Nifty slides 1% as tariff jitters return; broader markets bleed

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we trace the evolution of this concept, from its origins in Sir Francis Galton’s Victorian laboratory to the "fundamental" value investing of Graham and Dodd, and finally to the technical indicators used today.

We break down the statistical engine that drives mean reversion - Mean, Standard Deviation, and Normal Distribution-and explore how legends like John Bollinger turned these math concepts into practical trading tools. Most importantly, we discuss Market Regimes: why simply buying the dip works until it doesn't, and how to identify when the market is conducive to reversion strategies.

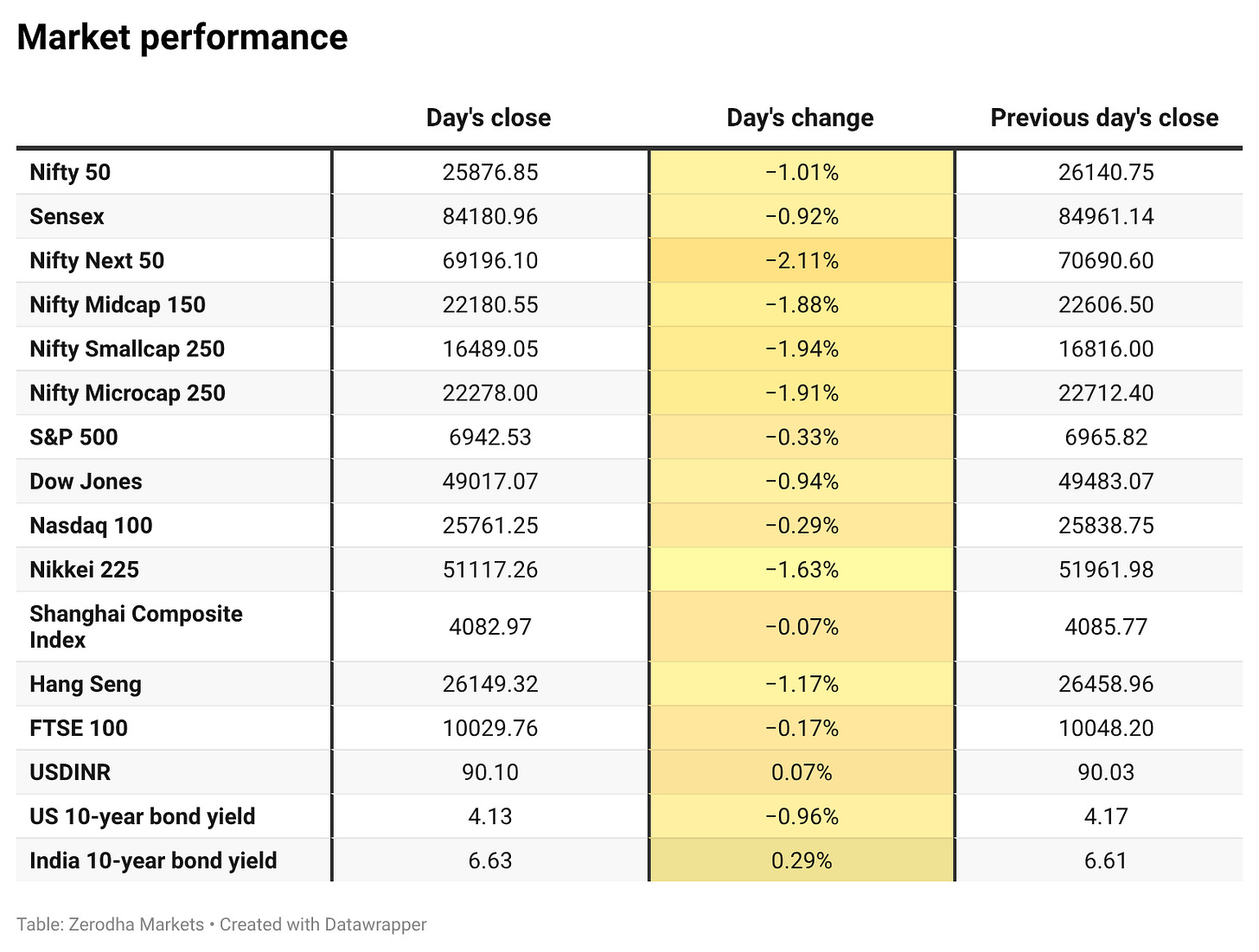

Market Overview

Nifty opened with a 34-point gap-down at 26,107 and came under immediate selling pressure, slipping sharply in the opening hour toward the 26,030–26,050 zone. Early rebound attempts were weak and short-lived, and the index continued to drift lower through the late morning session, slipping below the 26,000 mark after 11 AM and breaching 25,900 by noon.

In the second half, selling pressure persisted, though Nifty traded in a narrow range between 25,900 and 25,940 for most of the session. Fresh selling in the final 45 minutes dragged the index back toward the day’s lows. Nifty eventually closed at 25,876.85, down nearly 1%, marking a weak session dominated by sustained selling and a clear bearish bias throughout the day.

Looking ahead, markets are likely to remain sensitive to global risk appetite, the start of the Q3 earnings season, and further developments around India–U.S. trade negotiations.

Broader Market Performance:

The broader market had an extremely deteriorating market breadth today. Out of 3,247 stocks that traded on the NSE, 545 advanced, while 2,625 declined, and 77 remained unchanged.

