Nifty trims losses with 200-point bounce to close near 25,500; sentiment still cautious

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we put two foundational trend-following signals under the microscope — Exponential Moving Averages (EMAs) and Supertrend — and show how timeframe reshapes everything you see and do as a trader.

We start with a simple idea: EMAs = speed, Supertrend = volatility-adjusted staying power. Then we build a rules-based SAR system and test both signals on Nifty (Spot) across three timeframes — Daily (8 EMA), 4-Hour (21 EMA), and 1-Hour (50 EMA) — with Supertrend (10,3) held constant. Using data from Jan 2015 to Oct 2025(illustrative backtests on spot prices), we compare long-only vs long+short, and break down trade frequency, average P&L per trade, win rate, and drawdowns.

Market Overview

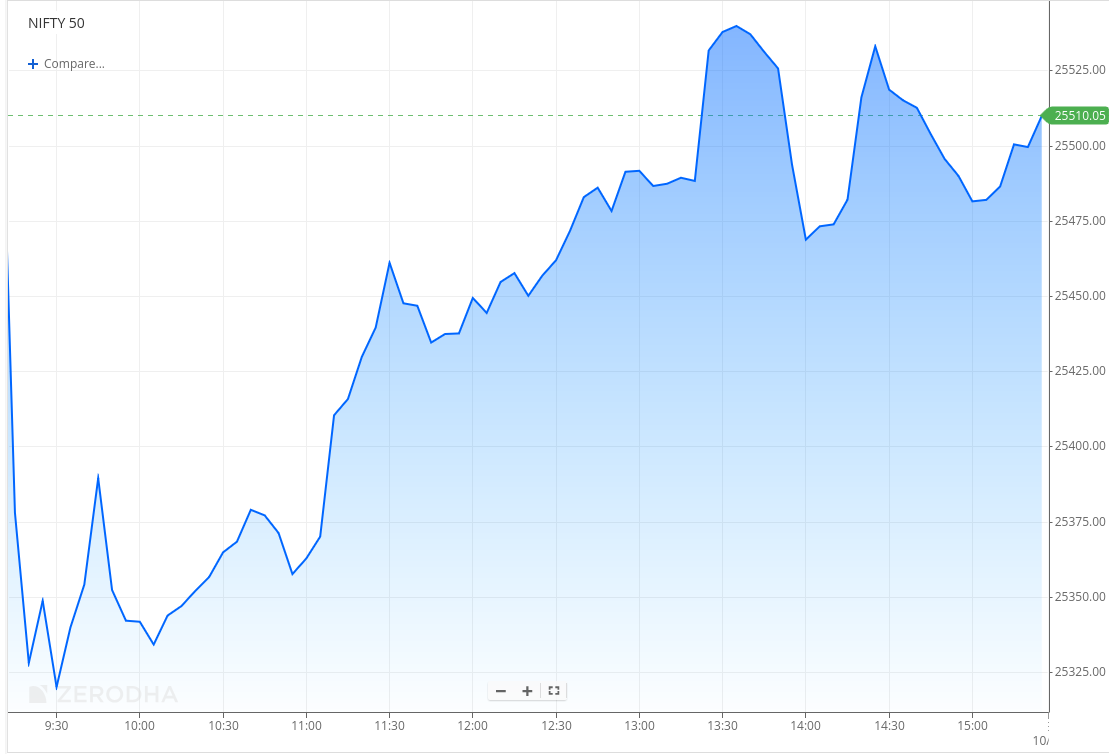

Nifty opened with a 75-point gap-down at 25,434, tracking weak global cues and subdued domestic sentiment. The index extended its decline in the opening hour, slipping below 25,350 and touching an intraday low near 25,320 before stabilising within the 25,350–25,380 range.

After 11 AM, Nifty gradually pared some losses, and post noon, it recovered further to reclaim the 25,500 mark, briefly turning positive by 1:30 PM. However, selling pressure re-emerged at higher levels, leading to back-and-forth movement between 25,470 and 25,520 zones. The index eventually ended the day flat at 25,492.30, down 0.06%.

Looking ahead, markets are expected to remain sensitive to developments around the India–U.S. trade deal, while investors closely monitor Q2 earnings and management commentary on festive-season demand momentum following the recent GST rate cuts.

