Nifty slips below 24,900 as weak sentiment drags markets

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened with a 20-point gap down at 25,064 and quickly slipped by 115 points to 24,950 within the first 20 minutes. Selling pressure persisted through the session, with the index consolidating between 24,900 and 24,950 until 2 PM. In the final hour, even the 24,900 level was breached, and Nifty stayed below it, eventually closing near the day’s low at 24,870.10, down 0.85%.

Market sentiment remains fragile. While there have been signs of recovery since last week, concerns linger over escalating tariffs, continued FII outflows, and muted earnings reactions. Investors are closely tracking the worsening U.S.-India trade tensions and ongoing U.S.-Russia discussions on the Ukraine conflict, both of which are expected to guide near-term market direction.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,050 stocks traded on the NSE, 1,178 advanced, 1,760 declined, and 112 remained unchanged.

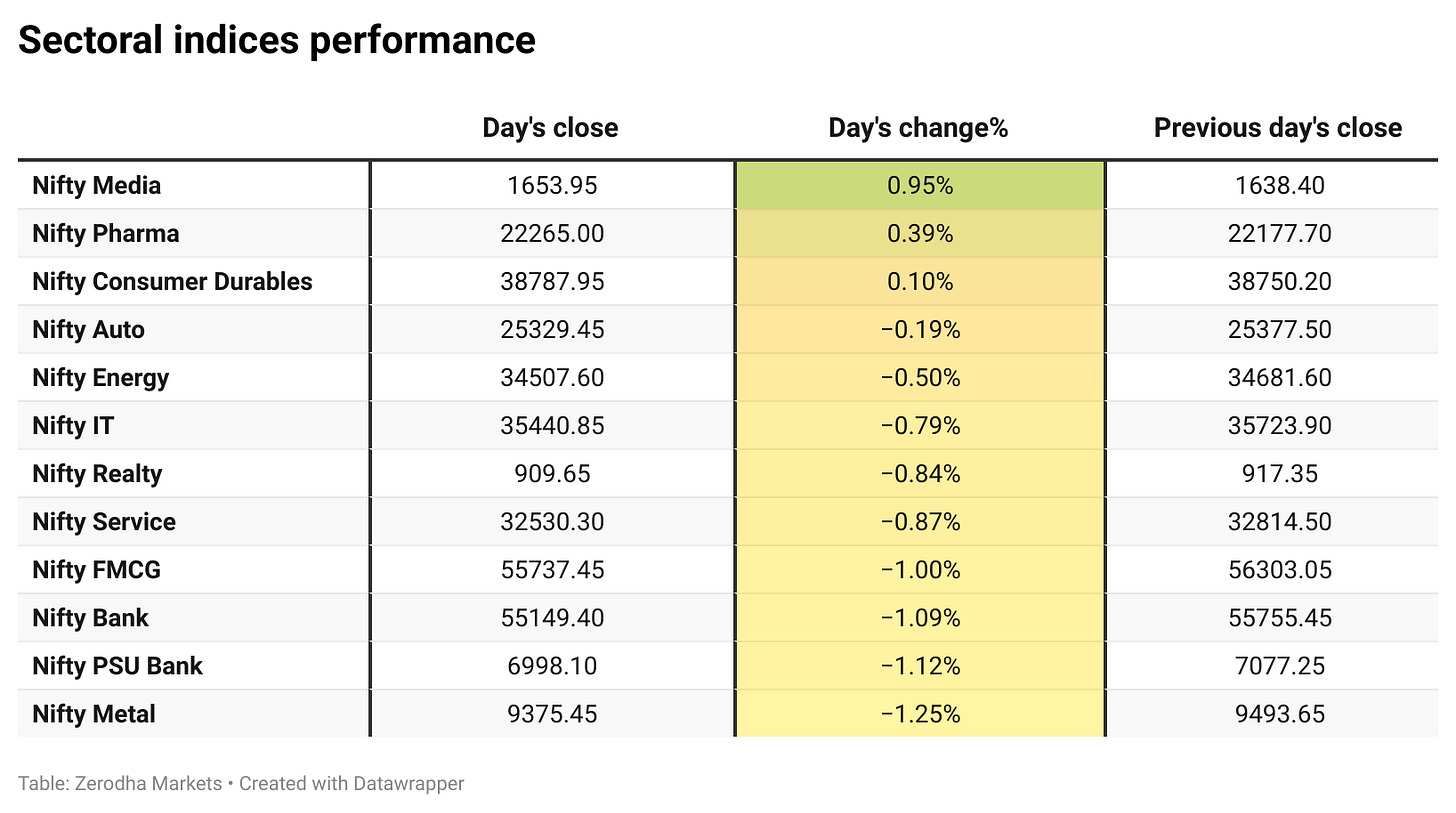

Sectoral Performance

Among the sectoral indices, Nifty Media was the top gainer, rising 0.95%, while Nifty Metal was the top loser, declining 1.25%. Out of the 12 sectors listed, only three sectors closed in the green, while the remaining nine sectors ended in the red, indicating broad-based weakness in the market.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th August:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 25,100, suggesting strong resistance at 25,100 - 25,200 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 24,500, suggesting strong support at 24,800 to 24,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

