September expiry ends in a range-bound session; All eyes on RBI policy

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, Sandeep breaks down the week gone by and shares key pointers to watch out for in the days ahead.

Market Overview

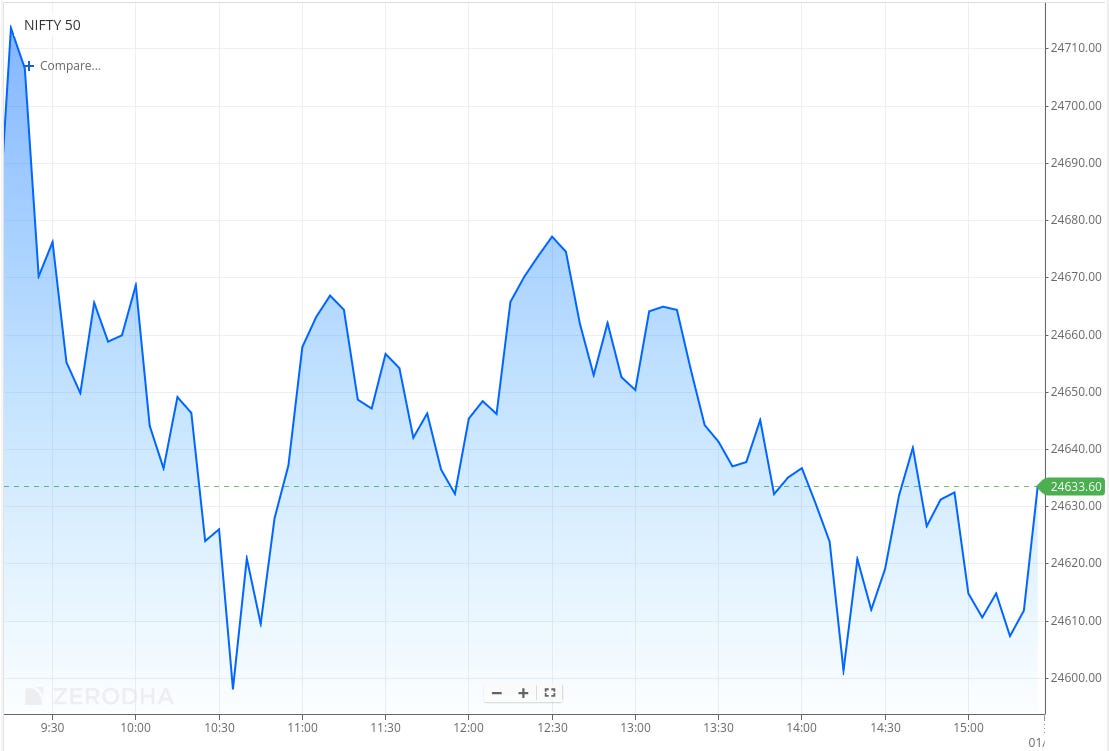

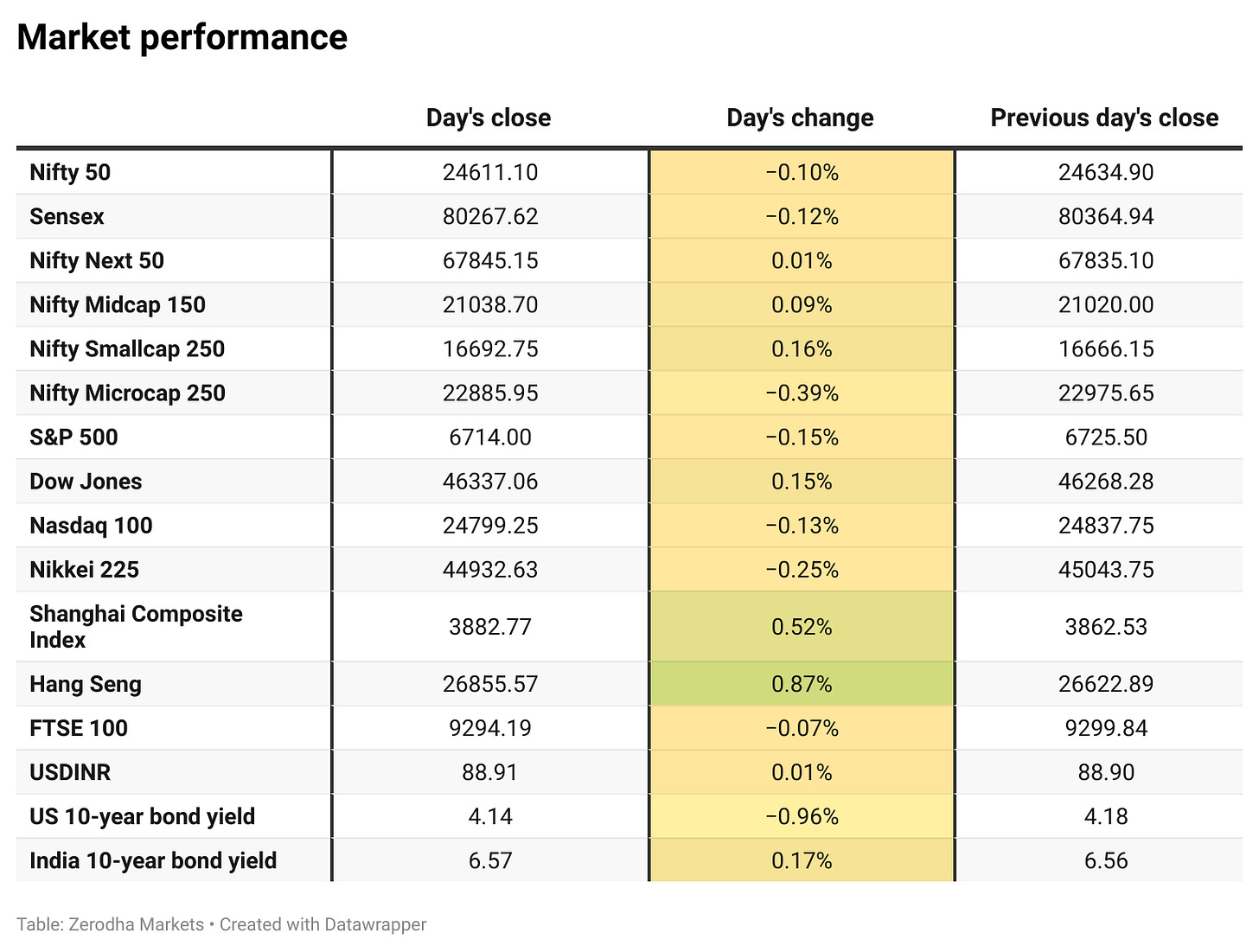

Nifty opened with a 57-point gap-up at 24,692 but drifted lower in the opening hour, testing the 24,600 zone. Through the first half, the index remained choppy, swinging between 24,610 and 24,660 without a clear direction. By mid-day, it managed a modest rebound toward 24,680, but selling pressure resurfaced in the afternoon session. In the final hour, Nifty drifted lower again, touching an intraday low near 24,588 before a minor recovery attempt. The index eventually closed at 24,611.10, down 0.09% from its previous close, extending its weak streak.

Market sentiment has once again turned cautious after tariffs on Pharma and a hike in H1-B visa fees affecting the IT sector. As we advance, investors will closely track festival season sales and management commentary on demand trends across industries. Traders will also keep a keen eye on tomorrow’s RBI policy.

Broader Market Performance:

Broader markets had a mixed session today. Of the 3,118 stocks traded on the NSE, 1,517 advanced, 1,506 declined, and 95 remained unchanged.

