Nifty slides toward 25,200 as global risk sentiment deteriorates

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we break down the origins of cryptocurrencies and trace how India’s crypto ecosystem has evolved over the past decade. Starting with the Cypherpunk movement and the birth of Bitcoin, we move through the rise of Indian exchanges, regulatory pushback, taxation frameworks, and recent security incidents to build a clear foundation of what crypto actually is, how it works, and what is legal in India today.

Along the way, we explain how Bitcoin functions without banks, how mining really works, what private keys represent, how Indians access crypto via exchanges, and why custody and security matter far more than most people realise. This is Part 1 of a two-part series on crypto in India.

Market Overview

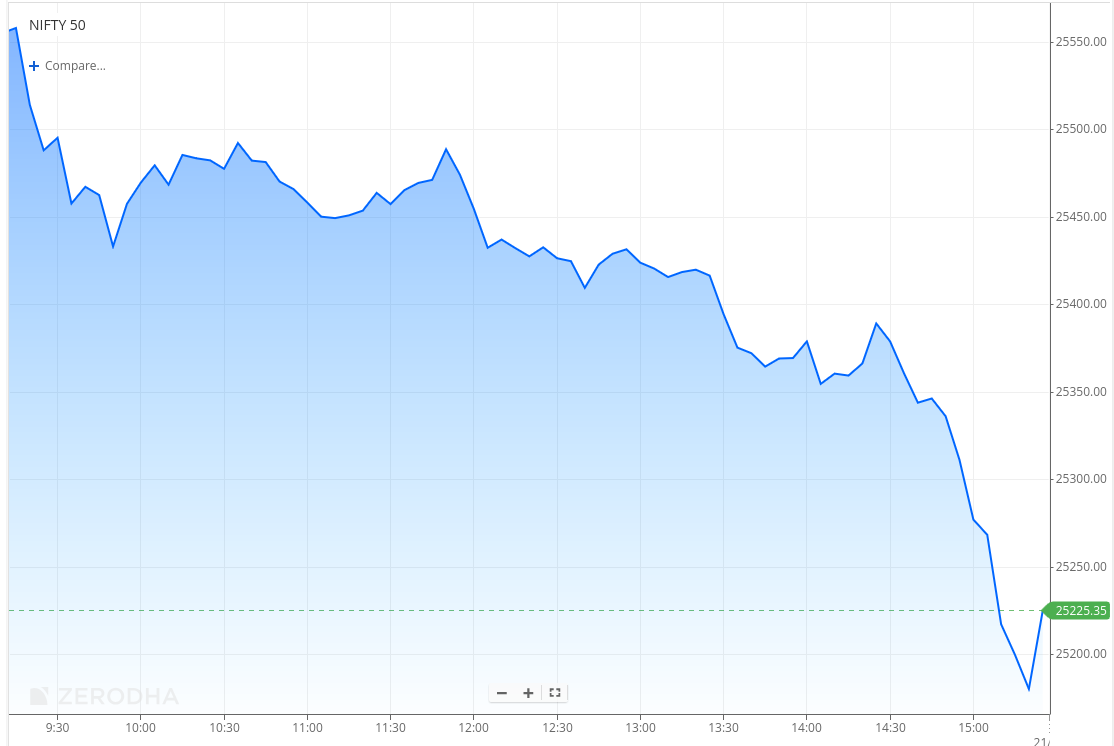

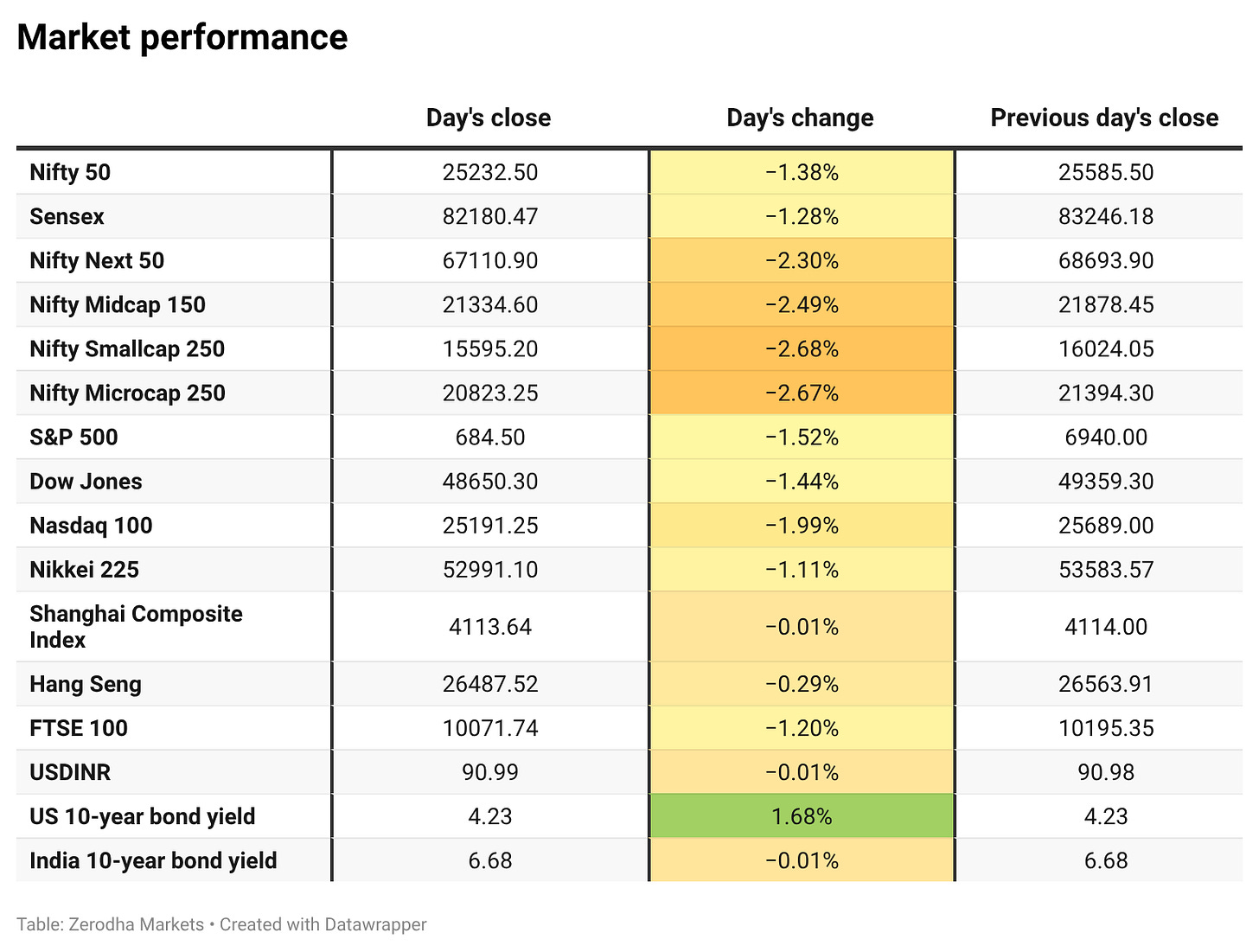

Nifty opened flat at 25,580 but came under immediate selling pressure in the opening hour, slipping quickly toward the 25,450–25,470 zone amid weak sentiment, compounded by extremely weak global cues as U.S. futures fell nearly 2%. Early recovery attempts were modest and short-lived, with the index trading in a narrow and choppy range between 25,450 and 25,490 through the late morning session, struggling to regain lost ground.

By the end of the first half, Nifty drifted lower toward the 25,430–25,450 area as selling pressure remained steady. In the second half, weakness intensified, particularly after 1:30 PM, with the index sliding sharply to test the 25,350 mark. A relentless, one-sided sell-off in the final hour dragged Nifty to intraday lows below the 25,200 zone, near 25,170, before a small bounce into the close. The index eventually settled at 25,232.50, ending sharply lower and marking a weak session dominated by sustained selling and a clear risk-off tone.

Looking ahead, markets are likely to remain sensitive to global risk appetite, ongoing Q3 earnings, the upcoming Union Budget, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had an extremely weak session today. Out of 3,309 stocks that traded on the NSE, 538 advanced, while 2,685 declined, and 86 remained unchanged.

Sectoral Performance:

