Selling spreads beyond IT as Nifty closes below 25,500

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we begin a brand-new series on what many professionals consider the single most important pillar of trading: Position Sizing. You can survive with an imperfect strategy. You cannot survive with a broken position sizing framework.

Most traders obsess over entries, indicators, and setups. Very few spend enough time on how much capital to deploy, how much risk to take, and how to stay alive during drawdowns. In reality, performance does not end at backtests. That is where the real work begins.

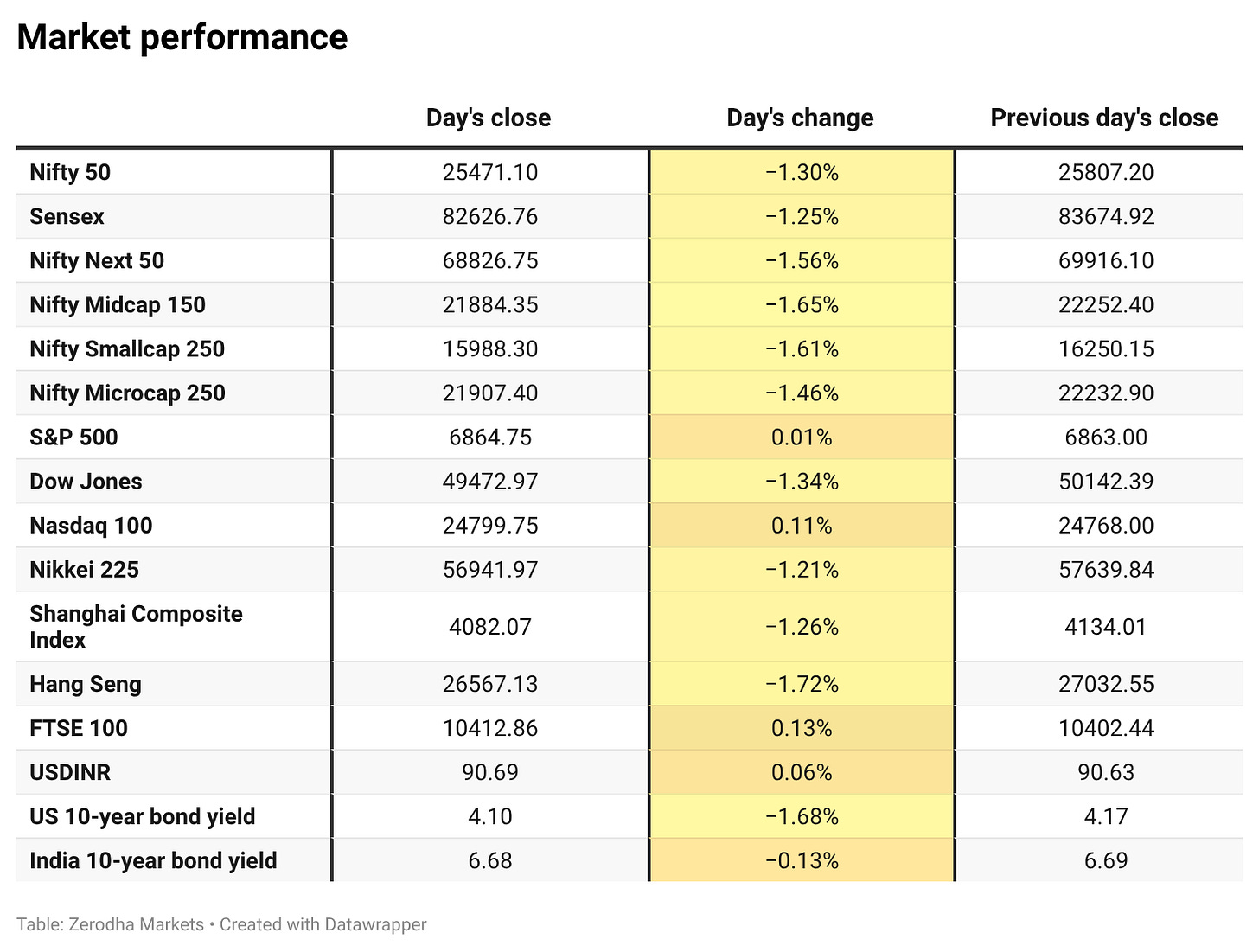

Market Overview

Nifty opened with a sharp 236-point gap down at 25,571, tracking weak global cues and a nearly 4% cut in the IT index. After the gap-down, the index saw mild volatility in the opening hour but remained under pressure, slipping toward the 25,520–25,530 zone as sentiment stayed cautious. A brief mid-morning recovery in IT stocks, which pared some losses, pushed the Nifty back toward the 25,590–25,600 zone, but the upside was capped, and buying lacked follow-through.

In the second half, the index gradually drifted lower again, with selling pressure building through the afternoon. Nifty slipped below 25,500 post 2:30 PM and continued to weaken into the final hour, eventually closing near the day’s lows at 25,471.10. Overall, it was a weak session dominated by sustained selling, with IT-led pressure and fragile global sentiment keeping risk appetite muted.

Looking ahead, markets are likely to remain sensitive to global risk appetite, ongoing Q3 earnings, and domestic cues.

Broader Market Performance:

