Nifty scales fresh yearly highs on strong earnings momentum; Closes near 25,850

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Before we start, we at Markets by Zerodha would like to wish you a very happy Diwali! We hope you have an incredible time with your loved ones. You’ve certainly kept our year bright with all the love you’ve given us so far.

In our latest episode of In The Money by Zerodha video series, we step away from our regular format to explore something close to every trader and investor’s heart — the Muhurat Trading session. We’ll look at how this one-hour symbolic session beautifully blends tradition and trading, and how you can make the most of it — whether you’re a long-term investor or a short-term trader sneaking in a quick Diwali setup before the sweets arrive. This episode isn’t just about charts and numbers — it’s about faith, discipline, and a fresh financial start for the new Samvat year.

Market Overview

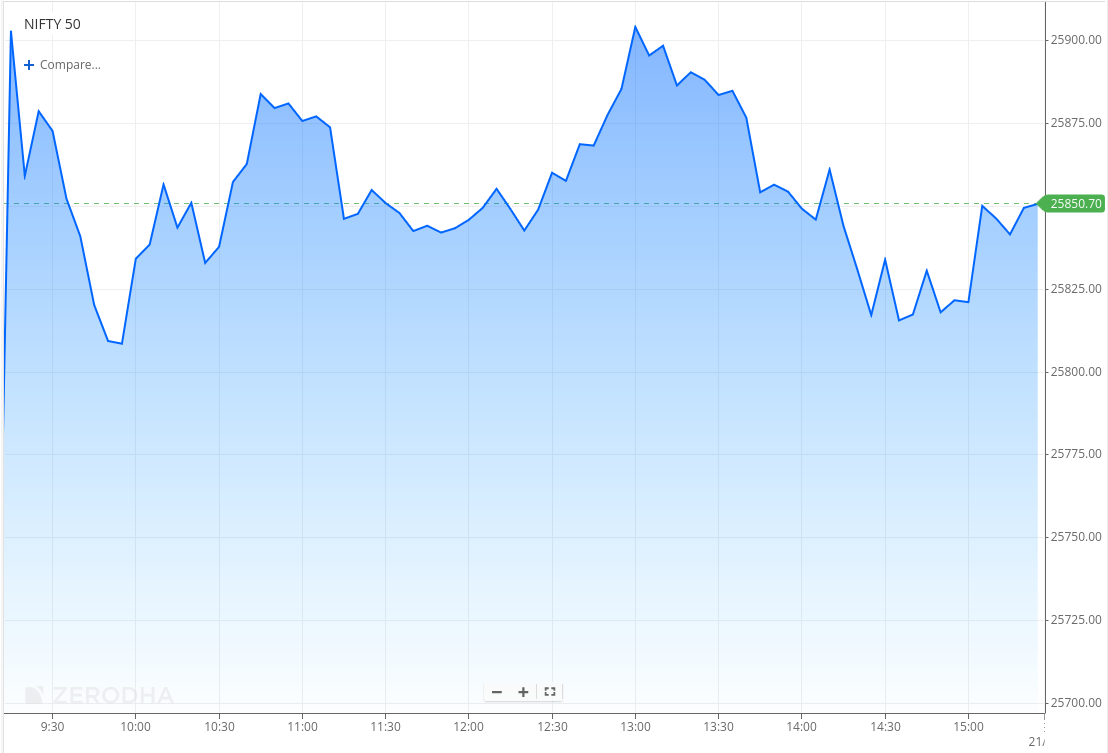

Nifty opened with a 115-point gap up at 25,825, supported by strong global cues and continued optimism across Asian markets. The index saw mild volatility in the early session, oscillating between 25,810 and 25,870 as investors reacted to mixed earnings from key heavyweights — Reliance rose 3.5%, ICICI Bank slipped 3.2%, while HDFC Bank remained largely unchanged.

During the mid-session, Nifty traded steadily above the 25,800 mark, reflecting a balanced sentiment between profit booking and selective buying. Post 1 PM, the index made a brief move toward 25,900, but mild selling at higher levels capped further gains.

