Nifty slips to close near 25,200 as IT drags on H-1B visa fee hike

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take a step deeper into the trading landscape and explore the three foundational trading strategy archetypes: Trend Following, Mean Reversion, and Arbitrage.

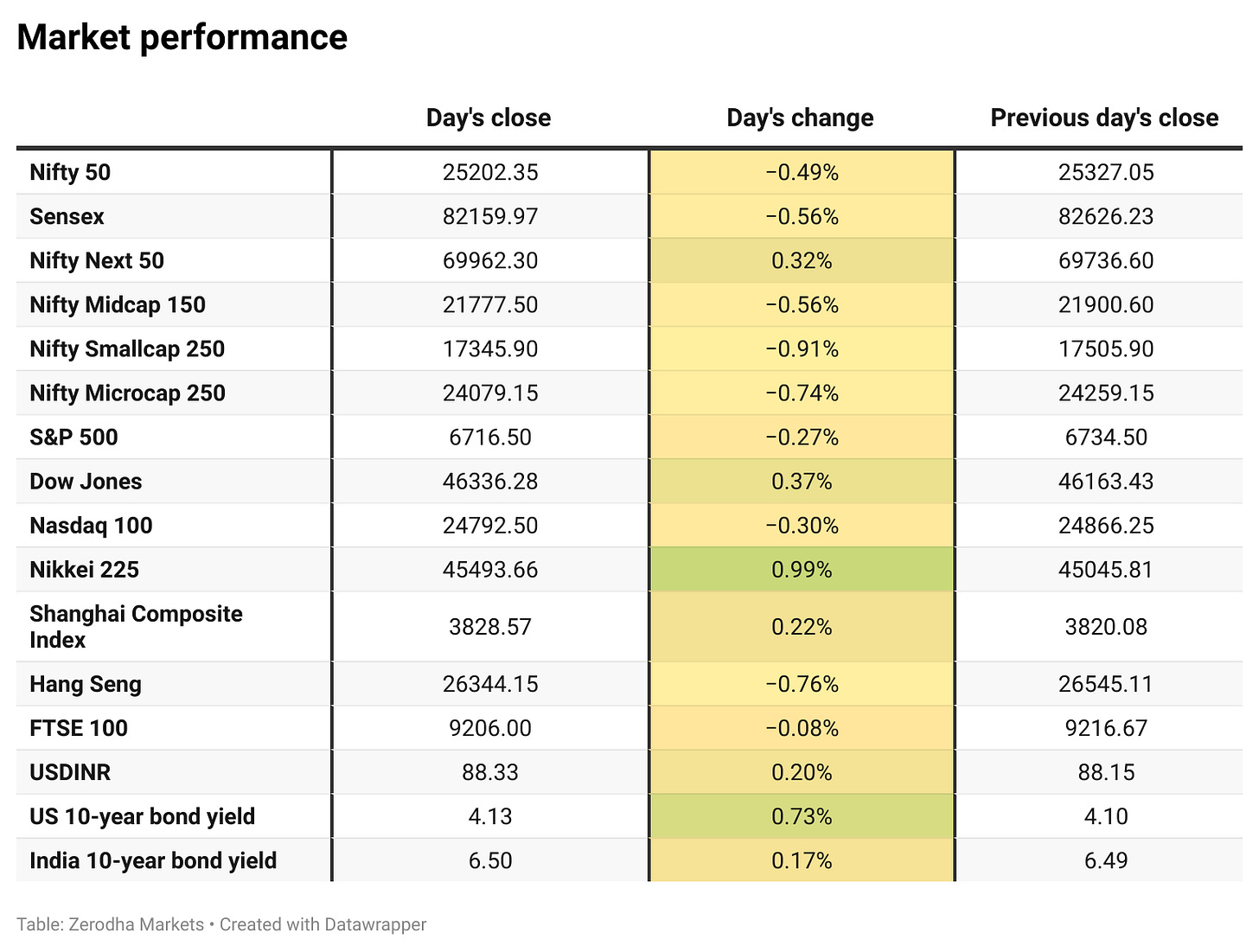

Market Overview

Nifty opened with a 90-point gap-down at 25,238, reacting to the U.S. President Donald Trump’s announcement of higher H-1B visa fees, which weighed on sentiment in IT stocks. The index attempted a recovery in the opening hour, moving toward 25,330, but selling pressure soon resurfaced.