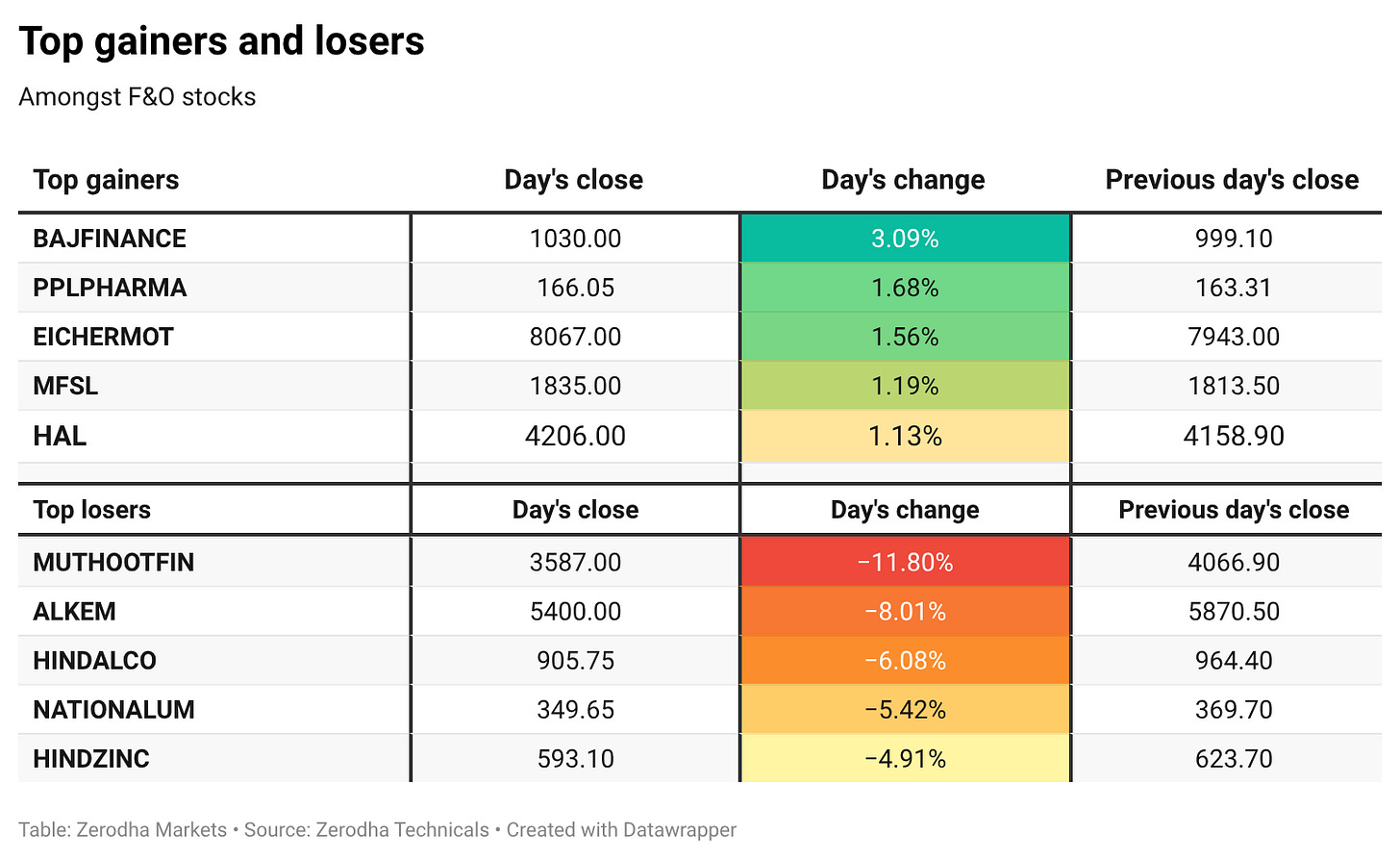

The broader market had an extremely weak session today. Of the 3,249 stocks that traded on the NSE, 766 advanced, 2,388 declined, and 95 remained unchanged.