Broader Market Performance:

The broader markets had a mixed session today. Of the 3,211 stocks traded on the NSE, 1,588 advanced, 1,523 declined, and 100 remained unchanged.

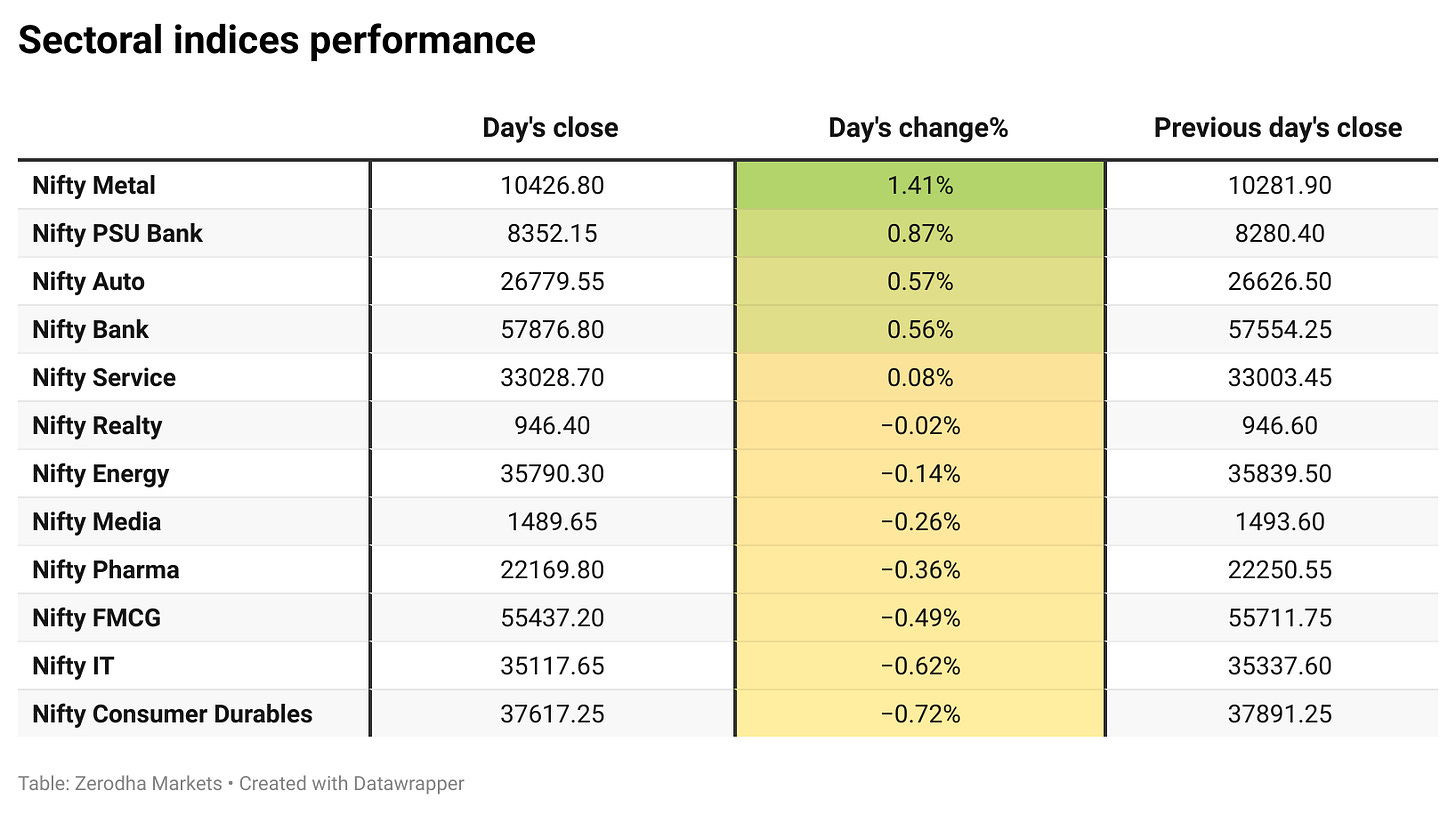

Sectoral Performance:

Nifty Metal was the top gainer, rising 1.41%, while Nifty Consumer Durables was the biggest loser, falling 0.72%. Out of the 12 sectoral indices, 5 ended in the green and 7 closed in the red, indicating a mildly negative market breadth for the day.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 11th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,700 & 25,600, indicating potential resistance at the 25,700 -25,800 levels.

