Nifty struggles amid global uncertainty; Broader markets stay resilient

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

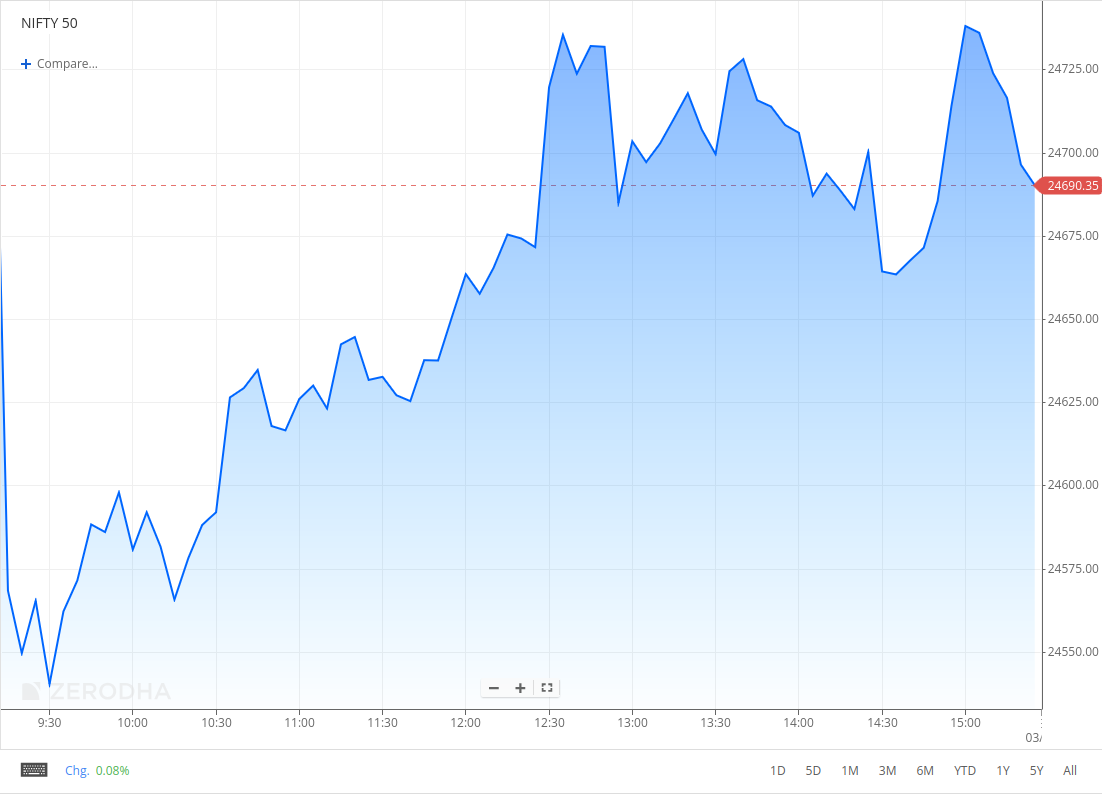

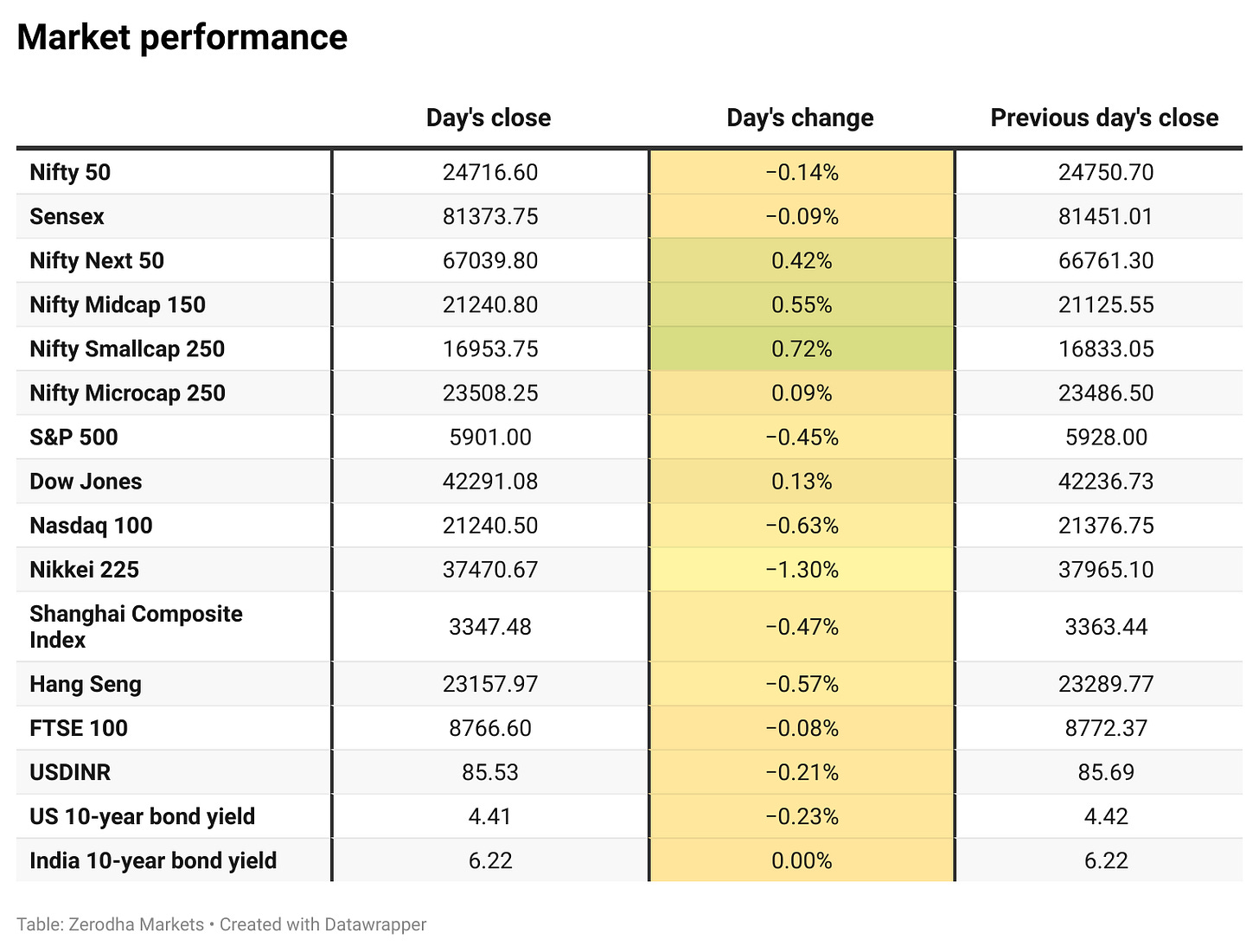

Nifty opened with an 80-point gap down at 24,670 and continued to decline, hitting a low of 24,526 within the first 20 minutes. The index stayed below 24,600 during the first hour before gradually stabilizing and recovering all its losses, briefly turning positive after 1 PM. In the final hour, Nifty moved within a narrow range of 24,680 to 24,720 and eventually closed at 24,716.60, down by 0.14%.

While GDP growth came in much stronger than expected at 7.4% for the last quarter and GST collections remained robust, rising macroeconomic uncertainty and geopolitical tensions continue to be key concerns. Investors are also closely tracking developments in the India-U.S. trade deal.

Broader Market Performance:

Broader markets had a mixed session with a positive bias today. Of the 3,014 stocks traded on the NSE, 1,529 advanced, 1,402 declined, and 83 remained unchanged.

