Nifty stays under pressure as broader markets slide further

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 50 of 2025, a volatile yet largely directionless stretch for markets, marked by sharp early-week moves followed by a late recovery. A delayed reaction to the US Fed’s 25 bps rate cut kept traders on edge, while Indian indices continued to hover near all-time highs, struggling to commit to a clear directional trend with just two weeks left in the year.

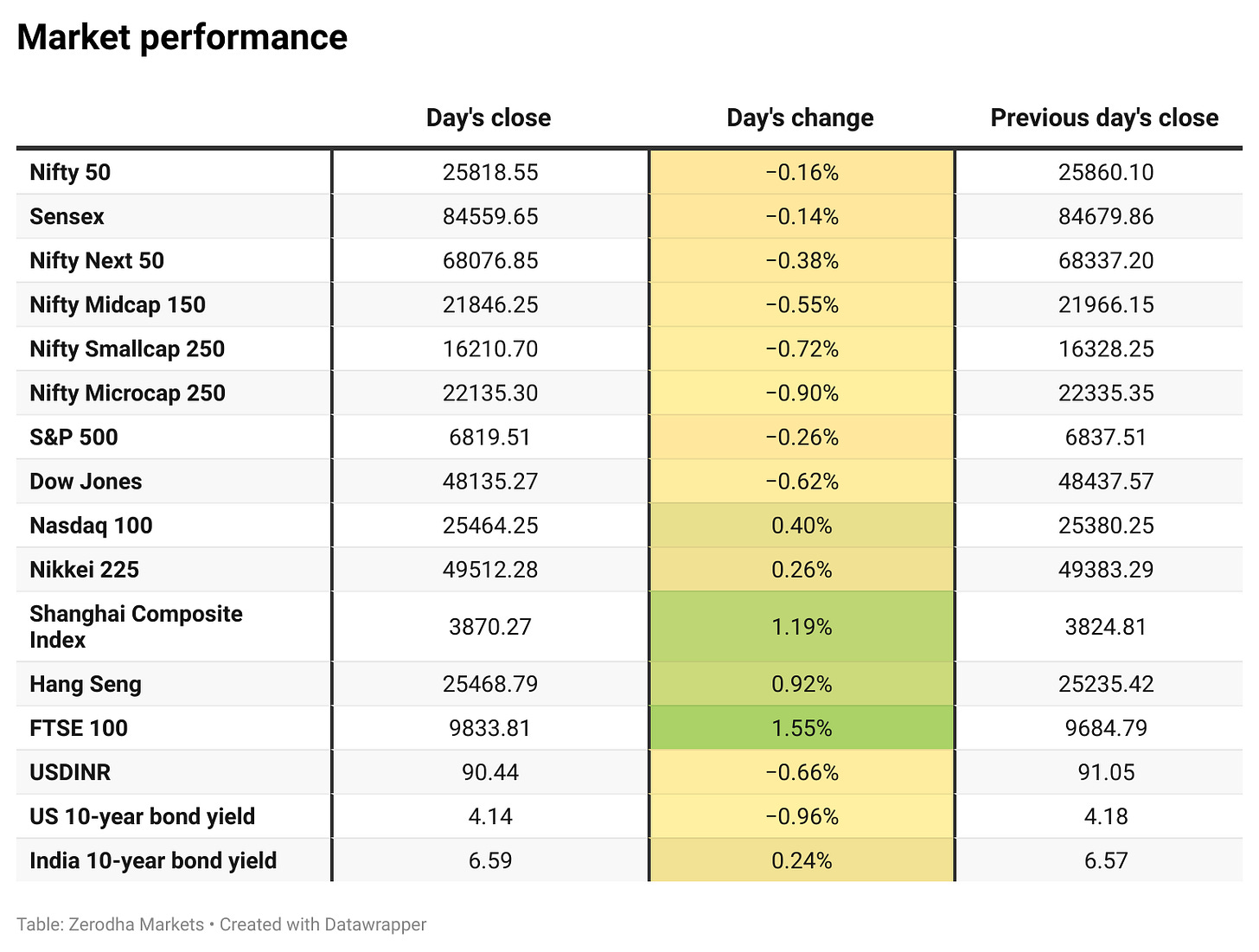

Market Overview

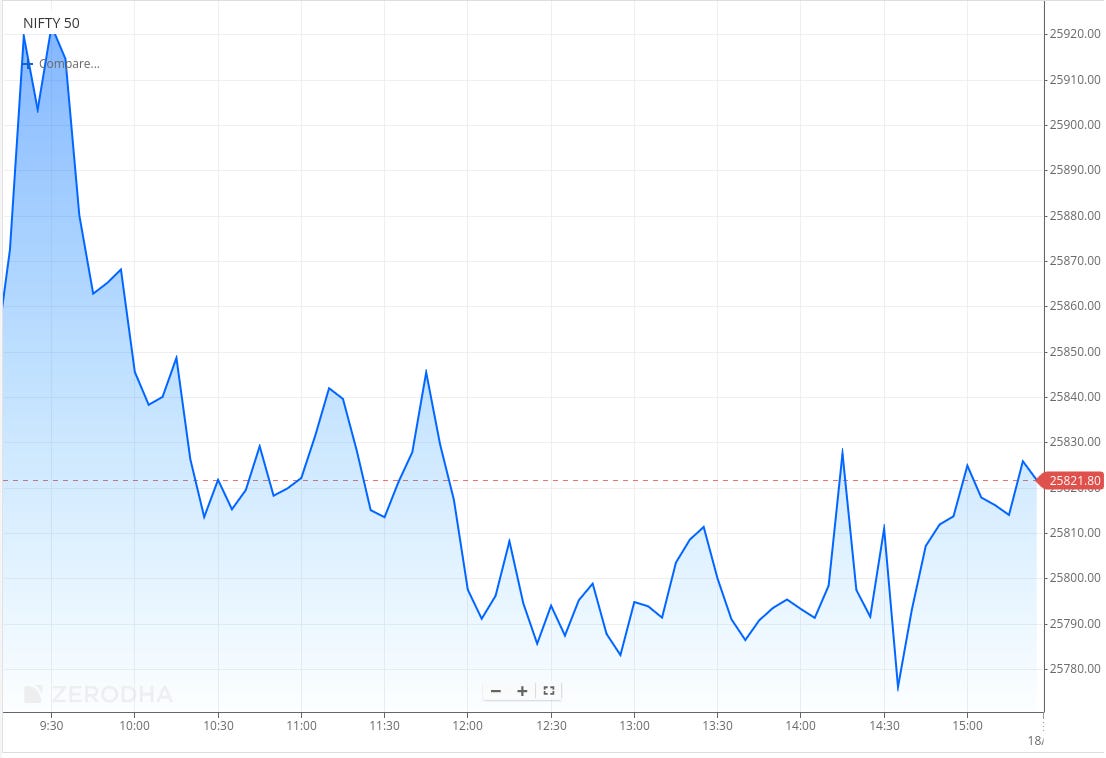

Nifty opened with a 42-point gap-up at 25,902 but remained volatile from the outset. The index briefly dipped toward 25,860 before pushing up to around 25,930 within the first 20 minutes. However, the early optimism faded quickly as selling pressure emerged, dragging Nifty down to the 25,830–25,840 zone within the first hour. For the remainder of the first half, the index stayed range-bound in a narrow 25-point band between 25,825 and 25,850.

In the second half, Nifty continued to trade with a weak undertone, gradually slipping toward the 25,780–25,800 zone around mid-session. Choppiness persisted through the afternoon, with repeated recovery attempts toward the 25,830–25,850 range consistently met with selling. The final hour saw sharp intraday swings, but the index failed to generate any sustained upside momentum.

Nifty eventually closed near the day’s lows at 25,818.55, ending marginally lower on the day. Overall, it was a weak and indecisive session, marked by persistent selling pressure despite a positive opening. Broader market sentiment remained extremely weak.

Looking ahead, markets are likely to stay sensitive to global risk appetite, currency movements, and further developments around the India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a weak session with extremely deteriorating breadth. Out of 3,224 stocks that traded on the NSE, 1,054 advanced, while 2,083 declined, and 87 remained unchanged.