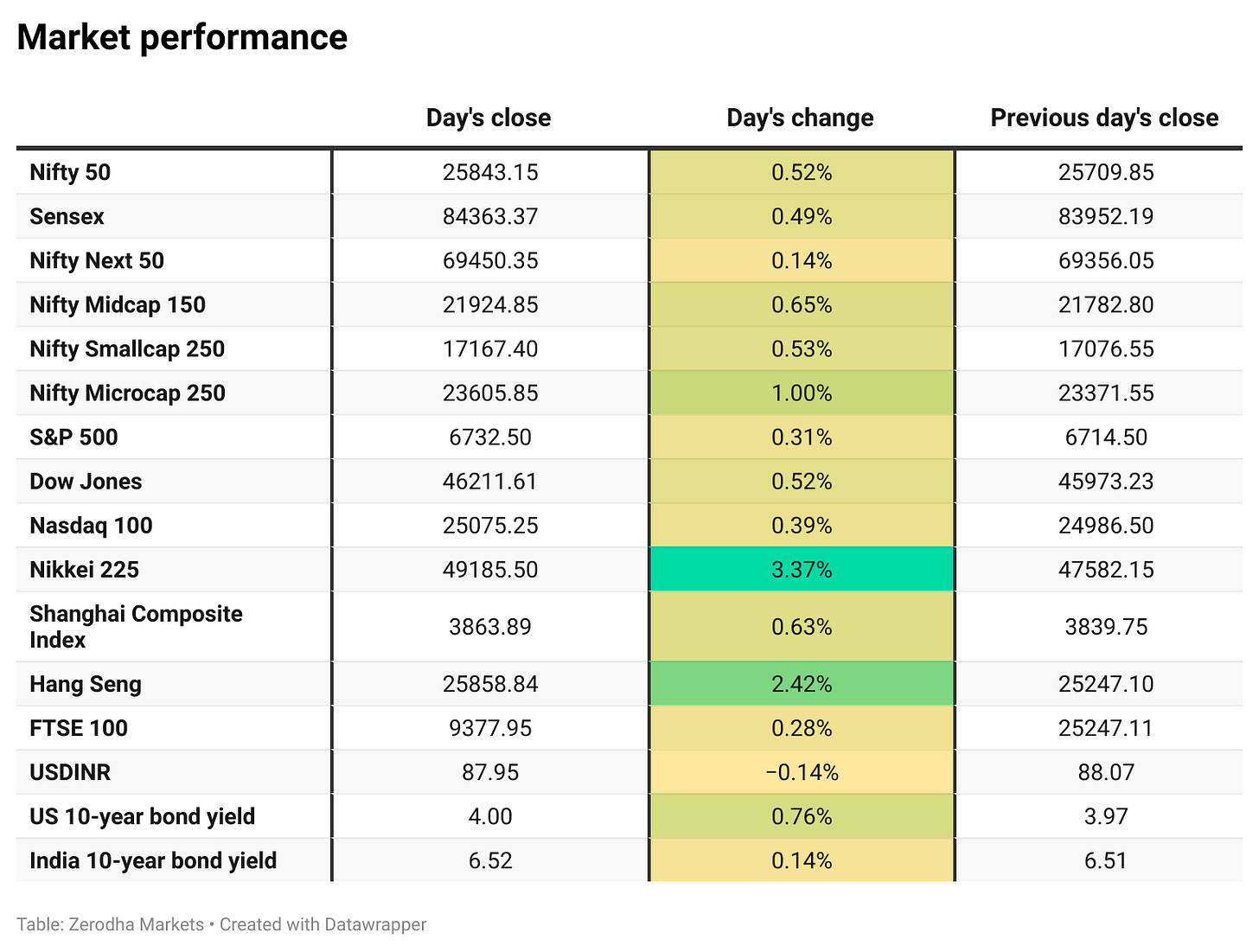

Despite intraday fluctuations, the index held firm through the closing hour to end 0.51% higher at 25,843.15. The market tone remained broadly positive, with investors focusing on Q2 earnings, festive season demand indicators, and sector-specific trends for cues on near-term momentum.