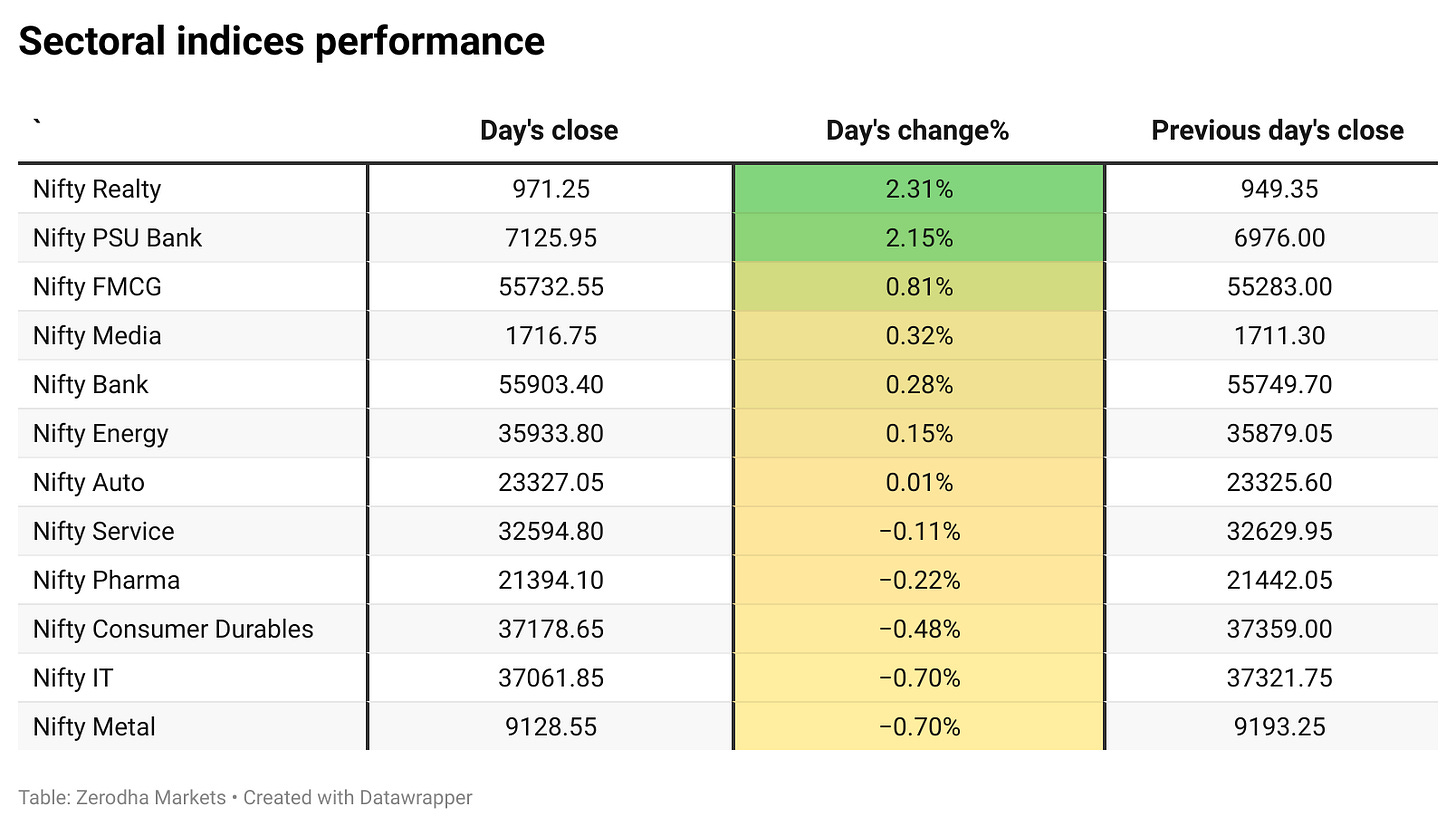

Sectoral Performance:

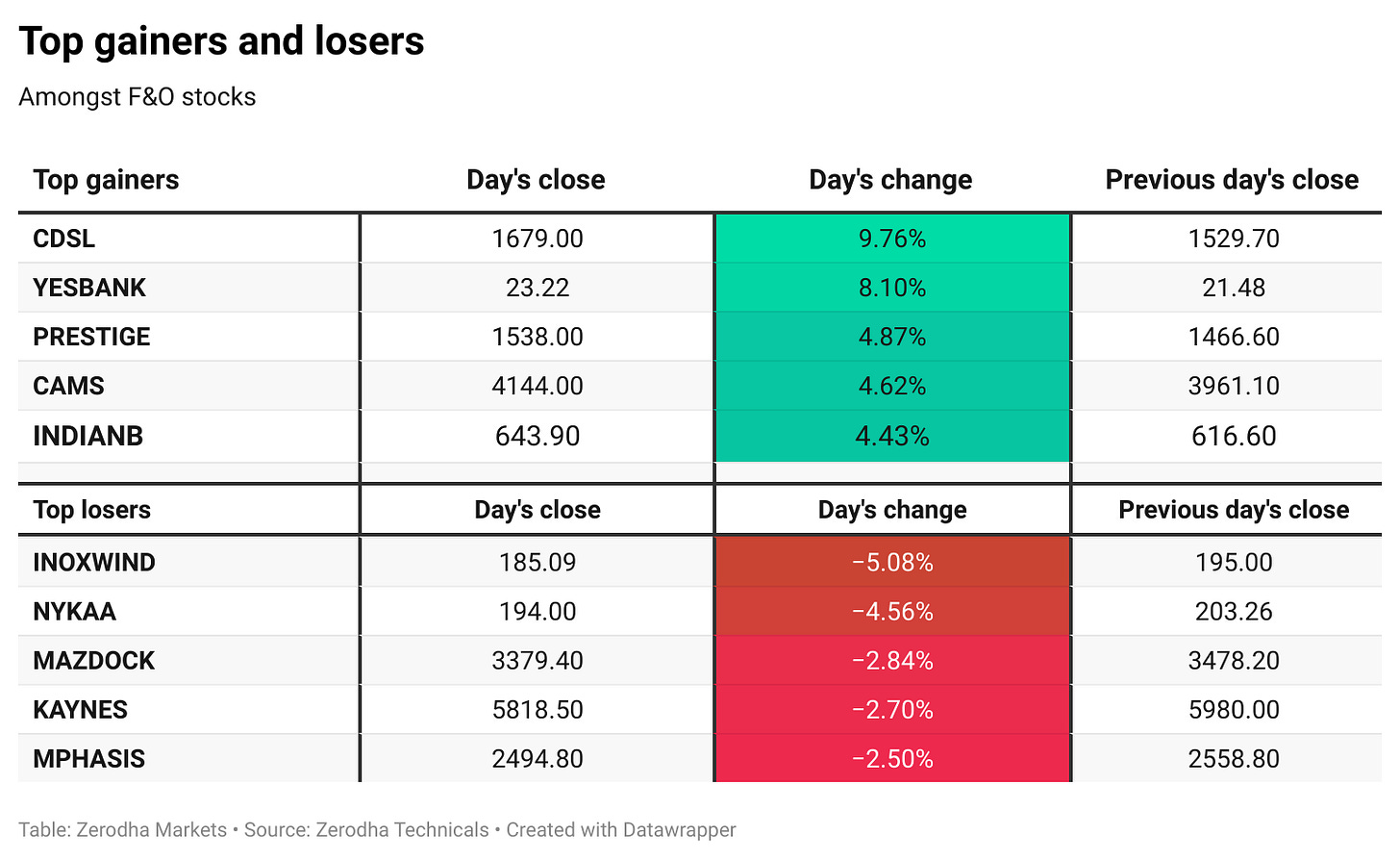

Nifty Realty emerged as the top-gaining sector with a sharp rise of 2.31%, followed closely by Nifty PSU Bank, which gained 2.15%. On the other hand, Nifty IT and Nifty Metal were the top losing sectors, both declining by 0.70%. Out of the 12 sectoral indices, 7 closed in the green while 5 ended in the red, indicating a mildly positive sectoral breadth for the day.

