Nifty slips as rupee hits record low; banks drag index lower

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Market Overview

Nifty opened on a muted note today, but early trade quickly came under pressure as currency weakness and profit-booking in financials weighed on sentiment. The rupee hit a record low against the dollar before stabilising after likely intervention, and that set a cautious tone across equities.

Through the session, the index failed to build any upward momentum and kept drifting lower. By afternoon, Nifty was struggling to hold the 26,000–26,050 zone, with buying interest remaining weak. Volatility stayed elevated in large-cap banks and energy stocks. By the close, the index settled at 26,032.20, down about 0.55 percent.

Overall, it was a soft, range-bound day with clear negative undertones. Profit-taking after the recent rally, combined with external headwinds such as the rupee slide and foreign outflows, kept risk appetite subdued. Market breadth was firmly negative, with far more stocks declining than advancing.

Broader Market Performance:

Broader markets also weakened. Both mid-cap and small-cap indices ended lower in line with the headline index.

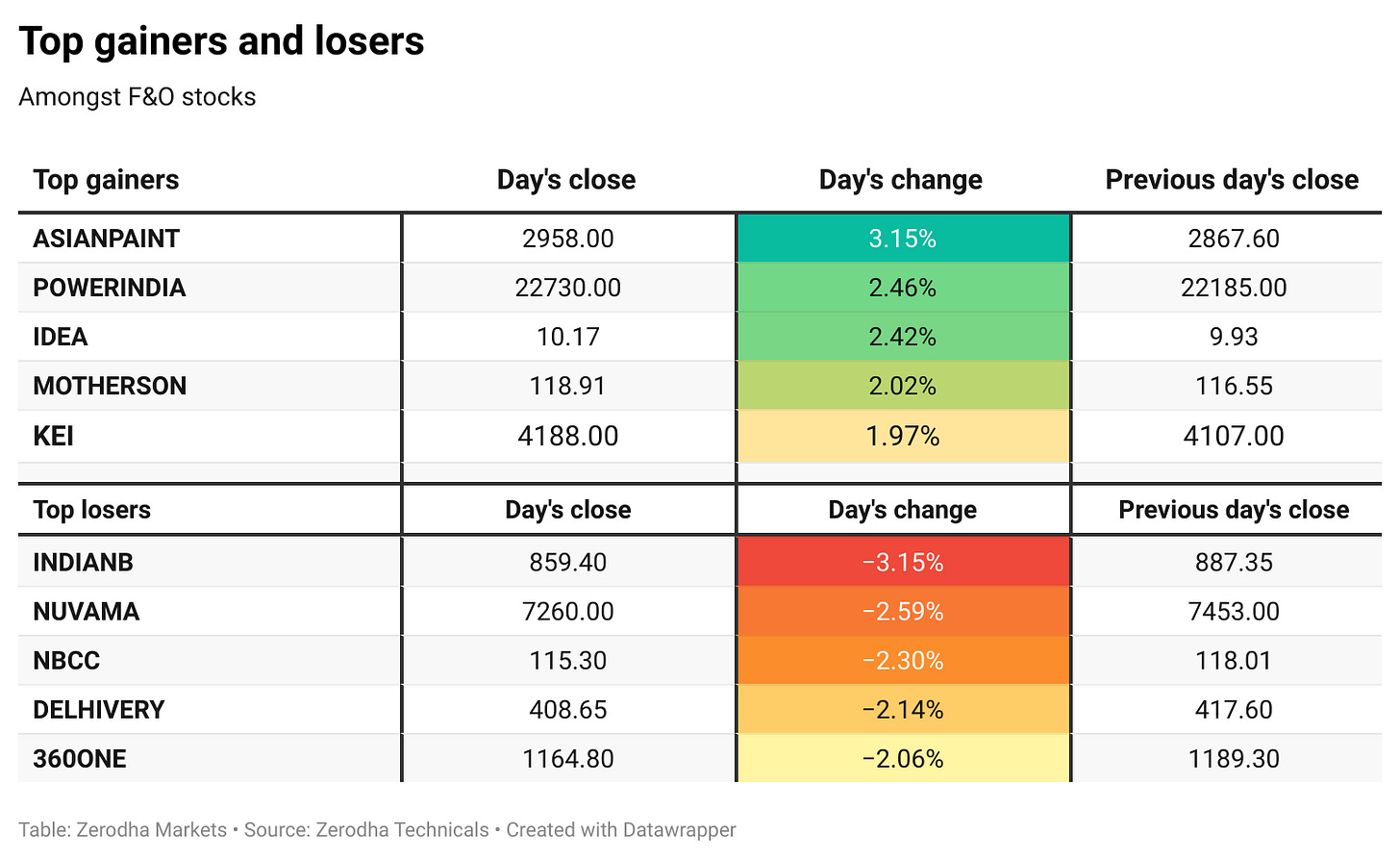

Among sectors, financials, particularly banks, were the biggest drag. A few pockets like consumer-facing names, telecom, and select defensives managed modest gains, but selling in banks, financial services, and energy names dominated sectoral moves.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd December:

The highest Call OI is at 26,200, followed by 26,300 and 26,400. This cluster’s major resistance is between 26,200 and 26,400, where call writers have built strong positions.

On the Put side, the highest Put OI is at 26,000, with notable additions at 25,900 and 26,100. This creates a broad support zone around 25,900–26,100, suggesting put writers may try to defend this region.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Reliance has completed the merger of Star Television Productions into JioStar, consolidating the ‘STAR’ brand within the group’s merged media business. Dive deeper

The rupee slid to around 89.9/$, a fresh record low, as trade uncertainty with the US, high tariffs, and widening external imbalances kept sentiment weak despite strong GDP data. Dive deeper

India’s current account deficit narrowed to $12.3 billion (1.3% of GDP) in the September quarter, improving from $20.8 billion (2.2%) a year ago as the merchandise trade gap eased. Dive deeper

