Nifty settles flat near 25,950 amid expiry volatility; late recovery lifts index off lows

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, Sandeep breaks down the Diwali week that had both sparkle and sobering moments. Markets started strong with a 400-point GIFT NIFTY surge on the Hindu New Year but cooled off later, leaving NIFTY only slightly higher. Still, the overall sentiment remains upbeat, with key indices holding above crucial moving averages.

Market Overview

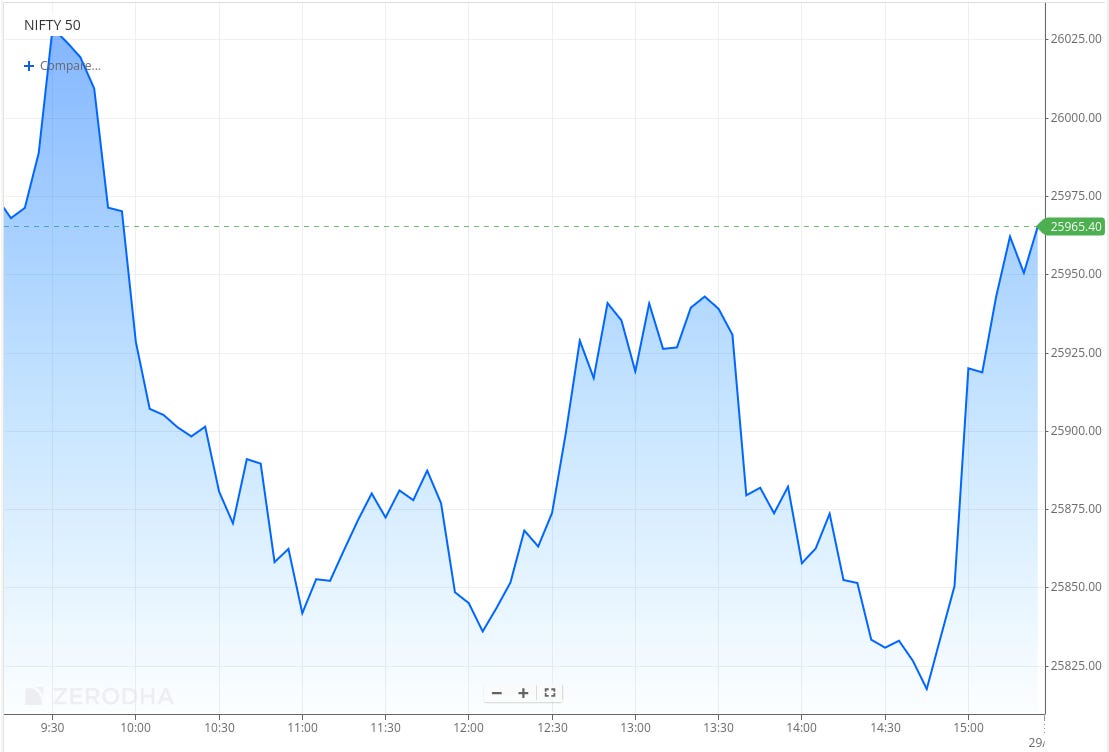

Nifty opened with a 26-point gap-down at 25,940, tracking mixed global cues ahead of the monthly expiry. The index initially climbed above the 26,000 mark, hitting an intraday high near 26,040 in early trade, but failed to sustain gains as selling pressure set in.

By 11 AM, Nifty drifted lower toward 25,850, moving sideways in a narrow range for most of the session. Around 12:30 PM, it attempted a brief rebound toward the 25,930 zone, but renewed selling at higher levels capped the upside, dragging the index to the day’s low of 25,810 post 2:30 PM.

In the final 45 minutes, Nifty staged a sharp 150-point rebound from the lows, closing nearly flat at 25,936.20, down 0.11%. The session reflected a volatile expiry day with consolidation between 25,800 and 25,900, and stiff resistance near the 26,000 level.

