Nifty snaps 3-day losing streak to close near 25,900; USD-INR hits fresh lows

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore the widely-used but deeply misunderstood expiry-day phenomenon of penny options—those far-OTM ₹1–₹2 “chillar” strikes that create asymmetric payoffs for both buyers and sellers.

We examine how far-OTM pricing reflects market fear, when selling can make sense around events, and why famous blow-ups like LTCM, XIV, and volatility spikes echo the same risk profile—showing why penny options look tempting, so often ruin traders, and why payoff asymmetry ultimately drives both risk and reward.

Market Overview

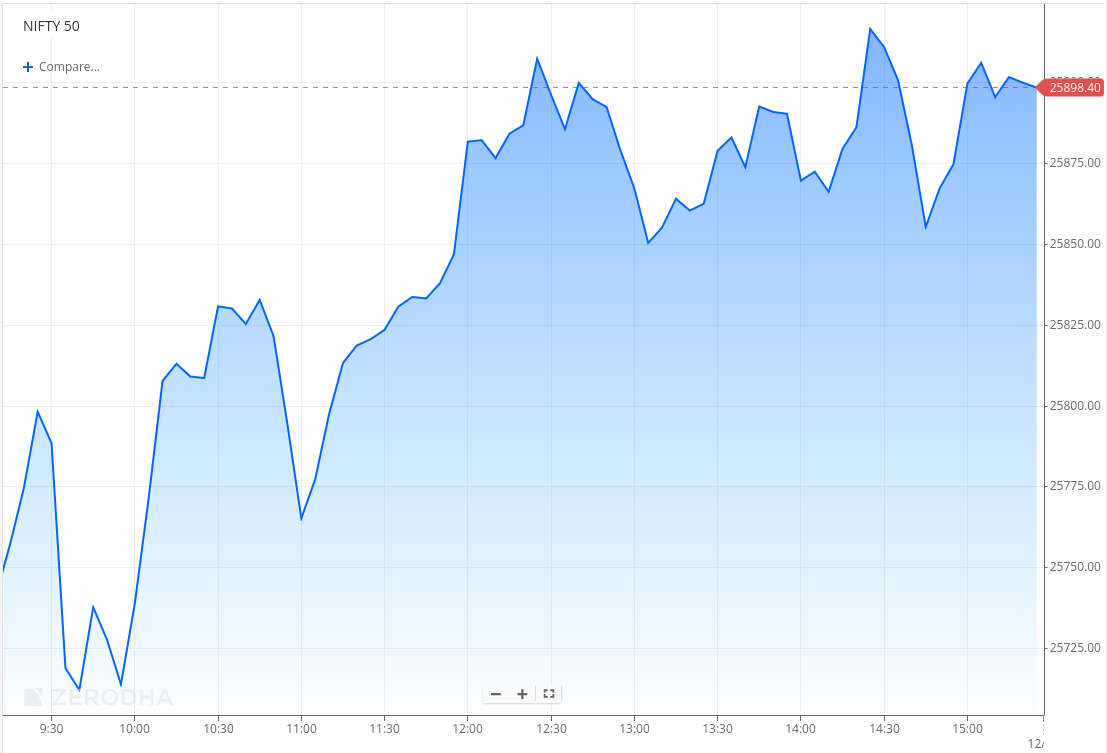

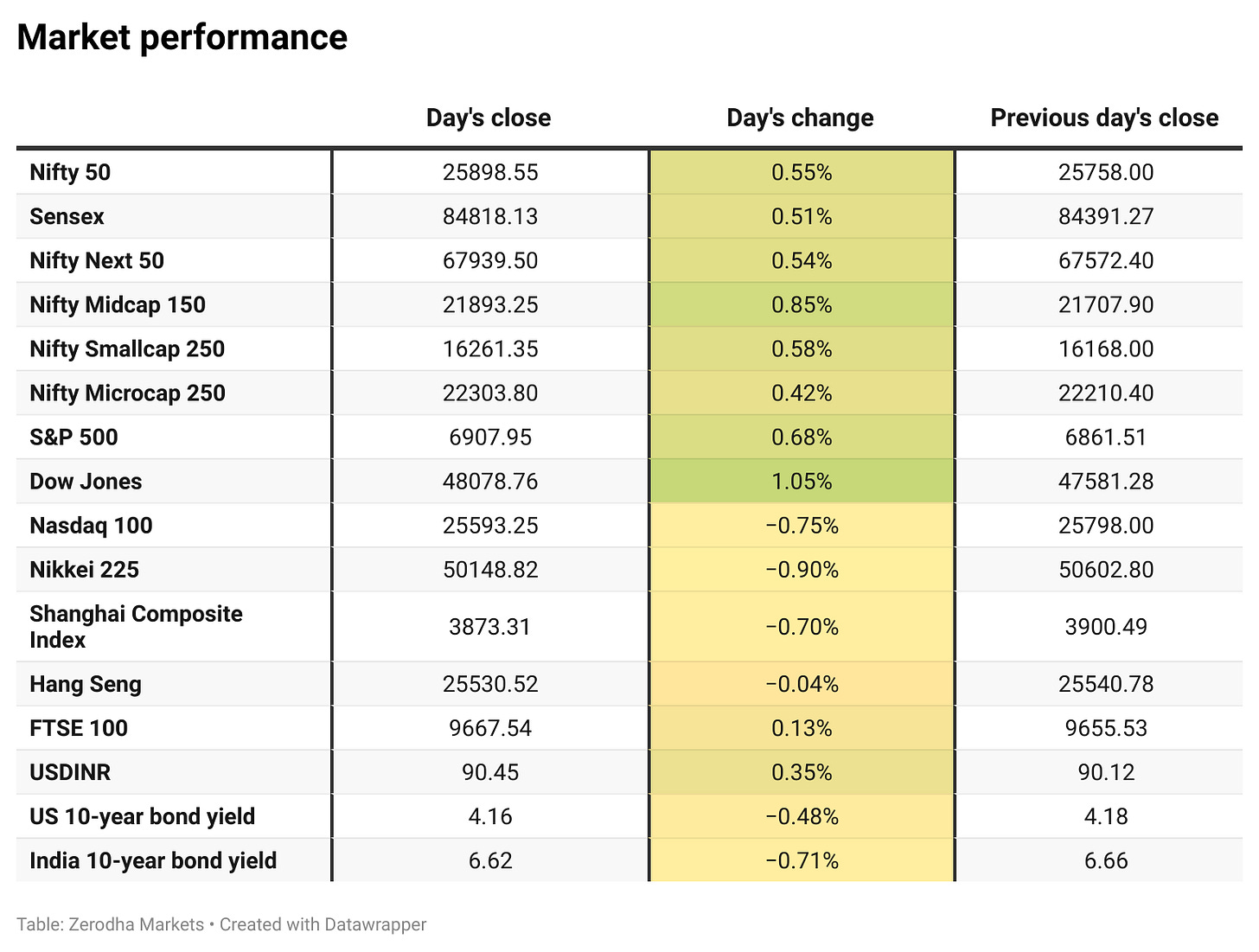

Nifty opened flat at 25,771 despite a positive close in U.S. markets after the Fed delivered a 25 bps rate cut. After briefly testing 25,800, the index slipped toward the 25,700–25,710 zone within the first hour before staging a steady 120-point rebound to around 25,820 by 11 AM. Through the late morning session, Nifty continued its upward trajectory, climbing past 25,850 and maintaining a firm recovery trend.

In the second half, the index extended its gains further, moving into the 25,880–25,900 zone and even testing levels close to 25,920. Although some intraday volatility pulled the index back toward 25,850, Nifty held on to most of its recovery and eventually closed at 25,898.55, up around 0.55% from the previous close. Overall, it was a constructive session, supported by a strong intraday comeback.

Looking ahead, markets are likely to remain driven by global risk appetite, currency movements, and developments around the India–U.S. trade negotiations.