Broader Market Performance:

Broader markets had a strong session today. Of the 3,234 stocks traded on the NSE, 1,882 advanced, 1,242 declined, and 110 remained unchanged.

Sectoral Performance

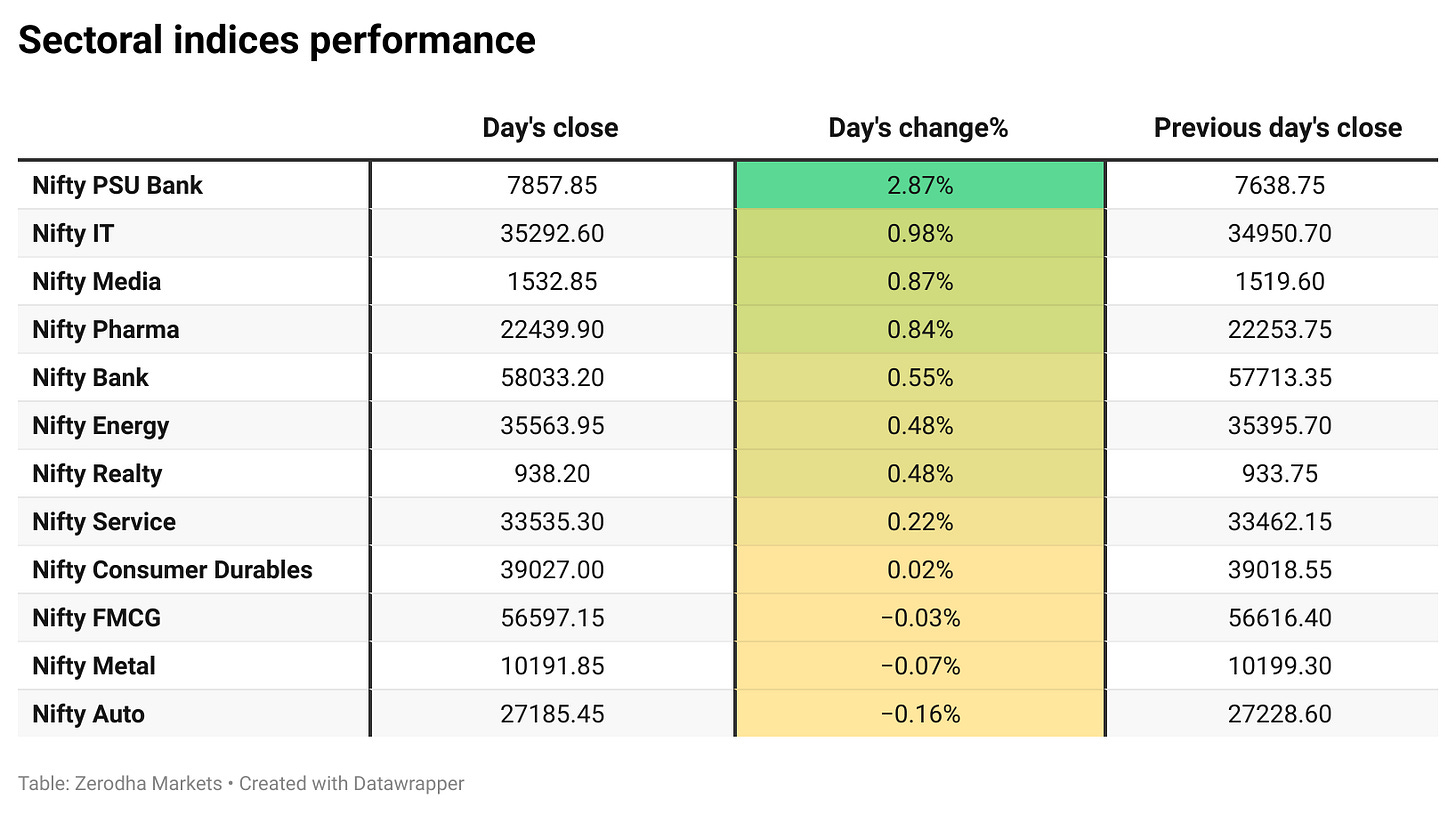

The top-gaining sector for the day was Nifty PSU Bank, which surged by 2.87%, while Nifty Auto was the top laggard, slipping 0.16%. Out of the 12 sectoral indices, 9 ended in the green, and 3 closed in the red, indicating a broadly positive market sentiment.