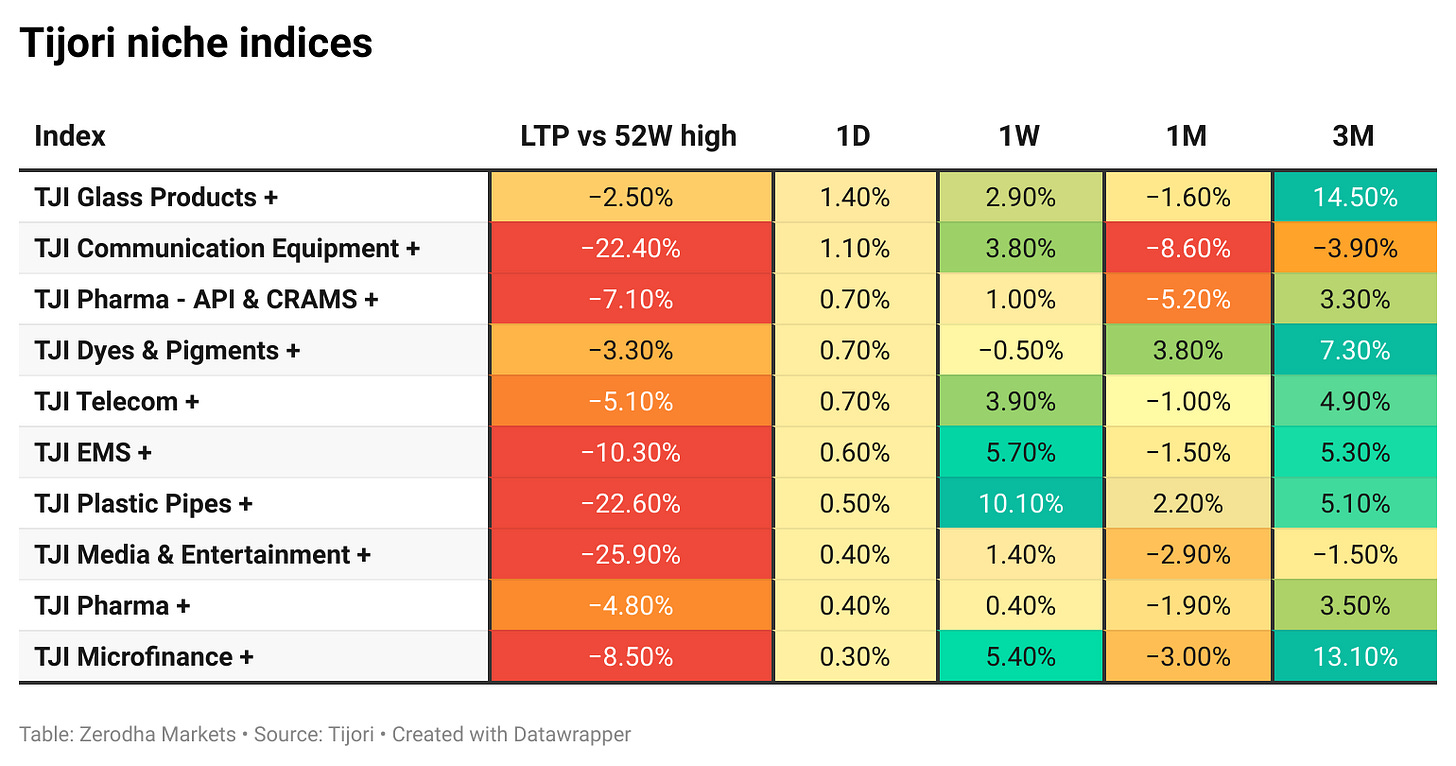

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Vodafone Idea shares rose after reports that the government is considering a relief package on AGR dues. The DoT has proposed measures such as extending moratoriums, easing repayment terms, and possible waivers on penalties and interest. The move is seen as critical for the debt-laden telecom’s survival. Dive deeper