The maximum Put Open Interest (OI) is observed at 25,300, followed by 25,400 & 25,000, suggesting support at the 25,400 to 25,300 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Infosys set November 14 as the record date for its ₹18,000 crore share buyback, the largest in the company’s history, involving 10 crore shares at ₹1,800 each. Dive deeper

Singtel sold 5.1 crore Bharti Airtel shares in a block deal worth about ₹10,300 crore as part of its stake reduction strategy. Dive deeper

Adani Enterprises will raise ₹25,000 crore via a rights issue spread over four tranches in 6-8 months, largely to repay promoter shareholder loans and create debt headroom. Dive deeper

Trent’s Q2 FY26 profit rose 11% YoY to Rs 377 crore, while revenue grew 16% to Rs 4,818 crore. Total income, including other income, stood at Rs 4,845 crore, up 15% YoY. Dive deeper

NTPC Green Energy will raise Rs 1,500 crore via unsecured NCDs on November 11, 2025, through private placement. The 10-year debentures carry a 7.01% coupon, and proceeds will fund capex and general corporate purposes. Dive deeper

Swiggy approved a Rs 10,000 crore fundraise via public or private routes, including QIP, to strengthen its balance sheet. The move aims to boost food delivery and quick-commerce expansion amid rivalry with Zepto and Blinkit. Dive deeper

Hindalco Q2 FY26 profit rose 21% YoY to ₹4,741 crore, revenue up 13% to ₹66,058 crore. EBITDA grew to ₹9,684 crore, led by strong India aluminium performance. Novelis shipments were flat, while downstream aluminium EBITDA hit a record. Dive deeper

Zydus Lifesciences plans to raise ₹5,000 crore via equity to reduce debt and fuel expansion, while reporting a 38% YoY rise in Q2 profit to ₹1,258.60 crore. Dive deeper

Smartworks Q2 loss narrowed to ₹3.1 crore from ₹15.8 crore YoY despite higher expenses. Revenue grew 22% YoY to ₹441 crore. The company highlighted scaling managed campuses and maintaining a negative net-debt position. Dive deeper

SEBI flagged over 1 lakh social media posts for misleading investment content, warning that unregulated influencers pose a direct risk, with 62% of investors reportedly acting on their advice. Dive deeper

Piramal Finance listed on BSE at ₹1,270, a 13% premium over the discovered price of ₹1,124.20. The listing happened through a merger with Piramal Enterprises with a 1:1 share swap and no IPO. The move was part of RBI norms requiring a single NBFC-ICC structure per group. Dive deeper

Godrej Properties reported Q2 net profit of ₹405 crore, up 21% YoY, while bookings jumped 64% to ₹8,505 crore, driven by strong project launches. Dive deeper

MCX reported a 29% YoY rise in Q2FY26 PAT to ₹197.47 crore, driven by strong revenue and higher bullion trading, while average daily turnover surged 87% YoY. For H1FY26, PAT stood at ₹400.66 crore, up 51% YoY. Dive deeper

TVS Motor is divesting its stake in Rapido for ₹287.93 crore, selling shares to Accel India VIII and MIH Investments, marking a strategic exit from its 2022 partnership. Dive deeper

Amber Enterprises reported a Q2FY26 net loss of ₹32 crore versus a profit last year, with revenue slipping 2% and EBITDA down 19% amid higher costs and JV losses. Dive deeper

Bajaj Auto’s unit will acquire 24,000 shares in Pierer Bajaj AG for €24.32 million, taking its holding to 100% and making it a wholly-owned subsidiary. Dive deeper

