Selling dominates most of the day; last-hour rally lifts Nifty above 25,700

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 2 of 2026, where the year started on a shaky note as Indian markets reversed sharply after fresh all-time highs just a week earlier. Rising global tariff tensions—particularly around the US trade stance—hit sentiment hard, leading to a broad-based sell-off, broken support levels, a pickup in volatility, and a sharp expansion in option premiums.

In this episode, we break down price action across NIFTY, SENSEX, and BANKNIFTY across timeframes, examine ranges and open interest positioning, track the volatility spike, review sector and commodity performance, and discuss what this sudden regime shift means for traders and investors heading into the coming week.

Market Overview

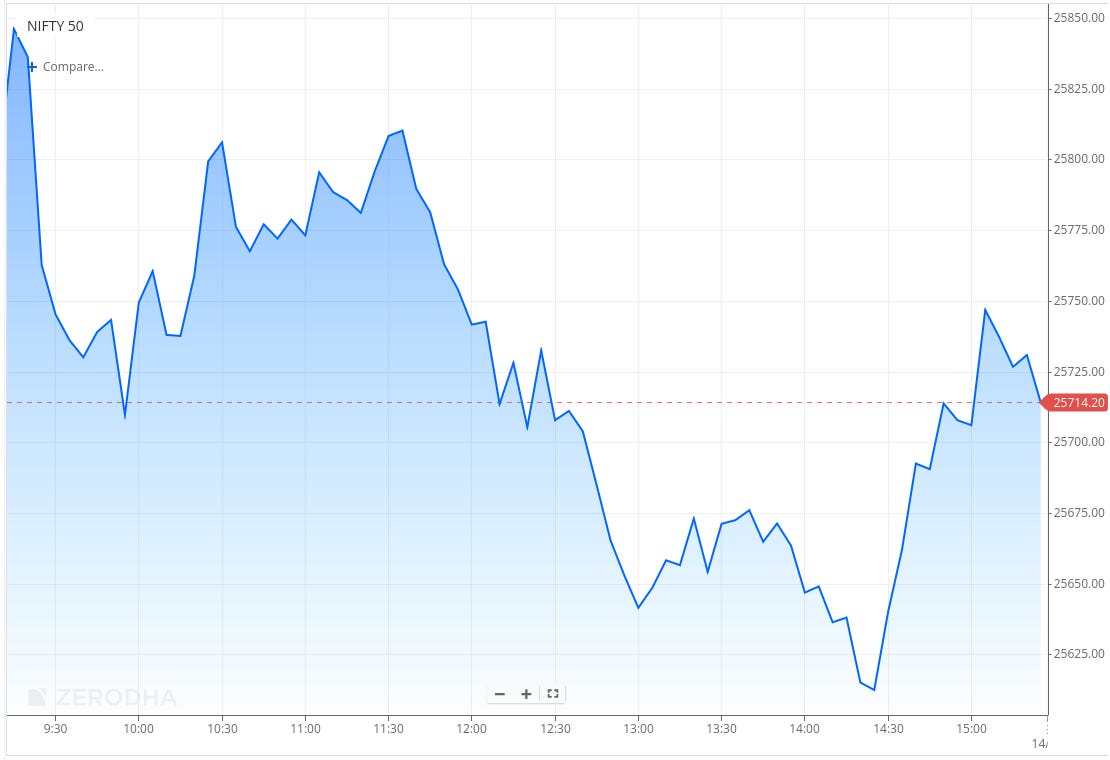

Nifty opened with a strong 107-point gap-up at 25,897, extending the previous session’s recovery momentum. However, early optimism faded quickly as the index slipped from opening highs and turned volatile in the first hour, falling nearly 200 points to test the 25,700–25,720 zone amid selling pressure at higher levels. A brief mid-morning rebound pushed Nifty back above the 25,800 mark, but the move lacked follow-through, and the index gradually drifted lower through the late morning session.

By the end of the first half, weakness intensified, with Nifty slipping below 25,750 and extending losses toward the 25,620 zone in the early afternoon. The index hit intraday lows near the 25,600 level around 2:30 PM, marking the weakest phase of the session. A sharp recovery unfolded in the final hour, driven by late buying interest, lifting Nifty back above 25,700 and briefly above 25,750 after 3 PM. Despite the rebound, the index closed well off the day’s highs at 25,732.30, ending slightly lower and highlighting a volatile, range-bound session dominated by selling pressure for most of the day.

