Nifty snaps four-day losing streak with a modest rebound led by IT stocks

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Market Overview

Nifty opened the day on a weak note, slipping below prior levels as domestic equities faced early selling pressure. The index spent the first hour hovering around the 25,980–26,000 zone, reflecting investor caution amid renewed concerns over foreign outflows and continued weakness in the rupee.

Through the late morning, sentiment began to stabilise as IT stocks staged a recovery, supported by a sharply depreciating rupee that boosted earnings optimism for exporters. Buying interest gradually broadened across select sectors, helping the index reverse its early losses.

In the second half, Nifty consolidated its gains with volatility easing noticeably. The index inched higher into the close and eventually settled at 26,033.75, up 48 points or 0.18%, ending a four-day losing streak. While the rebound was modest, it marked a clear improvement in intraday sentiment.

The broader market was mixed. Large-caps participated in the rebound, but mid-cap and small-cap indices lagged, with both segments ending in the red, highlighting continued risk aversion outside frontline stocks.

Of the 3212 stocks tarded on NSE, 1380 advanced, 1740 ended the day in red, and 92 remained unchanged.

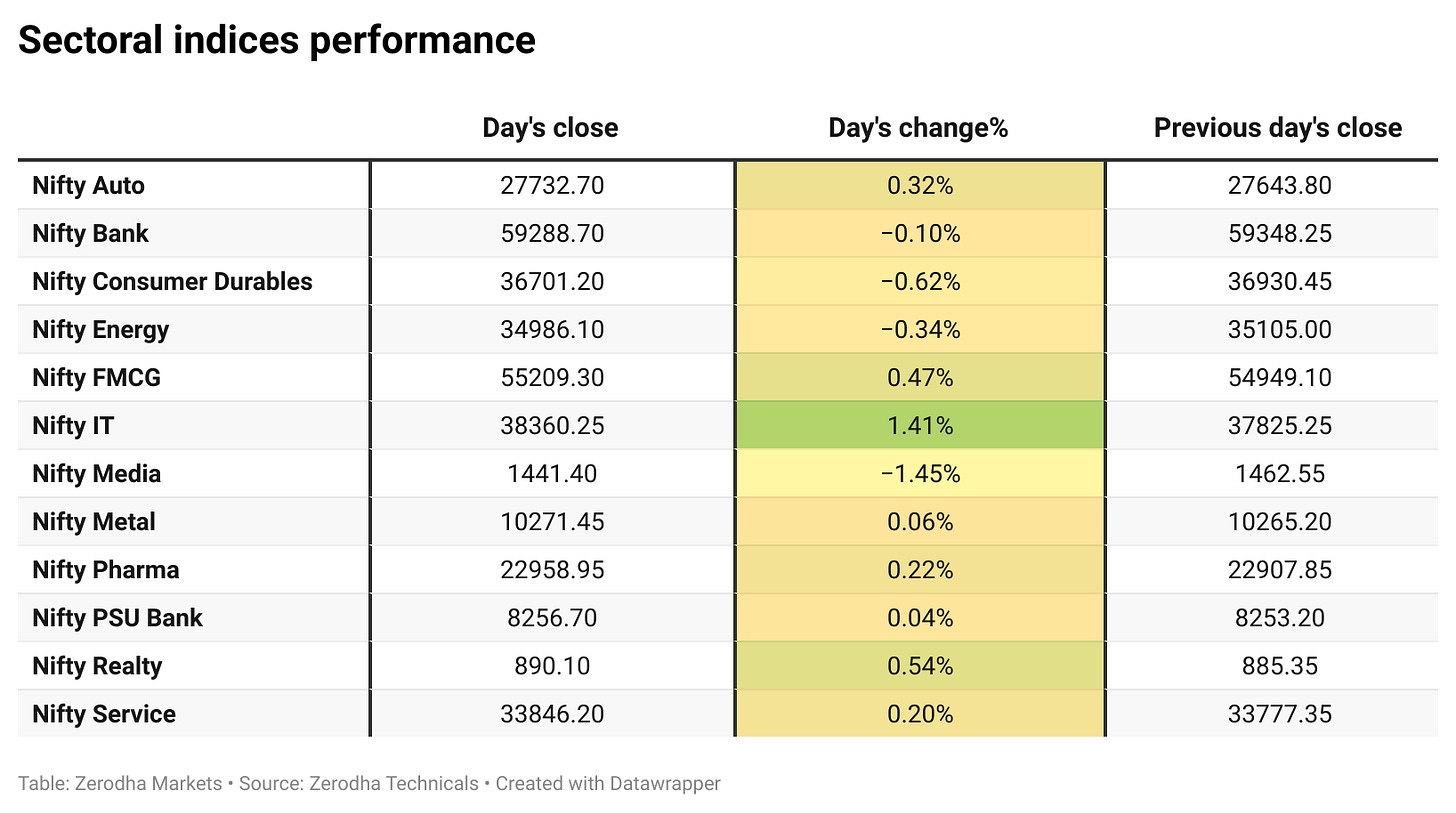

Sectoral Performance:

IT was the standout sector of the day, with strong buying interest in names such as Tech Mahindra, TCS, Infosys, and HCL Tech. In contrast, banking stocks underperformed.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th December:

The highest Call OI is at 26,500, followed by 26,300 and 26,200, indicating a strong resistance zone between 26,300 and 26,500.