Looking ahead, markets are likely to remain sensitive to developments around the India–US trade deal, while investors will closely monitor Q2 earnings and management commentary on festive-season demand trends following the recent GST rate cuts.

Broader Market Performance:

Broader markets had a weak session with a bearish bias today. Of the 3,237 stocks traded on the NSE, 1,385 advanced, 1,730 declined, and 122 remained unchanged.

Sectoral Performance

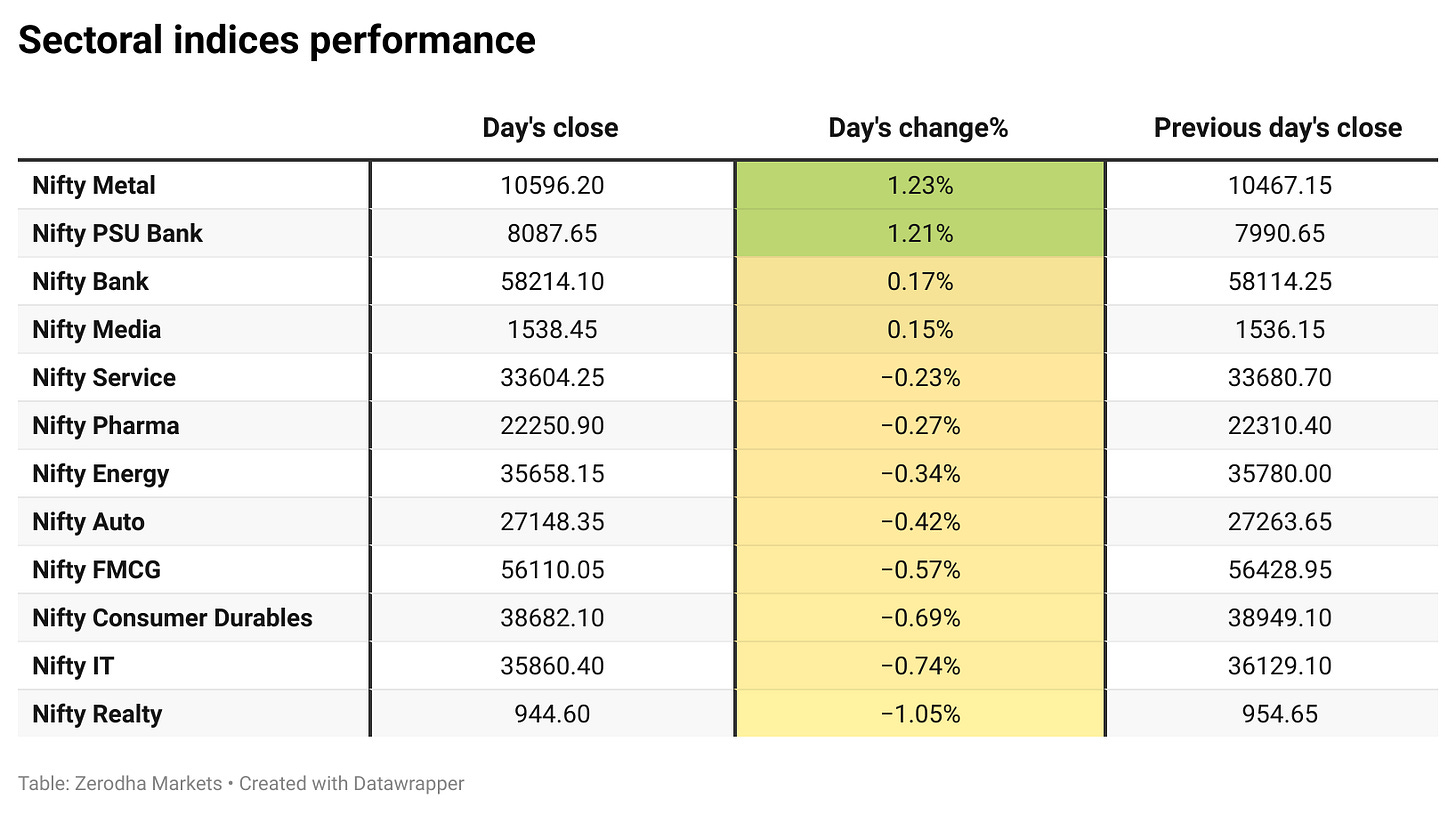