Looking ahead, markets are likely to remain sensitive to global risk appetite, the onset of the Q3 earnings season, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a mixed session today. Out of 3,248 stocks that traded on the NSE, 1,586 advanced, while 1,542 declined, and 120 remained unchanged.

Sectoral Performance:

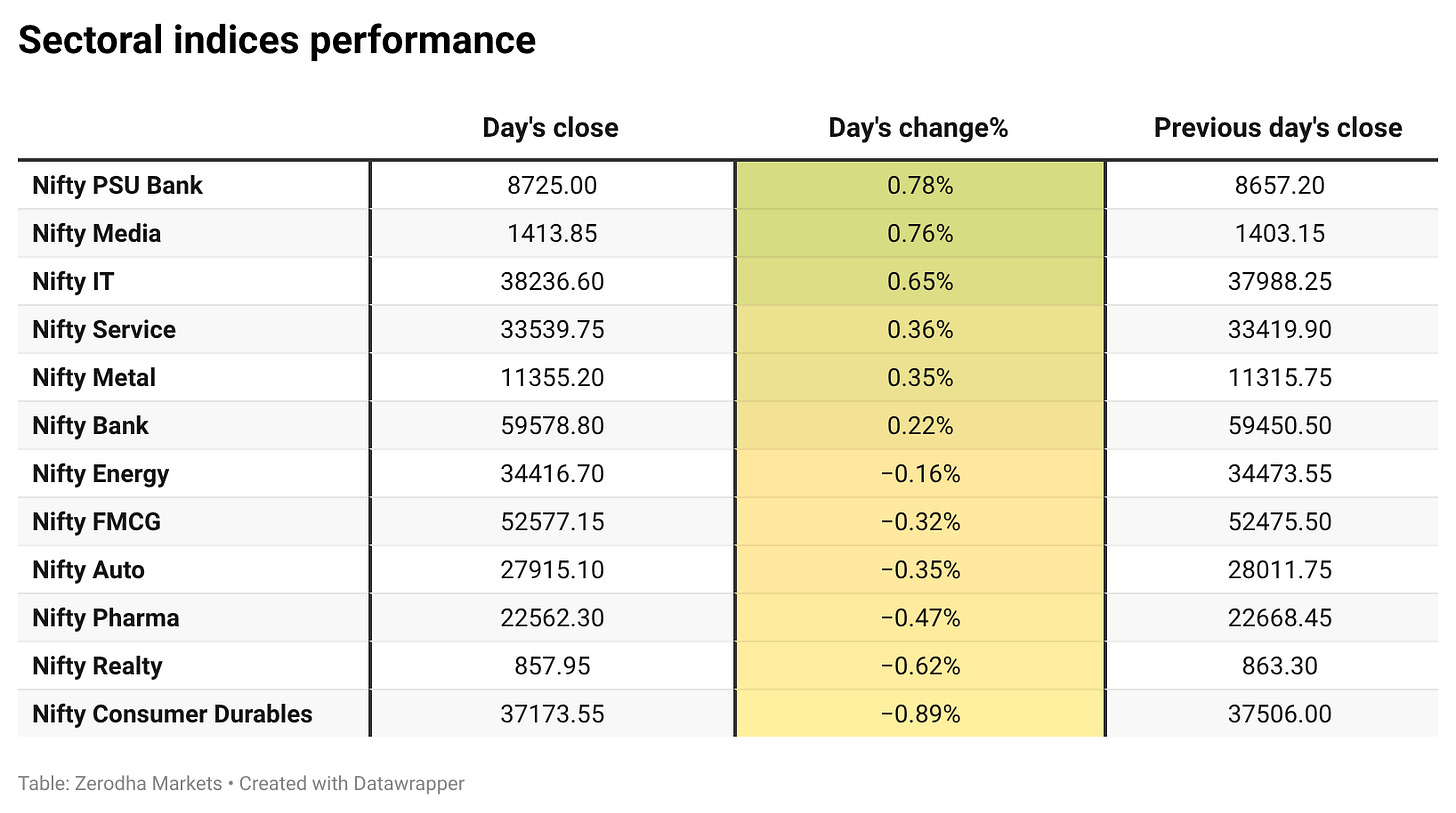

Nifty PSU Bank was the top gainer of the day, rising 0.78%, while Nifty Consumer Durables led the losses, slipping 0.89%. Out of 12 sectoral indices, 6 ended in the green and 6 closed in the red, reflecting a mixed session.