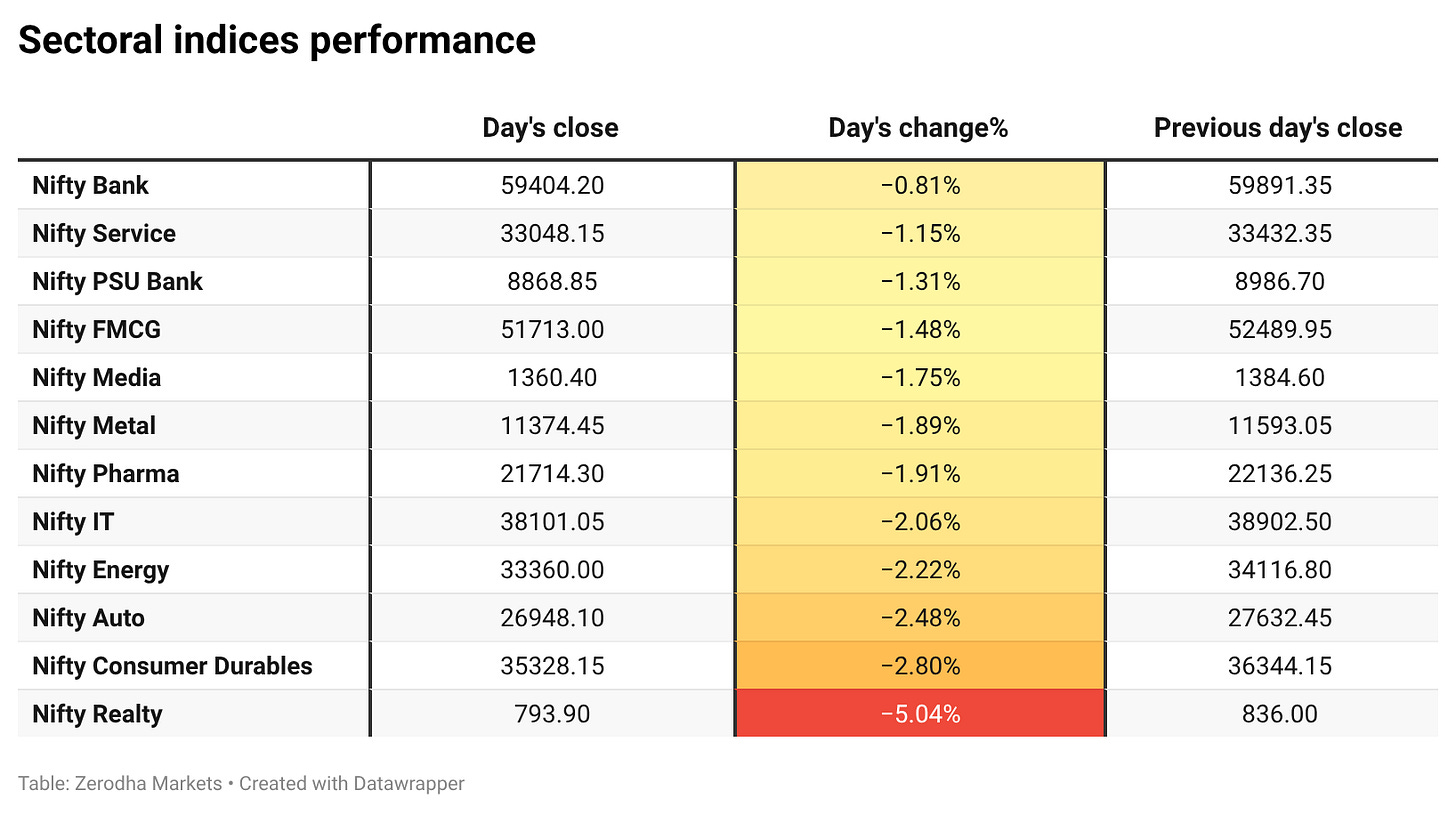

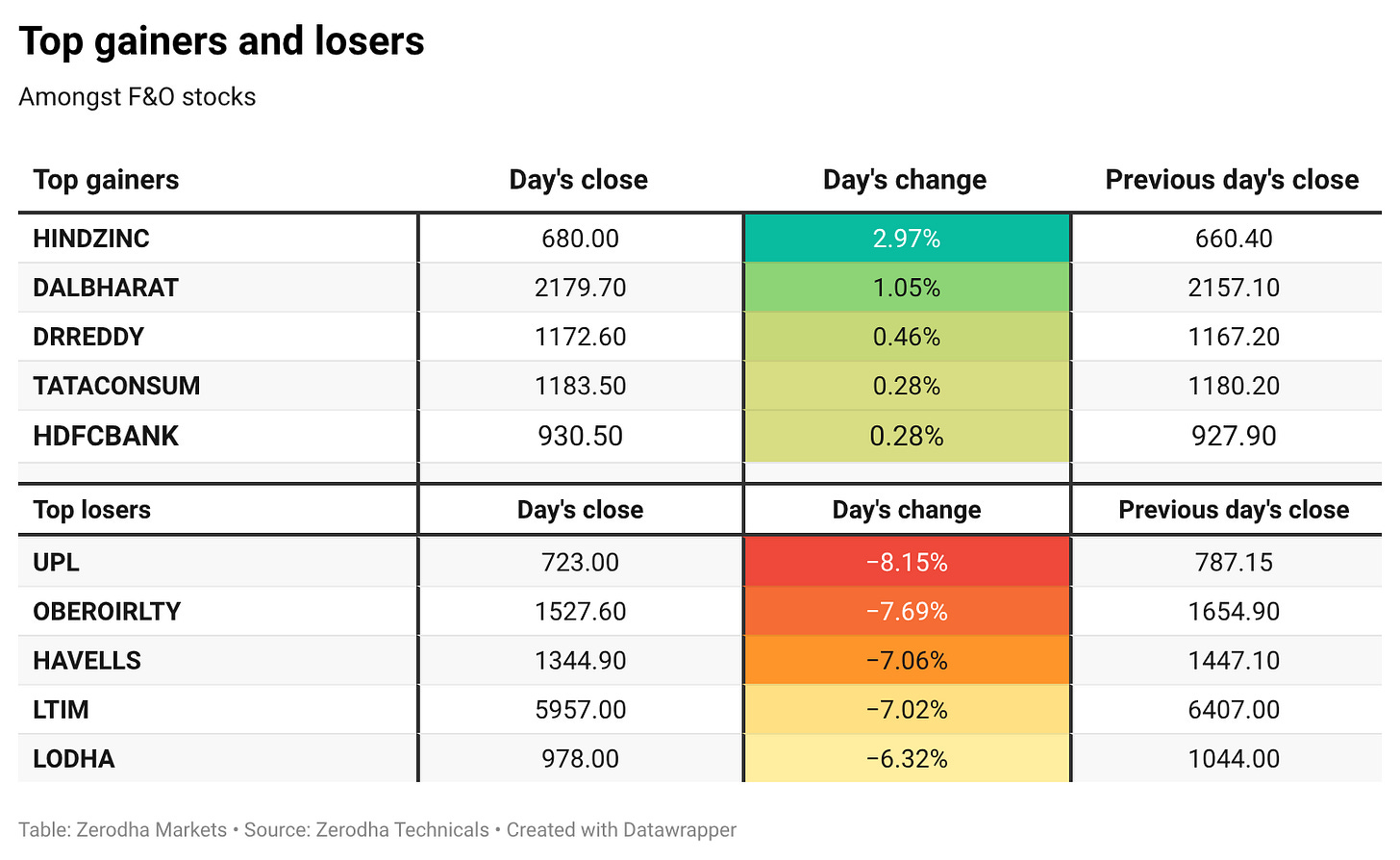

A broad-based sell-off gripped the market with all 12 sectoral indices ending in the red. Nifty Realty led the decline with a sharp 5.04% drop, followed by losses in Consumer Durables, Auto, and Energy. No sector managed to close in the green.

