Nifty slips below 24,850 as Bajaj Finance’s MSME slowdown warning hits sentiment

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

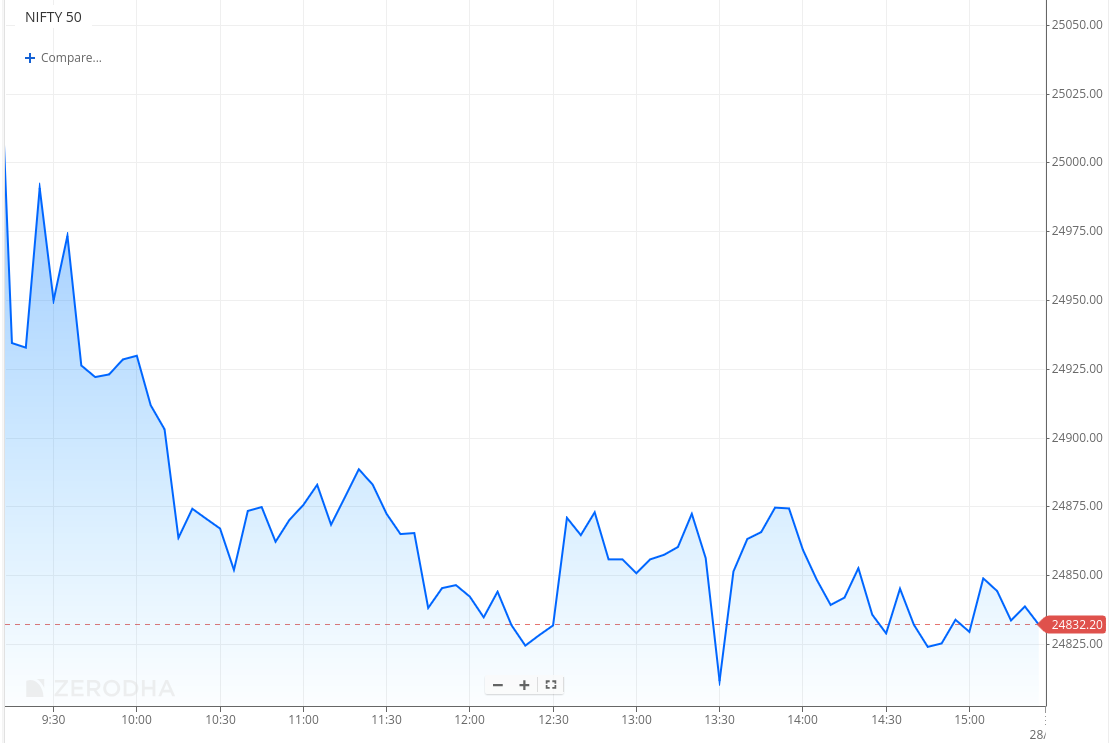

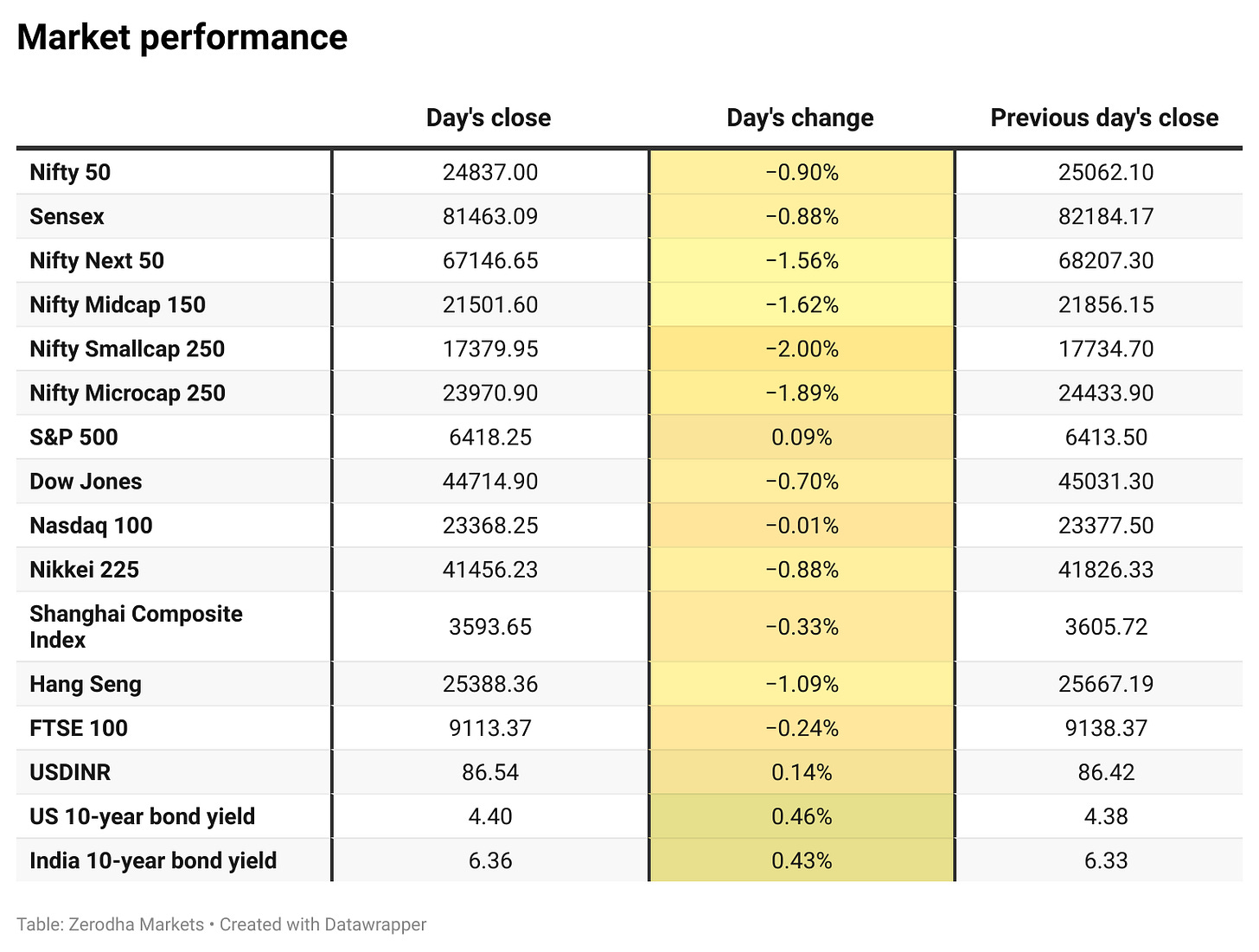

Nifty 50 opened with a 50-point gap-down at 25,010 and immediately began to decline, falling nearly 90 points to around 24,920. After consolidating between 24,920 and 24,980 for some time, the index sold off further, slipping below 24,850. It then remained in a volatile range between 24,800 and 24,880 for the rest of the day, eventually closing at 24,837, down 0.90%.