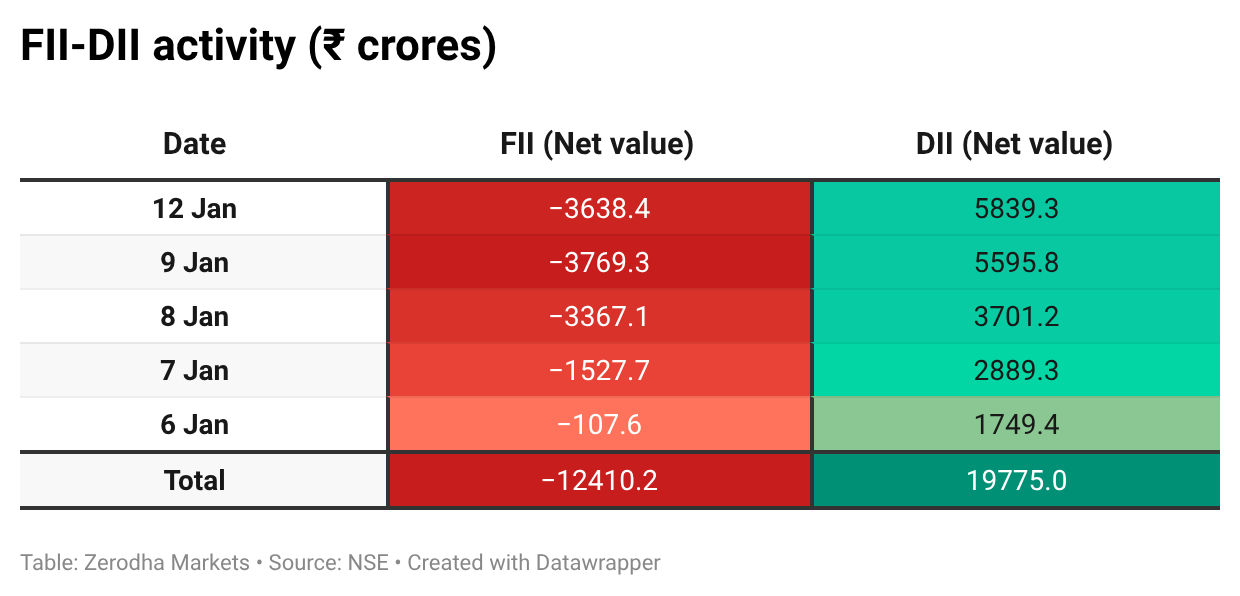

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th January:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,800, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,700, followed by 25,500, suggesting support at the 25,600 to 25,500 levels.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