What’s happening globally

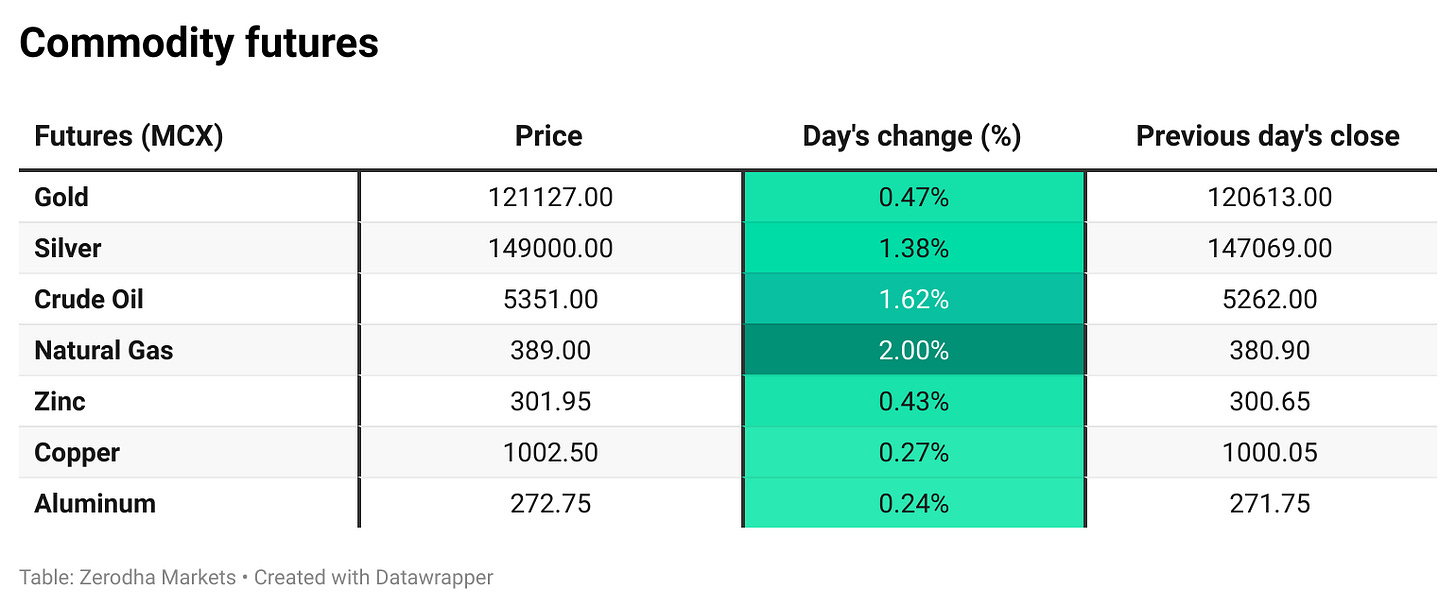

WTI crude traded near $60/bbl, heading for a second weekly loss amid rising OPEC+ and non-OPEC supply and demand weakness, while geopolitical risks and shifting import flows kept supply concerns in focus. Dive deeper

Gold climbed near $4,000/oz as weak labor data boosted expectations of a December Fed rate cut, with markets pricing a 69% probability. Dive deeper

FAO Food Price Index fell 1.6% to 126.4 in Oct 2025, the lowest since Jan, led by declines in cereals (-1.3%), dairy (-3.4%), meat (-2%), and sugar (-5.3%) on strong supply. Vegetable oils rose 0.9%, hitting the highest level since Jul 2022. Dive deeper

UK house prices rose 1.9% YoY in October, the fastest since September, with the average home hitting a record £299,862, while monthly prices gained 0.6%, the strongest since January. Northern Ireland led regional growth at 8% YoY, while London and South East remained softer. Dive deeper

China’s exports fell 1.1% YoY in October to USD 305.4B, the first drop since February, hit by weaker orders and tariff-driven uncertainty. Dive deeper

Tesla shareholders approved Elon Musk’s pay package worth up to $878 billion, linked to long-term milestones in autonomous driving, AI, and robotics, with over 75% support. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Tuhin Kanta Pandey, Chairperson, SEBI, on short selling & SLBM review

“We will comprehensively review the short-selling framework and the Securities Lending and Borrowing Mechanism (SLBM), which remains underdeveloped compared to global markets.”

“An active SLBM is critical for better price discovery and linking the cash and derivatives segments, while enabling lenders to earn on idle securities.”