Nifty Metal led the gains with a 1.23% rise, followed closely by Nifty PSU Bank, which added 1.21%. On the flip side, Nifty Realty was the biggest laggard, slipping 1.05%. Out of the 12 sectoral indices, only 4 ended in the green while 8 closed in the red, reflecting a largely subdued market breadth for the day.

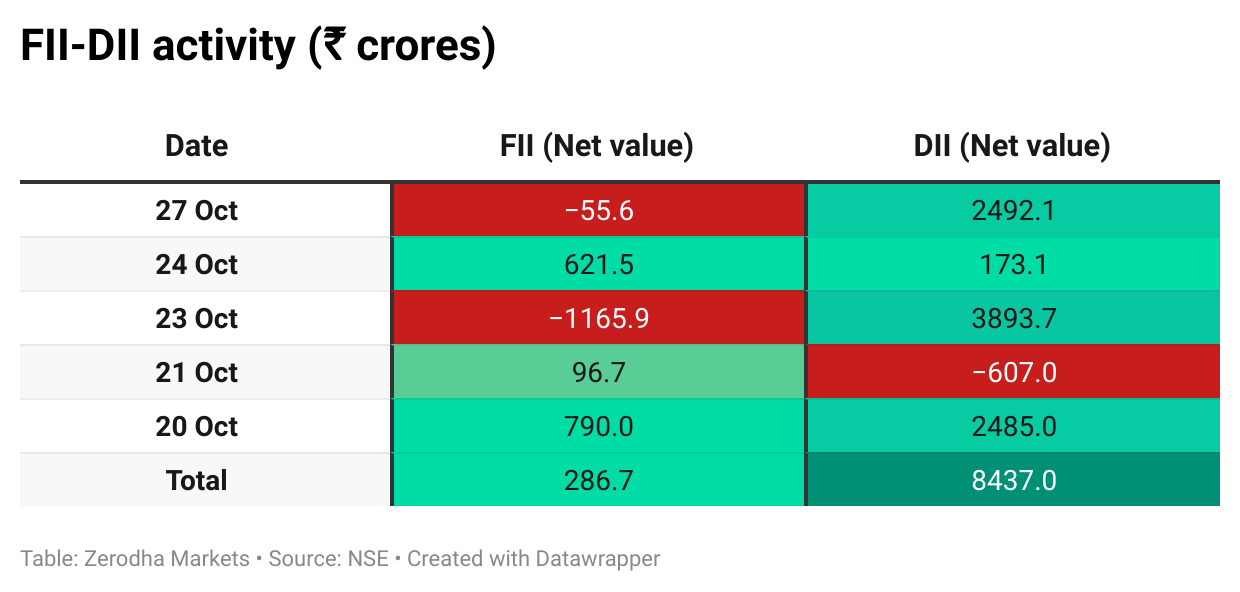

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 4th November:

The maximum Call Open Interest (OI) is observed at 26,100, followed by 26,000 & 26,200, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 26,000, suggesting support at the 25,900 to 25,800 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

