Selling returns in broader markets after one-day pause; Nifty ends weak near 25,750 before Fed

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore the widely-used but deeply misunderstood expiry-day phenomenon of penny options—those far-OTM ₹1–₹2 “chillar” strikes that create asymmetric payoffs for both buyers and sellers.

We examine how far-OTM pricing reflects market fear, when selling can make sense around events, and why famous blow-ups like LTCM, XIV, and volatility spikes echo the same risk profile—showing why penny options look tempting, so often ruin traders, and why payoff asymmetry ultimately drives both risk and reward.

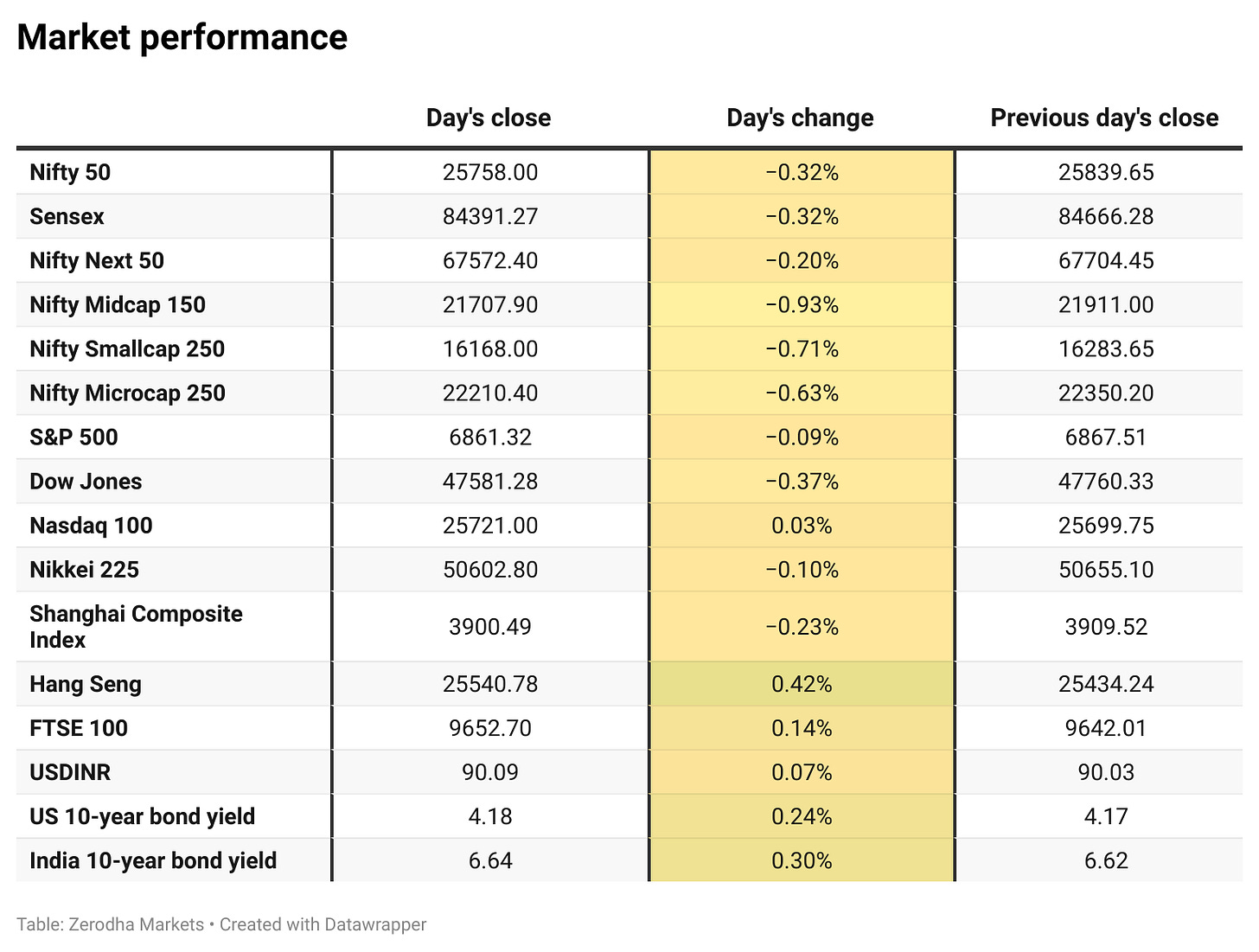

Market Overview

Nifty opened with a small 25-point gap-up at 25,864. After an initial round of volatility, the index briefly moved higher toward 25,930 in the first hour, touching an intraday high near 25,950. However, this early strength faded quickly as Nifty slipped below 25,850 by around 11 AM. Through the late morning and early afternoon, the index remained weak, drifting steadily into the 25,780–25,800 zone with only shallow recovery attempts.