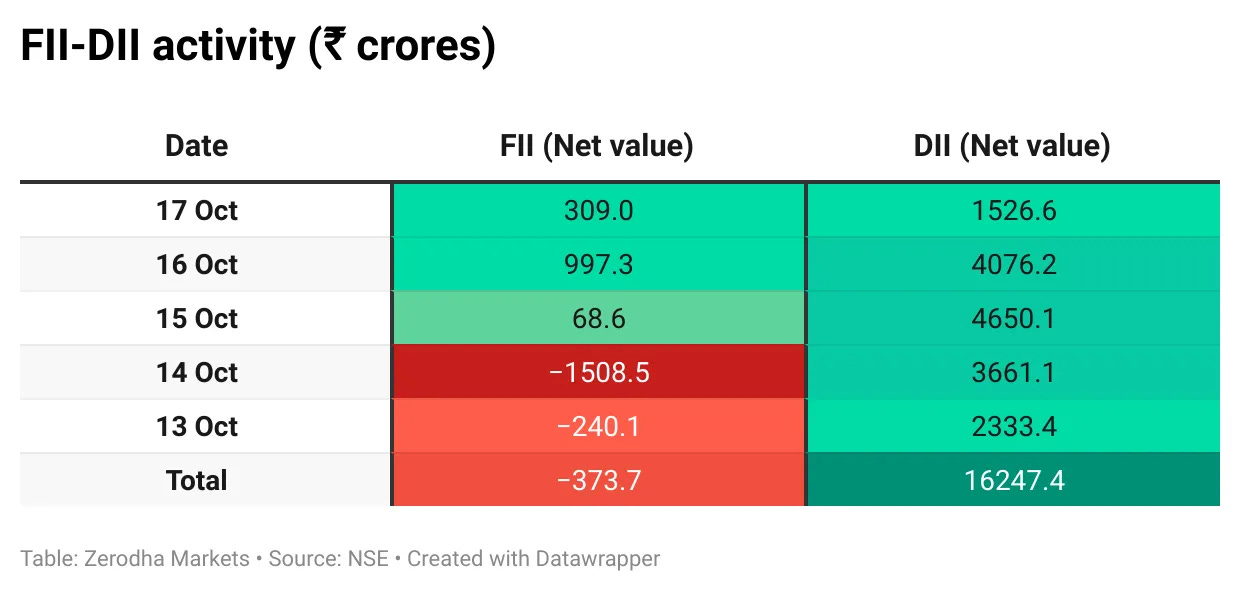

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th October:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,200, indicating potential resistance at the 25,900 -26,000 levels.

The maximum Put Open Interest (OI) is observed at 25,500, followed by 25,700, suggesting support at the 25,700 to 25,600 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

