Nifty sustains above 25,300 on trade optimism; Fed decision in focus

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore the three main streams of market analysis: Technical, Fundamental, and Alternative data. No matter whether you trade systematically or with discretion, the decisions you make depend on the information you use. Each of these approaches gives you a different lens on the market — and when combined, they can help you form a more complete view of a stock, index, or commodity.

Market Overview

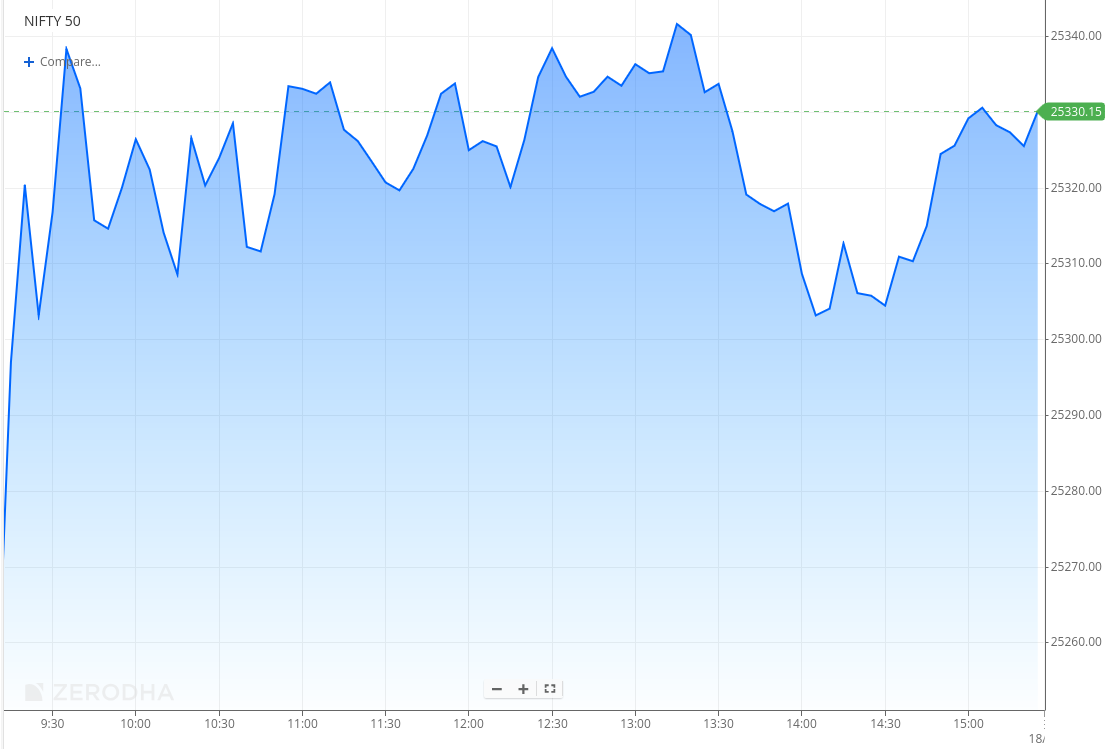

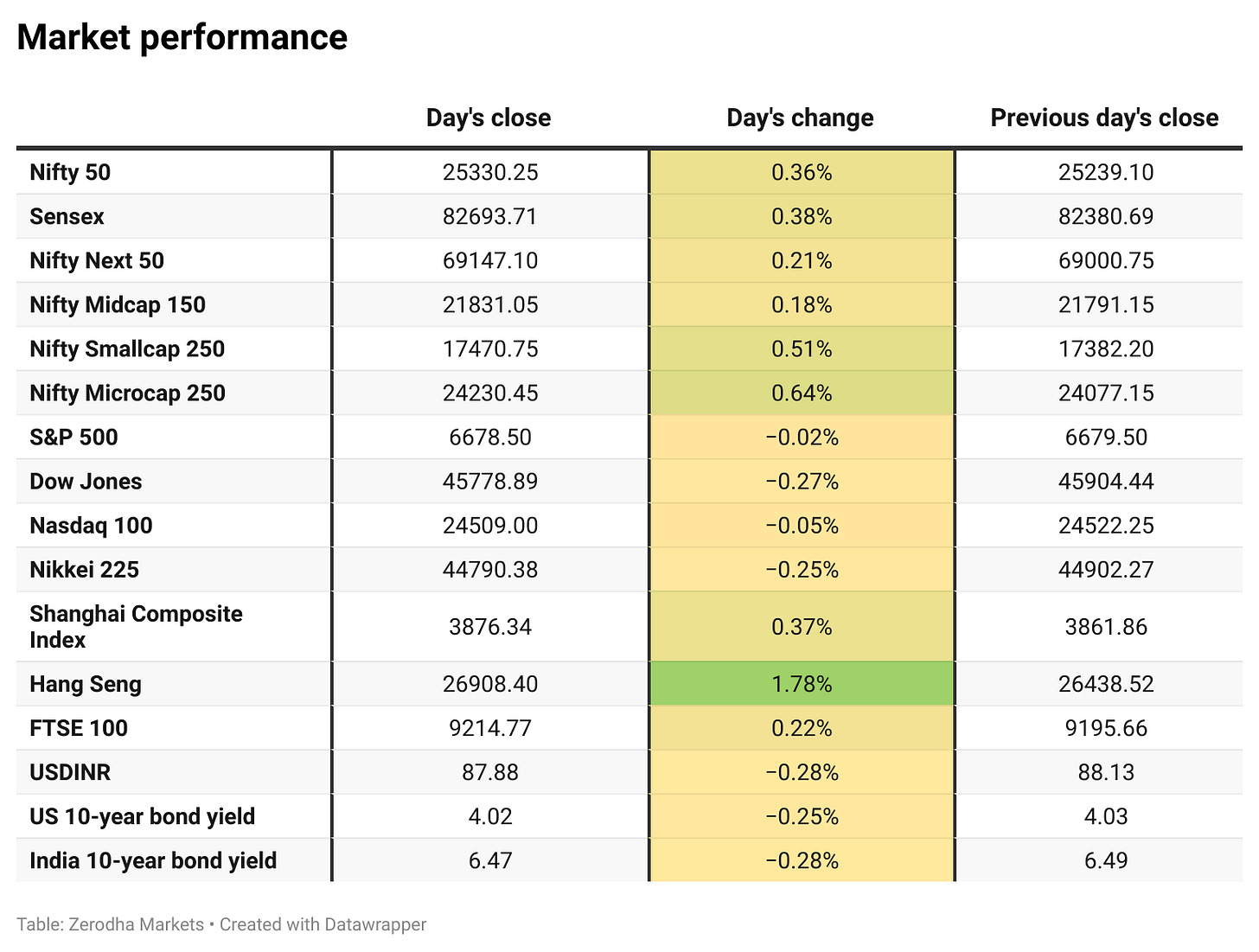

Nifty opened with a 38-point gap-up at 25,277 and extended gains in the opening hour, moving past 25,320. Through the morning session, the index held firm, consolidating within the 25,310–25,340 range.

In the second half, Nifty remained largely steady, with mild intraday dips finding support near 25,300. A late rebound lifted the index back toward the highs, and it eventually closed at 25,330.25, up 0.36%, comfortably holding above the 25,300 mark.

Market sentiment is slowly tilting from caution to optimism, supported by signs of easing U.S.-India trade tensions. Still, worries over steep 50% tariffs, persistent foreign investor outflows, and muted earnings are tempering the upside. Investors are also closely watching tonight’s U.S. Fed interest rate decision for further cues.

Broader Market Performance:

Broader markets had a bullish session today. Of the 3,177 stocks traded on the NSE, 1,763 advanced, 1,313 declined, and 101 remained unchanged.

