Nifty sinks to weekly low, registers rare 6th consecutive weekly loss

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

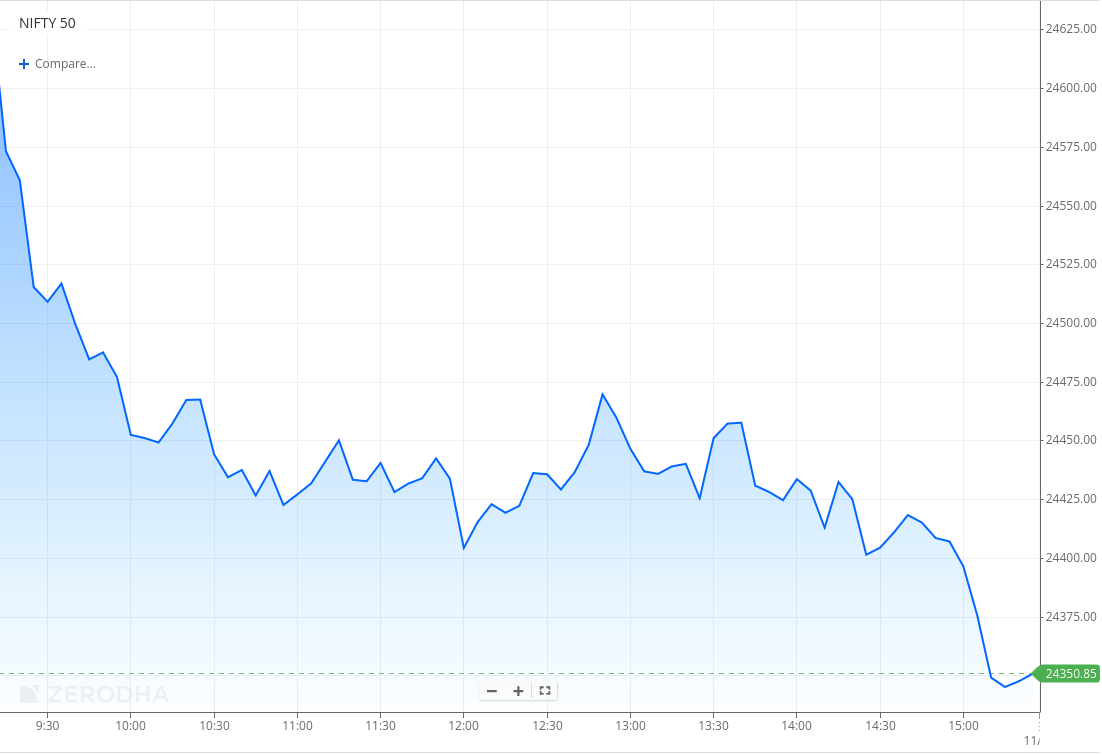

Nifty opened with a 50-point gap-down at 24,544 and quickly extended losses, testing 24,450 in the first hour. The index then consolidated between 24,420 and 24,480 for most of the day before slipping below 24,400 in the last 30 minutes and falling to 24,337. It eventually closed near the day’s low at 24,363.30, down 0.94%. This marked the sixth consecutive weekly red candle for Nifty, a rare occurrence.

Market sentiment remained extremely weak amid negative global cues, continued FII outflows, and muted earnings reactions. Investors are closely watching the escalating U.S.-India trade tensions, which are likely to drive near-term market direction.

Broader Market Performance:

Broader markets had a weak session today. Of the 3,038 stocks traded on the NSE, 983 advanced, 1,966 declined, and 89 remained unchanged.

Sectoral Performance

Nifty Media emerged as the top gainer, slipping only 0.10%, while Nifty Realty was the worst performer, falling 2.11%. All 12 sectors ended in the red, with none closing in green.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th August:

The maximum Call Open Interest (OI) is observed at 24,500, followed closely by 24,600, suggesting strong resistance at 24,600 - 24,800 levels.