SEBI’s advisory panel has proposed capping intraday net positions in equity index derivatives at ₹1,500 crore, citing concerns over manipulative strategies and retail investor losses. The move follows the Jane Street episode and aims to set clear thresholds for exchanges to monitor and penalize breaches. Dive deeper

SEBI is considering regulating the grey market for unlisted shares to improve price discovery before IPOs and boost tax revenues. The plan involves working with the corporate affairs ministry and stock exchanges to create a regulated pre-IPO trading platform with necessary disclosures. Dive deeper

The rupee hovered near 87.26 per USD, weighed by a stronger dollar ahead of Fed Chair Powell’s Jackson Hole speech. Dollar demand from oil importers added pressure, though foreign inflows and bank selling offered support. Dive deeper

WestBridge Capital is acquiring a 15% stake in Edelweiss Asset Management for ₹450 crore, valuing the AMC at about ₹3,000 crore. Edelweiss MF, with ₹1.52 lakh crore AUM as of June 2025, sees the deal as a step toward its next growth phase. The transaction is subject to regulatory approvals. Dive deeper

R Systems has acquired Novigo Solutions for ₹400 crore, with additional stock consideration tied to future performance. The deal adds strengths in low-code/no-code development, automation, and agentic AI. Dive deeper

OpenAI has established OpenAI India Private Limited and will open its first office in New Delhi. India is its second-largest market after the U.S., with hiring already underway. The move aligns with the government’s IndiaAI mission to advance AI development. Dive deeper

Yes Bank shareholders have reappointed Prashant Kumar as MD & CEO until April 2026, extending his term beyond October 2025. The move follows RBI’s earlier approval for a six-month extension. Dive deeper

Wipro is acquiring Harman’s Digital Transformation Solutions for $375 million, bringing over 5,600 employees on board. The deal enhances its Engineering Research & Development portfolio. It broadens offerings across technology, industrial, aerospace, healthcare, and consumer sectors. Dive deeper

L&T Finance has partnered with Google Pay to provide personal loans to eligible users. The initiative aligns with its product strategy and is positioned to expand access to digital credit in India. Dive deeper

India Inc’s overseas equity investment fell 22% YoY in July to $1.59 billion amid tighter FDI rules, RBI data showed. However, total financial commitment rose to $3.51 billion due to higher guarantees issued. Dive deeper

Dream11, Zupee, and MPL will shut their real-money gaming businesses following the passage of the Online Gaming Bill. The law bans monetary online games, restricts financial transactions, and prohibits advertising such platforms. Dive deeper

IRDAI is holding internal discussions on capping health insurance premium hikes, with a possible limit of 10% from next year. It clarified that no talks are underway with insurers at this stage. Dive deeper