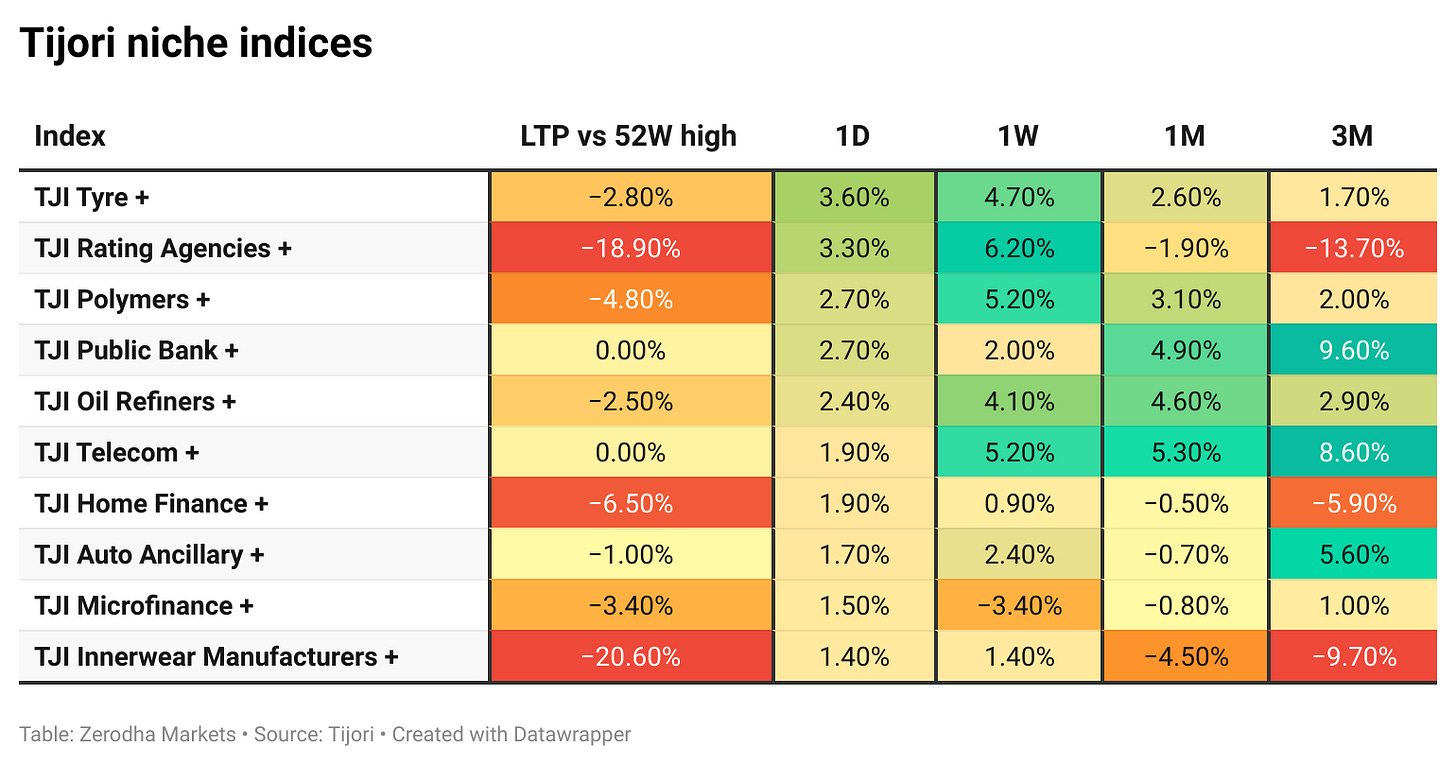

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The Indian rupee traded around 88 per USD, near a one-month high, as the RBI and local banks continued dollar sales to stabilize the currency after recent interventions lifted it from record lows. Dive deeper

Reliance Industries (RIL) shares surged 3.5% after the company reported a 10% year-on-year rise in consolidated net profit to ₹18,165 crore for Q2 FY26. Revenue from operations grew 10% to ₹2.59 lakh crore, driven by strong performance across key business segments. Dive deeper

HDFC Bank reported a 10.8% year-on-year rise in net profit to ₹18,641 crore for Q2 FY26. Net interest income grew to ₹31,552 crore with a stable NIM of 3.27%. Asset quality improved, with gross NPAs down to 1.24% and net NPAs at 0.42%. Dive deeper

ICICI Bank shares fell over 3% after the lender reported its Q2 FY26 results. The bank posted a 5.2% year-on-year rise in net profit to ₹12,359 crore, while net interest income grew 7.4% to ₹21,530 crore. Provisions declined 26% to ₹914 crore. Dive deeper

RBL Bank announced a ₹26,853 crore investment from Emirates NBD, which will acquire a 60% stake through a preferential issue, marking the largest FDI in India’s financial services sector and strengthening the bank’s capital base and growth prospects. Dive deeper