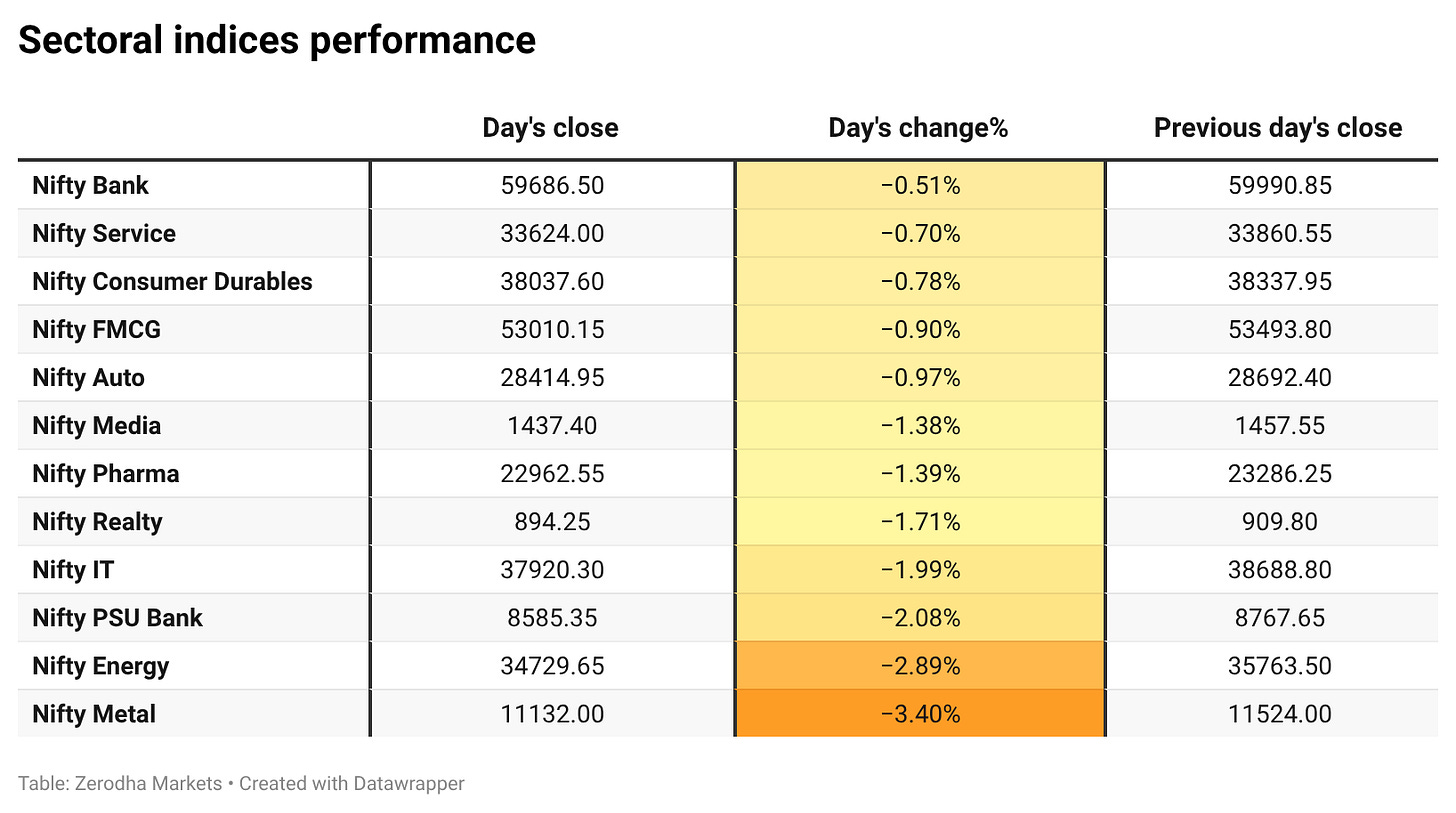

Sectoral Performance:

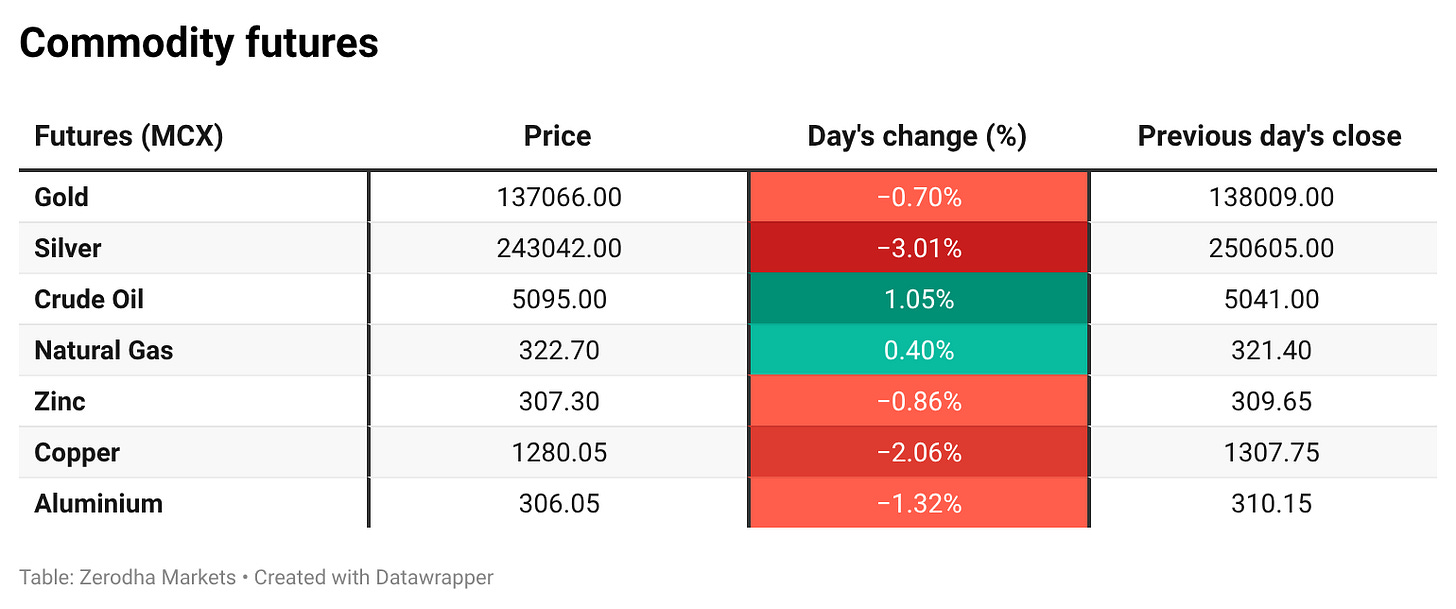

The sector with minimal cuts for the day was Nifty Bank, while Nifty Metal emerged as the top losing sector with a steep decline of 3.40%. Out of the 12 sectoral indices, none closed in the green, reflecting broad-based weakness across the market.

