Nifty shrugs off weak start to close back above 26,000

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore Week 50 of 2025, a volatile yet largely directionless stretch for markets, marked by sharp early-week moves followed by a late recovery. A delayed reaction to the US Fed’s 25 bps rate cut kept traders on edge, while Indian indices continued to hover near all-time highs, struggling to commit to a clear directional trend with just two weeks left in the year.

Market Overview

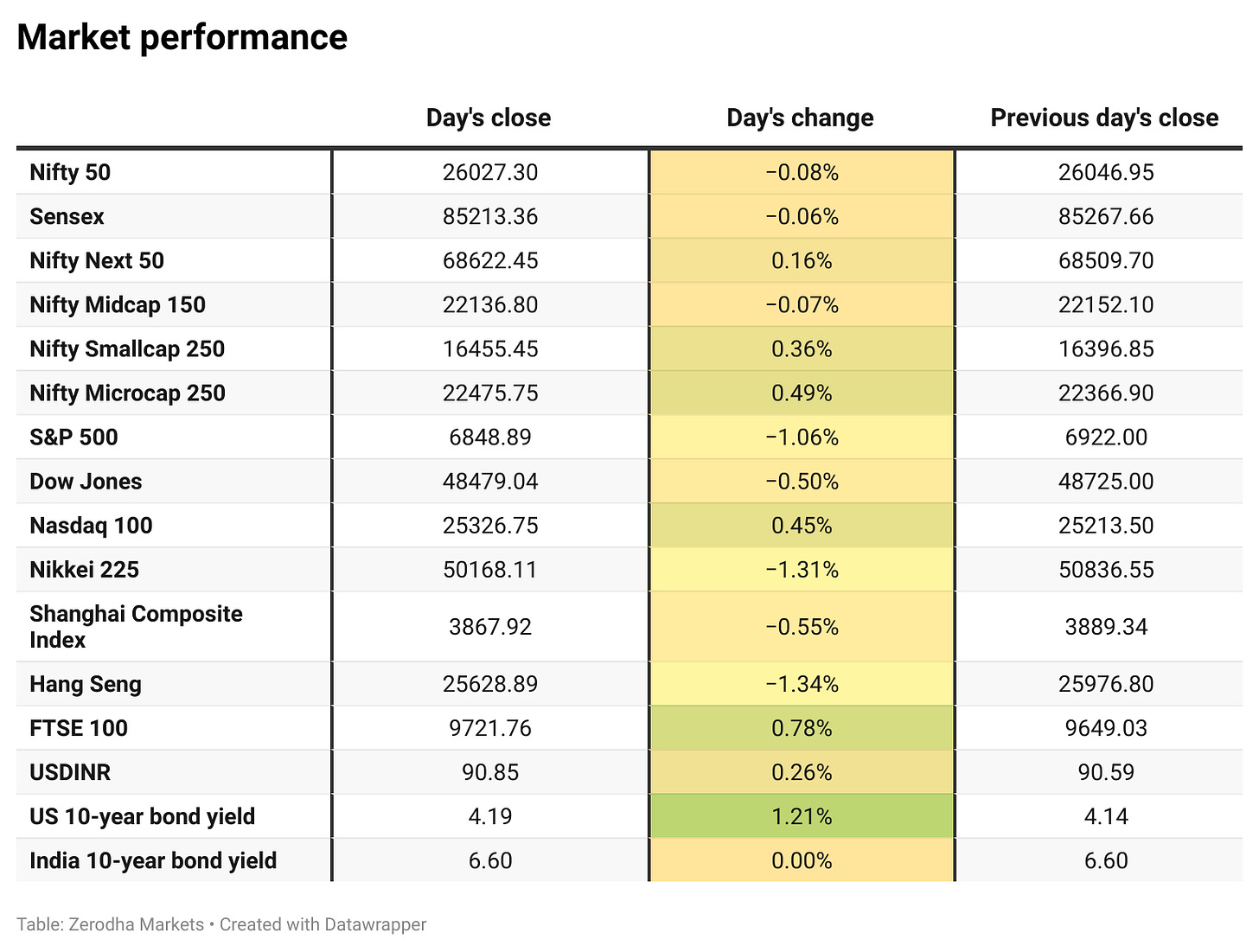

Nifty opened with a sharp 117-point gap-down at 25,930, tracking weak global cues. The index remained range-bound with a negative bias in the 25,905–25,950 zone during the first half hour before gradually regaining strength. By noon, Nifty reclaimed the 26,000 mark and went on to stabilise in the 25,990–26,030 range for most of the second half.

