Nifty trims losses after sharp morning drop; manages to close above 25,800

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore what proprietary trading really means versus what the term has unfortunately come to represent in India, breaking down how true prop firms operate, how the space evolved, and how recent scams twisted the concept into unrealistic leverage pitches. By using real regulatory context, historical examples, and recent cases, we separate genuine institutional prop models from the shadow ecosystems built around misleading promises and illegal structures.

Market Overview

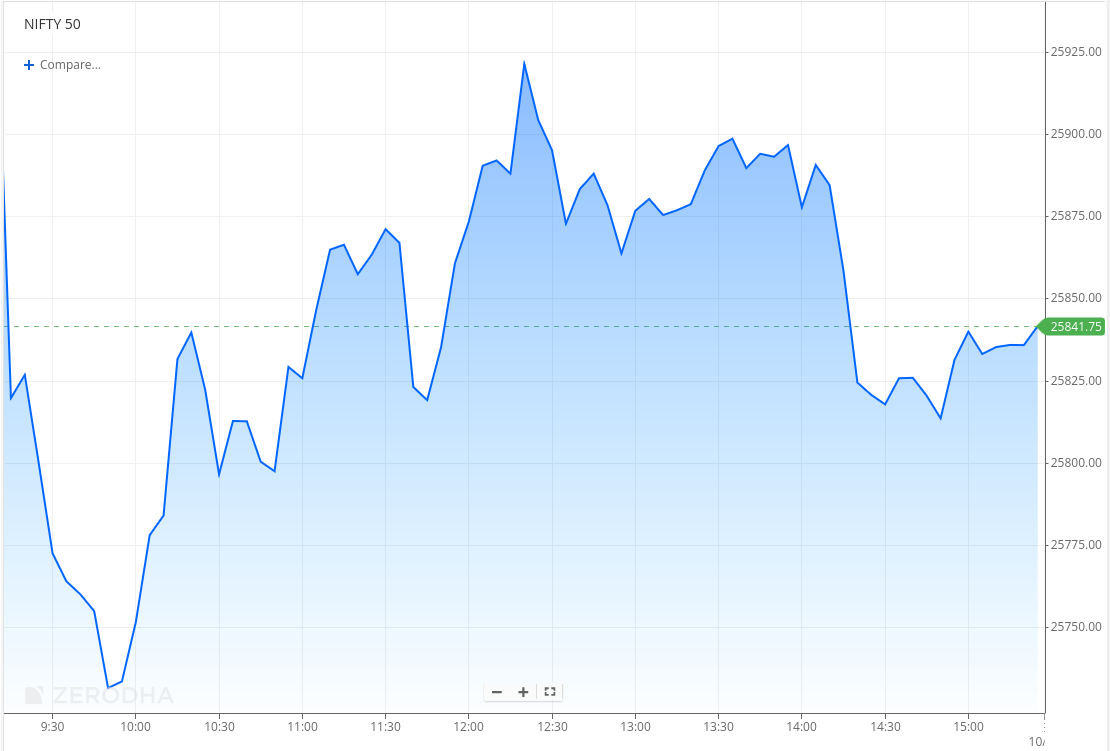

Nifty opened with a 93-point gap-down at 25,867, extending the weakness from the previous session. The index slipped further toward the day’s low of around 25,730 in the first hour, before staging a quick rebound toward 25,850. For most of the morning, Nifty oscillated in a narrow band between 25,800 and 25,870.

In the second half, the index made an attempt to reclaim 25,900, hitting an intraday high near 25,920 on selective buying interest, but lacked follow-through. Post 2 PM, Nifty drifted lower again, struggling to hold above 25,850 and briefly retesting the 25,800–25,820 zone. It eventually settled at 25,839.65, down about 0.46% from the previous close.

Overall, it was a subdued and choppy session with weak sentiment, although the index did manage to recover from the morning lows. Looking ahead, markets are likely to remain driven by global risk appetite, currency movements, and developments around the India–U.S. trade negotiations.

Broader Market Performance:

The broader markets staged a decent recovery today. Out of 3,208 names traded on the NSE, only 1,987 advanced, while 1,127 declined, and 94 remained unchanged.