The maximum Put Open Interest (OI) is observed at 24,000, followed closely by 24,500, suggesting strong support at 24,300 to 24,200 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

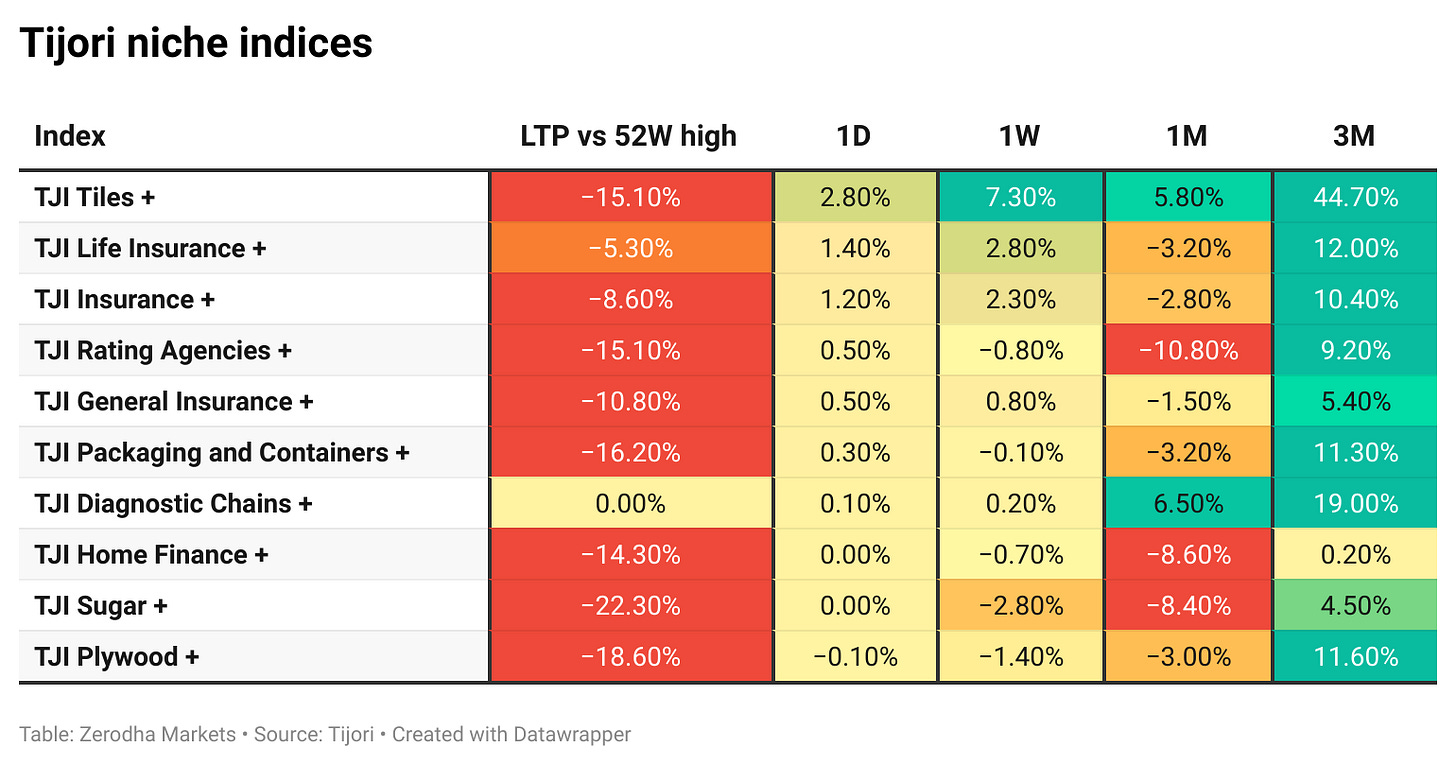

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Finance Minister Nirmala Sitharaman withdrew the Income Tax Bill to introduce an updated version on August 11 with Select Committee changes. It replaces the 1961 Act and keeps tax exemptions for anonymous donations to religious trusts. Late TDS refund claims will be allowed without penalties. Dive deeper

India is not planning to pause US arms purchases despite tariff tensions and recent reports of paused talks. The move comes amid strained India-US relations following President Trump’s 50% tariffs and growing strategic ties between India, Russia, and China. Dive deeper

The Cabinet approved a Rs 30,000 crore fund to compensate oil market companies for losses on domestic LPG sales. This will help OMCs cover procurement, debt servicing, and capital expenditure while keeping LPG prices regulated for consumers. Compensation will be paid to IOCL, BPCL, and HPCL in 12 tranches. Dive deeper