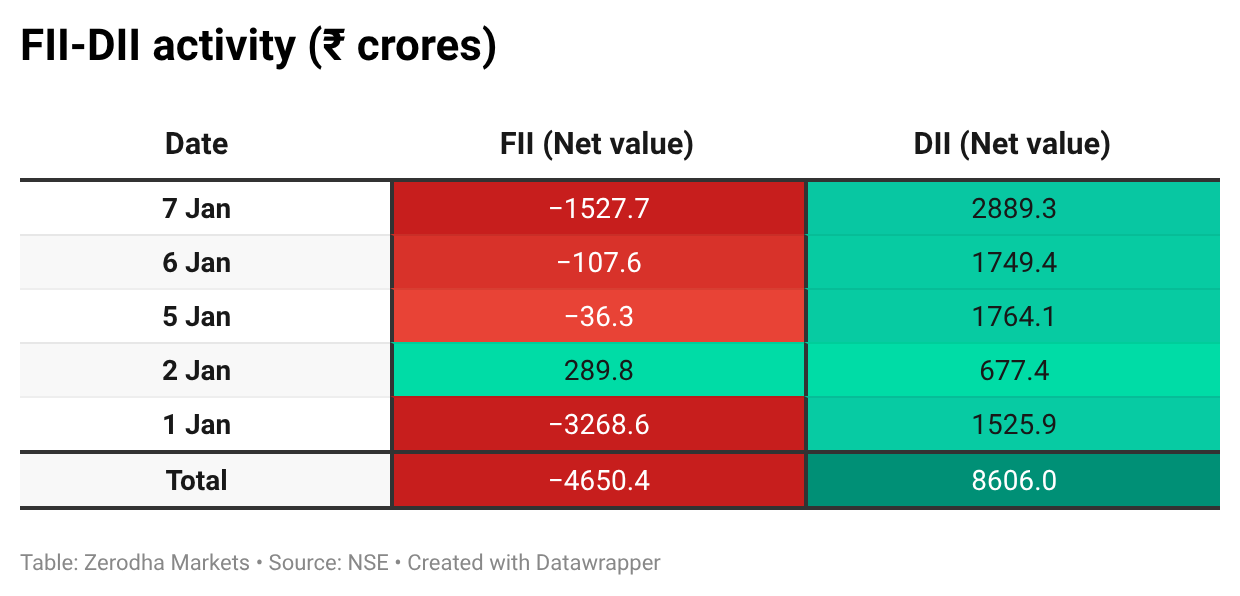

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th January:

The maximum Call Open Interest (OI) is observed at 26,200, followed equally by 26,100 & 26,000, indicating potential resistance at the 26,000 -26100 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,700, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

