Nifty snaps 3-day losing streak on strong GDP, Auto sales data

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Introducing In The Money by Zerodha

This newsletter and YouTube channel aren’t about hot tips or chasing the next big trade. It’s about understanding the markets, what’s happening, why it’s happening, and how to sidestep the mistakes that derail most traders. Clear explanations, practical insights, and a simple goal: to help you navigate the markets smarter.

Market Overview

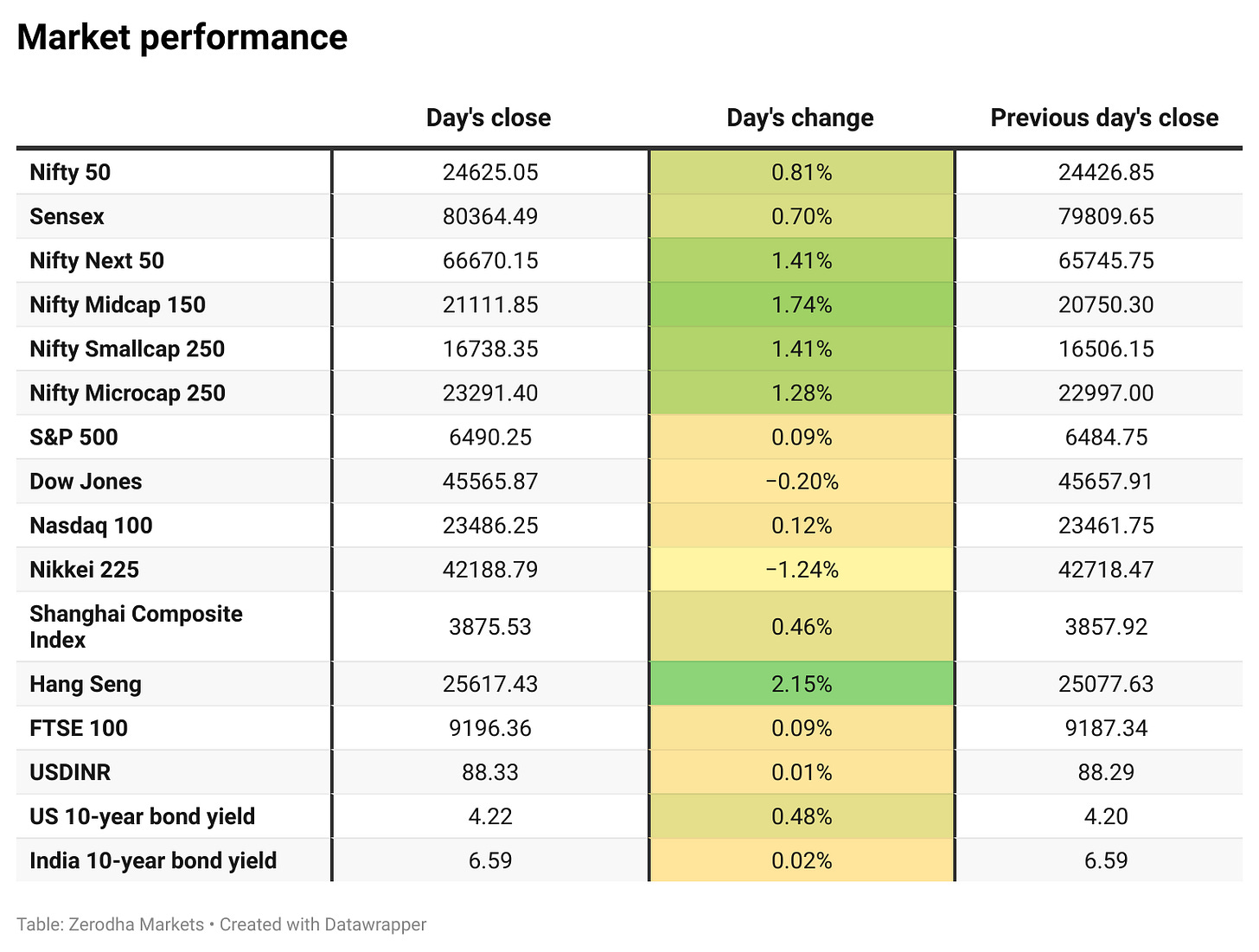

Nifty opened flat at 24,433 but quickly spiked by 115 points to reach 24,550 in the first 20 minutes, supported by early buying interest. After a brief consolidation phase during mid-morning, the index resumed its upward trend post-noon.

Through the second half, Nifty steadily climbed, crossing 24,600 and hitting an intraday high near 24,630. The upmove remained intact with higher lows being formed throughout the session.

