Nifty stays resilient above 26,150 as heavyweight stocks drag

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 1 of 2026, where markets began the new year on a strong note, with NIFTY and BANKNIFTY closing at fresh all-time highs. Expanding ranges, improving momentum, and leadership from cyclicals like banking and metals drove the move, while mid-week compression gave way to rising volatility into Friday — setting a constructive early-year tone even as option-implied moves stayed relatively modest.

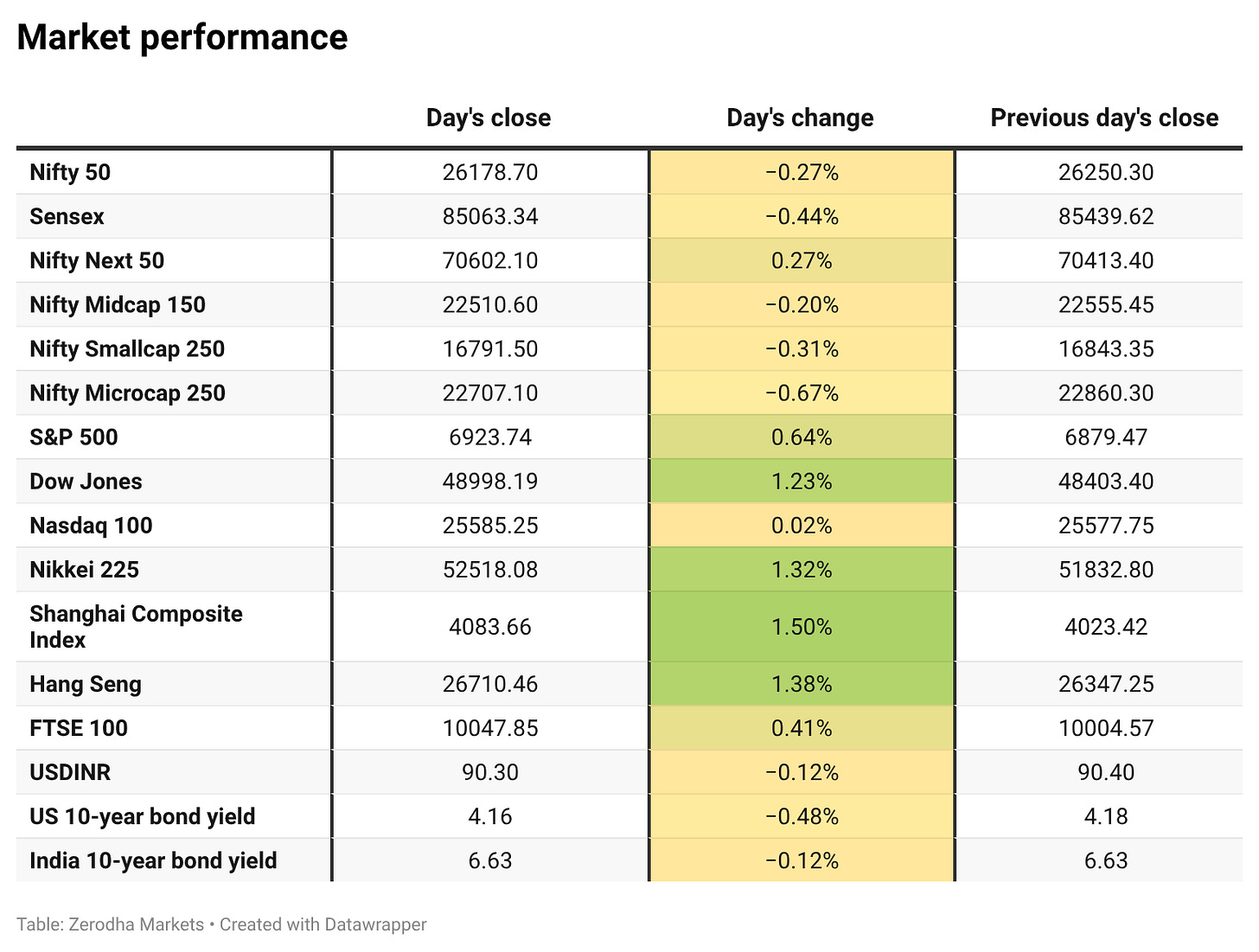

Market Overview

Nifty opened with a 60-point gap down at 26,190, despite positive global cues, weighed down by early selling pressure in heavyweight stocks such as Reliance Industries, HDFC Bank, and other index majors. The index remained volatile in the opening hour, making brief attempts to rebound toward the 26,240–26,260 zone, but each rally was met with selling pressure. By late morning, sustained weakness dragged Nifty below 26,150, with the index testing the 26,140–26,150 zone around midday.

