Nifty slides below 25,700 as market sell-off deepens

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we trace the evolution of this concept, from its origins in Sir Francis Galton’s Victorian laboratory to the “fundamental” value investing of Graham and Dodd, and finally to the technical indicators used today.

We break down the statistical engine that drives mean reversion - Mean, Standard Deviation, and Normal Distribution-and explore how legends like John Bollinger turned these math concepts into practical trading tools. Most importantly, we discuss Market Regimes: why simply buying the dip works until it doesn’t, and how to identify when the market is conducive to reversion strategies.

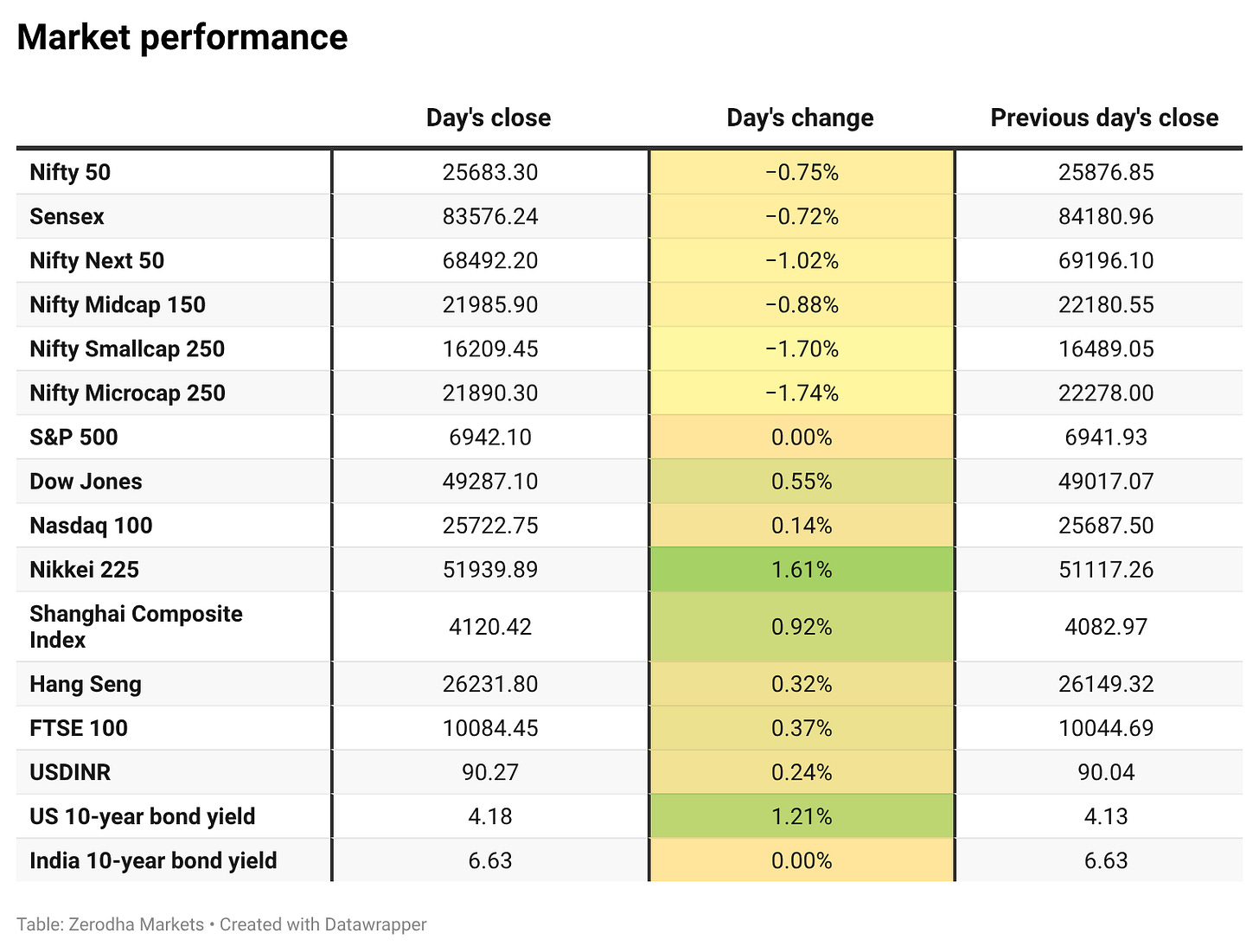

Market Overview

Nifty opened with a 37-point gap-down at 25,840 and witnessed sharp volatility in the first 15 minutes, swinging up to 25,940 before slipping back to 25,850 within the same window. After a brief attempt to stabilise in the 25,820–25,900 range until around 11 AM, selling pressure resumed, and the index drifted steadily lower through the morning session. By late morning, Nifty slipped below 25,800 and continued to weaken into the first half, reflecting persistent risk-off sentiment.