Sectoral Performance:

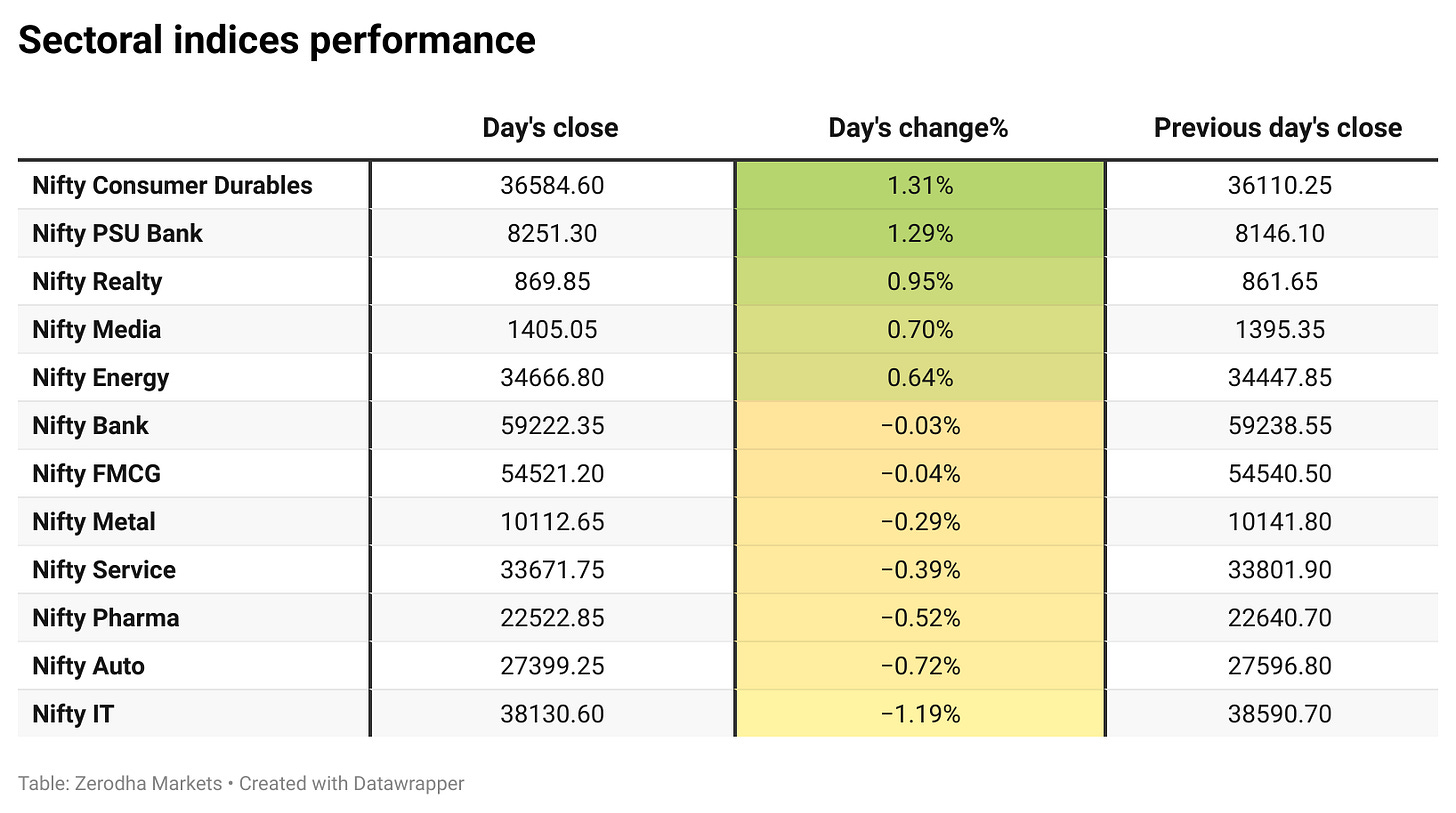

The top-gaining sector for the day was Nifty Consumer Durables, which rose by 1.31%, followed closely by Nifty PSU Bank at 1.29%. On the flip side, Nifty IT was the worst performer, declining by 1.19%.