In the second half, Nifty attempted to reclaim the 26,190–26,200 levels, but the bounce proved short-lived as selling pressure resurfaced. The index slipped to fresh intraday lows near the 26,125–26,130 zone around 2:30 PM. A modest recovery followed in the final hour, lifting Nifty back toward 26,180, though upside momentum remained limited. The index eventually closed at 26,178.70, ending the session lower after a choppy and volatile day marked by persistent selling in heavyweight stocks and a lack of broad-based support.

Looking ahead, markets are likely to remain sensitive to global risk appetite, the start of the Q3 earnings season, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had a weak session today. Out of 3,237 stocks that traded on the NSE, 1,239 advanced, while 1,894 declined, and 104 remained unchanged.

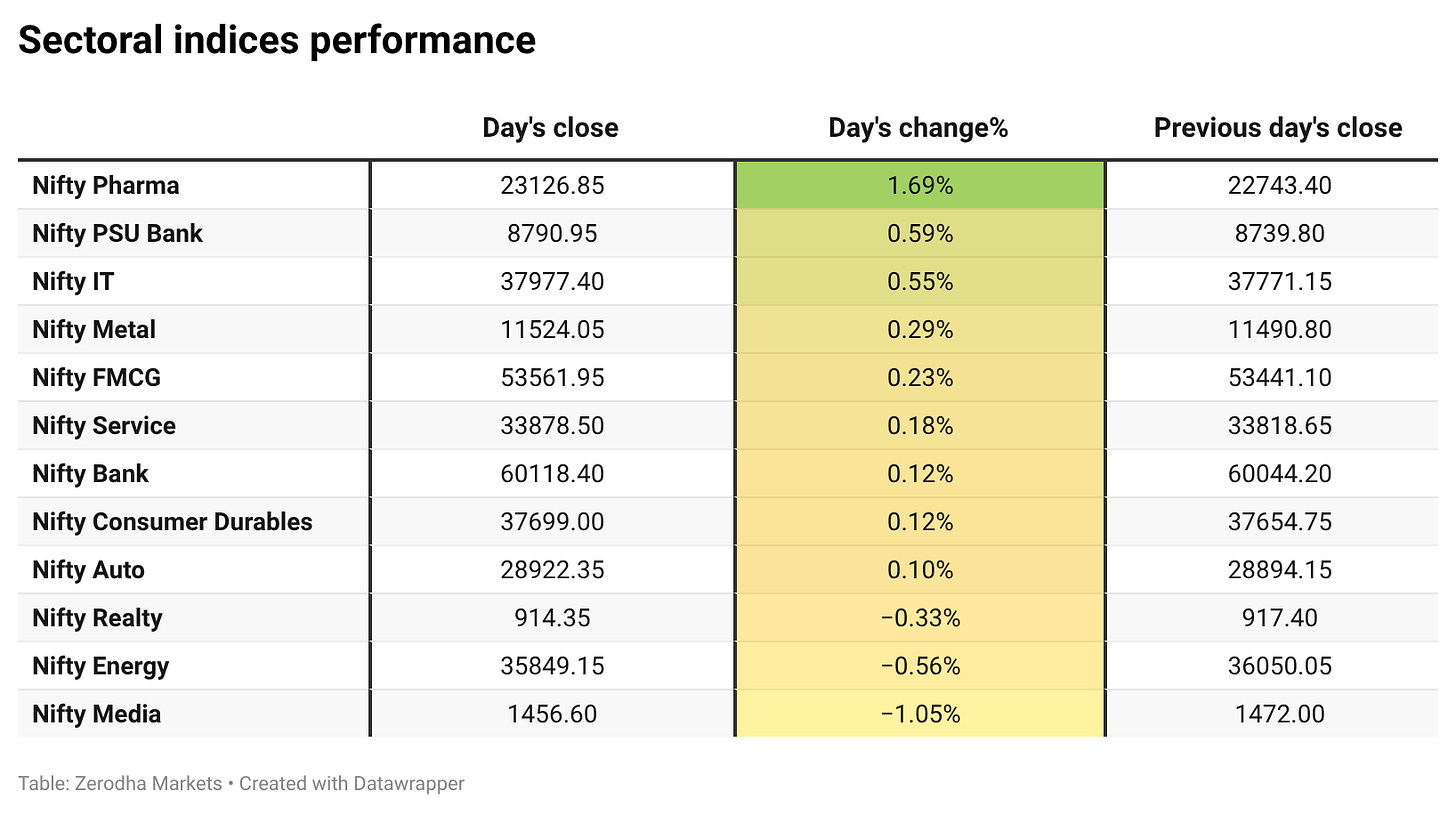

Sectoral Performance:

Nifty Pharma emerged as the top gainer with a 1.69% rise, while Nifty Media was the biggest loser, shedding 1.05%. Out of the 12 tracked sectoral indices, 9 closed in the green and 3 ended in the red.

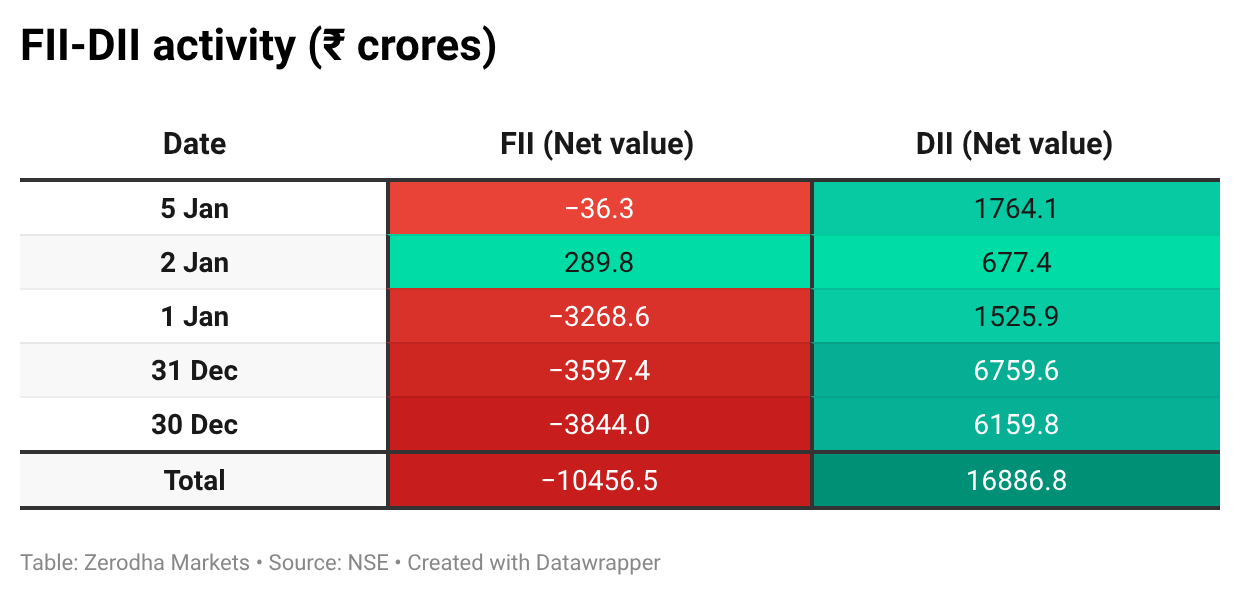

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 6th January:

The maximum Call Open Interest (OI) is observed at 26,500, followed by 26,200 & 26,300, indicating potential resistance at the 26,300 -26400 levels.

The maximum Put Open Interest (OI) is observed at 25,700, followed by 26,000 & 26,200, suggesting support at the 26,100 to 26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