Despite minor intraday pullbacks, the index showed resilience, holding above 26,000 through much of the session. Nifty eventually closed at 26,027, recovering sharply from intraday lows and ending nearly flat for the day—highlighting strong dip-buying support despite weak global sentiment.

Looking ahead, markets are likely to remain sensitive to global risk appetite, currency movements, and further updates on India–U.S. trade negotiations.

Broader Market Performance:

The broader markets had a mixed session today. Out of 3,237 stocks that traded on the NSE, 1,665 advanced, while 1,468 declined, and 104 remained unchanged.

Sectoral Performance:

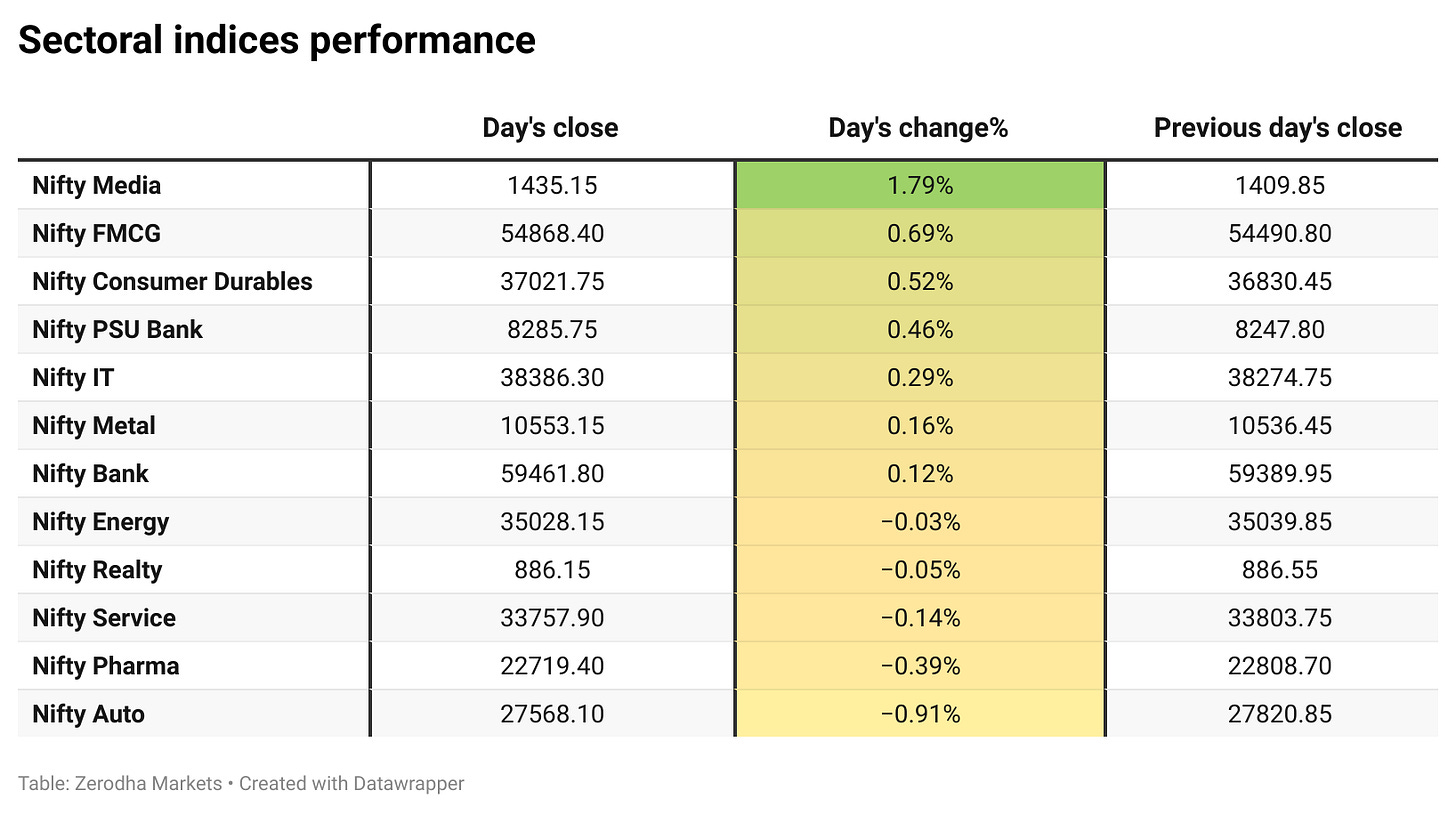

Nifty Media was the top gainer for the day, rising 1.79%, while Nifty Auto was the biggest loser, slipping 0.91%. Out of the 12 sectoral indices, 7 closed in the green and 5 ended in the red, indicating a mildly positive sectoral breadth.

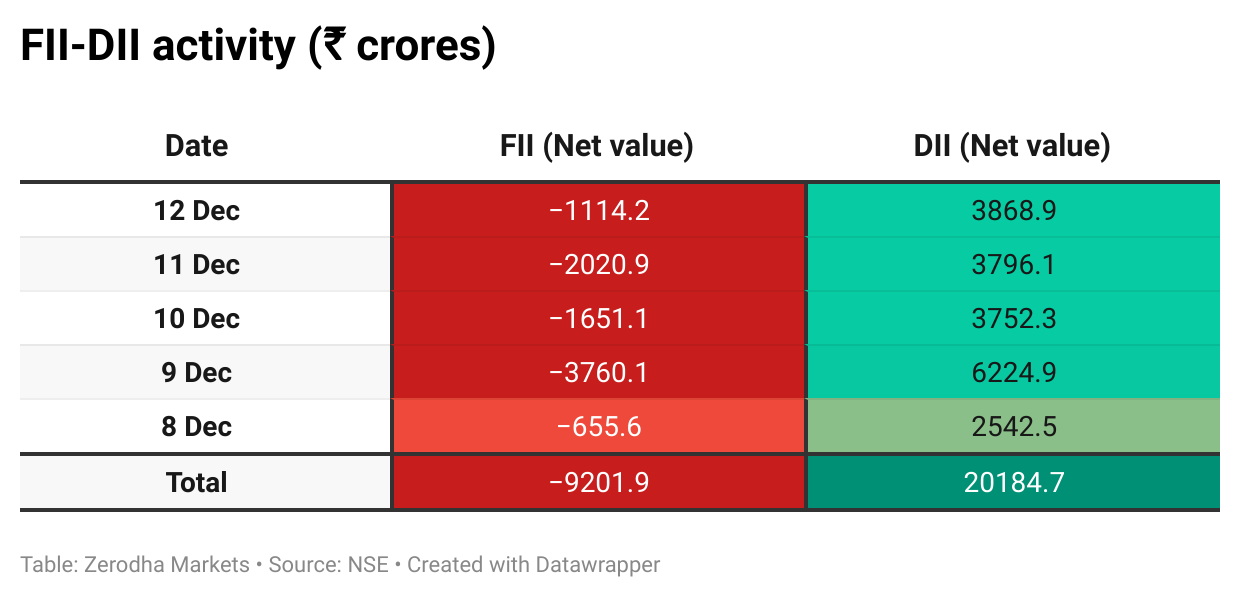

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th December:

The maximum Call Open Interest (OI) is observed at 26,100, followed by 26,200, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 25,900, followed by 26,000, suggesting support at the 26,000 to 25,900 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