Post 1 PM, another brief rebound toward 25,840–25,850 was met with renewed selling, pushing the index further lower toward 25,740–25,750. A small uptick around 2:30 PM failed to sustain, and Nifty eventually ended near the day’s low at 25,758, down almost 0.3% from the previous close, reflecting persistent intraday pressure and lack of follow-through buying. Broader markets also weakened again, falling over 1–1.2% after yesterday’s brief respite.

Looking ahead, markets are likely to remain driven by global risk appetite, currency movements, and developments around the India–U.S. trade negotiations.

Broader Market Performance:

The broader markets once again turned weak, especially in the second half. Out of 3,200 names traded on the NSE, 1,351 advanced, while 1,752 declined, and 97 remained unchanged.

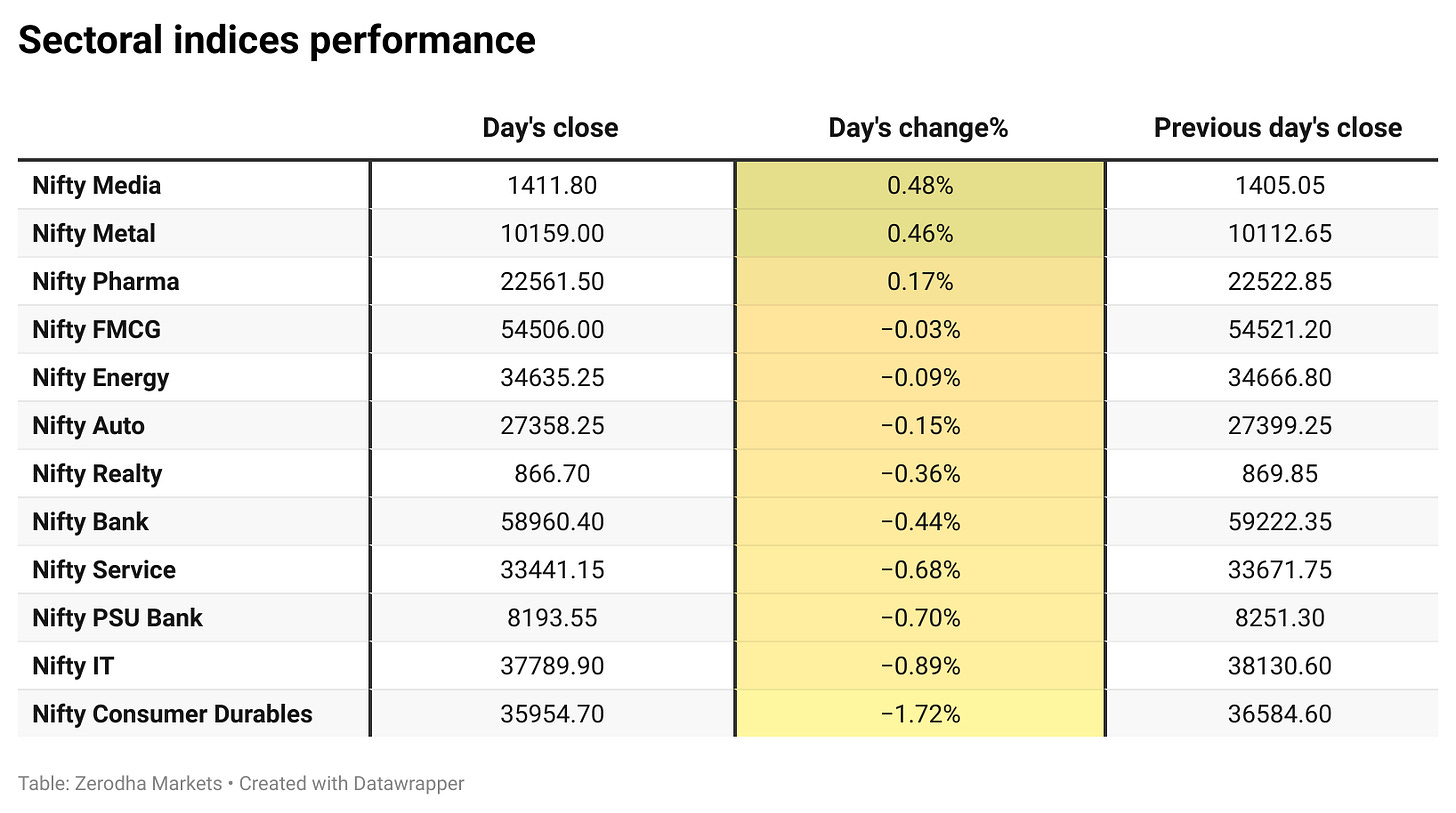

Sectoral Performance:

The top-gaining sector for the day was Nifty Media, up by 0.48%, while the biggest loser was Nifty Consumer Durables, down 1.72%. Out of the 12 sectoral indices, 3 closed in the green and 9 ended in the red, indicating broad-based weakness across the market.

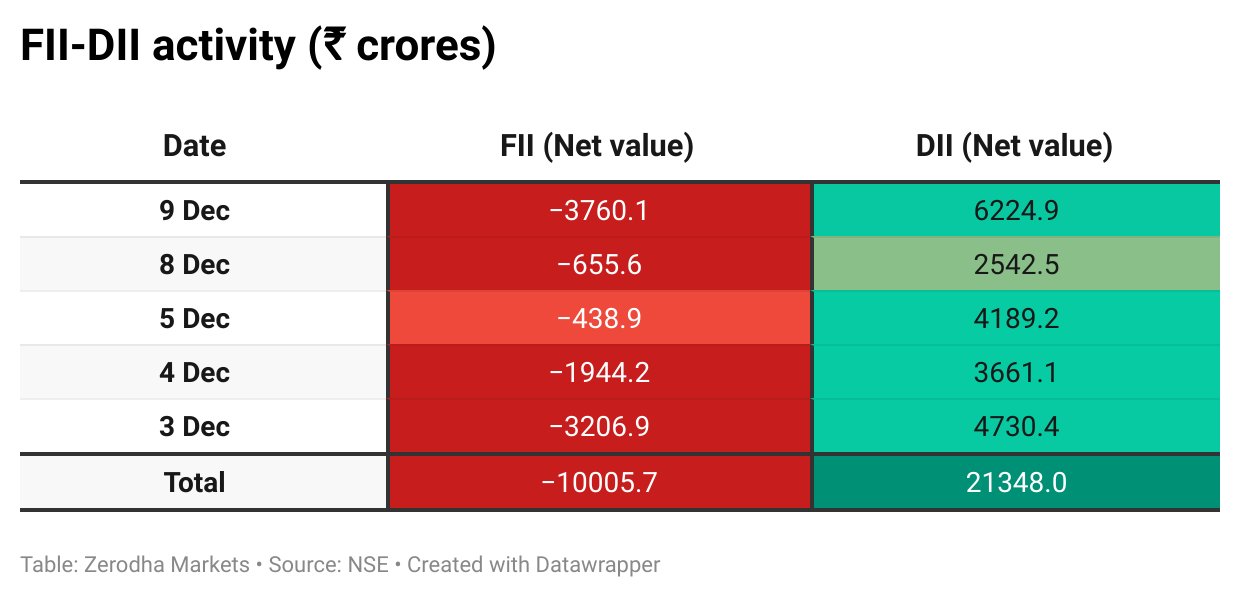

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,900 & 26,100, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,800, suggesting support at the 25,700 to 25,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