Sectoral Performance

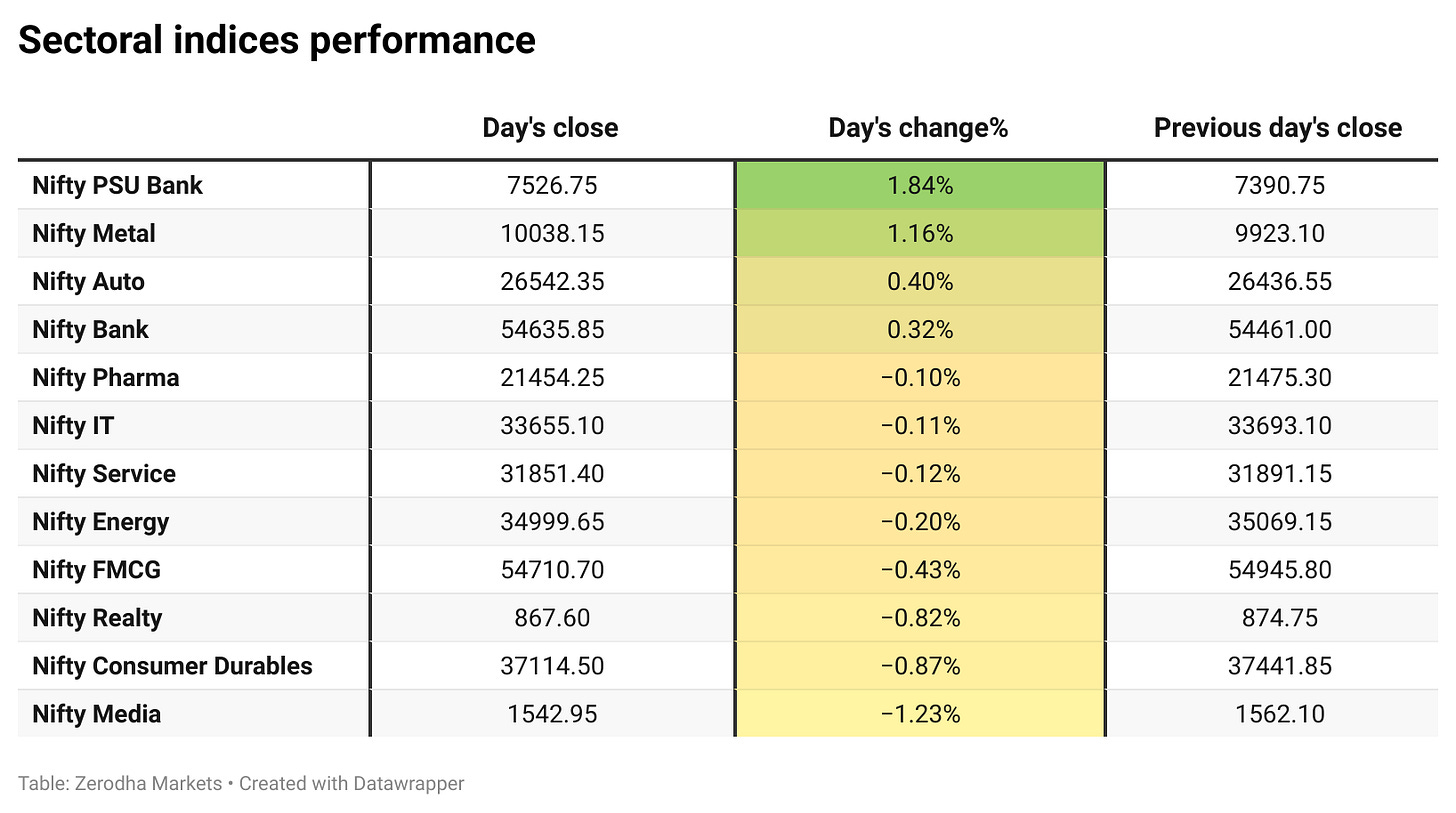

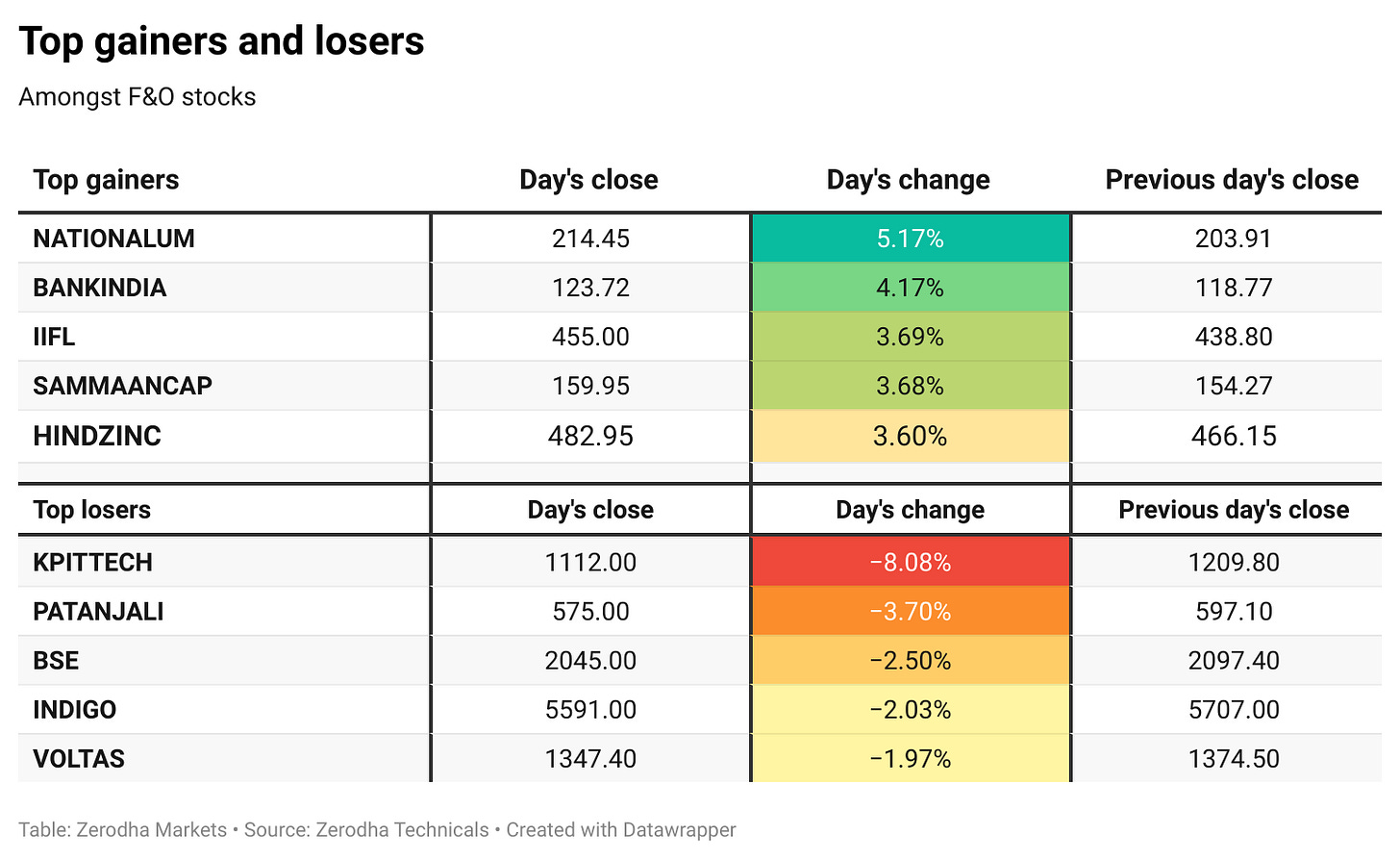

The Nifty PSU Bank index was the top gainer, rising 1.84%, while Nifty Media was the worst performer, dropping 1.23%. Out of the 12 sectoral indices, 4 closed in the green and 8 ended in the red, indicating broad-based weakness despite strength in PSU Banks and Metals.