What’s happening globally

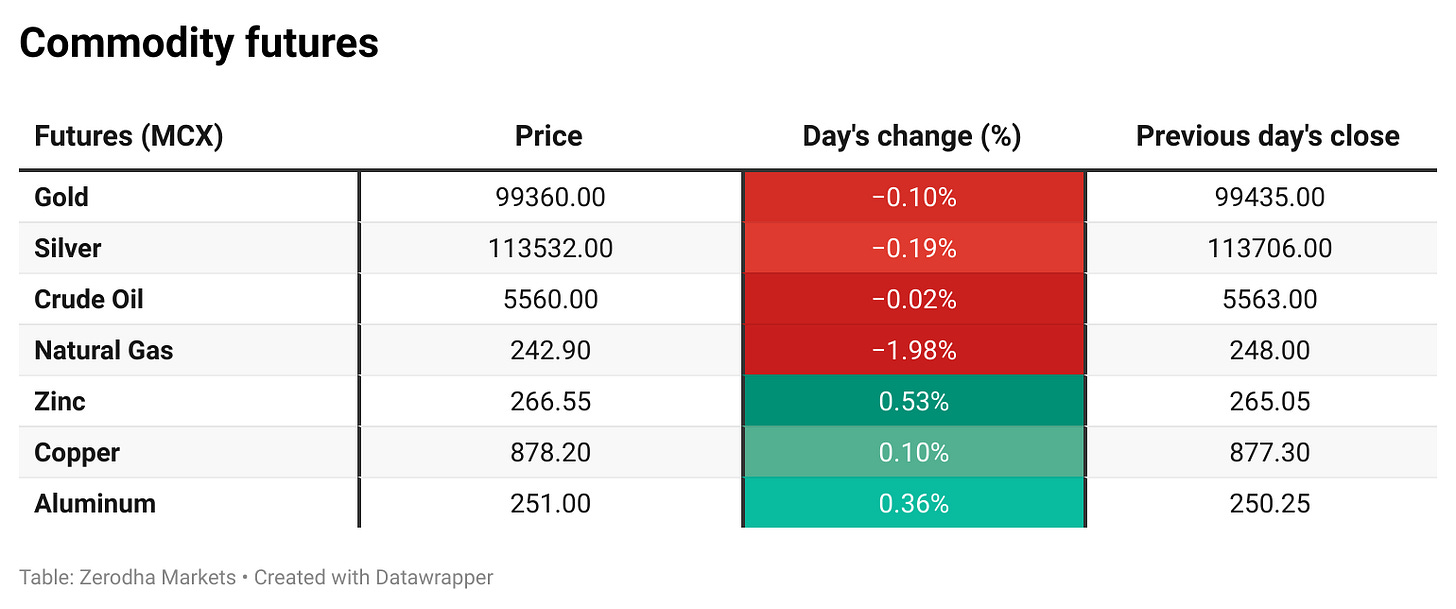

Gold hovered around $3,330 per ounce as traders awaited Powell’s Jackson Hole remarks for policy signals. Markets still see a strong chance of a September rate cut despite cautious Fed comments. Geopolitical tensions lingered after Russia’s major strike on Ukraine. Dive deeper

US natural gas futures fell to $2.8/MMBtu, near nine-month lows, amid record output and storage levels 5.8% above average. Weekly injections stayed below the five-year norm, while LNG exports averaged 15.8 bcfd in August. Dive deeper

US initial jobless claims rose by 11,000 to 235,000 in mid-August, the highest in eight weeks and above expectations. Continuing claims climbed to 1.97 million, the strongest since 2021, signaling a cooling labor market. Dive deeper

US existing home sales rose 2% in July to 4.01 million, the fastest gain since February and above forecasts. Inventory edged up to 1.55 million units, while median prices grew 0.2% YoY to $422,400 as affordability showed slight improvement. Dive deeper

UK consumer confidence rose to -17 in August, a one-year high boosted by the BoE’s rate cut. Personal finance sentiment improved, though concerns over inflation, jobs, and taxes persisted. Dive deeper

The 10-year US Treasury yield rose to 4.33% ahead of Fed Chair Jerome Powell’s Jackson Hole speech. Markets see about a 65% chance of a September rate cut, though officials’ hawkish remarks and mixed data add uncertainty. Dive deeper

France’s manufacturing index stayed at 96 in August, below the 100 average, with weak production and orders. Inventories fell, supply constraints eased, and sentiment improved only in transport equipment. Dive deeper

Japan’s inflation eased to 3.1% in July 2025, the lowest since November 2024, down from 3.3% in June. Energy costs softened with electricity turning negative, while food inflation accelerated to 7.6% on soaring rice prices. Core inflation also matched the headline rate at 3.1%, a five-month low. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Tuhin Kanta Pandey, Chairman, SEBI, on equity derivatives reform

"We will consult with stakeholders on improving the tenor and maturity of derivative products in a calibrated manner, so they better serve hedging and long-term investing."

"We are looking to deepen the cash equities market, which is the true foundation of capital formation, even as derivatives play a crucial role."

"Equally important is ensuring risk awareness and suitability amongst participants, with simple mechanisms to make derivative participation informed and appropriate." - Link

Sudarshan Venu, MD, TVS Motor Company, on scooter segment growth

"Scooter category has grown faster than other categories in the last few years."

"We are continuously launching products and keeping our products fresh."

"The share of scooters, across both ICE and EV segments, will continue to grow." - Link

Tarun Arora, CEO & Director, Zydus Wellness, on GST reforms and demand outlook

"There has been an interest rate cut, a reduction in income tax, and now this GST cut, all consistent efforts to support demand."

"Rural conditions have improved over the last four to five quarters, while these measures should also boost urban consumption, which accounts for 70% of packaged goods demand."

"Several of these steps, including the proposed GST reforms around Diwali, will help revive consumption across rural and urban markets." - Link

Jensen Huang, CEO, Nvidia, on H20 chip shipments to China

"The H20 chip is not a national security concern; it is great for America and great for the Chinese market."

"We have made very clear that H20 has no security backdoors, there never have been, and we hope this satisfies the Chinese government."