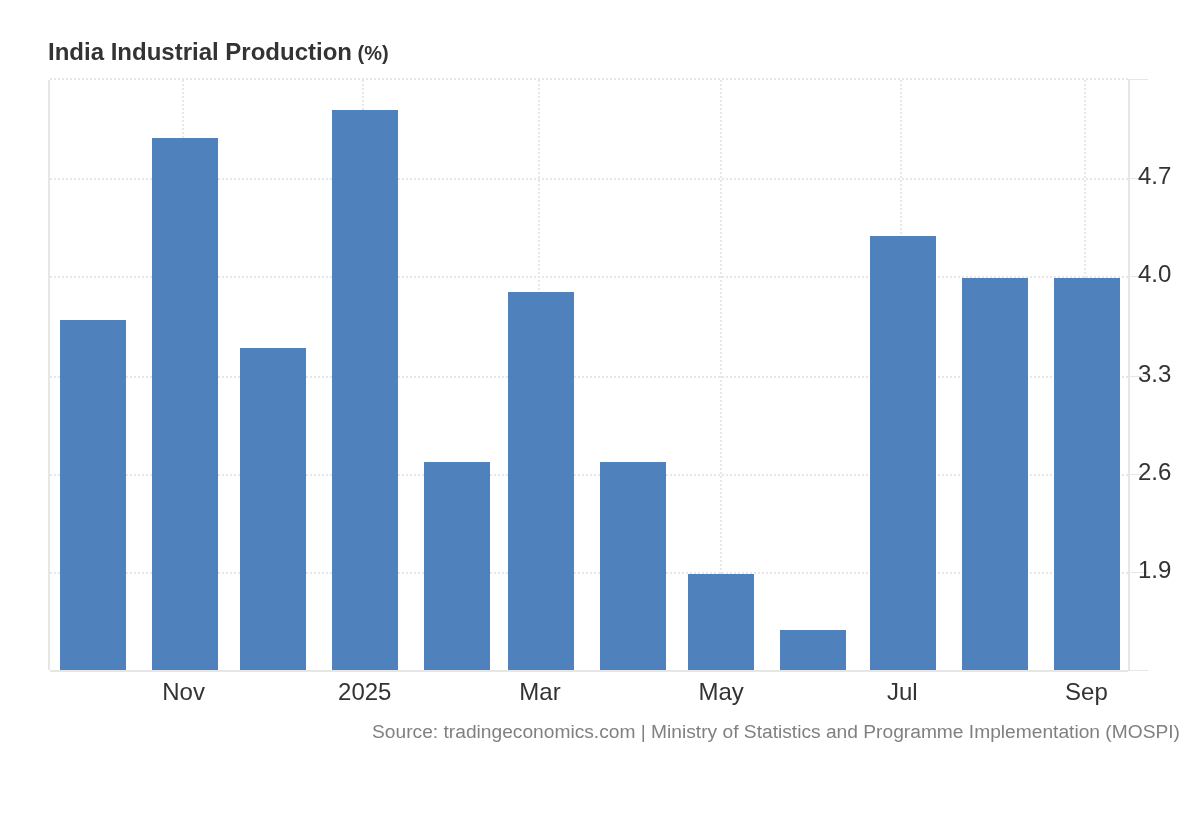

India’s industrial production rose 4% YoY in September 2025, marking 12 consecutive months of growth, driven by a 4.8% rise in manufacturing output. Electricity growth slowed to 3.1%, while mining output declined 0.4%, according to MOSPI data. Dive deeper

RBI has returned Jana Small Finance Bank’s application to transition into a universal bank, citing eligibility shortfalls. The lender recently approved a ₹250 crore NCD issue and had reported a 40% YoY drop in Q1 profit to ₹102 crore. Dive deeper

Hindustan Aeronautics Limited (HAL) and Russia’s United Aircraft Corporation (PJSC-UAC) signed an MoU in Moscow on October 27, 2025, to jointly produce the SJ-100 civil commuter aircraft in India. Under the agreement, HAL will have manufacturing rights for domestic customers, marking the first full-scale passenger aircraft production in India since the AVRO HS748 project (1961–1988). HAL said the SJ-100 will be a “game changer” for short-haul connectivity under the UDAN scheme. Dive deeper

TVS Motor’s Q2FY26 net profit rose 42% YoY to ₹833 crore, while revenue grew 25% to ₹14,051 crore. The company reported record sales of 15.07 lakh units and its highest-ever EBITDA of ₹1,509 crore with a margin of 12.7%. Dive deeper