Overall market sentiment was weak after Bajaj Finance flagged unexpected stress in its unsecured MSME loan portfolio, along with signs of slowing incremental disbursements. Looking ahead, investors remain focused on upcoming earnings announcements and developments around global trade deals.

Broader Market Performance:

Broader markets had an extremely weak session today. Of the 3,118 stocks traded on the NSE, 1,138 advanced, 1,398 declined, and 582 remained unchanged.

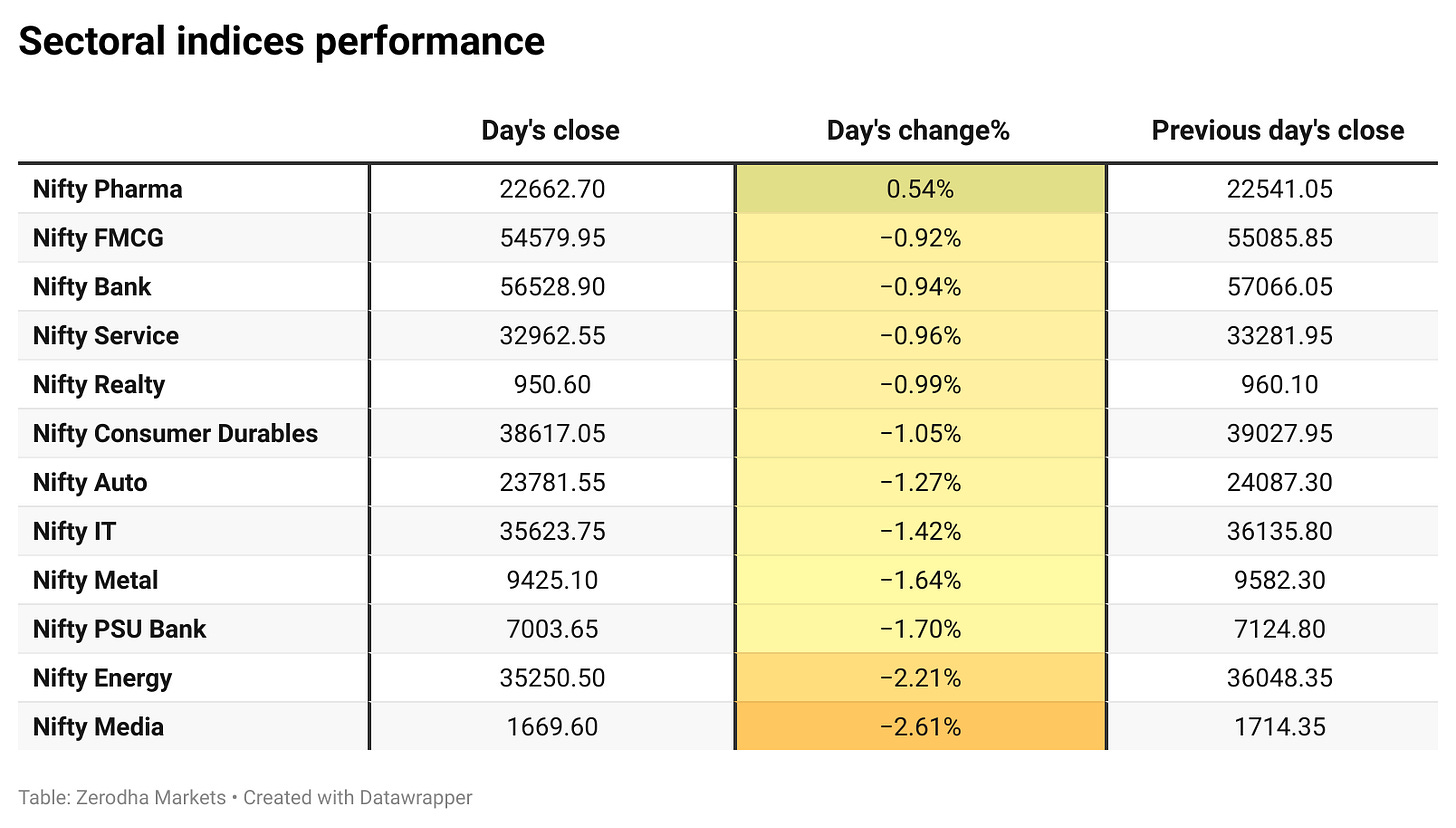

Sectoral Performance:

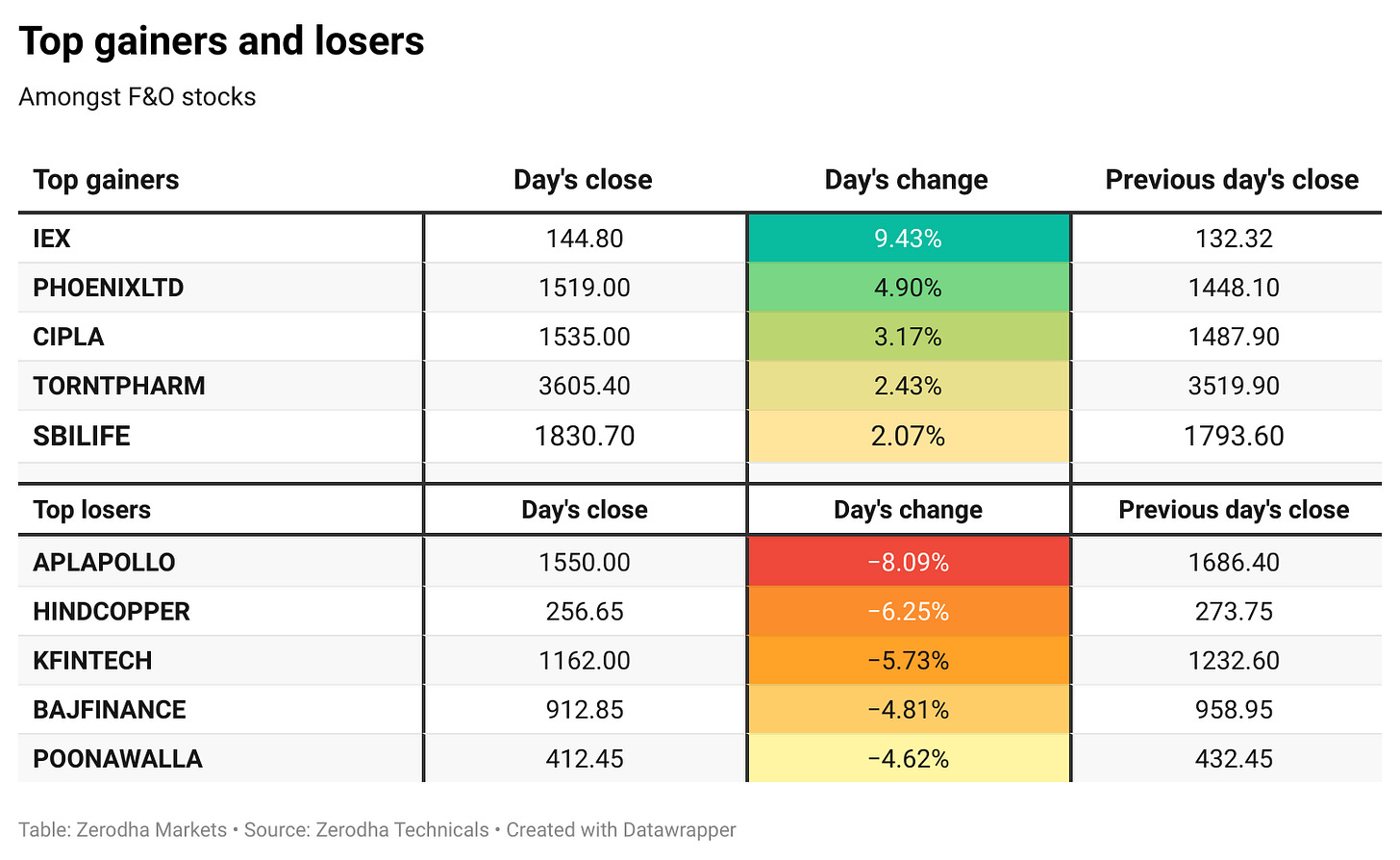

Among the sectoral indices, Nifty Pharma emerged as the top gainer, closing up by 0.54%, while Nifty Media was the biggest loser, declining by 2.61%. Out of the 12 sectors listed, only one sector closed in the green, while the remaining 11 sectors ended in the red, indicating broad-based weakness across the market.

