Nifty trims gains after testing 25,200; holds above 25,100

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

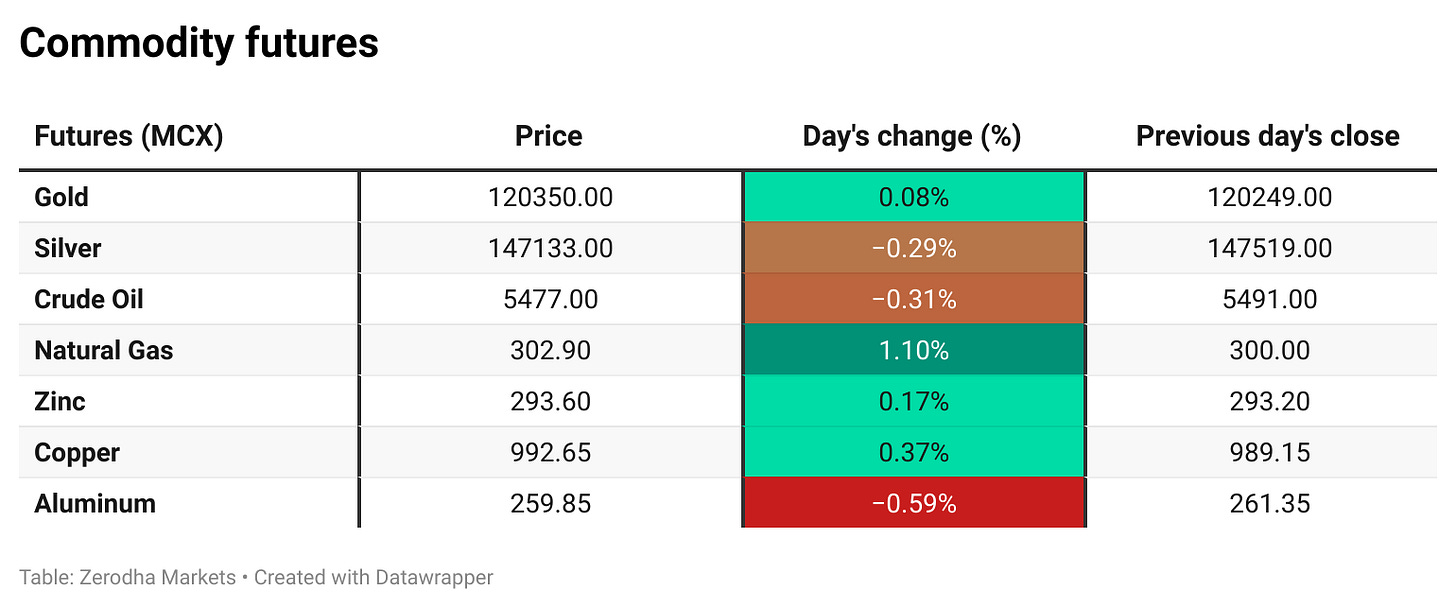

In our latest episode of In The Money by Zerodha video series, Sandeep breaks down the week’s market action despite shortened trading hours—analyzing the RBI’s monetary policy, revised GDP outlook, and their impact on NIFTY and BANKNIFTY’s strong performance led by PSU Banks and Metals. He also explores the precious metals rally with Gold and Silver hitting record highs, contrasted against crude oil’s continued weakness.

Market Overview

Nifty opened flat at 25,085 and moved higher in the early trade, touching the 25,200 zone within the first hour as sentiment stayed mildly positive. However, the index failed to sustain momentum and slipped back toward 25,100 by mid-morning, oscillating in a narrow range.

In the second half, Nifty briefly reclaimed the 25,200 mark but faced profit-booking in the 90 minutes, erasing most of the gains. The index eventually closed nearly unchanged at 25,108.30, marking a subdued session after the previous day’s advance, with participants preferring to stay on the sidelines amid mixed global cues.

Market sentiment has once again turned cautious after tariffs on Pharma and a hike in H1-B visa fees affecting the IT sector. As we advance, investors will closely track the upcoming quarterly results, festival season sales, and management commentary on demand trends across industries.

Broader Market Performance:

Broader markets had a mixed session with a slightly bearish bias today. Of the 3,184 stocks traded on the NSE, 1,433 advanced, 1,634 declined, and 117 remained unchanged.