PTC Industries and Bharat Dynamics signed an MoU to form a joint venture for developing propulsion systems, guided bombs, and aero-engines for missiles and UAVs, aimed at strengthening India’s defence manufacturing under the ‘Make in India’ initiative. Dive deeper

Yes Bank reported an 18% year-on-year rise in Q2 FY26 net profit to ₹654 crore, with net interest income up 4.5% to ₹2,301 crore and advances crossing ₹2.5 lakh crore, reflecting steady loan growth and improved asset quality. Dive deeper

IndusInd Bank reported a net loss of ₹437 crore in Q2 FY26, compared to a profit of ₹1,331 crore a year earlier, due to lower income and asset quality pressures. Dive deeper

Developers expect record festive-season demand across premium metro and Tier-2 housing markets, driven by cultural optimism, favorable financing, and improving infrastructure, with Diwali remaining a key period for property investments in India. Dive deeper

WeWork India refuted governance concerns raised by InGovern, clarifying issues related to its IPO structure, profitability route, promoter litigation, and related-party transactions. The company reaffirmed full SEBI compliance, transparency, and strong operational performance. Dive deeper

CEAT reported a 54% rise in Q2 net profit to ₹186 crore and a 12% increase in revenue to ₹3,773 crore, driven by strong domestic demand and GST-led growth. EBITDA rose 39% to ₹504 crore, with margins improving to 13.4%. Dive deeper

Meesho plans to raise ₹42.5 billion ($484 million) through a fresh issue in its upcoming Indian IPO. Dive deeper

Brookfield-backed Avaada Electro has filed a draft prospectus with SEBI for a ₹9,000–10,000 crore IPO to fund the expansion of its high-efficiency solar cell and module manufacturing capacity in Uttar Pradesh and Maharashtra. Dive deeper

The NCLT dismissed an insolvency plea filed by TVS Supply Chain Solutions against ZTE Telecom India, citing a pre-existing dispute between the parties that made the application under Section 9 of the IBC non-maintainable. Dive deeper

