Pre-Diwali fireworks continue in Nifty; Broader markets cool off

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we uncover one of the most fascinating and persistent market puzzles ever documented — the Overnight Anomaly, also known as the Overnight Drift Effect. First identified in the late 1970s by Ken French (of Fama-French fame), this anomaly challenges the Efficient Market Hypothesis (EMH) by revealing that most market gains occur outside trading hours, while intraday returns often drift lower.

In this episode, we explore this enduring overnight effect across markets — from the US to India — testing it on indices and stocks to understand why it persists and what it means for systematic traders.

Market Overview

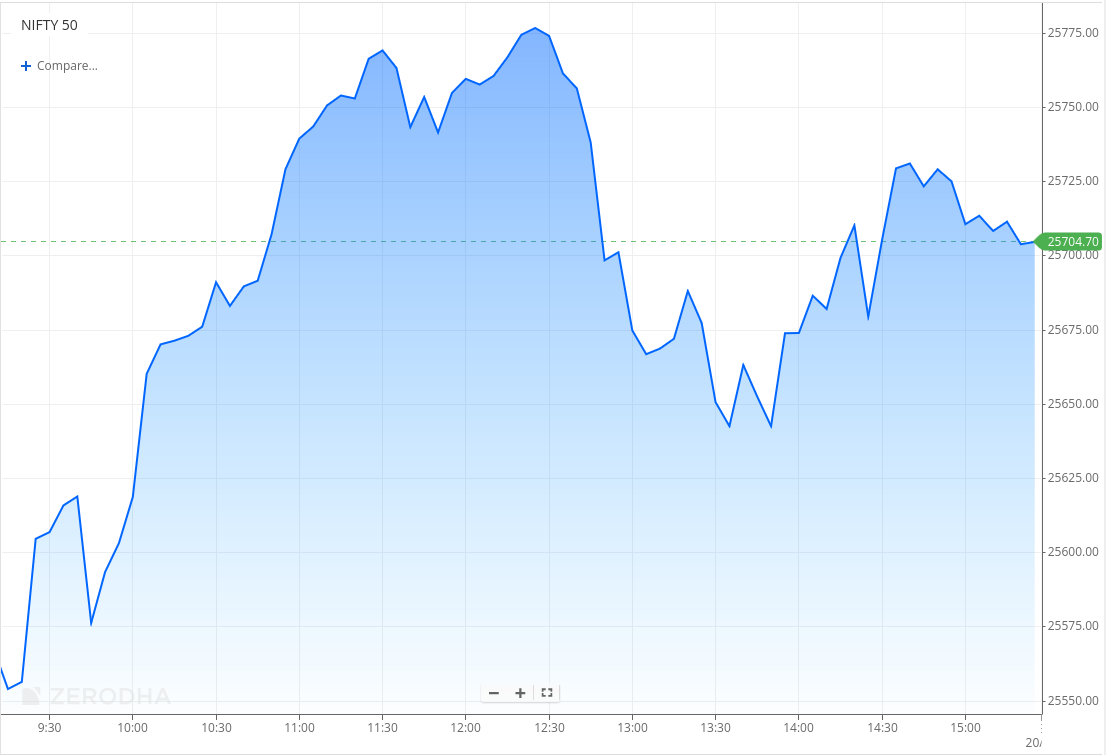

Nifty opened with a 40-point gap down at 25,547, tracking mixed global cues and mild profit booking after Thursday’s strong rally. The index quickly rebounded from the early dip and climbed steadily through the morning, reclaiming the 25,700 mark by 11 AM and extending gains to touch highs near 25,780.