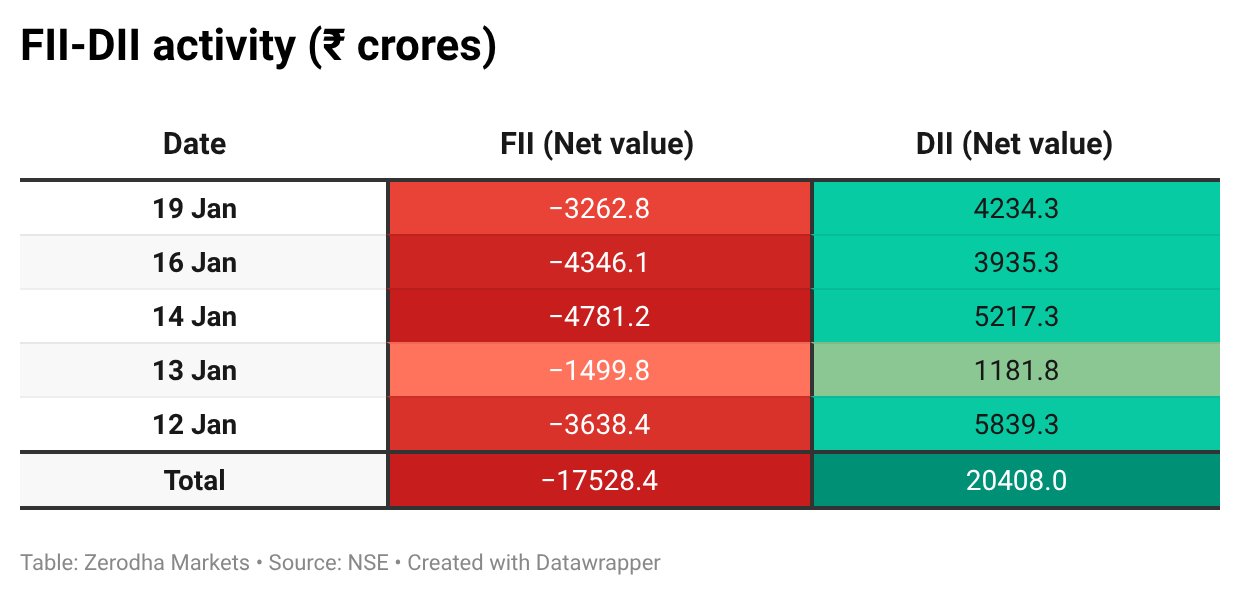

Here’s the trend of FII-DII activity from the last 5 days:

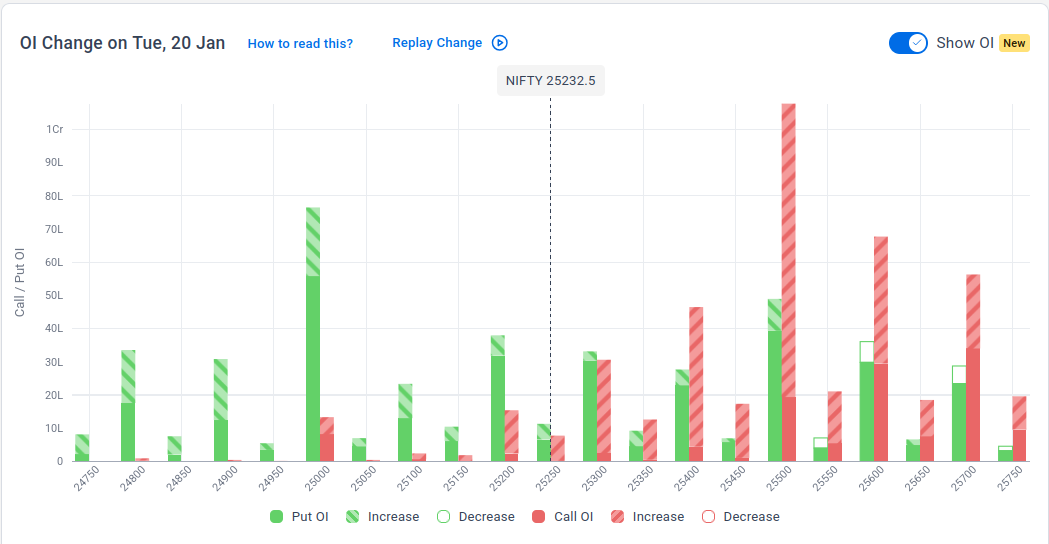

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 27th January:

The maximum Call Open Interest (OI) is observed at 25,500, followed by 25,600, indicating potential resistance at the 25,500 -25,600 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,500, suggesting support at the 25,100 to 25,000 levels.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