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 5th June:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,800, suggesting strong resistance at 25,000 - 25,100 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,600, suggesting strong support at 24,600 to 24,500 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

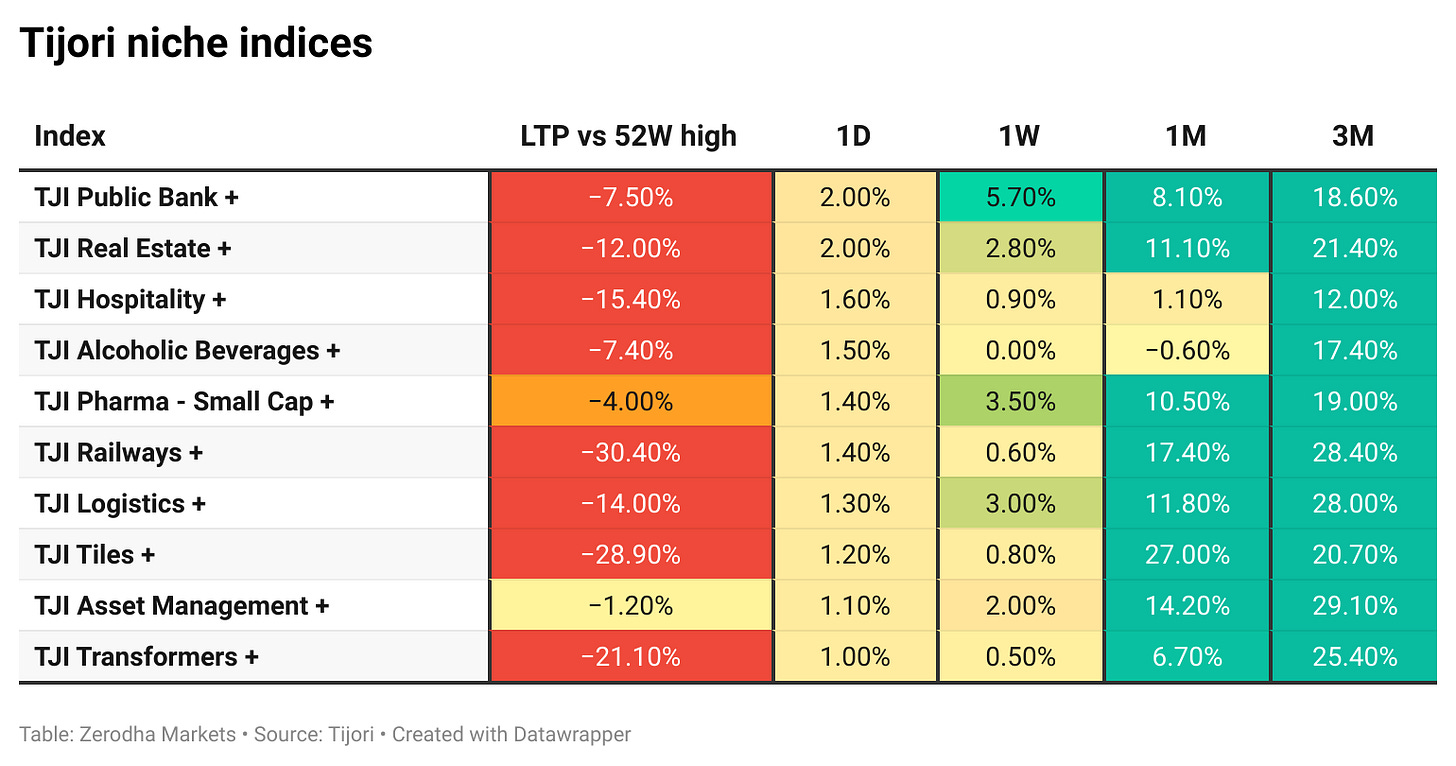

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s economy grew 7.4% in Jan–Mar 2025, pushing full-year growth to 6.5%. Construction, services, and manufacturing drove this strong performance. India remains the fastest-growing major economy despite global challenges. Dive deeper