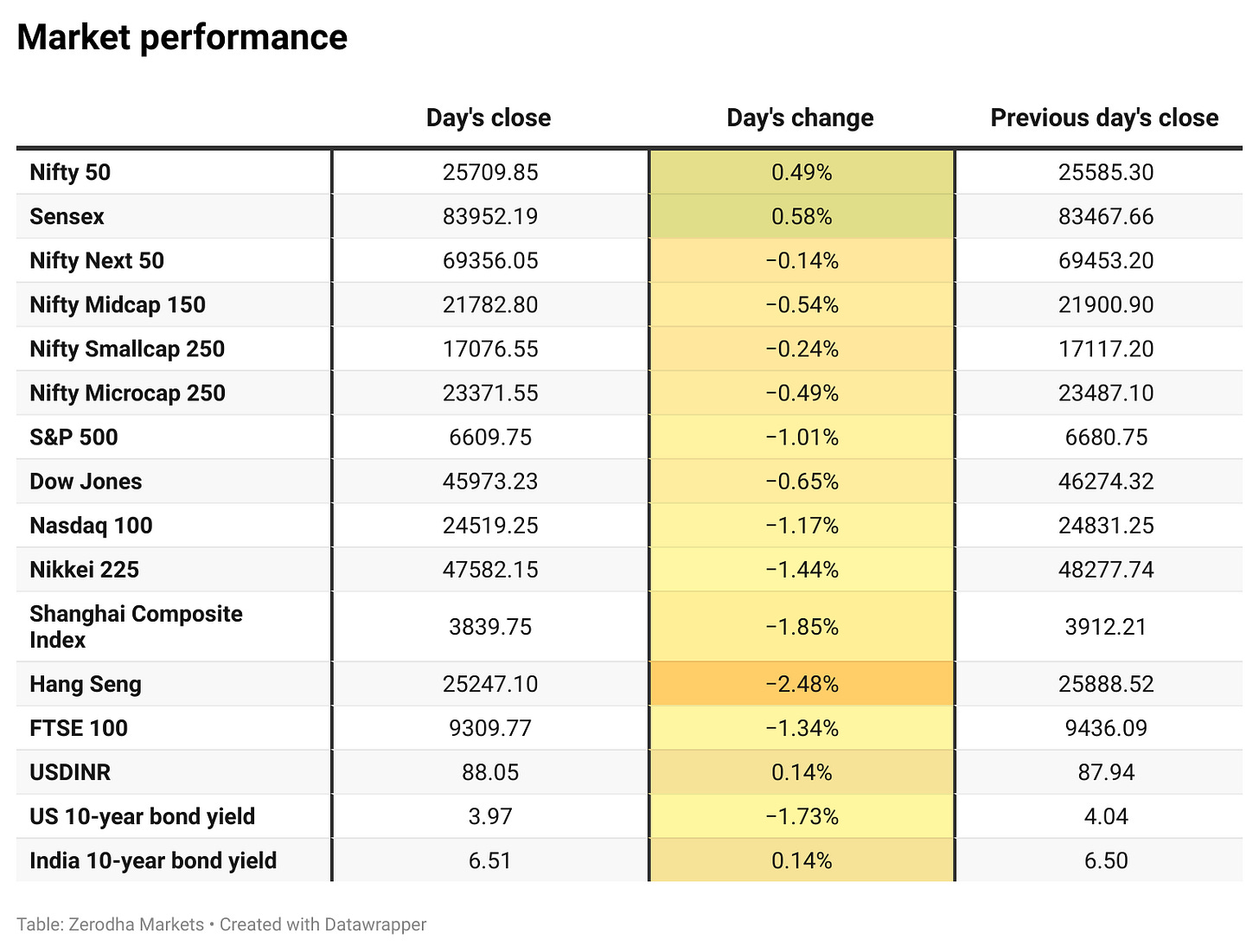

However, momentum eased post-lunch as selling pressure emerged at higher levels, leading to a brief mid-session pullback. Despite this, Nifty managed to stabilize and hold firm above the 25,650 zone in the final hour. It eventually settled at 25,709.85, up around 0.5%, extending its positive momentum for another session.

Market sentiment has turned optimistic once again, buoyed by expectations of a demand revival following the recent GST cuts. However, a degree of caution persists on the global front amid renewed U.S. tariff concerns. Going forward, investors will keep a close watch on Q2 earnings, festive season sales, and management commentary on demand trends across key sectors.

Broader Market Performance:

Broader markets had a weak session today, underperforming the headline indices. Of the 3,161 stocks traded on the NSE, 1,200 advanced, 1,871 declined, and 90 remained unchanged.

