Nifty tests 26,000 but closes flat; Markets brace for Bihar election outcome tomorrow

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down the story of FPI (formerly FII) and DII flows — their origins, evolution, and how they became dominant forces in India’s equity markets. From the 1990s market liberalization to the post-2016 shift where domestic investors absorbed foreign selling, we explore the economic, regulatory, and behavioral drivers behind these trends — and ask whether tracking daily or weekly FPI-DII data truly gives traders an edge.

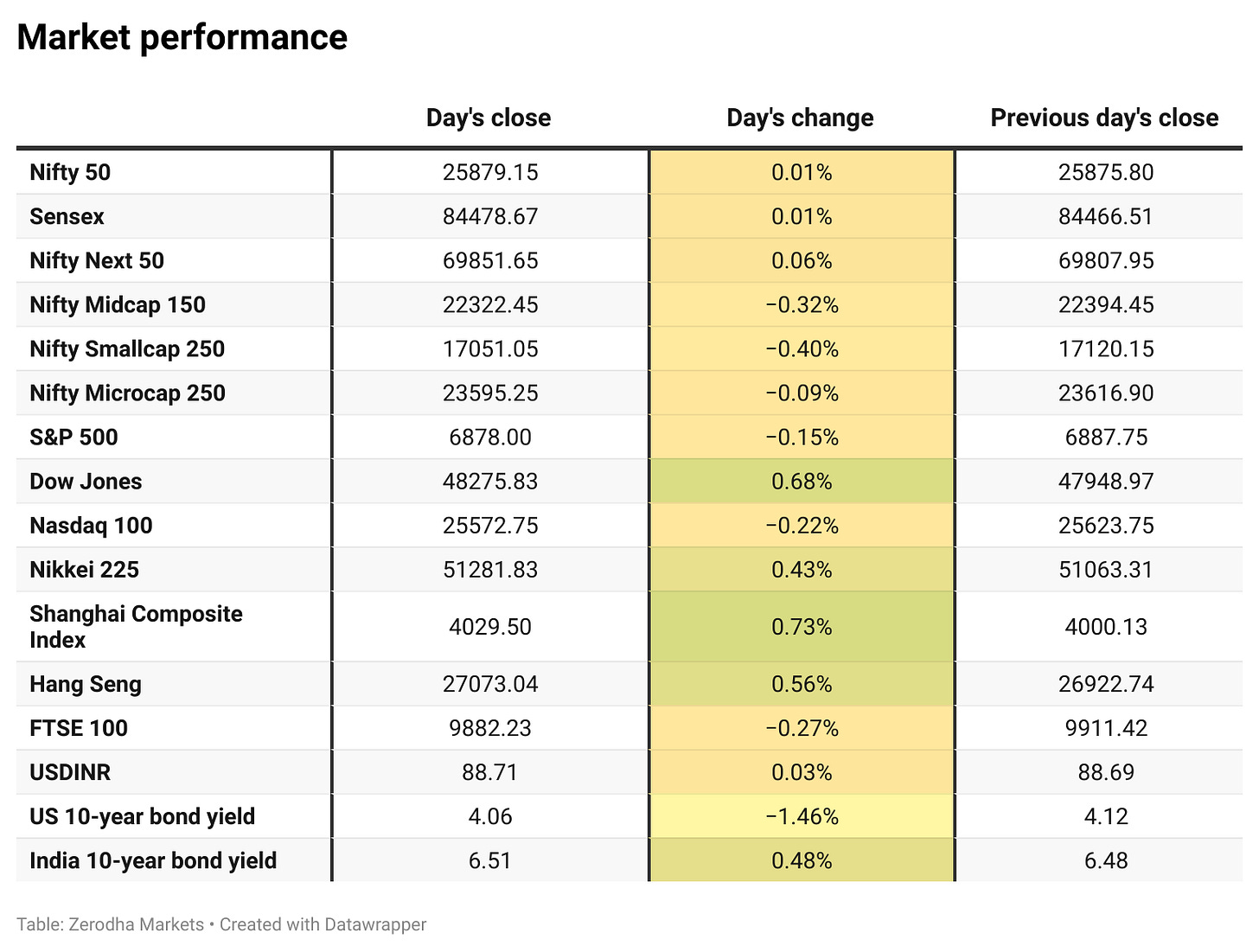

Market Overview

Nifty opened with a 30-point gap-up at 25,906 but quickly slipped 80–90 points, testing the 25,810–25,820 zone within the first few minutes. After stabilising around 25,820–25,850 for most of the opening hour, the index gradually recovered, climbing past 25,940 by 11 AM and sustaining above the 25,950 mark through the late morning session.