Out of the 12 tracked sectors, 5 closed in the green while 7 ended in the red, indicating a mildly negative sectoral breadth despite strength in select pockets.

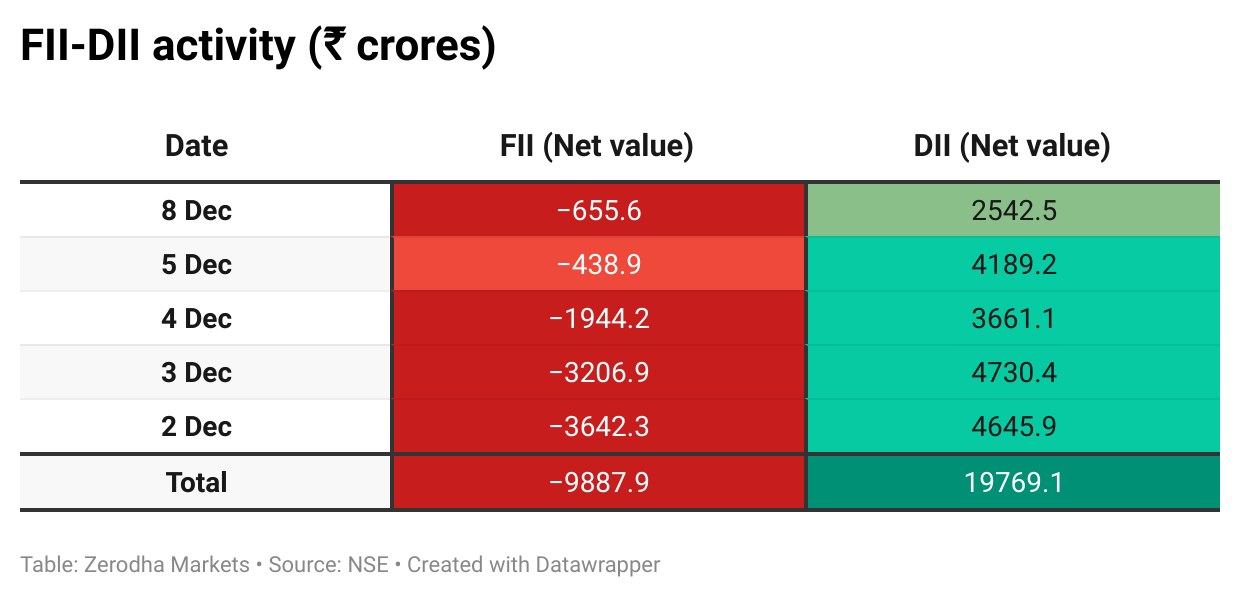

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100 & 26,200, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,400 & 25,800, suggesting support at the 25,700 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