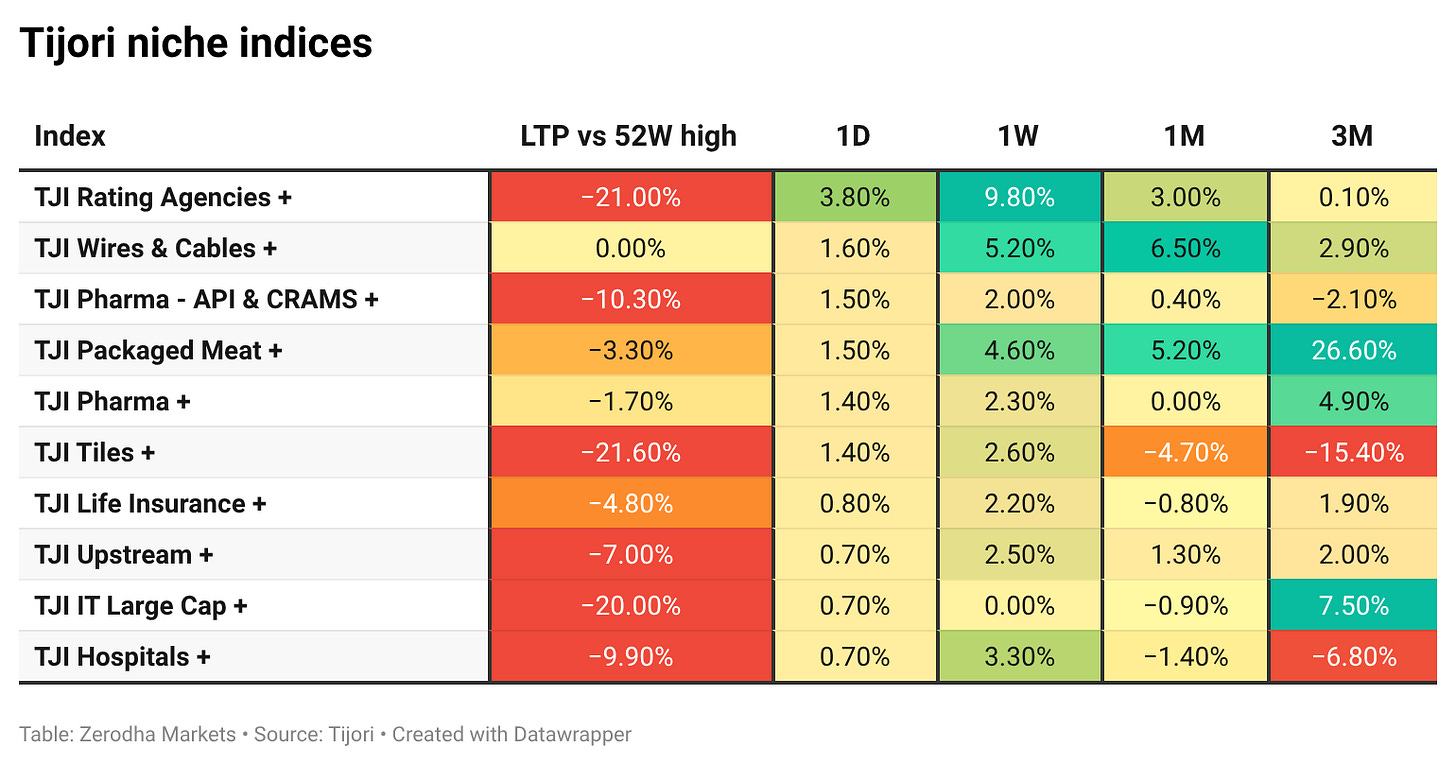

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s services sector growth slowed in December, with the PMI revised lower as new business and output moderated. Employment dipped marginally, and business sentiment weakened, despite a pickup in export orders. Dive deeper

The rupee stayed weak near 90 per dollar amid continued uncertainty over a US–India trade deal and persistent dollar demand. Trade-related concerns and importer hedging kept pressure on the currency, despite some support from a softer US dollar. Dive deeper

The Reserve Bank of India has signed an agreement with the Delhi government to manage its banking operations and rupee public debt. The arrangement will come into effect from January 9. Dive deeper

NALCO shares reached a record high after rising across four sessions, supported by sustained trading interest and positive sentiment around the aluminium sector. Dive deeper

Hindustan Copper shares rose to a 52-week high as copper prices reached record levels, lifting sentiment in metals markets. The stock’s gains reflected strong commodity price trends and investor interest in the sector. Dive deeper

India’s Russian oil imports are likely to drop sharply in January after Reliance Industries said it does not expect any Russian crude deliveries this month. The move follows renewed US pressure on India over its Russian oil purchases, raising trade and tariff concerns. Dive deeper

