Nifty snaps 8-day winning streak after a quiet, range-bound session

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore the three main streams of market analysis: Technical, Fundamental, and Alternative data. No matter whether you trade systematically or with discretion, the decisions you make depend on the information you use. Each of these approaches gives you a different lens on the market — and when combined, they can help you form a more complete view of a stock, index, or commodity.

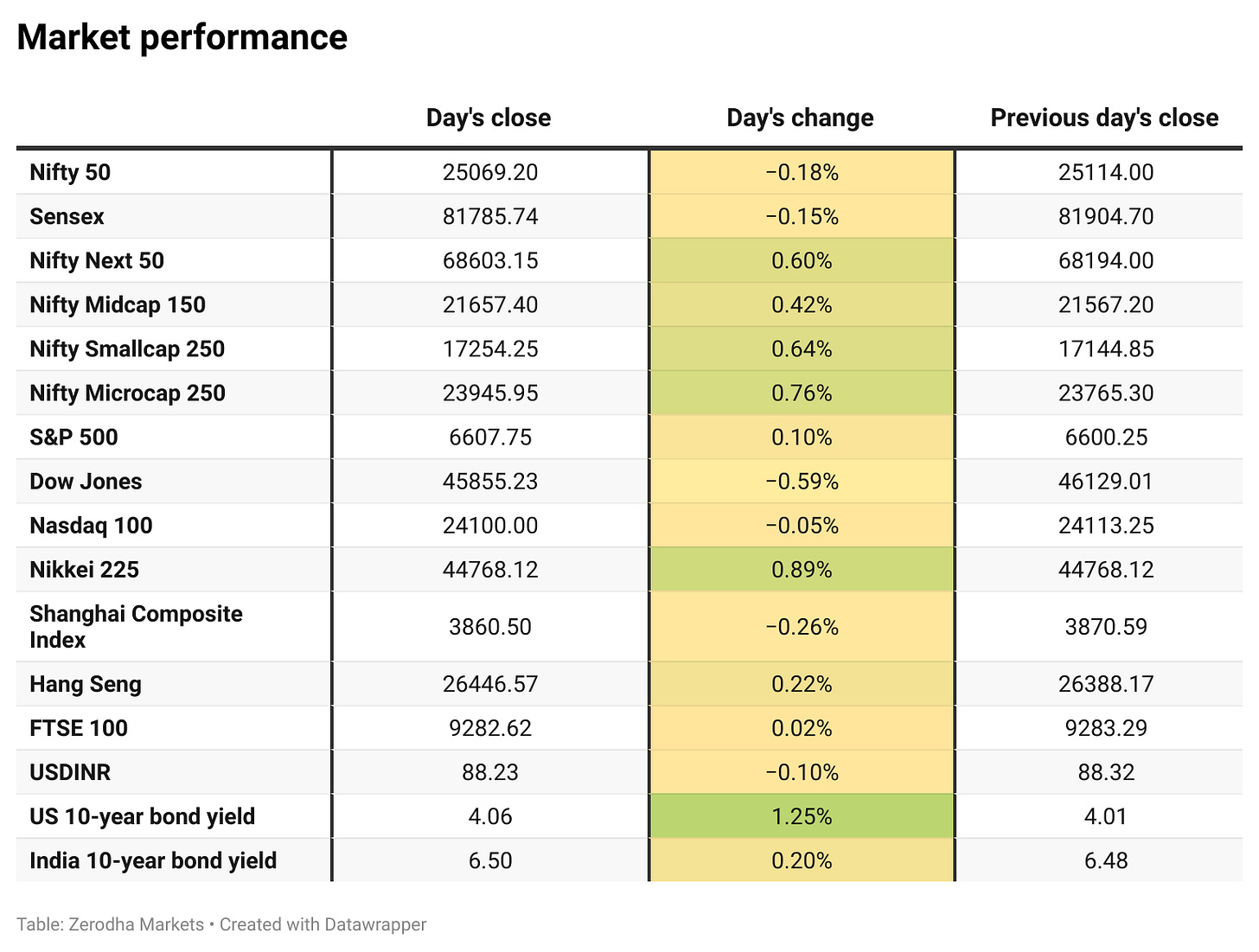

Market Overview

Nifty opened flat at 25,119 and remained volatile in the opening hour, swinging between 25,080 and 25,115 before stabilizing. Through the first half, the index moved in a choppy range, struggling to find direction but largely holding above the 25,080 mark.