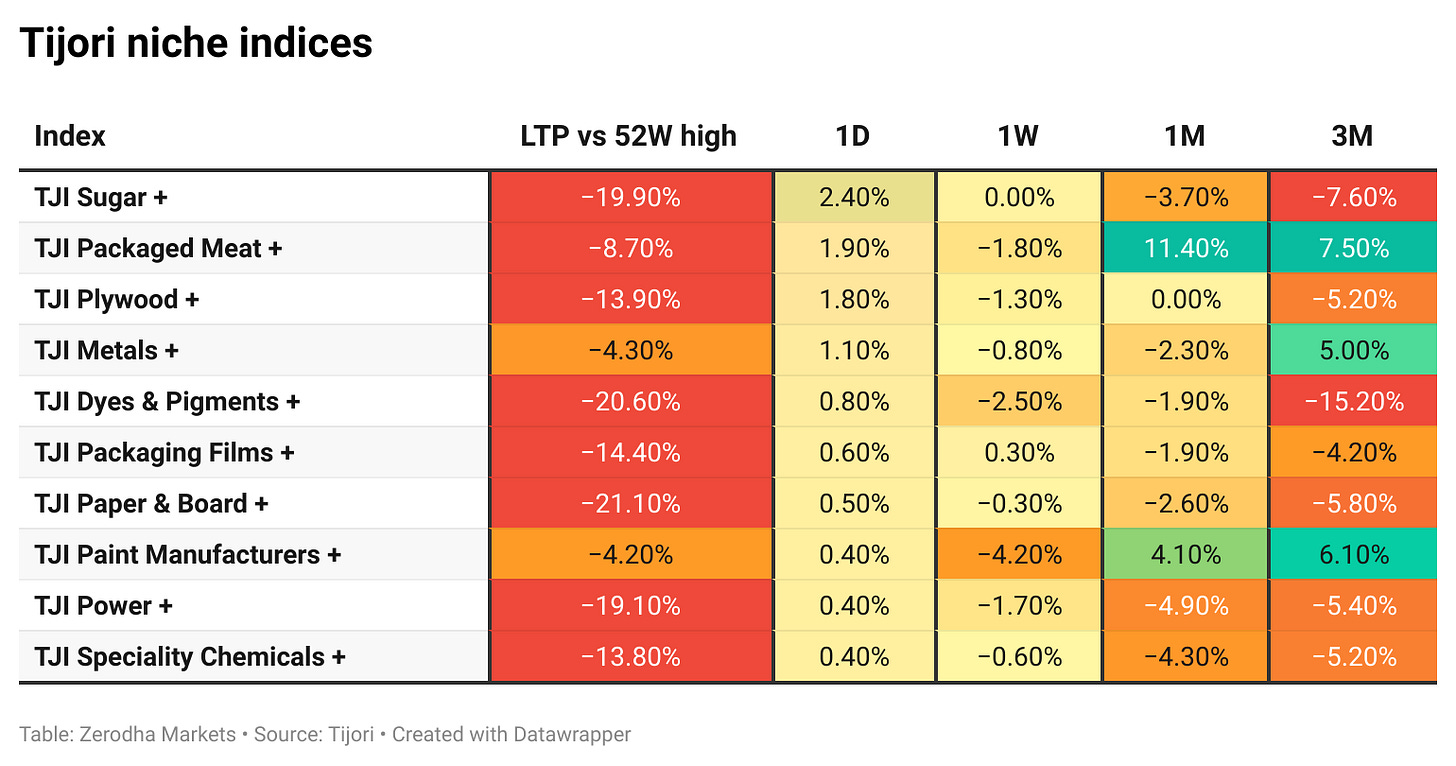

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Microsoft reiterated its $17.5 billion India investment plan through 2030, focused on expanding data-centre and AI cloud infrastructure, including a Hyderabad cloud region due in mid-2026. It also plans to roll out sovereign cloud offerings for Indian customers as data protection rules take effect. Dive deeper

Amazon plans to invest $35 billion in India by 2030 across its businesses, focusing on AI-led digitisation, exports, and job creation. The company targets scaling India-enabled exports to $80 billion and supporting another one million jobs by 2030. Dive deeper