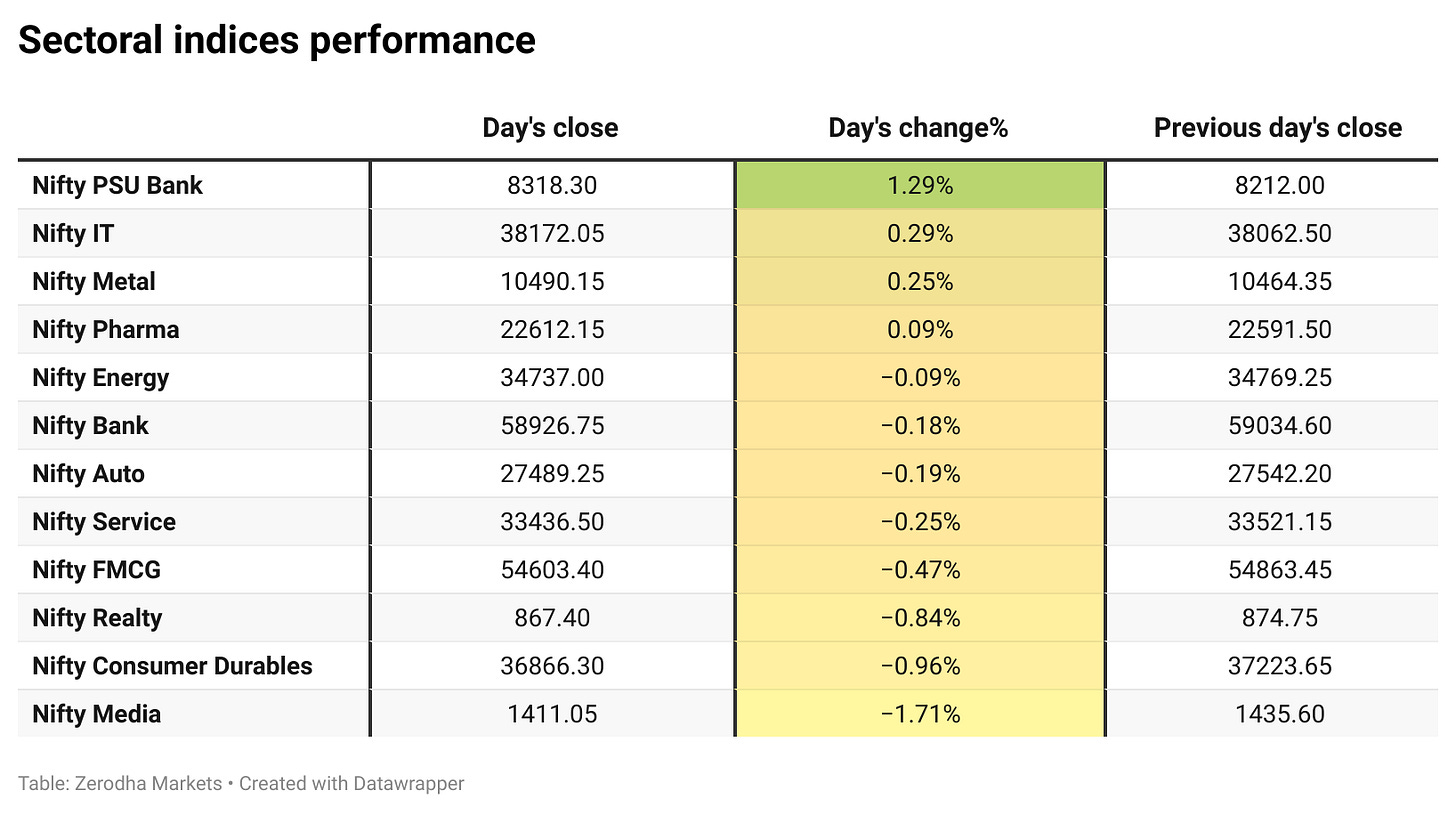

Sectoral Performance:

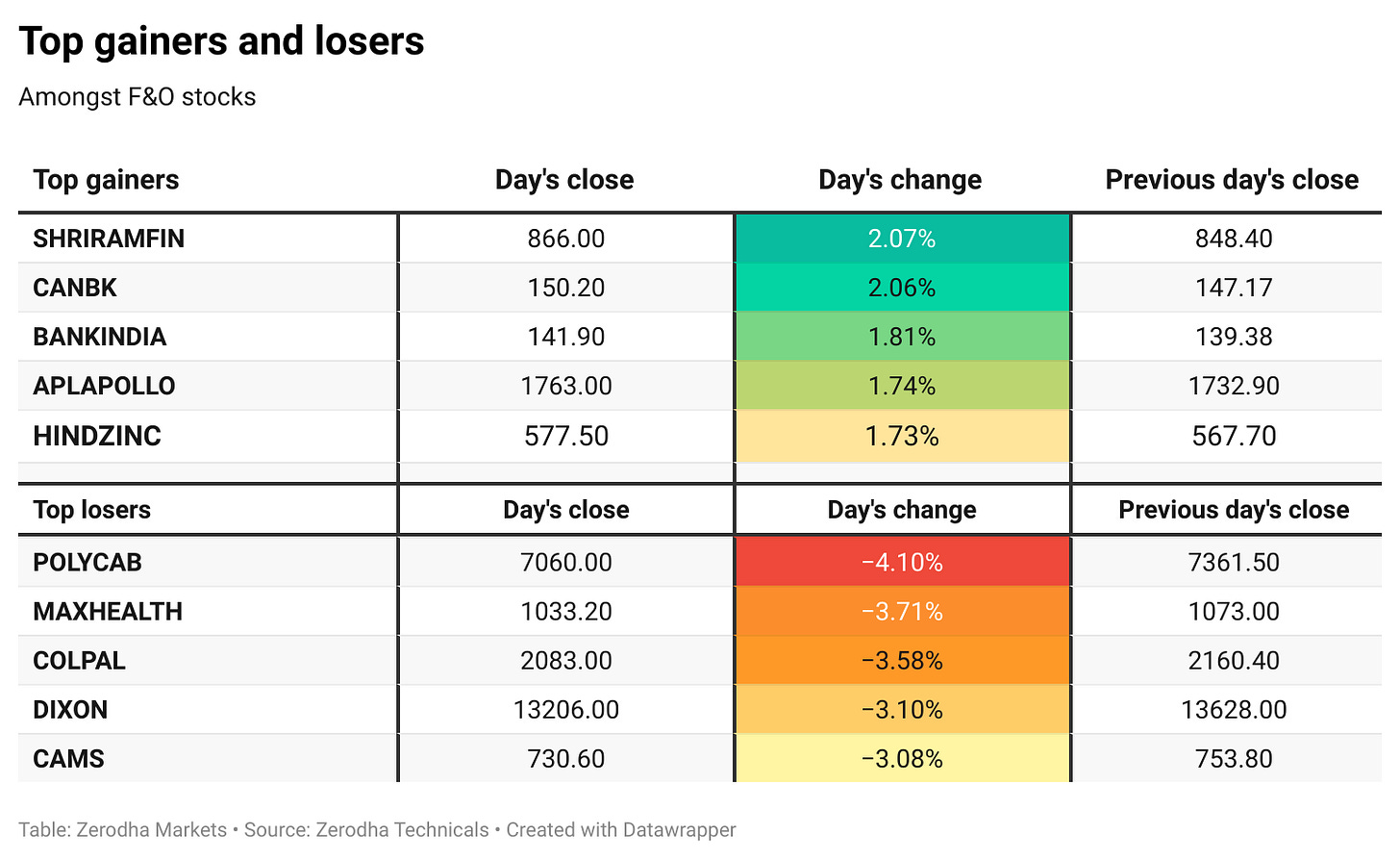

The top-gaining sector today was Nifty PSU Bank, which rose by 1.29%, while the biggest loser was Nifty Media, falling 1.71%. Out of the 12 sectoral indices, 4 ended in the green and 8 closed in the red, reflecting a largely negative market breadth.