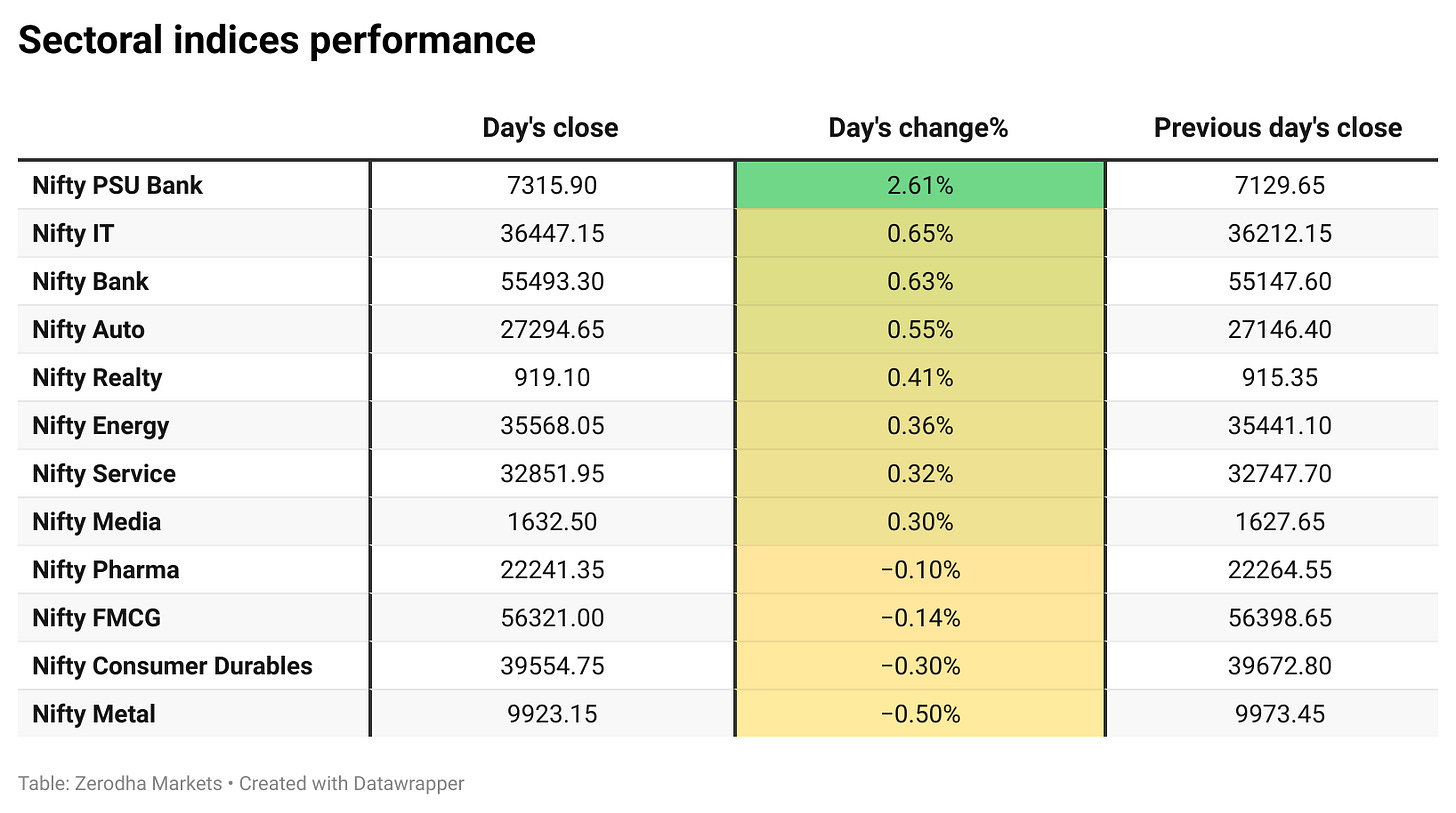

Sectoral Performance

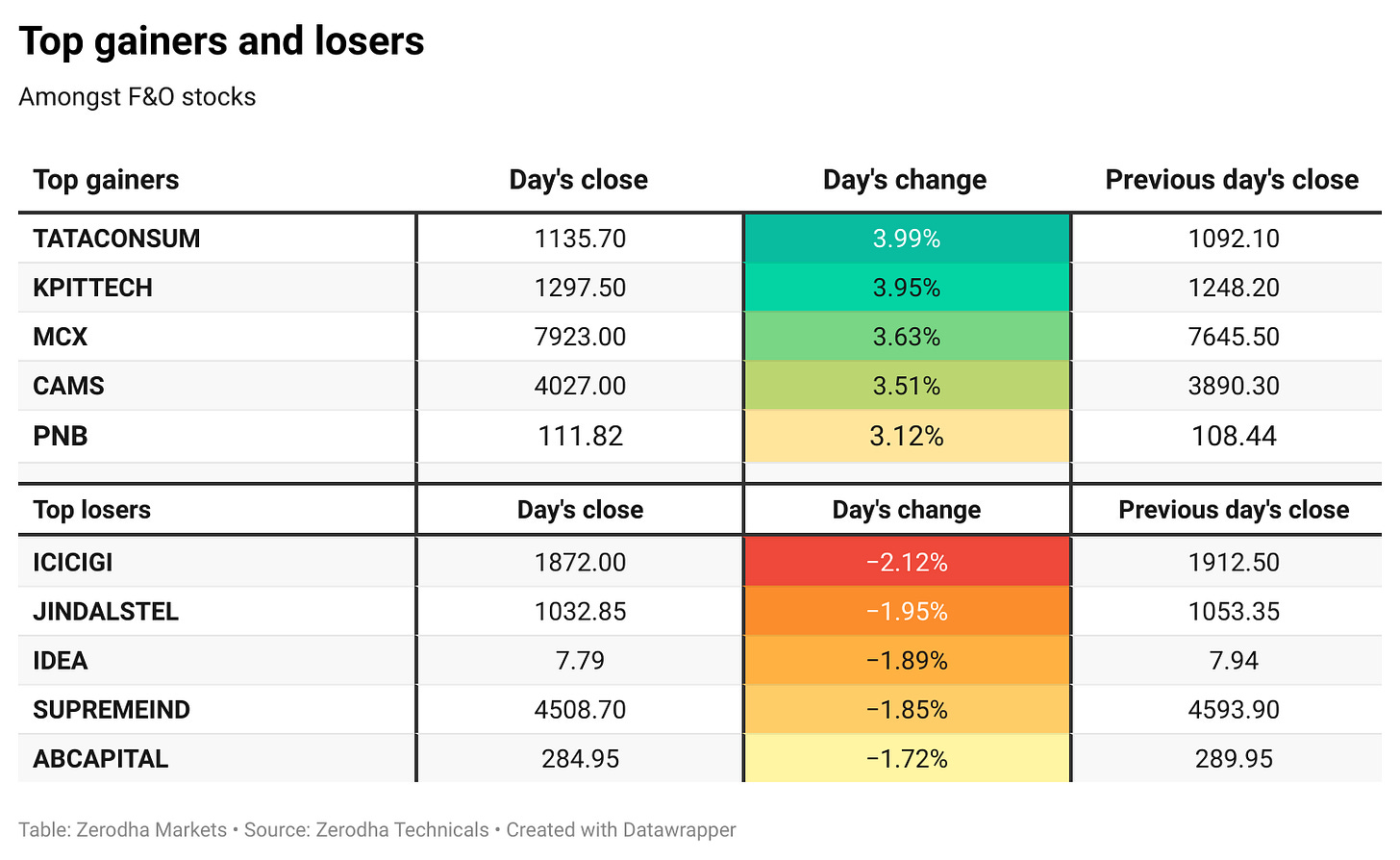

Nifty PSU Bank was the top gainer of the day, rising 2.61%, while Nifty Metal was the worst performer, slipping 0.50%. Out of the 12 sectoral indices, 8 closed in the green and 4 ended in the red.

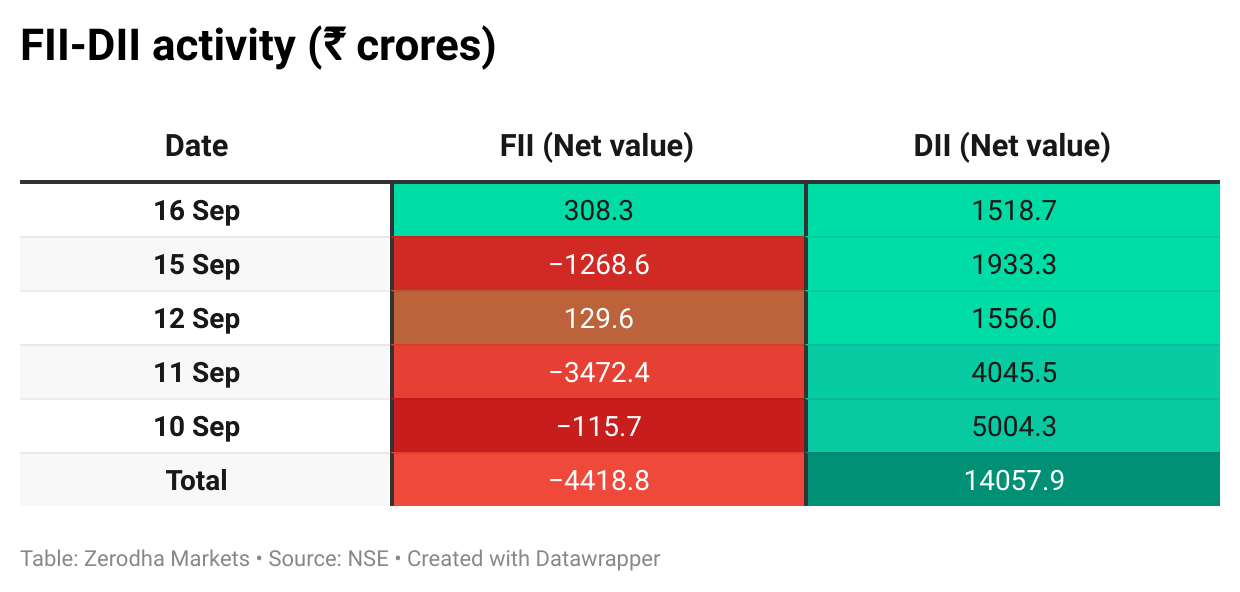

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd September:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,400, suggesting strong resistance at 25,400 - 25,500 levels.

The maximum Put Open Interest (OI) is observed at 25,300, followed closely by 25,200, suggesting strong support at 25,200 to 25,100 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