In the second half, losses deepened further, with Nifty hitting intraday lows near the 25,650–25,670 zone around 12:30 PM before extending the decline to 25,630 levels by 2:30 PM as selling turned relentless and one-sided. A mild recovery emerged in the final hour, allowing the index to retrace part of the losses, though buying interest remained limited. Nifty eventually closed near 25,683.3, down around 0.75% on the day, marking a weak session dominated by sustained selling pressure and cautious market sentiment.

Looking ahead, markets are likely to remain sensitive to global risk appetite, the onset of the Q3 earnings season, and further developments around India–U.S. trade negotiations.

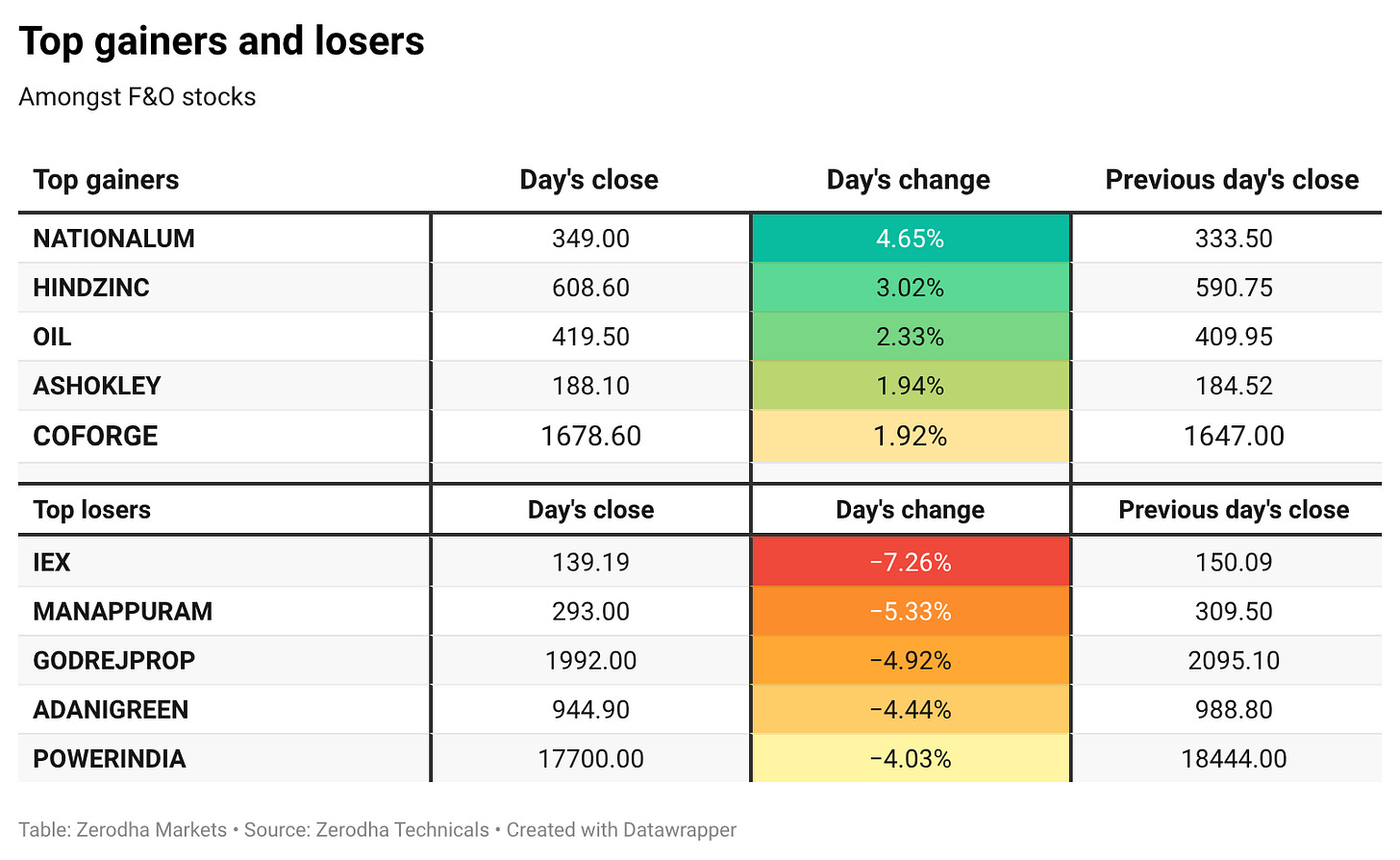

Broader Market Performance:

The broader market had an extremely deteriorating market breadth today. Out of 3,240 stocks that traded on the NSE, 744 advanced, while 2,394 declined, and 102 remained unchanged.