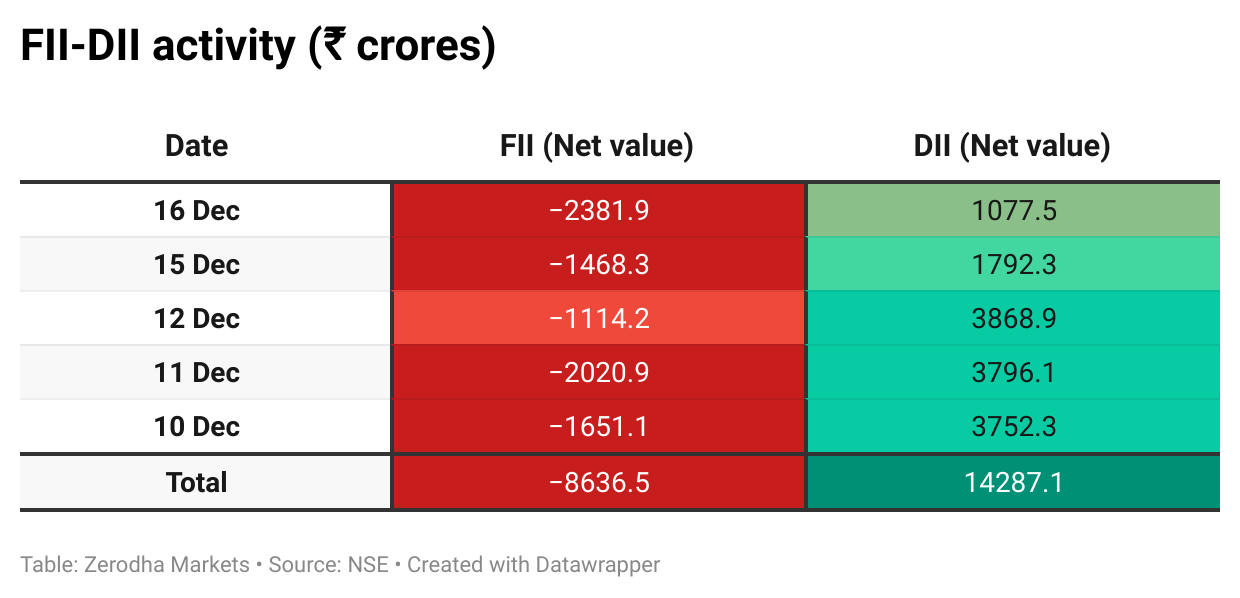

Here’s the trend of FII-DII activity from the last 5 days:

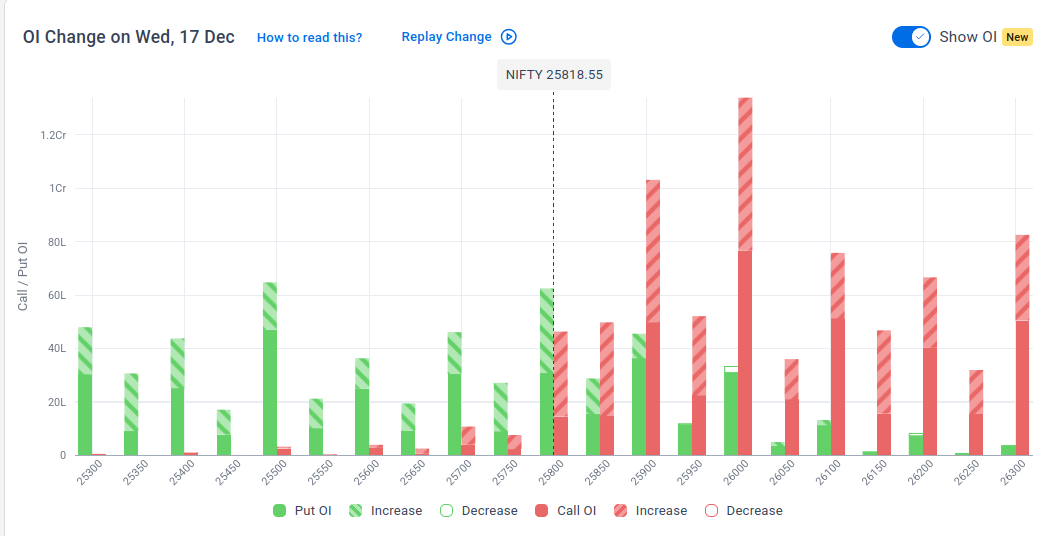

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 25,900 & 26,300, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,800, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