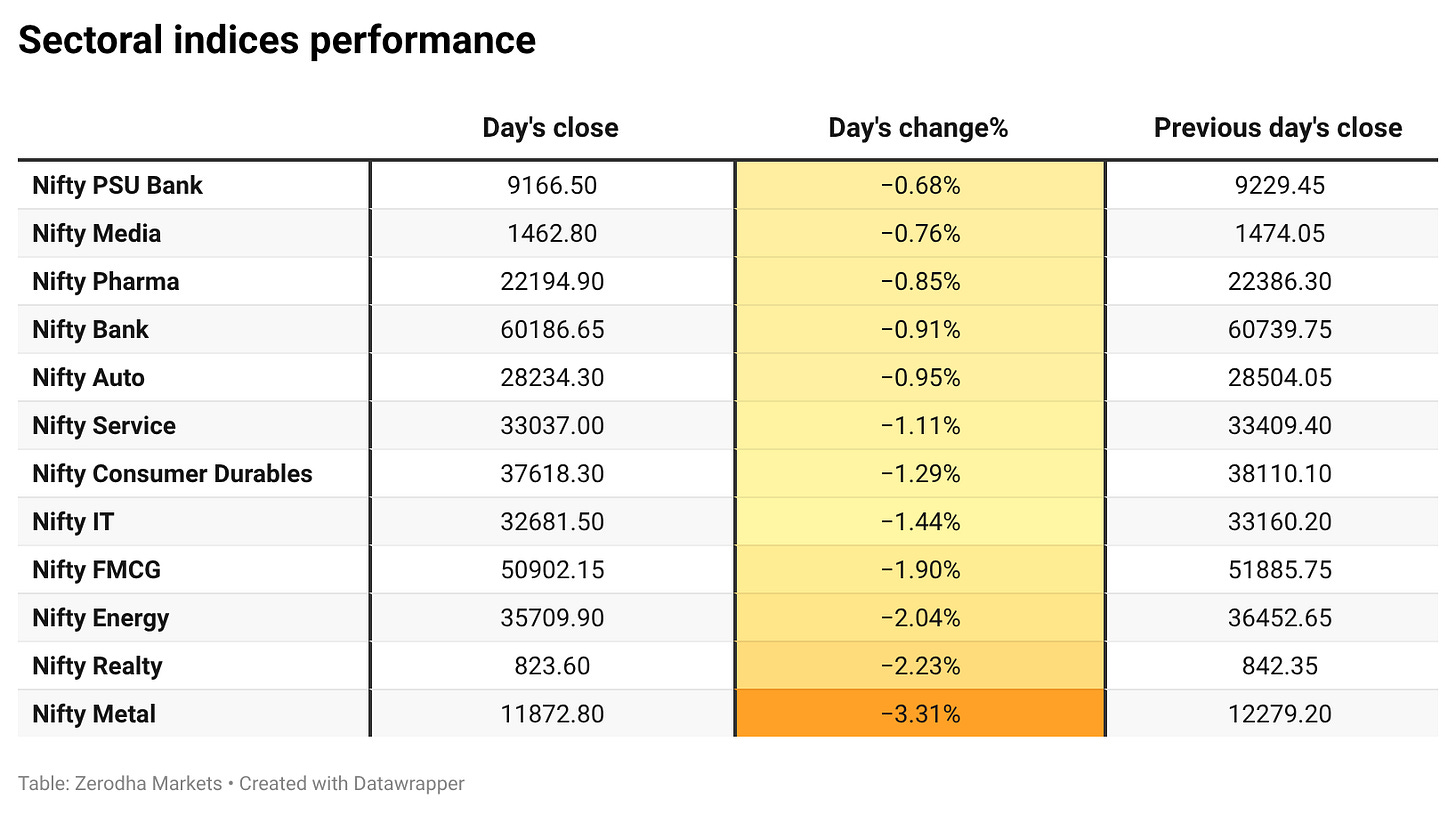

Sectoral Performance:

All sectoral indices closed in the red today. Nifty PSU Bank fell the least, down 0.68%, while Nifty Metal was the worst hit, falling 3.31%. Overall, 0 sectors closed in green, and 12 sectors ended in red.

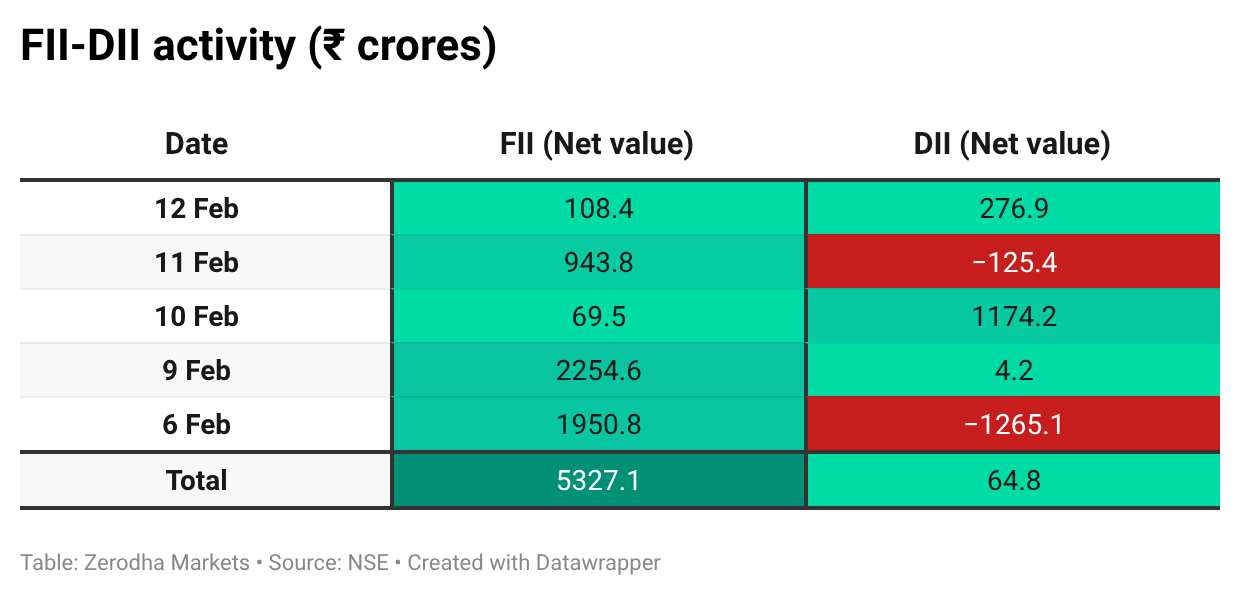

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 17th February:

The maximum Call Open Interest (OI) is observed at 25,600, followed by 25,800 & 25,900, indicating potential resistance at the 25,600 -25,700 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,500, suggesting support at 25,400-25,300.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