"The demand is strong, and we appreciate the ability to ship H20s to China, even as we remain in dialogue with the US government on future products." - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

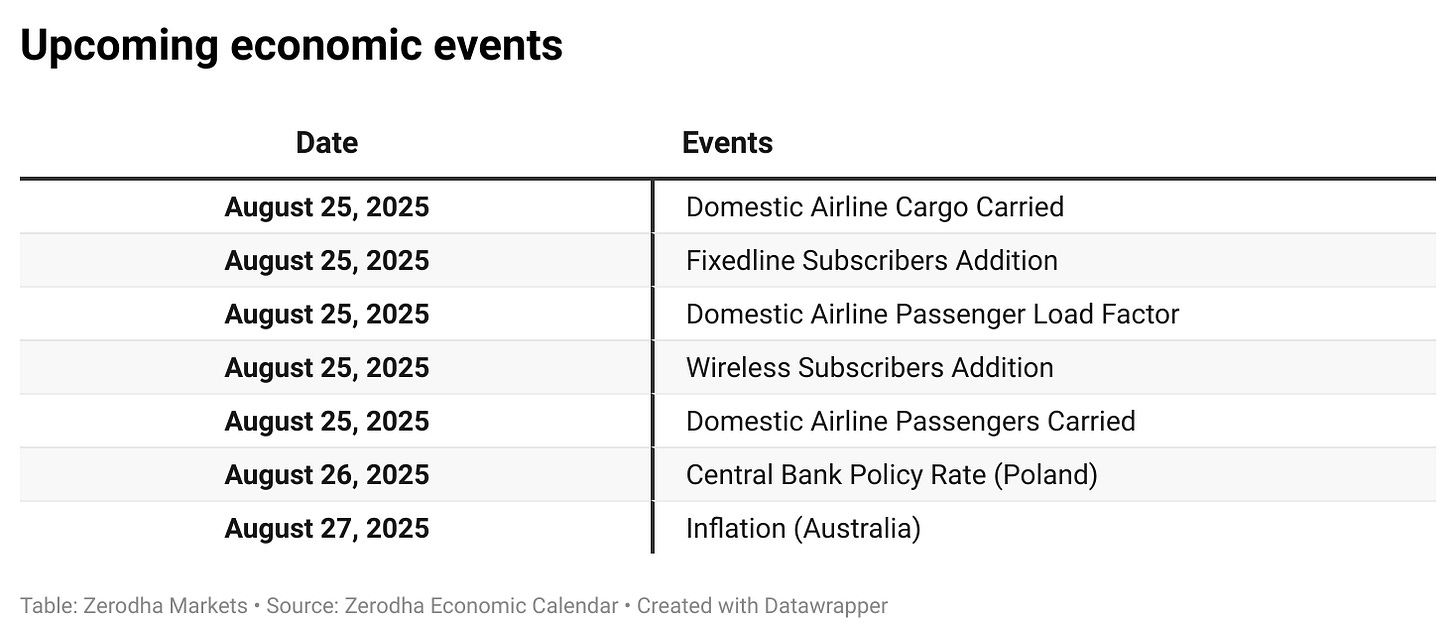

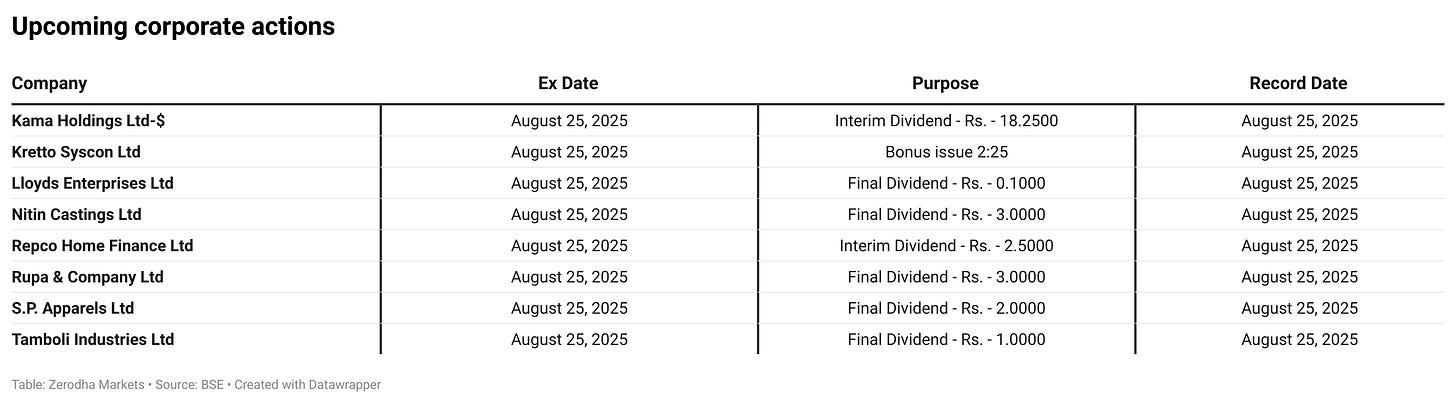

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

I like your report but too long. Please give a TL;DR