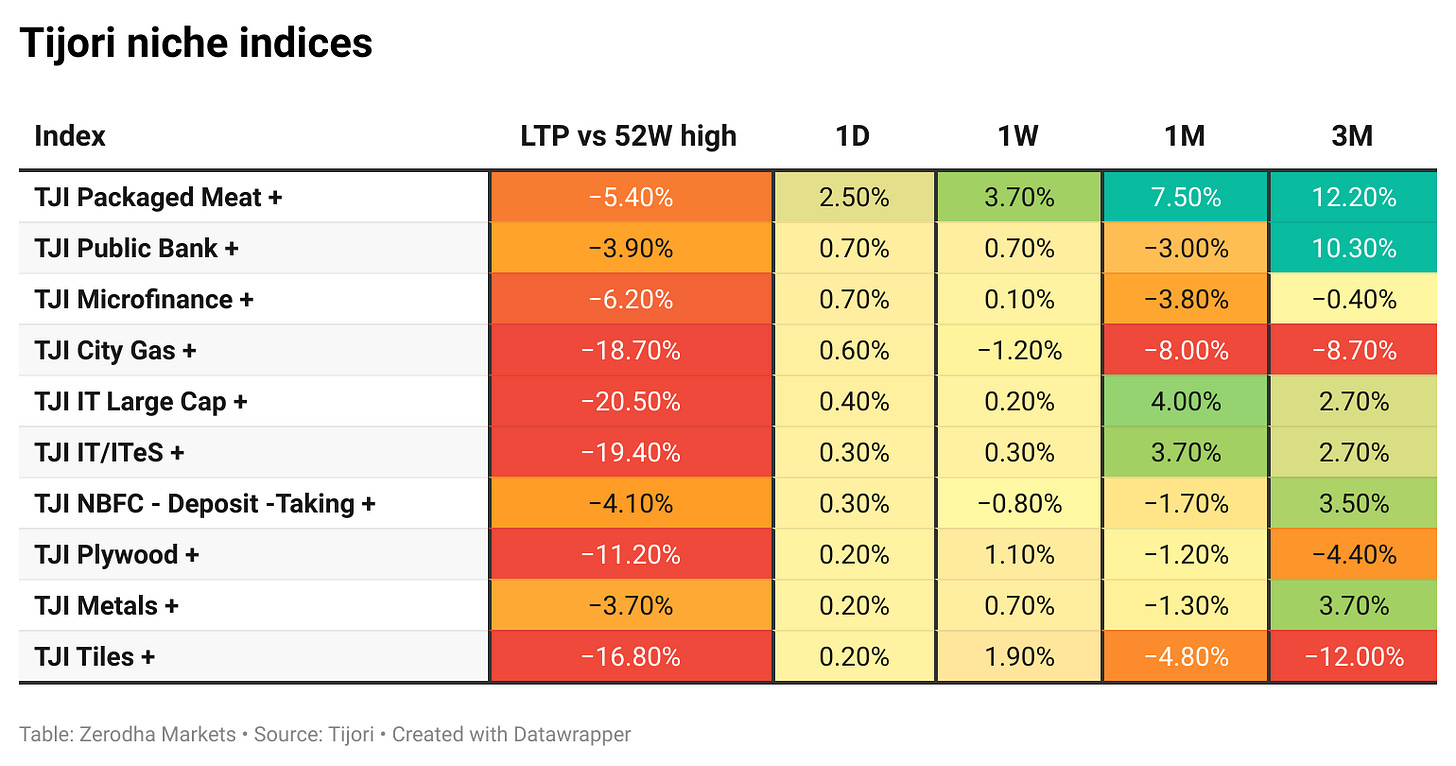

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee recovered from record lows after RBI-linked dollar sales helped stabilise the currency. However, it remains under pressure amid portfolio outflows and uncertainty around US–India trade negotiations. Dive deeper

India’s 10-year yield held around 6.58% as investors stayed cautious ahead of the RBI’s scheduled ₹500 billion bond purchase, with expectations that recent rupee support could also translate into added liquidity. Dive deeper

India’s passenger vehicle sales rose 18.1% year-on-year in November, supported by festive demand and the recent GST cut, lifting industry optimism into 2026. However, sales fell month-on-month, reversing October’s sharp surge. Dive deeper

InvITs and REITs experienced strong distribution growth in Q2 FY26, driven by healthy operating performance across commercial real estate, roads, telecom infrastructure, and other asset classes. Dive deeper

Indian Overseas Bank shares fell after the government opened an offer-for-sale at a discount, with the floor price set at ₹34 per share. The sale of up to a 3% stake has created a near-term supply overhang on the stock. Dive deeper

RailTel is reportedly in discussions with Starlink for a potential satellite broadband partnership in India. The move could expand its connectivity offerings beyond its core rail and government network business. Dive deeper