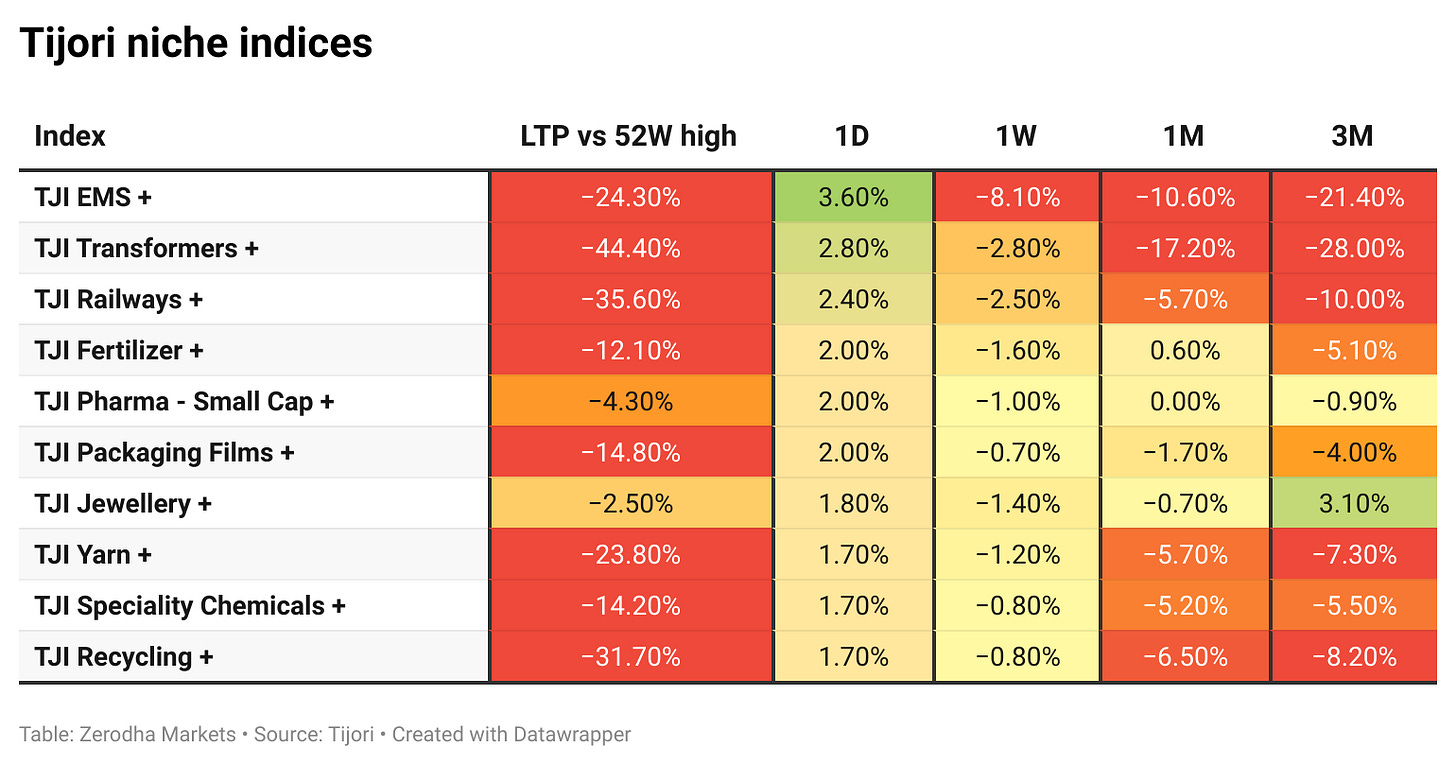

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Shares of rice exporters fell after US President Donald Trump threatened new tariffs on India’s rice exports, weighing on sentiment. Trump indicated his administration may impose fresh duties on agricultural imports, including Indian rice and Canadian fertilisers, following complaints from American farmers. Dive deeper

Welspun One plans to invest ₹550 crore to develop a 1.2 million sq ft logistics and warehousing park in Talegaon, Pune, on a 46-acre MIDC-notified land parcel. Dive deeper

Swiggy has launched a ₹10,000 crore qualified institutional placement after shareholders cleared the fundraise, marking its first major capital raise since the IPO. Dive deeper

HCL Technologies signed a strategic partnership with France-based Dolphin Semiconductor to co-develop energy-efficient chips, marking a push into next-generation silicon design. The tie-up targets rising enterprise demand for high-performance, low-power computing solutions. Dive deeper

Steamhouse India has filed updated IPO papers with SEBI to raise ₹425 crore through a ₹345 crore fresh issue and an ₹80 crore OFS by promoter Vishal Budhia. Dive deeper