Sectoral Performance

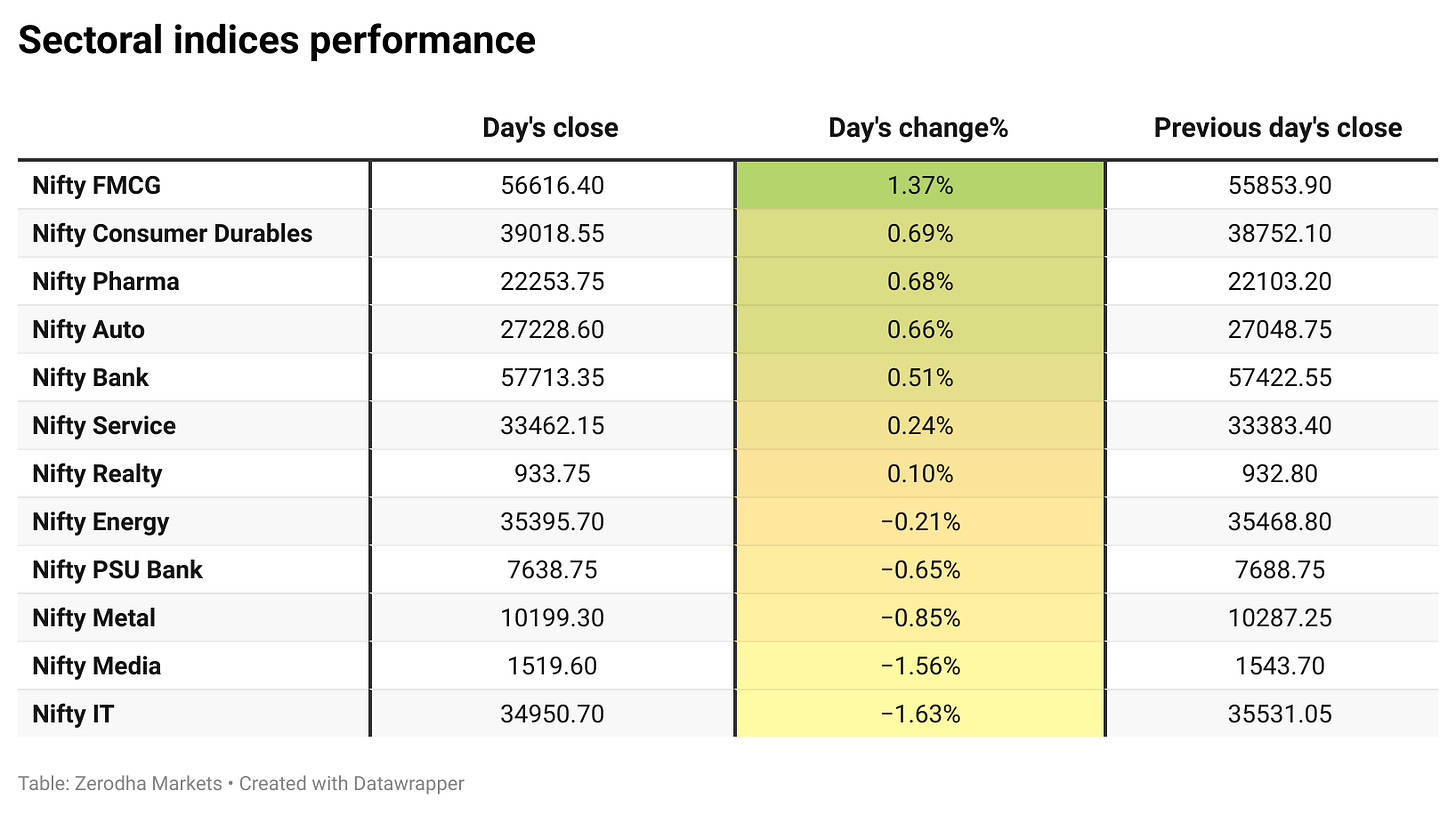

Nifty FMCG was the top gainer, rising 1.37%, while Nifty IT led the losses with a 1.63% drop. Out of 12 sectoral indices, 7 closed in the green and 5 ended in the red.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th October:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,800, indicating potential resistance at the 25,800 -25,900 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,300, suggesting support at the 25,500 to 25,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year G-Sec yield fell below 6.5%, its lowest in three weeks, as dovish RBI signals and easing inflation strengthened expectations of a near-term rate cut. Dive deeper

