Record highs fail to hold as Nifty ends flat; Broader markets still subdued

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore how to run a proper trading backtest end-to-end — starting with forming a clear hypothesis and turning it into a precise, testable rule set, then generating Pine Script code (using Claude AI) and running the backtest on TradingView. From there, we break down how to export and analyse the full trade log in depth, while also covering the nuances that matter in real-world testing, including continuous futures, back-adjusted data, instrument limitations, and where TradingView works well — and where it doesn’t — in a trader’s workflow.

Market Overview

Nifty opened with a 56-point gap-up at 26,261, extending yesterday’s strong momentum, but soon slipped toward the 26,225–26,230 zone before rebounding to cross the 26,300 mark and register fresh all-time highs. After consolidating at higher levels between 26,280 and 26,310, the index cooled off and drifted into the 26,230–26,250 range by 1 PM.

Intraday weakness then emerged, pulling Nifty toward the 26,140–26,150 zone, before a late 60–70 point recovery helped it close almost flat at 26,215.55, missing follow-through at higher levels.

While Nifty and Sensex continue to hover near record highs, the same strength remains absent in the mid and small-cap segments.

Looking ahead, markets are likely to remain sensitive to progress on the India–U.S. trade deal and broader global cues.

Broader Market Performance:

The broader markets had a mixed session, slightly tilted towards bearish bias. Of the 3,193 stocks traded on the NSE, 1,486 advanced, 1,598 declined, and 109 remained unchanged.

Sectoral Performance:

The top-gaining sector for the day was Nifty Media, up 0.84%, while Nifty Realty was the top loser, slipping 0.72%. Out of the 12 sectoral indices, 6 closed in the green and 6 ended in the red, indicating an evenly balanced market breadth.

Here’s the trend of FII-DII activity from the last 5 days:

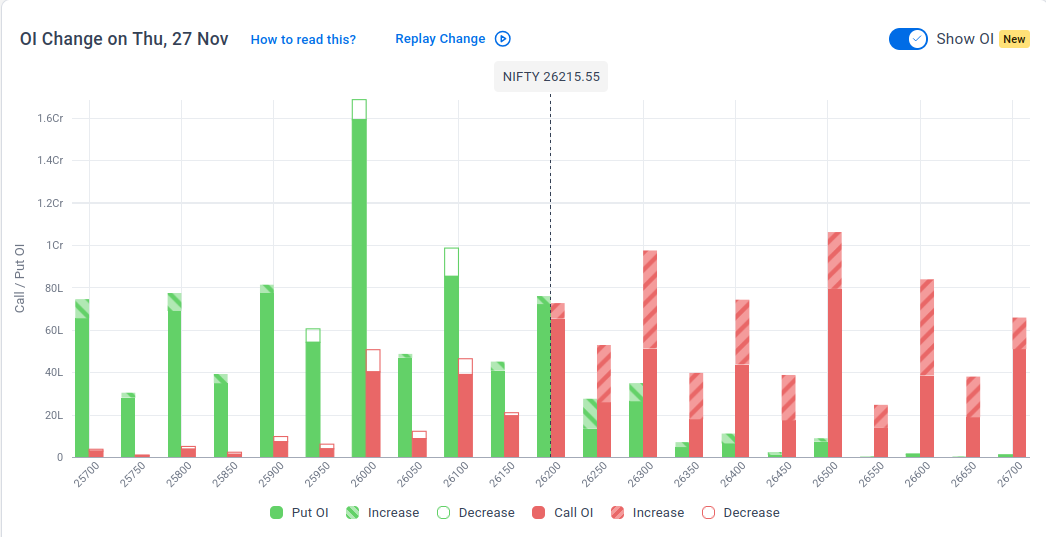

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd December:

The maximum Call Open Interest (OI) is observed at 26,500, followed by 26,300, indicating potential resistance at the 26,300 -26,400 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 26,100, suggesting support at the 26,100 to 26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The RBI and SEBI are reportedly in discussions to review existing curbs on currency derivatives. The talks focus on evaluating current restrictions and potential adjustments to improve market functioning. Dive deeper

Patel Engineering has secured a ₹798-crore coal excavation order. The contract adds to its project portfolio and is expected to support its ongoing operational pipeline. Dive deeper

Tata Consultancy Services (TCS) has signed a five-year agreement with SAP to modernise the German software company’s enterprise-wide cloud and generative AI operations. Dive deeper

India and the UAE reviewed progress under their CEPA agreement, discussing market access, data sharing, gold import quotas, anti-dumping issues and services. Dive deeper

Mahindra & Mahindra has launched a new seven-seater electric SUV, XEV 9S, starting at around ₹20 lakh, as part of its push into India’s growing EV market. Dive deeper

Asian Paints’s UAE-based step-down subsidiary plans to invest around AED 140 million (≈ ₹340 crore) to build a new paint manufacturing facility in the UAE. Dive deeper

What’s happening globally

WTI crude hovered around $58 per barrel as markets monitored Russia-Ukraine peace talks and the potential impact on sanctions and supply. Dive deeper

Gold eased to about $4,150 per ounce but stayed close to a two-week high as markets continued to expect a Federal Reserve rate cut next month. Despite stronger-than-expected economic data, traders are pricing in a high likelihood of a 25-bps cut. Dive deeper

Silver traded just below $53 per ounce, staying near record highs as expectations strengthened for a Federal Reserve rate cut in December. Dive deeper

US durable goods orders rose 0.5% in September 2025, exceeding expectations, with broad-based gains across transportation, electronics, metals, and machinery. Dive deeper

The UK 10-year gilt yield fell to 4.44% after briefly rising to 4.562%, amid market volatility following the government’s updated fiscal plans. Dive deeper

China’s industrial profits rose 1.9% year-on-year in the first ten months of 2025, slowing from earlier growth as private-sector earnings weakened and several key industries saw declines. Dive deeper

Japan’s Nikkei 225 rose 1.22% to 50,165 and the Topix gained 0.39%, tracking Wall Street’s strength amid expectations of further Fed rate cuts. Dive deeper

Toyota’s global production rose nearly 4% in October to 926,987 units, while sales increased 2% to 922,087, supported by strong US demand for hybrids. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Manishi Raychaudhuri on India’s valuation reset and potential FII inflows:

“India’s valuation reset could attract FIIs back”

“After more than a year of waiting, Indian markets have finally touched a new all-time high.”

“With this milestone achieved, investors are now turning their attention to what comes next, whether to add fresh positions, adjust sector weights, or reassess their overall strategy.” - Link

Mayuresh Joshi, Head of Equity, Marketsmith India, on India’s rare-earth processing push and its impact on auto/EV supply chains:

“India’s long-awaited move to boost domestic rare earth processing has the potential to reshape manufacturing supply chains, sharply reduce reliance on China, and strengthen the country’s auto, EV, and aerospace sectors.”

“This is a long-term structural shift, not a short-term fix.”

“Auto, EV & aerospace [sectors] will benefit the most.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!