What’s happening globally

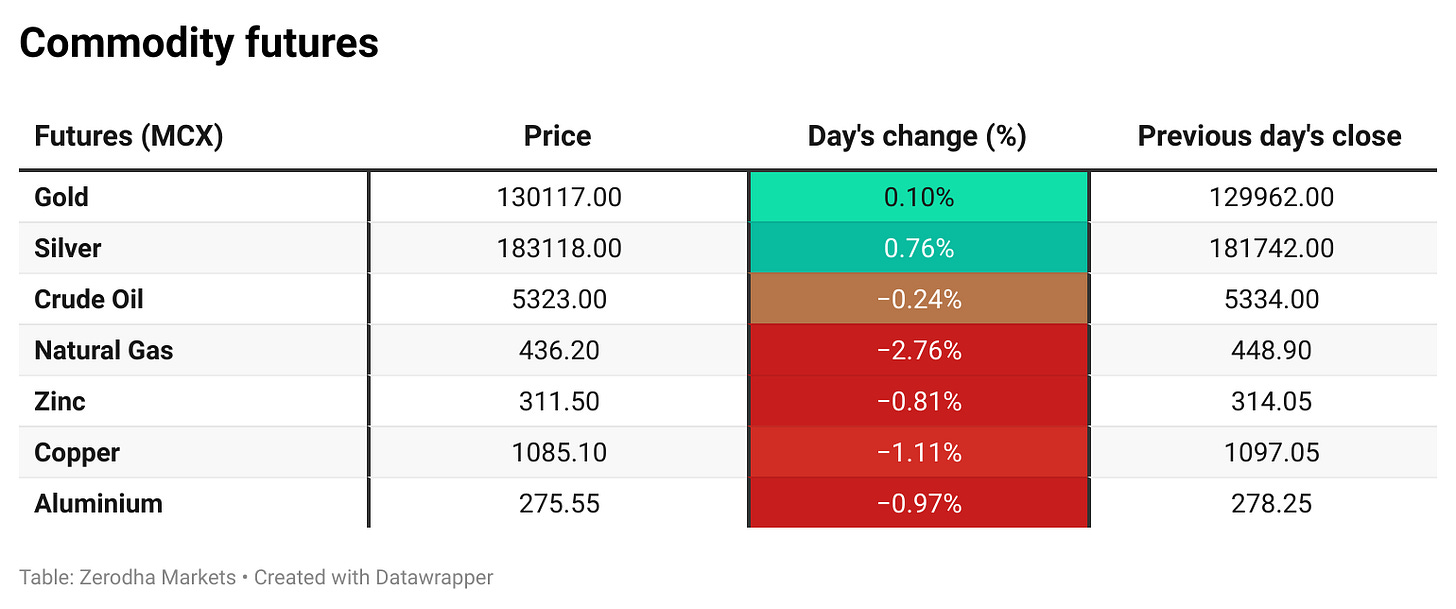

Gold hovered near $4,200/oz as markets fully priced a Fed rate cut while watching for signals on a slower easing path via updated projections and Powell’s guidance. Dive deeper

WTI held near $59/bbl as expectations of a 2026 supply glut and Iraq’s restored output at West Qurna-2 outweighed geopolitical risk premiums. Dive deeper

US small-business optimism rose to 99 in November, its highest in three months, as sales expectations improved and fewer owners cited labour quality as their top problem. Pricing intentions strengthened notably, though expectations for broader business conditions eased. Dive deeper

European stocks edged up slightly ahead of the Fed decision, with sentiment helped by signs the US may allow Nvidia’s H200 chip shipments to approved customers in China. Dive deeper

Germany’s exports edged up 0.1% in October to a six-month high, beating expectations as stronger demand from EU partners offset weaker shipments to major non-EU markets. Exports to the US fell sharply amid tariff effects, while shipments to the UK and China also declined. Dive deeper

China urged trade partners to resist tariffs and protectionism after posting a record $1 trillion trade surplus, warning that escalating trade restrictions are hurting global growth. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Nidhi Dhruv, Moody’s Ratings on IndiGo’s disruptions and near-term financial impact:

“This is mainly because of the loss of revenue, not just from flight cancellations but also refunds and other compensations that may have to be paid to affected customers, and there could be potential penalties imposed by the DGCA.”

“While IndiGo does not have any employee issues, this recent disruption shows that pilots still possess significant collective bargaining power.”

“If the EBIT margin falls below 13% on a sustainable basis, or if liquidity deteriorates significantly, that would be a cause for concern,” - Link

Sandeep Kalra, Chief Executive Officer and Executive Director at Persistent Systems, on AI

“My short answer is AI is not a bubble,”

“If you look at their (Nvidia, AMD, and Broadcom) order books, they are booked out for the next year, two years, and so on. So as far as the AI chip player is concerned, this is less of a bubble, more of a super cycle,”

“It is a multi-year journey, and let’s say three to five years from now, this should be 30 to 40% or more AI native kind of a journey for many,” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!