By mid-day, Nifty maintained its positive tone and inched toward an intraday high of 26,010 before mild profit-booking capped the upside. In the second half, the index drifted slightly lower as buying momentum softened, but it continued to hold firm above the 25,850–25,860 range. By the close, Nifty ended flat at 25,879.15.

Looking ahead, markets are likely to stay sensitive to developments around the India–U.S. trade deal and the Bihar state election results tomorrow, both of which could introduce short-term volatility. Investors will also track Q2 earnings and management commentary on festive-season demand trends following the recent GST rate cuts.

Broader Market Performance:

The broader markets had a mixed session with a bearish bias today. Of the 3,187 stocks traded on the NSE, 1,366 advanced, 1,730 declined, and 91 remained unchanged.

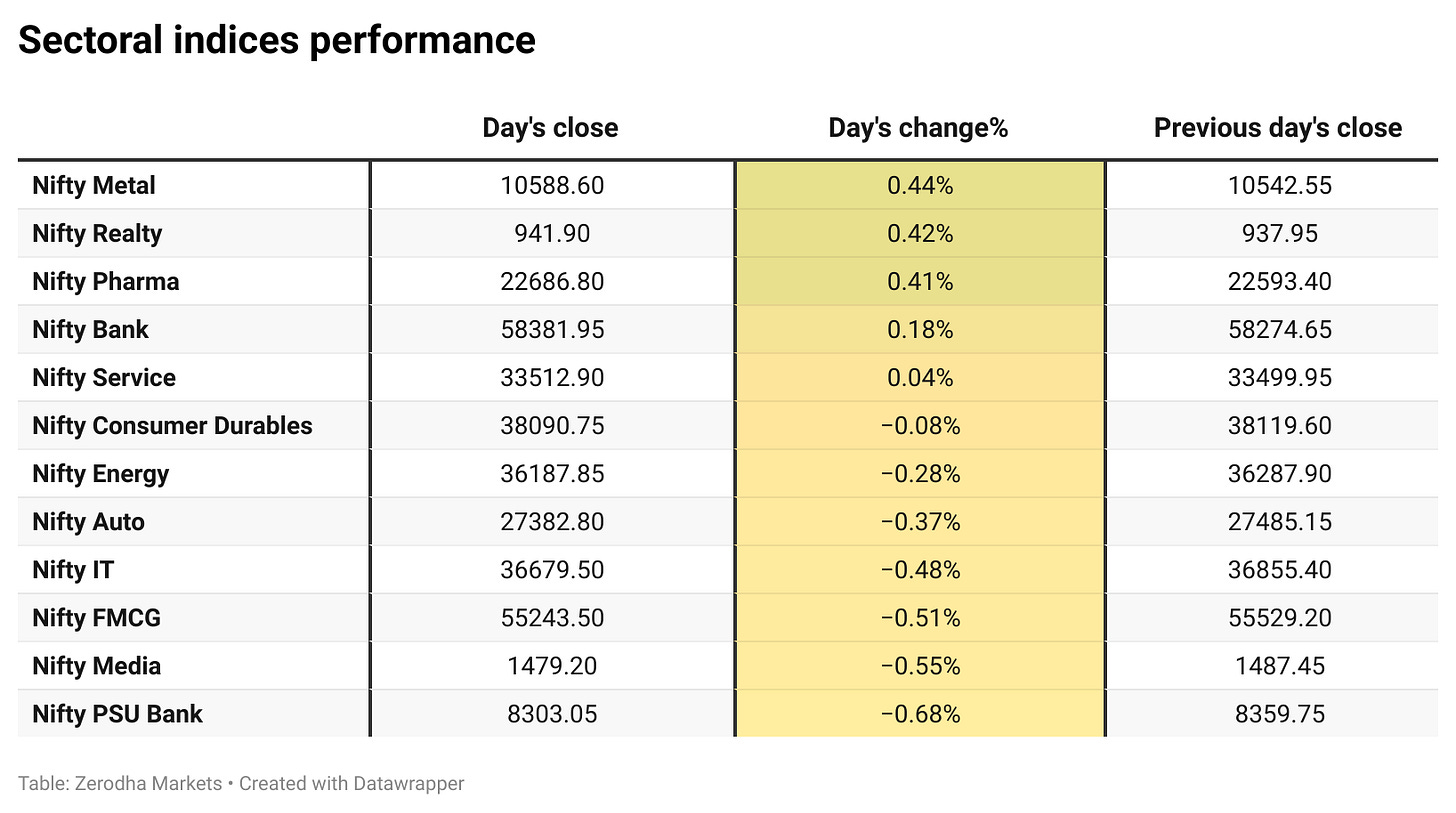

Sectoral Performance:

Nifty Metal emerged as the top gainer, rising 0.44%, while Nifty PSU Bank was the biggest loser, slipping 0.68%. Out of the 12 sectoral indices, 5 ended in the green and 7 closed in the red, reflecting a largely subdued market breadth.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 18th November:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,200, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,800, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

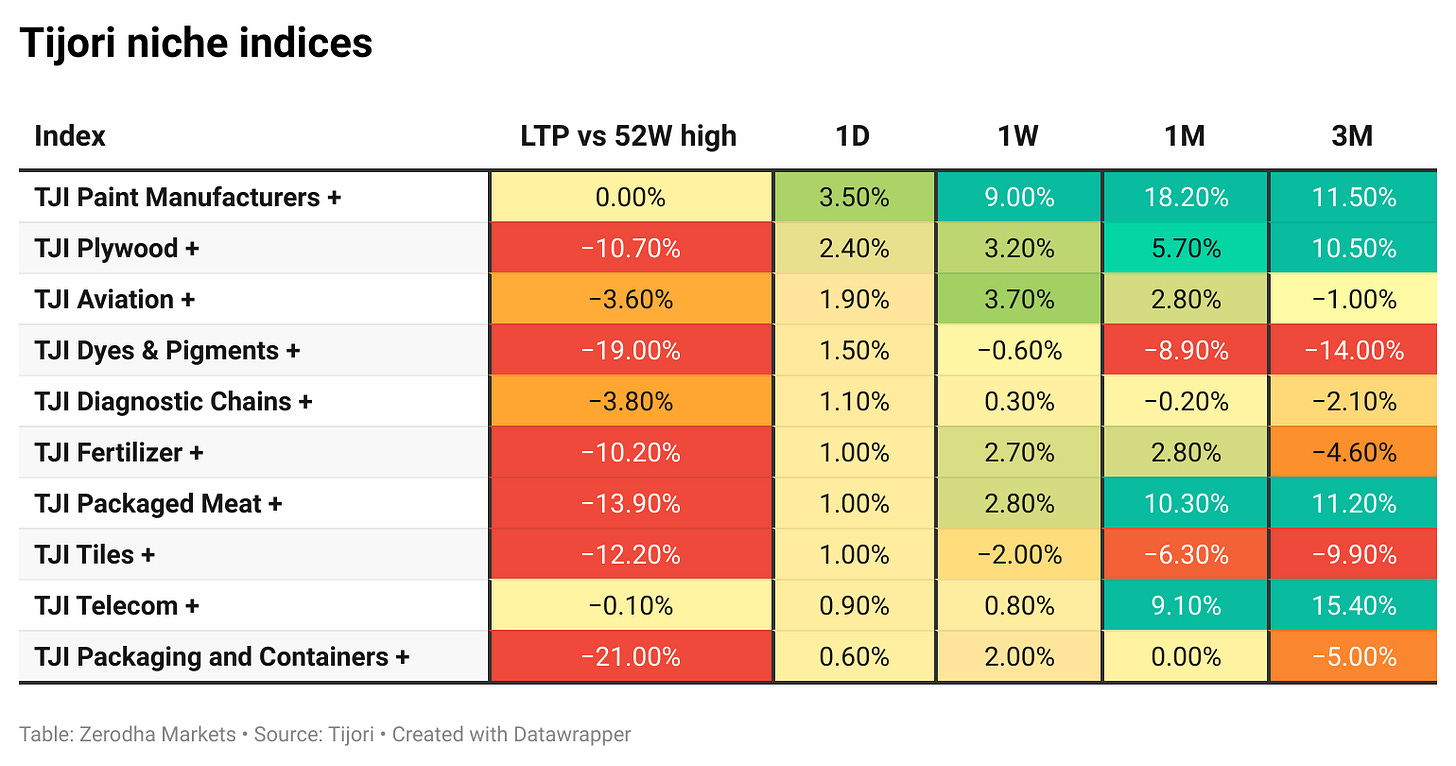

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The government has approved a ₹25,060 crore Export Promotion Mission for six years, implemented through the Niryat Protsahan and Niryat Disha schemes. The programme aims to support exporters facing high U.S. tariffs by improving access to trade finance and strengthening non-financial enablers like compliance, branding, and logistics. Dive deeper