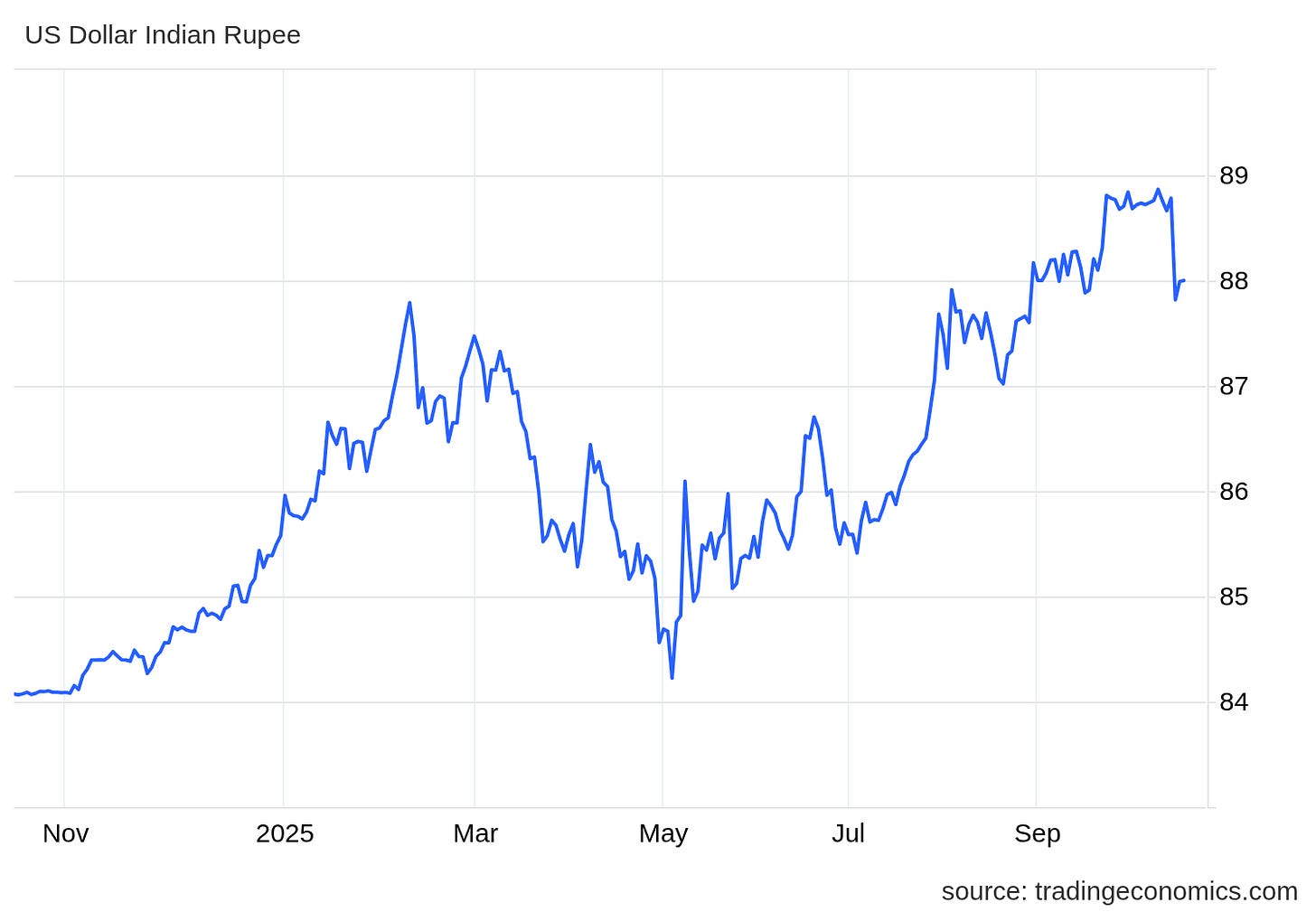

The Indian rupee traded around 88 per USD, near four-week highs, supported by RBI’s intervention through dollar sales and offshore forward positions, which curbed volatility and short-selling pressure. Dive deeper