Through the first half, Nifty remained range-bound between 25,270 and 25,310, with weakness in IT offset partly by support from select heavyweights. In the second half, the index drifted lower as selling broadened, slipping below 25,200, making lows around 25,150 after 2:30 PM. Despite a brief bounce attempt, weakness persisted, and Nifty eventually closed at 25,202.35, down nearly 125 points from the previous close.

Market sentiment is slowly tilting from caution to optimism, supported by signs of easing U.S.-India trade tensions. Still, worries over steep 50% tariffs, persistent foreign investor outflows, and muted earnings are tempering the upside.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,206 stocks traded on the NSE, 1,184 advanced, 1,919 declined, and 103 remained unchanged.

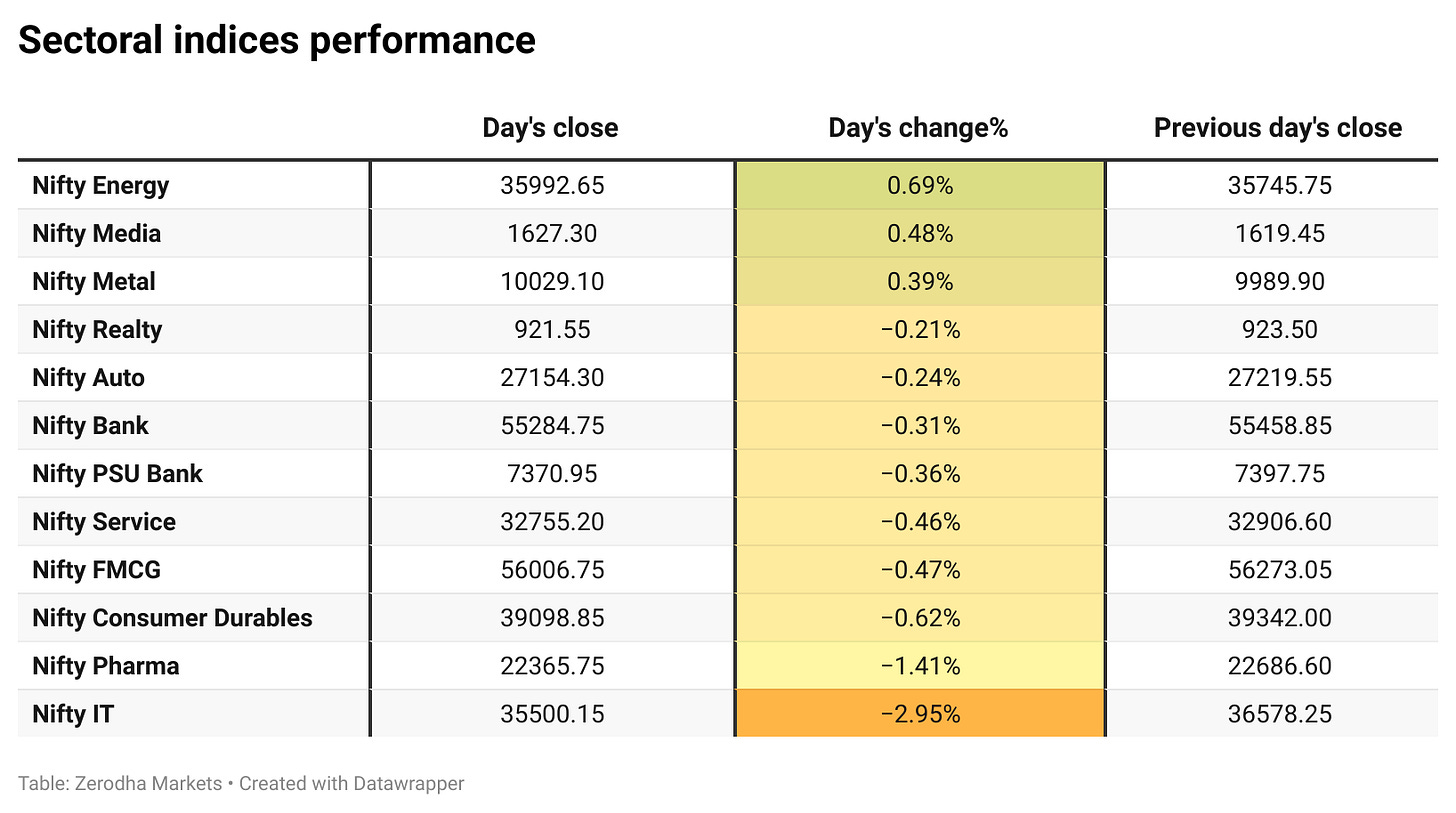

Sectoral Performance

Nifty Energy was the top gainer among sectoral indices with a rise of 0.69%, while Nifty IT was the biggest loser, plunging 2.95%. Out of 12 sectors, 3 closed in the green and 9 ended in the red, indicating broad-based weakness in the market.

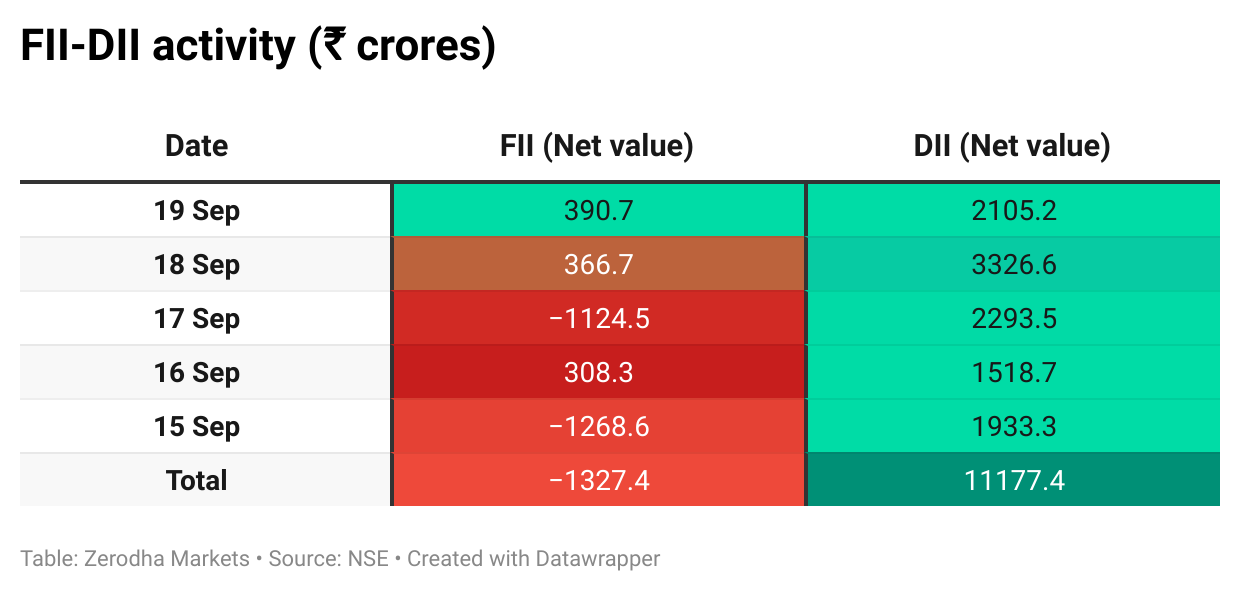

Here’s the trend of FII-DII activity from the last 5 days:

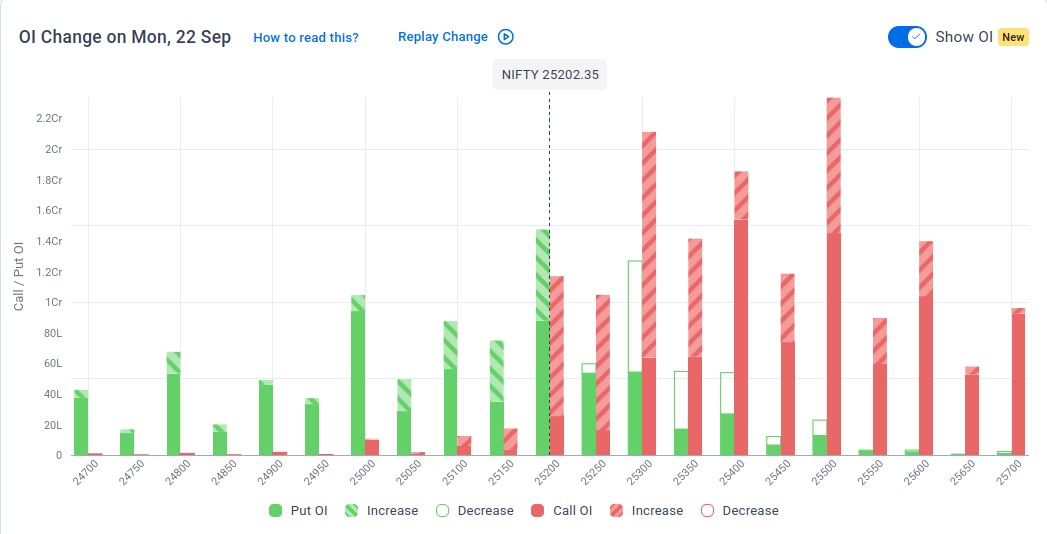

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd September:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,300, suggesting strong resistance at 25,300 - 25,400 levels.

The maximum Put Open Interest (OI) is observed at 25,200, followed by 25,000, suggesting strong support at 25,100 to 25,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

