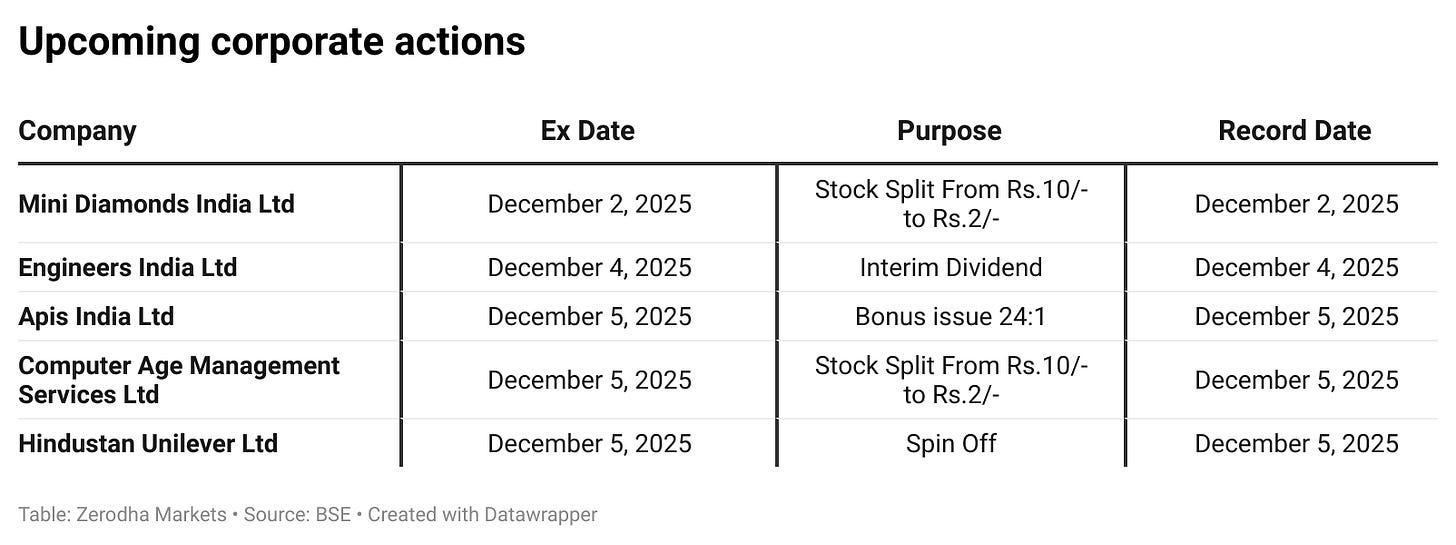

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

good bro

love it