Coal production fell 8.5% in October to 77.43 MT as prolonged monsoons hit output and lowered power demand. Power generation also declined, with coal-based generation down sharply and overall offtake weakening across most sectors. Dive deeper

Biocon is evaluating a restructuring of its biosimilars arm, Biocon Biologics, including a potential $4.5 billion internal merger with the parent. Other options under review include an IPO and share swap as the company looks to unlock value and streamline operations. Dive deeper

Kinara Capital is negotiating a ₹1,150 crore debt recast with international lenders and finalising a one-time settlement with domestic lenders after recent payment delays. The company is also looking to raise about ₹200 crore from strategic investors while halting new lending to focus on collections. Dive deeper

Tata Steel reported Q2 net profit of ₹3,183 crore, driven by strong performance in its India business, where profit and turnover both increased. The board also approved a ₹1,100 crore acquisition to take full control of Tata BlueScope Steel. Dive deeper

Ashok Leyland’s Q2 net profit rose to ₹756 crore on revenue of ₹10,544 crore, supported by growth across truck and bus segments. Export volumes also increased during the quarter. The board declared an interim dividend of ₹1 per share. Dive deeper

Debt mutual funds saw a strong rebound in October with inflows of ₹1.59 lakh crore as investors turned cautious on equities. Liquid and overnight funds led the surge, while equity inflows moderated during the month. Dive deeper

Cochin Shipyard’s Q2 net profit fell sharply to ₹101 crore from ₹193 crore, hurt by higher subcontracting costs and provisions, while revenue declined to ₹951 crore. The company also declared an interim dividend of ₹4 per share. Dive deeper

Honasa Consumer, the parent of Mamaearth, reported a ₹39 crore profit in Q2FY26, reversing last year’s loss. Revenue grew year-on-year with strong performance across key categories. Dive deeper

Black Box reported a Q2 PAT of ₹56 crore, up 9% year-on-year, with revenue rising to ₹1,585 crore. The company’s order backlog and quarterly bookings also increased, supported by strong demand in data centres and digital infrastructure. Dive deeper

Prestige Estates reported a Q2 net profit of ₹457.4 crore, nearly doubling from last year, supported by higher income and lower expenses. Total income for the quarter rose to ₹2,698 crore. Dive deeper

Sweden-based Modern Times Group is preparing a $450 million IPO in India for its gaming arm PlaySimple, targeting listing in H1 2026. Dive deeper

The Indian Government has imposed anti-dumping duties for five years on certain Vietnamese steel imports, aiming to protect domestic producers from subsidised foreign competition. Dive deeper