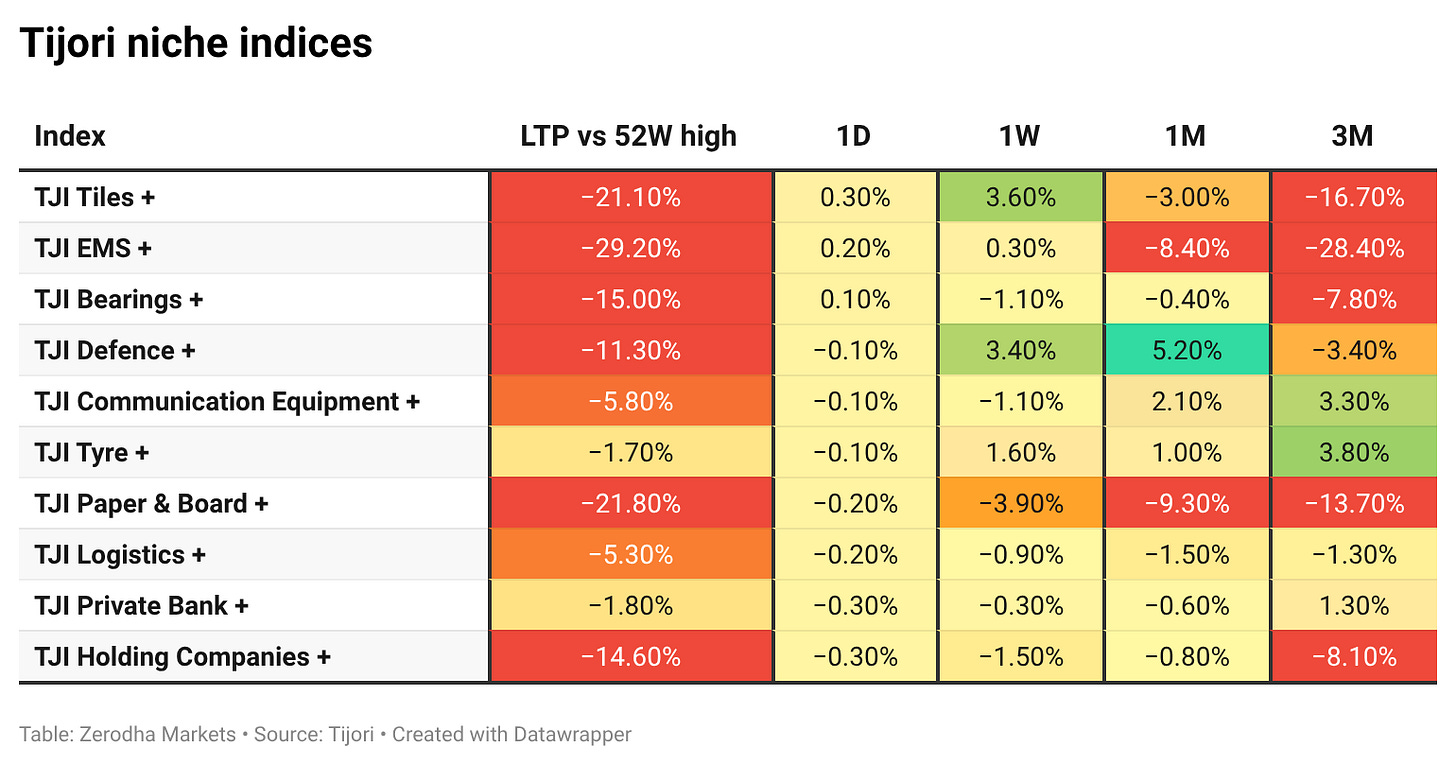

Tijori is an investment research platform that has constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee strengthened to a one-week high after RBI intervention helped push it back above the 90 level. Market focus remains on foreign equity outflows, US–India trade uncertainty, and upcoming domestic inflation data. Dive deeper

SEBI has accused a Bank of America unit of violating insider trading rules during a 2024 share sale. The regulator cited failures in maintaining internal information barriers. Dive deeper

Tata Steel reported a record quarterly crude steel production in India during the December quarter, supported by higher output at its Jamshedpur and Kalinganagar plants. Deliveries also reached an all-time high despite pricing pressure from imports. Dive deeper

India plans to remove restrictions on Chinese firms bidding for government contracts, imposed after the 2020 border clash, as it looks to ease project delays and shortages. The proposal, led by the finance ministry, is awaiting final approval from the Prime Minister’s office. Dive deeper

Torrent Pharma is planning a large bond sale to fund its proposed acquisition of JB Chemicals & Pharmaceuticals. Bankers are in talks to arrange the financing. Dive deeper

Hindustan Copper shares fell, extending declines as global copper prices retreated and weighed on the metal-linked stock. The drop continued a recent pullback in sentiment after earlier strength in copper prices. Dive deeper

Adani Green’s unit signed a captive hybrid renewable power agreement with Asahi India Glass. The deal will supply clean energy to support the glassmaker’s operations. Dive deeper

India and Germany are close to finalising an agreement for submarine cooperation under India’s Project 75I programme. The deal would involve technology transfer and joint manufacturing. Dive deeper