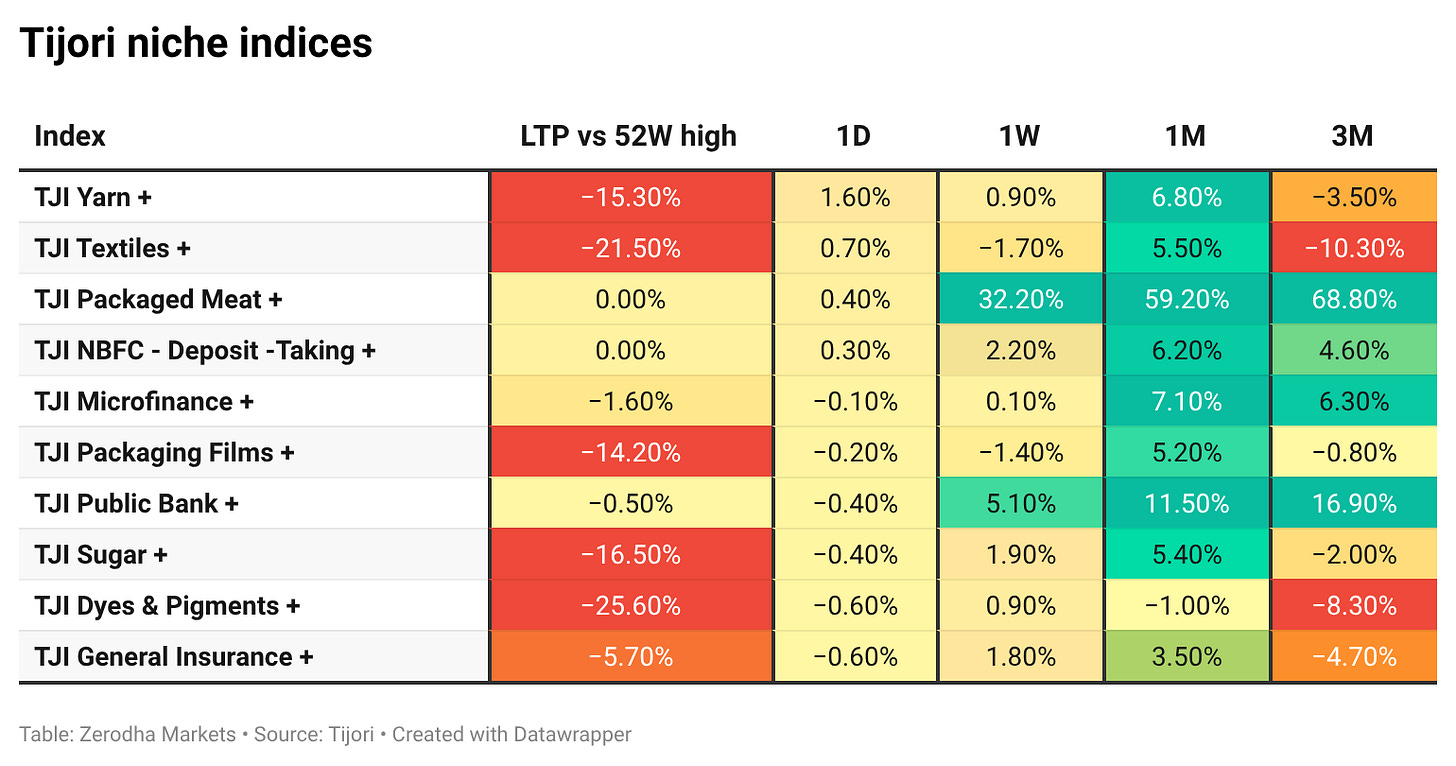

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s forex reserves fell by $6.71 billion to $717.6 billion as of Feb 6, 2026, RBI data showed. RBI Governor Sanjay Malhotra said the central bank remains well-positioned to manage external financing needs. Dive deeper

The Defence Acquisition Council cleared in-principle purchases worth ~₹3.6 lakh crore, including Rafale jets and U.S.-made maritime aircraft. Reports suggest the IAF is looking at 114 Rafales, while the Navy has sought six more P-8I planes. Dive deeper