What’s happening globally

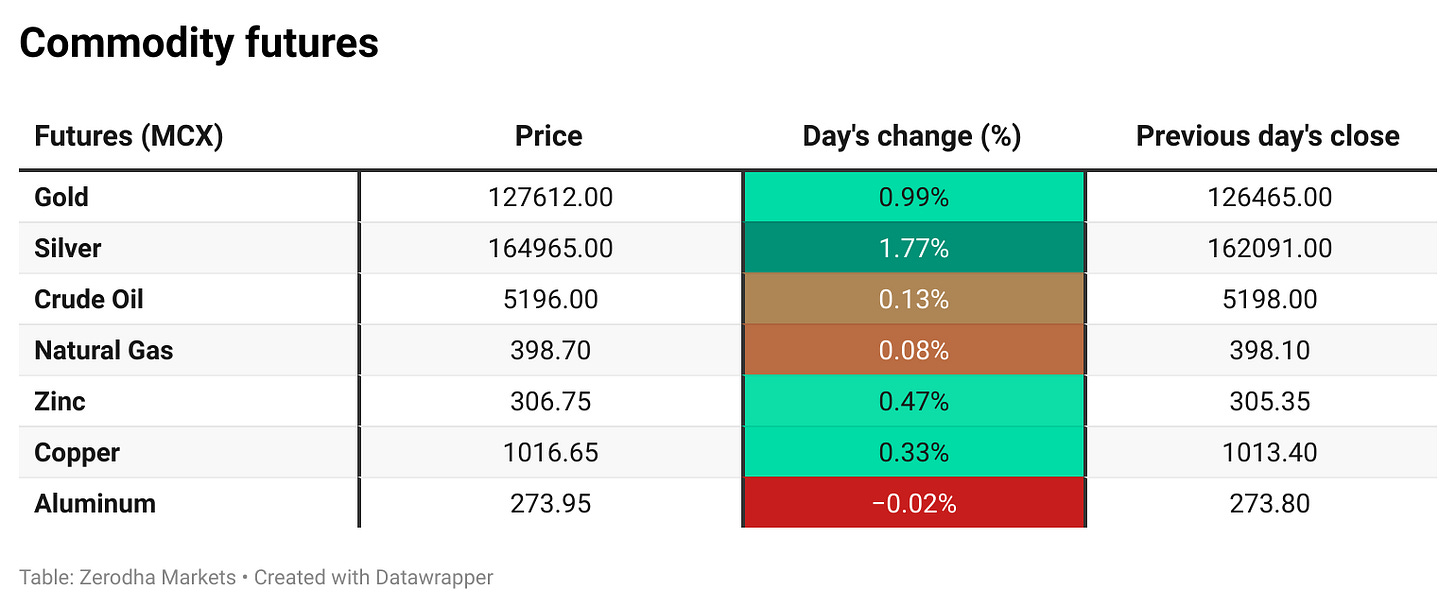

WTI crude traded around $58.8 per barrel after a sharp drop, as the IEA projected large global oil surpluses for this year and next, with supply outpacing demand. Rising US output and new inventory builds further reinforced oversupply concerns. Dive deeper

Gold rose above $4,230 per ounce to a three-week high as investors focused on the Fed’s rate outlook after the US government reopened. Private labour data indicating job weakness strengthened expectations of another rate cut. Dive deeper

European natural gas futures fell to €30.5/MWh, the lowest since May 2024, as strong LNG arrivals, Norwegian flows, and mild, windy weather reduced demand. EU storage remains over 82%, even as renewed Russian strikes on Ukrainian infrastructure raise winter supply concerns. Dive deeper

China’s new yuan loans fell sharply to CNY 220 billion in October, well below expectations and last year’s levels, reflecting weak credit demand and economic softness. Total social financing also dropped significantly, with loan growth slowing to its lowest pace since at least 1998. Dive deeper

The UK economy grew 0.1% in Q3 2025, slowing from Q2 and missing expectations as production contracted and services moderated. Manufacturing was hit particularly hard by a cyberattack at Jaguar Land Rover, while annual GDP rose 1.3%. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Jaiprakash Toshniwal, Fund Manager, LIC MF Asset Management, on market valuations and outlook

“Markets are fairly valued even as Nifty nears 26,000, with valuations close to the 10-year rolling average.”

“We expect high single-digit earnings growth in FY26 and lower double-digit growth in FY27, supported by banking, pharma, and IT.”

“The recent rally has strong structural backing from retail credit growth, improving liquidity, and solid domestic demand.” - Link

Niraj Shah, Executive Director, HDFC Life, on post-GST surge in pure protection demand

“Retail protection growth jumped over 50% in September after GST removal, with Q2 protection growing 27%, nearly 2.5x overall company growth.”

“GST exemption has made term insurance more affordable and accelerated first-time buyer adoption.”

“We expect sustained momentum in protection demand as awareness and affordability continue improving.” - Link

Dheeraj Hinduja, Chairman, Ashok Leyland, on Q2 performance and outlook

“We continue to deliver profitable growth, driven by sustained demand and strong customer focus.”

“In international business, we are intensifying expansion across the Middle East, Africa, and SAARC, with Switch Mobility holding an order book of nearly 1,500 vehicles.”

“Our robust all-round performance reflects the competitiveness of our products and positions us well for continued momentum.” - Link

Anish Shah, Group CEO & Managing Director, Mahindra Group, on the 50:50 life insurance joint venture with Manulife

“Life insurance is a logical extension of our financial services portfolio, supported by Mahindra’s brand strength and deep rural distribution.”

“Manulife is the best partner for us, bringing global product, underwriting, and reinsurance capabilities.”

“With a strong tech-led approach, the joint venture aims to build an efficient, customer-centric insurer and create meaningful value for shareholders.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!