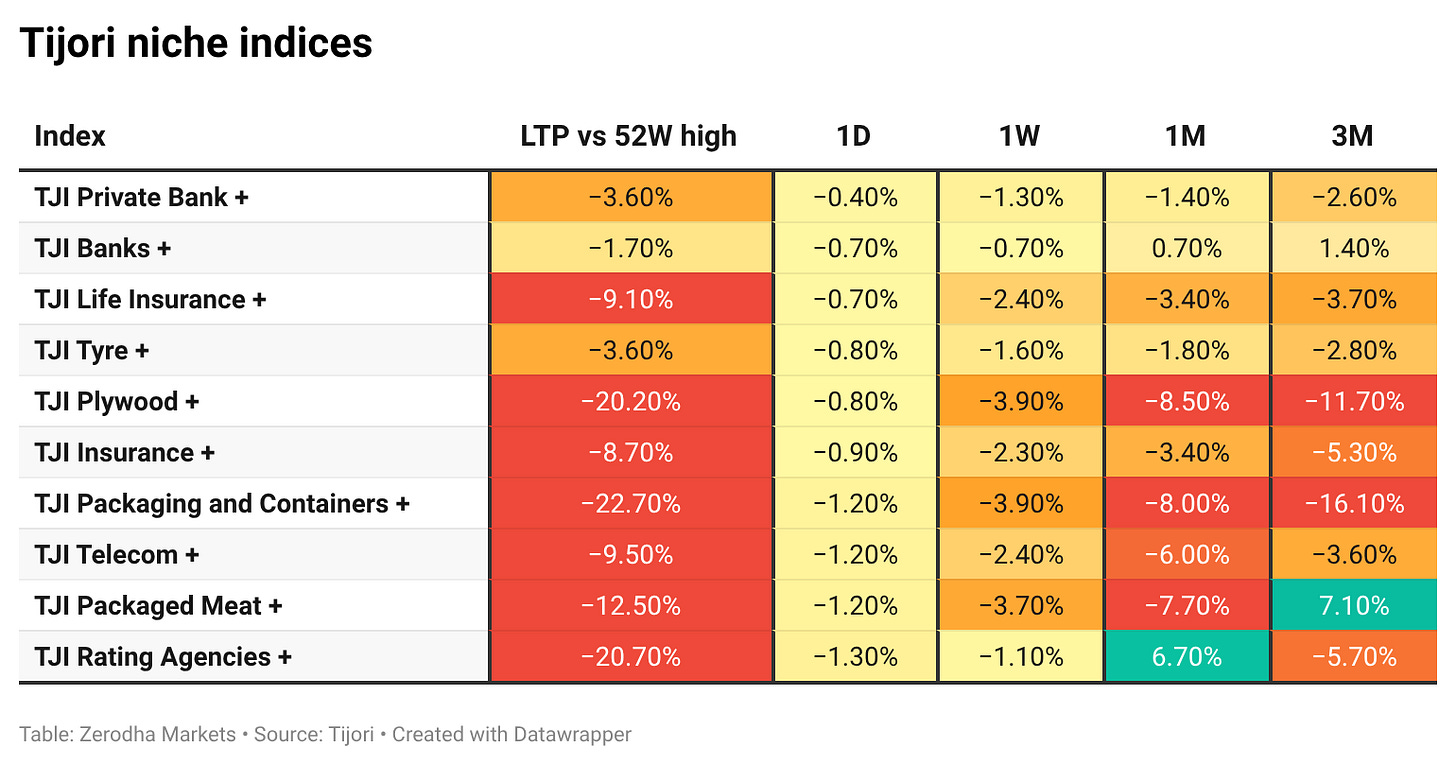

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s eight core sectors grew 3.7% year-on-year in December, accelerating from 2.1% in November, data from the Ministry of Commerce and Industry showed. Electricity output rose 5.3%, and crude oil production rebounded 5.6%, while natural gas output remained weak and refinery products declined 1%. Dive deeper

The Indian rupee weakened for a fifth straight session as strong dollar demand continued to pressure the currency, while likely intervention by the Reserve Bank of India helped prevent a fresh record low. Dive deeper

Indian government bonds strengthened as bargain buying emerged with the 10-year yield holding below key levels, supported by reduced state debt supply for the week. Dive deeper

Embassy Developments said it will invest ₹7,000 crore in Mumbai to develop three new luxury housing projects and complete three ongoing ones, tapping strong housing demand. The company plans to launch new projects at Juhu, Worli, and Alibaug in the Mumbai Metropolitan Region. Dive deeper

SRF Ltd reported a 59.6% year-on-year jump in Q3 net profit to ₹433 crore. Revenue rose 6.3% to ₹3,713 crore, and the company announced a second interim dividend of ₹5 per share. Dive deeper

SEBI has approved PhonePe’s IPO, clearing the way for the company to file an updated draft red herring prospectus soon. The approval marks a key regulatory step toward the payment firm’s public listing. Dive deeper

SEBI has proposed a new governance framework for significant market indices to strengthen oversight of index providers and enhance transparency. The move aims to improve governance standards and investor confidence in key benchmark indices. Dive deeper

ITC Hotels reported a 21% year-on-year rise in consolidated revenue to ₹1,231 crore for the December quarter. Net profit increased to ₹237 crore from ₹216 crore in the same period last year. Dive deeper