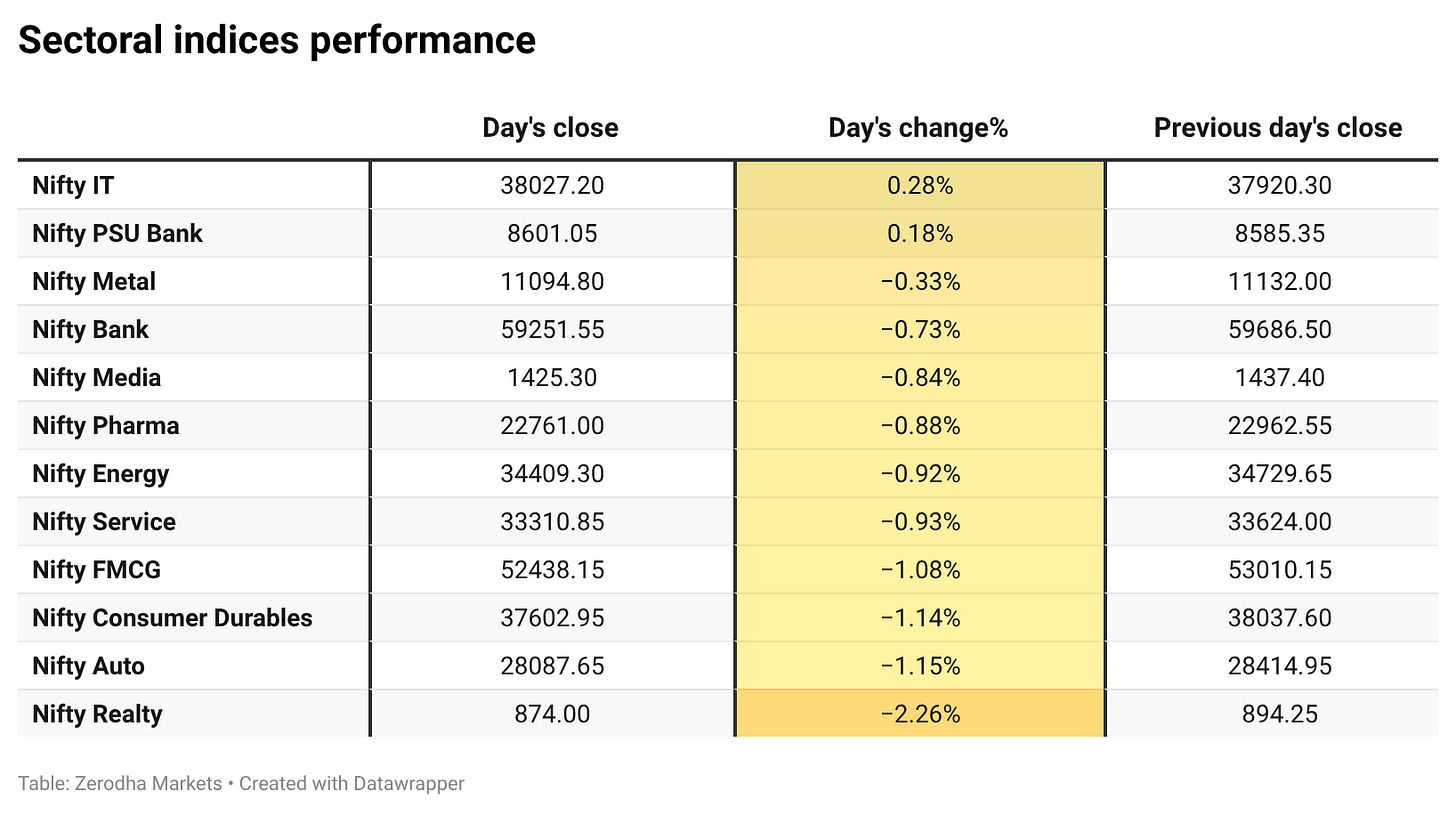

Sectoral Performance:

Nifty IT was the top gainer, rising 0.28%, while Nifty Realty was the biggest loser with a steep fall of 2.26%. Out of the 12 sectoral indices, only 2 ended in the green, whereas 10 closed in the red, indicating broad-based weakness across the market.