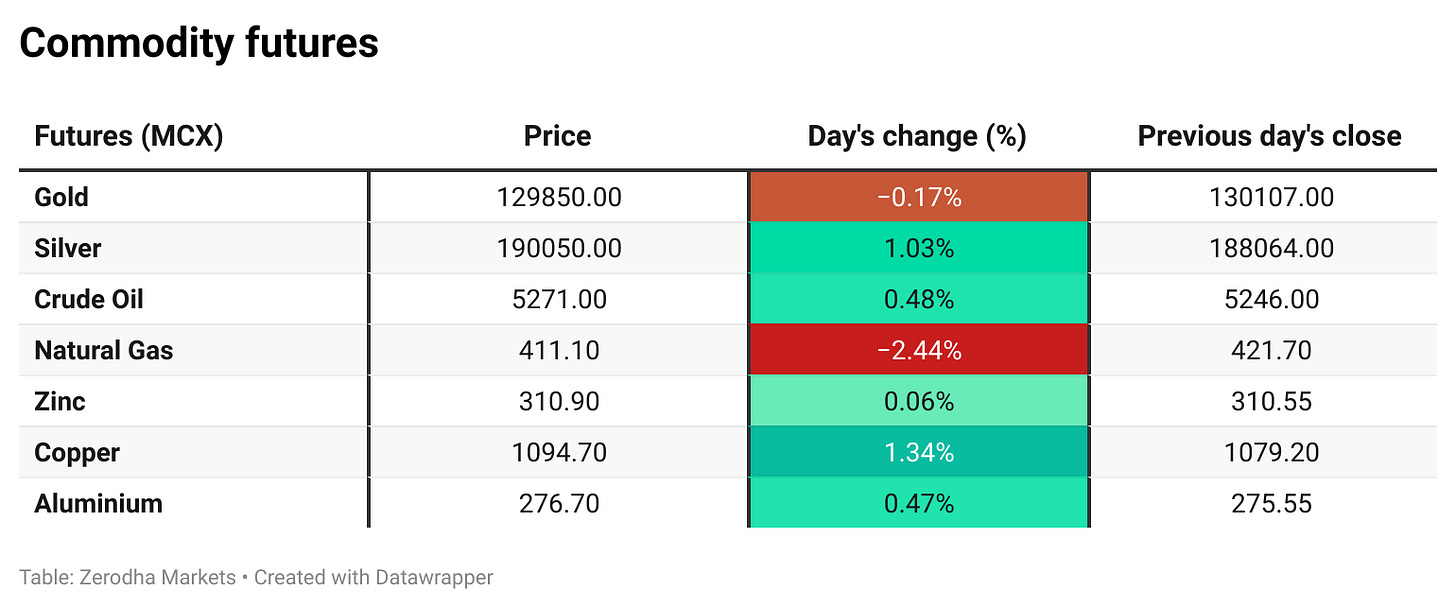

Hindustan Zinc surged by over 4% as record-high silver prices, driven by expectations of US rate cuts and tight supply, improved sentiment for silver-linked producers. Dive deeper

India’s 10-year G-Sec yield climbed to 6.6% as markets pared back expectations of further RBI rate cuts after the central bank signalled the latest 25 bps reduction may be the last for now. Dive deeper

Brookfield India Real Estate Trust has raised ₹3,500 crore by selling units to investors. The funds will be used to finance the acquisition of a Bengaluru property. Dive deeper

Meesho had a bumper listing as its shares closed with 53% gains at ₹172.65 after a strong market debut, listing at a 46% premium to its issue price. Dive deeper

What’s happening globally

Global bond yields rose further as markets sharply dialled back 2026 rate-cut expectations and even began pricing the chance of an ECB hike next year. The selloff persists despite an expected Fed cut, with sticky inflation and hawkish guidance shifting the outlook across major economies. Dive deeper

The Fed is expected to cut rates by 25 bps in December, taking the policy range to 3.5%–3.75% as labour-market cooling supports further easing despite data disruptions from the shutdown. Dive deeper

Silver jumped above $61/oz to fresh record highs as markets positioned for a likely Fed rate cut and assessed tighter physical supply, reflected in rising lease rates. Dive deeper

The dollar index held near 99.2 as markets awaited a widely expected Fed rate cut, with attention on Powell’s guidance for the 2026 path amid a divided committee. Dive deeper

China’s inflation rose to 0.7% in November, the highest since early 2024, helped by food prices turning positive and steadier non-food inflation supported by consumer trade-in programs. Housing prices were flat, while transport costs remained a drag as fuel-related declines deepened. Dive deeper

Japan’s producer prices rose 2.7% year-on-year in November, unchanged from October, indicating steady upstream inflation pressure. Monthly inflation eased to 0.3%, with gains in machinery and metals offset by declines in chemicals, steel, and petroleum products. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Albinder Dhindsa, CEO of Blinkit, warns about quick commerce:

“The pendulum has already swung once from skepticism to exuberance,”

“Whether the correction comes in three months or six months or next week, I do not know, but it will come.”