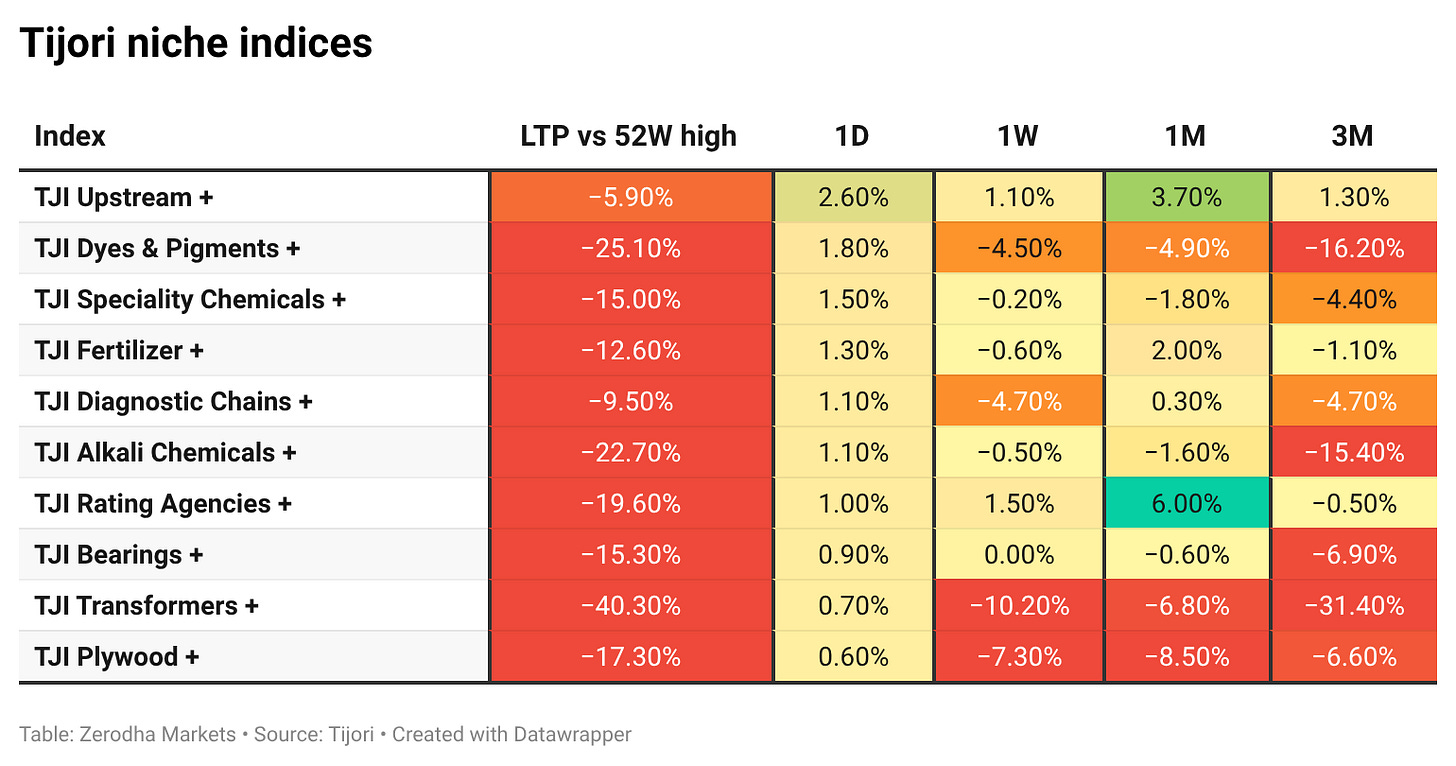

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year bond yield rose to around 6.63% after Bloomberg deferred the inclusion of Indian debt in its global bond index, prompting investors to unwind inflow-linked positions. Dive deeper