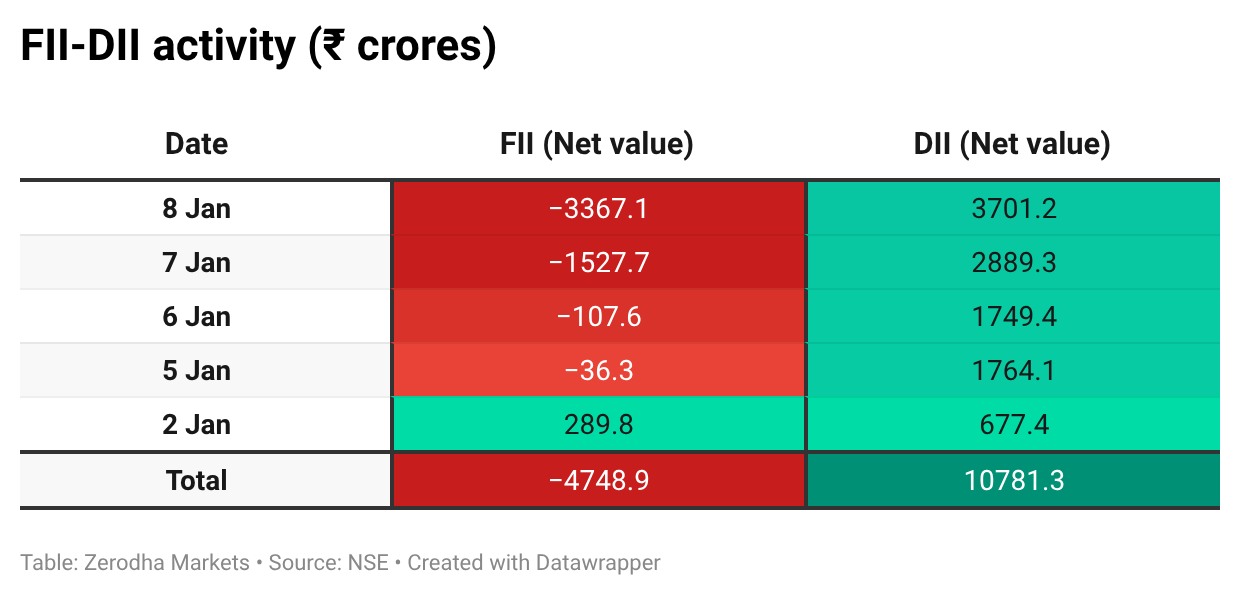

Here’s the trend of FII-DII activity from the last 5 days:

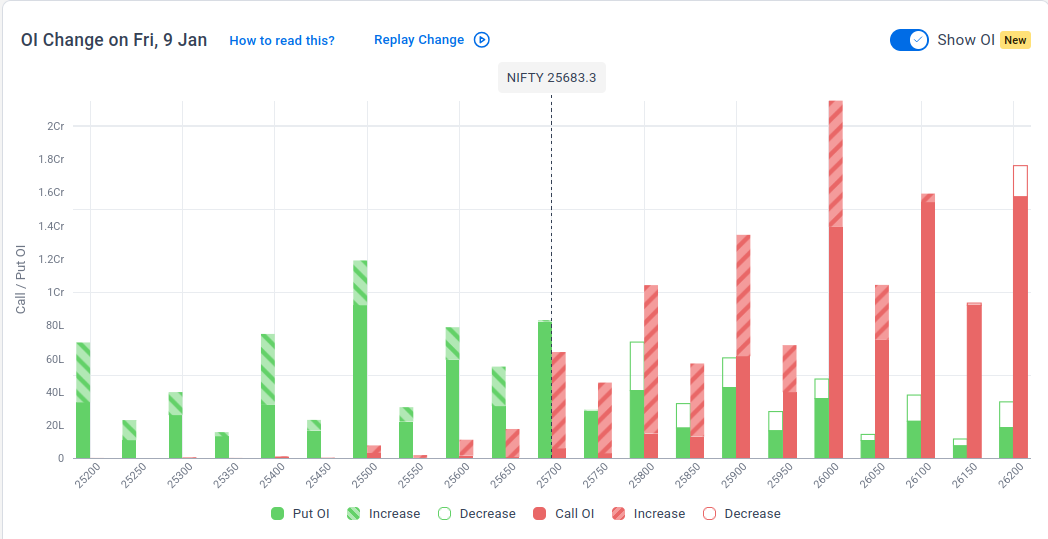

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th January:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,100, indicating potential resistance at the 26,000 -26,100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,700, suggesting support at the 25,600 to 25,500 levels.

Note: OI is subject to multiple interpretations; however, generally, an increase in Call OI indicates resistance in a falling market, while an increase in Put OI indicates support in a rising market.