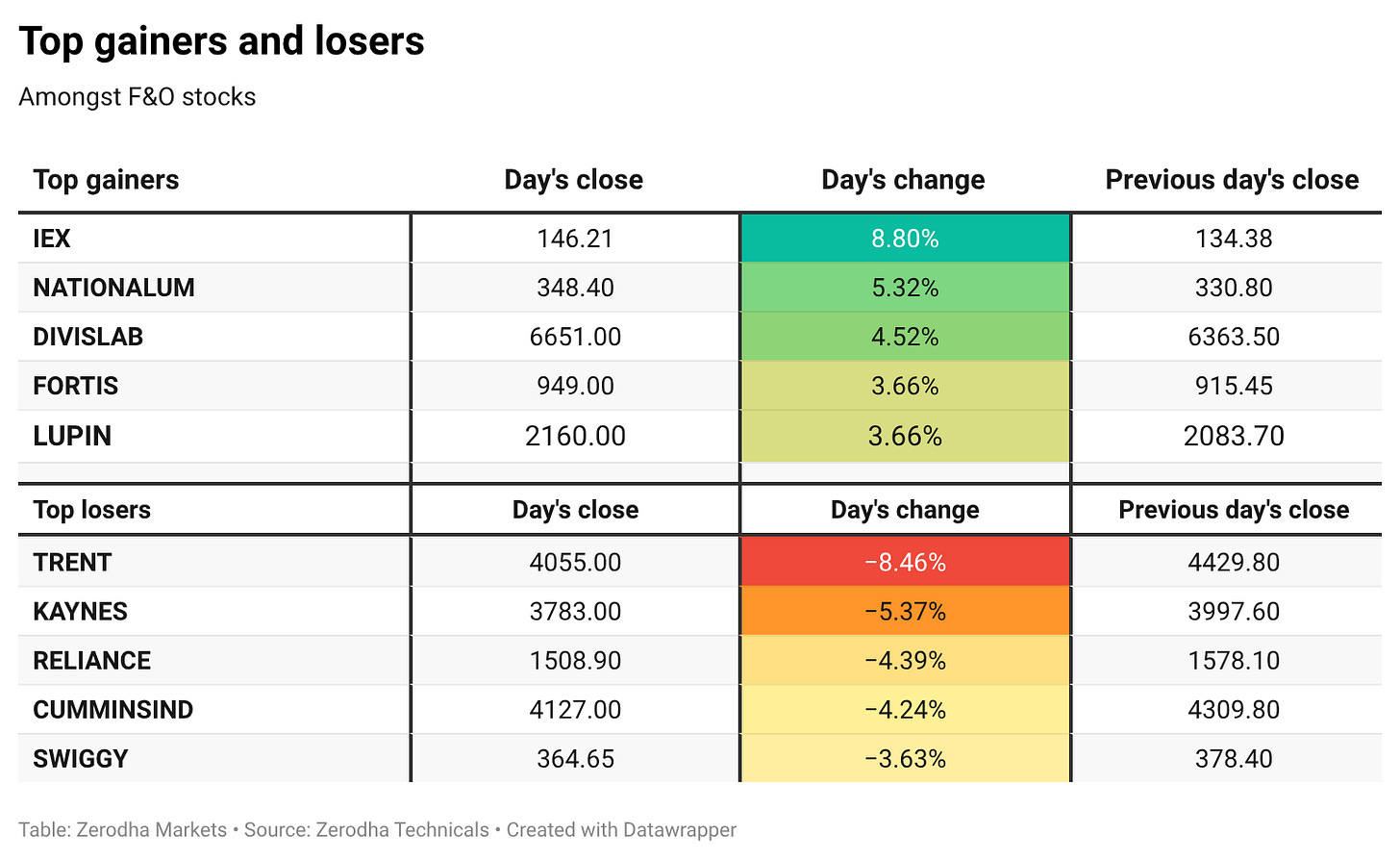

Shares of Trent declined by 8.5% after the apparel retailer reported quarterly revenue growth that fell short of market expectations. Dive deeper

ICICI Bank said Indian bonds may face headwinds as savings shift toward equities and changes in banks’ investment rules could damp demand for long-term debt. Dive deeper

IEX jumped as much as 14% before closing 9% higher after hopes of relief emerged in the market coupling case. During the hearing, the Electricity Appellate Tribunal raised concerns over how the rules were framed, questioning whether the CERC had acted independently. Dive deeper

What’s happening globally

WTI crude traded steady as markets assessed the impact of US actions on Venezuela, with limited near-term supply risks due to the country’s low output. Prices remained capped by ample global supply, lower Saudi selling prices, and unchanged OPEC+ output plans. Dive deeper

Gold prices extended gains as investors sought safe-haven assets amid political turmoil in Venezuela. Markets also remained focused on upcoming US labour data for signals on the Federal Reserve’s policy outlook. Dive deeper

Copper prices rose to fresh record highs as markets priced in tighter global supply and strong demand from energy and infrastructure projects. Concerns over potential US tariffs on refined metals also supported prices. Dive deeper