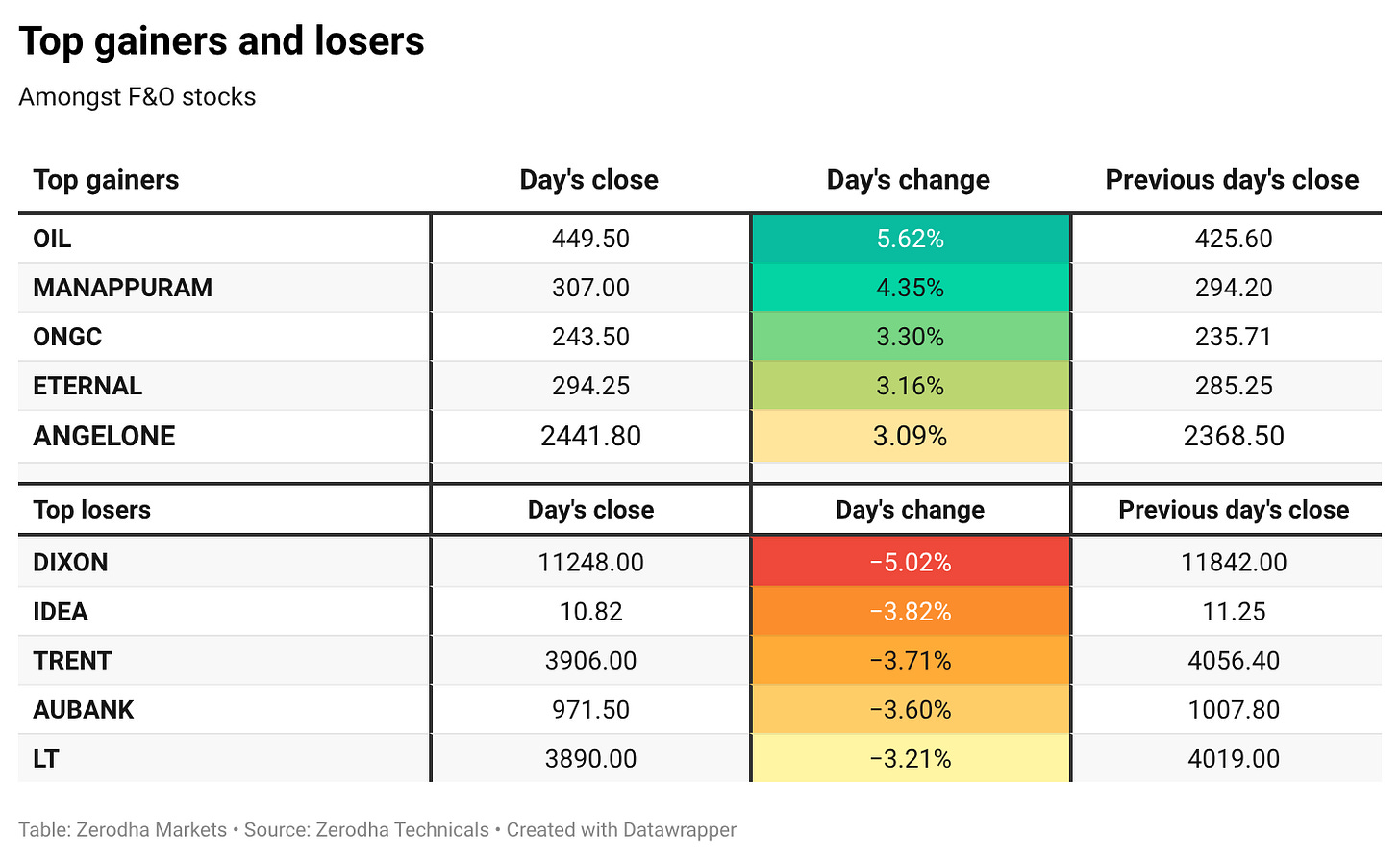

Larsen & Toubro fell 3.5% after reports suggested Kuwait may cancel $8.7 billion worth of oil project tenders. The company clarified that the projects mentioned were not part of its order book and said it cannot comment on clients’ tender or commercial decisions. Dive deeper

India’s palm oil imports fell to an eight-month low in December as refiners shifted to soyoil and sunflower oil amid weaker seasonal demand. Higher purchases of rival oils pushed total edible oil imports higher, even as palm oil inflows declined. Dive deeper

India slipped to third place among importers of Russian fossil fuels in December after Reliance Industries and state refiners reduced crude purchases. Imports fell to €2.3 billion from €3.3 billion in November. Dive deeper

Reliance Retail-owned Lotus Chocolate reported a 97% YoY drop in Q3 net profit to ₹14 lakh, while revenue declined 14% to ₹142 crore and EBITDA margin improved slightly to 4%. Dive deeper

Ola Electric launched its first residential battery energy storage system, Shakti, marking its entry into the home BESS market. Dive deeper

What’s happening globally

U.S. President Donald Trump said on Monday that any country doing business with Iran will face a 25% tariff on trade with the United States, as Tehran deals with its most significant anti-government protests in years. Dive deeper

Brent crude futures climbed above $64 a barrel, reaching the highest level since November on renewed geopolitical risk after the US announced tariffs on nations trading with Iran and heightened tensions around potential supply disruptions. Dive deeper

Gold prices hovered near record highs as safe-haven demand rose amid concerns over the Federal Reserve’s independence and escalating geopolitical tensions. Markets also awaited US inflation data for further cues on the Fed’s policy outlook. Dive deeper