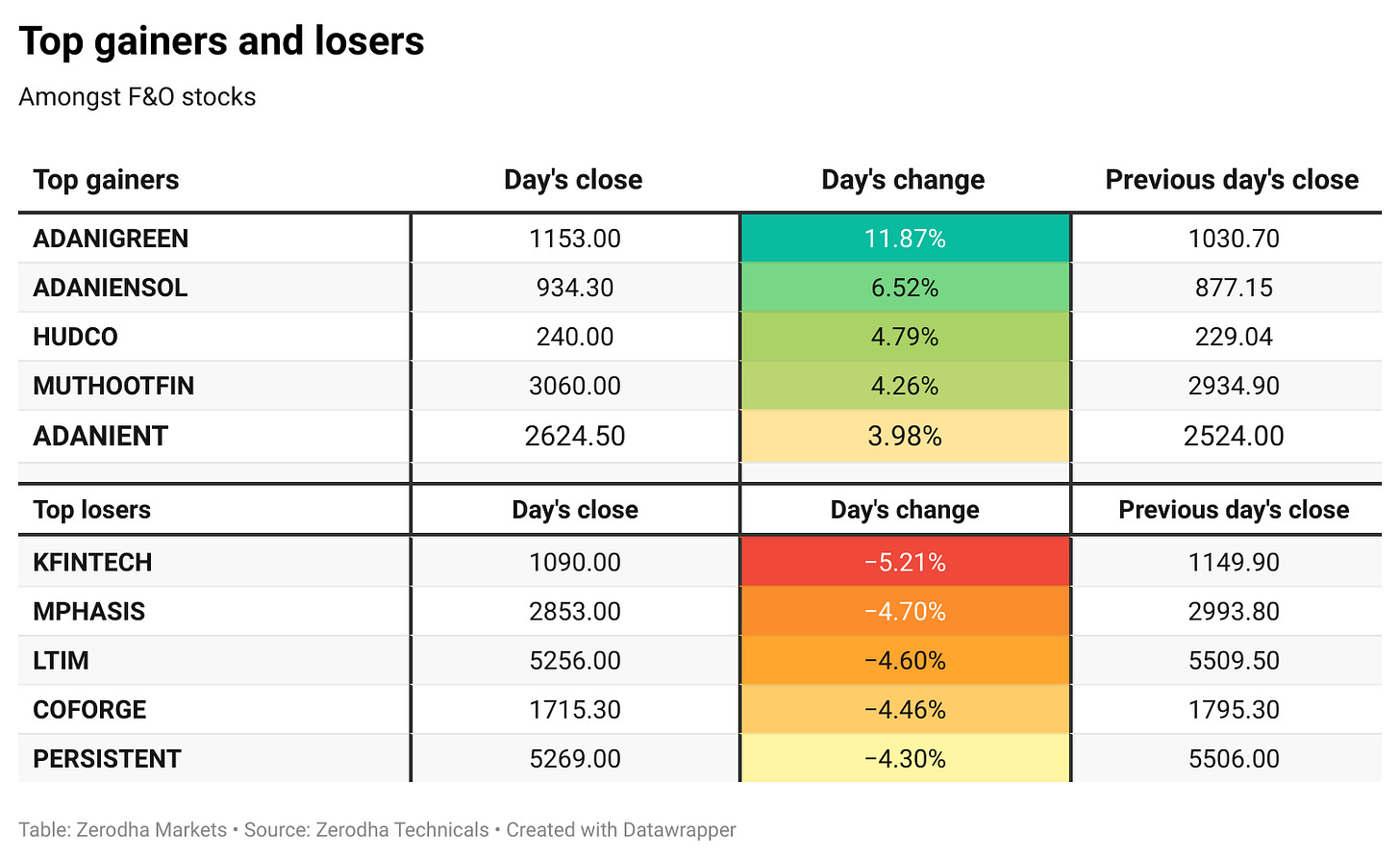

IT stocks slumped 3–4% after the U.S. announced higher H1-B visa fees. The hike raised concerns over increased costs and margin pressures for Indian IT companies. Dive deeper

Shares of Avanti Feeds and Apex Frozen Foods dropped up to 3% after U.S. senators proposed the “India Shrimp Tariff Act.” The move raised concerns over India’s shrimp export prospects. Dive deeper

Netweb Technologies won a ₹450 crore AI GPU systems order, following a ₹1,734 crore deal earlier this month. The company also posted triple-digit growth in revenue and EBITDA. Dive deeper

HUDCO shares rose over 4.5% after signing an MoU with NBCC. The deal covers four construction projects across multiple states, funded as deposit works. Dive deeper

Zydus Lifesciences’ oncology plant was upgraded by USFDA to VAI status from OAI. Its animal health unit also launched two USFDA-approved generics for pets. Dive deeper

PhonePe’s FY25 revenue rose 40% to ₹7,115 crore, with adjusted PAT up 220% to ₹630 crore. It turned free cash flow positive and reported its first adjusted EBIT profit, preparing for an IPO. Dive deeper

Shipbuilding stocks outperformed in an otherwise weak session after the government granted infrastructure status to large ships. An upcoming ₹80,000 crore Navy tender further boosted sentiment. Dive deeper

IndusInd Bank appointed Viral Damania as CFO, effective September 22, 2025. This marks another leadership change under CEO Rajiv Anand. Dive deeper

What’s happening globally

Japan’s Nikkei rose nearly 1% as concerns over the Bank of Japan’s ETF sales eased, with investors reassured about the gradual pace of the move. Optimism around possible new economic policies under fresh political leadership also supported sentiment, while semiconductor stocks led the gains despite some drag from SoftBank and Chugai Pharmaceutical. Dive deeper

European stocks were flat as gains in technology firms offset losses in automakers, particularly after Volkswagen-parent Porsche cut its profit outlook and scaled back EV plans. Investors are watching for upcoming speeches from multiple U.S. Federal Reserve officials for cues. Dive deeper

Pfizer will acquire weight-loss drug developer Metsera in a deal worth up to $7.3 billion, including milestone payments. The move strengthens Pfizer’s entry into the fast-growing obesity drug market, projected to hit $150 billion by the early 2030s, dominated by Novo Nordisk and Eli Lilly with their GLP-1 therapies. Dive deeper