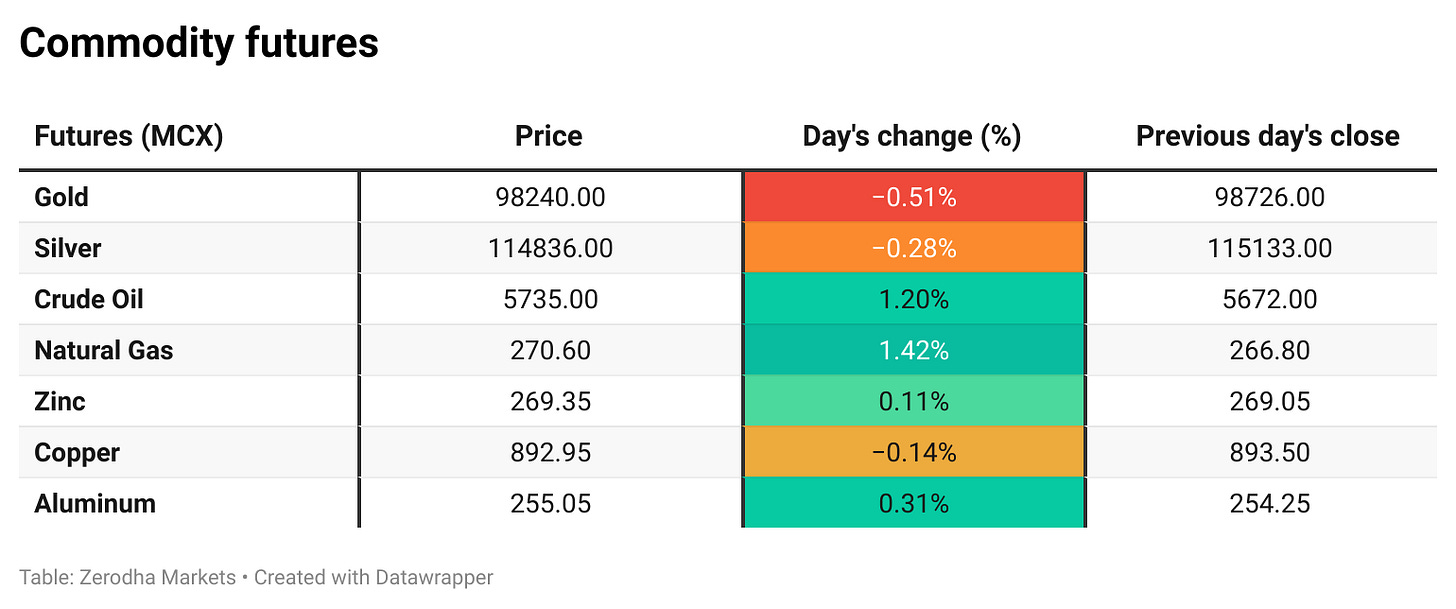

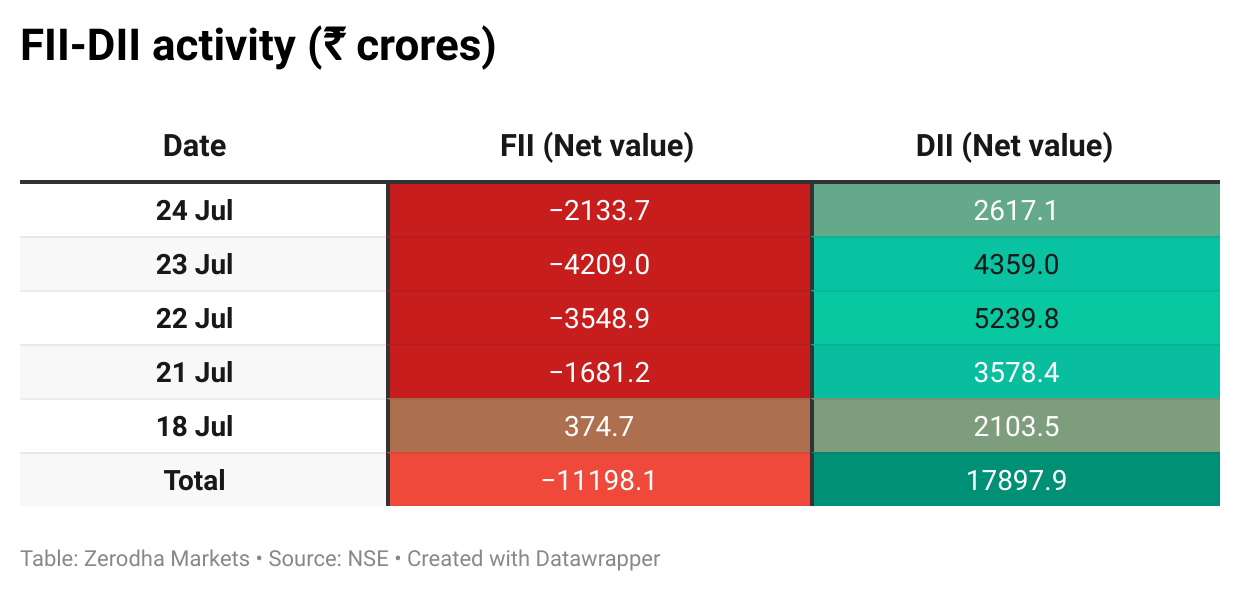

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

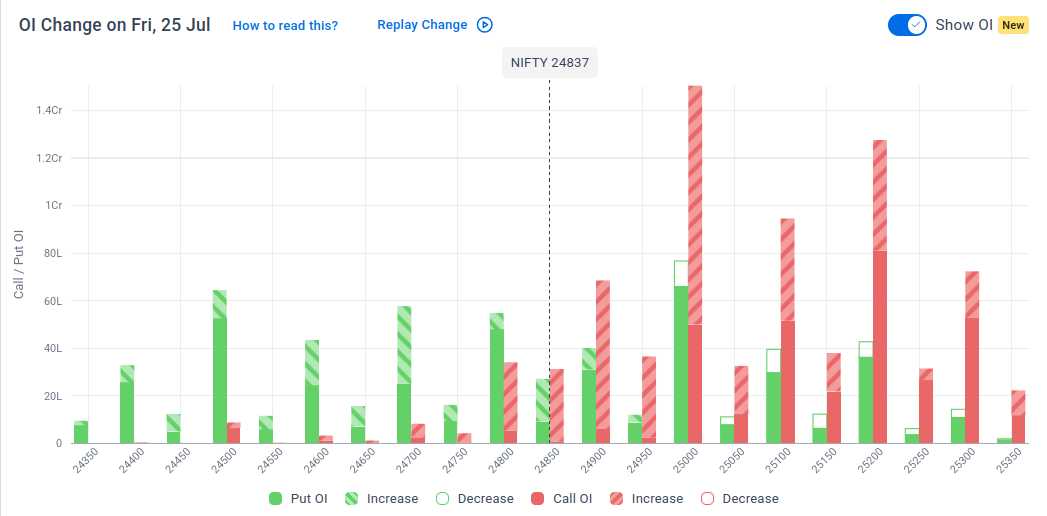

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 31st July:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 25,200, suggesting strong resistance at 25,100 - 25,200 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 24,500, suggesting strong support at 24,800 to 24,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