India’s 10-year yield slipped to ~6.67%, a three-week low, after the government’s debt switch eased near-term redemption pressure. The Centre bought back ₹755 bn of FY27 bonds and issued ₹694 bn of 2040 paper, trimming gross borrowing needs. Dive deeper

Passenger vehicle dispatches rose 13% YoY to 4.50 lakh units in January 2026, supported by strong demand. Two-wheeler sales jumped 26% to 19.26 lakh units, signalling broad-based momentum. Dive deeper

Transrail Lighting won fresh domestic EPC orders worth ₹2,350 crore, largely in transmission & distribution. Total FY26 order inflows have now crossed ₹7,980 crore, strengthening its order book. Dive deeper

Hindustan Aeronautics Limited secured a ₹2,312 crore order from the Ministry of Defence for eight Dornier 228 aircraft along with operational role equipment for the Indian Coast Guard. Dive deeper

Ola Electric posted a Q3 FY26 net loss of ₹487 crore, narrower than last year but higher than the previous quarter. Revenue fell sharply, down 55% YoY to ₹470 crore and 32% sequentially. Dive deeper

India’s gems and jewellery exports fell 5.79% YoY to $2.24 billion in January, as global headwinds and tariff pressures weighed on demand. The data was released by GJEPC. Dive deeper

U.S. chip equipment firm KLA signed an MoU with Tamil Nadu to invest $400 million (₹3,600 crore) for an R&D and innovation campus in Chennai. The move strengthens Tamil Nadu’s position in semiconductor design and development. Dive deeper

Info Edge reported a 12% YoY rise in Q3 FY26 net profit to ₹272 crore. Revenue grew 13% to ₹819 crore, reflecting steady operating performance. Dive deeper

What’s happening globally

WTI crude oil futures fell to around $62.5 per barrel, extending a nearly 3% loss from the previous session and heading for a second straight weekly decline, amid persistent oversupply concerns. Dive deeper

The Kremlin has proposed a broad economic partnership framework with the Trump administration, per an internal memo cited by Bloomberg. It outlines cooperation across seven areas, including fossil fuels and critical materials, and even suggests Russia could re-embrace the dollar in a post-war settlement scenario. Dive deeper

Google announced a major upgrade to Gemini 3 Deep Think, its reasoning mode for complex science, research, and engineering problems. Sundar Pichai highlighted benchmark gains, including 84.6% on ARC-AGI-2 and 48.4% on Humanity’s Last Exam. Dive deeper

China’s current account surplus hit a record $242.1 bn in Q4 2025, driven by a goods surplus of $297.3 bn. Exports rose 6.4% to a record $996.3 bn while imports increased just 1.8% to $699 bn, showing resilience despite U.S. tariffs. Dive deeper

Coal rose toward $120/ton, hitting one-year highs as China rolled out reforms to streamline its coal sector. The shift comes as signs emerge that China’s coal demand may be nearing a peak, tightening global supply dynamics. Dive deeper

The U.S. and Taiwan have signed a trade deal that cuts tariffs on Taiwanese exports to 15%, bringing them in line with Japan and South Korea. In return, Taiwan will provide wider market access for American goods. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Samir Arora, Founder of Helios Capital, on AI disrupting IT companies:

Everything does not have to be dramatized so much. Disruption does not mean extinction. WhatsApp disrupted SMS, but you still use SMS. OTT disrupted TV and theatres, but you still see TV and go to movies. Fear of disruption can mean lower valuations, lower growth expectations, and lower terminal growth assumptions- all leading to underperforming stock prices. The rest we will all see together. - Link

Rajeev Jain, Vice Chairman of Bajaj Finance, on the impact of using AI systems:

AI systems are being used to convert customer conversations into structured data, helping Bajaj Finance identify new lending opportunities and improve engagement. So far, voice-to-text conversion has been completed for over 520,000 customers, generating around 100,000 new offers where usable customer data was previously unavailable.