The government plans to divest up to 6% stake in Bank of Maharashtra via an offer-for-sale (OFS) opening December 2, as part of its broader disinvestment push. Dive deeper

India and Russia are looking to deepen energy, defense, and economic ties as Western sanctions tighten and some Indian refiners scale back Russian crude purchases. Dive deeper

What’s happening globally

Brent crude held above $63 a barrel as supply risks rose after damage to a key Caspian Pipeline mooring disrupted Kazakh export flows via Russia’s Black Sea route. Dive deeper

Gold slipped below $4,200/oz as investors booked profits after a six-week high, even as markets continued to price a high chance of a Fed rate cut next week. Dive deeper

Silver eased back to around $57/oz as investors took profits after a record run, following a six-session rally and sharp gains through 2025. The broader uptrend remains supported by tight supply, strong industrial demand, and expectations of a US rate cut. Dive deeper

The US ISM manufacturing PMI fell to 48.2 in November, signaling a ninth straight month of contraction and a faster slowdown led by weaker orders, employment, and supplier deliveries. Dive deeper

Euro area inflation ticked up to 2.2% in November, driven by firmer services inflation and a slower decline in energy prices, while core inflation held steady at 2.4%. Country trends diverged, with Germany re-accelerating above target even as France and Italy stayed well below 2%. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Rajani Sinha, Chief Economist, CareEdge Group, on nominal GDP slowdown despite 8.2% real growth:

“The sharp decline in nominal GDP growth to just 8.7% is a cause for concern.”

“This slowdown in nominal terms points to weak pricing power, which could negatively impact corporate revenues and strain government finances due to reduced tax collections.”

“The Reserve Bank of India (RBI) is faced with a complex scenario, making the decision to cut rates particularly challenging.” - Link

Vishal Manchanda, Equity Research Analyst – Pharma, Systematix Group, on Wockhardt’s Zaynich NDA review and approval odds:

“The drug Zaynich has not yet been approved, but the review acceptance significantly improves its probability of success.”

“The US FDA has accepted its New Drug Application (NDA) for review.”

“The acceptance itself is seen as a positive indicator of its potential success.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Super report on Indian market to read (post market ) after market closed. Continue the same for years to come.

FII / DII activity ?