Broader Market Performance:

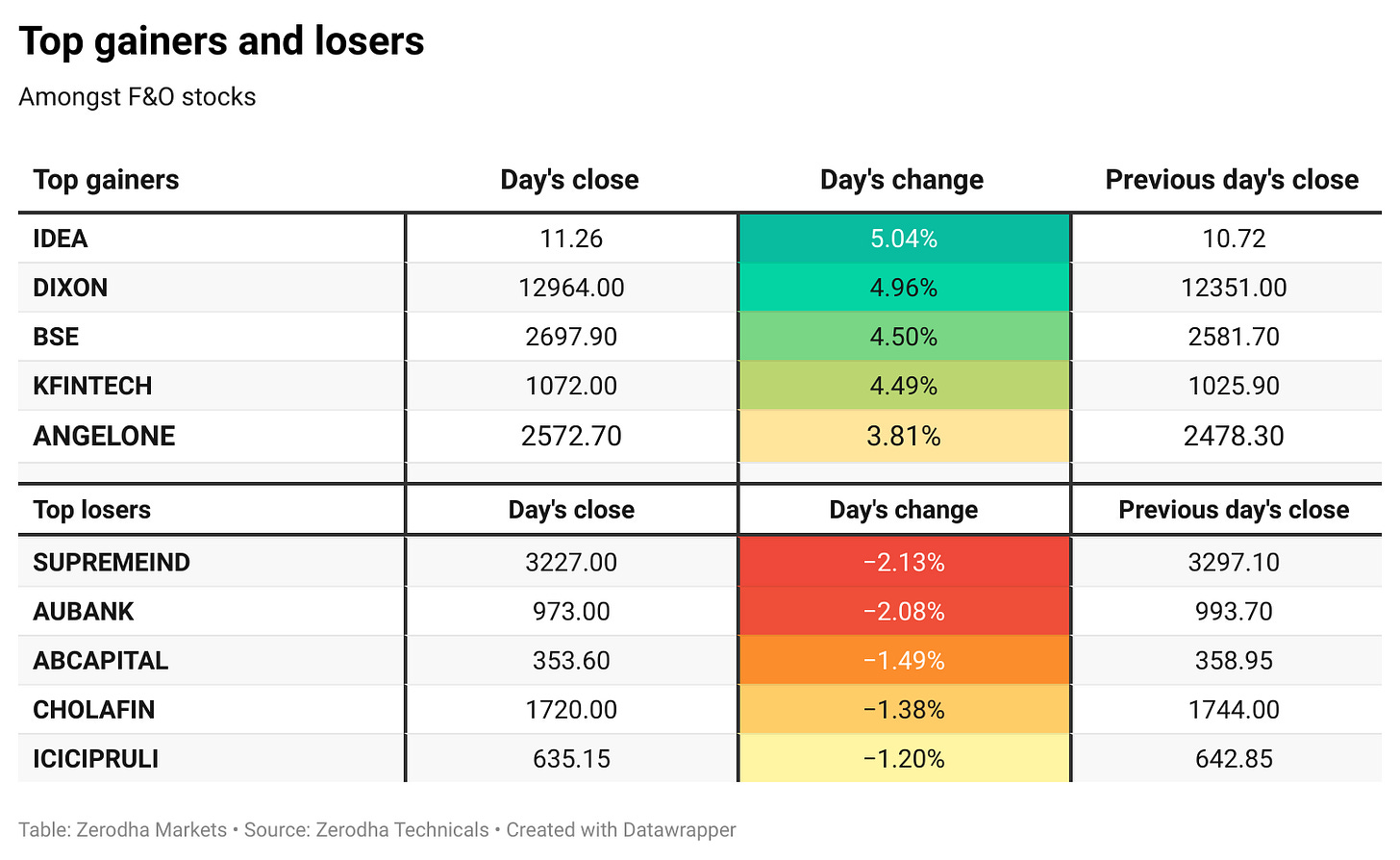

After the first hour hiccup, the broader markets staged a strong recovery. Out of 3,207 names traded on the NSE, 1,921 advanced, while 1,187 declined, and 99 remained unchanged.