Source: Sensibull

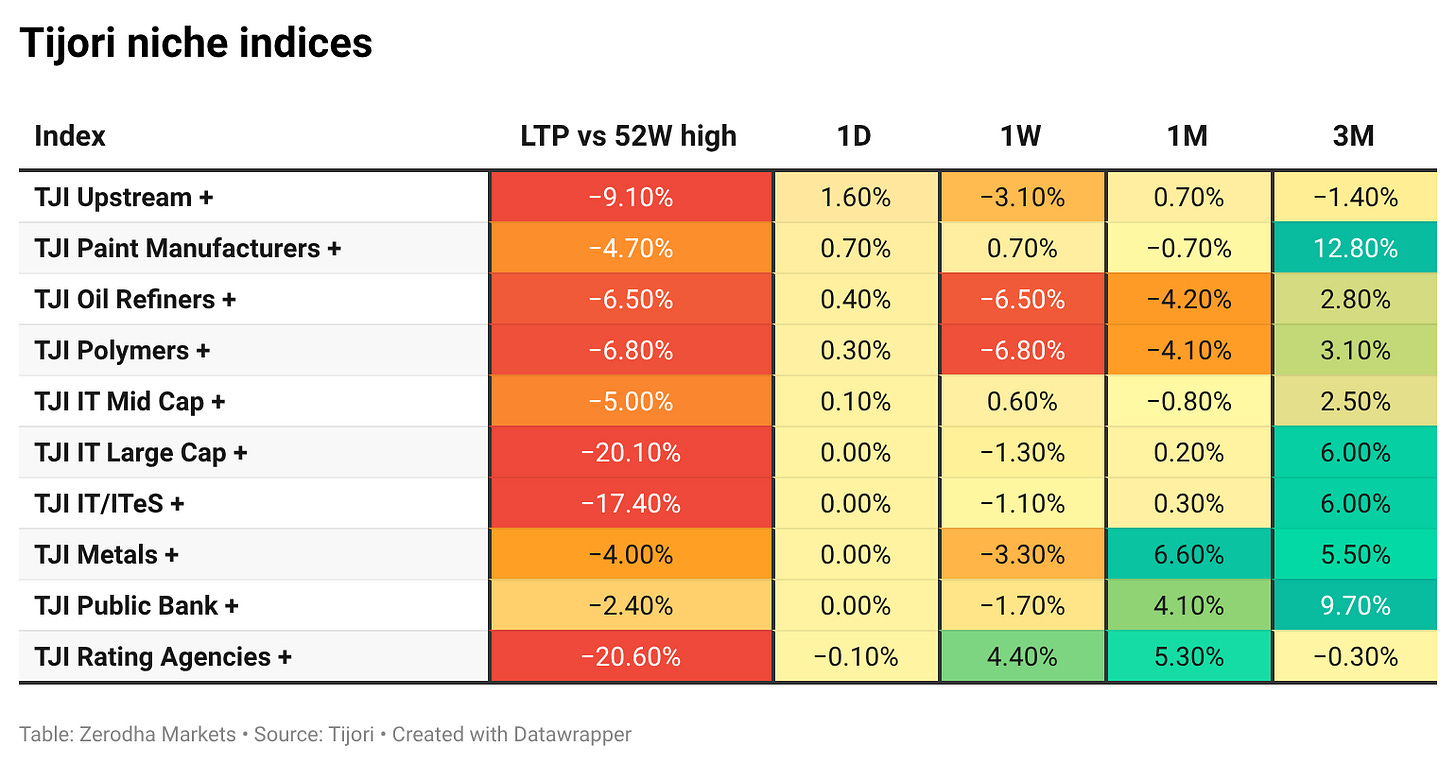

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Capital goods stocks fell sharply after reports suggested the government may consider reopening project bids to Chinese firms, raising concerns over increased competition. The move was driven by policy-related speculation, with no official confirmation so far. Dive deeper

Bharat Forge’s shares were in focus after the company signed a memorandum of understanding with Germany-based Agile Robots to explore AI-driven robotics and smart industrial automation technologies. Dive deeper

Mazagon Dock Shipbuilders’ shares rose about 3% as reports indicated India and Germany are nearing finalisation of an $8 billion submarine manufacturing deal, involving German partner ThyssenKrupp Marine Systems. Dive deeper

The rupee traded flat around 89.9 per dollar as markets awaited next week’s inflation data, while tariff concerns, foreign fund outflows, and RBI forward positions continued to weigh on the currency. Dive deeper

Reliance Industries said it would consider buying Venezuelan crude if sales to non-US buyers are permitted, citing potential benefits from discounted heavy oil and diversification of energy imports. Dive deeper

Hindustan Unilever received a tax demand of 15.6 billion rupees from Indian authorities and plans to appeal the order. The company said the demand is not expected to have any material impact on its financials or operations. Dive deeper

India’s sugar mills have signed export contracts for about 180,000 tonnes this season as lower domestic prices and a weaker rupee improved overseas viability. Dive deeper

A former chief economic adviser warned that higher US tariffs could pose a risk to India’s growth outlook, adding to pressures from rising imports and fiscal constraints. Policy uncertainty around trade remains a key external risk for the economy. Dive deeper