What’s happening globally

WTI crude rose after two days of losses as markets assessed new US measures to control and release Venezuelan oil supply. Prices were also supported by a larger-than-expected drop in US crude inventories. Dive deeper

Gold prices edged lower as investors assessed mixed US economic data ahead of the key jobs report. Developments involving US actions on Venezuelan oil and continued central bank gold buying were also noted. Dive deeper

US employers announced fewer job cuts in December, marking the lowest level since mid-2024. However, total layoffs in 2025 rose sharply to the highest since 2020, led by government and technology sectors, while planned hiring declined to its lowest level in over a decade. Dive deeper

Eurozone economic sentiment eased slightly in December, remaining below its long-term average as confidence weakened in services, retail, and among consumers. Dive deeper

Germany’s factory orders rose sharply in November, posting the strongest monthly gain in nearly a year and extending a three-month uptrend. Growth was driven by large industrial orders, with both domestic and foreign demand contributing. Dive deeper

France’s trade deficit widened in December as imports rose faster than exports. Higher imports of agricultural and industrial goods outpaced modest export growth across key categories. Dive deeper

Japan’s consumer confidence edged lower in December, falling from a recent 19-month high as views on livelihoods, employment, and durable purchases weakened. Expectations for income growth showed a modest improvement. Dive deeper

Nvidia is requiring Chinese customers to make full upfront payments for orders of its H200 AI chips, with no option for cancellations or refunds. The stricter terms reflect uncertainty around regulatory approvals for shipments to China. Dive deeper

Anthropic is planning a new funding round that could value the AI startup at about $350 billion, according to sources. The proposed raise would be led by GIC and Coatue, marking a sharp increase from its last valuation. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Himanshu Anand, Head of India Equity Strategy, UBS on India’s growth story and global client expansion:

“India is a compelling growth story with structural growth drivers that make it attractive to global clients.”

“Global clients are increasingly expanding their presence in India to capitalize on the country’s long-term growth prospects.”

“India’s preferential demographics, consumption growth, and investment rates support sustainable returns over the next decade.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