Wockhardt’s Q1 loss widened to Rs 108 crore from Rs 16 crore due to impairment from exiting the US generics business. Revenue stayed steady at Rs 738 crore, while expenses slightly fell to Rs 770 crore. The company impaired Rs 97 crore of goodwill tied to its US subsidiaries’ liquidation. Dive deeper

Electric passenger vehicle sales jumped 93% in July, led by Tata Motors. Electric two-wheeler sales fell slightly, while three-wheelers and commercial EVs grew notably. This shows India’s EV market gaining broader traction. Dive deeper

Tata Motors’ Q1 profit fell 63% to Rs 3,924 crore, beating estimates despite revenue slipping to Rs 1.04 lakh crore. Volume declines hit all segments, with Jaguar Land Rover affected by tariffs. The company aims to improve performance as tariff clarity emerges. Dive deeper

Nalco’s Q1 profit jumped 78% to Rs 1,049 crore on a 33% rise in revenue, led by higher production and efficiency. The company declared a Rs 2.50 final dividend. Dive deeper

SBI’s Q1 standalone profit rose 12% to ₹19,160 crore, with total income increasing to ₹1.35 lakh crore. Asset quality improved as gross NPAs fell to 1.83%, while provisions rose to ₹4,759 crore. On a consolidated basis, SBI Group's profit grew 10% to ₹21,627 crore. Dive deeper

Biocon’s Q1 net profit dropped 95% to Rs 31 crore due to prior one-time gains, while revenue rose 15% to Rs 3,942 crore. Like-for-like profit grew 65%, supported by Biocon Biologics and Syngene. A recent Rs 4,500 crore QIP strengthened its balance sheet and ownership. Dive deeper

India’s electronics exports jumped over 47% to $12.4 billion in Q1, led by a 55% rise in mobile phone exports to $7.6 billion. Non-mobile electronics exports also grew 37% to $4.8 billion. The industry aims to boost global competitiveness and expand key segments like IT hardware and wearables. Dive deeper

PTC India’s Q1 profit jumped 61% to Rs 243 crore on lower expenses and higher trading income. Earnings per share rose to Rs 6.59, with trading volume up 13%. Standalone profit declined 2% due to lower rebate and surcharge income. Dive deeper

AU Small Finance Bank got the RBI’s nod to become a Universal Bank, boosting its growth prospects and brand. The transition offers regulatory benefits and better deposit rates. Dive deeper

Grasim’s Q1 net profit rose 32% to Rs 1,419 crore, with revenue up 16% to Rs 40,118 crore, led by Cement and Chemicals. EBITDA grew 36%, partly offset by Paints business investments. The company plans Rs 2,263 crore capex for FY26, supported by India’s economic momentum. Dive deeper

PG Electroplast’s shares dropped 22% after cutting full-year revenue growth guidance to 17-19% with sales expected at ₹5,700-5,800 crore. Net profit forecast was lowered to ₹300-310 crore from ₹405 crore. Q1 profit fell 21.5% to ₹66.7 crore, while revenue rose 14% to ₹1,503.8 crore. Dive deeper

What’s happening globally

WTI crude rose above $64 but is near a two-month low, facing its worst weekly drop since June amid easing supply concerns. Upcoming Trump-Putin talks boosted optimism despite US tariffs on India’s Russian oil imports. Dive deeper

Spot gold held near $3,400 an ounce, while December futures hit a record $3,534 after new US tariffs on certain gold bars. The tariff move threatens Switzerland’s gold exports to the US. Dive deeper

The FAO Food Price Index rose 1.6% in July 2025, led by record-high meat and vegetable oil prices. Cereals, sugar, and dairy prices declined slightly. Overall, food prices are up 7.6% year-on-year but remain well below their 2022 peak. Dive deeper

SoftBank shares surged over 13% to a record high after Q1 profit of 421.8 billion yen beat expectations. Growth was driven by strong AI investments and a diversified portfolio. This boost also helped lift Japan’s Topix index to a historic high. Dive deeper

Bank of Mexico cut rates to 7.75% as inflation eased, planning further cautious easing amid global risks. Inflation is forecast to hit 3% by late 2026. Dive deeper

Canada’s unemployment rate held steady at 6.9% in July, slightly below expectations but near recent highs. Employment dropped sharply by 40.8 thousand, the biggest decline since 2022, amid slower hiring and a falling participation rate. Youth unemployment rose to 14.6%, the highest since 2010 outside the pandemic period. Dive deeper