What’s happening globally

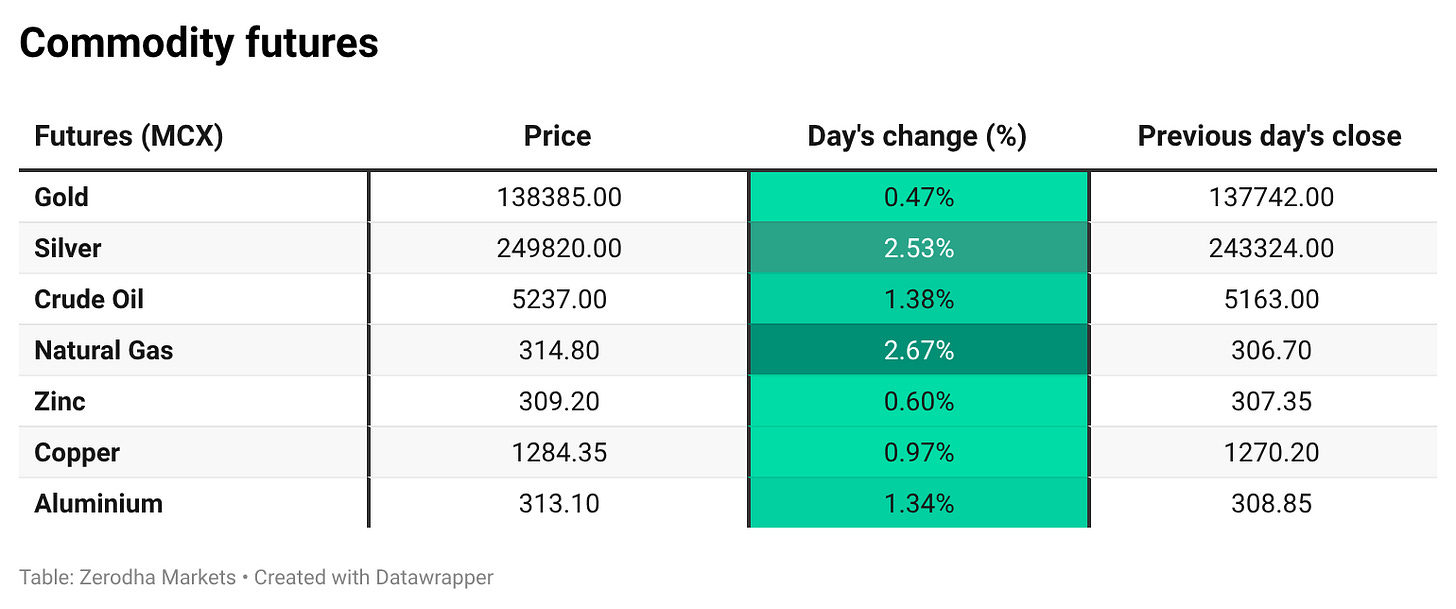

WTI crude oil futures climbed near $58 a barrel, extending gains from the prior session as markets weighed growing geopolitical risks around Venezuela and Iran that could disrupt supply. Dive deeper

Gold fell to around $4,460 per ounce as prices eased from recent highs amid a stronger US dollar. Dive deeper

The FAO Food Price Index fell 0.6% in December to its lowest level since August 2024, led by declines in dairy, meat, and vegetable oil prices. In contrast, cereal and sugar prices rose on concerns over Black Sea exports and lower sugar production in Brazil. Dive deeper

The dollar index rose toward 99, extending gains for a fourth session as investors positioned ahead of the US jobs report and assessed the Fed’s policy outlook. Dive deeper

Eurozone retail sales rose 0.2% in November, slightly beating expectations, led by higher non-food purchases despite weaker food and fuel sales. Annual retail growth accelerated to 2.3%, with gains in Spain, France, Italy, and the Netherlands offsetting a decline in Germany. Dive deeper

European stocks rose to record highs, with the STOXX 50 and STOXX 600 gaining 0.5% and 0.4%, led by mining and technology shares. Glencore surged on takeover talks with Rio Tinto, while ASML rallied, offsetting losses in select consumer stocks. Dive deeper

China’s inflation edged up to 0.8% in December, the highest since early 2023 but below expectations, driven mainly by higher food prices. Core inflation remained steady, while full-year inflation stayed flat and well below the official target. Dive deeper

Germany’s exports fell 2.5% in November to a 13-month low, led by weaker demand from EU partners and a sharp decline in shipments to the US amid tariff effects. Exports to China rose, while overall exports were still marginally higher year-to-date. Dive deeper

Japan’s household spending rose 2.9% year-on-year in November, beating expectations and rebounding sharply from the prior month’s decline. The increase was supported by higher winter-related purchases and broad-based gains across consumption categories. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Amit Jain, Head of Americas Equity Strategy, HSBC, on U.S. ETFs and stock selection for 2026:

“ETFs still matter for broad market exposure, but stock selection will drive returns in 2026.”