In the second half, Nifty briefly climbed to test highs near 25,115 around 1:30 PM, but selling pressure soon dragged it lower. The index slipped steadily post 2 PM, touching intraday lows near 25,050 before a mild recovery attempt toward the close. Nifty eventually settled at 25,069, ending slightly lower and giving up its early gains.

While market sentiment remains cautious in general, with concerns over 50% tariffs, persistent foreign investor outflows, and muted earnings weighing on confidence, some encouraging triggers, such as easing U.S.-India trade tensions, have helped markets recover from lows in the last week.

Broader Market Performance:

Broader markets had a mixed session with bullish bias today. Of the 3,165 stocks traded on the NSE, 1,711 advanced, 1,356 declined, and 98 remained unchanged.

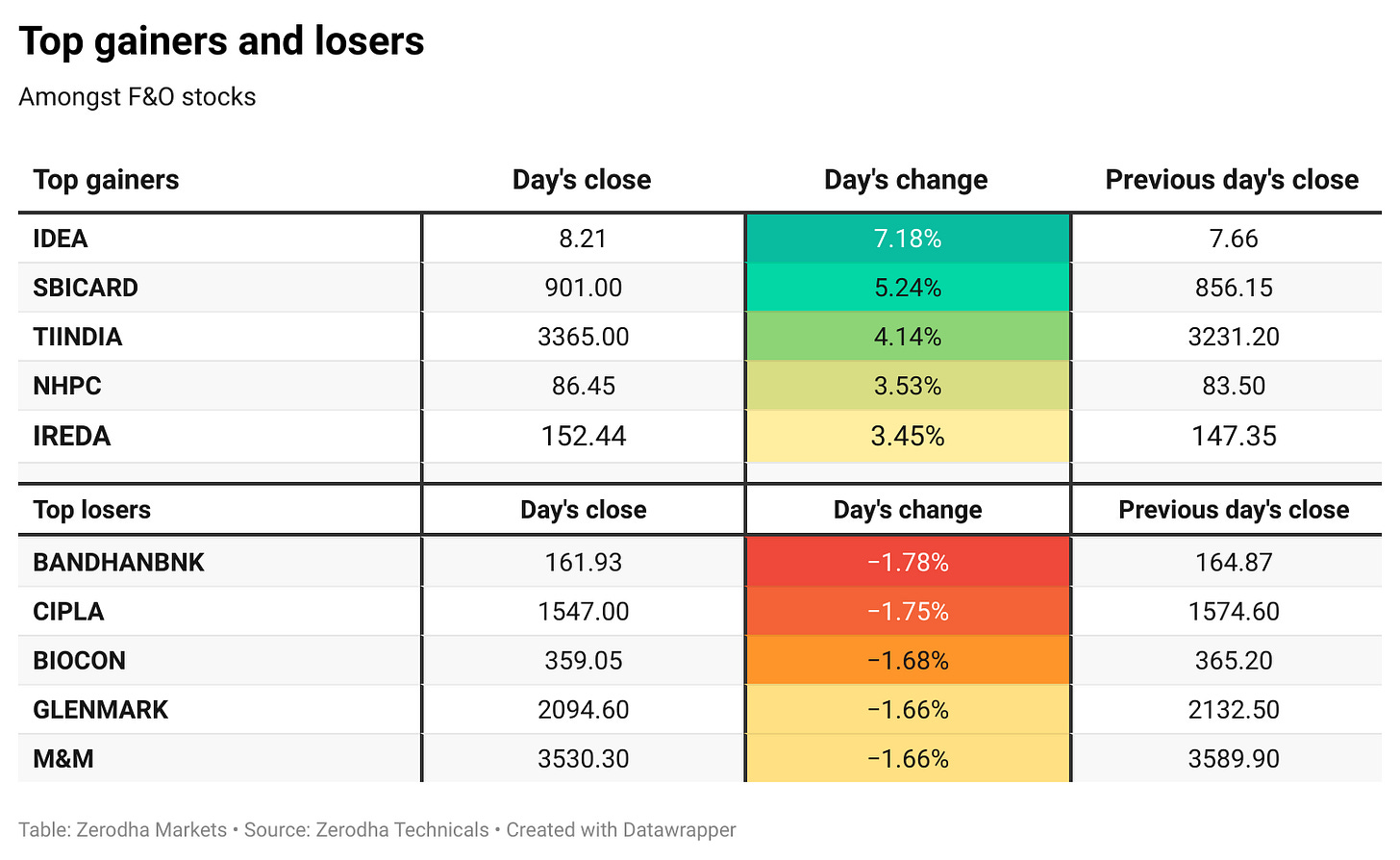

Sectoral Performance

The top-gaining sector for the day was Nifty Realty, which surged 2.41%, while the top losing sector was Nifty Pharma, declining 0.64%. Out of the 12 sectoral indices, 5 ended in the green and 7 closed in the red, indicating a slightly negative overall breadth despite strength in Realty and PSU Banks.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th September:

The maximum Call Open Interest (OI) is observed at 25,100, followed by 25,200, suggesting strong resistance at 25,100 - 25,200 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 25,100, suggesting strong support at 25,000 to 24,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

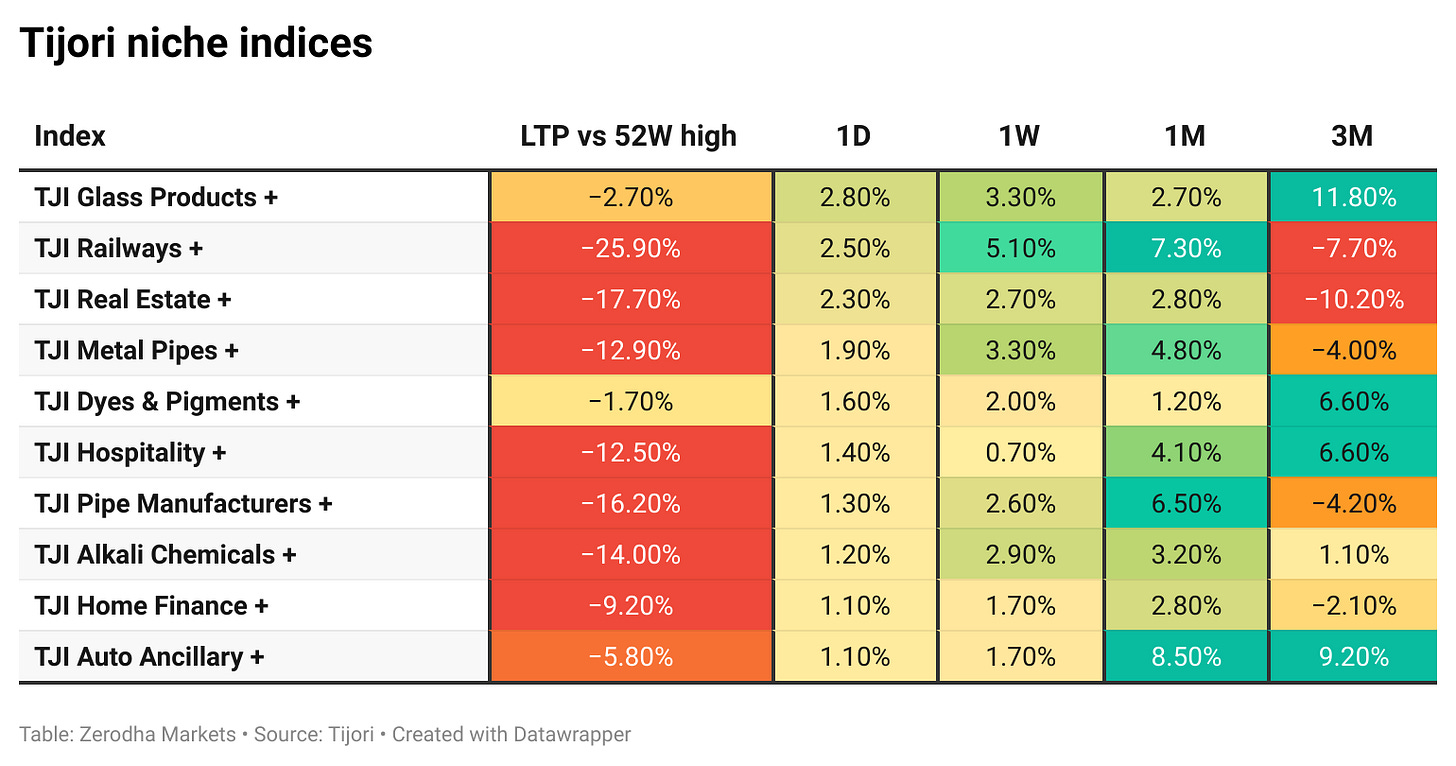

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

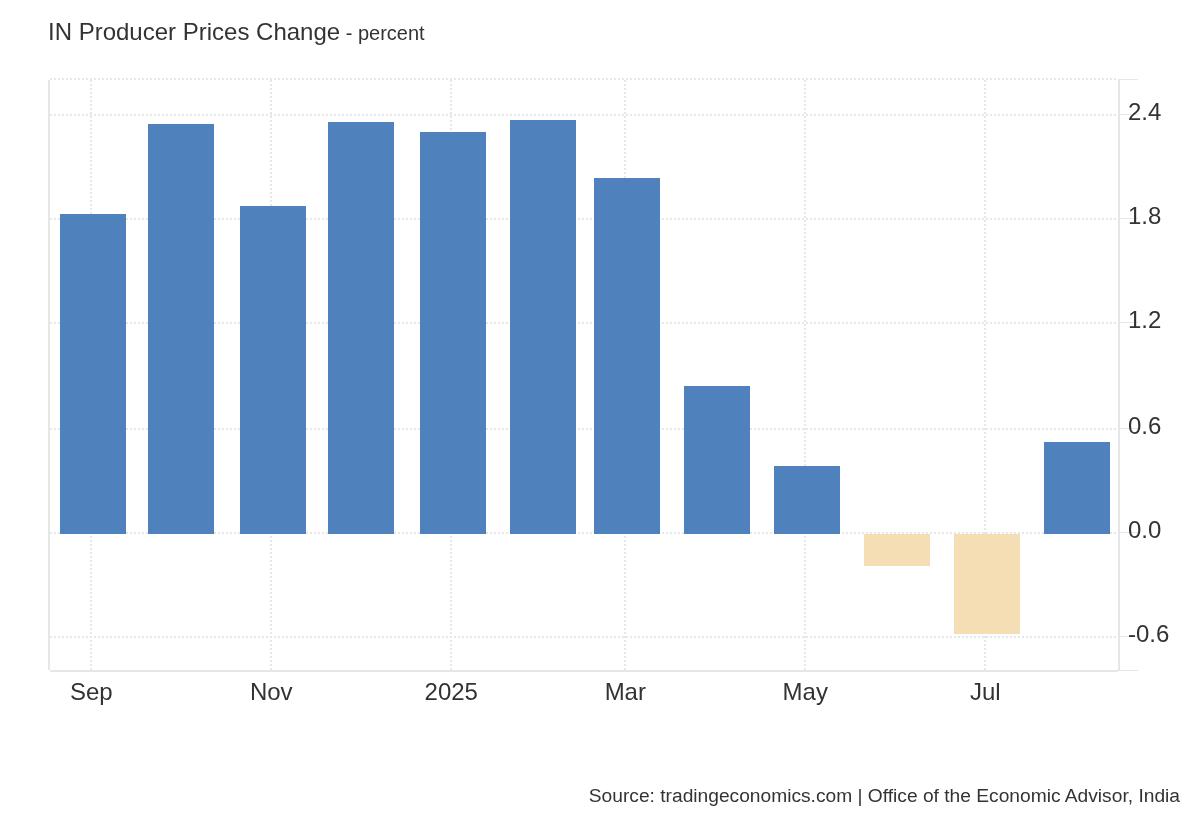

India’s wholesale prices rose 0.52% year-on-year in August 2025 after a 0.58% decline in July, driven by higher food and manufacturing costs, while fuel prices fell 3.17%, according to the Office of the Economic Advisor. Dive deeper

India’s unemployment rate eased to 5.1% in August 2025 from 5.2% in July, matching the record low seen in April. Male unemployment fell to 5%, while female labor force participation rose to 33.7% from 33.3%, according to MOSPI. Dive deeper

India’s merchandise trade deficit stood at $26.49 billion in August 2025, down from $29.7 billion a year earlier. Imports fell 10.1% to $61.59 billion, while exports rose 6.7% to $35 billion, according to the Ministry of Commerce and Industry. Dive deeper

India’s exports rose 6.7% to $35.1 billion in August, while imports fell 10% to $61.59 billion, narrowing the trade deficit to $26.49 billion from $35.64 billion a year earlier. For April-August 2025-26, exports stood at $184.13 billion and imports at $306.52 billion. Dive deeper

SEBI announced measures to attract foreign capital, including a single-window clearance system for overseas funds, relaxed IPO rules for large firms, extended timelines for public float compliance, and simplified disclosure norms. The reforms aim to support big IPOs and strengthen India’s listings market. Dive deeper