The dollar index held near 99 as investors awaited US inflation data for cues on the Fed’s policy path, with markets still pricing in rate cuts later this year. Dive deeper

US small business optimism rose for a second month in December, reaching its highest level since August, supported by improved expectations for business conditions. However, plans for hiring and investment weakened, while taxes emerged as the top concern for owners. Dive deeper

US inflation is expected to hold at 2.7% in December, with core inflation seen ticking up slightly after reaching multi-year lows. The data may signal easing disinflation, though concerns remain over data distortions from the government shutdown. Dive deeper

European equities continued to extend gains and hit fresh record highs, supported by positive corporate updates and attractive valuations, despite ongoing geopolitical risks. Orsted rose after receiving approval to resume work on a US wind project, while most major stocks traded higher. Dive deeper

Japan’s 10-year bond yield rose to its highest level since 1999 amid political uncertainty and expectations of increased fiscal spending. Markets remained divided on the timing of the Bank of Japan’s next rate hike despite reaffirmed guidance from the central bank. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Sukhvinder Singh Sukhu, Chief Minister, Himachal Pradesh, on apple import duty cuts

“I will meet the Union Finance Minister and the Commerce Minister and urge them to take necessary measures to protect the interests of the orchardists of the State.”

“Apple production is a major pillar of the hill State’s economy and its protection and promotion is a top priority of the government.”

“I will firmly raise the issue before the Centre to safeguard the livelihoods of local apple growers.” - Link

Raamdeo Agrawal, Chairman and Co-Founder, Motilal Oswal Financial Services, on PSU banks, earnings, and FII flows

“PSU banks are cheaper to buy, and they have cleaned up their act. There is no directed lending anymore, and they are now professionally managed and technologically strong.”

“When housing picks up, it leads to demand for plumbing, furnishing, labour and eventually broader consumption. The domino effect is difficult to quantify, but it builds momentum quarter after quarter.”

“If earnings grow at 20% over the next year, valuations will automatically moderate and FIIs will come back.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