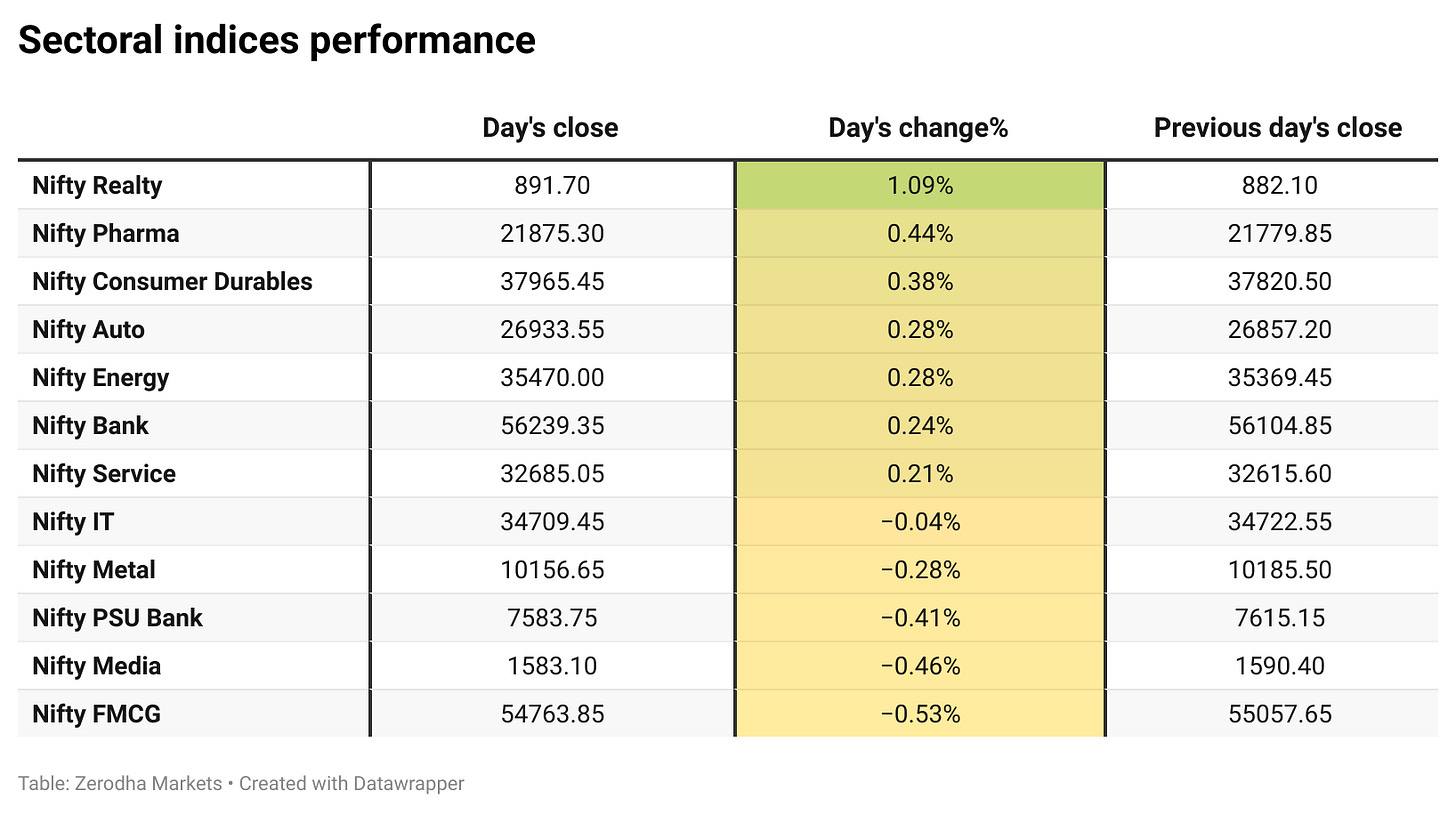

Sectoral Performance

The top-gaining sector for the day was Nifty Realty, which rose 1.09%, while the biggest loser was Nifty FMCG, down 0.53%. Out of the 12 sectoral indices, 7 closed in the green and 5 in the red, indicating a mildly positive market breadth.