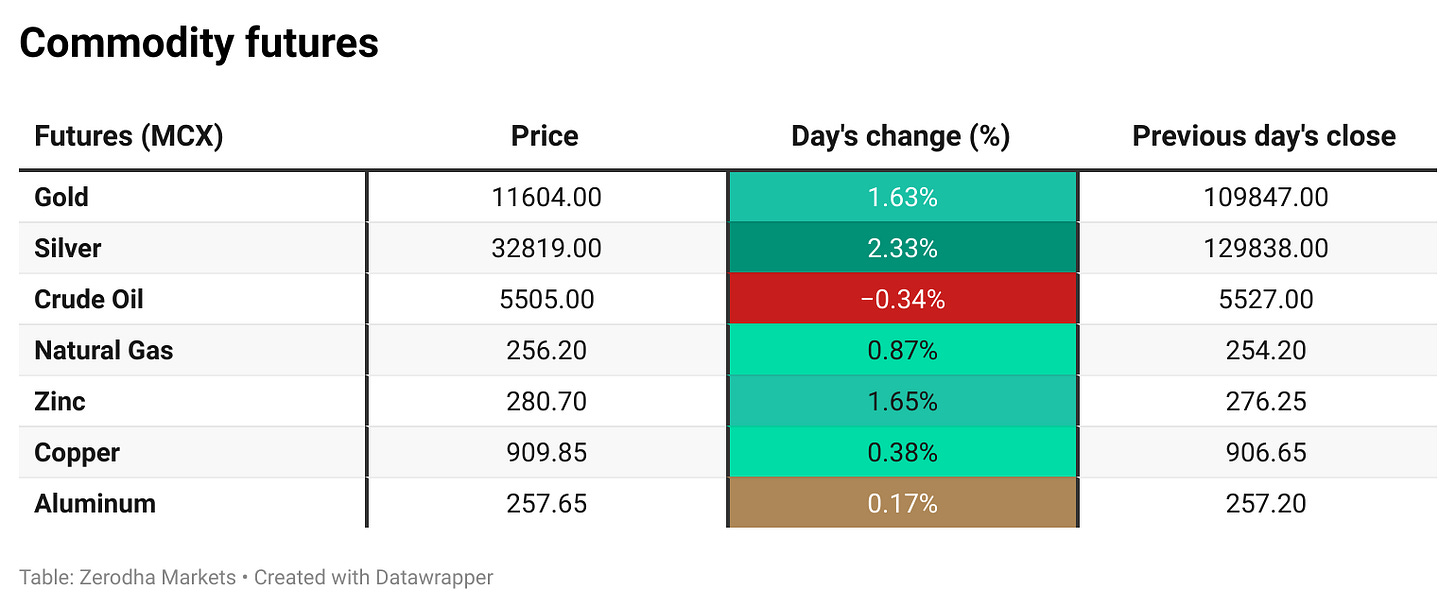

Gold surged to a record $3,710 per ounce as investors awaited U.S. inflation data and Fed officials’ remarks for policy cues. The rally follows the Fed’s first rate cut of the year and hints of more easing amid a softening labor market. Dive deeper

China’s PBOC held its key lending rates steady for the fourth month in September, keeping the one-year LPR at 3.0% and the five-year LPR at 3.5%. The decision, in line with expectations, follows last week’s move to leave the seven-day reverse repo rate unchanged. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Mohit Malhotra, CEO of Dabur, on Free Trade Agreement (FTA) and GST reforms

“Forex is one aspect we are not able to put our finger on. But if the FTA concludes by the end of the year, it will be a big positive,”

“We expect demand to move up by 500–600 basis points, which will have a trickle-down effect on investments. Besides augmenting demand, there will be relocation of capacities also.”

“What we see optically is a rate reduction, but what we don’t see are the procedural simplifications. Earlier, a local Chyawanprash had 5% GST while a branded one had 12–13%. Now, all Ayurvedic medicines fall under 5%. This bridges the gap between unorganised and organised players, and gives a major boost to quality production in India,” - Link

Coal Ministry on GST reforms to address input tax credit anomalies in the coal sector

“For instance, G-11 non-coking coal produced in the largest quantity by Coal India had a tax incidence of 65.85% compared to 35.64% for G2 coal, With the cess removed, tax incidence across all categories has been aligned to a uniform 39.81%.”

“With no provision for refund, this amount kept increasing, blocking valuable funds,”

“Now, the unutilised amount can be used over the coming years to pay off GST tax liability, leading to the release of blocked liquidity and helping coal companies mitigate losses due to the accumulation of unutilised GST credit and enhances financial stability.” - Link

Industry body NASSCOM on H-1B fee hike and its implications

“The clarification makes clear that the measure will not affect current visa holders and will apply as a one-time fee only to fresh petitions. This has helped address the immediate ambiguity surrounding eligibility and timelines. This alleviates concerns on business continuity and uncertainty for H-1B holders that were outside the U.S.”

“Over the years, Indian and India-centric companies operating in the U.S. have significantly reduced their dependencies on H-1B visas and steadily increased their local hiring. As per available data, H-1B issued to the leading India and India centric companies has decreased from 14792 in 2015 to 10162 in 2024. H-1B workers for the top 10 Indian and India centric companies are less than 1% of their entire employee base. Given this trajectory, we anticipate only a marginal impact for the sector.”

“Moreover, with the fee being applicable from 2026 onward, gives companies time to further step up skilling programs in US and enhance local hiring. The industry is spending more than a billion dollars on local upskilling and hiring in the US, and the number of local hires has increased tremendously.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!