Bank of India reported a 7.6% rise in net profit to ₹2,554 crore for Q2 FY26, compared to ₹2,374 crore a year ago. Total income increased to ₹20,626 crore, while gross NPAs improved to 2.54% from 4.41%. Provisions for NPAs declined to ₹472 crore from ₹1,427 crore in the same quarter last year. Dive deeper

Japan’s Sumitomo Mitsui Banking Corporation (SMBC) clarified it has no plans to raise its stake in Yes Bank beyond 24.99%, with India head Rajeev Kannan stating the focus will remain on board contribution rather than an executive role. Dive deeper

Tenneco Clean Air India, a unit of US-based Tenneco, plans a ₹3,000 crore IPO in November, seeking a valuation of up to $2 billion through an offer for sale by Tenneco Mauritius Holdings. Dive deeper

PVR Inox reported a net profit of ₹105 crore in Q2 FY26, turning profitable from a loss of ₹12 crore a year ago. Revenue rose 12.3% to ₹1,823 crore, while EBITDA increased 27.7% to ₹612 crore, with margins improving to 33.5%. Dive deeper

Polycab India reported a 56% YoY rise in consolidated net profit to ₹693 crore for Q2 FY26, with revenue up 18% to ₹6,477 crore. EBITDA grew 62% to ₹1,021 crore, driven by strong performance in the Wires and Cables segment and steady growth in the FMEG division. Dive deeper

Whirlpool of India signed new brand, technology, and service agreements with Whirlpool Corporation and affiliates to enhance growth and innovation. The company will retain exclusive rights to use the ‘Whirlpool’ brand across existing and future product segments. Dive deeper

State Bank of India plans to raise ₹7,500 crore through 10-year Tier II bonds, marking its first such issuance. The issue includes a ₹5,000 crore base size and a ₹2,500 crore green shoe option, with pricing expected above a 7% coupon. Dive deeper

LTIMindtree reported a net profit of ₹1,381 crore for Q2 FY26, up 10% year-on-year, driven by broad-based performance and disciplined execution. The company added 2,558 employees during the quarter, taking its total headcount to 86,447. Dive deeper

Wipro reported a net profit of ₹3,246 crore for Q2 FY26, up slightly from ₹3,208 crore a year ago, with revenue rising 1.7% to ₹22,697 crore. The company secured total contracts worth $4.7 billion, including 13 large deals, and added 2,260 employees, taking its headcount to 235,492. Dive deeper

Canara HSBC Life Insurance made a flat debut on exchanges at ₹106 per share after a ₹2,517 crore offer for sale.

Coca-Cola is reportedly considering a $1 billion IPO for its Indian bottling arm, Hindustan Coca-Cola Beverages, which could value the unit at around $10 billion and may take place next year. Dive deeper

What’s happening globally

WTI crude oil hovered near a five-month low of $57 per barrel, set for a third weekly decline, as rising inventories and hopes of progress in upcoming US–Russia talks weighed on prices. Dive deeper

Gold rose to around $4,340 per ounce, nearing record highs and heading for its strongest weekly gain since March 2020, supported by safe-haven demand amid US–China tensions, banking concerns, and expectations of Fed rate cuts. Dive deeper

The dollar index rose to 98.4 after President Donald Trump indicated that high tariffs on Chinese goods may not remain in place long-term. Dive deeper

Foreign investors added C$25.9 billion in Canadian securities in August 2025, led by C$32.6 billion in debt inflows—the highest since April 2024, partly offset by C$6.7 billion equity sales. Most bond buys were private corporate issues, while stock selloffs were concentrated in energy and mining. Dive deeper

President Trump announced plans to meet Russian President Vladimir Putin in Budapest to discuss ending the war in Ukraine, following what he described as a “very productive call” and ahead of his meeting with Ukrainian President Volodymyr Zelenskyy at the White House. Dive deeper