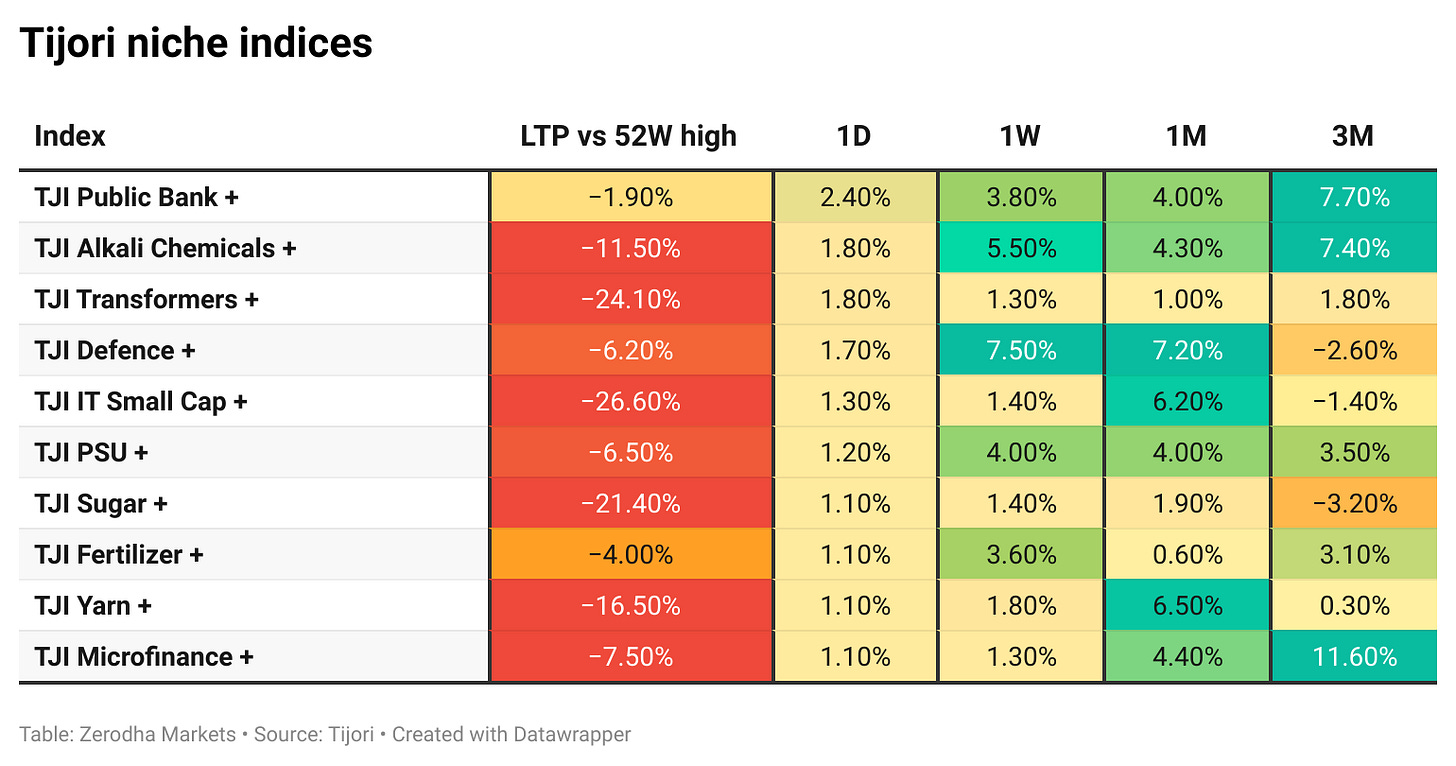

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee gained 25 paise to close at 87.84/$ on Wednesday, its strongest in over two weeks, supported by upbeat equities, Fed rate cut hopes, and optimism around U.S.–India trade talks. Dive deeper

Hyundai Motor India signed a wage settlement with its recognised union for 2024–2027, effective from April 1, 2024. The agreement provides a monthly salary increase of ₹31,000, phased in over three years at 55%, 25%, and 20%. HMIL said the pact reflects mutual trust and a focus on employee welfare and long-term growth. Dive deeper

SBI has divested its 13.19% stake in Yes Bank to Japan’s Sumitomo Mitsui Banking Corporation for ₹8,889 crore at ₹21.50 per share, after securing RBI and CCI approvals. The stake sale was part of commitments made under the RBI’s 2020 reconstruction scheme, which involved a consortium of eight banks led by SBI. Dive deeper

The government raised strong objections to Vedanta’s demerger, citing concealment of details, inflated revenues, and risks to dues recovery, while Sebi flagged breaches. The Supreme Court also rejected Vedanta’s plea for extra compensation on the Talwandi Sabo project. Dive deeper

Luxury housing in India is booming while affordable supply lags, with a 10 million-home deficit that could triple by 2030. Rising prices, stagnant wages, and soaring rentals are pricing out first-time buyers despite rate cuts. Dive deeper

HCL Technologies’ software arm launched HCL Unica+, an AI-first MarTech platform designed for India’s multi-lingual digital market of over 800 million users. Already deployed by a leading bank, it manages 500 million accounts and 1.4 billion touchpoints across 28 languages. Dive deeper

Mobikwik reported a suspected ₹40 crore fraud after a system glitch let nearly 5 lakh UPI transactions bypass balance checks and PIN verification. Police have frozen ₹8 crore, arrested six men, and are probing possible insider involvement. The company said it has so far recovered ₹14 crore, with the net impact estimated at ₹26 crore. Dive deeper

DreamFolks Services has exited the domestic airport lounge business with immediate effect, terming the impact material. Other domestic services and global lounge operations will continue, with discussions on alternate offerings underway. The move follows recent contract terminations by partners, including Travel Food Services, Adani Airports, and GMR Airports. Dive deeper