Tata Capital’s Q2FY26 net profit rose 2% YoY to ₹1,097 crore, while net interest income jumped 23% to ₹2,637 crore. Assets under management grew 22% to ₹2.15 lakh crore, reflecting broad-based business momentum across segments. Dive deeper

Mazagon Dock Shipbuilders’ Q2FY26 profit rose 28% YoY to ₹749 crore, while revenue grew 6% to ₹2,929 crore. The strong results, backed by a robust defence order book, reflect steady operational growth and sustained investor confidence. Dive deeper

The IT Ministry approved seven projects worth ₹5,532 crore under the Electronics Component Manufacturing Scheme, expected to generate ₹44,406 crore in output and 5,195 jobs. Kaynes Circuits leads with a ₹3,280 crore investment in PCB and laminate units in Tamil Nadu. Dive deeper

HARMAN, a Samsung subsidiary, will invest ₹345 crore to expand its automotive electronics facility in Chakan, Pune, boosting capacity by 50% and creating 300 jobs. By 2027, the plant will produce four million car audio components, 1.4 million infotainment units, and 0.8 million telematics units annually. Dive deeper

Hatsun Agro’s Q2 net profit rose 70.3% YoY to ₹109.54 crore, driven by higher sales, while total income increased 17.15% to ₹2,427.59 crore. The Chennai-based dairy firm continues to strengthen its portfolio across milk, milk-based foods, and cattle feed. Dive deeper

Indus Towers’ Q2 net profit fell 17% YoY to ₹1,839 crore due to pending dues from a major client, while revenue rose 9.6% to ₹8,188 crore. The company added 26,416 towers over the year and plans to expand into Africa to drive long-term growth. Dive deeper

Bharat Petroleum Corporation Ltd (BPCL) inked three major agreements, including with Oil India Ltd and Numaligarh Refinery Ltd to build a greenfield refinery & petrochemical complex worth ₹1 trillion in Andhra Pradesh, and a 700 km cross-country pipeline project. Dive deeper

Noel Tata and two trustees blocked the reappointment of Mehli Mistry as a trustee of Tata Trusts, marking a rare split within the organization. Dive deeper