India collected ₹2.01 lakh crore in GST for May 2025, up 16.4% from last year. This is the second month in a row that GST crossed the ₹2 lakh crore mark. The growth came from higher imports and stronger domestic sales. Dive deeper

India’s manufacturing sector growth fell to a 3-month low in May, as new orders and output increased at a slower pace. Despite this, hiring was strong and export orders rose sharply. Rising input costs led to higher product prices, putting pressure on businesses. Dive deeper

In May 2025, India's automotive sector experienced mixed results across various segments. Maruti Suzuki maintained its leadership position with a 3.16% year-on-year (YoY) increase in total vehicle sales, reaching 180,077 units. Mahindra & Mahindra reported a robust 17% YoY growth, selling 84,110 units, driven by strong demand for its SUV lineup. Conversely, Tata Motors faced an 8.6% decline, with sales dropping to 70,187 units, while Hyundai's sales were impacted by a scheduled maintenance shutdown, totaling 58,701 units. Dive deeper

The U.S. is doubling tariffs on steel and aluminium imports, but India’s government says the impact will be minor. India exports very little of these metals to the U.S., so it won’t cause significant harm. Some engineering goods may get affected, but overall trade impact is expected to be low. Dive deeper

Apollo Hospitals reported a 53.5% year-on-year rise in net profit for Q4FY25, reaching ₹390 crore, surpassing analysts' expectations. Revenue grew 13% to ₹5,592 crore, driven by healthcare services, diagnostics, and digital health. The company announced a ₹10 per share dividend and plans to add 700 beds in Bengaluru as part of a ₹6,000 crore expansion plan. Dive deeper

Yes Bank's stock rose 6% to ₹22.86, outperforming a weak market. The surge followed the bank's announcement of a board meeting on June 3 to discuss raising capital through equity, debt, or other instruments. Investors are optimistic about the bank's growth plans and potential partnerships. Dive deeper

Mphasis is set to lose its key client FedEx, which contributed around 8% of its revenue, as the logistics giant shifts its IT services to Accenture by end-2025. The news led to a 6.5% drop in Mphasis's stock amid broader IT sector concerns. Despite this setback, Mphasis remains optimistic, citing a strong pipeline and significant growth in non-BFSI segments. Dive deeper

What’s happening globally

U.S. President Donald Trump announced on Friday his plan to double tariffs on imported steel and aluminum from 25% to 50%, intensifying pressure on global steel producers and escalating the ongoing trade war. Dive deeper

U.S. futures declined on Monday amid rising trade tensions, with S&P 500 and Nasdaq 100 futures down 0.4% and Dow futures falling about 100 points. China accused the U.S. of violating their recent trade agreement and pledged to defend its interests, following similar allegations from President Trump last week. Dive deeper

France's Sanofi has agreed to acquire U.S.-based Blueprint Medicines Corporation for up to $9.5 billion, aiming to strengthen its position in rare immunology diseases. According to LSEG data, this marks the largest deal by a European healthcare company so far this year. Blueprint, listed as BPMC.O, specializes in treatments for systemic mastocytosis, a rare blood disorder. Dive deeper

U.S. heating oil futures rose over 3% to $2.07 per gallon, rebounding from a three-week low, driven by gains in the broader energy market and an unexpected drop in inventories. The rally followed a 4% jump in oil prices after OPEC+ announced it would increase output by 411,000 barrels per day in July, easing concerns of a steeper supply hike. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sudarshan Venu, MD, TVS Motor, on China's rare earth magnet curb impact on EV production

"The impact of the ban will begin to reflect in production by June or July,"

"We’re actively exploring ways to de-risk the situation, but there could be cost increases down the line," - Link

Steel Minister H.D. Kumaraswamy on the impact of Trump's steel tariff plan

“Minor impact will be there... We are not exporting (to the U.S.) in a big way,” - Link

CEO Nicolas Hieronimus, CEO of L’Oréal's on the company’s future plans in India

Intend to more than double production in India in the next couple of years

Will expand our factories, which are currently manufacturing 95% of what we sell in India and export in the region