“Usually when this kind of imbalance exists, the correction is very swift. It often catches people by surprise.” - Link

Pankaj Murarka, CIO, Renaissance Investment Managers, on expected market returns, valuations, and positioning:

“I expect the markets to deliver late single-digit to low double-digit returns over the next 12 months.”

“Market exuberance is primarily in the midcap and smallcap segments.”

“As FY26–27 approaches, the focus shifts back to bottom-up stock picking and companies with strong cash flows, with IT poised for mean reversion.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

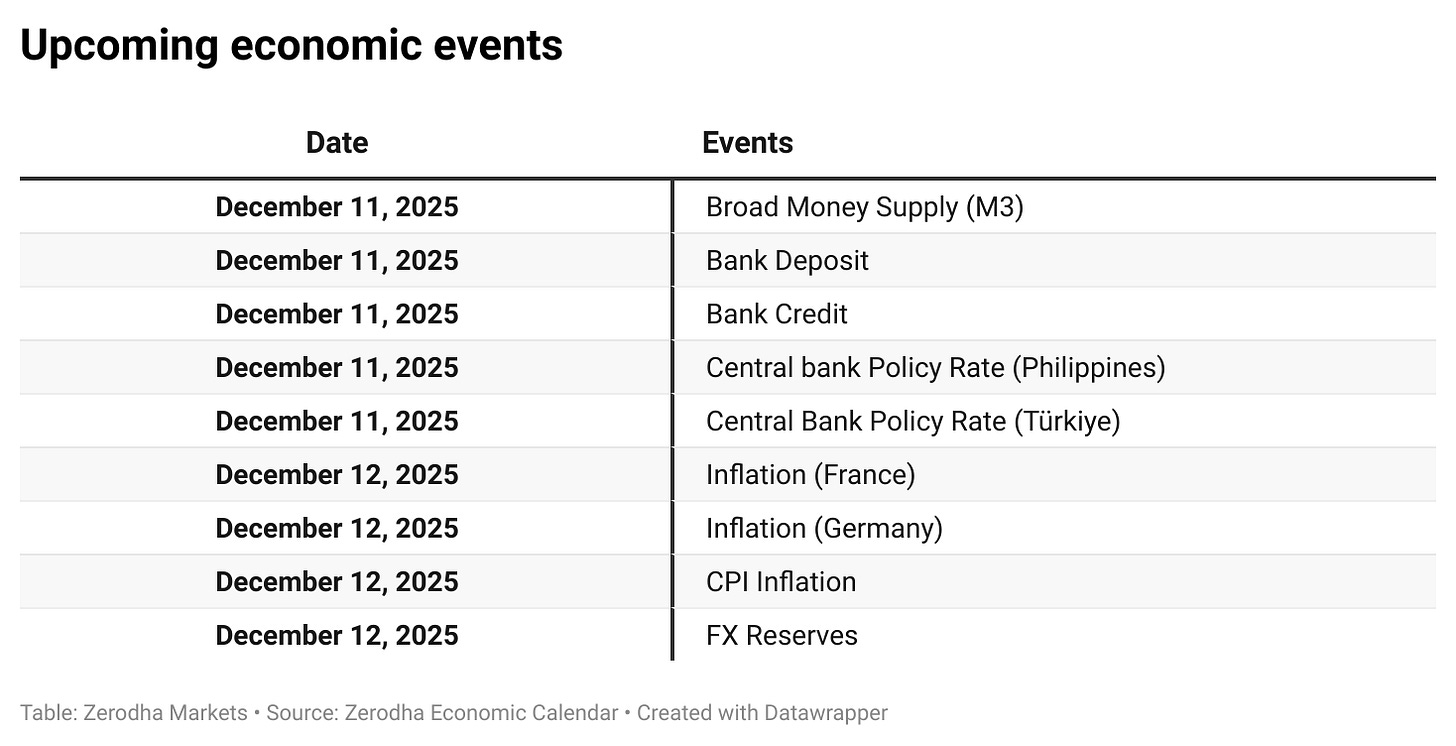

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!