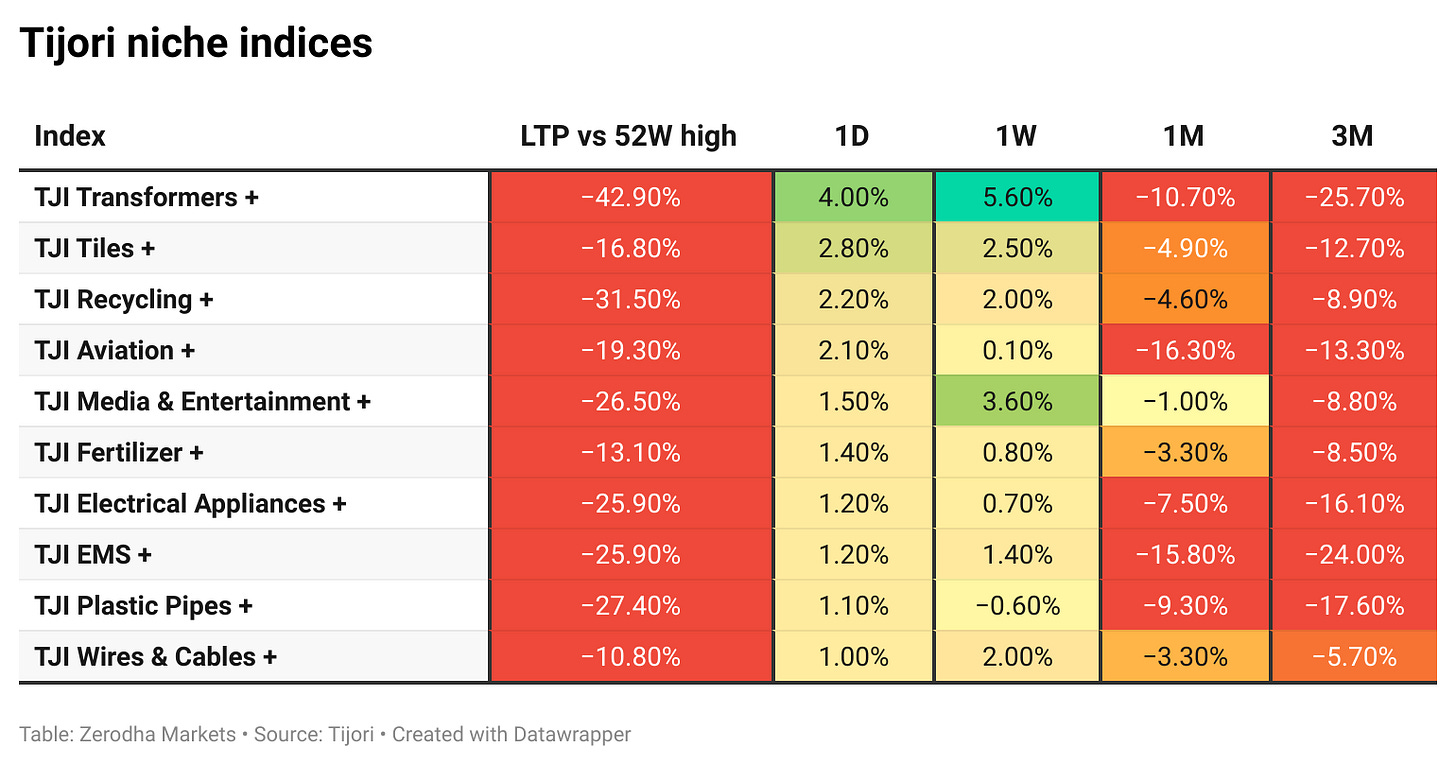

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

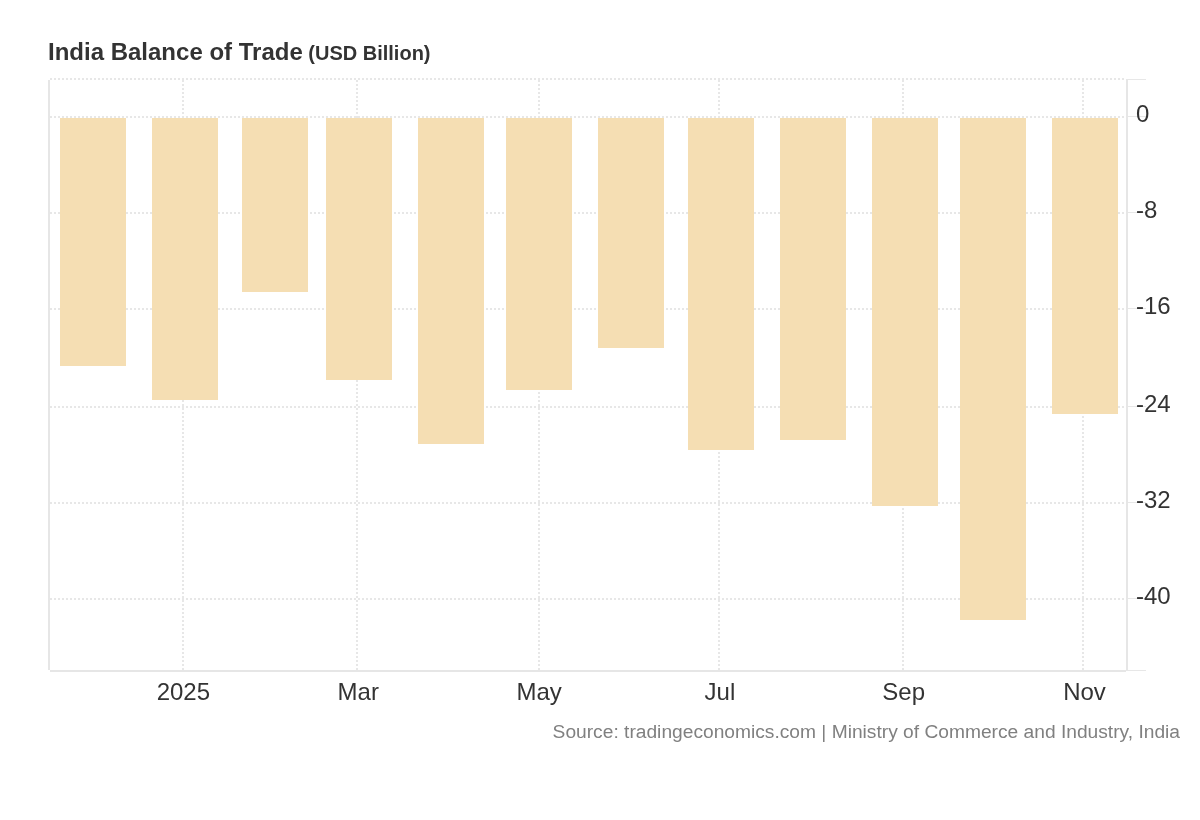

India’s trade deficit narrowed to USD 24.53 billion in November 2025 as exports rose 19.37% to USD 38.13 billion and imports fell 1.88% to USD 62.66 billion. For April - November, exports grew 2.62% to USD 292.07 billion, while imports increased 5.59% to USD 515.21 billion. Dive deeper