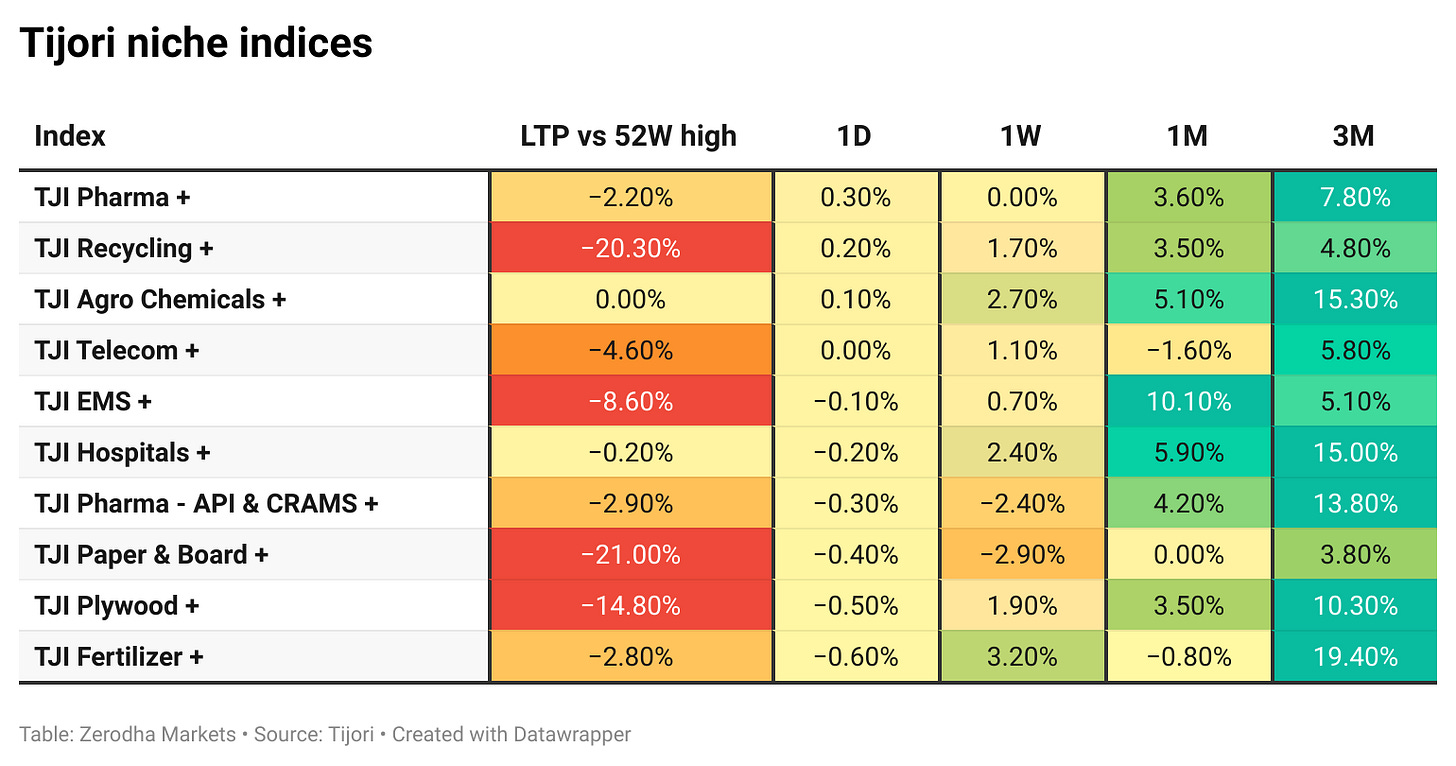

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

BEL secured fresh defence orders worth ₹563 crore across key systems, adding to ₹3,000+ crore orders in June. It also partnered with Tata Electronics to explore semiconductor opportunities. Dive deeper

Bajaj Consumer approved a ₹186.6 crore share buyback via tender offer at ₹290 per share, covering 4.69% of equity. Shareholder approval is pending. Dive deeper

DLF and Trident Realty sold all 416 luxury flats in their Mumbai project ‘The Westpark’ for ₹2,300 crore within a week. The ₹900 crore project marks DLF’s re-entry into Mumbai and contributes significantly to its FY26 sales target. Dive deeper

Paras Defence reported flat Q1FY26 net profit at ₹15 crore, while revenue rose 11.5% YoY to ₹93.2 crore. Margins dipped to 23.6% from 28.9% YoY. The company also declared a ₹0.50 per share final dividend with August 8 as the record date. Dive deeper

DGCA issued four show-cause notices to Air India for 29 safety violations, including fatigue breaches, inadequate training, and understaffed long-haul flights. The regulator flagged systemic non-compliance despite past warnings. Air India cited voluntary disclosures and plans to respond. Dive deeper