On the Put side, the highest Put OI is at 26,000, followed by 25,900 and 25,800, suggesting a support band around the 25,800–26,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

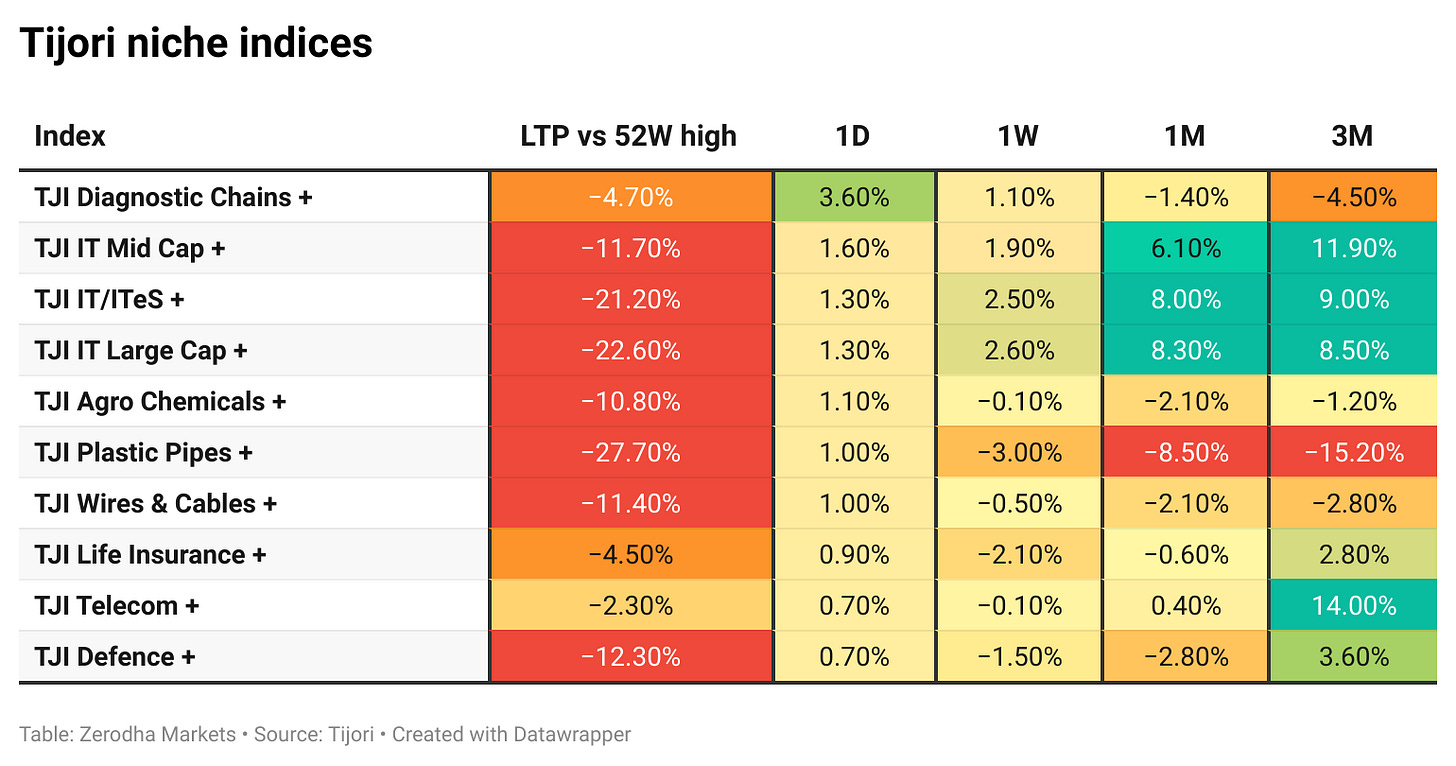

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Reliance Industries has begun drafting the prospectus for Jio Platforms’ IPO, which is expected to be India’s largest. The company is in early discussions with banks, and the formal IPO process will begin after new listing rules are implemented. The offering could raise billions and value Jio at up to $170 billion. Timing depends on regulatory approvals. Dive deeper.

Petronet LNG gained close to 4% after announcing a 15-year binding term sheet with ONGC for ethane unloading, storage, and handling services at Dahej. Dive deeper.