The index eventually closed at 24,625.05, marking a strong recovery session and snapping the recent 3-day losing streak, reflecting renewed buying interest and improved sentiment.

Market sentiment remains cautious. While the recent GST cut announcement has lifted hopes of a consumption boost, concerns around 50% tariffs, persistent FII outflows, and muted earnings continue to weigh on investor confidence. Focus remains on escalating U.S.-India trade tensions, which are expected to shape near-term market direction.

Broader Market Performance:

Broader markets staged a strong comeback today. Of the 3,156 stocks traded on the NSE, 2,128 advanced, 935 declined, and 93 remained unchanged.

Sectoral Performance

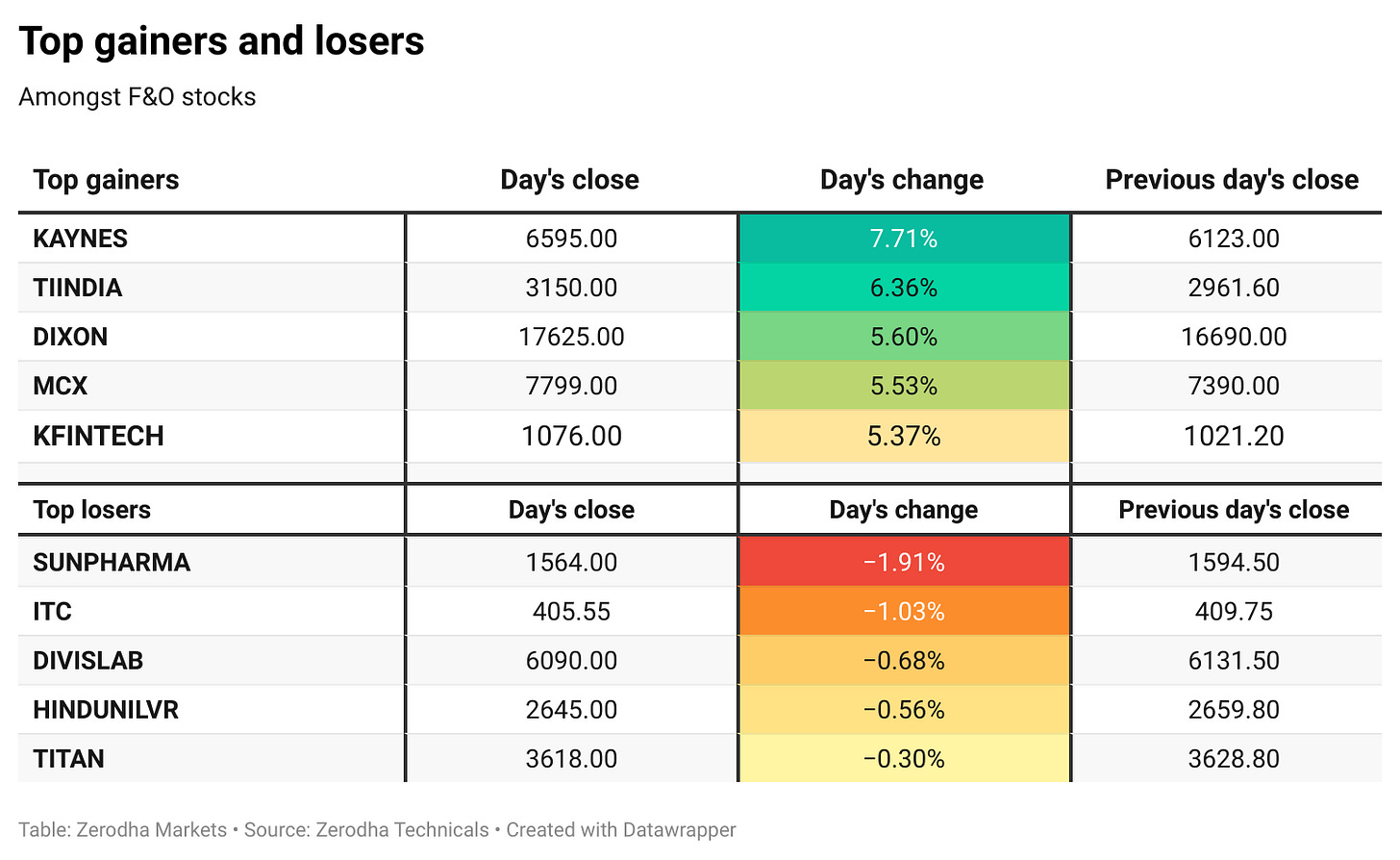

Nifty Auto was the top gainer, surging 2.80%, while Nifty Media was the top loser, down 0.32%. Out of the 12 sectoral indices, 10 closed in the green and only 2 ended in the red, indicating broad-based market strength led by strong buying in autos, consumer durables, and metals.