AI-driven call centre interactions have already contributed significantly to business volumes. Loan disbursements originating from AI-assisted calls stood at Rs 1,600 crore, while insights derived from call data generated an additional Rs 325 crore in lending. - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

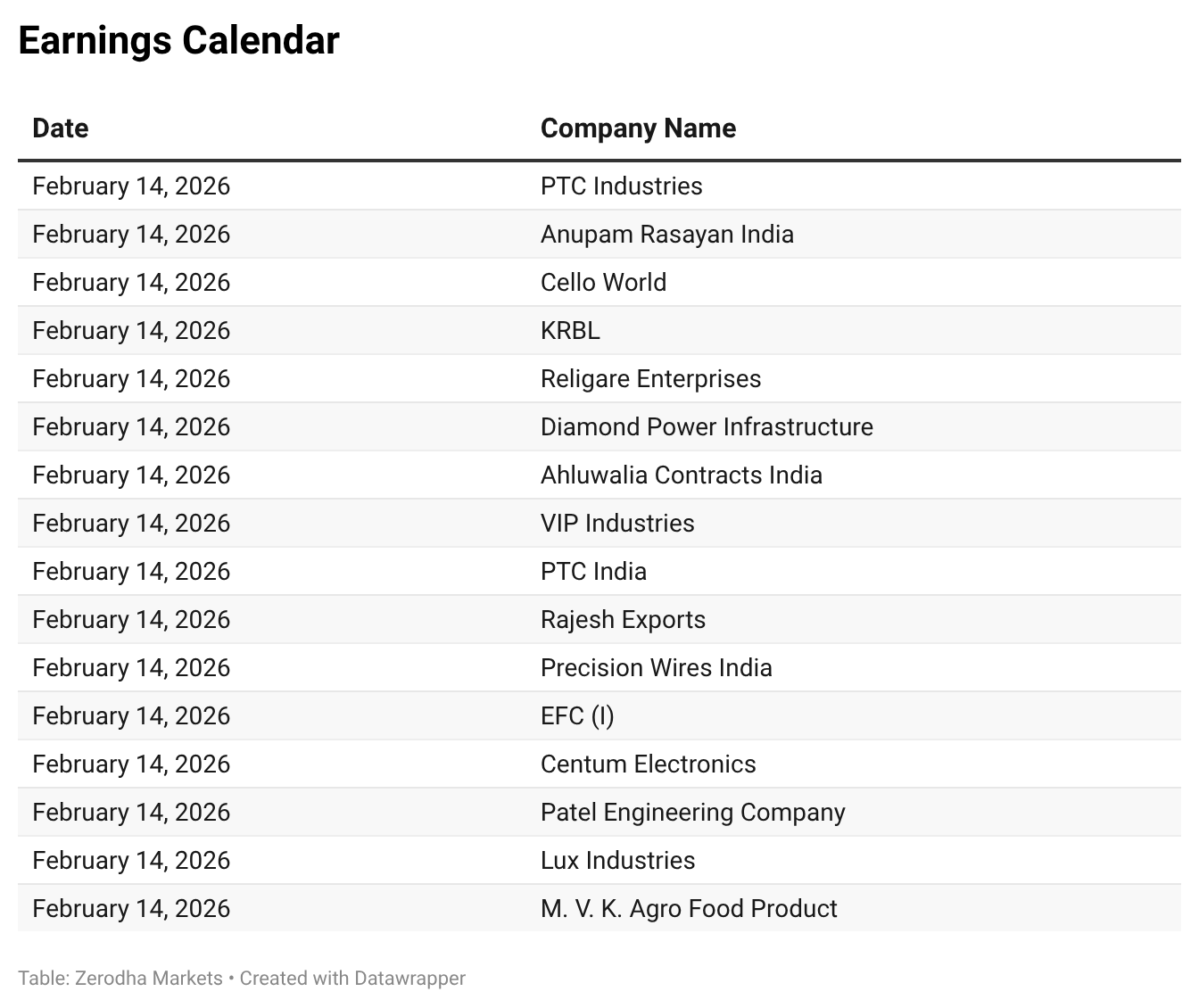

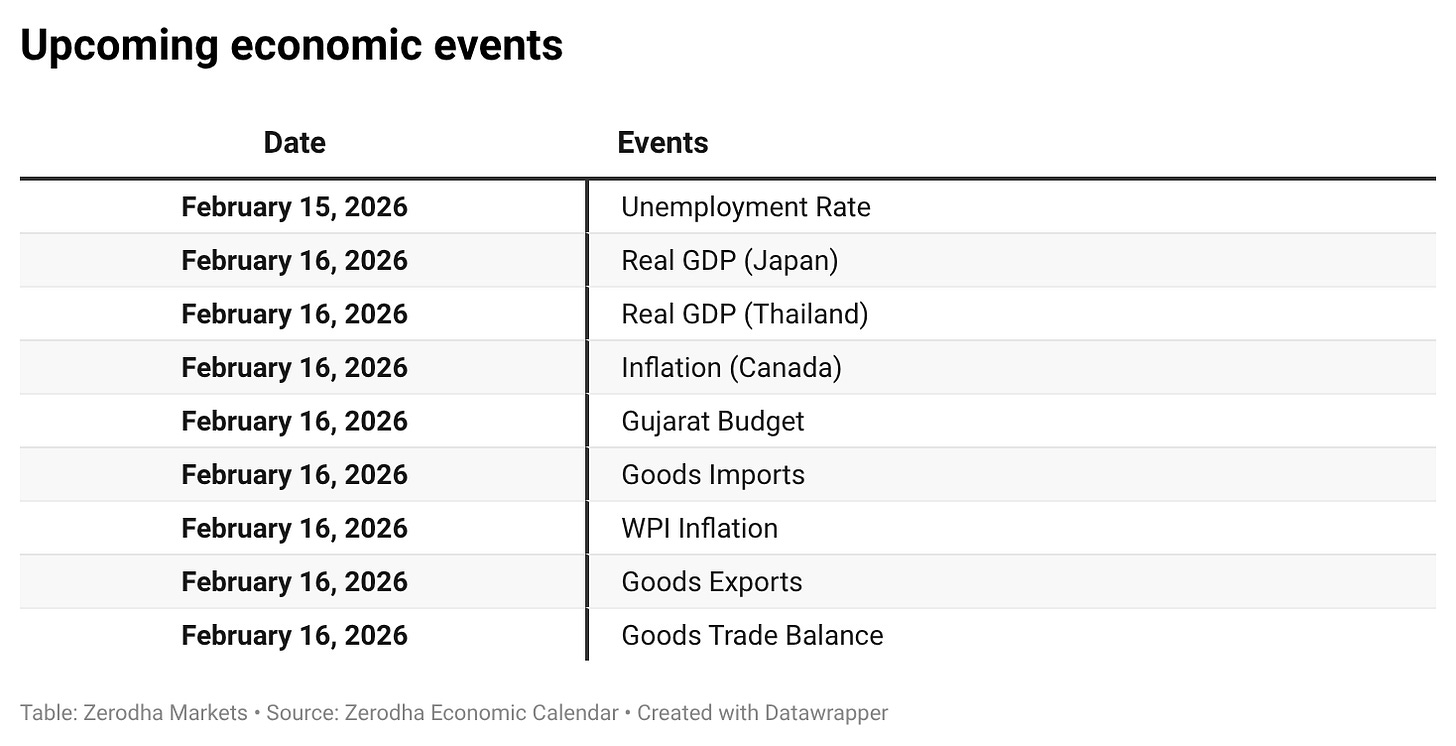

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Excellent summary of the session's volatility. The 236-point gap was the market’s forced response to the global liquidation we’ve been tracking since the pre-market.

While the broader market sentiment is fragile, the precision of the tape is what stands out:

- IT Sector Precision: Despite the cut, the index found its footing exactly at the 32,000 floor, carving a resilient recovery candle after testing the 31,487 depth.

- Structural Breach: The real shift today wasn't just the point drop, but the close below the Weekly 20 EMA. This turns a standard correction into a regime of structural fatigue.

The 'Standoff' is over; the 'Siege' has returned. We just declassified our final free audit on this structural breakdown for those mapping the next floor.