India’s concert economy is projected to create 1.2 crore temporary jobs by 2030–32, driven by over 100 large-format concerts annually. This boom is boosting allied sectors like travel, hospitality, and F&B, with tier II and III cities emerging as key hubs. Around 10–15% of gig roles are turning into full-time jobs. Dive deeper

Motilal Oswal Financial Services posted its highest-ever quarterly net profit of ₹1,430 crore in Q1FY26, up 40% YoY, driven by strong growth in AMC, private wealth, and capital markets. Operating revenue rose 24% to ₹1,412 crore, with AUM nearing ₹1.17 lakh crore. ROE stood at 48%. Dive deeper

Phoenix Mills reported a 3.5% YoY rise in Q1FY26 net profit to ₹241 crore, with revenue up 5.4% at ₹953 crore and EBITDA margin improving to 59.2%. Residential revenue jumped 34%, while hospitality and property segments also saw growth. Rajesh Kulkarni was appointed whole-time director for five years. Dive deeper

ED alleged Reliance MF's ₹2,850 crore investment in YES Bank AT-1 bonds was siphoned off, with funds diverted via undisclosed related parties. Over ₹10,000 crore in loan diversions were uncovered, mostly unrecoverable. Reliance firms denied any impact from the investigation. Dive deeper

Adani Enterprises will divest 50% of its subsidiary Kutch Copper Tubes to MetTube and acquire a 50% stake in MetTube’s Indian unit, forming an equal JV to manufacture copper tubes. The alliance aims to support India’s HVAC and infrastructure needs, aligned with the Make in India initiative. Dive deeper

UTI AMC reported a 7% YoY drop in Q1FY26 net profit to ₹237 crore, while revenue rose 3% to ₹547 crore. Group AUM stood at ₹21.93 lakh crore, with UTI Mutual Fund’s quarterly average asset base at ₹3.61 lakh crore. SIP inflows remained steady. Dive deeper

Coromandel International will invest $7.7 million to raise its stake in Senegal-based BMCC from 53.82% to 71.51%, securing rock phosphate supply. It also approved a ₹137 crore in-house bagging plant at Kakinada. Q1FY26 net profit rose 62% YoY to ₹501.6 crore on strong agri demand. Dive deeper

Airtel Africa's Q1FY26 net profit surged to $156 million from $31 million YoY, aided by customer growth, forex gains, and lower capex. Revenue rose 22.4% to $1,415 million, with strong data and mobile money user expansion. Dive deeper

Canara Bank reported a 22% YoY rise in Q1FY26 net profit to ₹4,752 crore, driven by a 33% jump in other income despite a dip in net interest income. Asset quality improved, with gross NPA at 2.69% and net NPA at 0.63%. The bank plans to list Canara Robeco MF and Canara HSBC Life within 2-3 months. Dive deeper

GMR Airports will consider raising ₹6,000 crore via rupee-denominated non-convertible bonds in one or more tranches to refinance existing debt. The board will also review Q1FY26 unaudited results in its July 29 meeting. The planned issuance will be through private placement. Dive deeper

Former finance secretary Ajay Seth has been appointed chairman of the Insurance Regulatory and Development Authority of India (IRDAI) for a three-year term, succeeding Debasish Panda. Dive deeper

ACC's Q1FY26 net profit rose 4% YoY to ₹375 crore, with revenue up 17% to ₹6,087 crore and sales volume at a record 11.5 million tonnes. EBITDA grew 15% to ₹778 crore, while margins slipped to 12.8%. Tax expenses surged 51% YoY. Dive deeper

Domestic air traffic rose to 1.36 crore passengers in June, up 3% from May, with January-June growth at 7.34% YoY. IndiGo’s market share dipped to 64.5%, while Air India Group rose to 27.1%. Flight delays affected over 1.2 lakh passengers, with airlines compensating ₹1.68 crore. Dive deeper

Karur Vysya Bank reported a Q1FY26 net profit of ₹522 crore, up from ₹459 crore YoY, with total income rising to ₹3,016 crore. Gross NPA improved to 0.66% from 1.32% YoY. The board approved a 1:5 bonus share issue, subject to shareholder approval. Dive deeper

Sun Pharma and its subsidiaries have agreed to pay $200 million to settle a US antitrust litigation involving generic drug pricing. The amount may be reduced based on class member participation and is subject to court approval. Dive deeper

Mphasis reported an 8.4% YoY rise in Q1FY26 PAT to ₹442 crore, while revenue rose 0.6% QoQ to ₹3,732 crore. EBIT stood at ₹571 crore with stable margins, and the company secured record TCV wins of $760 million, driven largely by AI-led deals. Dive deeper

Women’s share in blue and grey collar jobs rose to 19% in FY24 from 16% in FY21, but early attrition remains high, with 52% of those with under a year’s experience planning to quit. Poor pay, transport issues, and lack of workplace proximity are key barriers to retention and re-entry. Dive deeper

What’s happening globally

UK retail sales rose 0.9% MoM in June 2025, rebounding from May’s 2.8% drop but below the expected 1.2% gain. Growth was driven by food, fuel, and online sales amid warm weather, while annual sales rose 1.7%, slightly missing estimates. Dive deeper

Tokyo’s core consumer prices rose 2.9% YoY in July 2025, easing for a second month but staying above the BOJ’s 2% target. Markets expect a rate hike later this year, though growth concerns and recent US tariffs may weigh on policy decisions. Dive deeper

The S&P Global US Composite PMI rose to 54.6 in July 2025, the fastest pace this year, driven by strong services growth. Manufacturing expanded modestly, while input and output price inflation accelerated due to rising wages and tariffs. Business confidence weakened amid concerns over spending cuts. Dive deeper