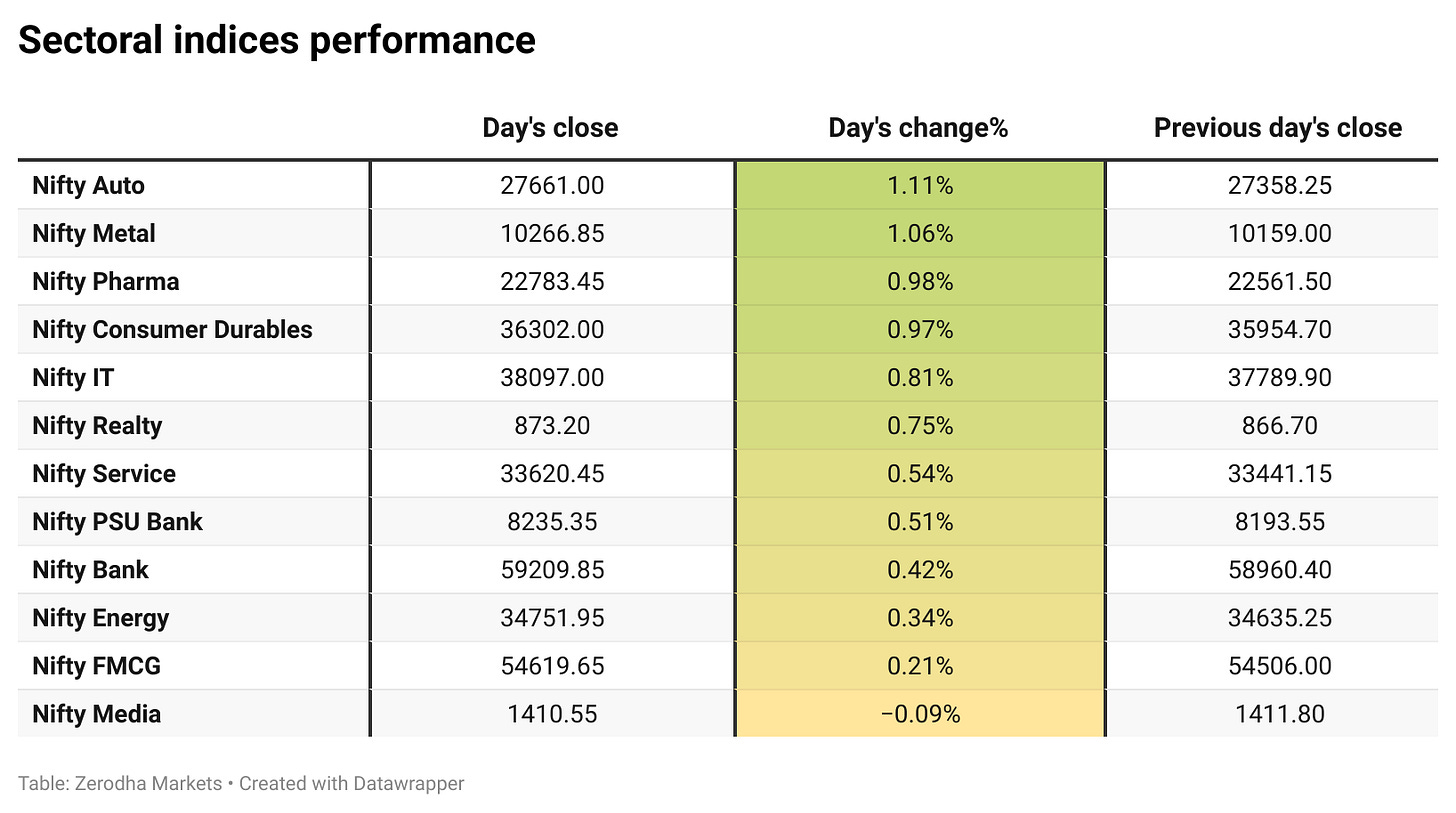

Sectoral Performance:

Nifty Auto emerged as the top gainer with a 1.11% rise, followed closely by Nifty Metal and Nifty Pharma. On the flip side, Nifty Media was the sole sector to close in the red, slipping by 0.09%. Out of the 12 sectoral indices, 11 ended in the green while only 1 closed in the red — signaling broad-based market strength for the day.