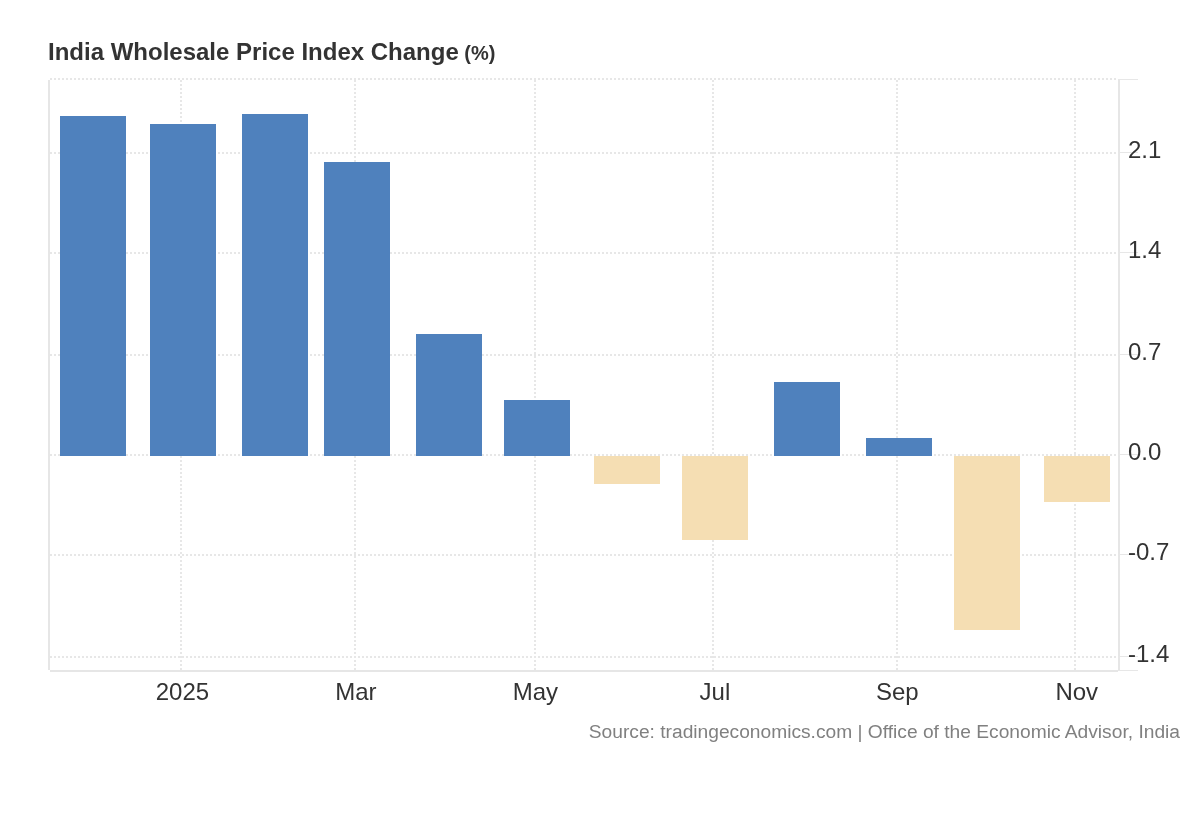

India’s wholesale prices fell 0.32% year-on-year in November 2025, marking a second straight decline after a 1.21% fall in October. The softer contraction was led by a slower fall in food and fuel prices, while manufacturing inflation eased to 1.33%. Dive deeper

Tata Steel plans to increase its steelmaking capacity in India by nearly 50% as part of its long-term growth strategy. Dive deeper

Indian government bond yields were largely unchanged, with supply concerns and positioning ahead of auctions offsetting the RBI’s bond purchase announcement. Dive deeper

Vodafone Idea may receive an interest-free moratorium of four to five years on over ₹83,000 crore of pending AGR dues, with the payable amount potentially reduced after reassessment. The proposal is awaiting Cabinet approval. Dive deeper

Wipro announced strategic AI partnerships with Google Cloud and Microsoft to support enterprise AI adoption using their respective AI platforms. Dive deeper

Mebigo Labs, the parent of audio platform Kuku FM, has appointed bankers for a potential IPO of up to $200 million. Dive deeper

The RBI’s $5 billion FX swap is expected to attract demand from banks and importers as the central bank injects rupee liquidity. Dive deeper

Andhra Pradesh has allotted about 29.6 acres near the Juvvaladinne fishing harbour in Nellore to Sagar Defence to set up an autonomous maritime shipyard for unmanned surface and underwater platforms. Dive deeper

Sebi’s board will discuss proposals to revamp mutual fund fee structures and simplify IPO disclosures at its upcoming meeting. The agenda also includes easing pre-IPO lock-in rules and reviewing conflict-of-interest norms. Dive deeper

Wakefit Innovations debuted on the stock exchanges at around its issue price of ₹195, valuing the home and furnishings company at about ₹6,146 crore. Dive deeper