Mahindra Lifespace Developers has secured two society redevelopment projects in Chembur, Mumbai, with a combined gross development potential of ₹1,700 crore. The projects span 2.6 acres and 1.8 acres, adding significantly to the company’s portfolio. Dive deeper

Adani Ports and SEZ will invest ₹30,000 crore over two years to expand operations, mainly at Mundra, Dhamra, and Vizhinjam, aiming for one billion tonnes of cargo handling by 2030. The plan covers ports, logistics, renewables, and marine services, with a focus on berth and terminal expansion. Dive deeper

ESAF Small Finance Bank plans to raise ₹300–500 crore in tier-1 capital to strengthen adequacy and fund growth, with details to be decided on September 20. The bank is shifting toward secured lending while cutting microloans, which fell 31% year-on-year. Dive deeper

What’s happening globally

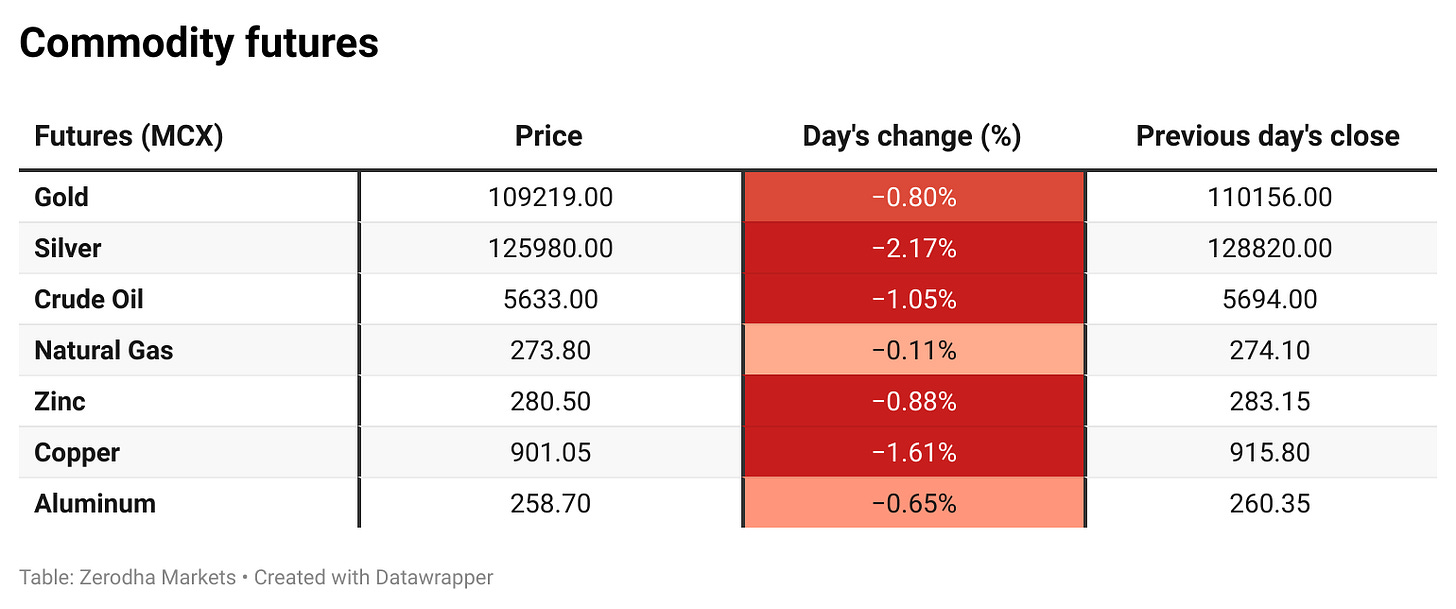

Brent crude fell to $68 per barrel as markets weighed reports of Ukrainian strikes on Russian energy assets, later denied by Transneft. European officials called for faster cuts in Russian fuel imports. US crude inventories dropped 3.42 million barrels, more than double forecasts, while traders awaited the Fed’s policy decision. Dive deeper

Gold traded near $3,670 per ounce after briefly testing the $3,700 level, as markets awaited the Fed’s policy decision with a 25 bps cut widely expected. Softer payroll data reinforced expectations for multiple cuts this year. Dive deeper

The UK’s inflation rate stayed at 3.8% in August, matching July and forecasts, with declines in transport, services, and clothing offset by higher food, fuel, and hospitality costs. Monthly CPI rose 0.3% after a 0.1% gain in July. Core inflation eased to 3.6% from 3.8%. Dive deeper

US housing starts fell 8.5% in August to 1.307 million units, one of the lowest levels since 2020. Single-family and multi-family starts both declined, with single-family at a 13-month low. Sharp drops in the South and Midwest offset gains in the West and Northeast. Dive deeper

The average 30-year US mortgage rate fell to 6.39% in the week ending September 12, its lowest since October 2024. Rates declined for a third week, tracking lower Treasury yields amid Fed rate cut expectations. Mortgage applications rose 29.7%, with refinancing surging 58%. Dive deeper