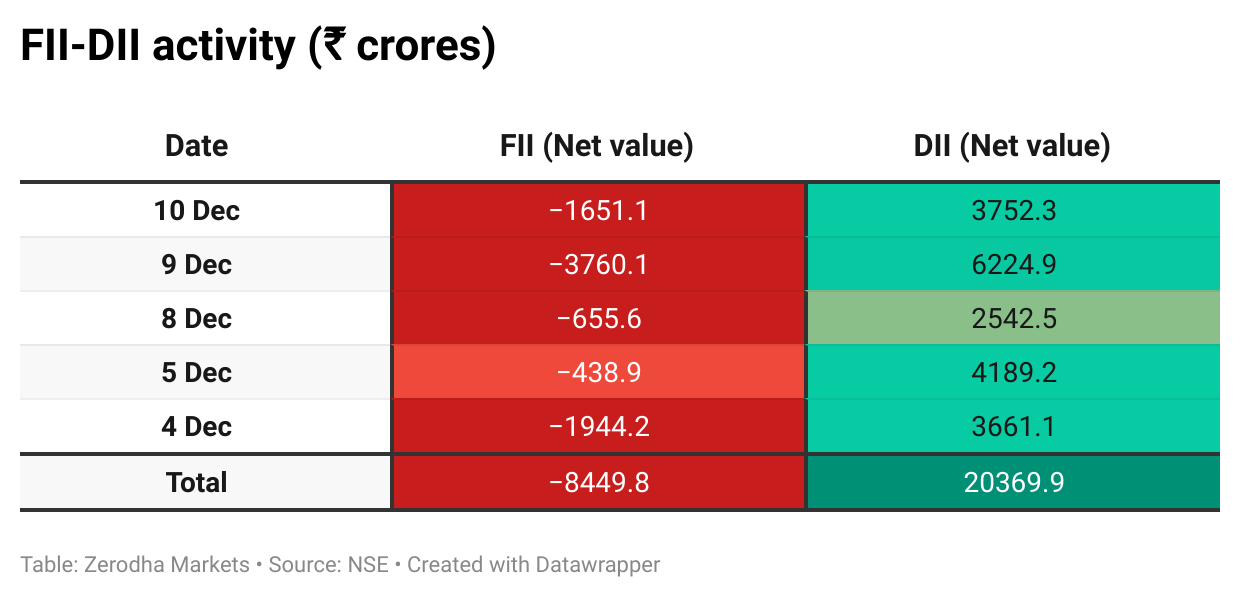

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,800, followed by 25,700, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