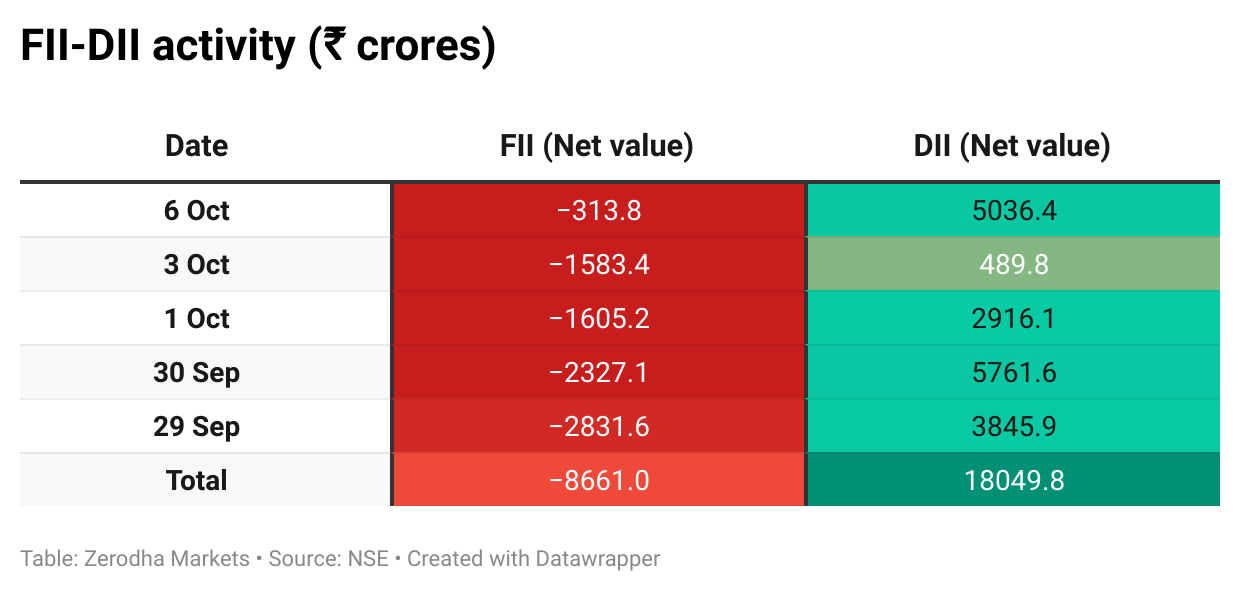

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th October:

The maximum Call Open Interest (OI) is observed at 25,200, followed by 25,500, indicating potential resistance at the 25,200 -25,300 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,100 & 24,900, suggesting strong support at 25,000 to 24,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Jubilant FoodWorks reported a 19.7% rise in consolidated revenue to ₹2,340 crore for Q2 FY26, with standalone revenue at ₹1,699 crore. The company added 93 stores during the quarter, taking its total network to 3,480. Domino’s India saw 9.1% like-for-like growth, while Turkey operations grew 5.6%. Dive deeper

ONGC received clearance to invest ₹8,110 crore in developing 172 onshore wells across eight blocks in Andhra Pradesh. The plan includes ₹172 crore for environmental management and ₹91 crore in annual recurring costs. No wells will be set up within 10 km of Coringa Wildlife Sanctuary. Dive deeper

Brookfield-backed Clean Max plans a ₹5,200 crore IPO in November, including fresh shares and an offer for sale by existing investors. Proceeds will go toward debt repayment and corporate purposes. The company operates 2.54 GW of renewable capacity with 2.53 GW under execution. Dive deeper

Institutional investments in Indian real estate rose 11% to USD 1.27 billion in July-September, driven by strong office asset inflows. Domestic investors contributed 60% of the total, while foreign inflows declined. Colliers said the trend reflects sustained confidence in India’s real estate market. Dive deeper

Auro Realty, the real estate arm of Aurobindo Group, plans to raise ₹20 billion ($225 million) through two-to-four-year bonds to fund a key acquisition, including Hotel Taj Banjara in Hyderabad. The issue, offering coupons of 11-15%, is expected to close this month with private credit funds as investors. Dive deeper

LTIMindtree signed its largest-ever $580 million multi-year deal with a global media and entertainment firm to drive digital transformation. The partnership will modernize operations and boost efficiency. Dive deeper

Brigade Enterprises signed a JDA for a 6.6-acre land parcel in West Chennai to develop a premium residential project with an estimated value of ₹1,000 crore. The ESG-compliant project is slated for launch in 2026. Dive deeper