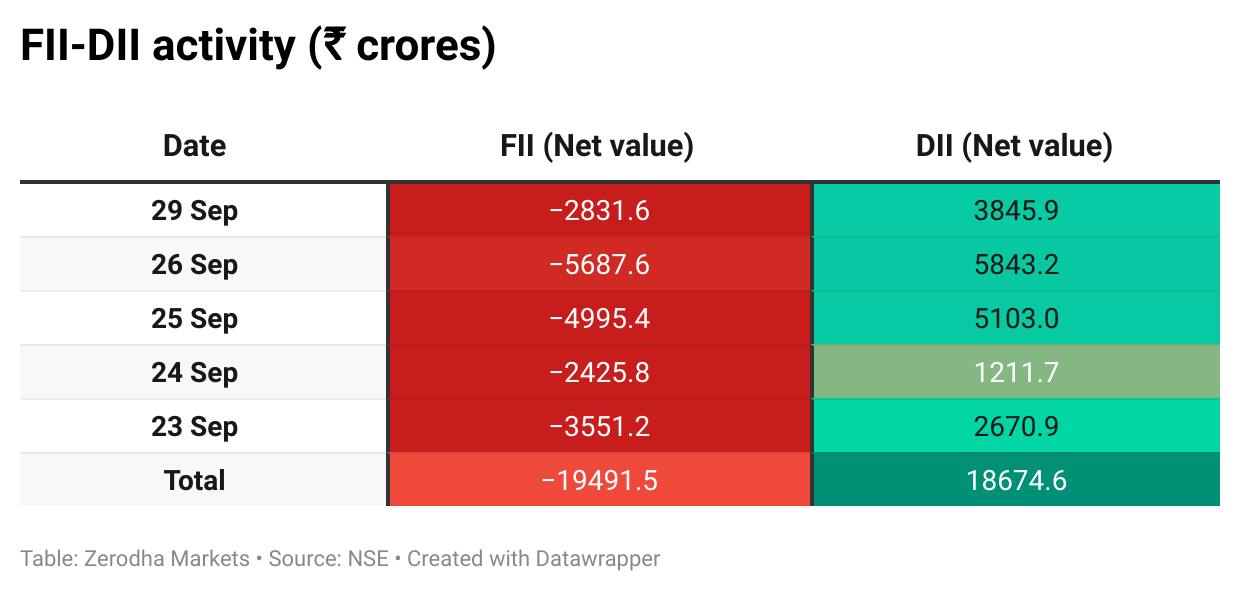

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 7th October:

The maximum Call Open Interest (OI) is observed at 25,000, followed by 24,700, suggesting strong resistance at 24,800 - 24,900 levels.

The maximum Put Open Interest (OI) is observed at 24,600, followed by 24,500 & 24,700, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