China’s 10-year government bond yield fell to around 1.75%, a six-week low, as deflation pressures and US–China trade tensions fueled expectations of further policy easing ahead of key economic data next week. Dive deeper

South Korea’s unemployment rate fell to 2.5% in September 2025 from 2.6% in August, as the economy added 312,000 jobs—the strongest gain in 19 months—despite continued weakness in manufacturing and construction. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Srini Pallia, CEO & Managing Director, Wipro, on growth outlook and AI-led transformation

“We closed $9.5 billion in bookings for the first half of FY25, with AI-led modernization and vendor consolidation driving a strong pipeline.”

“Three of our four strategic market units grew sequentially, and Europe turned positive after several soft quarters.”

“Our focus is on embedding AI and automation across client engagements to accelerate transformation and position Wipro for gradual growth in FY26.” - Link

Amit Ramchandani, MD & CEO, Motilal Oswal Investment Advisors, on India’s F&B IPO boom

“The appetite for F&B IPOs underscores investors’ confidence in India’s consumption story, combining recurring demand with improving margins and formalized distribution.”

“With rising per capita incomes, discretionary spending on branded and convenience foods is growing disproportionately, driving this ₹9,000 crore IPO wave.”

“Companies are leveraging technology, expanding distribution, and turning to public markets to fund growth as organised players gain share from the unorganised segment.” - Link

Tuhin Kanta Pandey, Chairperson, SEBI, on strengthening India’s commodity and derivatives markets

“We are looking to enhance institutional participation in agriculture and non-agriculture commodity markets to make them more attractive for hedging.”

“Deepening our cash equities market and improving the derivatives market remains a high priority for SEBI.”

“We are also exploring bond derivatives and engaging with the government to permit banks and pension funds to trade commodities.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