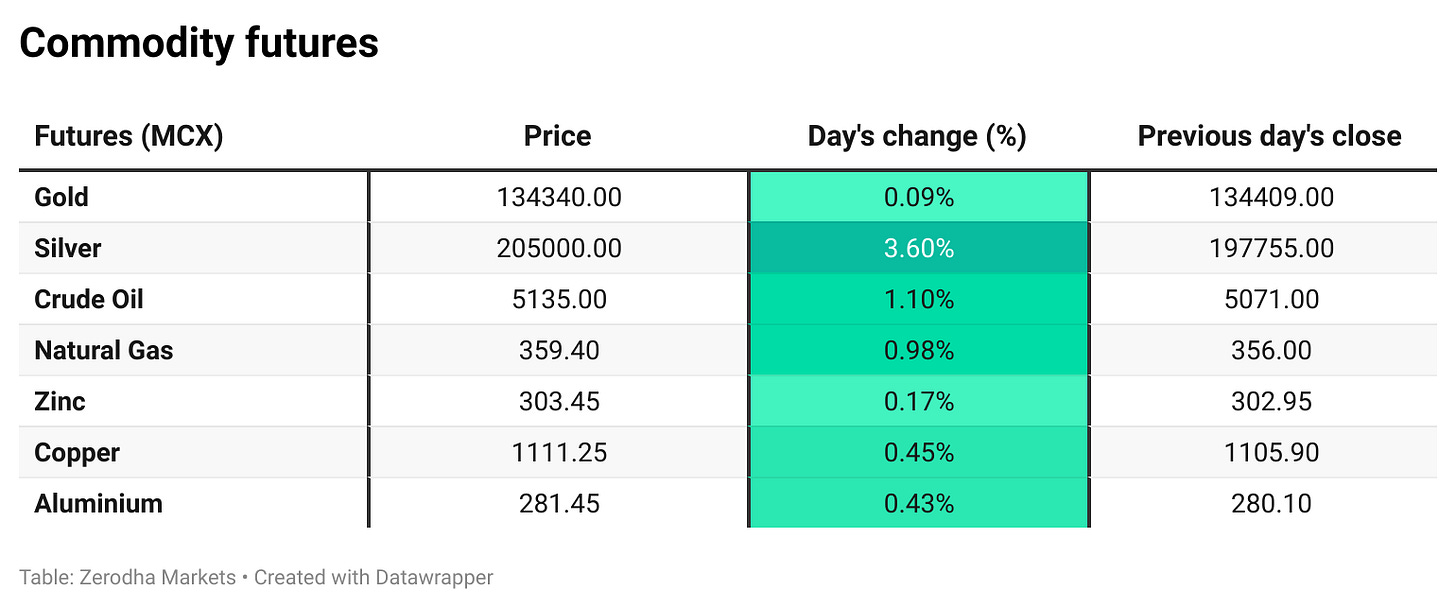

Hindustan Zinc’s stock hit a fresh 52-week high as silver prices climbed above $65/oz, underscoring strong commodity-linked earnings potential for the major producer. Dive deeper

India’s Russian crude imports are holding up despite recent US sanctions, with December inflows expected to stay above 1 million bpd as refiners shift to non-sanctioned sellers offering deeper discounts. Dive deeper

Ola Electric shares fell over 4% after founder Bhavish Aggarwal sold 2.6 crore shares (0.6% stake) via a bulk deal worth about ₹92 crore. The company stated that the sale was a one-time personal monetization to repay a promoter-level loan of ₹260 crore in full. Dive deeper

What’s happening globally

Brent crude edged higher after the US moved to block Venezuela-linked oil tankers. Gains were capped by concerns about oversupply and the prospect of more Russian oil returning to the market. Dive deeper

Gold rose above $4,320/oz as softer US jobs data reinforced expectations of Fed rate cuts next year. Dive deeper

US payrolls rose by 64K in November, beating expectations, with gains led by healthcare and construction. Federal employment continued to decline, while earlier payroll data was revised lower. Dive deeper

UK inflation eased to 3.2% in November, its lowest in eight months and below forecasts, led by slower food, alcohol, and services price growth. The monthly CPI fell 0.2%, marking the sharpest decline since mid-2024. Dive deeper

Japan’s exports rose 6.1% in November, beating expectations and marking the fastest growth since February, helped by a weaker yen and a rebound in shipments to the US. Dive deeper

Amazon shares gained after reports that OpenAI is in talks to raise at least $10 billion from the company. The funding would support OpenAI’s rising computing needs and could strengthen its cloud partnership with Amazon. Dive deeper

Apple is reportedly in early talks with Indian chipmakers to assemble and package iPhone components in India, marking a potential step beyond handset assembly into higher-value semiconductor work. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Jim Walker, Market Strategist, Aletheia Capital, on India’s growth story amid FII outflows and key risks:

“I am astonished that foreign investors are selling their India holdings… It is just in my view madness that you would be selling down the fastest major economy in the world with a very bright outlook for the future.”