Zydus Lifesciences received approvals from Health Canada for generic Liothyronine tablets and from the USFDA for Deflazacort oral suspension. The approvals expand its presence in Canada and the US. With these, Zydus now holds 424 cumulative approvals and 487 ANDA filings. Dive deeper

Canara HSBC Life Insurance set a price band of ₹100-106 per share for its ₹2,517 crore IPO, entirely an offer for sale by Canara Bank, HSBC Insurance, and Punjab National Bank. The issue opens on October 10 and closes on October 14. Dive deeper

Adani Green has secured a USD 250 million offshore loan, marking its first major foreign borrowing since the U.S. probe, signaling a partial return of investor confidence in the group. Dive deeper

Bank of India shares jumped 3% before closing flat following a strong Q2 update, driven by an 11.8% YoY rise in its global business to ₹15.62 lakh crore. Dive deeper

What’s happening globally

The S&P 500 and Nasdaq closed at fresh all-time highs, driven by renewed optimism from AI-related dealmaking, particularly a surge in semiconductor and tech names despite ongoing concerns over the U.S. government shutdown. Dive deeper

WTI crude fell to $61.3 per barrel as oversupply concerns outweighed OPEC+’s smaller-than-expected output hike of 137,000 bpd. Rising Venezuelan exports and resumed Kurdish flows added pressure, though Russian supply risks limited losses. Dive deeper

Gold prices slipped to around $3,950 per ounce but stayed near record highs, supported by safe-haven demand amid the U.S. government shutdown and rate-cut expectations. Dive deeper

France’s trade deficit narrowed to €5.5 billion in August, the smallest since December 2024, as imports fell 0.4% to €57.3 billion while exports held steady at €51.8 billion. Strong transport and agricultural exports offset weaker petroleum and industrial goods. Dive deeper

The U.S. Logistics Manager’s Index fell to 57.4 in September, a six-month low, indicating slower sector growth. Transportation stagnated while inventory expansion eased. Warehousing activity improved, though prices dropped sharply. Dive deeper

The U.S. Supreme Court refused to block an order requiring Google to reform its Play Store after Epic Games’ antitrust win. The ruling mandates allowing rival app stores and external payment links. Google plans to appeal the decision by October 27. Dive deeper

The dollar index rose for a second straight session to 98.4, its highest in two weeks, supported by weakness in the euro and yen. The U.S. government shutdown entered its seventh day, delaying key data releases. Dive deeper

Germany’s factory orders fell 0.8% in August, marking a fourth straight monthly decline amid weakness in autos, electronics, and pharmaceuticals. Foreign demand dropped sharply, while domestic orders rose. Overall, industrial activity remained subdued, down 2.3% on a three-month average. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nitin Gadkari, Union Minister for Road Transport and Highways, on EV adoption and industry growth

“Within the next 4-6 months, the cost of electric vehicles will be equivalent to the cost of petrol vehicles.”

“India spends ₹22 lakh crore annually on fuel imports, a major economic and environmental burden that makes clean energy adoption crucial.”

“Our goal is to make India’s automobile industry the number one in the world within five years, building on its current size of ₹22 lakh crore.” - Link

Piyush Goyal, Union Minister for Commerce and Industry, on India-U.S. trade pact negotiations

“We are in constant dialogue with the U.S. on the trade pact, and talks are progressing at various levels.”

“There is every possibility of meeting the November deadline for concluding the negotiations.”

“You all know, the U.S. government is currently in shutdown mode, so we’ll have to see how, where, and when the next round of discussions can take place.” - Link

World Bank on India’s economic outlook for 2025-26

“India is expected to remain the world’s fastest-growing major economy, underpinned by continued strength in consumption growth.”

“The growth forecast for 2025–26 has been raised to 6.5%, supported by strong domestic demand and GST reforms simplifying compliance.”

“However, the 50% U.S. tariff on Indian exports will have implications next year, leading to a slightly lower 6.3% forecast for 2026–27.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