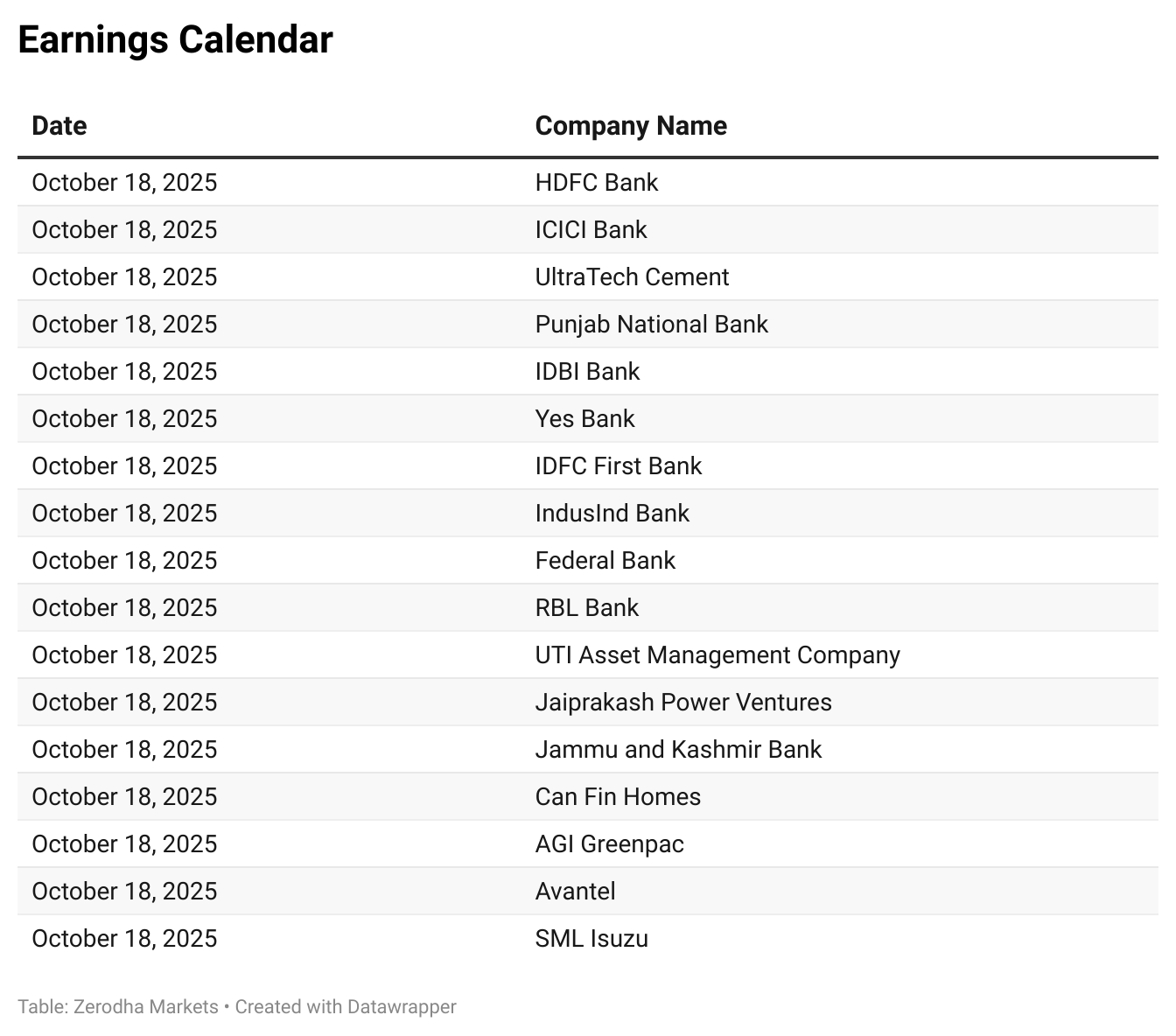

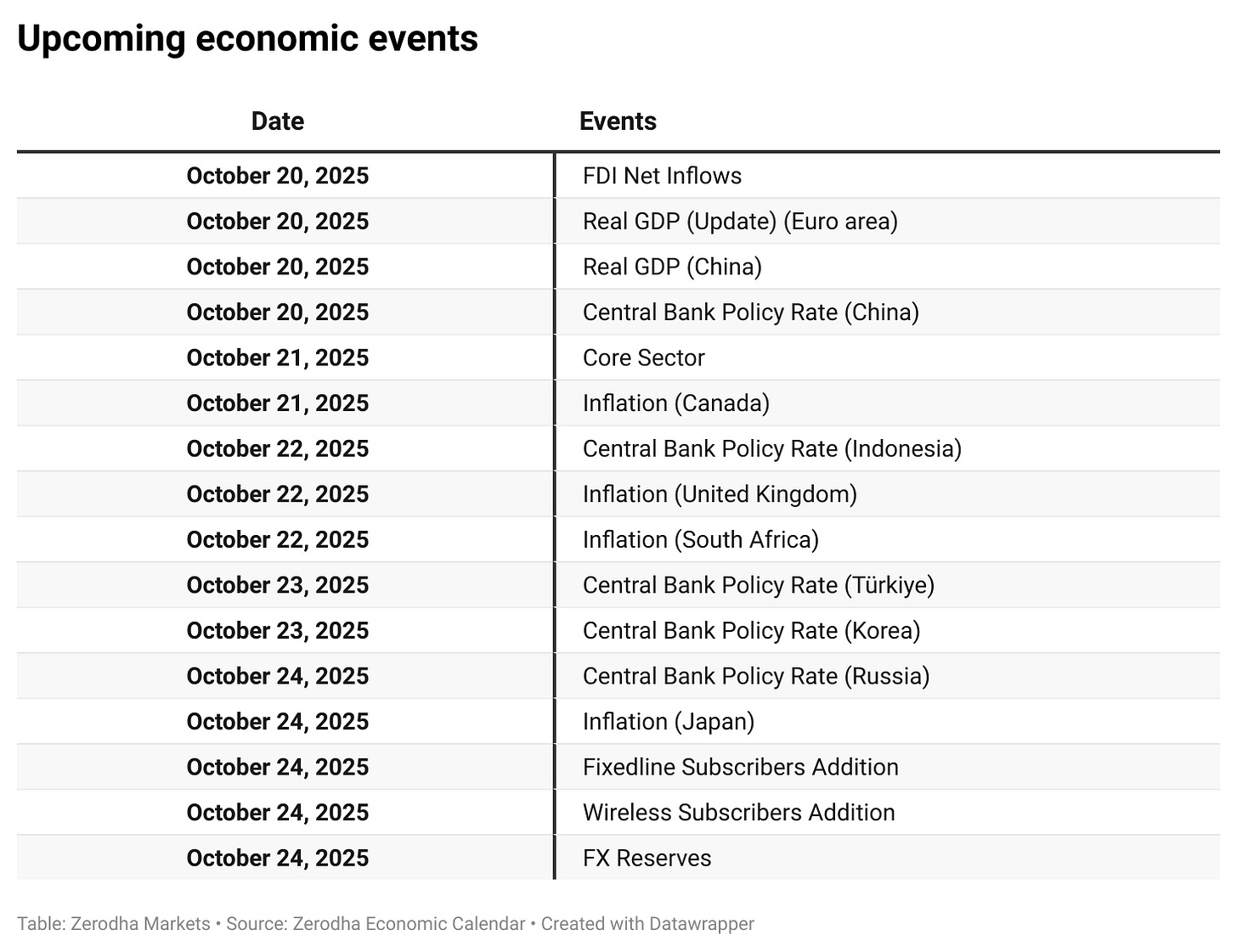