The rupee has fallen past 90 per dollar, triggering a market sell-off and hitting rate-sensitive sectors the most. Despite strong GDP growth, the nearly 5% decline this year makes it the worst-performing major EM currency, raising fresh inflation worries. If the rupee continues to weaken, the RBI may have limited room to cut interest rates. Dive deeper.

India’s strong 8.2% Q2 GDP momentum is fading. IIP growth dropped to a 14-month low, manufacturing slowed due to U.S. tariffs and weak exports, PMI eased, and electricity, mining, investment, and consumption also softened. Early indicators suggest Q3 may be weak despite a strong Q2. Dive deeper.

IndiGo cancels over 200 flights nationwide amid crew shortage and new roster rules, triggering chaos at major airports. Dive deeper.

FM Nirmala Sitharaman said excise duty will be levied on tobacco to keep its overall tax burden unchanged after the GST compensation cess ends. Without excise, the tax rate would fall because the GST law caps the maximum rate at 40%. Dive deeper.

India’s smartphone exports to the US jumped over threefold YoY to $1.47 billion in October, up from $0.46 billion a year ago, despite global headwinds. Dive deeper.

The HSBC India Services PMI for November rose to 59.8, up from 58.9 in October, signalling acceleration in India’s services-sector activity, though export growth remained sluggish. Dive deeper.

A new report by the Council on Energy, Environment and Water (CEEW) projects that India’s green economy could attract US $4.1 trillion in investments and generate ~48 million full-time jobs by 2047, underscoring long-term promise from sustainable growth and clean-energy transition. Dive deeper.

Indian refiners sharply cut imports of Russian crude in October 2025, a 38% drop from prior levels, the steepest since sanctions on Moscow intensified. The reduction comes as new US sanctions on top Russian producers Rosneft and Lukoil triggered major supply-chain disruptions, prompting most Indian refiners to pause direct Russian oil orders ahead of December. Dive deeper.

What’s happening globally

Gold slipped to around $4,180/oz as investors booked profits ahead of next week’s FOMC meeting. Weak US data showed a sharp ADP job loss and the slowest hiring since 2023, boosting expectations of a 90% chance of a 25 bps Fed rate cut next week. Geopolitical tensions offered mild support but didn’t stop the pullback. Dive deeper.

Brent rose to $62.97/bbl on December 4, up 0.48% day-on-day, but remains down 0.87% over the month and 12.65% YoY. Despite the uptick, prices are far below the 2008 peak of $147.50. Dive deeper.

The US500 rose to 6,859 on December 4, up 0.14% for the day, 0.93% over the month, and 12.91% YoY. It remains just below its all-time high of 6,921.75 reached in October 2025. DIve deeper

Brazil’s GDP grew 0.1% in Q3 2025, slowing from 0.3% in Q2 and missing expectations. Consumer spending remained weak amid high inflation and interest rates, while government spending and investment rose. Exports grew 3.3%, outpacing a 0.3% rise in imports. Dive deeper.

Lithium carbonate futures in China climbed above CNY 94,000/tonne, an 18-month high, driven by stronger battery and EV demand. China plans to double EV charging capacity by 2027, NEV output and sales are surging, and producers expect lithium demand to grow 30% next year. Supply remains tight as CATL’s major mine is only now preparing to reopen. Dive deeper.

Japan’s stock market index (Nikkei 225) surged ~2.2%, aided by strong demand at a 30-year Japanese Government Bond auction, improving risk sentiment across regional markets. Dive deeper.

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Sharad Agarwal, CEO, Sify Infinit Spaces on data-centre strategy and AI demand.

“While artificial intelligence is not a bubble, rampant industry growth and herd behaviour could lead to over-building and excess capacity.”

“We are investing cautiously to avoid over-exposure, even as we expand our footprint — we currently operate 14 data centres, with 11 more underway.”

“Post-IPO, we aim to broaden our client base beyond hyperscalers to include sectors such as banking, e-commerce, and media, and enter edge-data centre space starting with Visakhapatnam- Link

Novo Nordisk on its India market strategy.

Novo Nordisk is gearing up to launch its diabetes drug Ozempic in India this month, aiming to tap into the nation’s growing demand for diabetes and weight‑management treatments.

The company said it aims to price Ozempic competitively, as India is a price‑sensitive market. - Link

HDFC Bank — Arup Rakshit, Group Head of Treasury on the rupee outlook

“The weakness is driven by a widening current‑account deficit, reduced foreign investments, and drying dollar inflows into India.