Muthoot Finance raised $600 million through international bond markets under its $2 billion Global Medium-Term Note programme to fund lending activities. Dive deeper

The Supreme Court will hear Vodafone Idea’s petition on September 19 seeking quashing of additional AGR demands up to FY17 and a reassessment of dues under the 2020 Deduction Verification Guidelines. The company currently owes over ₹83,000 crore in AGR dues, of which it has sought a waiver on ₹45,000 crore. Dive deeper

Tata Technologies will acquire Germany’s ES-Tec Group for €75 million in cash, with the deal expected to close by December 2025. The acquisition will strengthen its ER&D capabilities in next-gen mobility and systems engineering and is projected to be earnings accretive from the first full year. Dive deeper

SEBI has reclassified REITs as equity instruments, clearing the path for index inclusion and higher mutual fund allocations. The move brings India in line with global practices and is expected to boost liquidity and institutional participation. It also aims to attract larger capital flows into the real estate sector. Dive deeper

Eight mutual funds, including SBI MF and JioBlackRock, saw their AUM fall by over ₹3,000 crore each in August. HSBC MF reported the highest decline of ₹6,253 crore, followed by SBI MF at ₹5,603 crore, JioBlackRock at ₹5,389 crore, UTI MF at ₹4,919 crore, Aditya Birla Sun Life at ₹4,370 crore, DSP at ₹3,355 crore, Quant at ₹3,282 crore, and HDFC MF at ₹3,047 crore. Dive deeper

Pine Labs has received SEBI approval for its IPO, which could be worth $1 billion with a valuation of up to $6 billion. The company plans to use the proceeds for overseas investments, technology development, and debt reduction. Dive deeper

Adani Cement has launched Adani Cement FutureX to train a future-ready workforce for infrastructure, fostering collaboration between industry, academia, and students. The initiative includes Smart Cement Labs, R&D exposure, field visits, and internships, with a focus on new-age materials, decarbonisation, and innovation. Dive deeper

RailTel won a ₹209 crore order from the Bihar Education Project Council under the PM SHRI scheme and two orders worth ₹103.4 crore from Panvel and Nashik municipal corporations. Dive deeper