The Bank of Russia cut its key rate by 200 bps to 18% in July 2025, citing stronger-than-expected disinflation and growth concerns. It signaled further easing ahead, as inflation fell to 9.4% and tight financial conditions weighed on consumption and employment. Dive deeper

Germany’s Ifo Business Climate Index rose to 88.6 in July 2025, its highest since May 2024 but below expectations of 89.0. Slight improvements in current conditions and expectations indicate a sluggish recovery. Sentiment improved in manufacturing and construction but dipped in services and trade. Dive deeper

Alphabet’s Q2 results showed a 32% surge in cloud revenue, driven by AI investments in Gemini and custom chips, prompting a $10 billion increase in 2025 capex guidance. Ad revenue rose 10.4%, easing macro concerns, while Gemini hit 450 million users. Dive deeper

Tesla’s Q2FY25 revenue fell 12% YoY to $22.5 billion, with a 16% drop in automotive sales and net income down to $1.17 billion, marking its sharpest quarterly sales decline in a decade. The slump was driven by lower vehicle deliveries and reduced ASPs. Dive deeper

Volkswagen cut its 2025 guidance after a $1.5 billion tariff hit in H1, lowering profit margin outlook to 4-5% and expecting flat sales. Q2 operating profit fell 29% YoY to €3.8 billion. The company urged faster cost cuts as tariff uncertainty persists. Dive deeper

Puma warned of a full-year loss after U.S. tariffs cut profit by €80 million and sales fell, prompting a 16% drop in its shares. Q2 sales declined 10% YoY, with sharp drops in North America and Europe. CEO Arthur Hoeld called 2025 a reset year, with a new strategy due by October. Dive deeper

LG Energy Solution warned of slowing EV battery demand due to U.S. tariffs and subsidy cuts, despite Q2 operating profit more than doubling to 492 billion won on IRA tax credits. The company plans to shift some U.S. EV battery lines to energy storage systems (ESS) and boost ESS capacity to 30 GWh by 2026. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Ashish Chauhan, MD & CEO, National Stock Exchange, on India-UK FTA and trade prospects

“For services, the trade is around $56 billion. This deal is expected to take the total trade to around $120 billion over the next five years.”

“It could be even larger, as it has opened up the services sector in a big way, in addition to pharma, agriculture, and other sectors.”

“Earlier, Indian professionals had to pay Social Services Tax in the UK, but they weren’t eligible for any benefits upon returning to India. Now, that issue has been resolved.”

“Indian professionals’ salaries won’t be cut as much, which is a major gain for our services sector. People will now be able to work longer in the UK, indicating that the visa regime is also being revised.” - Link

Rajeev Jain, Vice Chairman & MD, Bajaj Finance, on 2 & 3-wheeler and MSME business outlook

“MSME business has shown some strain since February, so it's coming a little too suddenly. We've taken a whole host of actions to prune the business. It's likely that both these businesses will grow lot more slowly in the current year.”

“Two & Three-Wheeler Finance AUM declined by 20 percent year-on-year to Rs 15,703 crore in April-June quarter.”

“Close to Rs 219 crore of standard account customers were assisted with the restructuring option, and relevant provision was taken on these clients.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