South Africa’s inflation eased to 3.3% in August from 3.5% in July, below market expectations of 3.6%. The slowdown was driven by softer food prices and a sharper fuel cost decline. Core inflation inched up to 3.1%, while monthly CPI slipped 0.1%. Dive deeper

Bank Indonesia cut its benchmark rate by 25 bps to 4.75% in September, its lowest since October 2022, against expectations of a hold. The move, part of 150 bps easing since last year, reflects stable inflation, a firm rupiah, and growth support. GDP rose 5.12% in Q2, while inflation eased to 2.31% in August. Dive deeper

Tencent raised 9 billion yuan ($1.27 billion) through a three-tranche offshore yuan bond deal, issuing 5-, 10-, and 30-year bonds priced tighter than initial guidance. The move comes as the company moderates capital expenditure after heavy AI investments. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nirmala Sitharaman, Finance Minister, on GST 2.0 reforms

"GST 2.0 will put ₹2 lakh crore into the hands of the common man by reducing the tax burden and improving liquidity in the economy."

"From September 22, there will be only two slabs, 5% for common consumer goods and 18% for others, replacing the earlier five-slab system."

"Taxes on essentials like soaps, toothpaste, medicines, two-wheelers, cars, TVs, and cement have been cut sharply, directly benefiting the middle class and the poor." - Link

Steel Secretary Sandeep Poundrik on National Mission for Sustainable Steel

"The government is working on a ₹5,000 crore scheme to promote clean steel-making technologies and reduce carbon emissions."

"About 75–80% of the fund will be earmarked for secondary steel players, with incentives linked to how much emissions are reduced year-on-year."

"This scheme will push decarbonisation in one of India’s hardest-to-abate sectors, which currently contributes 12% of the country’s greenhouse gas emissions." - Link

Commerce Ministry on India - U.S. trade talks

"Discussions between India and the U.S. were positive and forward-looking, with both sides agreeing to intensify efforts for an early conclusion of a trade agreement."

"The Indian team, led by Rajesh Agrawal, met Brendan Lynch and the U.S. delegation for nearly seven hours in New Delhi."

"While the sixth official round of talks was called off after U.S. tariff hikes, both sides agreed to continue negotiations virtually to move the process forward." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