What’s happening globally

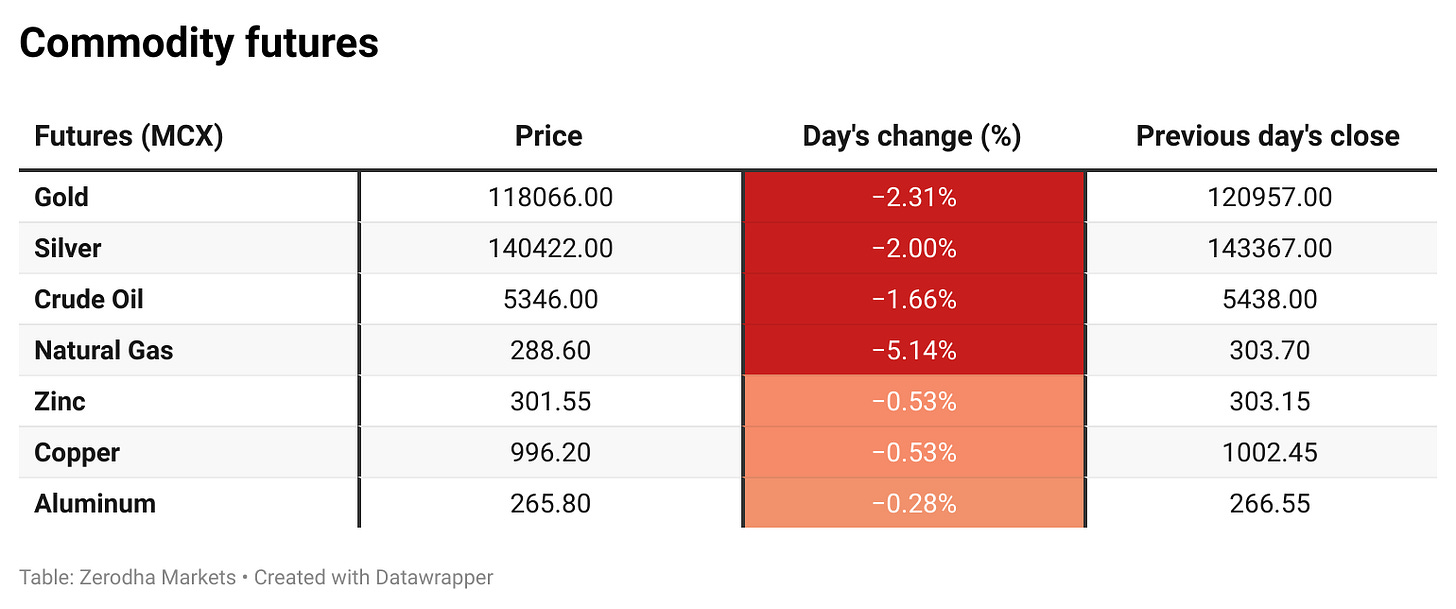

Brent crude futures fell over 1% to below $65 per barrel, extending losses on concerns of a supply glut amid reports that OPEC+ may raise output in December. Dive deeper

Gold prices fell over 2% to below $3,900 per ounce, hitting a three-week low, as optimism over a potential US–China trade deal reduced safe-haven demand. Dive deeper

EU passenger car registrations rose 10% YoY to 888,672 units in September 2025, marking the third month of growth, led by Spain and Germany. Battery electric vehicle sales surged 20%, making up 16.1% of the market, according to ACEA. Dive deeper

Italy’s consumer confidence index rose to 97.6 in October 2025, the highest since February, driven by stronger economic expectations and improved personal, future, and current sentiment, according to ISTAT. Dive deeper

Eurozone median consumer inflation expectations eased to 2.7% in September 2025 from 2.8% in August, while long-term expectations stayed stable, indicating steady inflation and labour market outlook, according to the ECB. Dive deeper

Google plans to restart the Duane Arnold nuclear plant in Iowa with NextEra Energy to power its AI and cloud infrastructure. The facility, set to reopen in 2029, will supply Google under a 25-year power purchase agreement as part of its push for carbon-free energy. Dive deeper

China’s 10-year government bond yield fell below 1.75%, its lowest since early September, as the PBoC prepared to resume sovereign bond trading to stabilize liquidity and support orderly debt-market functioning. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Arvinder Singh Sahney, Chairman & Managing Director, Indian Oil Corporation, on Q2 performance and compliance stance

“Indian Oil’s net profit surged over forty-fold YoY to ₹7,610 crore in Q2, driven by stronger refining margins and a lower base effect.”

“Our average gross refining margin rose 55% to $6.32 per barrel in the first half of this year, reflecting improved operational efficiency.”

“We will abide by all sanctions imposed by the international community in our crude sourcing and trading practices.” - Link

Ashish Khanna, CEO, Adani Green Energy, on Q2 performance and growth outlook

“Adani Green’s Q2 profit more than doubled YoY to ₹583 crore, backed by strong capacity additions and efficient operations, even as total income dipped 4%.”

“Our robust EBITDA and cash profit growth reflect 5.5 GW of greenfield capacity addition and the commissioning of new renewable assets in Khavda and Rajasthan.”

“We remain firmly on track to add 5 GW in FY26 and achieve our 50 GW renewable energy capacity target by 2030, driven by innovation and digital transformation.” - Link

Pralhad Joshi, Union Minister for New & Renewable Energy, on India’s solar leadership

“India’s experience with the PM Surya Ghar and PM-KUSUM schemes has been excellent, and we’re ready to share our expertise and success with other countries through the International Solar Alliance.”

“We’ve already completed 10 lakh solar rooftops, with another 21 lakh nearing completion under PM Surya Ghar, a testament to India’s rapid solar adoption.”