US stock futures were steady after major indices advanced in the previous session, with markets largely looking past recent geopolitical developments. Investors are now focused on upcoming US labour market data for cues on Federal Reserve policy. Dive deeper

US manufacturing activity contracted further in December, with the ISM PMI falling to its lowest level since October 2024 as production and inventories weakened. Dive deeper

European equities were mixed, with the STOXX 600 edging to a record high supported by gains in basic resources, while technology stocks saw some profit-taking. Markets also tracked developments in Venezuela and incoming economic data across the region. Dive deeper

France’s annual inflation eased to a seven-month low in December, driven mainly by a sharper decline in energy prices. Monthly inflation edged up slightly, while food price pressures picked up and services inflation remained steady. Dive deeper

Mainland Chinese equities rose to multi-year highs, led by technology stocks amid strong interest in artificial intelligence. Sentiment was also supported by policy support and improved optimism around China’s economic recovery. Dive deeper

Japan’s Nikkei share average closed at a record high as expectations for improved corporate profits supported the market. The broader Topix index also ended at a record level, with gains driven by strength across major sectors. Dive deeper

Nvidia said its next-generation AI chips are now in full production, with the new Vera Rubin platform set to launch later this year. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Abhay Agarwal, Head of Research, TCG AMC, on market range, FPI caution, and midcap participation:

“The markets have been stuck in a range as FPI caution continues to cap the upside.”

“The valuations in the broader midcap segment are becoming more compelling, which may lead to broader participation.”

“Quality companies with consistent earnings growth and strong balance sheets will likely outperform in the current environment.” - Link

Nitin Aggarwal, Senior Vice President & Head of Financials, IIFL Securities, on Q3 credit growth and stress trends in financial services:

“Credit growth was broad-based across the PSU banks, mid-sized lenders and NBFCs, with PSU banks reporting a double-digit loan book growth.” (m.economictimes.com

“There was a sequential moderation in stress in microfinance and credit card portfolios, with slippages trending lower.”

“Overall performance in Q3 has been encouraging, largely backed by healthy asset quality and resilient profitability trends across lenders.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

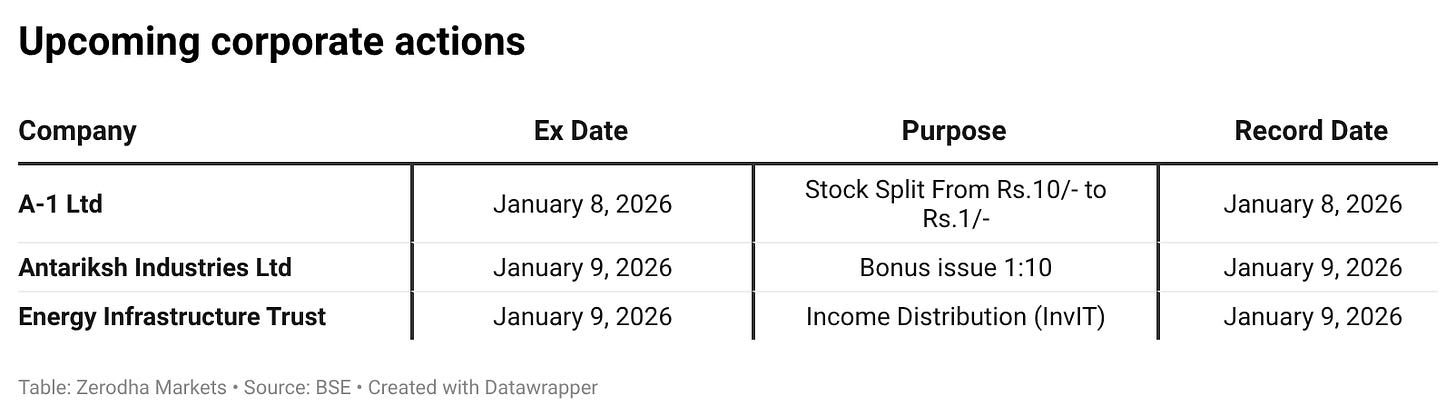

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

The headline index is distorted by the RIL drag (-4%), but the structural defense of 26,150 is the real signal.

Smart money rotated into Pharma (+1.7%) today, while IT showed surprising resilience (+0.5%) against the broader pressure. As long as the 26,050 cluster holds, the structural uptrend remains intact.

invit means?