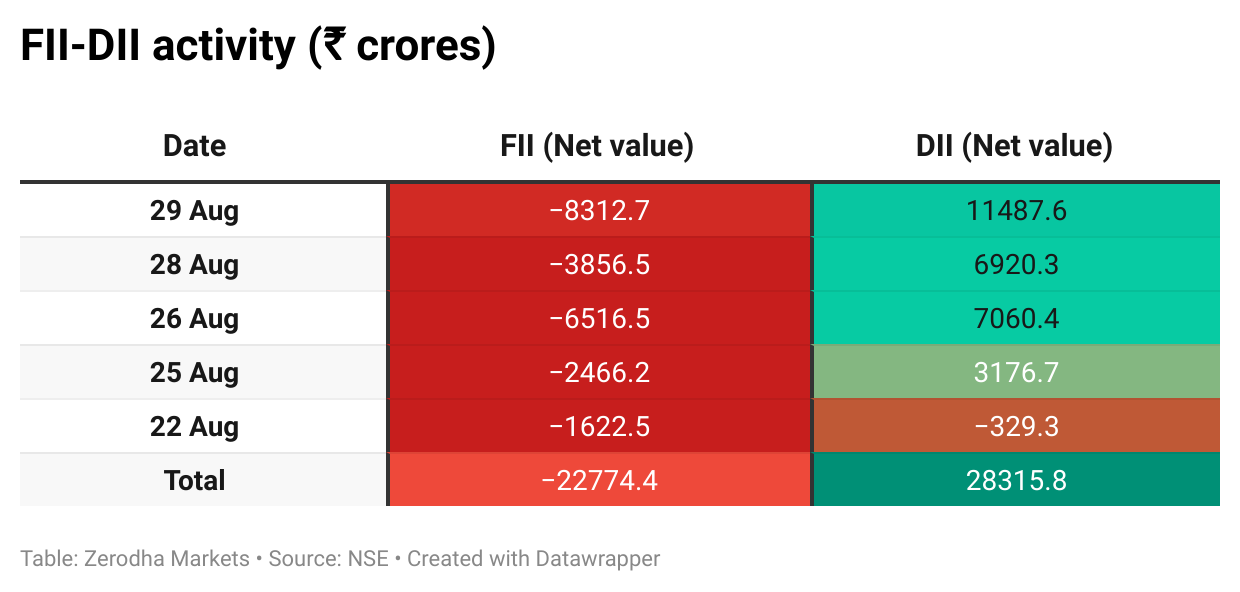

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd September:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 24,700 & 24,800, suggesting strong resistance at 24,700 - 24,800 levels.

The maximum Put Open Interest (OI) is observed at 24,500, followed closely by 24,600, suggesting strong support at 24,500 to 24,400 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

NSE has shifted all index and stock derivatives expiries from Thursday to Tuesday, starting today, September 1, 2025, with the first Nifty weekly expiry tomorrow. BSE has moved its expiries to Thursday, with the first Sensex weekly expiry on September 4. Dive deeper

India’s manufacturing PMI rose to 59.3 in August 2025, the fastest expansion in over 17 years, driven by strong demand, record new orders, and accelerated output. Firms boosted input buying and inventories, with moderate price pressures and rising optimism offsetting weaker exports amid US tariffs. Dive deeper

The rupee hovered near a record low at 88.15 per dollar on Monday, pressured by US tariffs, FPI outflows, and broad Asian currency weakness. Traders noted limited RBI intervention, while focus shifted to US jobs data and India’s stronger but temporary Q2 GDP boost. Dive deeper

India’s GST collections rose 6.5% YoY to ₹1.86 lakh crore in August, with net collections at ₹1.67 lakh crore amid lower refunds. April–August revenues stood at ₹10.04 lakh crore, up 9.9% from last year. Dive deeper

FPIs pulled out $4 billion from Indian equities in August, the highest in seven months, taking 2025 outflows to $14.9 billion amid US tariffs and a weak rupee. Domestic funds and rising SIP inflows provided a strong counterbalance. Dive deeper

CMS Info Systems has secured a contract from India Post Payments Bank to replace 1,000 ATMs after AGS Transact’s collapse. The move comes amid a broader industry shift, with banks transitioning to CMS and exploring fixed-cost contracts and cash recyclers to modernize ATM networks. Dive deeper