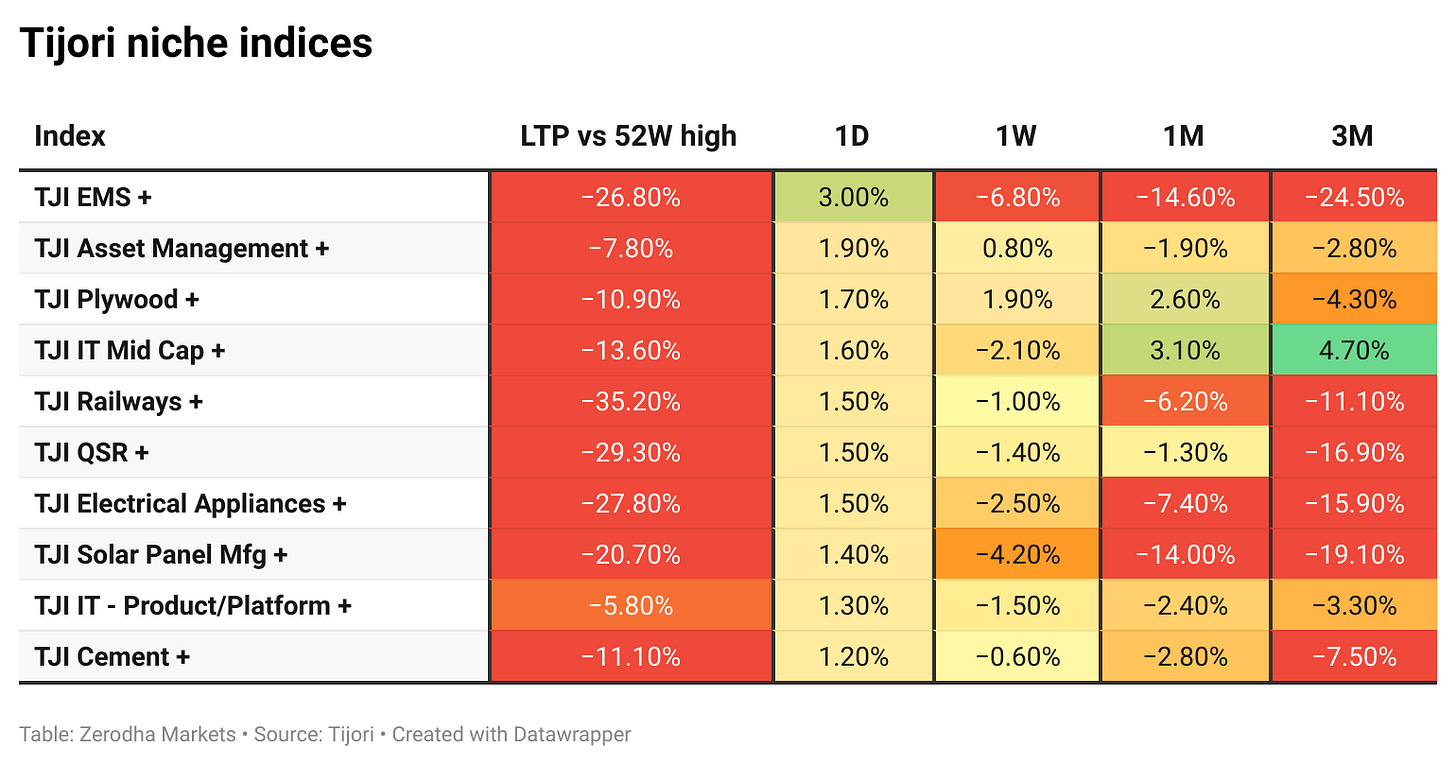

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee hit a fresh record low around 90.46 per dollar on Thursday amid ongoing pressure from steep US tariffs, weak exports and persistent portfolio outflows. Dive deeper

RBI bought about $5.5 billion worth of government bonds at its first open-market auction since May, as part of a broader liquidity push following the recent rate cut. The purchases are aimed at easing financial conditions and supporting the bond market without directly targeting the benchmark 10-year yield. Dive deeper

Adani Enterprises’ nearly ₹25,000 crore partly paid rights issue closed with a robust 108% subscription, with bids for 14.95 crore shares against 13.85 crore on offer, signalling strong confidence from both promoters and public investors. Dive deeper

Hubtown shares fell over 9% after the company withdrew its proposed preferential share issue. The stock closed at ₹229 and has now dropped 25% over the last five sessions. Dive deeper

Shakti Pumps shares surged over 12% after the company announced it had received a new order from the Maharashtra State Electricity Distribution Company (MSEDCL). Dive deeper

What’s happening globally

The Fed cut the funds rate by 25 bps to 3.5%–3.75% in December, its third straight reduction and the lowest level since 2022, with a rare three-member dissent split between calls for a larger cut and no move. Dive deeper

China’s vehicle sales rose 3.4% y/y in November to an 11-month high of 3.43 million units, while new energy vehicle (NEV) sales jumped 20.6% to a record 1.82 million, marking a ninth straight monthly gain. Dive deeper

Japanese government bonds climbed on Thursday after a 20-year bond auction saw the strongest demand in over five years. The 20-year JGB yield fell 4.5 bps to 2.90%, its lowest since December 3. Dive deeper

Brent crude fell below $62 as reports that Trump’s Ukraine peace plan could restore Russian energy flows to Europe eased supply concerns that had flared after tanker-related disruptions. Dive deeper

US stock futures fell on Thursday, with Dow, S&P 500 and Nasdaq 100 futures down 0.5%, 0.8% and 1.1%, respectively, as Oracle slumped over 11% in extended trade after missing revenue estimates, issuing soft guidance and flagging a sharp increase in planned spending, reviving worries over AI investment returns. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Sandip Agarwal, Fund Manager & Co-founder, Sowilo Investment Managers, on Fed cuts, AI disruption, and IT valuations:

“The US Fed rate cut gives clarity and removes a major overhang for global corporates, including Indian IT clients, but it will not materially boost spending in the near term.”

“The real disruption for the IT sector will come from AI-led effort cuts, which will fundamentally change how IT deals are structured and how revenues are booked.”

“For FY26, growth will be limited and FY27 is still uncertain, but large-cap IT stocks are already trading at high valuations, which is a key challenge for investors.” - Link

Satya Nadella, CEO, Microsoft, on Copilot adoption by Cognizant, Infosys, TCS, and Wipro:

“Cognizant, Infosys, TCS and Wipro will collectively deploy over 200,000 Microsoft Copilot licences, with each of them implementing more than 50,000 licences across their organisations.”

“These companies are truly frontier firms in the adoption of Copilot and agent AI.”