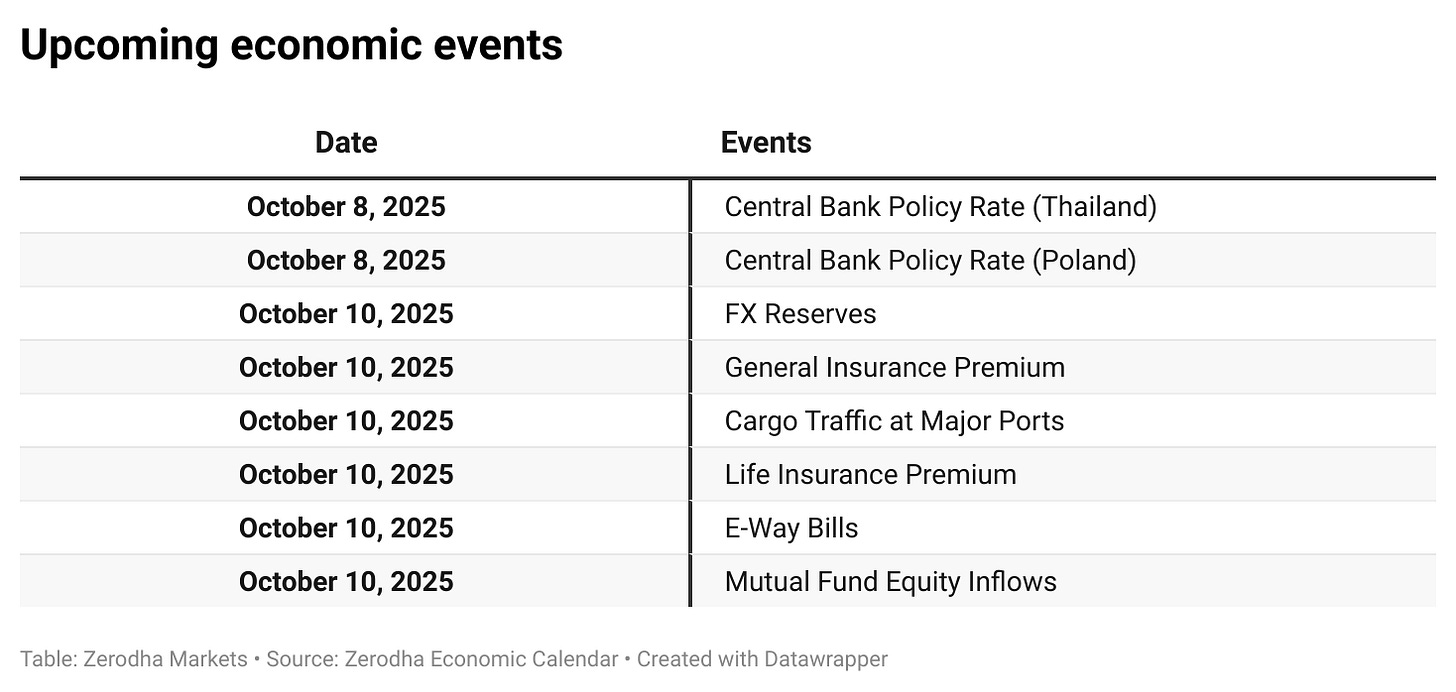

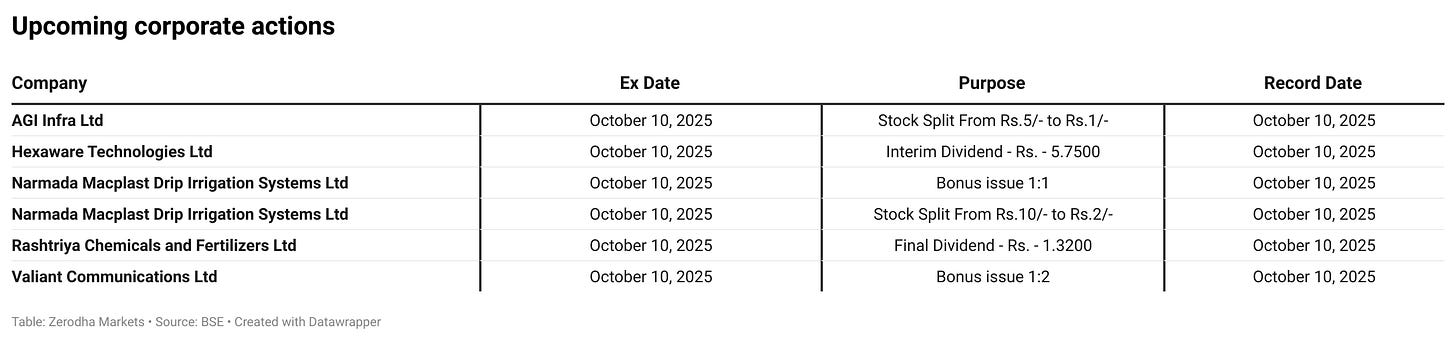

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!