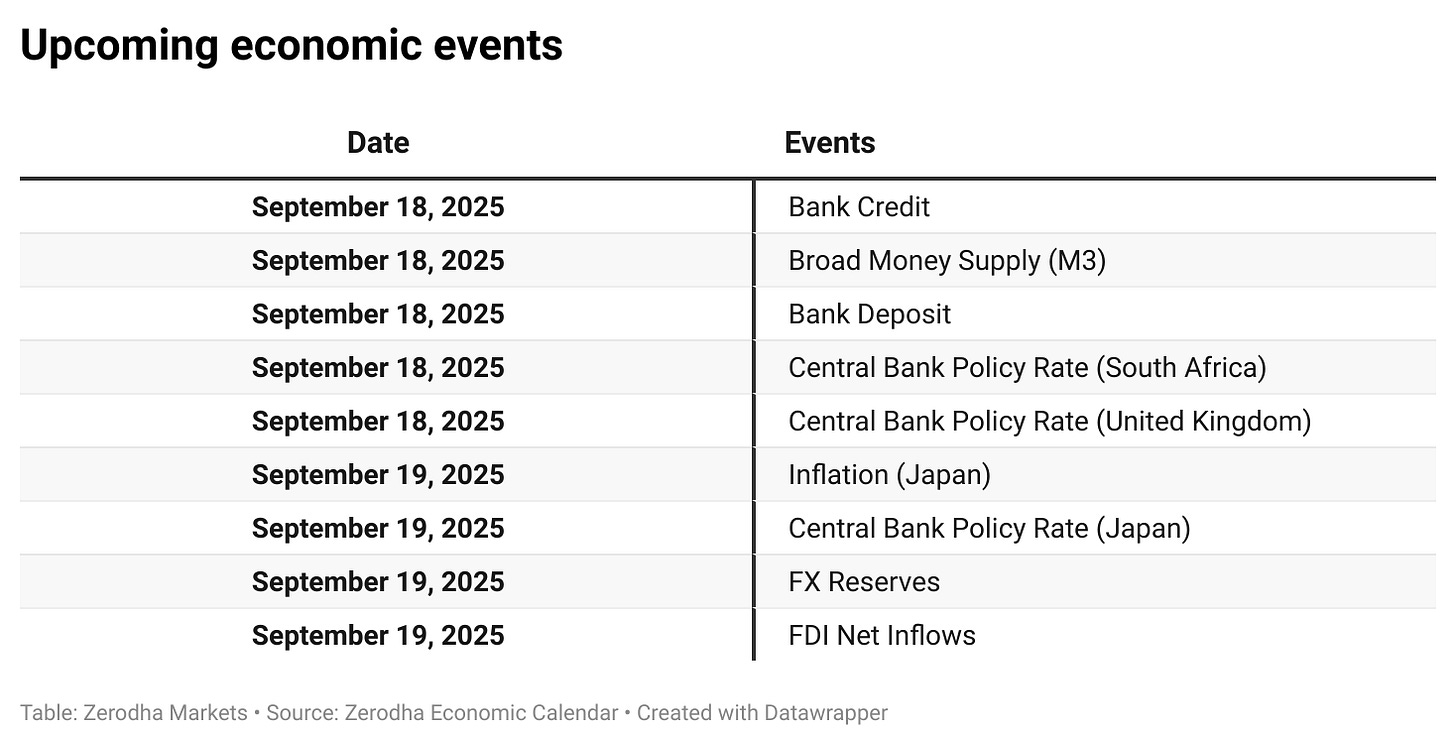

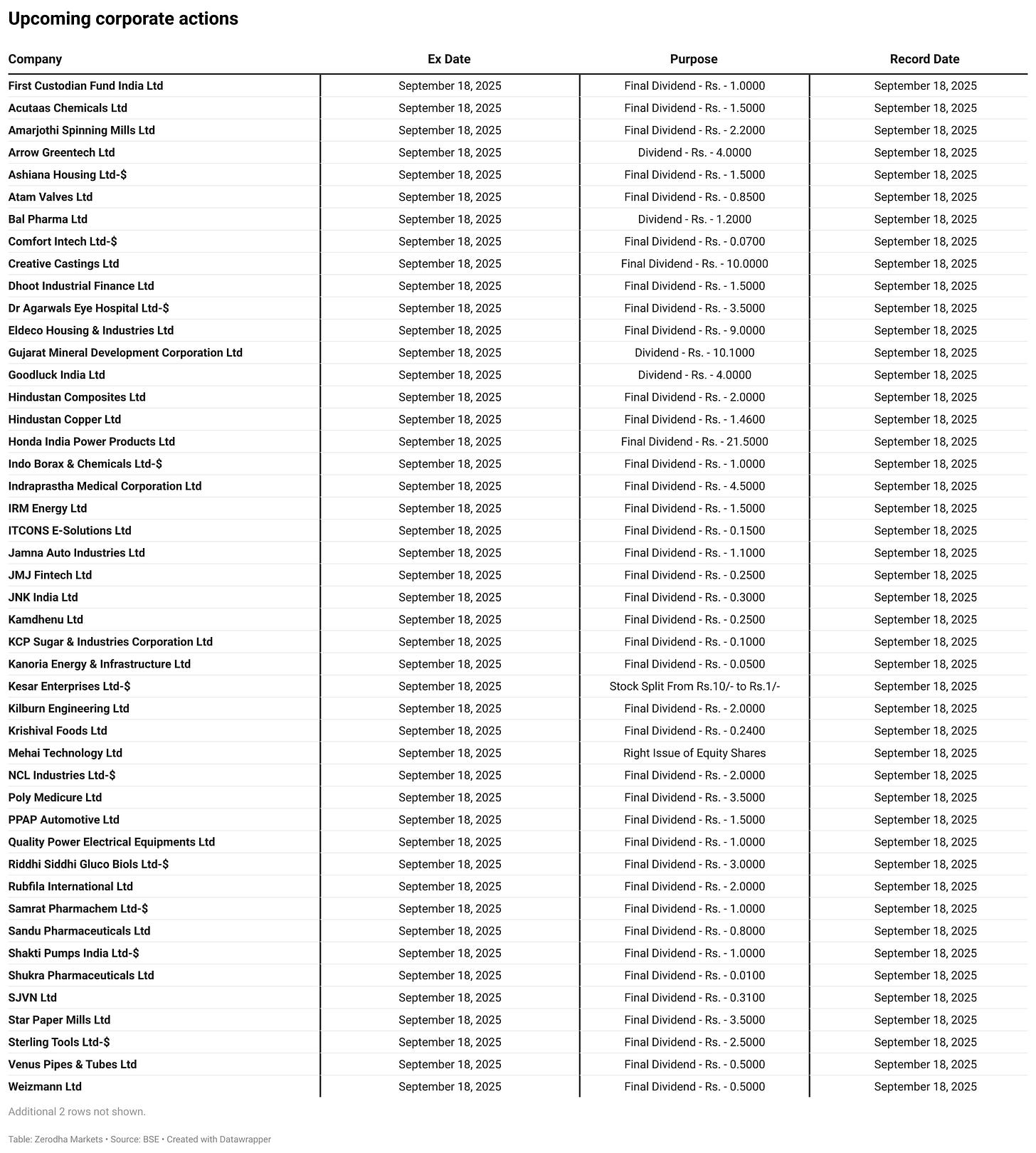

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!