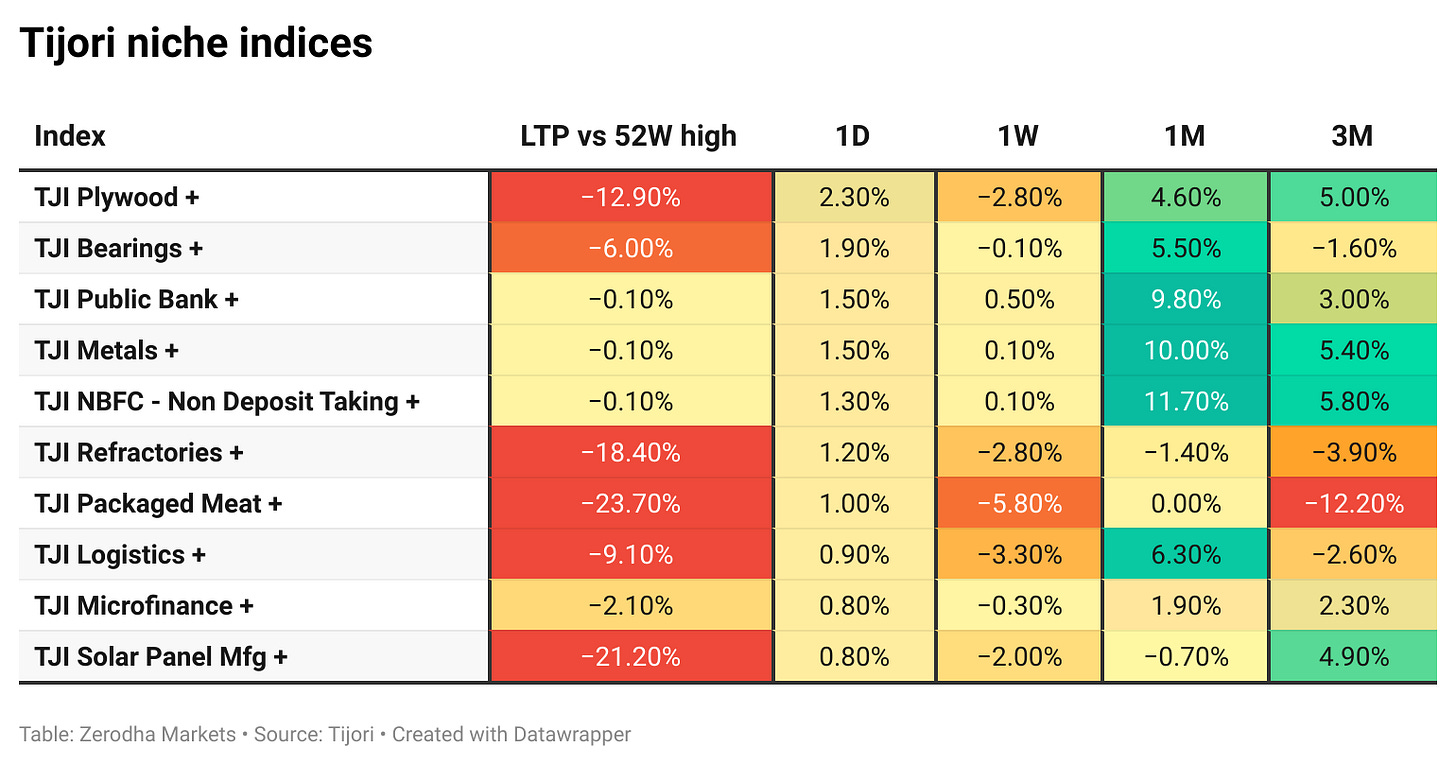

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

NSE announced the introduction of daily expiry on GIFT Nifty contracts, with zero-day-to-expiry contracts set to begin from October 13, 2025. Dive deeper

IRFC signed loan agreements worth Rs 16,489 crore with state utilities in Maharashtra and Haryana to fund thermal power expansion projects, including Rs 10,560 crore for Koradi’s 1,320 MW expansion and Rs 5,929 crore for Yamunanagar’s 800 MW unit. Dive deeper

Sebi issued an administrative warning to Godrej Agrovet for delayed disclosures on shareholding changes in Astec Lifesciences between 2017 and 2020, cautioning the company against future lapses after delays ranging from 11 to 2,725 days. Dive deeper

RBI has allowed banks to extend working capital loans to manufacturers using gold as raw material, expanding a provision earlier limited to jewellers, while also easing norms on loan spreads, fixed-rate options, and overseas capital-raising, effective October 1, 2025. Dive deeper

The Commerce Ministry told the Public Accounts Committee that US tariffs, including a 50% duty imposed in August 2025, will have a long-term impact on India’s marine exports, especially shrimp, while efforts are underway to diversify markets through FTAs and expanded access to the EU and other regions. Dive deeper

BNP Paribas acquired stakes worth Rs 1,806 crore in Hero MotoCorp and IndusInd Bank through bulk deals, while offloading Rs 882 crore worth of shares in Max Healthcare Institute. Dive deeper

SBI’s credit card business has grown sharply post-COVID on the back of youth-focused expansion, while HDFC Bank retained its lead in card issuance and transaction value. Standard Chartered Bank, meanwhile, saw a steep decline in both volume and value. Dive deeper

Bharat Electronics Limited (BEL) announced additional orders worth Rs 1,092 crore since mid-September, covering EW system upgrades, defence network improvements, tank sub-systems, TR modules, communication equipment, EVMs, spares, and services, further strengthening its position in defence electronics. Dive deeper

L&T secured a $700 million sustainability-linked trade facility from Standard Chartered, aligned with global sustainability loan principles and tied to emission and water targets, reinforcing its ESG leadership after issuing India’s first listed sustainability-linked bond earlier this year. Dive deeper

Tata Investment’s stock jumped ~17.5% to breach ₹10,000 for the first time, driven by anticipation of Tata Sons’ mandatory listing under RBI rules. Investor optimism was also bolstered by its stake in the upcoming Tata Capital IPO and its announcement of a 1:10 stock split. Dive deeper