“Instead, what they have been doing is taking profits in India… It might take them another few months, if nota few quarters, to realise that they have just made a gigantic mistake.”

“Well, the biggest headwind is probably sentiment.” - Link

Rajesh Menon, Director General, SIAM, on passenger vehicle sales momentum

“Passenger vehicle sales rose 18.1% year-on-year in November, supported by festive demand and the recent GST rate reduction.”

“Despite a month-on-month moderation, the broader demand trend remains positive.”

“The industry is optimistic that supportive policy reforms and improved market sentiment will sustain growth into 2026.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

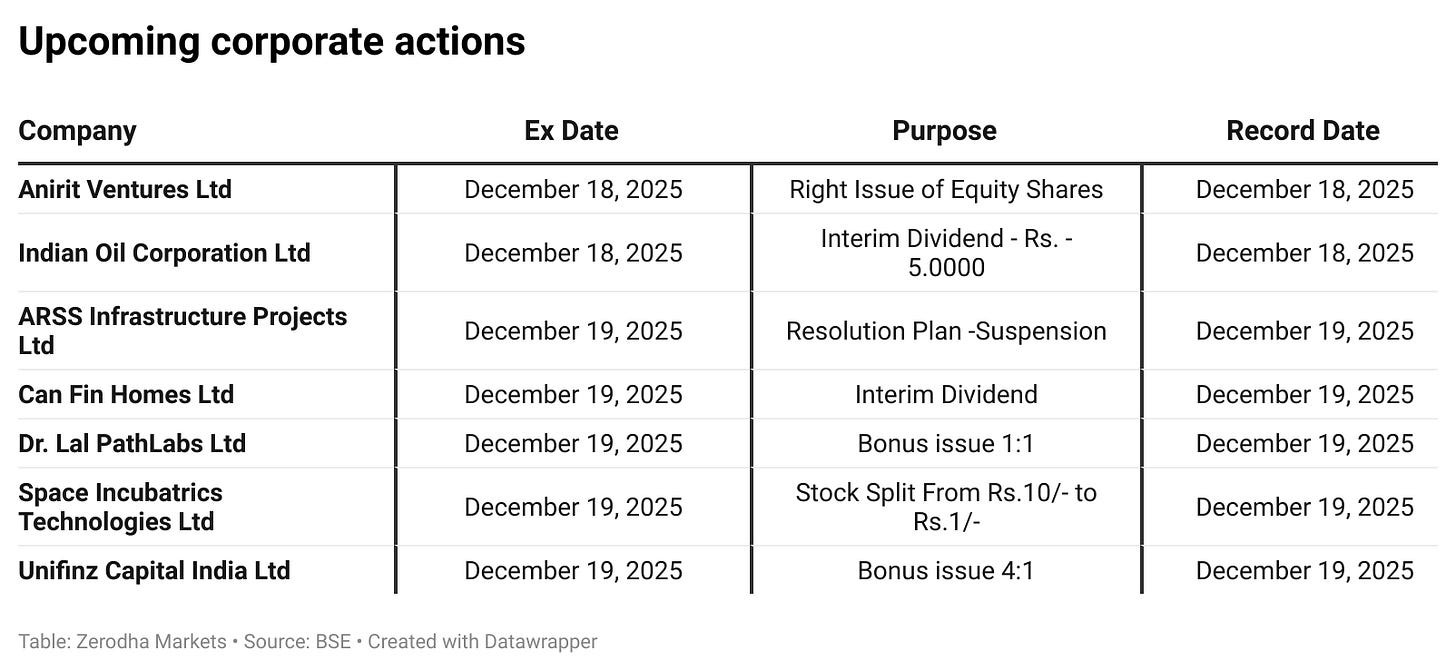

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!