Singapore Exchange reported a record profit of S$609.5 million, up 15.9%, fueled by higher trading volumes. It has the strongest IPO pipeline in years, with over 30 companies preparing to list. Dive deeper

The UK Competition and Markets Authority approved Boeing’s acquisition of Spirit AeroSystems, allowing the deal to proceed without a Phase 2 investigation. This clearance is a key step, though further approvals may still be required. Dive deeper

China ended the VAT exemption on interest income from new government and financial institution bonds issued from August 8, 2025, to ease fiscal pressure. Bonds issued before this date remain exempt until maturity. The move is expected to boost fiscal revenue by billions over the next few years amid efforts to balance fiscal strain. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Alok Aggarwal, MD & CEO, Brookfield India REIT and Chairman, Indian REITs Association on REIT milestone

“We welcome this significant milestone as evidence of the sector’s resilience, maturity, and potential.”

“This fiscal year has commenced on a strong footing, driven by robust leasing momentum, high occupancy levels, and sustained growth in distributions for the sector.”

“As REITs continue to scale and attract long-term capital, their growing market capitalisation is expected to further enhance liquidity, benefiting issuers through improved access to capital, and investors through increased trading volumes and tighter spreads.” - Link

Vir S Advani, Chairman and Managing Director, Blue Star Ltd., on growth outlook and demand

“Blue Star is targeting a topline growth at 15% CAGR between FY26 and FY28.”

“The muted performance in Q1FY26 is due to deferred demand.”

“An air conditioner is on top of everyone’s purchase list, but with a ticket size of over Rs 35,000, it’s often a multi-season purchase.”

“We’re quite hopeful that there will be strong demand coming back in the second half of the year and going forward.”

“Blue Star is targeting an EBIT margin improvement of at least 100 basis points over the next few years.” - Link

K.N. Balagopal, Finance Minister of Kerala, on U.S. tariffs and Kerala’s economy

“The United States of America’s punitive tariffs on India could send shock waves through Kerala’s economy.”

“U.S. President Donald Trump’s ‘tariff bullying’ has raised the spectre of the State’s economy regressing to the grim COVID-19 pandemic period.”

“The tariffs would hit Kerala’s seafood, spices, agriculture, and coir sectors hard.”

“Lesser-priced milk cartons from foreign countries would imperil Kerala’s 14 lakh dairy farmers.”

“Suppliers would pass on the revenue shortfall to farmers, who will likely reduce wages and workers’ benefits.”

“Trade concessions would adversely impact the GST revenue of States.”

“The shortfall in revenue would imperil Kerala’s expanding social welfare security net, including payment of welfare pensions and medical insurance schemes.”

“Importing luxury cars at a negligible import duty from European nations would not incentivise basing production in India.”

“Products from Kerala, including milk, will have to compete with comparable products from countries that subsidise milk production.” - Link

Fernando Fernandez, CEO, Unilever, on growth and strategy overhaul

“Our focus is on achieving more than 2% volume growth, almost double Unilever’s 10-year average.”

“Volume growth has remained positive for seven consecutive quarters, averaging 2.3%, and we have outperformed peers in volume terms for 10 straight quarters.”

“Following the planned separation of Magnum, we intend to raise premium products’ share of revenues from 30% today to 50% in the mid-term.”

“Social media-led marketing will increase from 30% to 50% of our €10 billion brand and marketing budget, with a larger role for influencers and locally tailored campaigns.”

“Unilever’s gross margin has recovered by almost 500 basis points since 2022 to 45% in 2024, and operating margin is on track to deliver around 19% this year.”

“Post-ice cream separation, the operating margin is expected to reach 20%. Cost efficiencies, portfolio mix improvements, and targeted investments will support margin expansion.”

“Innovation is becoming more concentrated, with a goal of building at least 12 platforms capable of generating more than €100 million in sales within three years.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

📚 Also reading Mind Over Markets by Varsity?

It goes out thrice a week, covering markets, personal finance, or the odd question you didn’t know you had. The Varsity team writes across three sections: Second Order, Side Notes, and Tell Me Why, thoughtfully put together without trying to be too clever.

Go check out Mind Over Markets by Zerodha Varsity here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Suggestion kindly present company results in tabular form with notes or commentary below thanks