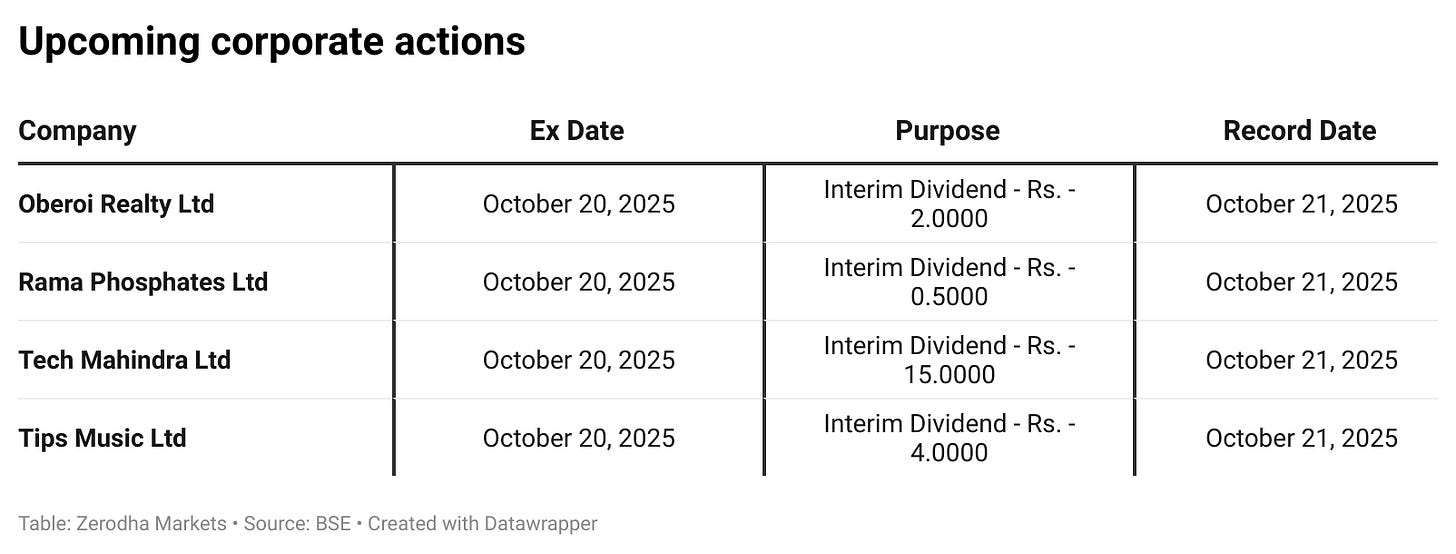

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!