Half a billion units manufactured in India currently, already exporting hair and skin products to the Gulf region - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

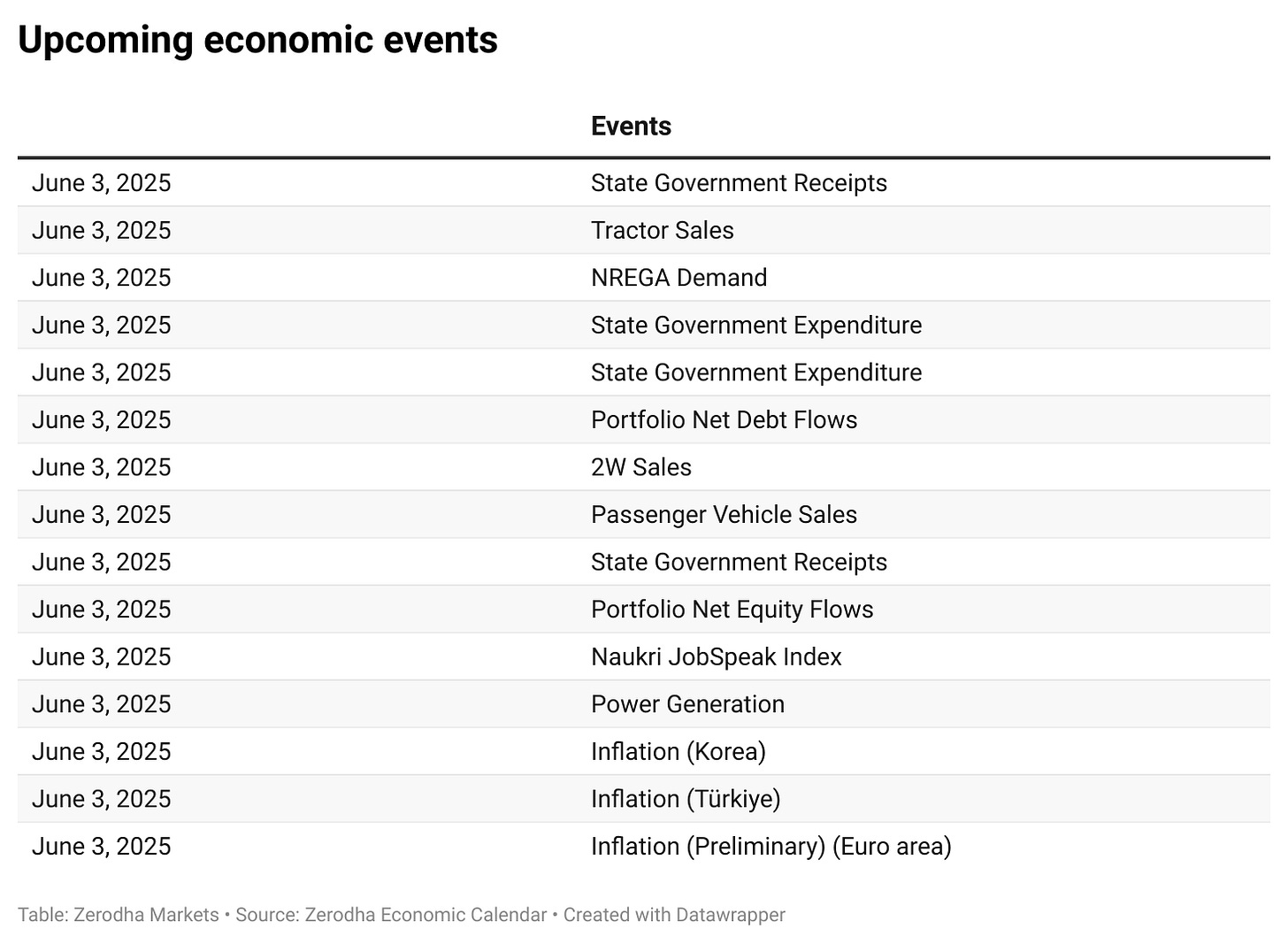

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.