The Govt has extended the RoDTEP export incentive scheme till March 2026, covering over 10,000 products with benefits of 1–4% of value. The scheme reimburses exporters for taxes not refunded elsewhere. The move comes amid exporter pressure and rising U.S. tariffs on Indian goods. Dive deeper

What’s happening globally

US stock futures were flat as investors awaited progress on averting a government shutdown that could delay key labor data, with focus also on the JOLTS report. Dive deeper

WTI crude fell below $63 per barrel as OPEC+ considered a November output hike and Iraq’s Kurdistan exports resumed after a long suspension. Hopes of a Gaza ceasefire and US shutdown risks also weighed on the demand outlook. Dive deeper

Gold slipped to $3,815 an ounce after hitting a record above $3,860, but remains set to finish September over 10% higher, gain 16% in the third quarter, and rise 47% year-to-date, marking its strongest annual performance since 1979. Dive deeper

Silver eased to $46 per ounce after a fourteen-year high of $47.2, with the Silver Institute projecting a fifth straight annual deficit as 2025 output trails demand by 100 million ounces. Dive deeper

South Africa’s trade surplus narrowed to ZAR 4 billion in August 2025, the smallest since January, as exports fell 6.8% to ZAR 171.3 billion on weaker shipments of precious metals, base metals, foodstuffs, and machinery, while imports rose 1.9% to ZAR 167.4 billion, driven by higher purchases of precious metals, vehicles, components, and electronics. Dive deeper

Germany’s retail sales fell 0.2% in August 2025, marking a fourth monthly decline this year, with weaker non-food and online sales partly offset by higher food sales. Year-on-year growth eased to 1.8%, the slowest in 13 months. Dive deeper

The Reserve Bank of Australia kept its cash rate at 3.6% in September 2025 after an August cut, noting inflation stayed within target in Q2 but could rise in Q3. Policymakers flagged ongoing domestic and global risks, maintaining a cautious stance while remaining ready to act if needed. Dive deeper

China’s General Manufacturing PMI climbed to 51.2 in September 2025, the highest since March, beating forecasts. Output and new business expanded strongly, export orders rose after six months, and purchasing activity accelerated. Employment declined and input costs rose, though sentiment improved on hopes of stronger sales and policy support. Dive deeper

China has allowed foreign institutional investors to trade stock options on the Shanghai Stock Exchange, mainly for hedging. This move aims to attract global capital into yuan assets and signals Beijing’s push to open its financial markets further. Dive deeper

German inflation surprised on the upside at 2.4% in September, exceeding expectations and putting pressure on the ECB to stay cautious on further rate cuts. Dive deeper

Yemen, the Middle East’s least electrified country, is getting relief via its first large-scale solar power plant in Aden, which now supplies electricity to 150,000–170,000 homes. This UAE-funded initiative signals a push toward renewables in a nation crippled by war and energy shortages, with plans underway to double capacity in the next phase. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

R Balaji, CEO, PTC Financial Services, on board changes and strategy

“I would categorically say there are no issues, all board and committee meetings happened in a harmonious manner, and we remain one of the most independent boards in the country.”

“We are focusing on four pillars: better systems and processes, building institutional capability, broadening employee talent, and building a more granular book to withstand economic shocks.”

“Non-retail holding has increased, showing confidence in our transformation plan, and we continue to keep communication open with former directors.” Link

S.C. Ralhan, President, Federation of Indian Export Organisations, on RoDTEP extension

“The timely extension of RoDTEP has removed the uncertainty that was weighing on the exporting community.”

“This step comes at a critical juncture when exporters are navigating global headwinds.”

“It provides the much-needed policy continuity to plan exports with greater confidence.” - Link

Zeba Khan, Director, Consumer Electronics, Amazon India, on GST-led festive demand

“Premium segments, including QLED, mini-LED, and 55-inch+ TVs, are driving double-digit growth in the first 48 hours of our Great Indian Festival 2025.”

“Tier 2 and Tier 3 cities are expanding much faster, with 25–30% YoY growth and strong demand for premium products.”

“One in five Windows laptops we sell is AI-enabled, and premium smartphones above ₹20,000 are growing at 50% value growth with a 30% ASP increase.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Great stuff Sandeep wonderful market roundup