What’s happening globally

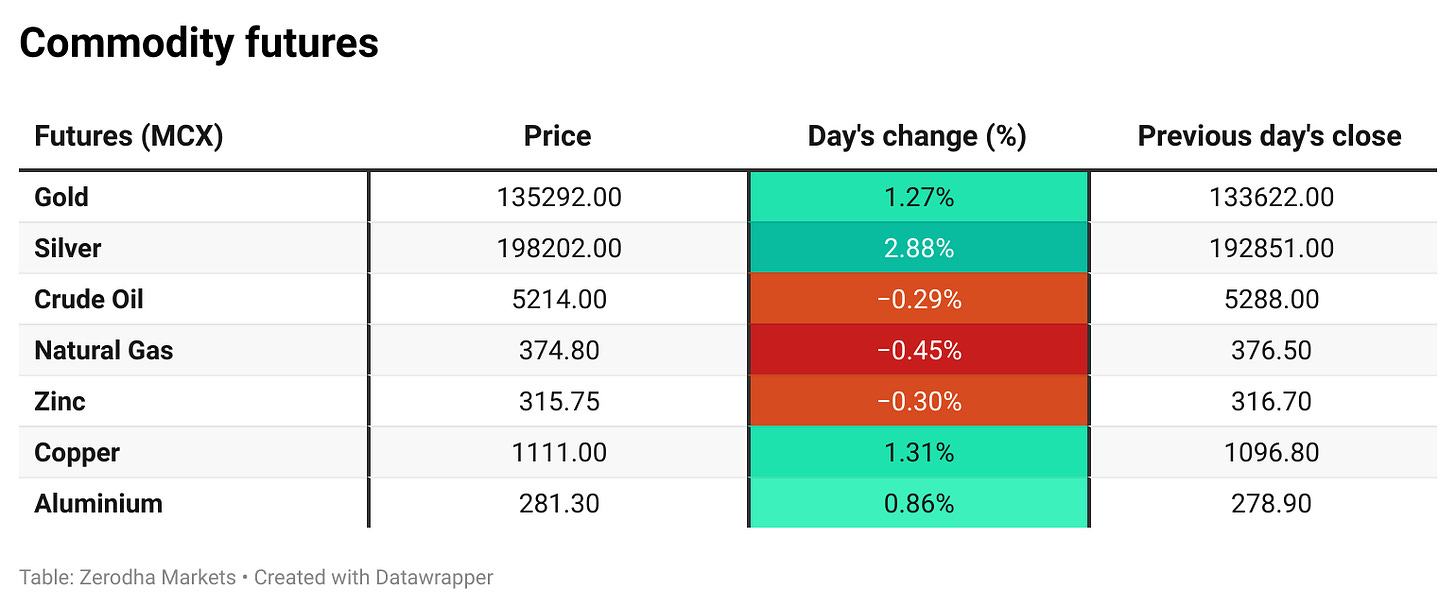

Brent hovered near $61.1/bbl as oversupply concerns capped prices, even as markets tracked Ukraine peace talks and ongoing strikes on Russian energy infrastructure. Dive deeper

Gold rose near $4,340 an ounce, close to record highs, as markets priced in further US rate cuts ahead of upcoming jobs and inflation data. Dive deeper

US 10-year yields climbed toward 4.2% as some Fed officials signalled greater caution on further rate cuts, citing still-elevated inflation risks. Dive deeper

The dollar index held near 98.4 as markets awaited delayed US payrolls, retail sales, and CPI data that could reset rate expectations after the Fed’s latest cut. Dive deeper

Steel rebar futures stayed below CNY 3,060 per ton after China announced export licensing for some steel products from January 1. The move comes amid high exports, weak domestic demand, and pressure on steelmakers’ profitability. Dive deeper

Eurozone industrial production rose 0.8% month-on-month in October 2025, the strongest increase since May, with gains across most sectors and major economies. On a year-on-year basis, output grew 2.0%, marking a five-month high, according to Eurostat. Dive deeper

Germany’s wholesale prices rose 1.5% year on year in November 2025, the highest since February, driven by higher food prices and a sharp rise in non-ferrous metals. Monthly, wholesale prices increased by 0.3%, unchanged from October. Dive deeper

China’s industrial production grew 4.8% year-on-year in November, slightly slower than in October and below expectations, marking the weakest pace since August 2024 as manufacturing and utilities cooled. Dive deeper

Japan’s Nikkei index fell 1.34%, tracking losses on Wall Street, as investors remained cautious ahead of the Bank of Japan meeting, where a rate hike is expected. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Rajesh Agrawal, Commerce Secretary, Government of India, on the November trade data:

“India’s exports rose 19.37% year-on-year to $38.13 billion in November, the highest monthly export figure in the last ten years.”

“Outbound shipments in November helped offset the losses seen in October this year.”

“Imports declined 1.88% to $62.66 billion, with the trade deficit narrowing to $24.53 billion in November.” - Link

Arul Selvan D, President & CFO, Cholamandalam Investment & Finance Company on H2 FY26 margin outlook and growth drivers:

“Chola expects a 10–15 basis point (bps) margin improvement in H2 FY26, backed by easing funding costs and the RBI’s recent rate cut.”

“The company maintains a strong growth outlook of 20–23%.”

“Chola expects its gold loan assets under management (AUM) to reach ₹1,000 crore.” - Link

Mayank Bathwal, CEO, Aditya Birla Health Insurance, on 100% FDI in insurance:

“In a market where penetration is still very low, more players and more competition are only good for the ecosystem, and the 100% FDI cap can bring fresh global capital and innovation.”