“India fully supports ISA’s global expansion and welcomes greater participation, including from countries like China and Russia, to advance the world’s solar transition.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

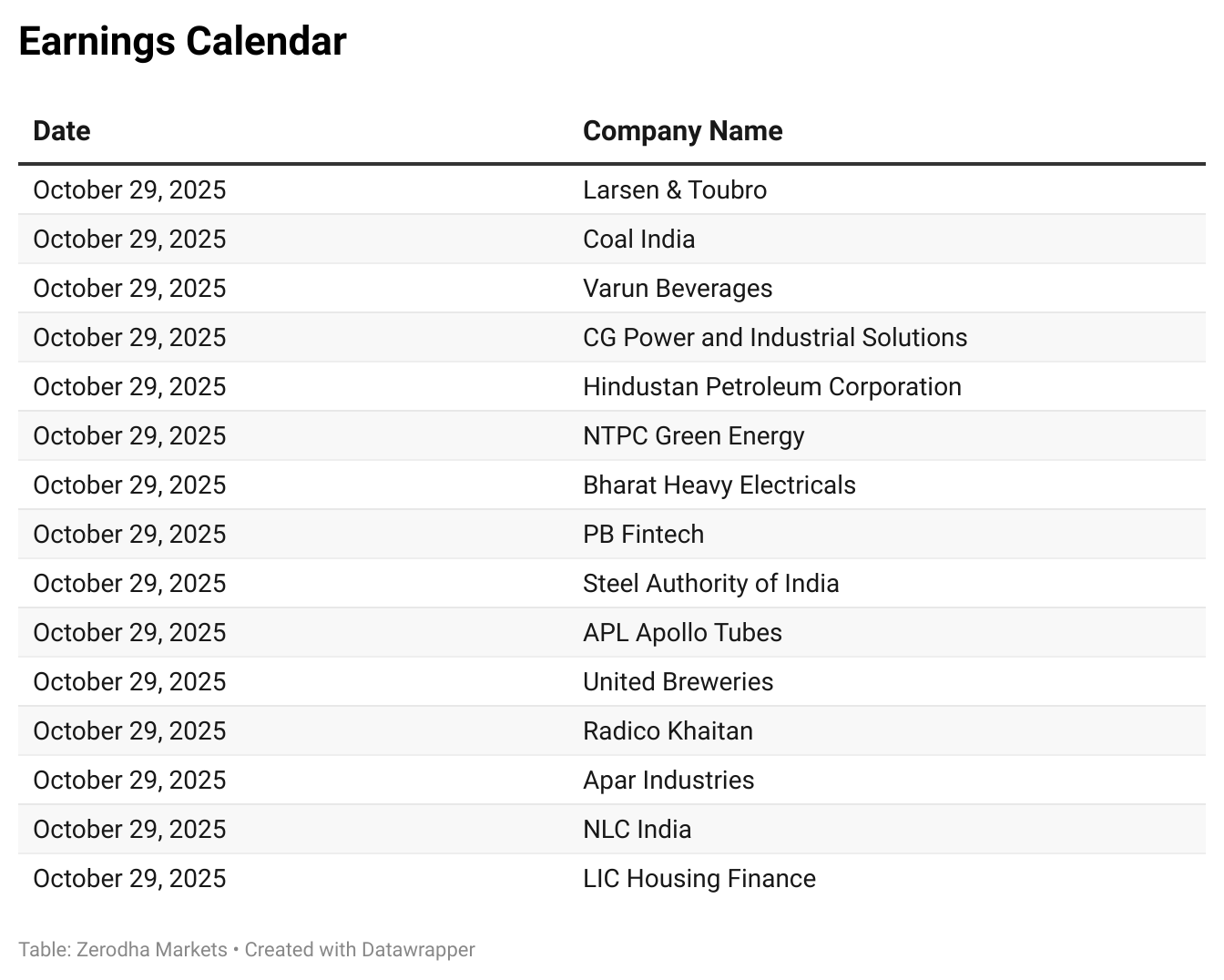

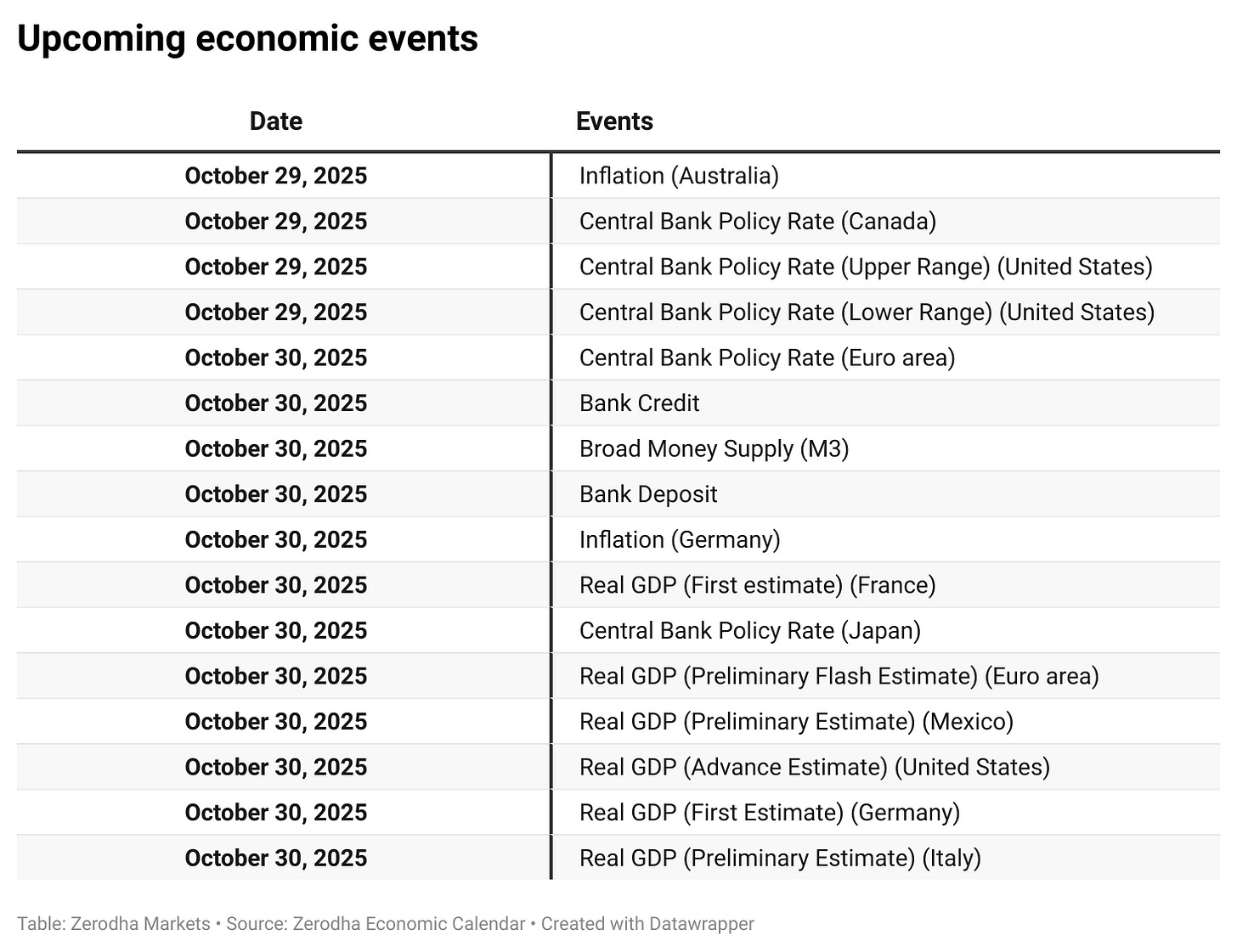

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!