“India’s primary markets are strong, with ₹4.6 trillion raised in FY25 and nearly ₹2 trillion already mobilised this year, supported by 135 million unique investors.” - Link

Nirmala Sitharaman, Finance Minister of India, on F&O trading and market approach

“Government is not here to shut the door on futures and options trading.”

“Govt is here to remove the roadblocks and work on them.”

“It is investors’ responsibility to understand the associated risks.” - Link

Sanjay Malhotra, Governor, Reserve Bank of India, on lifting curbs on bank acquisition financing

“Lifting restrictions on bank acquisition financing will help the real economy.”

“Guardrails like a 70% funding cap and debt-equity limits ensure safety while enabling banks to benefit from additional business.”

“No regulator can or should substitute boardroom judgment; decisions must be case-specific, not one-size-fits-all.” - Link

Piyush Goyal, Commerce & Industry Minister of India, on India - New Zealand FTA progress

“Talks are progressing rapidly. We hope to finalise the free trade agreement soon.”

“We’re working hard to strike a deal that will create real opportunities for Indian businesses in New Zealand and for New Zealand businesses interested in working with India.”

“Two-way trade has already increased by 10% over the last year; the pact will significantly enhance trade further.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

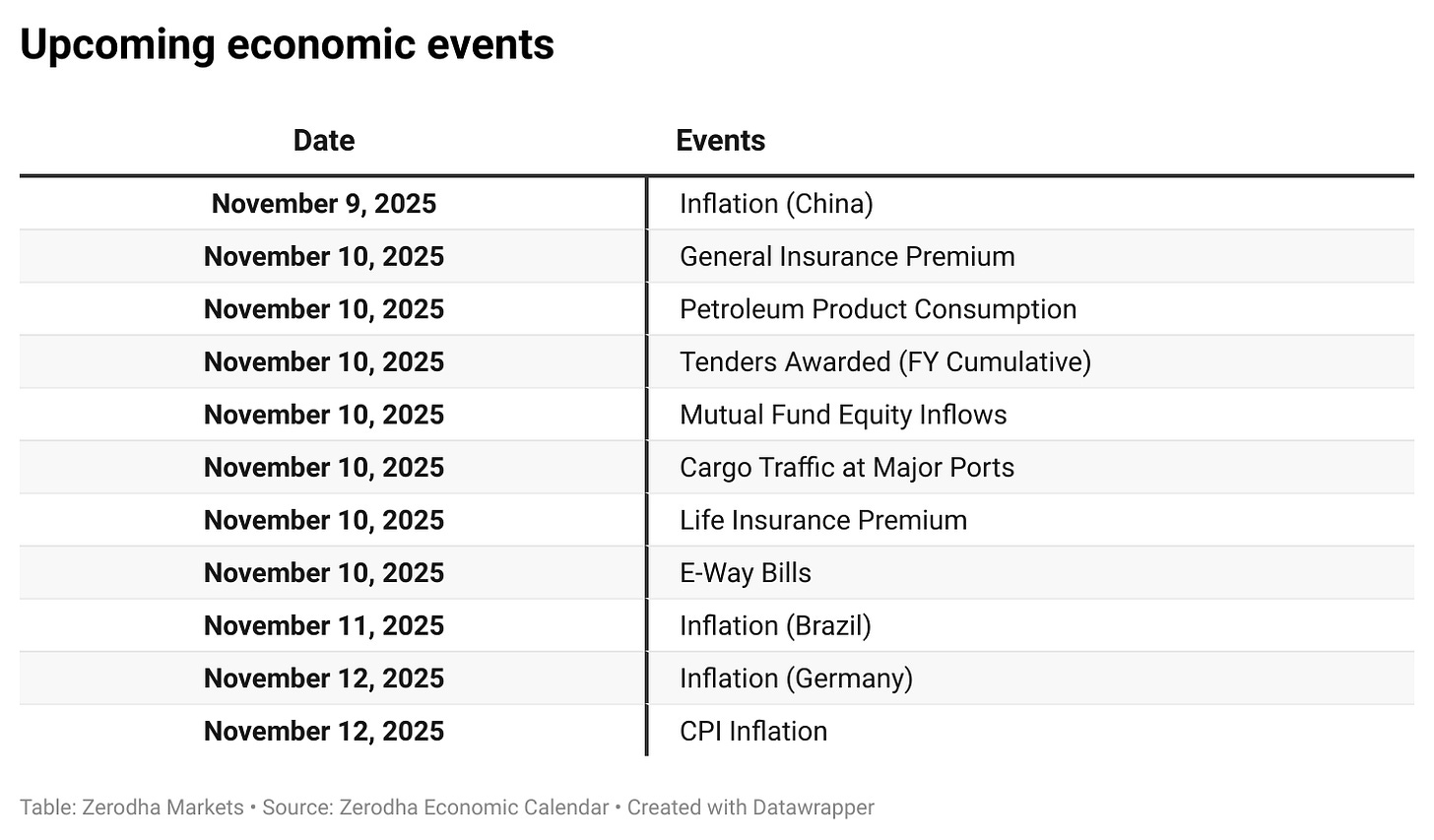

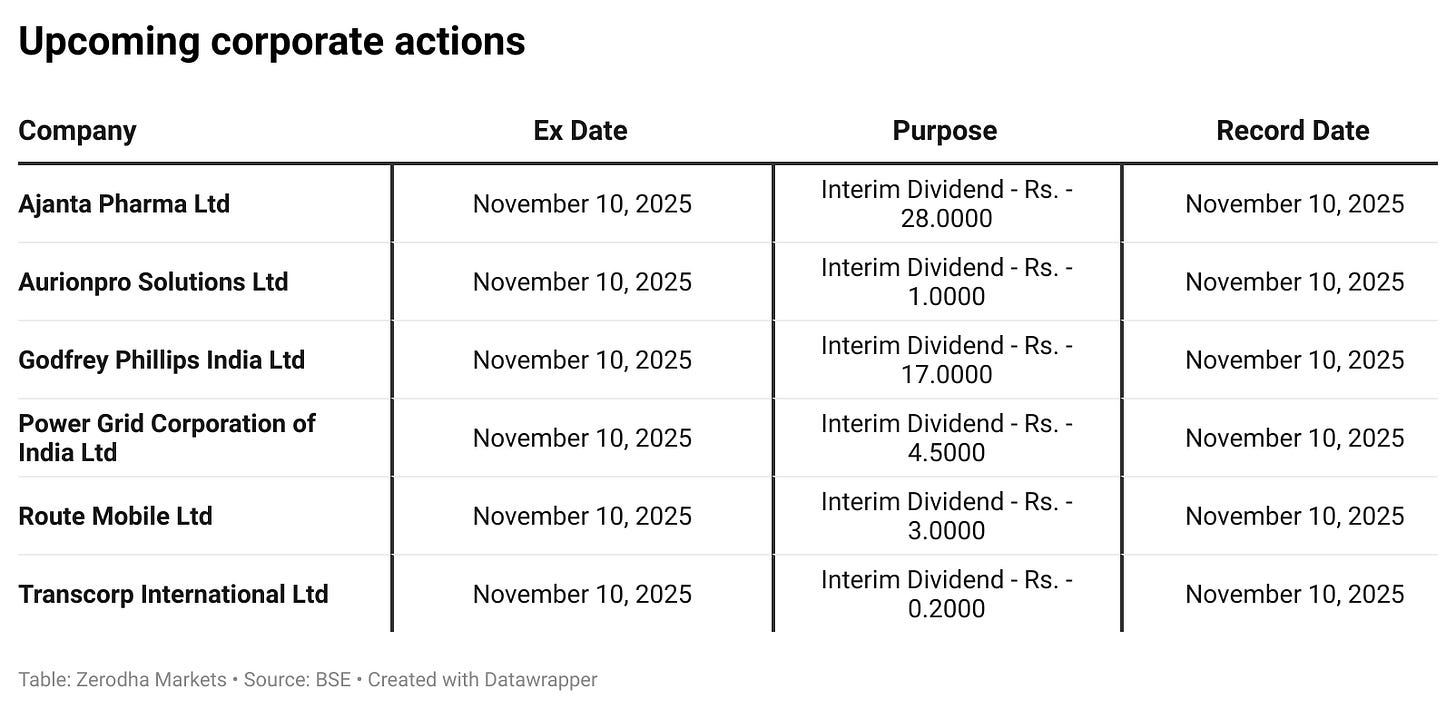

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

😍🥰