“The higher FDI limit can attract new global insurers with no current presence in India, expanding the market through new products, technology, and distribution models.”

“Price wars are unlikely, as health insurance is a long-term business; affordability will improve through innovation, scale, and lower distribution costs rather than unsustainable price cuts.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

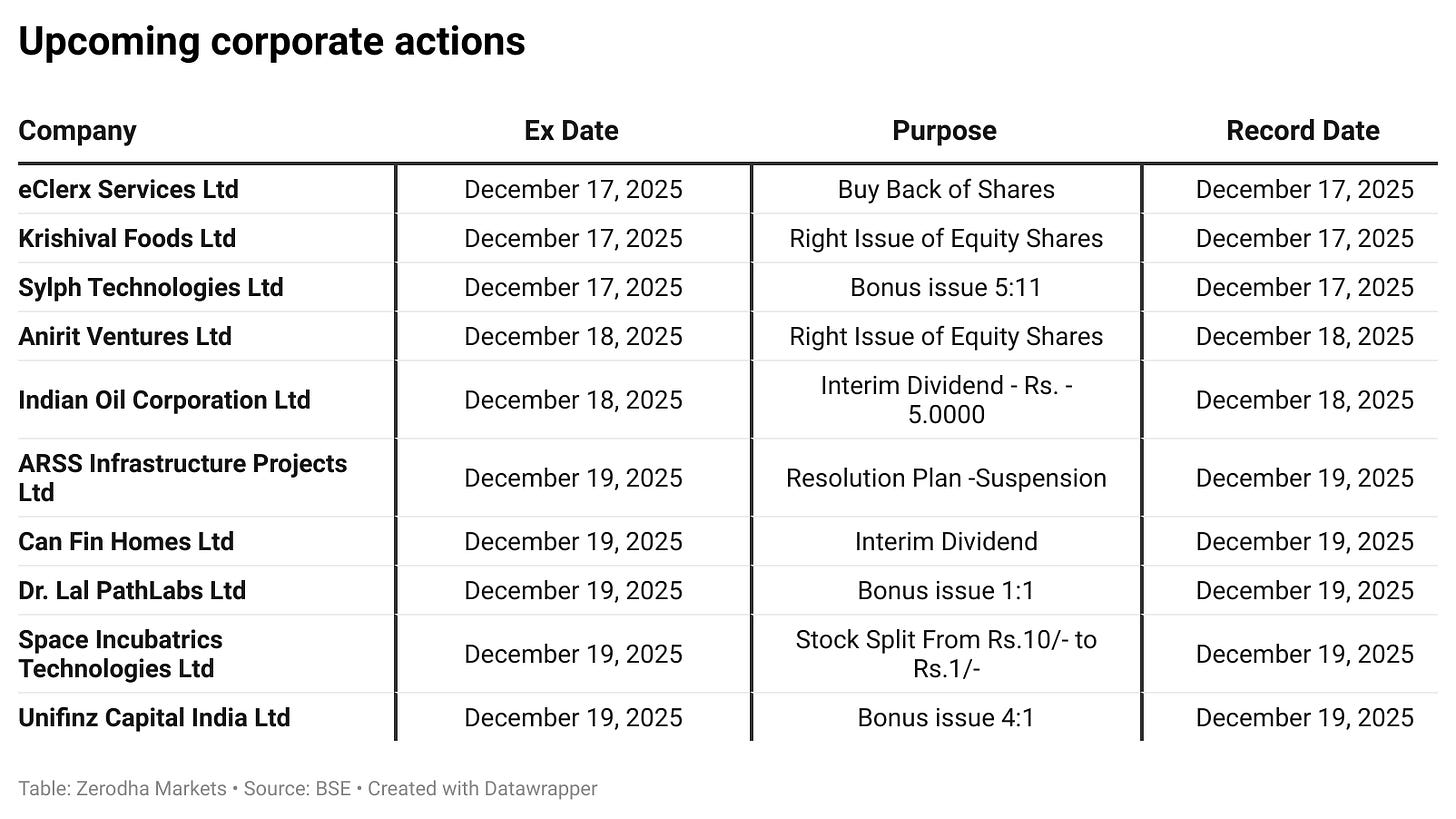

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

I have been reading these since a week and I had to say that it’s a great piece of information that is being provided by zerodha and team !