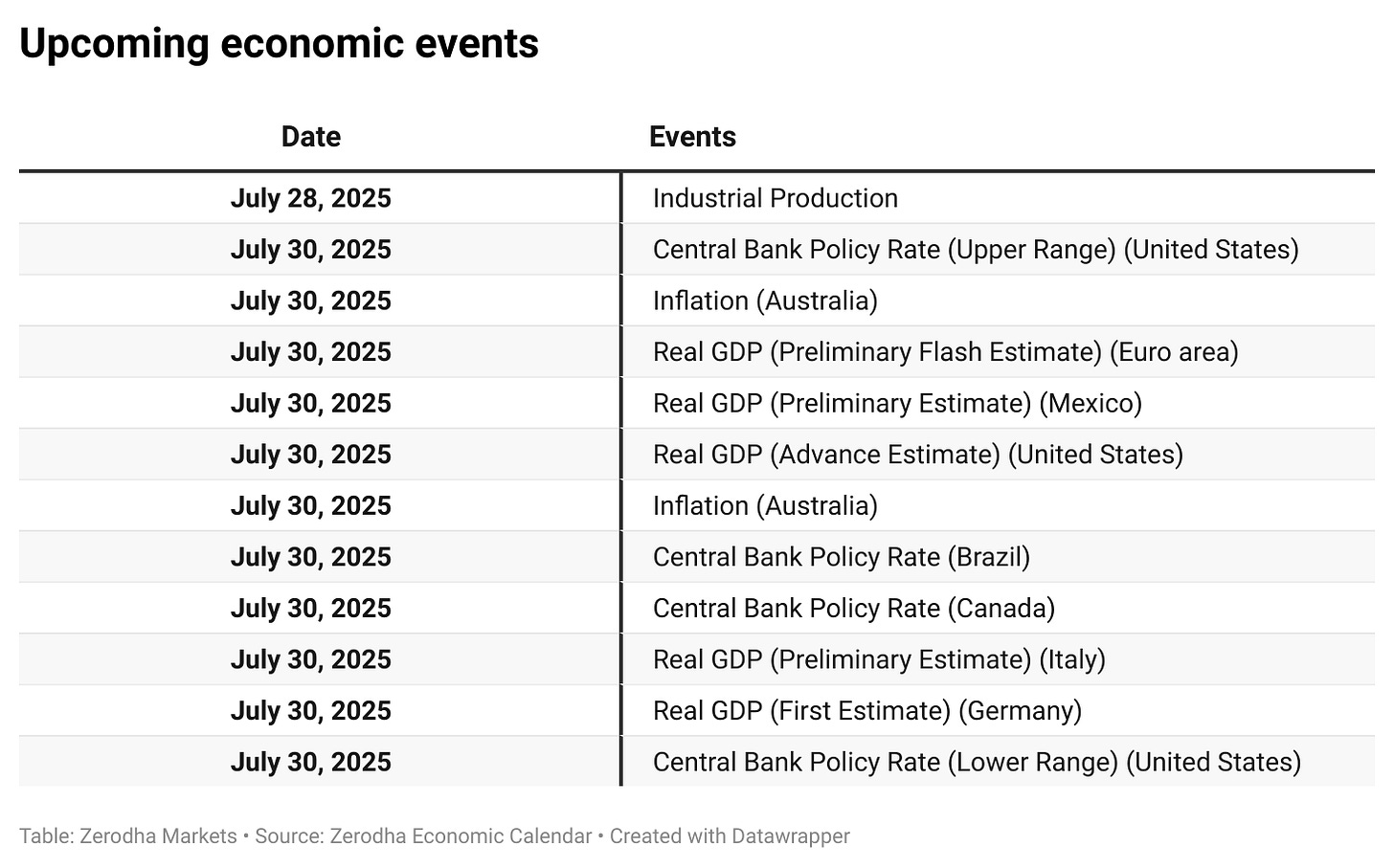

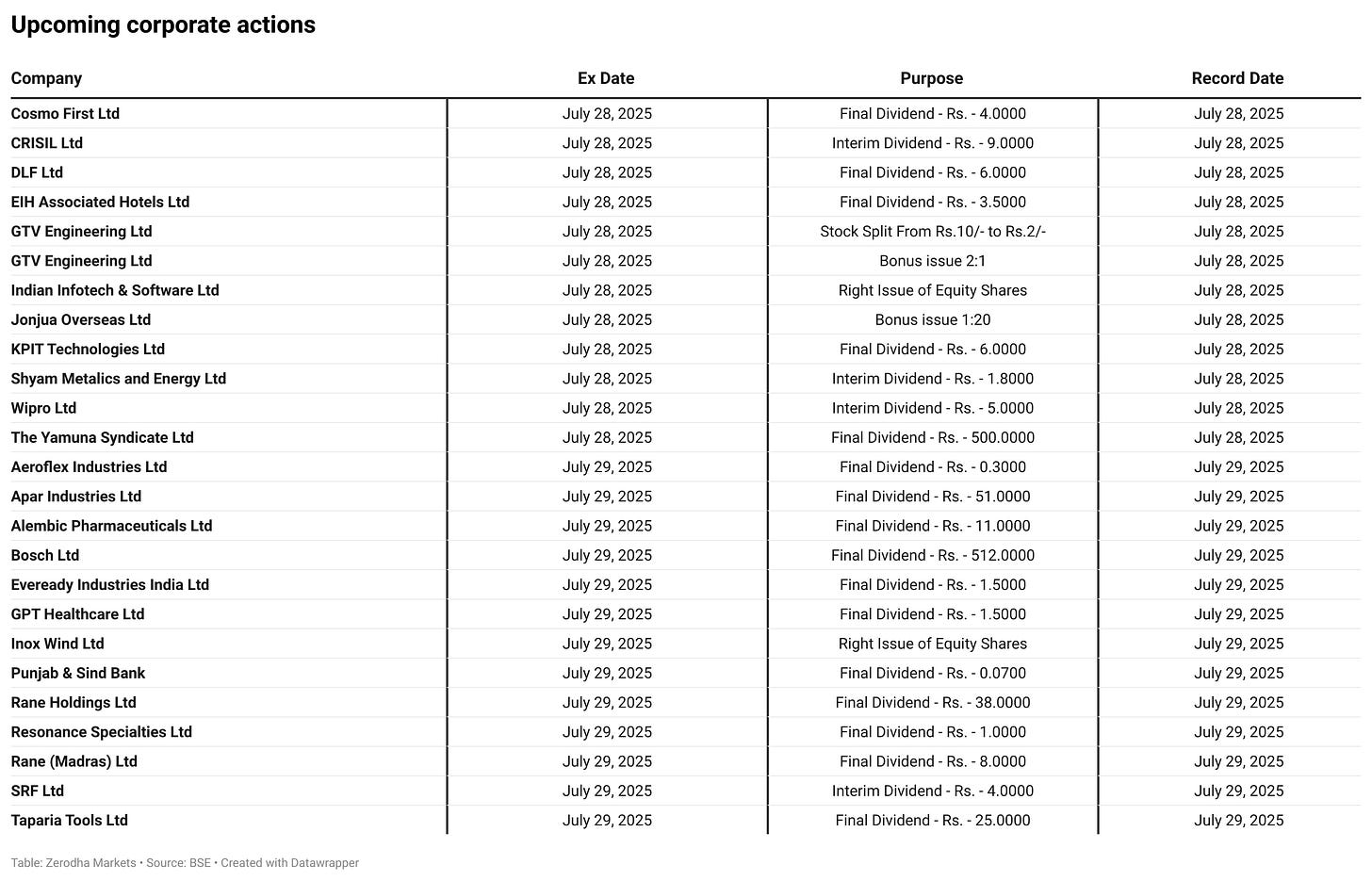

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.