“Active managers with the right bottom-up, fundamental analysis could outperform broad passive strategies next year.”

“Macro trends may remain mixed, but quality stocks with resilient earnings and valuation discipline should offer better risk-adjusted returns.” - Link

Arvind Subramanian, former chief economic adviser to the Government of India, on growth risks and tariffs

“We should read the 7.4% growth figure cautiously. Even directionally, it is not obvious that the economy is recovering.”

“If growth next year ends up similar to this year, India should consider itself fortunate given the heightened uncertainty.”

“It is now looking less likely that there will be a trade deal, and tariff rates may even move higher.”

“Chinese mercantilism is diverting low-cost goods into markets like India and weighing on the domestic economy.”

“With limited fiscal space, currency depreciation may be the only effective channel to support exporters.”

“The RBI’s intervention in currency markets remains well above what is needed to smooth volatility.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

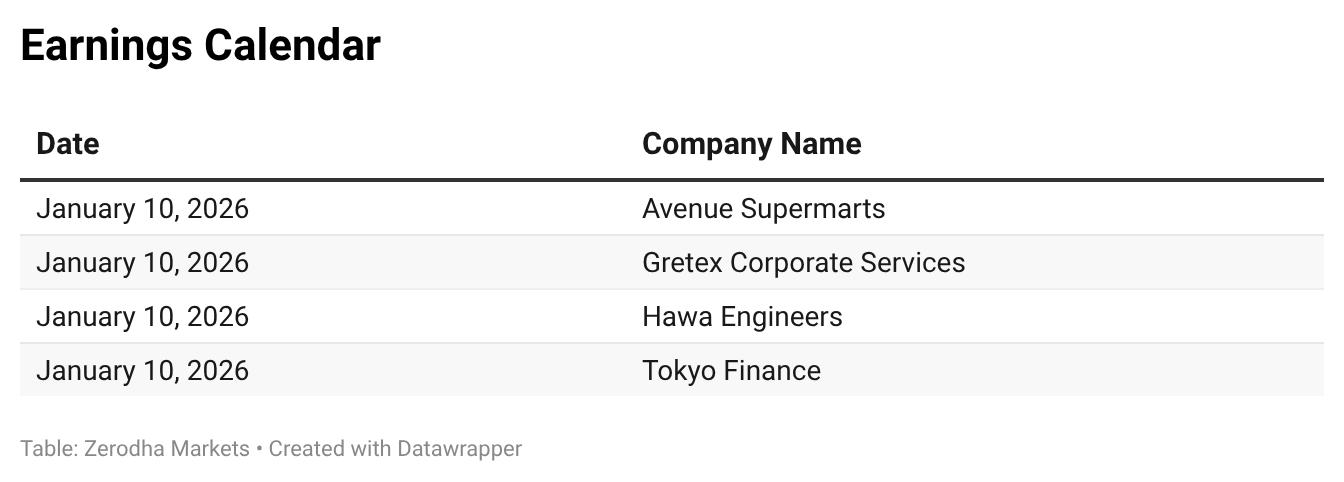

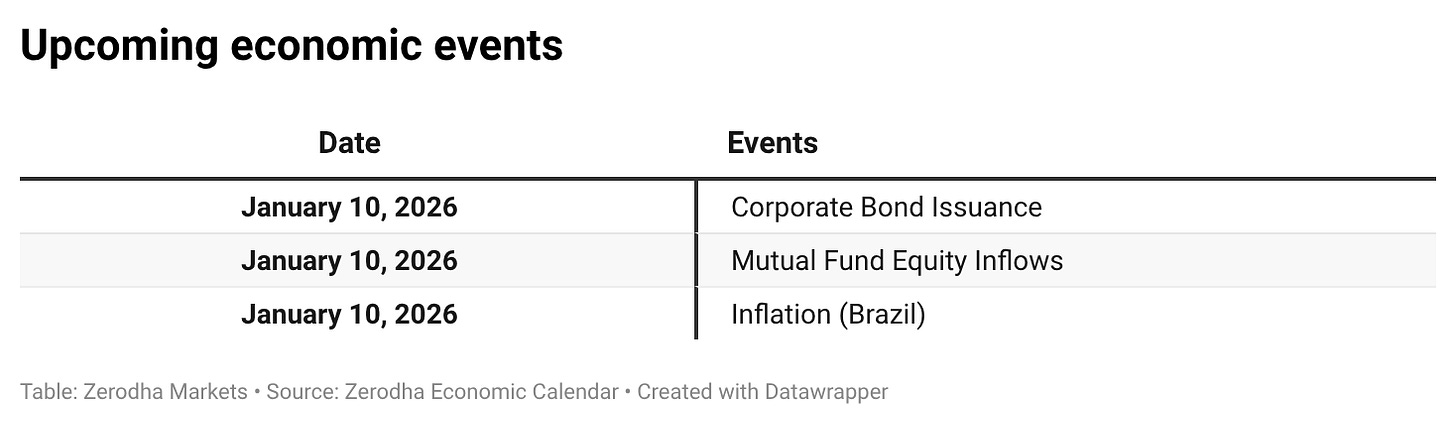

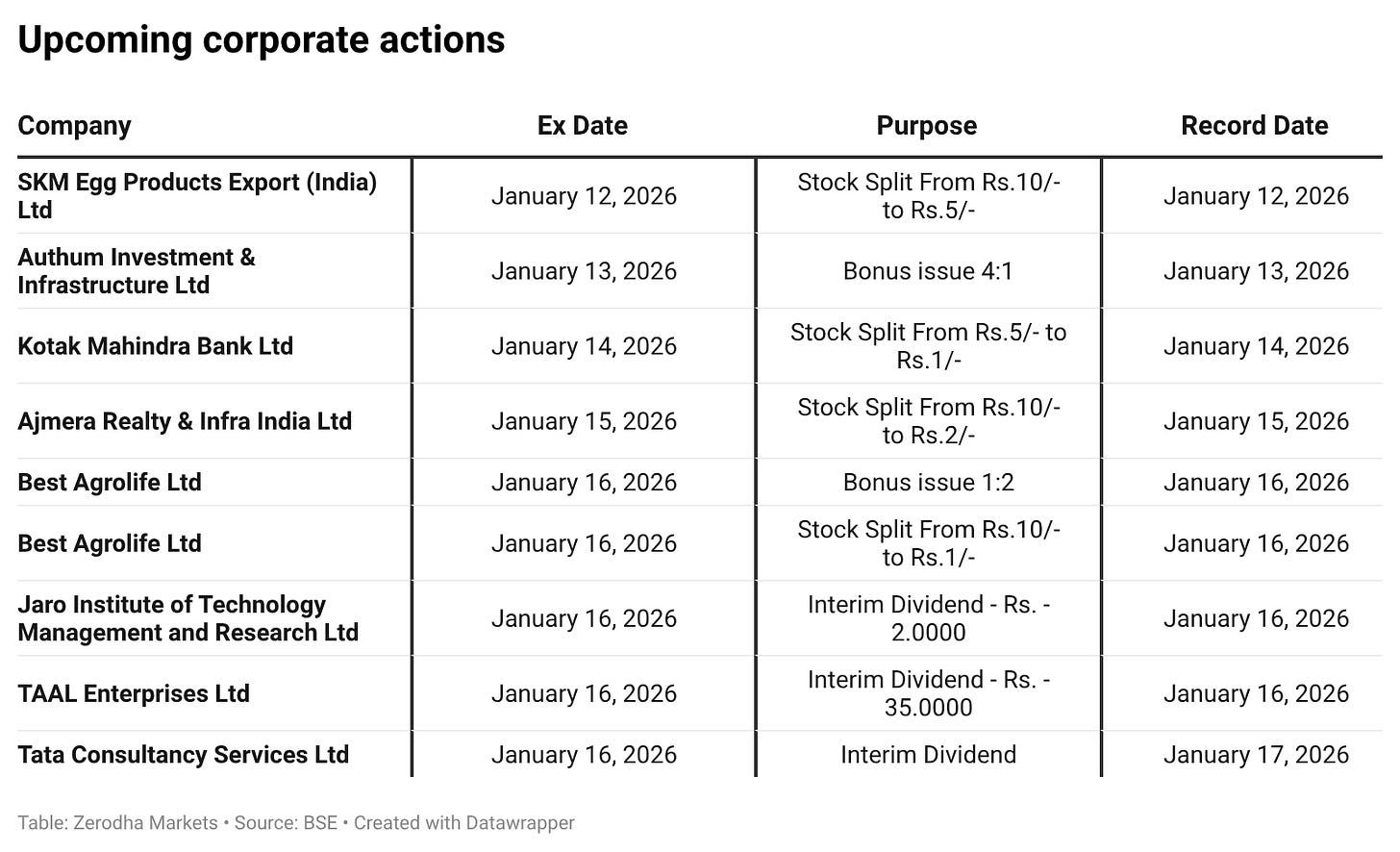

Calendars

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

The section on 'Market Regimes' is timely. We just witnessed a textbook regime shift this week—breaking the 50 DEMA flipped the texture from 'Buy on Dip' to 'Sell on Rise.'

That said, the easy selling was at 26,050. Shorting here at 25,600—after a 5-day flush into structural support—is chasing the bus. The Mean Reversion math now favors a tactical bounce/consolidation before the trend resolves.