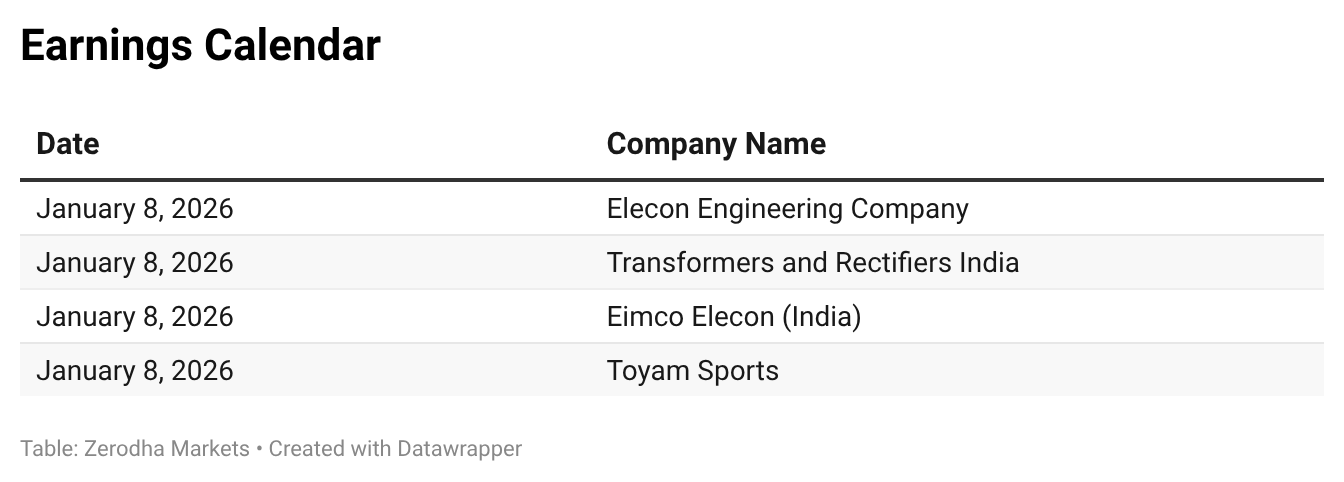

Calendars

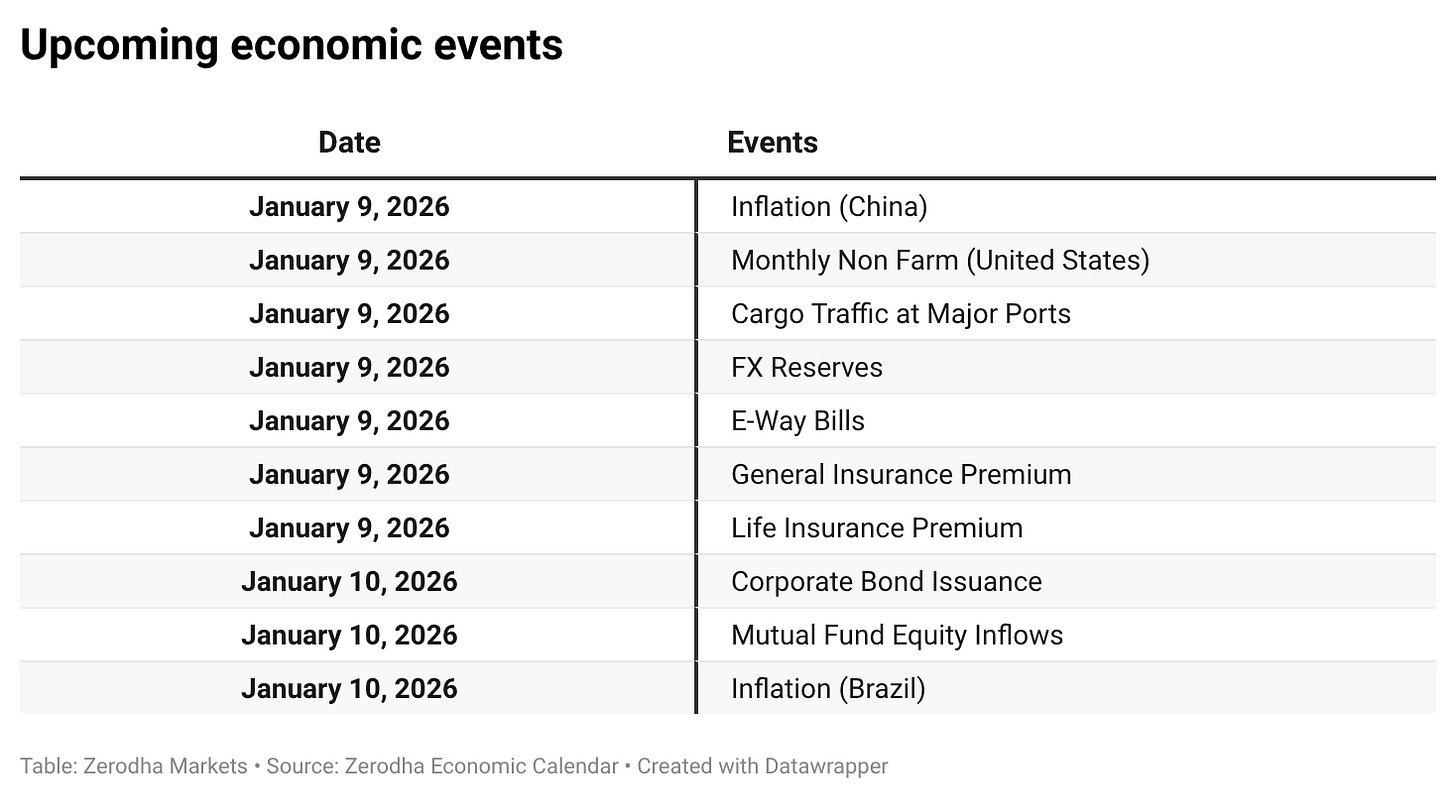

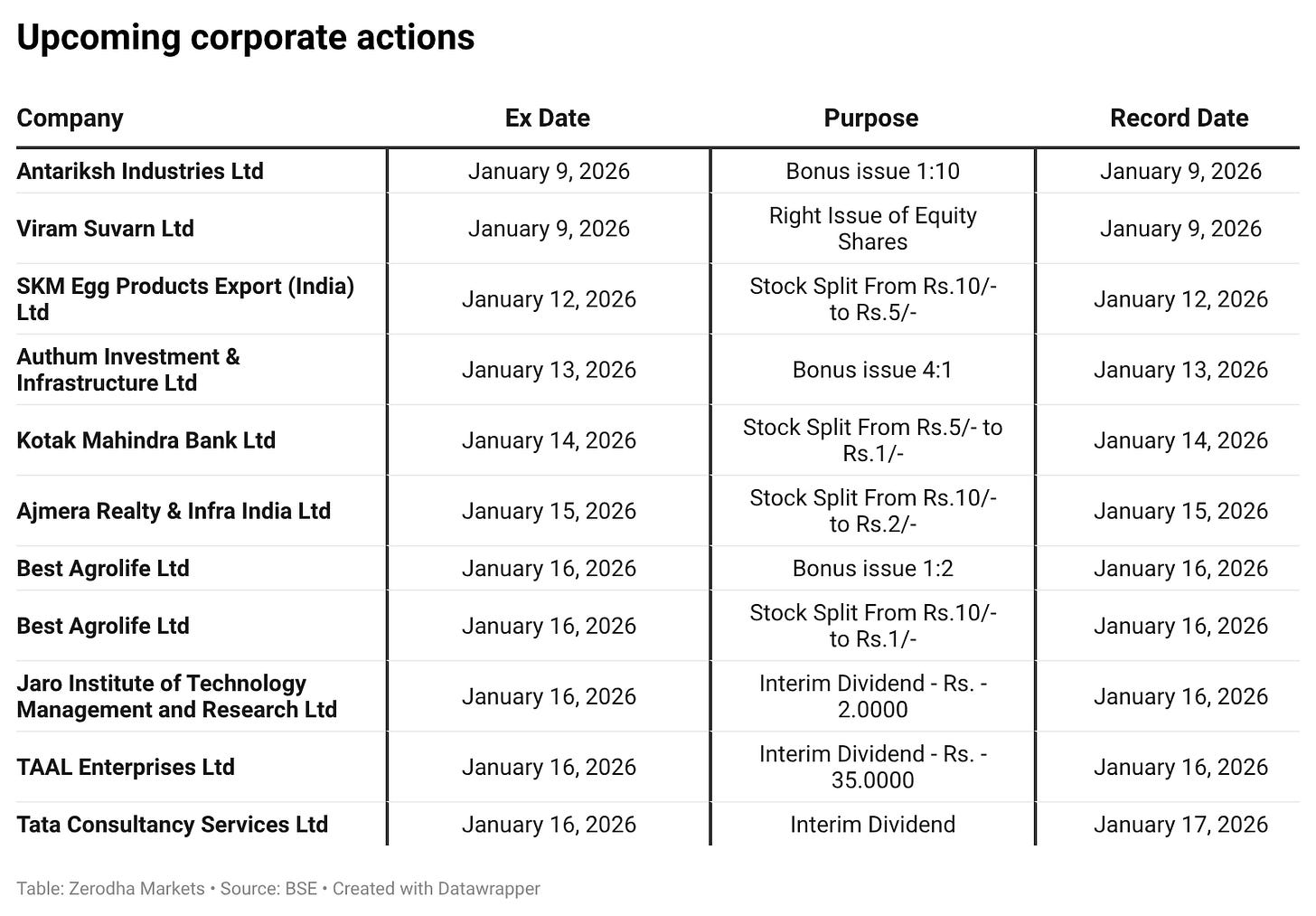

In the coming days, we have the following significant events, quarterly results, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

The 'Tariff' headline is the noise; the 'Breadth' is the signal.

With 2,625 stocks declining vs. only 545 advancing, this was a complete structural liquidation. We haven't just broken price support; we've broken the 50 DEMA (~25,900) for the first time in this leg. Until the 26,050 level is reclaimed, the market trend is now 'Sell on Rise'.