Ashok Leyland has partnered with China’s CALB Group to invest over ₹5,000 crore in battery production over the next 7–10 years, aiming to localize supply for its EV portfolio while also catering to wider automotive and energy storage demand. Dive deeper

Vedanta has awarded employee stock options worth ₹450 crore in FY25, covering both top management and entry-level staff, making it one of its most inclusive ESOS programmes. Dive deeper

Ather Energy hit a 52-week high after unveiling its next-gen EL scooter platform at Ather Community Day 2025. The platform is designed for scalability and efficiency, supported by updates like AtherStack 7.0, faster chargers, and Infinite Cruise. Dive deeper

NCC said it secured two state government contracts worth ₹788 crore in August under its Water Division. The company noted the projects were bagged in the normal course of business and are not related-party transactions. Dive deeper

PG Electroplast said its subsidiary signed an MoU with the Maharashtra government to invest ₹1,000 crore in a greenfield consumer electronics project at Ahilyanagar, expected to create over 5,000 jobs and boost local manufacturing. Dive deeper

Mahindra & Mahindra’s total sales fell 1% YoY to 75,901 units in August. Utility vehicle sales dropped 9% to 39,399 units, while tractor sales rose to 28,117 units from 21,917 a year ago. Truck and bus sales declined 9% to 1,701 units. Dive deeper

What’s happening globally

Gold surged past $3,470 per ounce on Monday, nearing record highs as Trump’s tariff battle and Fed tensions fueled safe-haven demand. Bets for a September rate cut strengthened after inflation data and dovish Fed remarks, with focus now on upcoming US labour reports. Dive deeper

US natural gas futures climbed above $3/MMBtu in early September, rebounding from last month’s lows on expectations of tighter domestic supply. Falling Russian LNG exports and stronger global demand have boosted competition for US gas, while EIA data showed storage 3.4% lower YoY. Dive deeper

Euro area unemployment eased to 6.2% in July 2025, matching its record low, as jobless numbers fell by 170,000. Youth unemployment also hit an all-time low of 13.9%, with Germany and the Netherlands recording the lowest rates. Dive deeper

UK mortgage approvals rose to 65,352 in July 2025, the highest since January, signaling a housing market recovery amid easing interest rates. Remortgage approvals fell to 38,900, while the average new mortgage rate dropped to 4.28%. Dive deeper

Spain’s manufacturing PMI rose to 54.3 in August 2025, its strongest since October 2024, driven by robust output, new orders, and modest export gains. Firms expanded hiring and purchasing, while prices rose moderately and business confidence hit a six-month high. Dive deeper

China’s factory activity improved in August, with the RatingDog PMI rising to 50.5, its highest since March, as output and new orders picked up. Foreign demand decline slowed, though firms cut jobs for a fifth month even as business confidence hit a five-month high. Dive deeper

BYD’s Q2 profit fell 30% to 6.36 billion yuan, its first decline in over three years, as dealer rebates, rising costs, and aggressive price cuts weighed on margins despite robust overseas sales. Dive deeper

Sri Lanka Customs has detained nearly 1,000 BYD electric vehicles over alleged misrepresentation of motor power to evade higher tariffs, marking the second such seizure after a similar dispute in July. The case is under investigation, with testing and court oversight pending. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Pawan Munjal, Chairman, Hero MotoCorp, on GST cut for two-wheelers

"Lowering of GST on two-wheelers will serve as a crucial enabler, offering much-needed relief to first-time buyers in rural and semi-urban areas."

"It will significantly enhance accessibility and affordability for millions of Indians."

"The two-wheeler industry is not only a key driver of mobility but also a vital pillar of the national economy, contributing revenues and employment across its value chain." - Link

Tarun Mehta, Co-founder & CEO, Ather Energy, on growth and new platform

"20% market share is something I think that is possible for our business in the near term, up from the current 17%."

"The EL platform reduces assembly costs by ~15% through a unibody steel chassis and integrated charge drive controller, improving margins in coming years."

"We are expanding to 700 outlets by March 2026 and pushing for charging infrastructure standardisation to accelerate EV adoption." - Link

Commerce Ministry official on SEZ relief measures amid US tariffs

"The ministry is working on a plan to ease SEZ rules to help exporters cope with the steep 50% tariff imposed by the US."

"One proposal under consideration is to permit SEZ units to sell into the domestic tariff area on a duty-foregone basis."

"The idea is to safeguard exporters and also absorb displaced production through domestic demand." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Kindly provide RRG charts for analysing dynamic movement of indices /sectors and kindly provide the market breadth in a tabular form with at least weeks data for better understanding.