What’s happening globally

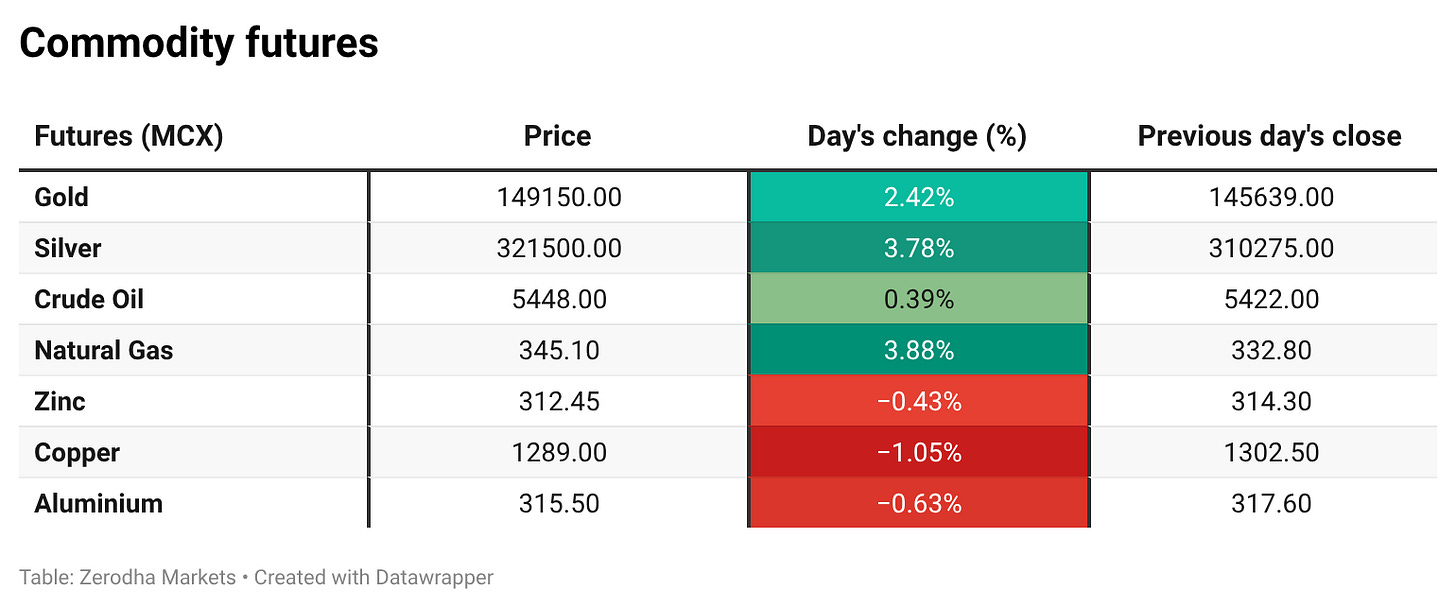

WTI crude fell below $59 a barrel as renewed US-EU trade tensions raised concerns over energy demand. Easing supply risks from Iran and expectations of a supply surplus also weighed on prices, despite regional disruptions. Dive deeper

Gold prices hit a fresh record above $4,720 an ounce as renewed US-EU trade tensions boosted safe-haven demand. Investors also remained cautious ahead of key US inflation data later this week. Dive deeper

Silver hovered near record highs around $94.5 an ounce as escalating US-Europe tensions over trade and geopolitics lifted safe-haven demand. Markets also remained volatile after the US exempted silver from tariffs on critical minerals. Dive deeper

US natural gas futures surged to a three-week high as forecasts shifted toward sharply colder weather across much of the US. Expectations of extreme Arctic cold later in January drove demand concerns despite elevated production levels. Dive deeper

European equities extended losses as trade tension concerns persisted following fresh US tariff threats against several European countries. Most major stocks declined, while semiconductor shares found some support after a sector upgrade. Dive deeper

Germany’s ZEW economic sentiment index rose sharply to 59.6 in January, its highest level since 2021, signalling improved investor confidence. Optimism was driven by stronger export-sector sentiment and expectations of a potential economic turning point in 2026. Dive deeper

UK unemployment held at 5.1% in the three months to November, its highest level since early 2021, as joblessness continued to rise. Employment edged higher, while inactivity declined modestly during the period. Dive deeper

China’s central bank kept its key lending rates unchanged in January, with the one-year and five-year LPRs remaining at record lows. The decision followed recent targeted rate cuts and data showing 2025 GDP growth met the official target. Dive deeper

Sony Group Corp. will sell a 51% stake in its home entertainment business, including the Bravia TV brand, to TCL Electronics Holdings Ltd.. The companies plan to form a joint venture starting April 2027 to produce Sony- and Bravia-branded TVs using TCL’s display technology, as Sony trims exposure to a low-margin segment. Dive deeper

Netflix shares rose 0.7% on Tuesday despite a 1.8% drop in the Nasdaq 100, after Netflix and Warner Bros. Discovery amended their merger to an all-cash deal. The revised agreement keeps the valuation at $27.75 per WBD share while removing the stock component, giving WBD shareholders greater certainty of value. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Rishi Kapoor, Investcorp’s CEO, on the global artificial intelligence race and the key area to watch out for:

"The implementation of agentic AI at the business level, the B2B and the B2B2C level, is where India ought to have a competitive advantage in terms of being the conduit of implementing and rolling that out globally, not just in the region. So we see that as a pretty strong fillip, tailwind, in that space."

"Logistics is another area that we really like, both in terms of serving the market domestically, but also as the supply chains globally reshape themselves, India has a role to play in it." - Link

Scott Bessent, US Treasury Secretary, on the dispute triggered by the US administration’s push to take over Greenland:

“It’s been 48 hours. As I said, sit back, relax...I am confident that the leaders will not escalate and that this will work out in a manner that ends up in a very good place for all,” - Link

S. K. Sayal, Executive Director & CEO, Bharti Realty on fractional ownership and REITs in commercial real estate:

“Fractional ownership and REITs are democratising access to commercial real estate for a wider set of investors.”