Even if the rupee stabilises after a deal, he expects its value may remain between ₹ 90–92 per dollar for the near term.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

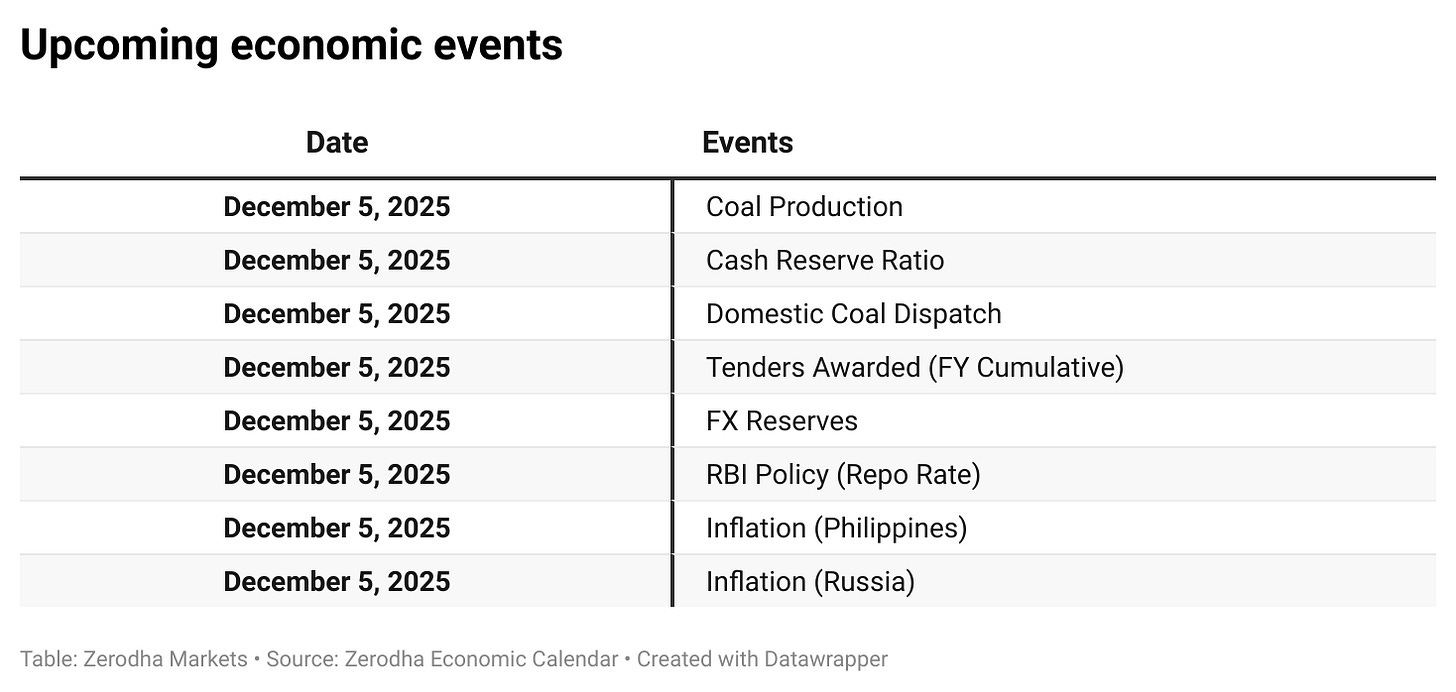

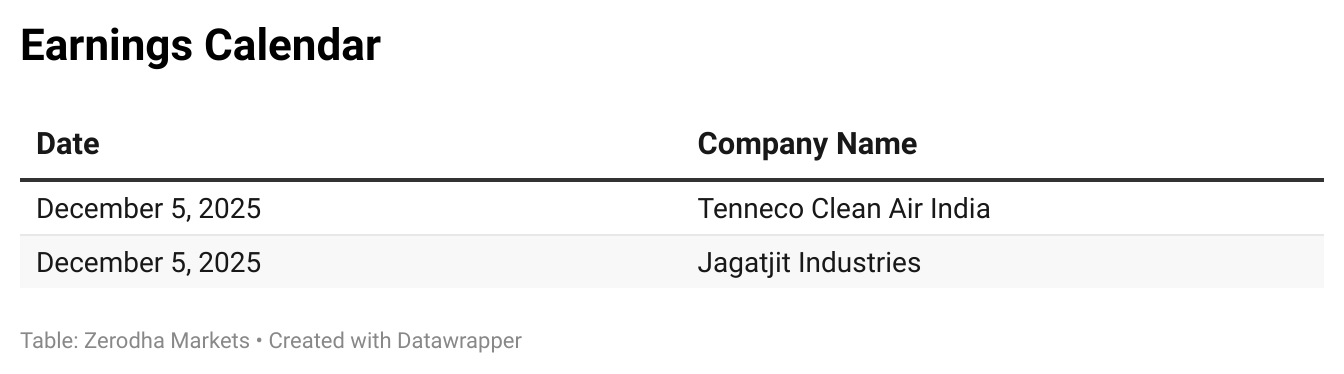

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Good analysis on index