What’s happening globally

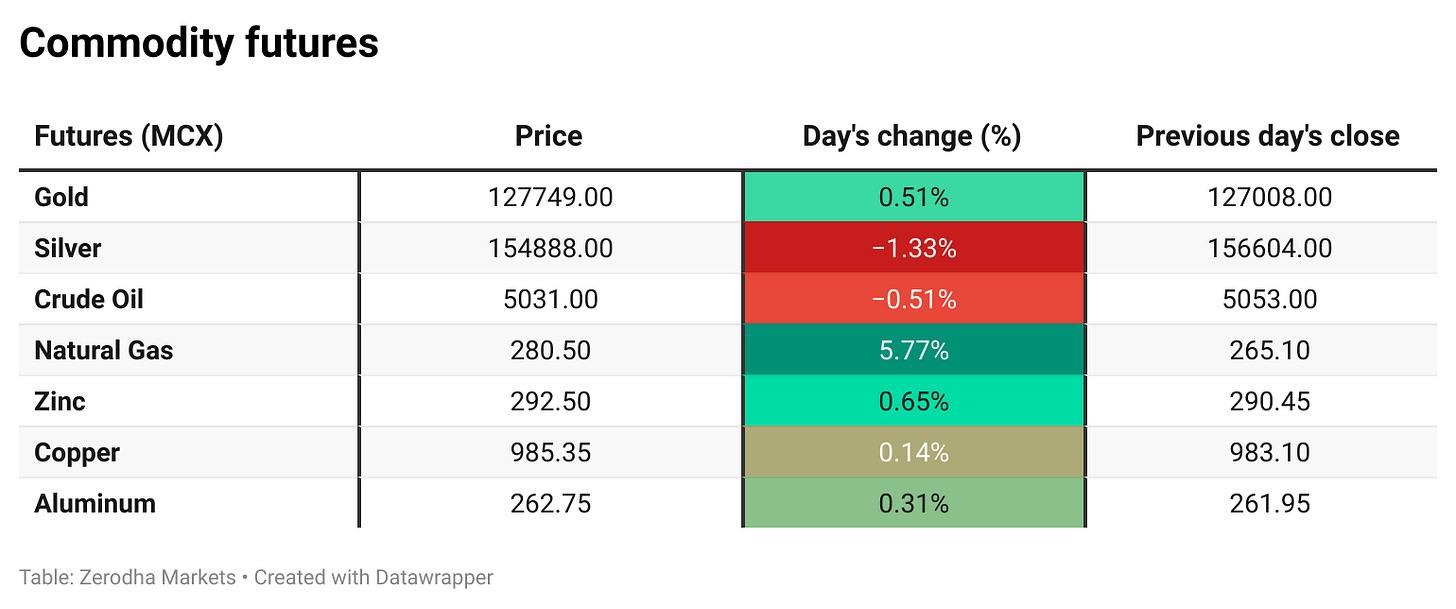

Brent crude futures fell toward $61 per barrel, near six-month lows, as global oversupply concerns deepened amid higher OPEC+ output and easing Middle East tensions, partly offset by disruptions at a Russian gas facility. Dive deeper

Gold prices held steady at $4,250 per ounce as investors awaited U.S.-China talks in Malaysia, while expectations of Fed rate cuts and ongoing U.S. government shutdown concerns supported demand for the metal. Dive deeper

The U.S. has expressed support for the IMF’s new lending program and the EU’s plan to provide Ukraine with a loan backed by frozen Russian assets, though it has yet to decide how to handle Russian funds frozen in the U.S. Dive deeper

US natural gas futures rose nearly 5% to above $3.16/MMBtu as output declined and LNG exports stayed strong, though high storage levels and warmer weather are expected to keep overall demand in check. Dive deeper

Germany’s producer prices fell 1.7% year-on-year in September 2025, marking a seventh straight decline, driven by a 7.3% drop in energy costs, while prices excluding energy rose 0.9%. Dive deeper

China imported no soybeans from the U.S. in September 2025 for the first time since 2018, as trade tensions deepened, while imports from Brazil and Argentina surged, making up over 94% of China’s total soybean purchases. Dive deeper

China’s economy grew 4.8% year-on-year in Q3 2025, slowing from 5.2% in the previous quarter, as trade tensions and a property slump weighed on momentum. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Shayne Nelson, Group CEO, Emirates NBD, on RBL Bank investment

“This investment reflects our confidence in India’s fast-growing financial sector and will help us support Indian businesses and trade across the MENATSA (Middle East, North Africa, Turkey, and South Asia) region.” - Link

Navneet Munot, MD & CEO, HDFC Asset Management Company, on market outlook and investor trends

“SIP investors are the true heroes of India’s market story, disciplined, patient, and driving stability with over ₹29,000 crore in monthly inflows.”

“Indian markets are in a healthy consolidation phase with an upward bias, supported by strong domestic flows and improving earnings visibility for FY26.”

“India’s next decade of wealth creation will be shaped by long-term investing, balanced portfolios, and the growing financial inclusion of millions of new investors.” - Link

Donald Trump, President of the United States, on key priorities in China trade talks

“I don’t want them to play the rare earth game with us; that’s not going to happen.”

“China needs to stop with the fentanyl; they’ve failed to curb exports that are fueling the U.S. opioid crisis.”

“We want China to resume soybean purchases. These are very normal, very basic things we expect in fair trade.” - Link

S&P Global on France’s credit rating downgrade

“S&P Global Ratings downgraded France’s sovereign credit rating from ‘AA-’ to ‘A+’ with a stable outlook, citing heightened political instability and fiscal risks.”

“We expect policy uncertainty will affect the French economy by dragging on investment activity, private consumption, and overall growth.”

“The downgrade reflects concerns over France’s ability to meet its fiscal targets, including reducing the deficit to within the EU ceiling of 3% of GDP by 2029.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following quarterly results, significant events, and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!