What’s happening globally

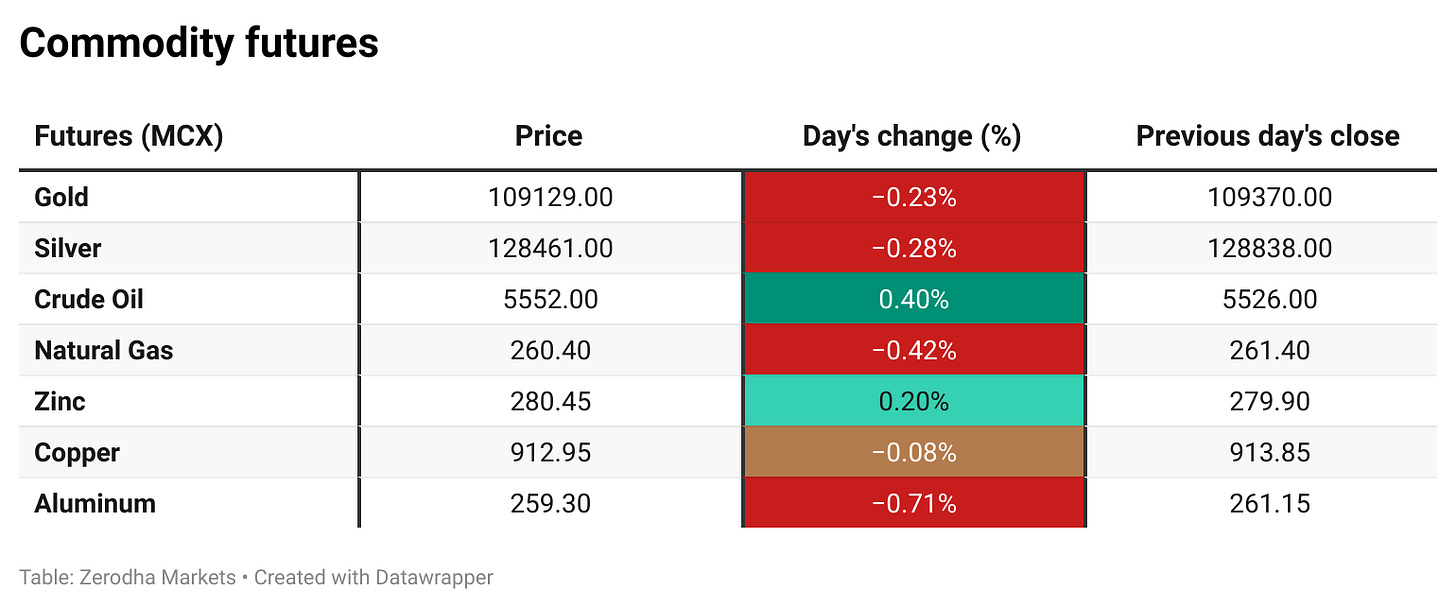

Brent crude rose to $67.2 per barrel after Ukrainian strikes on Russian energy infrastructure and renewed US pressure on Europe to cut Russian oil purchases. Concerns over weak US demand and higher OPEC+ supply limited gains. Dive deeper

Gold traded around $3,640 per ounce near record highs as markets awaited the US Federal Reserve’s policy decision, with investors watching upcoming US economic data, Fed leadership developments, and US-China trade talks. Dive deeper

The dollar index fell to around 97.5 ahead of the US Federal Reserve’s policy decision this week. Dive deeper

Germany’s wholesale prices rose 0.7% year-on-year in August 2025, marking the ninth straight increase, led by food and metals, while fuel and scrap prices declined. On a monthly basis, prices fell 0.6%, the sharpest drop in a year, according to the Federal Statistical Office. Dive deeper

UK house prices fell 0.1% year-on-year in September, the first annual decline since January, while rents rose 2.4%, the slowest increase in four years. Dive deeper

China’s property investment fell 12.9% year-on-year in January–August, with property sales down 4.7%, new construction starts dropping 19.5%, and developer funding declining 8%, according to official data. Dive deeper

China’s industrial production rose 5.2% year-on-year in August 2025, the slowest pace since August 2024, as manufacturing and utilities growth eased while mining output remained steady. For January-August, industrial production increased 6.2%, according to the National Bureau of Statistics. Dive deeper

Elon Musk bought $1 billion worth of Tesla shares, his first open market purchase since February 2020, acquiring about 2.57 million shares. Tesla is also seeking shareholder approval for a new pay package for him. Dive deeper

Citigroup’s refurbishment costs for its London tower have risen to $1.5 billion, nearly matching the building’s 2019 purchase price. The project, expected to finish next year, includes expanded workspace, gardens, and upgraded energy systems, underscoring Citi’s long-term commitment to Britain. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nirmala Sitharaman, Union Finance Minister, on AI regulation

"We do not want regulation that literally wipe out technology itself. We want regulations because we want a responsible application."

"AI is rapidly progressing and dynamic, so we must remain conscious of its ethical challenges."

"The challenge is not just in jobs but also in preventing misuse that could have repercussions for society." - Link

Vivek Gupta, CEO & MD, United Breweries Ltd., on growth outlook and GST reforms

"We are geared up to deliver 6-7% volume growth this fiscal, with premiumisation expected to rise by 25% despite rain impact in key states."

"GST reforms will boost consumption of alcoholic beverages if state governments avoid offsetting it with higher excise. Beer, being natural with less than 6% alcohol, should be taxed differently from spirits."

"The beer industry supports farmers, generates jobs, and pays huge taxes. With fair reforms and reduced tariffs, the opportunity is massive for growth." - Link

Deepesh Varma, Executive Vice President - Foreign Exchange, Thomas Cook India, on TC Pay launch

"With TC Pay, we've launched yet another consumer empowering innovation, offering our range of forex services under one intuitive app, for a truly seamless experience."

"This strategic move aims at leveraging technology to extend our reach beyond the physical and retail network, to unlock high-potential new and underleveraged markets."

"Our digital-first transformation enables us to extend our footprint beyond branches, tapping new opportunities through a strong, scalable digital presence." - Link

Feroze Azeez, Deputy CEO, Anand Rathi Wealth, on SEBI’s regulatory changes

"Some are hygiene changes. I would categorise the exit load cut to 3% as a hygiene change, not that the 5% limit was being utilised by anybody largely."

"Exit loads have not truly helped investors, and even 3% remains astronomically high."

"Reclassifying REITs as equities gives fund managers flexibility, though REITs in India haven’t delivered equity-like returns. Still, it’s a progressive step." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

👍

👍