“What they are doing with Copilot at this scale is going to fundamentally change how work gets done and set a benchmark for enterprise AI globally.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

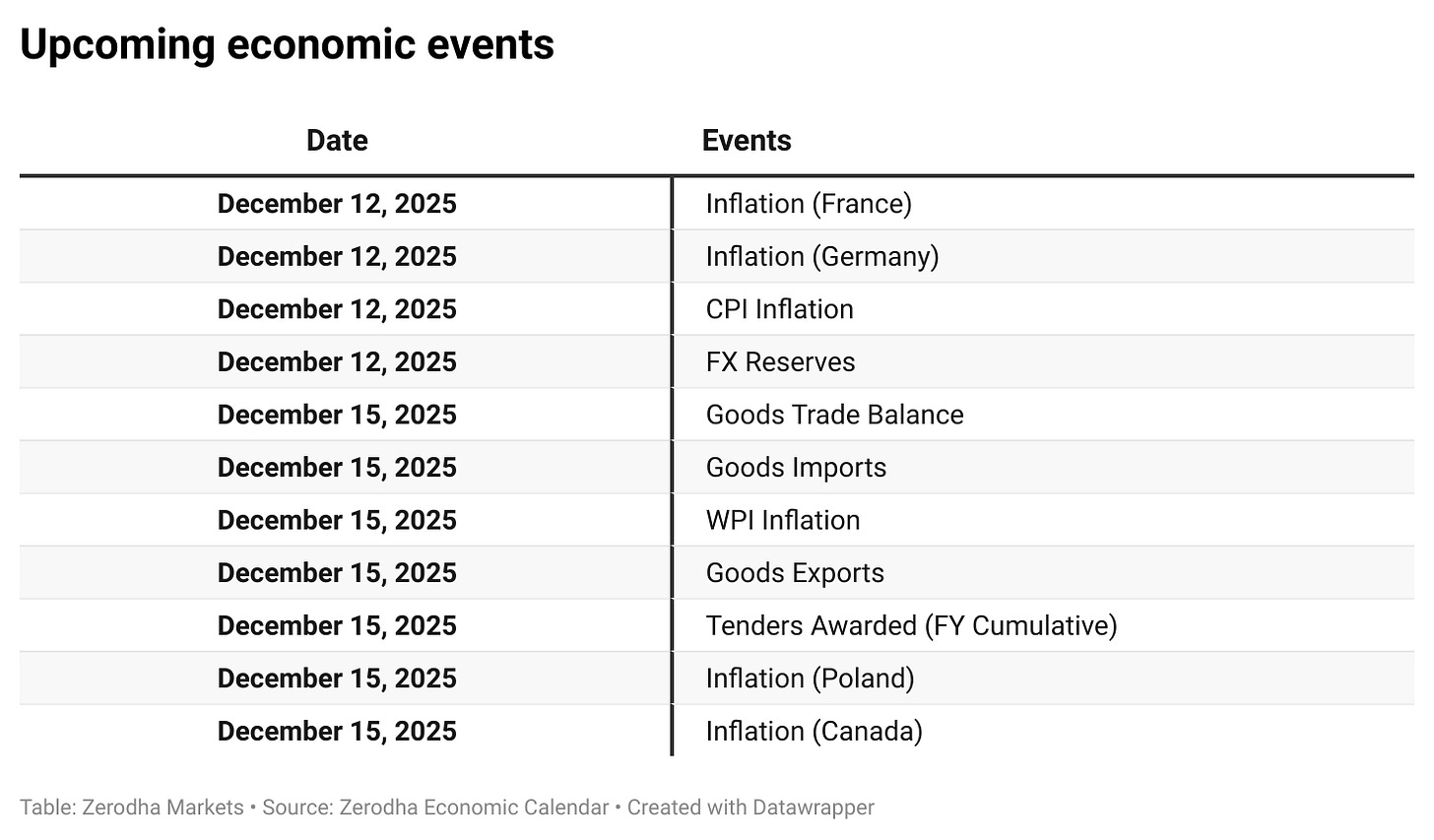

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Solid wrap. The Sandip Agarwal quote on AI-led effort cuts reshaping IT deal structures is the real story everyone's sleeping on. Current IT valuations are pricing in traditional revenue models when the actual business mechanics are abot to shift completley. FY27 visibility is murky but the market's already rewarding names at 25+ PE, which feels early given we dunno how Copilot deployments (200k licenses across the big four) actually flow through to billings yet.

Very well elaborated