“These structures significantly enhance liquidity and allow investors to participate in high-quality office assets without large capital outlays.”

“REITs and fractional investments help bridge the gap between traditional real estate and capital market investors.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

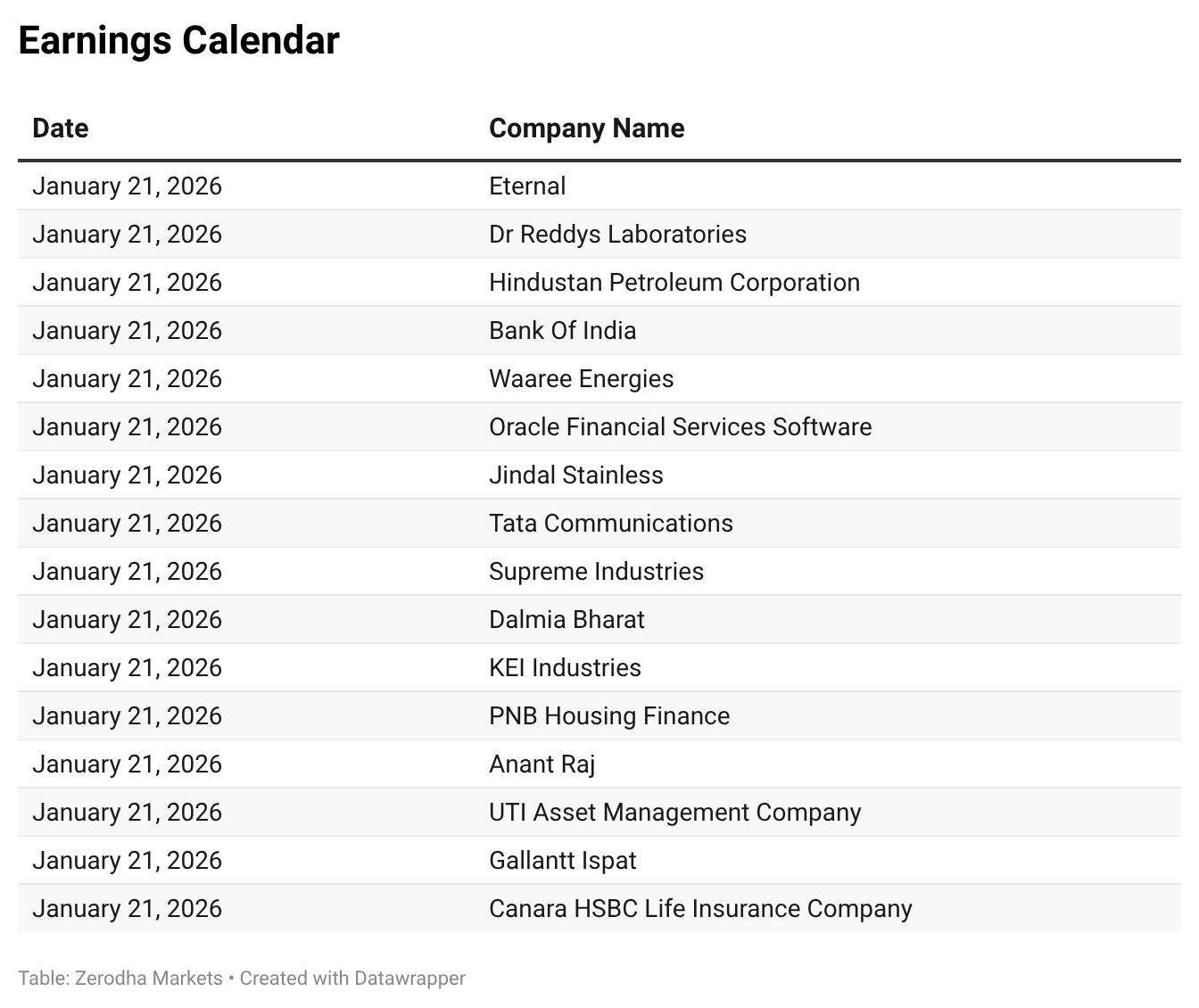

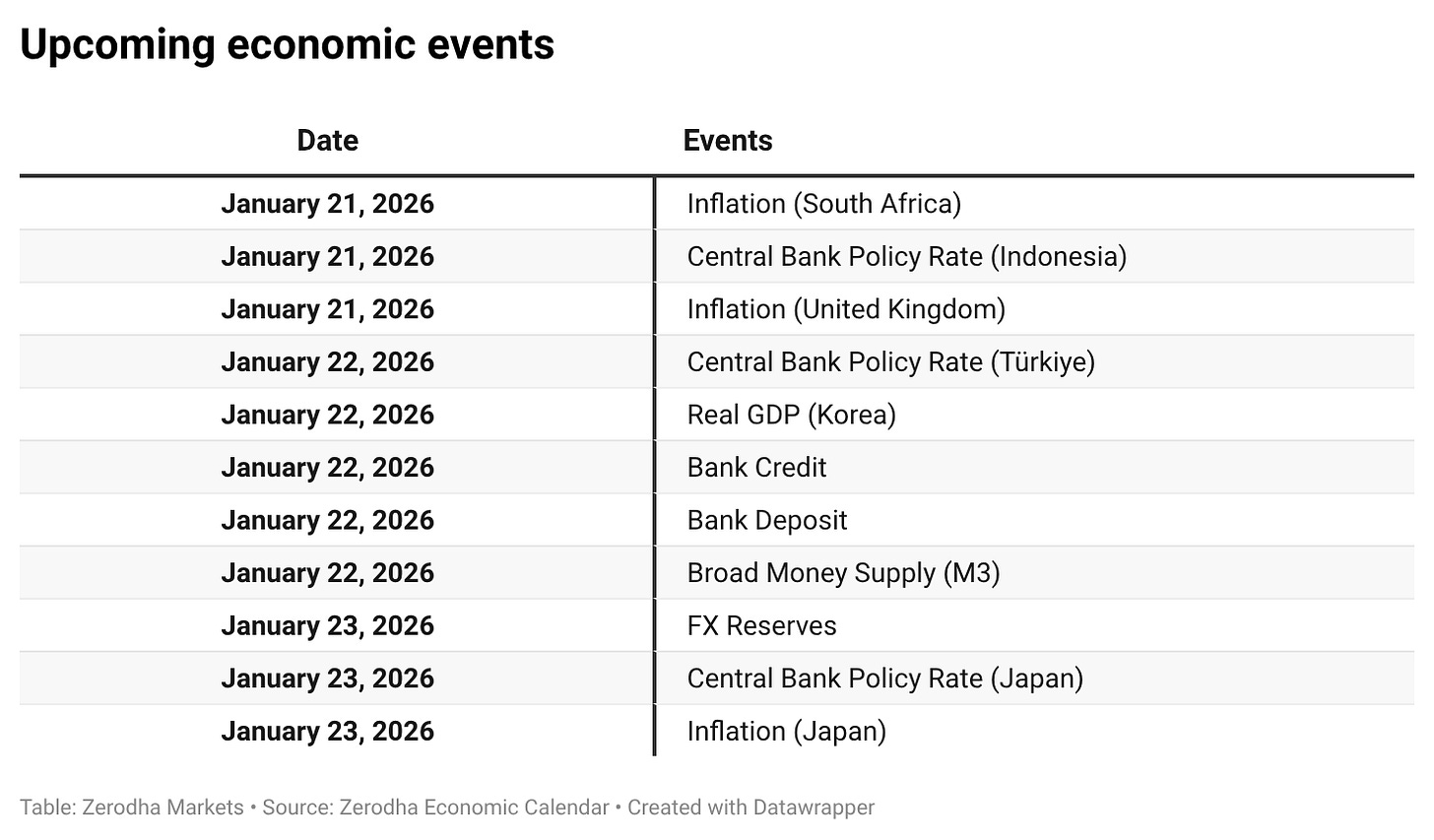

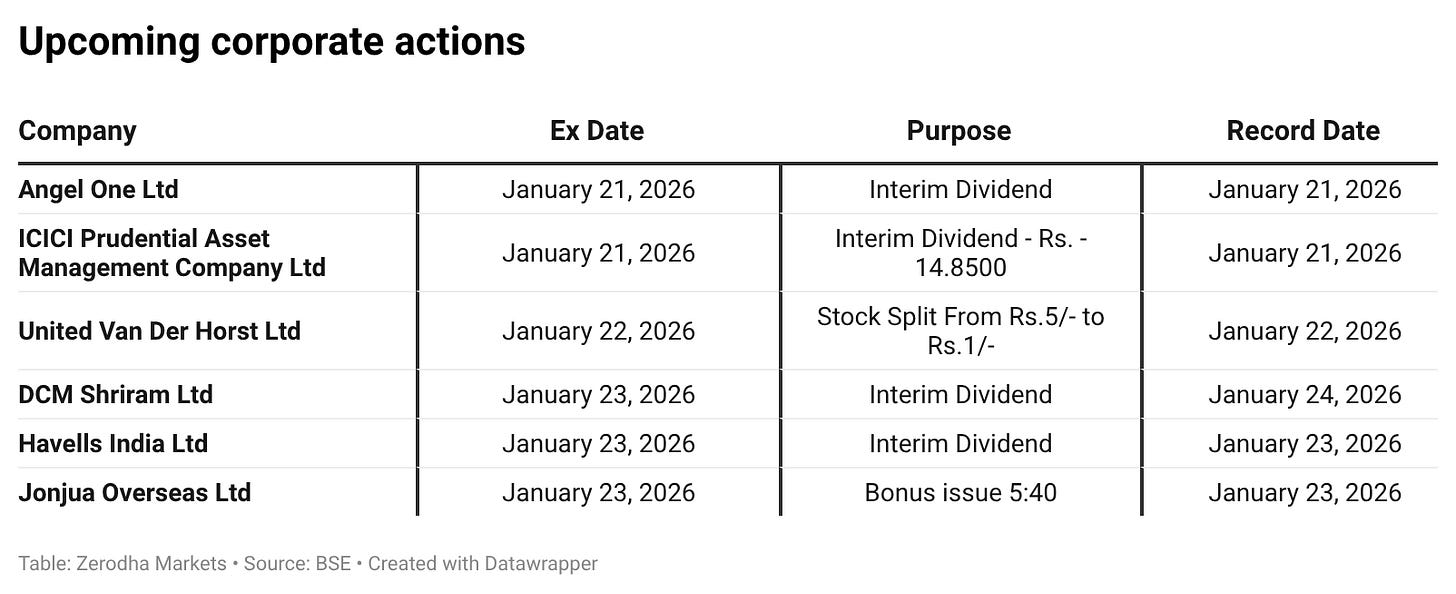

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!