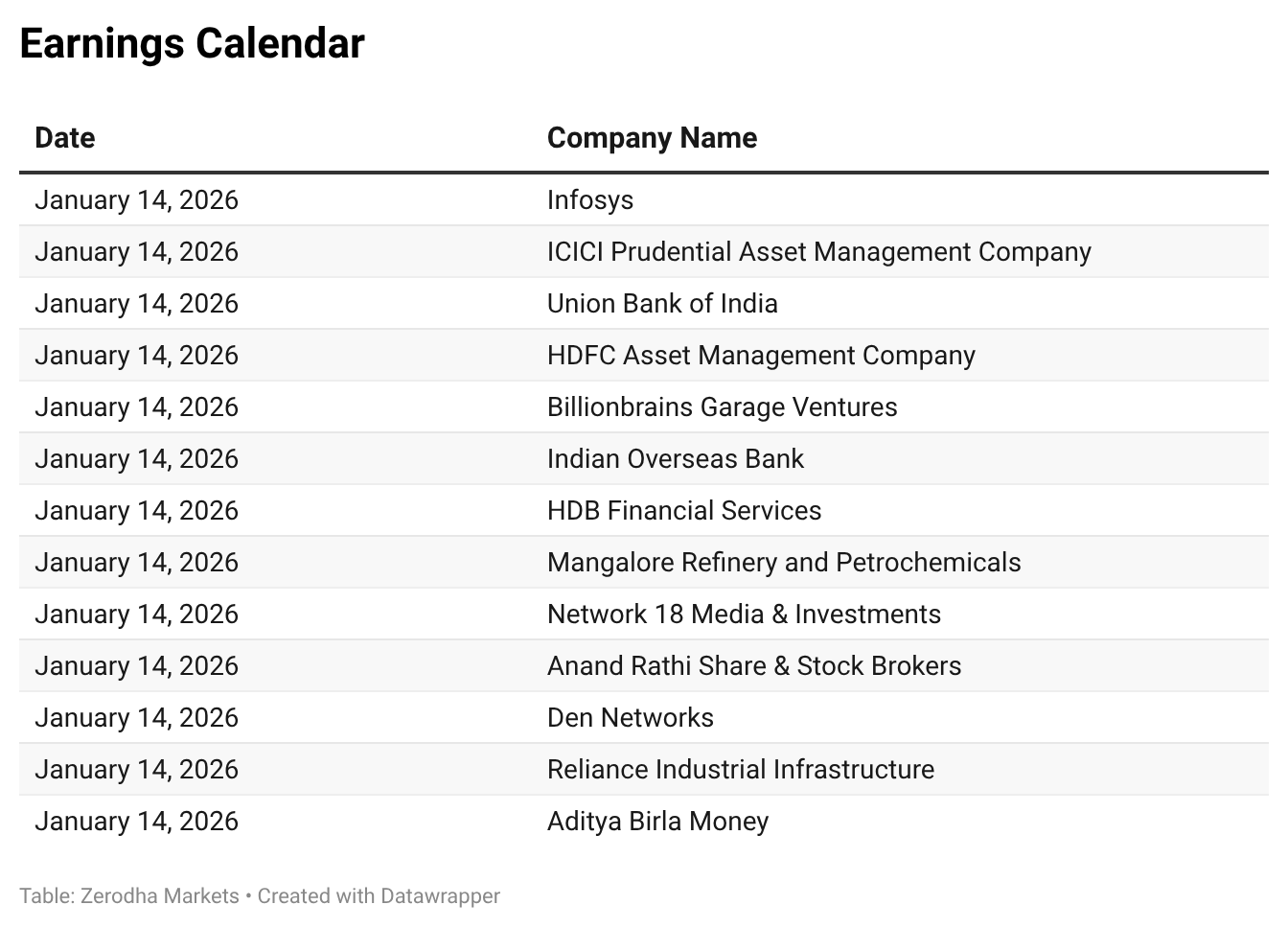

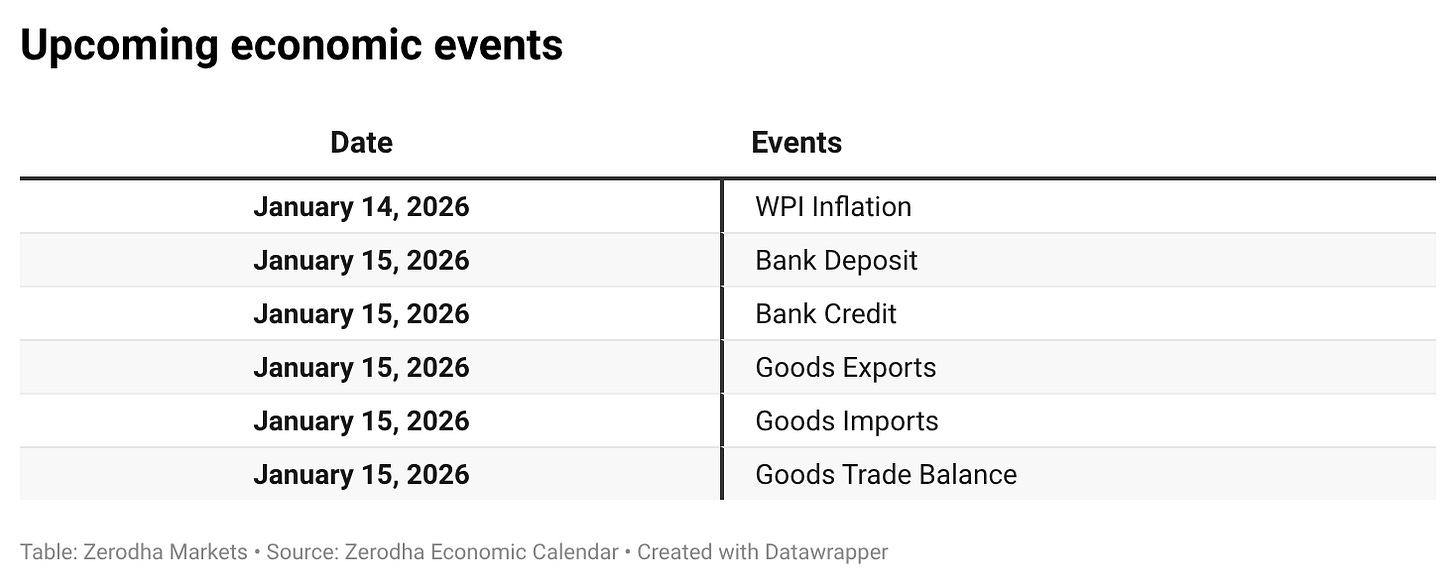

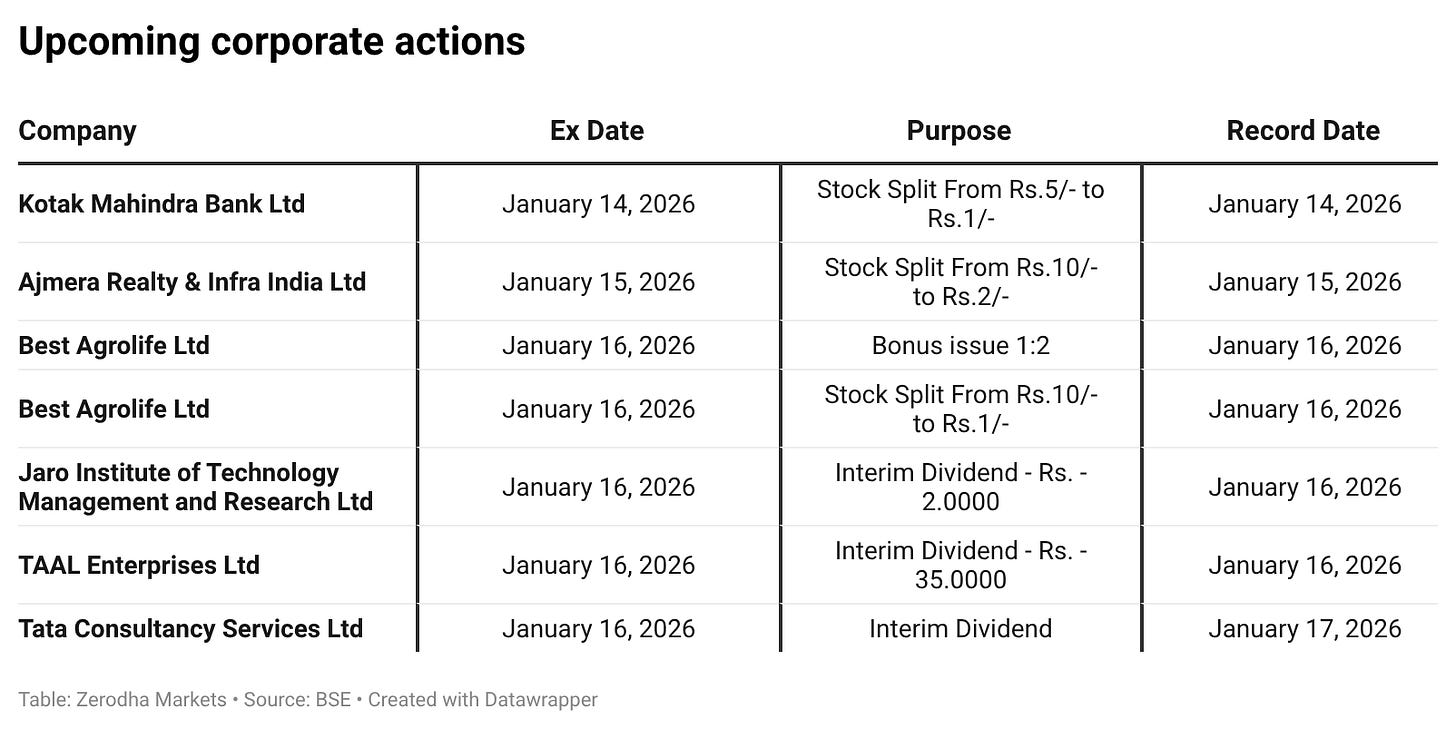

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Spot on regarding the 25,700 Put writing.

Crucially, that 2:30 PM recovery coincided perfectly with the 100 DEMA defence (~25,600). The hourly chart actually printed a silent 'Higher Low Double Bottom' right at that support.

We are now compressed in a 300-point cage:

🔴 25,900 (OI Wall)

🟢 25,600 (Structural Floor)

The breakout will be violent.